The Week Ahead: Sept. 15, 2024

— Trump safe after apparent attempted assassination during Florida Golf outing. Former President Donald Trump is safe following an apparent attempted assassination while he was golfing at his club in West Palm Beach, Florida. Secret Service agents fired at a suspect seen with a gun near the course, who later fled the scene. Local police apprehended a potential suspect in a nearby county. Authorities found an AK-47-style rifle, backpacks, and a camera believed to have been used for recording the event. Trump, who was playing golf with staff and a friend, was unharmed. President Biden and Vice President Harris expressed relief at Trump’s safety. Investigations are ongoing, with both state and federal charges expected. — Biden and UK’s Starmer discuss Ukraine missile use, express concerns over Iran, North Korea arms to Russia. The meeting between President Joe Biden and British Prime Minister Sir Keir Starmer centered around the ongoing issue of Ukraine’s potential use of Western-supplied long-range missiles against Russia, but it ended without a clear decision on the matter. Prior to the meeting, Biden dismissed Russian President Vladimir Putin’s threats that such a move would escalate into “war” with Russia. Starmer hinted that a decision on the missile issue might be made during the upcoming United Nations General Assembly. Beyond Ukraine, Biden and Starmer voiced concerns about Iran and North Korea’s reported weapons supplies to Russia, signaling a broader focus on geopolitical threats and the dynamics of international arms trade. Bottom line: This meeting reflects ongoing Western deliberations over how far to escalate military aid to Ukraine while balancing the risks of provoking a broader confrontation with Russia. The concerns about Iran and North Korea’s involvement indicate the West’s focus on external actors potentially shifting the conflict’s balance through arms support. — The Biden administration announced plans to close a significant loophole in U.S. trade rules known as the “de minimis” exemption, which has allowed a surge of Chinese goods to enter the country tariff-free. The de minimis rule allows packages valued at less than $800 to enter the United States without facing tariffs or customs duties. This exemption was originally intended for small shipments deemed too minor for close scrutiny by U.S. customs officials. In recent years, Chinese e-commerce companies and online retailers have taken advantage of this provision to expand their presence in the U.S. market. This approach not only avoids tariffs but also reduces expenses associated with warehousing in the United States. The volume of packages entering the U.S. under the de minimis rule has grown exponentially: The Biden administration’s changes will not go into effect immediately. The proposal will be subject to comment by industry before being finalized in the coming months, and some imports from China would still qualify for a de minimis exemption. Of note: The administration also urged Congress to enact legislation by the end of the year, saying the proposed changes to rules don’t go far enough. House Democrats on Wednesday released a letter urging President Joe Biden to take action to end what they called a loophole. Lawmakers from both parties have introduced legislation to address the issue, but action on the bills has stalled. The New York Times reports (link) that Friday’s action may head off a change that has been looming in global retail. “Amazon has been preparing a new discount service that would ship products directly to consumers, allowing those goods to bypass tariffs, according to people familiar with the plans. Even companies that preferred to keep their business models as-is — like Walmart — have been forced to consider using more de minimis to compete.” — Harris gains lead after debate, but race stays tight. Following the debate between Vice President Kamala Harris and former President Donald Trump, Harris has seen a slight boost in the polls. She now leads Trump by 5 points in several polls, including Reuters/Ipsos and Yahoo News/YouGov. Harris’s favorability has increased, and she leads Trump on personal attributes like honesty and mental sharpness. However, Trump still holds an edge on issues like the economy and immigration. The race remains close as the election nears. — Pope Francis expressed disappointment with both U.S. presidential candidates, criticizing Donald Trump for his stance on restricting immigration and Kamala Harris for supporting abortion rights. He questioned, “Who is the lesser evil?” and urged individuals to make their voting decisions based on personal conscience. His comments touch on the moral dilemma faced by many voters, particularly the 52 million American Catholics, who tend to lean slightly Republican, as they navigate these issues in alignment with their faith and values. — The 2024 presidential election may not have a clear winner on election night, due to the prolonged counting of mail-in ballots. This could create misleading early results, a scenario like 2020’s “red mirage,” where early leads shifted after all votes were tallied. Election officials urge patience, emphasizing that slow counts are due to security measures, not malfeasance. Key battleground states, like Wisconsin and Pennsylvania, may experience delays, fueling conspiracy theories if results take days. Link to more via the New York Times. — Vance backtracks on Trump’s stance on abortion ban, won’t commit to veto prediction. Ohio Senator and GOP vice presidential candidate JD Vance avoided confirming whether former President Donald Trump would veto a national abortion ban during an interview on Meet the Press, walking back on previous comments where he suggested Trump would veto such a ban. Vance called the issue “a ridiculous hypothetical,” after Trump himself refused to commit to vetoing a ban during a recent debate. Abortion remains a key topic as Republicans and Democrats continue to clash over its future in the upcoming election. — Vance: Trump’s tariff plan aims to offset tax cuts. JD Vance, Donald Trump’s running mate, defended Trump’s proposal for higher tariffs on U.S. imports to balance his expanding tax cuts if reelected. Speaking on CBS’s Face the Nation, Vance argued that penalizing companies manufacturing overseas could help avoid a larger deficit while allowing workers to keep more money. Trump has proposed a 10% across-the-board tariff on imports, including steep increases on Chinese goods, claiming it would generate trillions for the U.S. economy. However, economists warn that such tariffs could lead to higher consumer costs and reignite inflation. — On Friday, early in-person voting in Virginia and Minnesota gets underway, as does absentee voting in South Dakota. — Democrats target overseas voters in 2024 presidential race. As the 2024 U.S. presidential race tightens, the Democratic party is focusing on millions of Americans living abroad, aiming to secure their votes for Kamala Harris. High-profile figures like Nancy Pelosi, Beto O’Rourke, and Eric Holder are actively engaging overseas voters, reminding them of their crucial role in past elections. With approximately 9 million Americans abroad and nearly a million overseas ballots counted in 2020, their votes could be pivotal in swing states where Harris and Donald Trump are in a close contest. Democrats Abroad recently held a major fundraising event to support this effort. Link to more via the Financial Times. — On Saturday (Sept. 21), President Joe Biden welcomes the leaders of Australia, India and Japan for the final “Quad” summit of his term, adding a personal touch to the event by hosting it in his hometown of Wilmington, Delaware. — Boar’s Head Provisions indefinitely closed its Virginia facility due to a deadly listeria outbreak linked to its liverwurst product. The outbreak, reported in July by the CDC, is the largest in the U.S. since 2011, with nine deaths and 57 hospitalizations across 18 states. The facility, which recalled 7.2 million pounds of deli meat, had 69 violations of federal regulations, including mold and insect issues. The move is part of several changes made following what it called a “dark moment in our company’s history.” — Air Canada and the union representing more than 5,200 pilots announced Saturday night they have reached a tentative agreement on a four-year contract, averting a threatened strike that could have started within days. The preliminary deal must still be ratified by members of the Air Line Pilots Association. Air Canada said contract terms will remain confidential until the ratification vote, which is expected to take place within a month, and approval of the Air Canada board of directors. Ratification requires approval by a majority of the voting membership. ALPA said the tentative agreement will deliver an additional $1.9 billion of value for pilots over the length of the contract. |

| WASHINGTON FOCUS |

The House GOP will try again on funding for fiscal year (FY) 2025, which begins Oct. 1. Last week saw Speaker Mike Johnson (R-La.) yanking his prior approach which he knew would not get enough votes in the House and fail in the Senate. The White House also said it would veto any such move in the unlikely event it got to the White House.

— The push for a new farm bill continues. Last week saw several developments, including:

• Major commodity groups and associated ag sector groups has “fly-ins” to Congress to advocate for farm policy. “This was a well-designed and strategically calculated effort by many national, state and regional groups,” said Plains Cotton Growers CEO Kody Bessent. “It was also unique — we don’t typically see a cotton producer, wheat producer, sorghum producer, peanut producer etc. and a lending institution all walk into the same meeting, but that’s what happened this week. We all worked together to paint the picture of farm country’s suffering.”

• Ranking House Ag Member David Scott (D-Ga.) sent leadership a letter urging farm bill action and a two-year transition of disaster and financial aid.

• Over 300 groups called for farm bill passage before year’s end.

— House Republicans are set to force a vote on the EPA’s new tailpipe emission standards, which have been a source of controversy and debate. Key issues:

EPA’s new emission standards. The Environmental Protection Agency (EPA) finalized new, more stringent emissions standards for greenhouse gases and criteria pollutants for light-duty and medium-duty vehicles for model years 2027 through 2032. These standards aim to reduce over 7 billion tons of greenhouse gas emissions and other pollutants, resulting in significant public health improvements.

Criticism and opposition. Critics, including House Republicans and the ethanol industry, argue that these standards effectively mandate a shift toward electric vehicles (EVs). They claim that the standards could negatively impact gasoline usage and, consequently, the ethanol industry. The rules may reduce consumer choice and increase vehicle costs, and the electric grid may not be prepared to handle the increased demand from EVs.

Congressional Review Act (CRA) resolution. House Republicans are using the CRA to force a vote on nullifying the EPA’s new rules. This move is seen as an attempt to block what they perceive as a “de facto EV mandate.”

Potential impact on ethanol industry. The ethanol industry has expressed concerns about potential demand destruction:

• The Renewable Fuels Association estimates an average loss in ethanol demand from 2027-2032 of between 283 million and 425 million gallons annually for 10% and 15% blends, respectively.

• By 2032, demand for 10% ethanol could fall by 709 million gallons, and demand for 15% ethanol could drop by slightly more than 1 billion gallons.

Political Implications. The vote could pressure some House Democrats from farm districts. Former President Donald Trump has vowed to overturn the EPA’s rules if reelected. President Biden is expected to veto the resolution if it passes both chambers of Congress.

EPA projects that under these new standards:

• EVs could account for 30% to 56% of new light-duty vehicle sales by 2030-2032.

• EVs could make up 20% to 32% of medium-duty vehicle sales in the same period.

Bottom line: While EPA maintains that these standards do not mandate specific technologies, the agency acknowledges that they will likely accelerate the transition to electric vehicles.

— The Senate is expected to take another show vote on legislation that would expand access to and coverage of in vitro fertilization as Democrats look to pressure Republicans to take a stand on IVF policies former President Donald Trump has called for on the campaign trail.

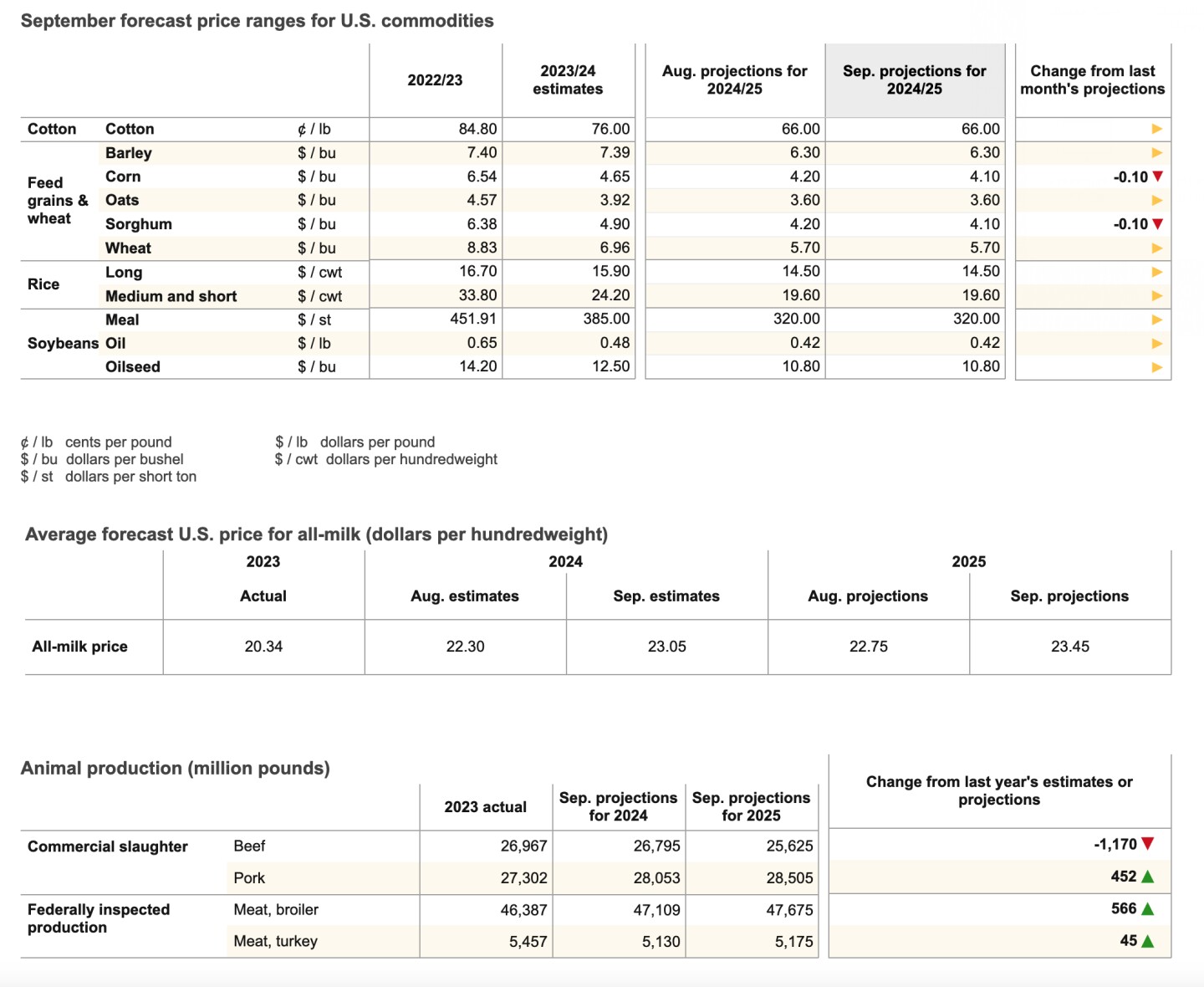

— USDA last week didn’t make major changes to its U.S. crop or price forecasts. Highlights:

• Corn crop: 15.186 billion bu. USDA raised its corn crop estimate 39 million bu. from last month. Yield increased 0.5 bu. to a record 183.6 bu. per acre. Harvested area was unchanged at 82.710 million acres.

• Soybean crop: 4.586 billion bu. USDA trimmed its soybean production estimate 3 million bushels. It made no changes to yield (53.2 bu. per acre) or

harvested area (86.271 million acres).

• Cotton crop: 14.512 million bales. USDA cut its cotton production estimate 596,000 bales from last month on a 33-lb. cut in yield to 807 lbs. per acre.

Harvested area was unchanged at 8.635 million acres.

| OTHER EVENTS & HEARINGS |

Monday, Sept. 16

• President Joe Biden is scheduled to travel to Philadelphia.

• U.S./China rivalry. Center for Strategic and International Studies and the Stanford Next Asia Policy Lab symposium on “The New Cold War? Congressional Rhetoric and Regional Reactions to the U.S./China Rivalry.”

• US elections and Europe. Brookings Institution and the Council on Foreign Relations virtual discussion on “Election ’24: What’s at Stake for U.S./European Relations?”

• Veterans rural health issues. Veterans Affairs Department virtual meeting of the Veterans Rural Health Advisory Committee for updates from department leadership, the executive director, VA Office of Rural Health and the committee chair and presentations by subject-matter experts on general rural health care access.

• Census data. U.S. Census Bureau virtual event for the upcoming release of the 2020 Census Supplemental Demographic and Housing Characteristics File.

Tuesday, Sept. 17

• International food and nutrition. U.S. Agency for International Development meeting of the Board for International Food and Agricultural Development to address evidence and evidence gaps, areas for additional research, and prioritized approaches and actions for U.S. Agency for International Development, centered around demand-side interventions to improve the processing, storage, distribution, sale, purchase, and consumption of safe and nutritious food.

• U.S. trade policy. Labor Department meeting of the Labor Advisory Committee for Trade Negotiations and Trade Policy to review and discuss current issues that influence U.S. trade policy and discuss potential U.S. negotiating objectives and bargaining positions in current and anticipated trade negotiations.

• American Frozen Food Institute forum, “A Comprehensive Look at Chemical Food Safety: Bridging State, Federal and Legal Perspectives.”

• U.S. energy outlook. Semafor discussion on “Powering the Next Era of American Energy.”

• National security issues. Senate Homeland Security and Governmental Affairs Committee hearing on “Ensuring a Trustworthy Government: Examining the National Security Risks of Replacing Nonpartisan Civil Servants with Political Appointees.”

• AI and tech. Politico 2024 Artificial Intelligence (AI) and Tech Summit.

• China PNTR status. Peterson Institute for International Economics virtual discussion on “The Economic Danger of Revoking China’s Permanent Normal Trade Status.”

• AI issues. Senate Judiciary Privacy, Technology, and the Law Subcommittee hearing on insiders’ perspectives on AI.

• Student loans. Senate Banking, Housing and Urban Affairs Committee hearing on “Back to School: Shedding Light on Risks and Harm in the Private Student Lending and Servicing Market.”

Wednesday, Sept. 18

• National school lunch programs. Senate Ag Food and Nutrition, Specialty Crops, Organics, and Research Subcommittee hearing on “Keeping Kids Learning in the National School Lunch Program and School Breakfast Program.”

• Support for rural small businesses. Senate Small Business and Entrepreneurship Committee hearing on “Streamlining and Coordinating Support for Rural Small Businesses.”

• Macro impacts of tax reform. Senate Banking, Housing, and Urban Affairs Economic Policy Subcommittee hearing on “The Macroeconomic Impacts of Potential Tax Reform in 2025.”

• SEC and digital assets. House Financial Services Digital Assets, Financial Technology and Inclusion Subcommittee hearing on “Dazed and Confused: Breaking Down the SEC’s Politicized Approach to Digital Assets.”

• U.S. southern border. House Homeland Security Committee hearing on “A Country Without Borders: How the Biden/Harris Open Borders Policies Have Undermined Our Safety and Security.”

• Americans detained in China. Congressional-Executive Commission on China hearing on “Bringing Home Americans Detained in China.”

• Pelosi book. Center for Strategic and International Studies virtual book discussion on “The Art of Power: My Story as America’s First Woman Speaker of the House.”

• Homeland Security investigations. House Judiciary Crime and Federal Government Surveillance Subcommittee hearing on “Oversight of Homeland Security Investigations.”

• Oversight of inspectors general. House Appropriations Transportation, Housing and Urban Development, and Related Agencies Subcommittee hearing on “Oversight Hearing: Inspectors General of the Department of Housing and Urban Development, Department of Transportation, and the National Railroad Passenger Corporation.”

• Indo-Pacific power competition. House Foreign Affairs Committee hearing on “Great Power Competition in the Indo-Pacific.”

• Cybersecurity threats to aviation. Senate Commerce, Science and Transportation Committee hearing on “Aviation Cybersecurity Threats.”

• National defense strategy. House Armed Services Committee hearing on “The Findings and Recommendations of the Commission on the National Defense Strategy.”

• Workers’ tips. House Education and the Workforce Protections Subcommittee hearing on “Examining the Biden/Harris Attacks on Tipped Workers.”

• 2024 foreign election threats. Senate Select Intelligence Committee hearing on “Foreign Threats to Elections in 2024 — Roles and Responsibilities of U.S. Tech Providers.”

Thursday, Sept. 19

• FTC practices. House Energy and Commerce Innovation, Data, and Commerce Subcommittee hearing on “Federal Trade Commission Practices: A Discussion on Past Versus Present.”

• Blinken contempt of Congress report. House Foreign Affairs Committee markup of a Committee Report, recommending the House of Representatives find Antony Blinken, Secretary, U.S. Department of State, in contempt of Congress for refusal to comply with a subpoena duly issued by the Committee on Foreign Affairs.

• China silencing critics. House (Select) Strategic Competition Between the United States and the Chinese Communist Party Committee hearing on “How the CCP Uses the Law to Silence Critics and Enforce its Rule.”

• Crypto and Congress. Axios discussion on “The State of Play for Crypto on Capitol Hill.”

• The Atlantic event. The Atlantic holds its annual Atlantic Festival conference, with remarks from House Minority Leader Hakeem Jeffries (D-N.Y.) and several Biden administration officials including Treasury Secretary Janet Yellen, Energy Secretary Jennifer Granholm, and Transportation Secretary Pete Buttigieg.

• FERC meeting. Federal Energy Regulatory Commission holds an open meeting.

• Federal prevailing wage. Office of Personnel Management holds a virtual meeting of the Federal Prevailing Rate Advisory Committee to discuss various agenda items related to the determination of prevailing wage rates for the Federal Wage System.

• Fusion development. Senate Energy and Natural Resources Committee hearing on “Fusion Energy Technology Development.”

• Biden/Harris energy policy. House Budget Committee hearing on “The Cost of the Biden-Harris Energy Crisis.”

• Illegal immigration. House Homeland Security Border Security and Enforcement Subcommittee and Counterterrorism, Law Enforcement, and Intelligence Subcommittee joint hearing on “Beyond the Border: Terrorism and Homeland Security Consequences of Illegal Immigration.”

• Biden administration oversight. House Oversight and Accountability Committee hearing on “A Legacy of Incompetence: Consequences of the Biden-Harris Administration’s Policy Failures.”

• CO2 removal. House Science, Space, and Technology Energy Subcommittee and Environment Subcommittee joint hearing on “Navigating the Blue Frontier: Evaluating the Potential of Marine Carbon Dioxide Removal Approaches.”

• Green spending. House Energy and Commerce Environment, Manufacturing, and Critical Materials Subcommittee hearing on “Holding the Biden-Harris EPA Accountable for Radical Rush-to-Green Spending.”

• Iran threat. House Foreign Affairs Middle East, North Africa, and Central Asia Subcommittee hearing on “Israel and the Middle East at a Crossroads: How Tehran’s Terror Campaign Threatens the U.S. and our Allies.”

• Venezuela elections. House Foreign Affairs Western Hemisphere Subcommittee hearing on “Maduro Stole the Elections Again: The Response to Fraud in Venezuela.”

Friday, Sept. 20

• Combatting global upheaval. Center for a New American Security virtual discussion on “Confronting the Axis of Upheaval,” focusing on how the United States and its partners should confront authoritarian leaders of China, Russia, Iran, North Korea, and extremist groups.

• The Atlantic conference. Final day of The Atlantic annual Atlantic Festival conference, with EPA Administrator Michael Regan participating in a discussion on “The Climate Summit.”

| ECONOMIC REPORTS & EVENTS |

This week’s major focus will be the Federal Reserve’s interest-rate decision on Sept. 18, with expectations of a rate cut, but uncertainty over whether it will be a 0.25% or 0.5% reduction. Traders are now pricing in a nearly 50% probability of a 50-basis point cut when the Federal Open Market Committee meets Sept. 17-18, according to the CME’s FedWatch tool (link). Fed-funds futures were indicating just a 28% probability of such a supersize cut on Thursday. The Fed will also update its economic outlook.

Other key events include retail sales data from the Census Bureau on Tuesday, housing-market data, and corporate earnings from major firms like General Mills and FedEx. The Bank of Japan is expected to maintain its interest rate at 0.25% during its policy meeting on Friday.

Monday, Sept. 16

Tuesday, Sept. 17

- Retail Sales

- Industrial Production

- Business Inventories

- Housing Market Index

- FOMC meeting begins

Wednesday, Sept. 18

- MBA Mortgage Applications

- Housing Starts

- FOMC Meeting Conclusion

- Fed projections

- Fed Chair press conference

Thursday, Sept. 19

- Jobless Claims

- Philadelphia Fed Manufacturing

- Existing Home Sales

- Current Account

- Leading Indicators

- Fed Balance Sheet

- Money Supply

Friday, Sept. 20

- Bank of Japan is expected to maintain its interest rate at 0.25%.

| KEY USDA & INTERNATIONAL AG & ENERGY REPORTS & EVENTS |

The ag focus will be on U.S. weather/crop updates while Thursday brings the International Grains Council report.

Several energy-related events will be held in Asia, the Middle East, Europe and the U.S., including the annual Gastech conference in Houston that starts Tuesday.

Monday, Sept. 16

Ag reports and events:

• Export Inspections

• Cotton and Wool Outlook

• Oil Crops Outlook

• Dairy Monthly Tables

• Feed Outlook

• Rice Outlook

• Wheat Outlook

• Livestock Historical Track Records

• Crop Progress

• StatsCanada reports on durum production

• Holiday: China, Indonesia, Malaysia, Japan, Korea, Pakistan, Bangladesh, Angola

Energy reports and events:

• World Utilities Congress, Abu Dhabi (through Sept. 18)

• RE-INVEST 2024 conference in Gujarat, India (through Sept. 18)

• IAEA General Conference, Vienna (through Sept. 20)

Tuesday, Sept. 17

Ag reports and events:

• Feed Grains: Yearbook Tables

• Fruit and Tree Nuts Data

• Vegetables and Pulses Data

• Stone Fruit: World Markets and Trade

• France agriculture ministry’s monthly report

• Holiday: China, South Korea

Energy reports and events:

• API weekly U.S. oil inventory report

• World Utilities Congress, Abu Dhabi (through Sept. 18)

• RE-INVEST 2024 conference in Gujarat, India (through Sept. 18)

• France’s SER renewable energy association holds annual conference, Paris

• Offshore Energies UK Conference 2024, Aberdeen

• IAEA General Conference, Vienna (through Sept. 20)

• Gastech conference, Houston (through Sept. 20

• BNEF Energy Transition Forum, Chicago

• WTI October options expire

Wednesday, Sept. 18

Ag reports and events:

• Livestock, Dairy, and Poultry Outlook

• Sugar and Sweeteners Outlook

• Broiler Hatchery

• Hop Stocks

• China’s 2nd batch of August trade data, including agricultural imports

• FranceAgriMer monthly grains balance sheet

• Holiday: Hong Kong, Korea, Chile

Energy reports and events:

• EIA Petroleum Status Report

• Weekly Ethanol Production

• U.S. weekly ethanol inventories

• Genscape weekly crude inventory report for Europe’s ARA region

• China August output data for base metals and oil products

• China second batch of August trade data, including LNG and pipeline gas imports, oil products trade breakdown

• Milken Institute’s Asia Summit 2024, Singapore (through Sept. 20)

• World Utilities Congress, Abu Dhabi (last day)

• RE-INVEST 2024 conference in Gujarat, India (last day)

• IAEA General Conference, Vienna (through Sept. 20)

• Gastech conference, Houston (through Sept. 20)

Thursday, Sept. 19

Ag reports and events:

• Weekly Export Sales

• Food Expenditure Series

• Livestock Slaughter

• IGC monthly grains market report (link)

• CONAB coffee production data

• Port of Rouen data on French grain exports

• Holiday: Chile

Energy reports and events:

• EIA Natural Gas Report

• Insights Global weekly oil product inventories

• Singapore onshore oil-product stockpile weekly data

• Milken Institute’s Asia Summit 2024, Singapore (through Sept. 20)

• Nuclear Energy Agency holds meeting of ministers and company executives, Paris (through Sept. 20)

• IAEA General Conference, Vienna (through Sept. 20)

• Gastech conference, Houston (through Sept. 20)

• WTI CSOs for October expire

• Earnings: Capricorn 1H

Friday, Sept. 20

Ag reports and events:

• CFTC Commitments of Traders report

• Cattle on Feed

• Milk Production

• Peanut Prices

• China’s 3rd batch of August trade data, including country breakdowns

• Grains Industry of Western Australia monthly crop report

• FranceAgriMer’s weekly crop condition report

• Malaysia’s Sept. 1-20 palm oil exports

• Holiday: Chile

Energy reports and events:

• Baker Hughes weekly U.S. oil/gas rig counts

• ICE weekly Commitments of Traders report for Brent, gasoil

• China third batch of August trade data/country breakdowns for energy, commodities

• Milken Institute’s Asia Summit 2024, Singapore (last day)

• IAEA General Conference, Vienna (last day)

• Nuclear Energy Agency meeting of ministers & company execs, Paris (last day)

• Gastech Conference, Houston (last day)

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |