Updates: Policy/News/Markets, March 3, 2025

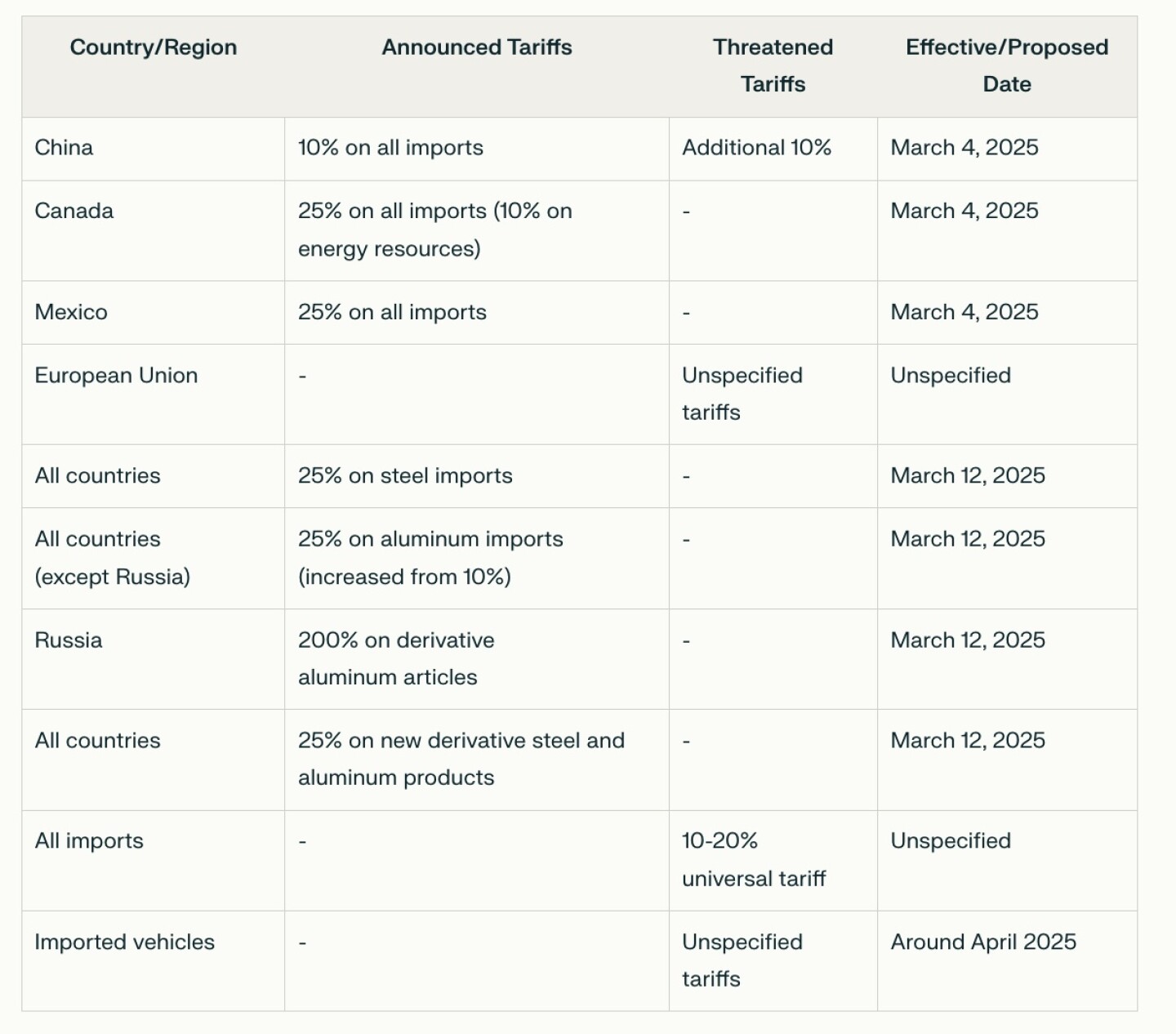

— China targets U.S. agriculture in trade war escalation. China is preparing countermeasures against new U.S. import tariffs, with American agricultural exports in its sights, according to China’s state-backed Global Times. This move comes after President Donald Trump threatened an additional 10% duty on Chinese products, accusing Beijing of insufficient efforts to curb fentanyl shipments to the U.S. China’s planned response may include tariffs and non-tariff measures, likely impacting key U.S. agricultural products like soybeans, meat, and grains. The U.S. agricultural sector, still recovering from the first Trump-era trade war, could face significant challenges despite efforts to diversify markets. Market reactions were swift, with Chinese soymeal and rapeseed meal futures surging 2.5%. Some analysts warn that Trump’s tariff strategy could “backfire,” further escalating tensions between the world’s top two economies. Facts and figures. China imported $29.25 billion worth of U.S. ag products in 2024, a 14% decline from the previous year, extending a 20% drop in 2023. U.S. exports to China have declined since 2018 after Beijing slapped tariffs of up to 25% on soybeans, beef, pork, wheat, corn and sorghum in retaliation for duties on Chinese goods imposed by Trump. Soybean exports to China totaled $12.8 billion, but the U.S. market share fell to 18% from 40% in 2016, as Brazil’s share rose to 74%. U.S. corn exports dropped sharply to $561 million from $2.6 billion in 2023, with Brazil emerging as the leading supplier. Meat and offal exports also declined to $2.54 billion from $4.11 billion in 2021. Cotton shipments decreased slightly to $1.49 billion, while sorghum exports rose to $1.73 billion. Wheat exports hit a three-year high of $600 million, though future shipments may be impacted by ample local supplies in China. — Trump to announce tariff decision on Tuesday (markets still expect they will be delayed). President Trump is set to announce on Tuesday whether he will implement 25% tariffs on imports from Mexico and Canada (with a 10% tariff on Canadian energy imports) and an additional 10% tariff increase on imports from China. Commerce Secretary Howard Lutnick indicated that efforts by Canadian and Mexican officials to curb migrant and drug crossings at the border could lead to reduced tariffs on the two major U.S. trading partners (link to The Week Ahead for more on tariffs). The levies would apply to roughly $1.5 trillion in annual imports, but… Of note: While Lutnick announced that tariffs on Canada and Mexico will take effect on Tuesday, the exact rate, potentially up to 25%, will be decided by President Donald Trump. Lutnick indicated the situation remains “fluid,” suggesting room for negotiation. Border security and fentanyl concerns: Lutnick noted that while Canada and Mexico have made “reasonable” efforts to secure their borders, fentanyl trafficking into the U.S. remains an issue. China tariff increase: Trump is also expected to double tariffs on Chinese goods from 10% to 20% on Tuesday unless China halts fentanyl trafficking. Meanwhile, investor Warren Buffett criticized Trump’s tariff plans, saying they will raise costs for consumers and fuel inflation. “Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” Buffett said in an interview with CBS News. — India’s trade minister visits U.S. for crucial trade talks. India’s Trade Minister Piyush Goyal has embarked on a sudden visit to the United States to engage in trade negotiations, ahead of President Donald Trump’s proposed reciprocal tariffs set to take effect in early April. Goyal aims to gain clarity on the tariffs’ impact on India and explore potential concessions to mitigate losses, which Citi Research estimates could reach $7 billion annually. India remains open to discussing tariff reductions on industrial goods but is resistant to lowering agricultural tariffs to protect its farmers. The visit follows Prime Minister Narendra Modi’s U.S. trip, where both nations targeted $500 billion in bilateral trade by 2030. — Rollins vows to shield farmers amid tariff turmoil. USDA Secretary Brooke Rollins assured farmers she’d be “in the room” to protect them from the economic fallout of Trump’s upcoming tariffs. Speaking at the Commodity Classic in Denver, Rollins pledged support against tariff retaliation, promised funding for conservation programs, and announced the new $10 billion Emergency Commodity Assistance Program (ECAP) which will be based on 2024 acreage reporting data. Additionally, she discussed the $21 billion in disaster relief, emphasizing that it would be distributed based solely on need, without consideration of race or geographic. She also addressed USDA’s staffing challenges, bird flu response, and her commitment to balancing health initiatives with agricultural interests. Conservation funding. Rollins again noted the release of payments from three major conservation programs: the Environmental Quality Incentives Program, Conservation Security Program, and Agricultural Conservation Easement Program. These programs had been paused since the beginning of the Trump administration. Rollins emphasized several key policy directions: Comments: The only real news from Rollins’ Denver remarks was the ECAP naming for the $10 billion in farmer economic aid. — Republicans concerned as Trump overlooks high prices, risks economic backlash. President Trump’s focus on federal workers, diversity programs, and foreign policy has left Republicans worried that his lack of attention to high consumer prices — especially record egg costs — could hurt him politically if inflation persists, the Wall Street Journal reports (link). Despite his campaign promises to lower prices, Trump’s proposed tariffs on foreign imports could further drive up costs. With U.S. consumer confidence seeing its steepest decline in four years, GOP strategists fear voters’ patience may wear thin if tangible economic relief doesn’t materialize soon. Of note: These tariffs could worsen inflation, influencing the Federal Reserve’s cautious approach to interest rate cuts. The Fed will release its Beige Book on Wednesday, offering insights into hiring, economic activity, and business borrowing across its 12 districts. Meanwhile, cost-cutting and job elimination measures could affect employment data over time. Trump will outline his agenda Tuesday in a joint address to Congress, with some GOP lawmakers pushing for $2 trillion in cuts. Despite higher jobless claims, the unemployment rate on Friday is expected to remain at 4%, with average hourly earnings predicted to increase by 0.3%, slightly down from January. Meanwhile, the Bloomberg Economics team has slashed its U.S. GDP forecasts to 0.4% for this quarter and 0.9% next, from 1.5% and 2% previously. On Wall Street, the narrative has shifted from “U.S. exceptionalism” to discussion of recession risks. “Stagflation” has also re-entered the conversation. But Treasury Secretary Scott Bessent says the administration is recalibrating the economy so that growth is led by the private sector, not government spending. Inflation will come down as Trump’s agenda of deregulation, energy expansion and permanent tax cuts takes hold, he said in an interview on Bloomberg TV Friday. — Tariffs and price impact: Why some goods cost more than others. A 10% tariff doesn’t always mean a 10% price increase. While Italian wine might see nearly the full tariff passed to consumers, raising prices by almost 10%, shoes from China might only rise about 4%. Factors like currency fluctuations, available alternatives, and producer pricing strategies influence how much of a tariff consumers actually feel. Moody’s analysis, cited by the WSJ, shows that a 10% tariff on Indian tablecloths would only bump prices by 2%, demonstrating how competition and market dynamics soften the impact of tariffs. — Tariffs update. President Trump has not officially announced new tariffs on the European Union yet, but he has threatened to impose 25% tariffs on EU imports in the near future. During a Cabinet meeting on Feb. 26, Trump stated that an announcement regarding these tariffs would be made “very soon.” He claimed that the tariffs would generally be 25% and would apply to cars and various other products. Trump justified this potential action by asserting that the EU was formed to “screw the United States” economically and that they have succeeded in doing so. He argued that the EU has a much higher tariff on American cars and agricultural products. In response to these threats, the European Commission has stated that it will react “firmly and immediately” against unjustified trade barriers. The EU maintains that high-level discussions with the U.S. are ongoing, and they are still in the early stages of understanding the situation. |

| FINANCIAL MARKETS |

— Equities today: Asian and European stock markets were mixed overnight U.S. stock indexes are pointed to firmer openings. In Asia, Japan +1.7%. Hong Kong +0.3%. China -0.1%. India -0.2%. In Europe, at midday, London +0.6%. Paris +0.8%. Frankfurt +1.4%.

— Retailers brace for economic uncertainty amid consumer boycotts. This week’s earnings reports from Target and Costco Wholesale highlight a retail landscape marked by cautious consumer spending and rising economic uncertainty. Bargain hunting, even among affluent shoppers, has surged as consumer confidence hits an eight-month low. Last Friday’s “economic blackout” day underscored growing consumer dissatisfaction with corporate backtracking on diversity goals. Target faces challenges as budget-conscious shoppers shy away from discretionary items like clothing and electronics. Despite this, BofA analysts remain optimistic about holiday sales and winter item demand. Meanwhile, Costco is capitalizing on opportunities with wealthier consumers and boosting its pharmacy business, maintaining its DEI initiatives. Looking ahead, inflation concerns and tariff impacts have led analysts to cut first-quarter earnings per share estimates for S&P 500 companies by 3.5%, signaling potential headwinds for the broader market.

— Lutnick proposes stripping government spending from GDP measure. U.S. Commerce Secretary Howard Lutnick announced plans to exclude government spending from the gross domestic product (GDP) report, aiming for greater transparency. While offering no timeline for the change, Lutnick argued that current GDP metrics overstate economic performance by including government expenditures. He dismissed fears of a recession despite recent economic indicators and defended the Trump administration’s policies of deep spending cuts and layoffs. Economists warned that altering GDP calculations could increase volatility and hinder comparisons with other economies.

— Trump unveils U.S. crypto reserve plan, boosting market. President Donald Trump announced the inclusion of five digital assets — bitcoin, ether, XRP, solana, and cardano — in a new U.S. strategic reserve of cryptocurrencies. The announcement, made on Truth Social, caused a surge in cryptocurrency values, with bitcoin rising over 11% to $94,164 and ether up 13% to $2,516. The total cryptocurrency market gained over $300 billion, according to CoinGecko. The move marks a significant shift in U.S. crypto policy, with analysts noting its potential to accelerate institutional adoption and provide regulatory clarity. Trump’s administration has taken a more favorable stance toward the crypto industry, including withdrawing SEC investigations into several crypto companies. Trump will host the first White House Crypto Summit on Friday as his administration pushes forward on pro-crypto initiatives.

Of note: Some Republicans raised questions about spending taxpayer money on risky assets instead of paying down the national debt.

— Honda shifts Civic hybrid production to Indiana to dodge tariffs. Honda will produce its next-generation Civic hybrid in Indiana instead of Mexico to avoid potential U.S. tariffs, Reuters reports, citing sources familiar with the matter. The decision marks the first concrete move by a major Japanese automaker to adapt to proposed 25% tariffs under President Donald Trump. Originally set for production in Mexico in 2027, the Civic hybrid will now be built in Indiana from May 2028, with an expected annual output of 210,000 units. The shift highlights how disruptive U.S. tariffs could be for automakers with established global production strategies.

| AG MARKETS |

— Ag markets today:

- Corn and beans weaker, wheat firmer this morning. Corn futures faced light followthrough selling overnight, while wheat firmed. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents lower, soybeans were fractionally to a penny lower and wheat futures were 1 to 2 cents higher. The U.S. dollar index was down more than 700 points, and front-month crude oil futures were modestly firmer.

- Wholesale beef prices trying to stabilize. Wholesale beef prices firmed 65 cents for Choice to $311.83 and slipped 8 cents for Select to $302.05 on Friday. After recent heavy price pressure, wholesale values have stabilized around current levels.

- Belly prices remain volatile. The pork cutout fell $2.54 to $98.42 on Friday amid a $22.88 plunge in primal bellies. Belly prices have been volatile, with large daily prices swings over the past week driving movement in cutout. The CME lean hog index is up a nickel to $89.44 as of Feb. 27, though it has declined four of the last six days.

— Ag trade: South Korea purchased 65,000 MT of U.S. feed wheat and tendered to buy 79,976 MT of rice, with 33,300 MT to be sourced from the U.S. and the remainder from China, Thailand and Vietnam.

— Brazil’s soybean harvest, safrinha corn planting surges. Brazil’s soybean harvest jumped 11 percentage points to 50% done as of last Thursday, according to AgRural. That was two points ahead of the same date last year. Safrinha corn planting surged 16 points to 80%, though that was still six points behind year-ago. AgRural said, “Crops are developing well throughout the region, but the hot and dry weather, which will continue for a few more days on the forecast maps, is causing concern in areas of Paraná, São Paulo, Minas Gerais and Mato Grosso do Sul.”

— Monthly slowdown in soy crush, corn-for-ethanol use expected. Analysts expect USDA to report January soybean crush totaled 210.9 million bu., according to a Bloomberg survey. That would be down 6.8 million bu. (3.1%) from the record in December but up 16.1 million bu. (8.3%) from year-ago. Corn-for-ethanol use is expected to come in at 465.8 million bu., which would be down 7.4 million bu. (1.6%) from December but up 24.7 million bu. (5.6%) from last year.

— Agriculture markets Friday and the week:

• Corn: May corn futures fell 11 1/2 cents to $4.69 1/2, near the session low and hit a six-week low. For the week, May corn lost 35 1/2 cents.

• Soy complex: May soybeans fell 11 1/2 cents to $10.25 3/4 and lost 21 1/2 cents on the week. May soymeal was unchanged at $300.20 but marked a weekly loss of $3.70. May soyoil slid 123 points and marked a 322-point week-over-week loss.

• Wheat: May SRW wheat futures fell 6 3/4 cents to $5.55 3/4, near the daily low and hit a four-week low. For the week, May SRW lost 48 1/4 cents. May HRW wheat futures also hit a four-week low today, closing down 12 1/4 cents to $5.73, near the session low and on the week down 48 3/4 cents. May HRS futures fell 7 cents to $5.97 3/4 and sunk 48 3/4 cents on the week.

• Cotton: May cotton tumbled 135 points to 65.25 cents and marked a weekly loss of 209 points.

• Cattle: The February live cattle contract expired at noon Friday, settling at $197.725, down $1.675 on the day. April live cattle tumbled $3.475 to close at $192.65. That represented a weekly drop of $1.30. Feeder futures also suffered sizeable losses, with nearby March futures declining $1.475 to $274.975, which marked a $7.025 advance from last Friday.

• Hogs: Futures proved unable to sustain their early rebound from Thursday’s big breakdown, with nearby April futures sliding 70 cents to $83.675 to end the week. That marked a weekly drop of $4.00.

| ENERGY MARKETS & POLICY |

— Oil prices steady amid China optimism and Ukraine uncertainty. Oil prices edged up slightly on Monday as positive manufacturing data from China boosted demand hopes, while concerns over a Ukraine peace deal and potential U.S. tariffs tempered gains. Brent crude rose 19 cents, 0.3%, to $73.00 a barrel, and U.S. West Texas Intermediate hit $69.95, up 19 cents. European leaders showed strong support for Ukrainian President Zelenskyy after a tense exchange with President Trump, raising speculation about U.S./Russia relations. Meanwhile, analysts expect oil prices to remain stable through 2025, with Brent averaging $74.63 a barrel.

— Oil prices dipped Friday amid geopolitical tensions and trade concerns. Oil prices fell on Friday, with Brent settling at $73.18 (-1.16%) and WTI closing at $69.76 (-0.84%), marking their first monthly decline since November. The market faced volatility due to a heated Oval Office exchange between Presidents Trump and Zelenskiy over a potential Russia/Ukraine ceasefire, raising speculation about increased Russian oil exports if a peace deal is reached. Further uncertainty stemmed from new U.S. tariffs on Mexican, Canadian, and Chinese imports. Meanwhile, Iraq resumed oil exports from Kurdistan, adding to concerns about OPEC+ compliance. Despite bearish trends, some analysts predict a rebound with rising seasonal fuel demand.

— EPA delays E15 expansion in South Dakota, Ohio. EPA said on Friday it would delay action by one year to allow year-round sales of E15 gasoline in South Dakota and Ohio, two of eight Midwestern states that requested the agency approve year-round sales of the product. States had until Feb. 26 to seek a one-year delay. EPA’s implementation will now only apply to Illinois, Iowa, Minnesota, Missouri, Nebraska and Wisconsin — after South Dakota and Ohio opted for the delay. Kansas, which was not among the eight states addressed in the final rule, had submitted a similar request to the petition as Ohio and South Dakota for a one-year delay, EPA said.

| CONGRESS |

— The Senate is set to hold confirmation votes for Education secretary nominee Linda McMahon and Labor secretary nominee Lori Chavez-DeRemer this week.

— Government shutdown looms as funding deadline nears. With less than two weeks until the March 14 government funding deadline, there’s still no agreement in sight. GOP leaders, who previously promised to handle the situation early, are now scrambling to pass a continuing resolution (CR) to maintain funding at current levels until Sept. 30. However, Democrats are demanding that any funding bill include provisions requiring President Trump to follow congressional spending directives — something Trump has resisted, and Republican leaders oppose. House Speaker Mike Johnson (R-La.) may struggle to pass a CR with only Republican votes, and Democrats are wary of stepping in to help, particularly amid fallout from the DOGE program cuts and layoffs, including 7,000 workers from the Social Security Administration, layoffs at the VA, and FAA layoffs while Musk is pushing to get a new Starlink contract out of the agency. While Johnson recently signaled he won’t pursue DOGE cuts until fiscal year 2026, his stance could create friction within his own party.

| CHINA |

— China’s factory activity gains momentum in February. China’s manufacturing sector saw accelerated growth in February, with the Caixin/S&P Global manufacturing PMI rising to 50.8 from 50.1 in January, a three-month high and above analysts’ expectations of 50.3. The rebound was driven by stronger supply and demand, boosted by seasonal holiday factors and a surge in export orders. However, rising input costs and declining employment presented challenges.

— China suspends beef imports from six South American meat plants. China’s General Administration of Customs (GACC) has suspended beef imports from six meat processing plants in Brazil, Argentina, and Uruguay, following a safeguard investigation into beef imports initiated in December 2024. The exact distribution of affected plants by country remains unspecified, and no official reason for the suspension was provided. This action aligns with China’s broader strategy to protect its domestic beef industry amid oversupply and weak demand. The suspension could significantly impact beef exports from the affected countries, particularly Brazil, which supplies approximately 43% of China’s beef imports. The situation is evolving as the investigation continues, with the potential for further regulatory actions.

| WEATHER |

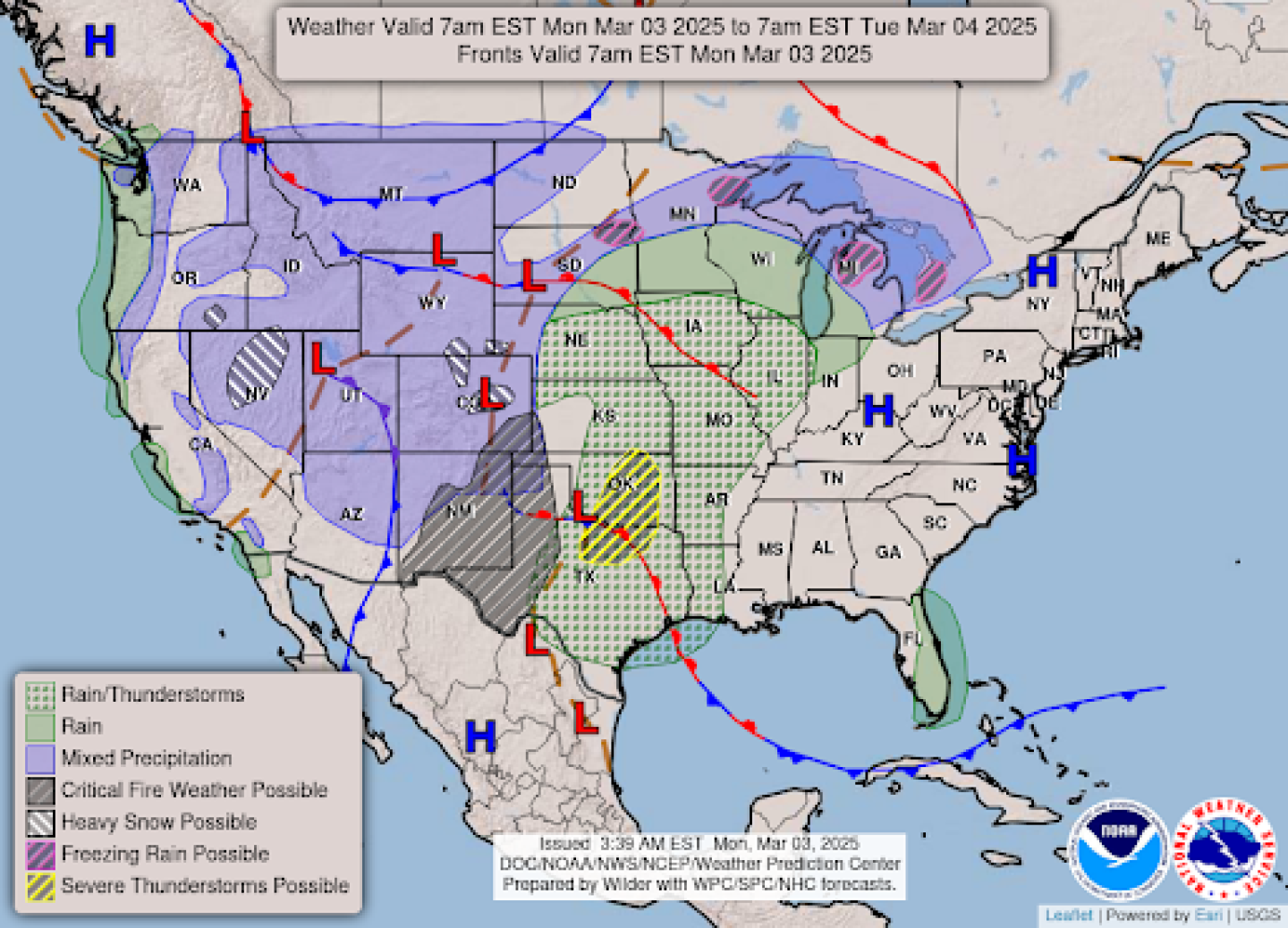

— NWS outlook: A major winter storm ejecting out into the Central U.S. will bring widespread hazards going through midweek including high winds, blizzard conditions, severe weather, and a concern for some flash flooding... ...There is critical to extreme fire weather danger across much of the Southern High Plains going through the early to middle part of the week... ...Much above normal temperatures across the Midwest will move into the Eastern U.S. by midweek, with below normal temperatures over the West

gradually reaching the Plains.

| KEY DATES IN MARCH |

4: Mardi Gras

5: Ash Wednesday

7: Employment report

9: Daylight saving time starts

11: USDA WASDE, Crop Production

12: CPI

13: Purim Fun Jewish holiday

15: Tax filing deadline for partnerships and S corporations

18: NCAA men’s basketball finals

18-19: FOMC meets (interest rates)

20: Spring equinox

21: USDA Chicken & Eggs report

25: USDA Cold Storage report

27: USDA Hogs & Pigs report

27: MLB Opening Day

29: Last day of Ramadan

31: USDA Prospective Plantings, Grain Stocks and Rice Stocks reports | Ag Prices

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | NEC task force on HPAI, egg prices | Options for HPAI/Egg prices | Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |