News/Markets/Policy Updates: Nov. 18, 2024

— USDA to announce $2 billion to $3 billion in aid to specialty crop producers modeled on the CFAP 2 program. The funds will reportedly come from USDA’s Commodity Credit Corporation (CCC). — It may take longer than expected for President-elect Donald Trump to invoke tariffs on some countries if implementation is done via a budget reconciliation measure. If so, funds received from tariffs would be used to offset extension of some 2017 tax cuts. If tariffs are announced via executive order, the Congressional Budget Office is unlikely to count the tariffs funds as an offset, sources advise. — Biden approves long-range missiles for Ukraine after Russian escalation. After nearly 1,000 days of war, President Biden is allowing Ukraine to use U.S. long-range ATACMS missiles to strike military targets inside Russia. This decision follows a brutal Russian missile assault on Ukraine’s energy infrastructure and the arrival of 10,000 North Korean troops in Russia (perhaps many more), reportedly to push Ukrainian forces out of Russia’s Kursk region. The White House aims to bolster Ukraine’s position before Biden’s term ends, while Donald Trump indicates a desire to end the conflict, though specifics remain uncertain. A leaked report from the Trump camp revealed that Donald Trump, in a recent phone call, urged Vladimir Putin not to escalate the Ukraine conflict. Putin’s response came swiftly, marked by deploying North Korean troops and launching a missile assault on Ukraine’s energy infrastructure. This escalation, as winter approaches, underscores Putin’s aim to push Ukrainian forces out of Russian territory, solidifying his hold on eastern Ukraine. Analysts say Russia’s escalatory tactics hint at tough settlement terms for Ukraine. — Caraveo, Chavez-DeRemer lose, Costa wins. House Ag Committee members Yadira Caraveo, a Colorado Democrat, and Lori Chavez-DeRemer, an Oregon Republican, lost re-election bids. But Jim Costa of California, the second-ranking Democrat on the committee, won his 11th term. Link for details. — Trump’s energy rebuild: Burgum and Wright lead the charge. President-elect Donald Trump’s appointments of North Dakota Gov. Doug Burgum for Interior Secretary and Liberty Energy CEO Chris Wright for Energy Secretary mark a renewed focus on boosting domestic fossil-fuel production. With deep expertise in energy markets and regulatory hurdles, Burgum aims to undo Biden-era restrictions, expedite federal permitting, and revive leasing programs, including the Arctic National Wildlife Refuge. Wright’s mission includes restarting LNG export permits and reassessing green project loans. Together, they represent a push for U.S. energy dominance through regulatory reform and enhanced private-sector investment. — National E. coli outbreak linked to Bakersfield, Calif.-based carrot producer. The U.S. Centers for Disease Control and Prevention has traced a multistate E. coli outbreak to Grimmway Farms, a major carrot grower headquartered in Bakersfield. As of Sunday, 39 people across 18 states have been infected, with 15 hospitalized and one death reported. The outbreak is linked to bagged organic baby and whole carrots from brands such as 365, Trader Joe’s, Wegmans, and more, sold from mid-August to late October. Consumers are urged to discard recalled carrots. Grimmway Farms CEO Jeff Huckaby assured customers of a comprehensive review of safety measures. — Trump to focus this week on economic positions. The biggest one is who will lead Treasury, and that position is down to a few people. Allies of two candidates, Howard Lutnick, the transition co-chair, and Scott Bessent, a top economic adviser, publicly lobbied for them this weekend. But the New York Times reports that the president-elect himself wants somebody “big” for the role and is now considering Marc Rowan, the CEO of Apollo Global Management, and Kevin Warsh, a former Fed governor. Bessent is also being floated for positions such as chair of the White House’s National Economic Council. Trump has a history with Warsh, having considered him as a potential Fed chair in 2017, only to choose Jay Powell instead, a choice he later publicly regretted. Trump considers Warsh smart and handsome, the NYT reports. Warsh is also being mentioned as a potential successor to Powell, whose term expires in 2026. Other personnel positions could include the U.S. Trade Rep and USDA secretary. Over the weekend we reported (link) that a late name was added to the USDA possibility list: Jimmy Emmons, currently senior vice president of climate-smart programs at Trust In Food, Farm Journal’s sustainable agriculture division. Meanwhile, Senate Ag member Cindy-Hyde Smith (R-Miss.) says she plans to stay in Congress. She was one of the possible picks. — Morning Joe hosts Joe Scarborough and Mika Brzezinski revealed Monday they had a “personal” sit-down with President-elect Donald Trump in Florida over the weekend in a bid to “restart communications” with him. — RFK Jr’s McDonald’s moment highlights contrasts in Trump alliance. Robert F. Kennedy Jr., known for his health advocacy and critiques of fast food, found himself dining on McDonald’s aboard Donald Trump’s private plane en route to a UFC fight. Recently named as Trump’s health secretary, Kennedy was captured reluctantly eating a Big Mac, a stark contrast to his past labeling of the chain’s food as “poison.” The scene, shared widely online, was seen as Kennedy swallowing his principles for political alignment. The meal, part of Trump’s signature campaign style, underscored his sway over allies, while sparking commentary on Kennedy’s role shift and potential policy impacts. Credit: Margo Martin |

| MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. stock indexes are pointed toward mixed to firmer openings. In Asia, Japan -1.1%. Hong Kong +0.8%. China -0.2%. India -0.3%. In Europe, at midday, London +0.1%. Paris -0.4%. Frankfurt -0.4%.

U.S. equities Friday and for the week: All three major indices lost ground Friday and posted losses for the week with the Dow down 1.25%, the Nasdaq fell 3.15%, and the S&P 500 was 2.1% lower. On Friday, the Dow declined 305.87 points, 0.70%, at 43,444.99. The Nasdaq dropped 427.53 points, 2.24%, at 18,680.12. The S&P 500 lost 78.55 points, 1.32%, at 5,870.62.

— Nvidia, Walmart, Deere lead earnings highlights this week. Nvidia’s earnings report on Wednesday post-market is a major focus as the third-quarter earnings season nears completion. Other key reports include Lowe’s, Medtronic, and Walmart on Tuesday; Snowflake and Target on Wednesday; followed by Deere and Intuit on Thursday. Economic updates feature November’s NAHB Housing Market Index (Monday), October housing starts (Tuesday), October existing-home sales (Thursday), and November’s S&P Global Manufacturing PMI (Friday). We have details in The Week Ahead (link).

So far, 75% of S&P 500 companies that have reported third quarter earnings have had positive earnings surprises, according to FactSet. The information technology sector has led all 11 sectors in revenue growth rate from a year ago, at 12.4%, while chip companies have had growth rates of 26%.

— Oil prices fell over 2% on Friday, with Brent settling at $71.04 per barrel, down $1.52 (-2.09%), and WTI at $67.02, down $1.68 (-2.45%). For the week, Brent dropped 4%, while WTI declined 5%, driven by weaker Chinese demand and uncertainty over U.S. Federal Reserve rate cuts.

— Ag markets today: Wheat futures firmed, soybeans weakened and corn chopped around unchanged during the overnight session. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny lower, soybeans were 5 to 7 cents lower and wheat futures were 2 to 4 cents higher. The U.S. dollar index and front-month crude oil futures were both modestly firmer this morning.

Wholesale beef prices softened 46 cents for Choice to $303.34 and 52 cents for Select to $276.14 on Friday. Falling wholesale prices have pushed packer margins deep into the red.

The CME lean hog index is down 51 cents to $89.27 as of Nov. 14, the fifth decline in the last six days. The pork cutout firmed $3.04 to $97.11 on Friday, driven largely by $18.44 jump in primal bellies though butts, picnics and ribs also posted strong gains.

— Agriculture markets Friday and the week change:

• Corn: December corn futures climbed 5 cents to $4.24 and closed near session highs, though still dropped 7 cents on the week.

• Soy complex: January soybeans rose 11 cents to $9.98 1/2 but fell 31 3/4 cents on the week. December soymeal rose $2.60 to $289.60 but notched a $6.60 weekly loss. December soyoil rose 91 points to 45.35 cents but lost 342 points on the week.

• Wheat: December SRW wheat futures rose 6 1/4 cents to $5.36 1/2 and near the session high. For the week, December SRW fell 36 cents. December HRW wheat gained 7 cents to $5.40, nearer the daily high and on the week down 24 1/4 cents. December spring wheat rose 5 3/4 cents to $5.72 1/4 , but fell 25 1/2 cents on the week.

• Cotton: December cotton fell 152 points to 66.80 cents and lost 418 points on the week.

• Cattle: December live cattle futures closed steady at $182.95, nearer the daily low and hit a seven-week low early on. For the week, December cattle lost 75 cents. January feeder cattle futures soared $4.025 to $247.225, nearer the daily high and hit a four-week high. On the week, January feeders rose $5.80.

• Hogs: Futures continued sliding Friday despite a big rebound in pork cutout. December hogs fell 60 cents to $79.50. The closing quote represented a weekly decline of 92.5 cents.

— Quotes of note:

• Federal Reserve Chair Jerome Powell said last week that housing inflation “has yet to fully normalize.” He could be waiting a while for that, says Bloomberg.

• Goldman Sachs lowered its forecast for Australia’s economic growth in 2025, pointing to likely “negative spillovers” from Trump’s expected tariffs on China.

— Addressing structural imbalances: Dr. Malanga’s economic outlook and policy recommendations. Dr. Vince Malanga, President of LaSalle Economics, suggests that despite a robust-looking economy with low inflation and moderate growth rates, there are deeper structural imbalances that need attention. He warns that the U.S. economy, under a new administration, faces challenges such as a manufacturing recession, an overburdened housing market, rising trade frictions, and a widening trade deficit.

Malanga believes the administration must act quickly, extending 2017 tax cuts to boost consumer and business confidence, while shifting economic growth from public to private sectors. Though he says this may cause short-term pain, it could lead to longer-term gains akin to the economic boom of the late 1920s driven by innovation and deregulation. However, unlike a century ago, modern fiscal complexities, regulatory burdens, and automatic federal spending on entitlements pose challenges.

He emphasizes that reigning in bureaucracy could save costs but warns of potential fiscal drag, recession risks, and a critical dependency on how quickly business and the Federal Reserve respond to policy changes, including tax cuts and deregulation. Malanga is optimistic that a balanced economic recovery is possible, contingent on timely and strategic government intervention and market responses.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly higher, even with the euro, yen and British pound all firmer against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 4.47%, with a mostly higher tone in global government bond yields. Crude oil futures were firmer ahead of U.S. trading, with U.S. crude around $67.20 per barrel and Brent was around $71.35 per barrel. Gold and silver futures were sharply higher, with gold around $2,601 per troy ounce and silver around $30.92 per troy ounce.

— Gold prices are climbing at the start of the trading week due to increased demand for safe-haven assets, triggered by rising tensions in the Russia/Ukraine conflict. According to Bloomberg, Goldman Sachs has identified gold as a top commodity trade for next year, predicting a potential rise to $3,000 per ounce by December 2025. The investment bank pointed to uncertainty surrounding policies introduced by the new Trump presidency as a key driver behind its bullish gold outlook. This reflects investor caution and hedging behavior amid geopolitical risks and potential policy shifts in the U.S.

— The Panama Canal Authority plans to build a land bridge that could handle some 5 million sea containers a year by 2045. Link for details.

— USDA daily export sales:

• 30,000 MT soybean oil to India, 2024-2025 marketing year

• 261,264 MT soybeans to Mexico, 2024-2025 marketing year

• 135,000 MT soybean cake and meal to the Philippines, 2024-2025 marketing year

— Ag trade update: Algeria tendered to buy a nominal 50,000 MT of durum wheat from unspecified origins.

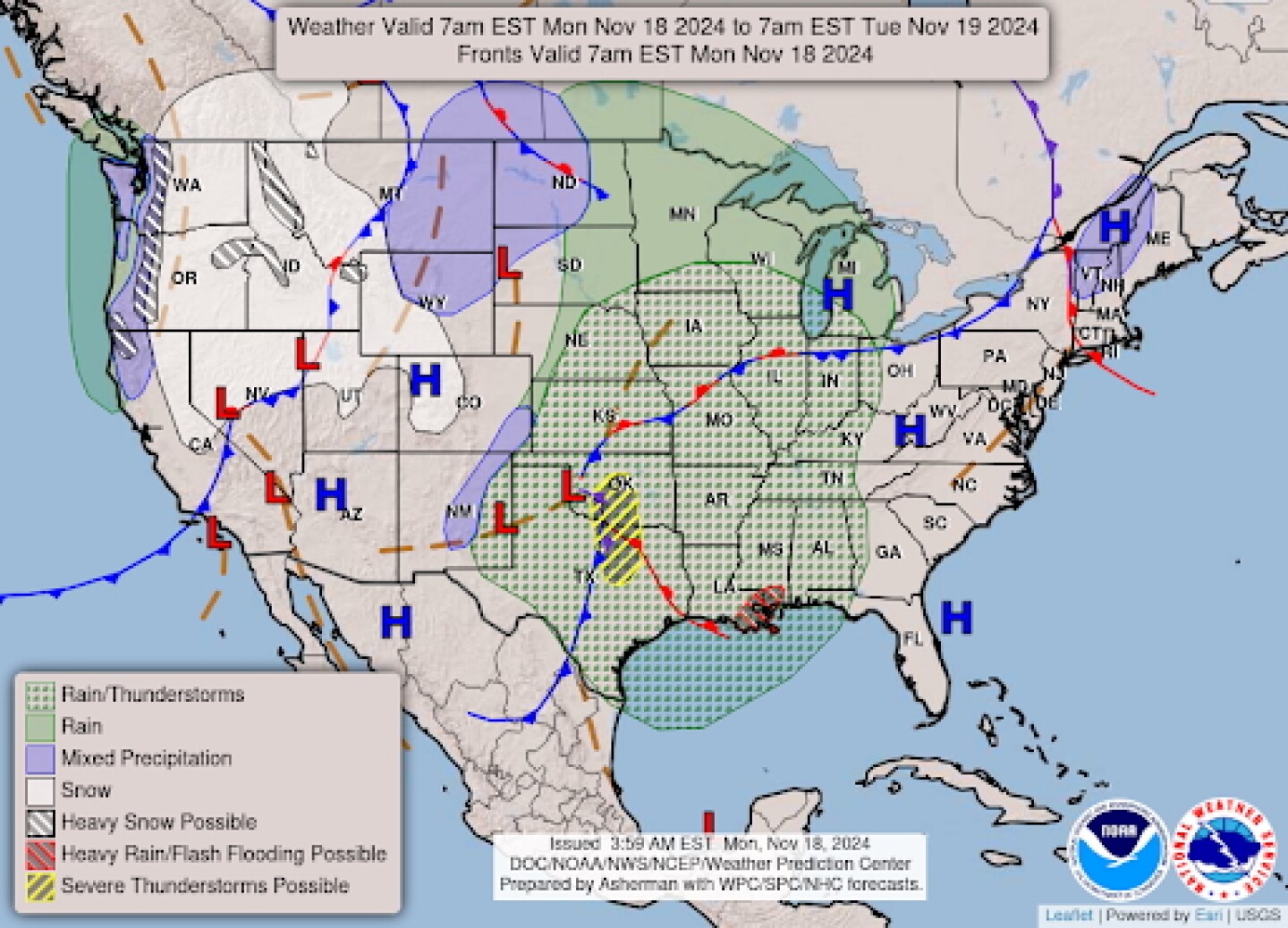

— NWS outlook: A potent storm system over the central U.S. today will create chances for heavy rainfall, severe thunderstorms, and gusty winds, while moderate snowfall is possible across the northern Plains by Tuesday... ...Heavy rain and flash flooding potential exists throughout the central and eastern Gulf Coast over the next few days... ...Powerful Pacific low pressure system to impact the Northwest with high winds and heavy mountain snow, while an atmospheric river takes aim at northern California by Wednesday.

Items in Pro Farmer’s First Thing Today include:

• Varied tone in grains overnight

• Wholesale beef prices continue to slide

• Cash hog index extends decline, pork cutout rebounds

• Central U.S. to receive rains, snow

• Brazil’s soybean planting now well ahead of last year

| CONGRESS |

— Congressional tax agenda aims to extend Trump’s tax cuts and support seniors, says Ways and Means chairman. House Ways and Means Chairman Jason Smith (R-Mo.) outlined the congressional priorities for extending President-elect Donald Trump’s tax cuts and supporting seniors on Social Security. Speaking on the Just the News, No Noise TV show, Smith emphasized using the reconciliation process to extend Trump’s tax provisions and address key campaign pledges such as eliminating taxes on tips. Reconciliation allows lawmakers to bypass the Senate’s 60-vote filibuster threshold, expediting legislation approval. However, Smith noted that the Social Security tax is excluded from reconciliation, adding that alternative measures within the tax code could alleviate seniors’ financial burdens.

“The Social Security tax thresholds have remained unchanged since the early 1980s, at $25,000 for individuals and $32,000 for married couples, creating a marriage penalty,” Smith explained, highlighting the impact of inflation on seniors’ finances. He expressed the committee’s commitment to addressing this issue.

Smith stated that the Ways and Means Committee is prepared to advance legislation promptly once Trump takes office, emphasizing readiness and coordination with other committees. Ensuring that “no tax on tips” is included in future tax legislation remains a priority, as pledged in the Republican Party platform.

Reiterating the importance of extending Trump’s tax cuts, Smith said, “I will not allow a $7 trillion tax increase on small businesses. Every single American will face a tax increase if Congress does not do their job, and I’m not going to allow that to happen under my watch.”

| POLICY UPDATE |

— Stabenow unveils 1,397-page details of her long-awaited farm bill. Early Sunday evening we broke the news (link) that Senate Ag Chairwoman (D-Mich.) had briefed Democrats but not Republicans on her coming farm bill text. Link to summary. Link to text.

Stabenow said in a news release, “The foundation of every successful farm bill is built on holding together the broad, bipartisan farm bill coalition. This is a strong bill that invests in all of agriculture, helps families put food on the table, supports rural prosperity, and holds that coalition together.”

The Rural Prosperity and Food Security Act includes $39 billion in new resources “to keep farmers farming, families fed, and rural communities strong.” The bill builds on the proposal Stabenow released in May by investing new resources and including innovative, new ideas to deliver the assistance farmers need faster. It provides farmers with the certainty of a 5-year farm bill and the immediate help they need to manage the urgent needs of the present. It doubles down on our commitment to rural communities, ensures that the Supplemental Nutrition Assistance Program (SNAP) keeps up with the realities of American life, and brings the historic investments in climate-smart conservation practices into the farm bill. These new investments include:

• $20 billion to strengthen the farm safety net to support all of agriculture and establishes a permanent structure for disaster assistance so emergency relief reaches farmers faster;

• $8.5 billion to help families make ends meet, put food on the table, and improve access to nutrition assistance;

• $4.3 billion to improve quality of life in the rural communities that millions of Americans call home.”

Comments: Several contacts, asked to respond to Stabenow’s late farm bill details, used the same words: “Wow, finally, but too late.” Stabenow is departing Congress after this session ends, and veteran farm bill watchers say this late-entry farm bill is not a positive chapter in her long career. Most are asking why she chose today in releasing the details, and why she took a partisan approach in briefing about the matter.

Of note: Ranking Senate Ag member John Boozman (R-Ark.) has not yet commented on Stabenow’s farm bill release.

— GT Thompson details key issues. The primary focus of the upcoming lame duck session will be providing disaster and financial aid to farmers, while progress on the overdue farm bill remains stalled. House Ag Committee Chairman GT Thompson (R-Pa.) indicated that despite efforts, the comprehensive farm bill, already a year behind schedule, may be pushed to 2025 unless there is a significant shift in approach within the Senate. As previously noted, Senate Ag Chairwoman Debbie Stabenow just released long-awaited text of her farm bill.

During a podcast discussion with Missouri Rep. Mark Alford, Thompson expressed confidence in passing stopgap aid to farmers but acknowledged the need for a farm bill extension if it could not be finalized soon. “The other things that we worked hard to put into this farm bill, we will get them done,” he said, adding, “it doesn’t mean we have to wait a year to get the rest of the farm bill done.”

Thompson attributed the delay to Stabenow, citing disagreements over Republican proposals to cut SNAP spending and allow broader uses for climate funds. He stated, “Unless the attitude really changes with the Senate Democrats, the farm bill will not move.”

He also highlighted the importance of addressing urgent disaster relief measures, noting that market volatility and disaster-driven needs are critical for supporting farmers.

The 2018 Farm Bill, which expired in September 2023, has been extended for one year. Without further extension, agricultural programs would default to outdated policies under the 1949 permanent agriculture law, creating financial strain with impractical subsidy levels.

| CHINA UPDATE |

— Expert warns U.S./China rivalry is already a new cold war, calls for careful management. Robin Niblett, a distinguished fellow with London-based think tank Chatham House, offers a sobering assessment of the current state of U.S./-China relations in an exclusive interview with the South China Morning Post (link). He argues that we are not merely approaching a new cold war between these global powers, but are already in the midst of one. “I believe we’re in a new cold war. We’re not going toward it. We’re not in the foothills. We’re in it,” Niblett states.

He identifies several key indicators of this cold war dynamic:

• Military competition: China’s nuclear arsenal expansion and the U.S. response.

• Ideological divide: A clash between top-down and bottom-up governance systems.

• Global influence contest: The formation of new blocs, with China and Russia on one side, and the U.S. with its allies on the other.

Of note: Niblett explains that the recent meeting between Presidents Xi and Biden has not fundamentally altered this trajectory: “Things will get worse before they get better, or before they get even worse.”

Regarding Europe’s position, Niblett notes that while European nations share some concerns with the U.S. about China, their approach differs in key areas. He states, “Europe is aligned with America for now, but it has different emphases.

The Ukraine conflict has been a significant factor in aligning European and U.S. positions on China.

Looking ahead, Niblett sees both challenges and opportunities in this new cold war dynamic. He suggests that developing nations may find opportunities to leverage the rivalry between major powers for their benefit. However, he emphasizes the critical importance of keeping this conflict “cold": “We need to be clearer about its boundaries, [and] try to work out arms control agreements that will soften its rough edges, whether in the South China Sea or on nuclear modernization plans. We need to keep trade and investment open in those areas that are not inside the tent of each side’s security.”

Bottom line: Niblett stresses the necessity of managing this new cold war carefully to prevent it from escalating into a hot conflict, a scenario that would have devastating global consequences.

— Banks downgrade China outlook. Morgan Stanley downgraded China to slight “underweight” from “equal weight” in emerging markets, with analysts noting efforts to revive the economy and a Republican sweep of Congress and the White House could significantly impact markets. “We expect even stronger headwinds on corporate earnings and market valuation in the coming months,” Morgan Stanley analysts said in a note dated Nov. 17. Goldman Sachs is more bullish on mainland stocks, but trimmed its recommendation on Hong Kong shares to “underweight” from “market weight.” “Although valuations are not demanding, Hong Kong does not offer much economic or earnings growth,” Goldman analysts said in an Asia-Pacific portfolio strategy note published on Sunday. “The property and retail sectors remain under pressure and the economy may not benefit as much from policy support in China as it previously has, given China’s focus on bolstering the domestic economy.” Both banks expect the yuan to weaken, with Goldman forecasting a dollar/yuan exchange rate of 7.5 at the end of next year and Morgan Stanley 7.6.

— China to front-load 2025 local government special bonds quota. China’s finance ministry is planning to front-load part of the 2025 local government special bonds quota to meet funding needs for major infrastructure projects, state-backed The Securities Times reported. “At present, the Ministry of Finance is formulating an advance work plan to better ensure the funding needs of major projects in key areas and to leverage the important role of government bond funds in the economic recovery,” it said, without giving specifics. By the end of October, local governments had issued 3.9 trillion yuan ($539 billion) in new special bonds, almost completing debt issuance under the 2024 quota, the report added.

— China’s pork imports continue to decline. China imported 90,000 MT of pork in October, down 10% from September and 1.6% less than last year. Through the first 10 months of the year, China imported 890,000 MT of pork, down 34.9% from the same period last year.

| TRADE POLICY |

— Proposed 60% tariffs on goods via Chinese-operated ports in Latin America. Mauricio Claver-Carone, a key adviser to President-elect Donald Trump’s transition team, has proposed that goods shipped through Chinese-owned ports across Latin America be subjected to the same 60% tariffs as imports from China, Bloomberg reports. This plan particularly targets a new Chinese-owned port in Chancay, Peru, recently inaugurated by President Xi Jinping and Peruvian President Dina Boluarte.

The proposed tariff would extend to all goods transiting through Chinese-controlled ports in the region, potentially affecting trade hubs from Mexico’s Manzanillo to Argentina’s Buenos Aires and even ports near the Panama Canal. Claver-Carone, known for his firm stance on Beijing during the first Trump administration, characterized the measure as a warning shot to countries partnering with China on maritime projects.

This proposal could impact regional trade optimism, especially for nations like Peru and Mexico, where Chinese port investments are prominent. Claver-Carone argues that such goods should be treated as if they originate from China due to Beijing’s influence on maritime infrastructure.

| ENERGY & CLIMATE CHANGE |

— Summit Carbon Solutions sues Bremer County, Iowa, over pipeline regulations. Summit Carbon Solutions has filed a lawsuit against Bremer County, Iowa, over local ordinances attempting to regulate the company’s planned carbon dioxide pipeline. This marks the third Iowa county Summit has taken to court, following a December 2023 federal ruling that permanently blocked similar ordinances in Story and Shelby Counties. Summit argues that Bremer County’s regulations, enacted in September 2024, mirror the previously invalidated rules. The company seeks declaratory and injunctive relief, claiming that Bremer County’s actions threaten project compliance and progress on its planned 2,500-mile multi-state CO2 pipeline network.

— Denmark unveils ambitious farmland-to-forest conversion plan. Denmark plans to convert 15% of its farmland into forests over the next 20 years, aiming to plant 1 billion trees. With a 43 billion Danish crowns ($6.1 billion) fund for land purchases, the initiative is part of a wider Green Tripartite Agreement, involving government, businesses, and NGOs. Beginning in 2030, a carbon tax on agriculture will further drive emissions reductions, contributing to Denmark’s goal to cut greenhouse gases by 70% from 1990 levels. The project also seeks to address oxygen depletion and marine life loss in Danish waters.

— Corteva plans to partner with BP to develop low carbon intensity bio-feedback sustainable aviation fuel (SAF) production, signing a non-binding memorandum of understanding to form a joint venture with the aim of eventually reaching delivery of 1M metric tons/year of biofuel feedstocks for SAF production by the mid-2030s. Corteva (CTVA) said it plans to contract with farmers in North America, South America and Europe to grow its proprietary mustard seed, sunflower and canola feedstocks well-suited for SAF production.

The JV would aim to introduce new cropping systems to produce oil that meets EU RED III criteria, and qualifies for U.S. Low Carbon Intensity policy incentives, while creating a new revenue stream for farmers, the company said. “We are excited at the prospect of partnering with bp to help the European airline industry become more sustainable while giving farmers a new source of income,” Corteva said.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Oregon confirms first human case of H5N1. The U.S. Centers for Disease Control and Prevention (CDC) on Friday confirmed H5N1 in a person in Oregon. The infected person is linked to a previously reported outbreak tied to a commercial poultry operation in the state, where the virus has been confirmed in 150,000 birds, the state health authority said.

| HEALTH UPDATE |

— Medicare costs to rise in 2025 with new Part D cap. The Centers for Medicare & Medicaid Services (CMS) announced that the standard monthly premium for Medicare Part B will increase to $185 in 2025, up $10.30 from 2024. Higher-income beneficiaries will see additional costs based on income-related adjustments, affecting roughly 8% of enrollees. The annual deductible for Part B will also rise, reaching $257. Part A hospital stay deductibles and premiums for a small number of beneficiaries will also see increases. Notably, a major change for 2025 will be a $2,000 out-of-pocket spending cap on Part D prescription drugs, projected to benefit around 3.2 million Americans.\

| OTHER ITEMS OF NOTE |

— USDA adjusts mix of United Soybean Board (USB). USDA has set forth changes to the number of members on the United Soybean Board (USB), the panel responsible for soybean checkoff activities. USDA said that the adjustments will keep total members on the USB at 77 but North Dakota will have one fewer member (three instead of four) and New York will now have two members instead of one. The changes are based on production shifts.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |