News/Markets/Policy Updates: July 18, 2024

— Biden has Covid amid calls to end campaign. President Biden has tested positive for Covid-19 and is experiencing mild symptoms, as reported by the White House.

Despite his condition, Biden, who is fully vaccinated and boosted, assured reporters, “I feel good.” He plans to self-isolate according to CDC guidelines.

Of note: Biden walked slowly off Air Force One and appeared to struggle to get into his motorcade Wednesday night.

The source and timing of Biden’s infection are unclear, but his diagnosis comes at a time when Democratic lawmakers are eager for his public presence.

Covid-19 cases have been rising across the U.S., with CDC data indicating a 23.5% increase in emergency visits for Covid-19 during the week ending July 6 compared to the previous week.

— JD Vance comments signal aggressive policy re: China, immigration and trade. Our GOP convention coverage in this dispatch clearly signals Donald Trump’s VP pick is alignment with the former president’s position on being aggressive toward China, immigration and a restructured U.S. trade policy.

— Speaker Johnson calls for Secret Service director’s resignation, promises task force. House Speaker Mike Johnson (R-La.) on Wednesday called for Secret Service Director Kimberly Cheatle to resign in wake of the attempted assassination of former President Trump.

On Wednesday, the Secret Service provided a House-wide briefing to lawmakers about the assassination attempt. Ronald Rowe, deputy director of the Secret Service, and Paul Abbate, deputy director of the FBI, led the briefing.

The Senate had a similar briefing.

House Republicans have subpoenaed Secret Service Director Kim Cheatle, and President Joe Biden has ordered an independent review. The inspector general for the Department of Homeland Security has opened an investigation into the Secret Service’s handling of the shooting. It will take months before the results of these investigations are completed.

| Today’s Digital Newspaper |

MARKET FOCUS

• Biden has Covid as calls accelerate for him to end presidential campaign

• Three Fed speakers today

• Fed focusing on timing of a potential rate cut between September and December

• Beige Book: Economic activity stable but slower growth expected

• ECB holds interest rate steady at 3.75%

• OPEC+ delegates anticipate no changes at monitoring session next month

• Ag markets today

• India plans to ease rice export restrictions

• Grain trader and analyst Richard Crow sums up grain markets

• USDA daily export sales:

— 510,000 metric tons soybeans to unknown destinations, 2024-2025 marketing year

— 150,000 metric tons soybean cake and meal to unknown destinations, 2024-2025

• Ag trade update

• NWS outlook

GOP NATIONAL CONVENTION

• Main themes on third night of Republican National Convention

• Peter Navarro, former White House adviser to Donald Trump, delivered notable speech

• JD Vance, Trump’s VP pick, aggressive on trade, China and immigration policy

CONGRESS

• Bipartisan support for disaster aid package, but unlikely until after August recess

• Sen. Menendez denies reports he plans to resign

ISRAEL/HAMAS CONFLICT

• U.S. military ending temporary pier mission off Gaza coast after limited days of operation

POLICY

• Thune anticipates new farm bill will be completed in 2025

• Farm lenders and financial experts advocate for strong U.S. sugar policy

• Farmdoc looks at crop insurance and statutory reference prices

CHINA

• China buys U.S. new-crop wheat, soybeans, sorghum and cotton

• Takeaways from Third Plenum Communique, according to Trivium China

• China pledges host of reforms, including ‘high-quality development’

• China’s fertilizer exports plunge amid restrictions

• China to probe EU pork for anti-dumping using sampling method

• China’s June pork imports continue to lag sharply from year-ago

TRADE POLICY

• Southern Ag Today: Trade policy also important in next farm bill

ENERGY & CLIMATE CHANGE

• Farm groups advocate for domestic feedstock in tax credits

• Judge orders additional environmental analysis for oil/gas lease sales called for in IRA

• Potential for sustainable aviation fuel production surge in U.S.

POLITICS & ELECTIONS

• Biden facing intensified calls to bow out of the 2024 race

• Most Dems want Biden to drop out of the race: AP-NORC poll

• MSNBC’s Joe Scarborough appears to suggest Biden drop re-election campaign

OTHER ITEMS OF NOTE

• Biden announces additional $1.2 billion in student loan debt forgiveness for 35,000

• Study on farmers’ stress and alcohol use

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened 130 points lower but is now up slightly in volatile trade.

U.S. equities yesterday: Tech shares were under pressure which sent the Nasdaq and S&P 500 lower for the day while the Dow managed an advance. The Dow rose 243.60 points, 0.59%, at 41,198.08. The Nasdaq fell 512.42 points, 2.77%, at 17,996.92. The S&P 500 lost 78.93 points, 1.39%, at 5,588.27.

— Ag markets today: Corn and soybeans pulled back from Wednesday’s corrective gains overnight, while wheat was mostly firmer. As of 7:30 a.m. ET, corn futures were trading mostly 2 cents lower, soybeans were a nickel lower, SRW wheat was fractionally to 2 cents higher, HRW wheat was narrowly mixed and HRS wheat was 5 to 7 cents higher. The U.S. dollar index was around 80 points higher, and front-month crude oil futures were modestly weaker.

Cash cattle trade steady. Light cash cattle trade started at steady $188.00 prices in the Southern Plains on Wednesday. Initial cash cattle trade not only came earlier in the week than anticipated but at stronger prices. Cash bids remained scarce in the northern market, though expectations are now for steady/firmer trade as supplies there are tighter.

Cash hog index rises again. The CME lean hog index is up 18 cents to $88.80 as of July 16, marking the first three-day string of gains since late-May/early June. August lean hog futures finished Wednesday at a $2.85 premium to today’s cash quote.

— Agriculture markets yesterday:

• Corn: December corn rose 3 cents to $4.11 3/4, ending the session above the 10-day moving average.

• Soy complex: August soybeans rose 6 3/4 cents to $10.97 1/4 and near mid-range. September soybean meal closed up $3.40 at $319.40 and near the session high. September soybean oil closed down 81 points at 45.42 cents and near the session low.

• Wheat: December SRW wheat rose 8 cents to $5.63 1/2, while December HRW wheat rose 10 1/2 cents to $5.77 1/2, both closed nearer the session high. December spring wheat rallied 14 1/4 cents to $6.11 1/2.

• Cotton: December cotton closed up 70 points at 72.07 cents and near mid-range.

• Cattle: Nearby August live cattle surged $1.60 to $184.275, but August feeder futures skid 7.5 cents to $258.55. Cash prices for fed cattle are expected to decline again this week.

• Hogs: August lean hog futures firmed 37.5 cents to $91.65 though the contract closed nearer session lows.

— Of note:

• A trio of Fed speakers come today — Austan Goolsbee, Lorie Logan and Mary Daly — in what will be some of the final remarks before the central bank makes its July decision.

— Federal Reserve is focusing on the timing of a potential rate cut between September and December. While the upcoming July 30-31 FOMC meeting is not expected to lower the Fed funds rate, the meetings on Sept. 17-18, Nov. 6-7, and Dec. 17-18 are considered likely for a rate reduction. CME Fed funds futures indicate high probabilities for a cut at each of these sessions. Fed Governor Christopher Waller mentioned that conditions for a rate cut might be right during this period. New York Fed President John Williams highlighted that the Fed will gain significant insights from two months of inflation data between July and September, aligning with the Fed’s data-driven approach. Officials have indicated that lower rates are becoming more likely, but have not committed to a specific timing. By the September FOMC meeting, the Fed will have two updates each on inflation and the job market, which will heavily influence their decision.

— Beige Book: Economic activity stable but slower growth expected. The Fed’s Beige Book highlighting economic activity in the 12 districts noted a slight to moderate pace of growth in most districts during the reporting period. However, expectations for the future of the economy were for slower growth over the next six months due to uncertainty around the upcoming election, domestic policy, geopolitical conflict, and inflation.

Specific to agriculture, districts reported:

• Atlanta: Agriculture conditions improved slightly in recent weeks. Cattle farmers reported strong sales resulting from limited national supply. Poultry sales strengthened amid high beef prices, and poultry farmers expressed increased optimism about the remainder of the year. Dairy farmers saw strong demand and higher sales prices and were confident looking forward, but low cattle supply limited growth opportunities. However, row crops including cotton, continued to see weak demand. Soft grain prices hurt growers but benefitted farmers buying feed. Florida citrus farmers struggled as harvests were disappointing, leading to expectations of more growers exiting the market over the next year.

• Chicago: Farm income expectations for the District waned in late May and June as key crop prices declined. Contacts indicated that farmers were slow to sell crops from storage and were holding back on selling ahead from their anticipated fall harvest in part because of low prices. Although recent flooding covered some acres, corn and soybean planting recovered from earlier weather-related challenges across much of the District, and overall crop conditions were off to a better start than in recent years. Corn, soybean and wheat prices were lower, with a strong wheat harvest already underway. A contact noted that an early wheat harvest would free up fields for second crop soybeans sooner than usual, allowing the soybeans to mature for longer. Milk and egg prices were higher, while hog prices faltered. Cattle prices were flat at a high level.

• St. Louis: Overall agriculture conditions have remained stable since our previous report. The share of major District crops of soy, rice, corn, and cotton rated fair or better declined slightly in every state except Tennessee, where the share remained the same. Despite extreme high heat, soil conditions have improved relative to the drought conditions observed last growing season. District contacts reported that rains earlier in the year have helped protect against high temperatures, but high temperatures remain a concern. Contacts in agriculture equipment and services stated that the slowdown in transactions relative to their peak in 2021–2022 has continued.

• Minneapolis: District agricultural conditions weakened since the last report. Lenders responding to an agricultural credit conditions survey overwhelmingly reported decreased farm incomes in the second quarter of 2024 relative to a year earlier, with expectations for further declines in the coming three months. Poultry producers were concerned about an avian influenza outbreak in the region. While ample precipitation was welcomed in some areas previously affected by drought, other areas were experiencing catastrophic flooding or delayed planting due to excess moisture.

• Kansas City: Agricultural economic conditions in the Tenth District remained subdued alongside weak crop prices. The latest planting estimates and favorable growing conditions suggested corn and soybean production could be strong, factors likely to weigh on prices. Grain stocks from last year also remained elevated within District states and across the U.S., putting additional downward pressure on prices and reducing revenue opportunities. Cattle prices remained strong and continued to support favorable profit opportunities for cow/calf producers. Contacts throughout the region reported some deterioration in financial conditions for farm borrowers that was more pronounced in areas more heavily reliant on crop revenues and less concentrated in cattle production. In addition, elevated production costs, interest expenses and farm household expenditures remained primary concerns for many agricultural lenders.

• Dallas: Crop and pasture conditions broadly improved with sufficient rainfall in most areas, particularly early in the reporting period. Livestock conditions were strong with little to no supplemental feeding needed thanks to ample availability of grazing and hay, and cattle prices continued to strengthen. Expected row crop production is promising, with moisture conditions much more favorable than last year. However, crop prices have fallen to levels below the cost of production for many producers, even with average yields.

• San Francisco: Activity in the agriculture and resource-related sectors decreased slightly. Crop yields and past harvest inventories of tree fruit, tree nuts, and seafood remained high, reducing prices to below the cost of production for apples, grapes, raisins, walnuts, almonds, and frozen salmon. Domestic demand from food services and the retail sector was stable but generally soft, and demand from abroad remained solid.

— ECB holds interest rate steady at 3.75%. Highlights:

• Interest rate decision: The European Central Bank (ECB) has kept its main interest rate at 3.75%, aligning with market expectations.

• Potential September cut: Despite concerns about geopolitical uncertainty and rising wages, the ECB has left the possibility of a rate cut in September open.

• Lagarde’s press conference: Investors await signals about future rate reductions from ECB President Christine Lagarde during her Thursday press conference, following June’s initial quarter percentage point cut.

• Economist predictions: Most economists predict a rate cut at the ECB’s next meeting on Sept. 12, provided inflation data continues to trend towards the 2% target by the end of next year.

• Inflation trends: Eurozone consumer price growth has decreased from a peak of 10.6% in October 2022 to 2.5% in June.

Concerns:

• Political uncertainty: This includes the inconclusive French election raising doubts about a high-spending new government potentially increasing inflation.

• Potential U.S. trade war: A possible Donald Trump victory in the upcoming U.S. presidential election could spark a trade war, contributing to inflation in Europe.

• Wage growth: The Eurozone is experiencing a 5% wage growth as workers seek compensation for significant inflation, keeping inflation above 4% in the services sector.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer ahead of economic data amid weakness in the euro and British pound. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.18%, with a mixed tone in global government bond yields. Crude oil futures swung to losses, with U.S. crude around $82.75 per barrel and Brent around $84.90 per barrel. Futures had been higher in Asian action with U.S. crude around $83.45 per barrel and Brent around $85.50 per barrel. Gold and silver futures were higher, with gold around $2,469 per troy ounce and silver around $30.62 per troy ounce.

— OPEC+ delegates anticipate that the upcoming monitoring session next month will proceed as planned without any adjustments. The group, led by Saudi Arabia and Russia, decided last month to incrementally increase crude oil production by about 2.2 million barrels per day starting in October. Initially, this decision caused a drop in prices, prompting officials to suggest that the committee meeting on Aug. 1 could delay the increase if needed. However, since then, the market has recovered, with Brent futures prices nearing $85 per barrel.

— India plans to ease rice export restrictions. India is likely to cut the floor price for basmati rice exports and replace the 20% export tax on parboiled rice with a fixed duty on overseas shipments, government sources told Reuters. India is expected to lower the minimum export price for basmati rice to $800.00 to $850.00 per metric ton from $950.00 a ton currently to boost shipments. New Delhi would also review the export ban on non-basmati white rice after assessing the progress of rice planting, the sources said. The country’s rice stocks at state warehouses jumped to 48.51 MMT as of July 1, the highest ever for the month and nearly 19% more than last year, according to the Food Corporation of India.

— Grain trader and analyst Richard Crow sums up the grain markets: “The markets have been unable to hold any rally. The idea of a large U.S. crop in beans and corn continues. The August report is three weeks away, and the weather in the U.S. is not threatening the report. The export demand has been questioned; this morning’s export sales report will give a read. The bean market has limited new crop demand registered. The lack of China interest may be tied to the political climate in the U.S. However, they cannot stay away forever in the bean market. For corn and wheat, it may be a different situation. Forward prices and production in parts of the world will be watched as planting time comes.”

— USDA daily export sales: • 510,000 metric tons soybeans to unknown destinations, 2024-2025 marketing year

• 150,000 metric tons soybean cake and meal to unknown destinations, 2024-2025

— Ag trade update: Japan purchased 115,208 MT of milling wheat via its weekly tender, including 55,318 MT U.S. and 59,890 MT Canadian. Algeria purchased between 700,000 and 750,000 MT of optional origin milling wheat, most of which is expected to be sourced from the Black Sea region.

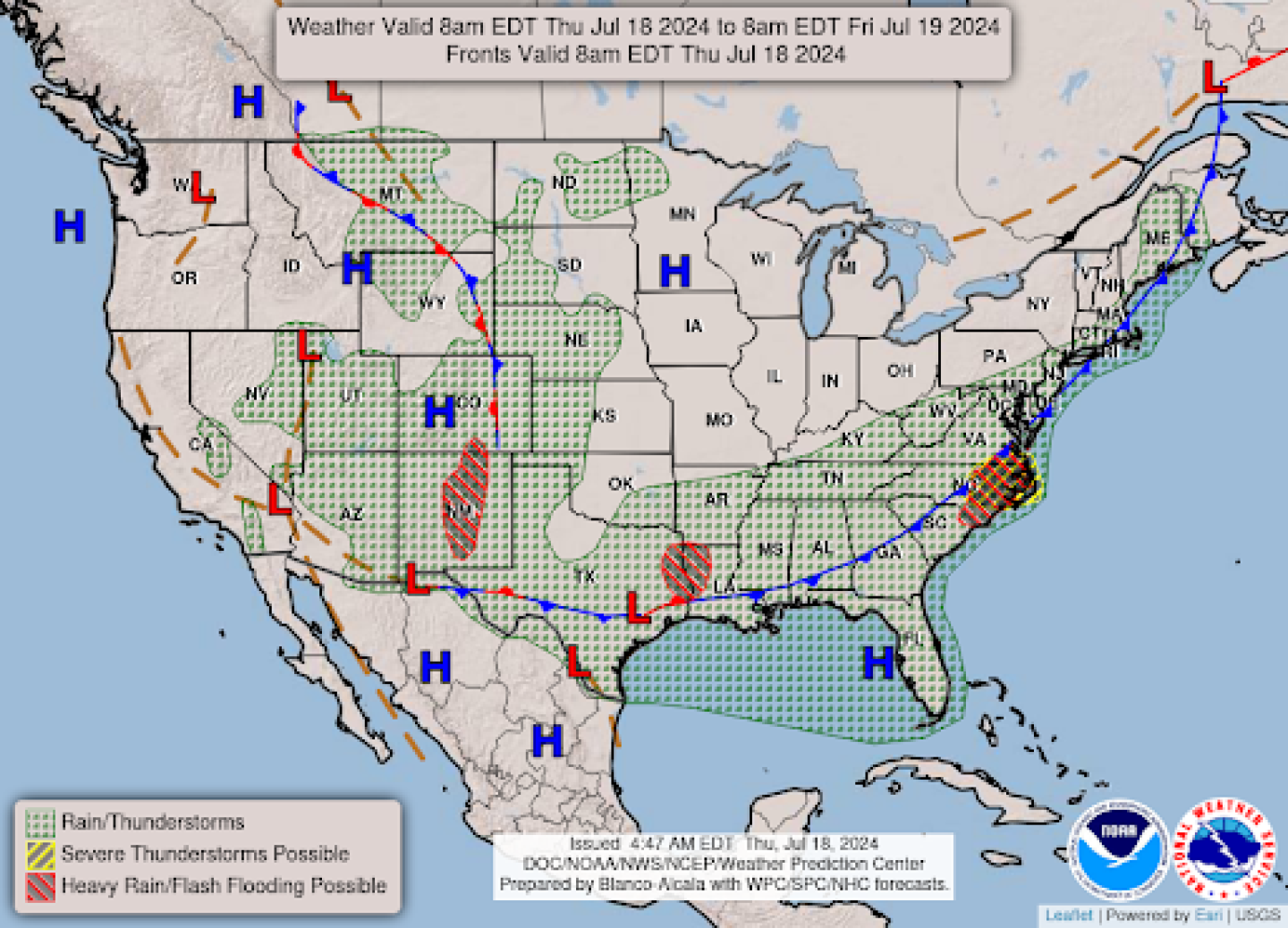

— NWS outlook: There is a Slight Risk of severe thunderstorms over parts of the southern Mid-Atlantic on Thursday... ...There is a Slight Risk of excessive rainfall over parts of the southern Mid-Atlantic, Southern Plains/Lower Mississippi Valley, and Southern High Plains/Southern Rockies on Thursday and over the southern Mid-Atlantic and

Southern Rockies on Friday... ...There are Excessive Heat Warnings/Watches and Heat Advisories over parts of the Pacific Northwest into parts of California/Southwest.

| GOP National Convention |

— Main themes highlighted by speakers on the third night of the Republican National Convention:

• National security and foreign policy: Speakers focused on critiquing President Biden’s handling of international crises, particularly in Europe and the Middle East. They emphasized a vision of foreign policy under a potential second Trump term, contrasting it with the current administration’s approach.

• Criticism of Biden administration: The convention featured sweeping critiques of President Biden, portraying him as a weak commander-in-chief and head of state. Speakers addressed issues such as border security, claiming a porous Southern border under the current administration.

• JD Vance’s vice-presidential introduction: As the newly announced vice-presidential nominee, J.D. Vance introduced himself to a national audience. He highlighted his background, vision for the country, and addressed issues like housing affordability and economic challenges faced by American families. (See next item for details.)

• Afghanistan withdrawal: The convention featured emotional testimonials from families of soldiers lost in the Kabul airport attack, criticizing Biden’s handling of the Afghanistan withdrawal.

• Russia-Ukraine conflict: Vance’s stance on ending U.S. aid to Ukraine was noted, aligning with Trump’s position on the conflict.

• American manufacturing and economic revival: Vance emphasized the need to revitalize American manufacturing and restore factories.

• Peter Navarro, a former White House adviser to Donald Trump, delivered a notable speech shortly after his release from federal prison. Navarro dramatically declared, “I went to prison so you don’t have to,” framing his incarceration as a sacrifice for the party’s supporters. He characterized his experience as a “wake-up call” for the audience, suggesting that they could face similar treatment. He had been found guilty of criminal contempt of Congress for failing to cooperate with the investigation into the Jan. 6, 2021, attack on the U.S. Capitol. In an unusual move, Navarro brought his fiancé onstage during his speech. He received a standing ovation.

Bottom line: These themes collectively presented a critique of the current administration while outlining the Republican vision for national security, foreign policy, and domestic issues under potential Trump/Vance leadership.

— JD Vance, Trump’s VP pick, aggressive on trade, China and immigration policy. JD Vance, Donald Trump’s vice-presidential running mate, delivered a speech Wednesday evening at the Republican National Convention, focusing on his personal background and his commitment to the America First agenda, including aggressive trade and immigration policies. Link to transcript of Vance’s address.

Vance presented himself as a “working-class boy” with humble origins, emphasizing his journey from a challenging upbringing to becoming a U.S. Senator. He shared his story of growing up in a working-class family in southwestern Ohio, dealing with his parents’ divorce and his mother’s struggle with drug and alcohol abuse.

Vance vowed to fight for “forgotten” workers, aligning himself with Trump’s populist message. He stated, “I’m here to tell you that the American dream is alive and well, but it’s under attack by the radical left and the Washington establishment.”

Vance also leaned into tensions with traditional conservatives, highlighting his commitment to the America First agenda. He declared, “We’re not just here to win an election. We’re here to transform our country and restore the promise of the American dream for every single citizen.”

A few key policy areas were mentioned:

• America First agenda: Vance emphasized his commitment to the America First approach, which typically includes policies on trade, immigration, and foreign policy.

• Defense spending: He mentioned a shift in approach regarding defense expenditure among U.S. partners, indicating an end to complacency in this area.

• Ukraine: Vance expressed a desire for a swift resolution to the Ukraine crisis. He advocated for shifting focus away from Ukraine and towards addressing the challenges posed by China, which he views as the most significant threat to the United States. This stance aligns with the “America First” doctrine that Vance supports, which generally emphasizes a more cautious approach to committing U.S. troops overseas. Russian Foreign Minister Sergey Lavrov commented on Vance’s support for ending aid to Ukraine, stating that it aligns with Russia’s desire for peace.

• Immigration: Vance criticized President Biden’s immigration policy, suggesting a tougher stance on border control and immigration reform.

• China policy: The speech included tough rhetoric on China, implying a more confrontational approach to U.S./China relations. Vance emphasized the need to “stop the Chinese Communist Party from building their middle class on the backs of American citizens,” suggesting a tougher stance on trade with China.

• Trade policy: Vance criticized President Biden for supporting NAFTA, calling it a “bad trade deal that sent countless good jobs to Mexico.” This comment suggests that Vance is taking a stance against free trade agreements that he believes harm American workers, aligning with the “America First” economic approach often associated with Donald Trump’s policies. (NAFTA passed with Republican votes as well.) He attributed job losses in Ohio and across the nation to Biden’s backing of NAFTA. He also criticized China’s entry into the World Trade Organization in 2001, linking it to job losses and economic challenges in the United States. He pledged to boost domestic manufacturing, stating, “We’re done sacrificing supply chains to unlimited global trade.” This indicates that Vance’s position represents a shift from traditional Republican trade policies, further emphasizing the change in the party’s approach to trade under Trump’s influence and a move toward protectionism.

• Energy policy: Vance stopped short of calling for more fossil fuel production or blasting electric vehicles, as he has in the past. But his message was clear: President Joe Biden’s clean energy agenda is harming Americans. Like other speakers at the convention Wednesday, Vance mocked the administration’s energy and climate goals as a “Green New Scam.” During his address, Vance said: “It’s about the energy worker in Pennsylvania and Ohio who doesn’t understand why Joe Biden is willing to buy energy from tinpot dictators across the world, when he could buy it from his own citizens right here in our own country… We’re done buying energy from countries that hate us; we’re going to get it right here, from American workers in Pennsylvania and Ohio and across the country.”

• Economic policies: Vance vowed to fight for “forgotten” workers and restore the American dream, suggesting policies aimed at supporting working-class Americans. In a speech crafted to appeal to blue-collar, swing-state workers, Vance specifically indicted “Wall Street barons” for the crisis of housing affordability.

| CONGRESS |

— Bipartisan and bicameral support for a disaster aid package, but action is unlikely until after the August recess, according to Politico. FEMA predicts that the Biden administration will nearly deplete its Disaster Relief Fund, which currently has about $9 billion, resulting in a $6 billion shortfall before the new fiscal year starts in October. The Department of Transportation reports that the emergency highway fund, which has been covering costs from the collapse of the Francis Scott Key Bridge in Baltimore, has about $900 million left. There is support in Congress for an emergency aid package following President Biden’s request for $4 billion in emergency cash. However, immediate action is hindered by ongoing regular funding bills and other political issues.

Timeline: Lawmakers are working on turning Biden’s request into a supplemental spending package, which may not be finalized until September. It could be handled either ahead of the Sept. 30 shutdown deadline or as part of a stopgap funding measure.

Of note: The House Ag Committee will hold a hearing Tuesday morning, July 23, on “Financial Conditions on Farm Country.” This comes amid declining commodity prices, ag-related weather woes in different parts of the country, and reports of some bankers calling in loans. Key factors that will likely be cited at next week’s hearing:

• Farm production: Farmers are expected to harvest record corn and soybean crops.

• Commodity prices: Ongoing decline in prices is negatively affecting farm income.

• Regional reports (more details in previous item above):

— Chicago Fed: Farm income expectations weakened; farmers are slow to sell due to low prices. Corn, soybean, and wheat prices down; hog prices faltered; milk and egg prices up; cattle prices flat at high levels.

— Minneapolis Fed: Agricultural conditions weakened; farm incomes decreased in Q2 2024 with further declines expected.

— Kansas City Fed: Strong corn and soybean production expected to lower prices; high grain stocks putting downward pressure on prices.

— St. Louis Fed: Crop conditions stable with high rainfall; slowdown in agriculture equipment and services transactions.

— Atlanta Fed: Improved conditions with strong cattle, poultry, and dairy prices; struggling citrus farmers in Florida.

— Dallas Fed: Improved livestock conditions due to eased drought; strong cattle prices.

— San Francisco Fed: Low market prices for apples, grapes, raisins, walnuts, almonds, and frozen salmon due to large inventories.

• Net farm income: Expected to fall in 2024 for the second consecutive year, down from the 2022 record but still the fourth-highest ever at $116.1 billion, 15% above the 10-year average.

Bottom line: The farm income outlook is weakening due to low commodity prices despite high production levels. Different regions are experiencing varied impacts, with some areas seeing improved conditions for livestock and dairy. Economic pressures and potential policy changes, such as interest rate cuts, are being closely monitored.

Of note: Operating loans up: The volume of new operating loans issued by ag banks during the second quarter of 2024 was up 20% from a year ago, rebounding with the rise in production costs, said a national survey. Link for details.

— Sen. Bob Menendez (D-N.J.), recently convicted on several corruption charges, denies reports that he plans to resign. Menendez told CBS News that he has not resigned and has not discussed resignation with any allies, suggesting that attempts to pressure him into making a statement are misguided. Despite calls for his resignation from Senate Democrats, including Senate Majority Leader Chuck Schumer (D-N.Y.), Menendez remains firm in his position. If he were to resign, New Jersey Governor Phil Murphy (D) would appoint a successor to keep the seat in Democratic control.

| ISRAEL/HAMAS CONFLICT |

— U.S. military is ending its temporary pier mission off the Gaza coast after limited days of operation. The pier delivered over 19 million pounds of humanitarian aid, but future shipments will go through an Israeli port. US officials assert the mission was successful, but the pier, anchored in Gaza since May, faced numerous issues. Analysts criticize the $230 million effort, saying it did little to improve the severe conditions in Gaza amid the ongoing war between Hamas and Israel.

| POLICY UPDATE |

— Senate Minority Whip John Thune (R-S.D.) anticipates the new farm bill will be completed in 2025, ideally under a Republican majority in the Senate. Speaking at a CNN/Politico event during the Republican National Convention, Thune, who aims to become the GOP Senate leader, expressed doubts about finishing the bill this year. He emphasized its importance to his state’s economy but acknowledged significant differences that will likely delay its completion until next year. Thune hopes the GOP will be in the majority when the bill is finalized.

— Farm lenders and financial experts advocate for strong U.S. sugar policy. Sixty farm lenders and financial experts urged Congress to reinforce U.S. sugar policy in the farm bill, opposing any efforts to weaken the farm safety net. The letter (link) emphasizes that an effective safety net is crucial for lenders to extend operating loans to sugarbeet and sugarcane farmers, given the significant investments required. Highlights of the letter signed by CoBank and 59 other financial institutions, CPAs, and tax professionals from over a dozen states:

• Financial stability: Strengthening U.S. sugar policy is essential for maintaining a stable financial framework for continued investment by family farmers and sugar processors.

• Rising costs: The cost of growing sugarbeets and sugarcane has increased by over 30% since the 2018 Farm Bill, highlighting the need for a robust safety net.

Consequences of weakening policy

• Increased financial risk: Weakening the no-cost U.S. sugar policy would heighten the risk of loan defaults and raise the financial risk associated with sugar production.

• Threat to jobs and farms: Unlimited foreign sugar imports could threaten multi-generational family farms and over 151,000 jobs in the sugar supply chain.

• National food security: Dependence on foreign sugar suppliers could compromise national food security and rely on producers with lower sustainability, labor, and environmental standards.

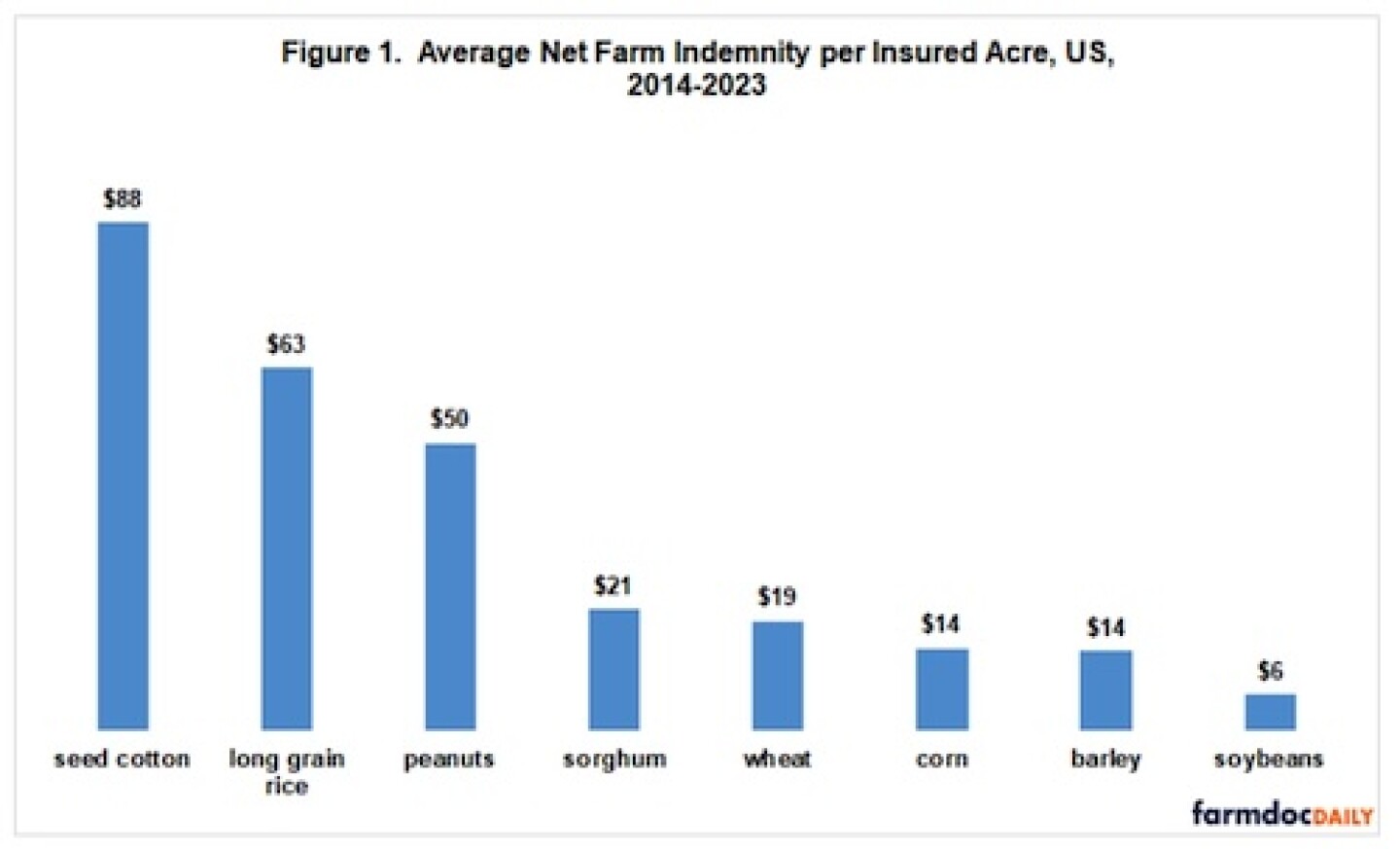

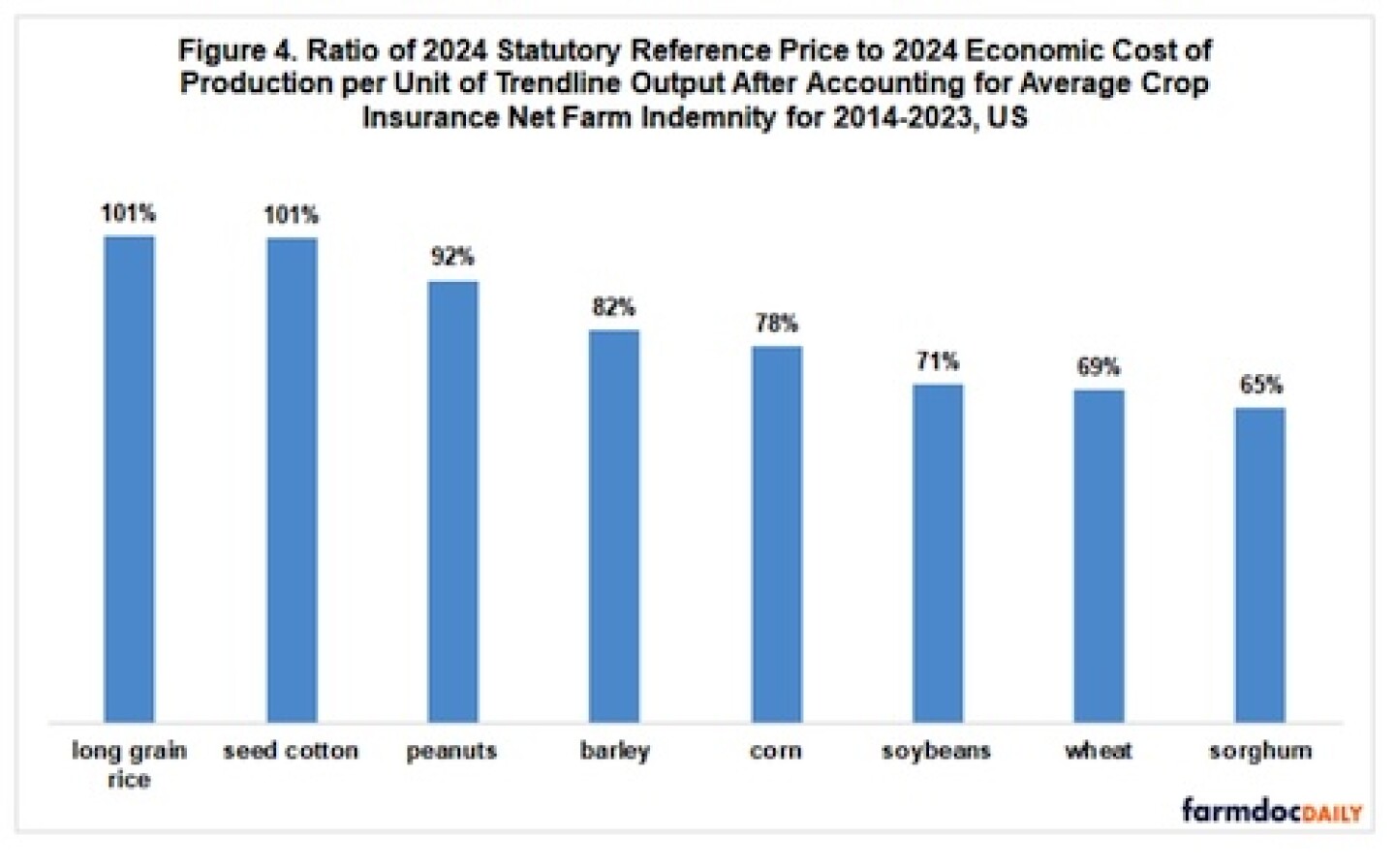

— Farmdoc Daily looks at crop insurance and statutory reference prices. In a report today (link), Farmdoc Daily says over the last ten crop years, net crop insurance payments per insured acre varied significantly, by a factor of 10, across different program crops, even when adjusted for total economic production costs. Ignoring these payments, the writers say, suggests that the farm safety net, including crop insurance and commodity programs, might cover more than the actual cost of production. They conclude this could lead to increased production costs and potentially stimulate higher production levels.

| CHINA UPDATE |

— China buys new-crop wheat, soybeans, sorghum and cotton. USDA Export Sales data for the week ended July 11 included fresh activity in sales to China for both old- and new-crop. For 2023-24, USDA reported net sales of 60,500 metric tons of sorghum, 137,000 metric tons of soybeans, and 5,604 running bales of upland cotton. Activity for 2024-25 included net sales of 72,300 metric tons of wheat, 50,000 metric tons of sorghum (their first for the marketing year), 10,000 metric tons of soybeans, and 32,125 running bales of upland cotton. Net sales for 2024 of 4,720 metric tons of beef and 2,843 metric tons of pork were also reported.

— Takeaways from the Third Plenum Communique, according to Trivium China:

• No major surprises: The Third Plenum communique didn’t reveal any groundbreaking reforms, which is typical for these concise documents. Detailed decisions expected soon may provide more insights.

• Leadership’s economic concerns: For the first time, top leadership discussed the economy’s current state at the Plenum, signaling increased worry about economic struggles.

• Focus on technological innovation: Developing technological capabilities is now central to economic policy, with a new section dedicated to boosting innovation, unlike the 2013 plan.

• National security emphasis: The new reform plan includes a section on “modernizing the national security system,” highlighting its growing importance.

• Limited fiscal reforms: Fiscal reforms are less extensive than expected, integrated as part of broader macroeconomic management rather than a separate section.

• Distinction between economic sectors: Despite lobbying, the communique maintains a clear distinction between the “public economy” and “non-public economy,” not elevating the private sector.

• Pro-trade and globalization: China remains committed to further liberalizing trade and investment regimes despite global protectionist trends.

Bottom line: Mixed news for foreign businesses. While China’s economy will become more market-oriented, the focus on national security could limit dependence on foreign companies in many industries.

Of note: The Central Committee’s Third Plenum communique reveals anxiety about the current economic situation.

Communique highlights:

• No major surprises or earth-shattering reforms.

• Focus on analyzing the current economic situation and tasks, emphasizing the importance of achieving annual economic and social development goals.

• Short-term focus: The discussion of the short-term economic outlook in the communique is a significant shift from the usual medium and long-term planning of past plenums.

• Leadership worry: Indications are that the leadership is clearly worried about the struggling economy.

• Potential policy interventions: More aggressive policy interventions might emerge from the upcoming econ-focused Politburo meeting at the end of the month.

— China pledges host of reforms, including ‘high-quality development’. “High-quality development is the top mission of building a modern socialist country,” Chinese leaders pledged after the Third Plenum of the Communist Party, according to the official Xinhua news agency. Chinese leaders pledged to modernize the country’s industrial complex, expand domestic demand, curb debt and property sector risks, as well as implement financial and fiscal reforms. Beijing wants to improve social security, healthcare and income distribution systems and introduce land reforms. China will “enhance the role of market mechanisms in the economy, create a fairer and more dynamic market environment and optimize the efficiency of resource allocation. Restrictions on the market will be lifted, while effective regulation will be ensured to better maintain order in the market and remedy market failures.”

— China’s fertilizer exports plunge amid restrictions. China’s exports of urea plummeted to 140,000 MT during the first half of this year, down 86.2% from the same period last year. Exports of di-ammonium phosphate (DAP) during the January to June period dropped 37% from a year ago to 1.51 MMT, while mono-ammonium phosphate (MAP) exports were virtually unchanged at 930,000 MT.

— China to probe EU pork for anti-dumping using sampling method. China has put three companies from the European Union at the center of its anti-dumping investigation into pork products from the bloc. Beijing has chosen Danish Crown A/S, Vion Boxtel BV, and Litera Meat S.L.U. — the top three exporters of pork products in the region to China — to determine if dumping has occurred and assess the damage to the domestic sector, the commerce ministry said. The investigation, which began June 17, will look into pork and its by-products imported from the EU after the bloc decided to impose anti-subsidy duties on Chinese electric vehicles.

— China’s June pork imports continue to lag sharply from year-ago. China imported 90,000 MT of pork in June, up 12.5% from May but 33.5% less than last year. Through the first half of 2024, China’s pork imports totaled 520,000 MT, down 45.3% from the same period last year.

| TRADE POLICY |

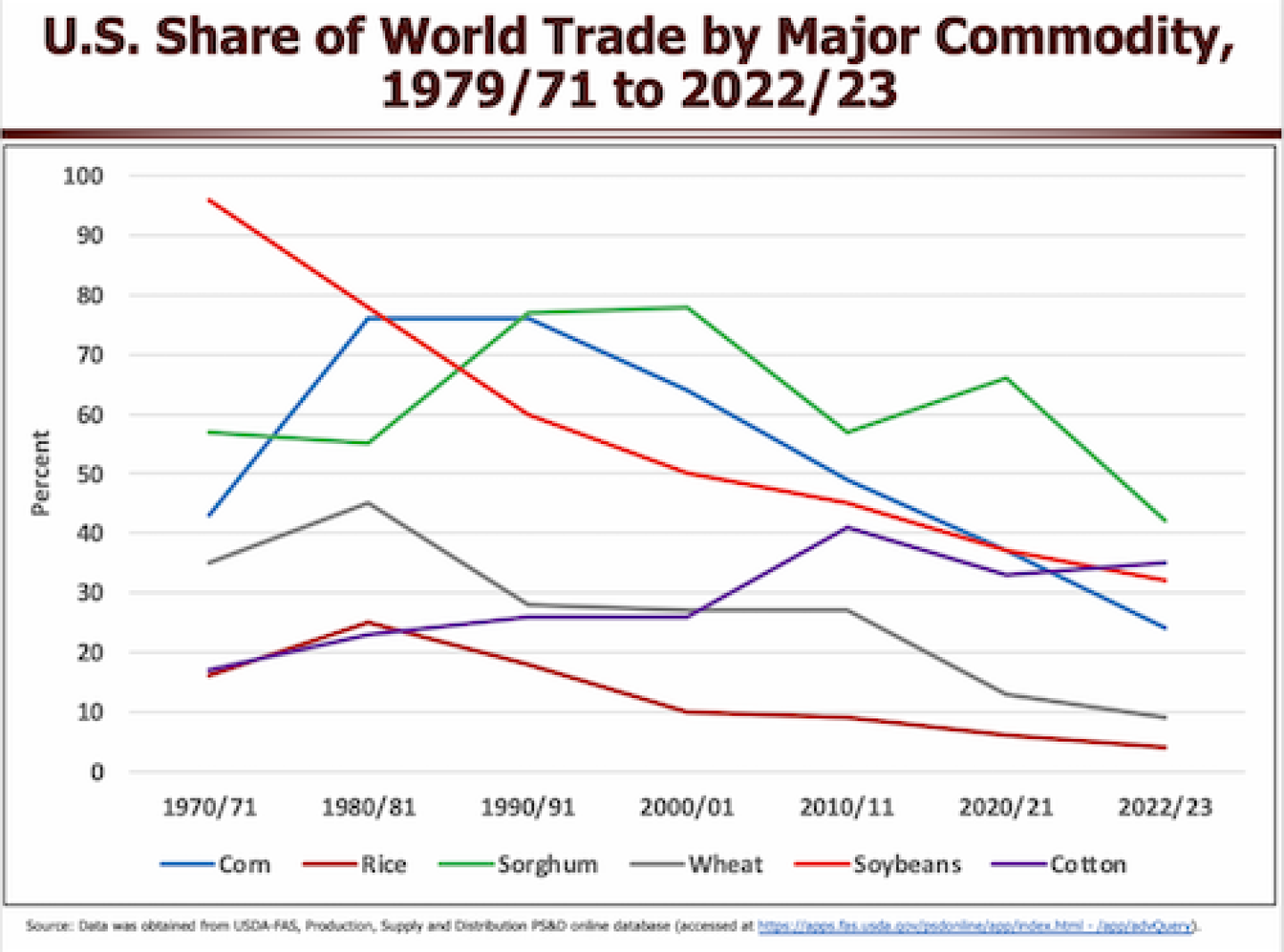

— Southern Ag Today: Trade policy also important in next farm bill. The latest issue of Southern Ag Today (link), notes the U.S. share of exports for major commodities has been steadily declining, exacerbating the cost-price squeeze due to high input costs. It says there is a call for meaningful enhancements in commodity programs and increased funding for trade promotion programs.

Trade promotion programs

• Foreign Market Development Program (FMD): Partners with agricultural organizations to reduce trade barriers and expand export opportunities by identifying new markets or improving processing capabilities.

• Market Access Program (MAP): Provides cost-sharing for consumer-oriented activities to increase demand for U.S. agricultural commodities.

Funding history and proposals

• Historical funding: The last increase in FMD and MAP funding was in the 2002 Farm Bill, setting MAP at $200 million and FMD at $34.5 million.

• Proposed increases: The House Agriculture Committee’s Farm, Food, and National Security Act of 2024 and the Senate Republican-drafted farm bill framework propose doubling MAP and FMD funding.

Bottom line: SAT writers (Dr. Joe Outlaw and Dr. Bart Fischer) say that while farm bills typically focus on commodity programs, enhancing market development activities is crucial to stimulate demand for U.S. agricultural products, benefiting the entire agriculture sector.

| ENERGY & CLIMATE CHANGE |

— Farm groups advocate for domestic feedstock in tax credits. Four farm groups in a letter (link) urged the Biden administration to ensure that lucrative tax credits of up to $1.25 a gallon are available only for low-carbon fuels made from U.S.-grown feedstocks. They also recommended broadening the list of climate-smart farming practices to produce lower-carbon “sustainable” crops.

• Request for 45Z tax credits: Four farm groups urged the Biden administration to limit lucrative tax credits (up to $1.25 per gallon) to low-carbon fuels made from U.S.-grown feedstocks.

• Broader climate-smart practices: The groups also called for an expanded list of climate-smart farming practices for producing lower-carbon “sustainable” crops.

• Signatories: The letter was signed by: American Farm Bureau Federation; National Farmers Union; National Corn Growers Association, American Soybean Association.

Program details:

• 45Z Tax credits: These tax credits will be available in 2025 for sustainable aviation fuel (SAF). The administration has yet to issue regulations for these credits.

• 40B tax credits: Current guidance for 40B tax credits (for SAF produced from 2022-24) only qualifies a fraction of U.S. biofuels, lacking a domestic feedstock requirement and being rigid in its farming practice stipulations.

Concerns and recommendations

• Domestic benefits: The farm groups emphasized that without clear domestic feedstock requirements, the policy’s benefits might be diverted from American farmers.

• Expanded compliance options: They criticized the 40B guidelines for being too strict and suggested additional compliance options for qualifying feedstocks.

Related developments

• Pilot project announcement: CF Industries and Poet announced a pilot project using low-carbon ammonia fertilizer to grow corn for ethanol production, potentially reducing ethanol’s carbon intensity by up to 10%. The project will start this fall and continue through the 2025 harvest.

— Judge orders additional environmental analysis for oil/gas lease sales called for in IRA. U.S. District Court Judge Sharon Gleason has ordered the Department of Interior to conduct additional environmental analysis for the offshore oil lease sales in Alaska’s Cook Inlet, mandated by the Inflation Reduction Act (IRA). Judge Gleason ruled that the initial environmental review did not adequately consider factors to reduce environmental impacts. While this ruling does not stop the lease sales, it requires the Interior to supplement its analysis. One sale made under the auction is suspended until the additional analysis is completed.

— Potential for sustainable aviation fuel production surge in the U.S. Reuters reported (link) that U.S. sustainable aviation fuel (SAF) production capacity could increase by 1400% in 2024 if all planned capacity additions are realized, according to the U.S. Energy Information Administration (EIA).

• Biofuels production increase: Domestic biofuels production is expected to rise by about 50% in 2024, driven primarily by the increase in SAF production.

• Government goals: The White House aims to meet the entire U.S. aviation fuel demand with SAF by 2050 and to supply at least 3 billion gallons annually by 2030.

Current and future production

• Jet fuel consumption: In 2023, the U.S. consumed around 1.6 million barrels per day (bpd) of jet fuel.

• SAF production increase: The EIA projects SAF output to grow from 2,000 bpd to nearly 30,000 bpd in 2024.

Notable projects:

• Phillips 66’s Rodeo facility: Achieved a renewable fuel production target of 50,000 bpd in June 2023, with 10,000 bpd being SAF.

• Valero’s Diamond Green project: In partnership with Darling Ingredients, this project at the Port Arthur, Texas refinery is expected to produce 15,000 bpd of SAF by the end of 2024.

Importance and Investments

• Environmental benefits: SAF, produced from agricultural and waste feedstocks, has gained increased investments due to the U.S. Environmental Protection Agency’s Renewable Fuel Standard.

• Strategic goals: Increasing SAF production is critical to meeting long-term environmental and energy goals set by the government.

| POLITICS & ELECTIONS |

— President Joe Biden facing intensified calls to bow out of the 2024 race. Prominent Democrats are voicing concerns about his ability to secure victory against former President Donald Trump. Rep. Adam Schiff, a high-profile Democrat and leading candidate for Senate in California, has publicly called on Biden to “pass the torch” and drop out of the race. Schiff expressed serious doubts about Biden’s capacity to defeat Trump in November, stating that while the decision to withdraw is ultimately Biden’s, he believes it’s time for the president to step aside.

This call comes in the wake of Biden’s recent lackluster debate performance on June 27, which has sparked worries among Democrats about his competence to lead for another term. Schiff’s statement reflects a growing sentiment within the party, as a recent poll (see next item) indicates that nearly two-thirds of U.S. Democrats believe Biden should allow the party to select a new candidate.

Adding to the pressure, Senate Majority Leader Chuck Schumer (D-N.Y.) had a “blunt” private conversation with Biden about the 2024 election. While the exact details of the meeting remain confidential, Schumer presented Biden with polling data about the current state of the race and its potential impact on the party’s future.

Former House Speaker Nancy Pelosi (D-Calif.) Pelosi is engaging in private discussions with anxious House Democrats who are concerned about Biden’s impact on the 2024 campaign. While not explicitly endorsing or opposing Biden’s continued candidacy, Pelosi is working behind the scenes to shape the party’s strategy. In a private conversation with Biden, Pelosi reportedly shared polling data suggesting he might struggle to defeat Donald Trump in the upcoming election. She also expressed worries about how his campaign could affect Democratic prospects in House elections

Recent polls show a close national race between Biden and Trump, with Trump leading in crucial battleground states, albeit within the margin of error. Biden’s approval ratings also present a challenge, with his disapproval rating among registered voters standing at 58.0% as of July 16.

Despite these calls and concerns, Biden remains resolute about continuing his campaign. He has refuted suggestions to drop out, emphasizing his determination to stay in the race and citing his accomplishments and mental sharpness compared to Trump.

The situation is further complicated by Biden’s recent positive test for Covid-19, which will temporarily keep him off the campaign trail. Meanwhile, failed discussions within the Democratic Party about potentially delaying Biden’s formal renomination until Aug. 1 indicate ongoing deliberations about his candidacy.

— Most Dems want Biden to drop out of the race: AP-NORC poll. Nearly two-thirds of Democrats say Biden should withdraw from the presidential race and let his party nominate another candidate, according to a new poll (link), sharply undercutting his post-debate claim that “average Democrats” are still with him even if some “big names” are turning on him.

— MSNBC’s Joe Scarborough appears to suggest President Biden drop his re-election campaign. The cable TV host ripped the commander-in-chief’s inner circle for keeping him in the race. “This is not going to end well if it continues to drag out,” Scarborough said during a lengthy spiel on his “Morning Joe” talk show. Scarborough, who has staunchly defended the 81-year-old president in recent weeks despite the mounting calls for him to step aside, called on those closest to Biden to help him “do the right thing… It’s really incumbent on people that are around Joe Biden to step up at this point and help the president and help the man they love and do the right thing,” he said. “The anger I hear are at the people that are keeping him in a bubble or who may have their own interests, some financial, in keeping him in the race. That is the real anger,” Scarborough continued. “It is widespread. Joe Biden deserves better. He deserves better than he is getting from those closest to him.”

| OTHER ITEMS OF NOTE |

— President Biden announced an additional $1.2 billion in student loan debt forgiveness for 35,000 public-sector workers, including teachers, nurses, and firefighters. These borrowers qualify for debt cancellation after making 10 years of payments while working in a qualifying public-sector job. The Biden administration highlights its record of canceling over $168 billion in student loan debt for nearly 4.8 million Americans, more than any previous administration. However, its main one-time student loan forgiveness program remains in legal uncertainty, with the Supreme Court soon to decide whether to block part of the SAVE plan while the issue is litigated.

— Study on farmers’ stress and alcohol use. A University of Georgia study (link) found that one in five U.S. farmers report binge drinking when experiencing high stress levels. The study highlights a link between farmers using alcohol to cope with the unique stresses of farming, including long hours, dangerous tasks, and financial risks. The study was published in the Journal of Agromedicine.

Healthcare access: Farmers face barriers to mental health care such as stigma, lack of trust in providers, and logistical challenges common in rural areas.

Stigma: Seeking mental health care is often stigmatized within the farming community, leading many to turn to alcohol instead.

Prevalence: 96% of farmers reported drinking alcohol, with over one-third consuming multiple drinks weekly, comparable to the general U.S. adult population.

Community resources: Farmers with strong community support and resilience are less likely to drink excessively.

Intervention: Promoting open conversations about mental health in rural areas and training local community members can help reduce stigma and encourage farmers to seek help.

Mental health and suicide: The study underscores the public health issue of mental health stigma in farming communities, linking it to higher suicide risks.

Call to action: The authors stress the importance of community involvement in addressing mental health to ensure the well-being of farmers and the stability of the global food supply.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |