News/Markets/Policy Updates: July 26, 2024

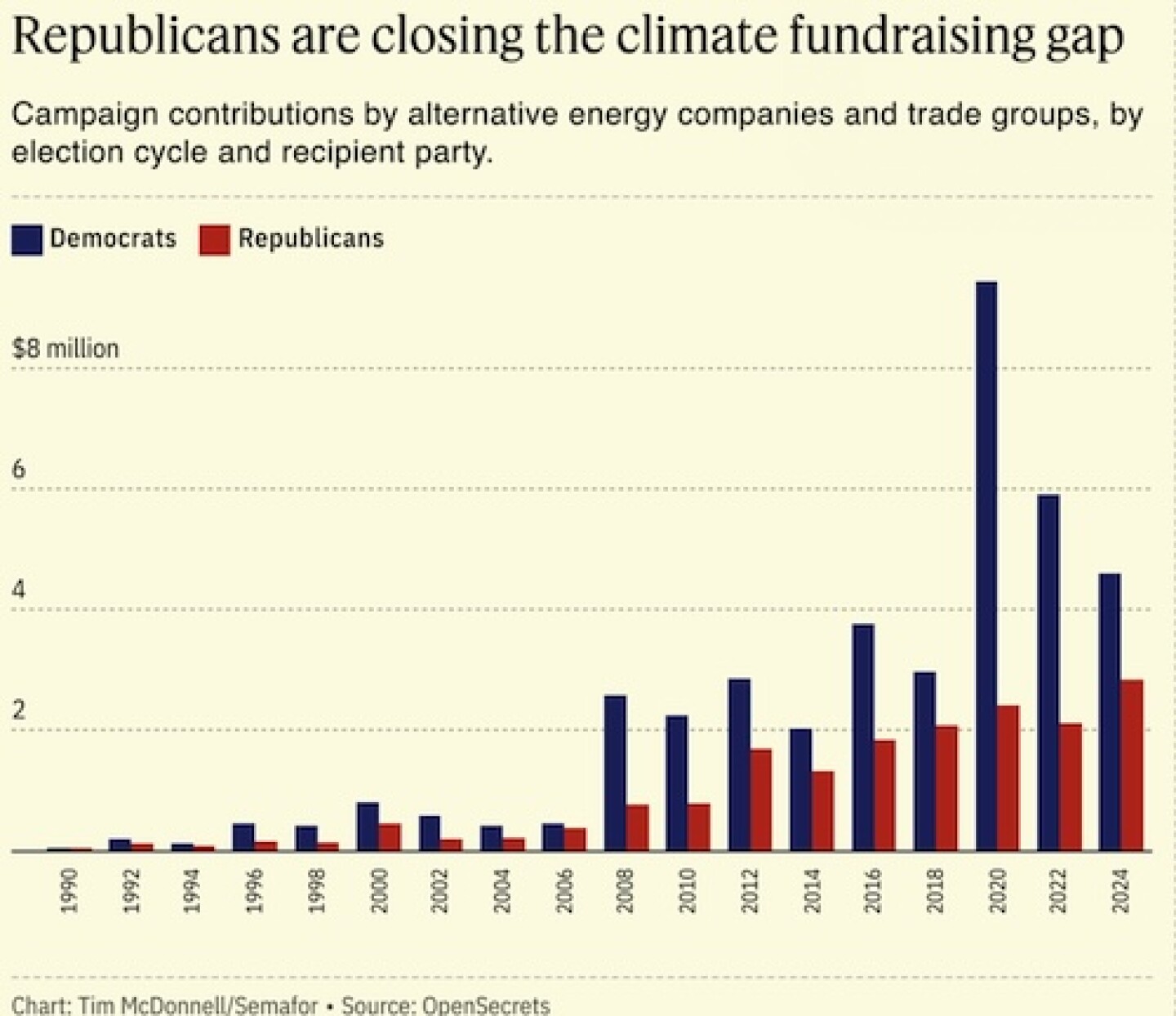

— The endorsement of Vice President Kamala Harris by former President Barack Obama and Michelle Obama marks a significant moment in the Democratic presidential campaign. The 55-second video released by the Harris campaign captures a warm and personal phone call between Harris and the Obamas, with both expressing their pride and support for her candidacy. Obama’s regular contact with Harris, offering advice on campaign logistics, underscores the strong backing she has from the party’s influential members. — VP choice. Prominent Democratic donors and leaders in Arizona are urging Vice President Kamala Harris to choose Sen. Mark Kelly as her running mate. Despite the tight timeline before the party’s convention next month, campaign aides say the selection process is still open. Polls indicate Kelly and Pennsylvania Governor Josh Shapiro are favorites among Democratic voters and donors. North Carolina Governor Roy Cooper and Kentucky Governor Andy Beshear are also being considered, offering Harris potential running mates with experience winning in red states. — Breaking down the Veepstakes: What top prospects could bring to the Harris ticket. Jessica Taylor of the Cook Political Report with Amy Walter discusses that topic. She writes Vice President Kamala Harris must quickly select a running mate after President Joe Biden’s withdrawal. Potential candidates include governors Josh Shapiro, Roy Cooper, Andy Beshear, and Tim Walz, along with Sen. Mark Kelly. She notes each brings unique strengths to balance the ticket and counter GOP attacks. Shapiro offers strong appeal in Pennsylvania, Kelly brings star power in Arizona, Cooper adds Southern charm, Beshear connects with GOP voters, and Walz highlights progressive achievements. Their diverse backgrounds could enhance Harris’ chances against Donald Trump in November, Taylor concludes. — The Trump campaign announced it would not commit to future presidential debates until the Democratic Party selects its nominee. Harris expressed her readiness to debate former President Donald Trump, who also expressed his desire to debate her. While a debate hosted by ABC was planned for Sept. 10, its status is uncertain. Fox News proposed a debate between Trump and Harris on Sept. 17 in Pennsylvania. Analysts believe such a debate could attract millions of viewers and potentially alter the race’s trajectory. — Former President Donald Trump, previously a critic of bitcoin, is set to headline the world’s largest bitcoin conference this weekend, signaling support for the crypto industry. Alongside running mate J.D. Vance, Trump has promised lighter crypto regulation, contrasting with the Biden administration’s stricter approach. Their campaign has raised over $4 million through crypto donations. Bitcoin sentiment has improved in July, partly due to the “Trump Trade,” with bitcoin rising 5% this morning to $67,200. — Harris and farmers… market. When asked what she missed most about living in California during a June 4 appearance on Jimmy Kimmel’s late-night show, Harris responded the farmers markets. “California, we’re very proud of the produce that we grow here, and I’ve actually spent a lot of time with the farmers in California,” Harris said. “There are great farmers, obviously, all over the country, but I’ve spent a lot of time with California farmers.” — Harris on livestock welfare laws. Bloomberg reports that Sara Amundson, president of the Humane Society Legislative Fund PAC, said one notable difference between a Harris and Biden administration could be their stances on state livestock welfare laws after “she fought so hard to uphold” several of them while serving as California’s attorney general. The group endorsed the pair’s 2020 campaign, citing her track record on the issue. Conversely, Biden backed a pork industry group’s Supreme Court challenge to California regulations about the size of cages for raising farm animals, which failed last year. Harris may not make animal welfare concerns a key administrative focus because the laws are especially unpopular with commercial livestock producers in Midwestern states, so “nationally it’s a lose-lose position for her,” the AEI’s Vincent Smith said, according to Bloomberg. — Harris’ climate focus drives fundraising surge, gains green endorsements. Vice President Kamala Harris’ ascension to the top of the Democratic presidential ticket is driving a surge in fundraising from climate-focused voters. Harris, with her strong climate track record, has gained endorsements from leading green groups and donors, leading to a significant increase in donations. A recent virtual fundraiser led by climate author Bill McKibben raised over $100,000. This shift highlights the growing influence of renewables and clean tech in U.S. politics, potentially rivaling the fossil fuel industry’s support for Donald Trump. Harris’ candidacy might significantly boost the Democratic campaign’s financial backing from the clean-power sector. |

| Today’s Digital Newspaper |

MARKET FOCUS

· Federal Reserve’s key inflation gauge rises 2.5% in June, meeting expectations

· Core PCE Price Index stayed at 2.6% when expectations were for it to decline

· John Deere official talks to U.S. Farm Report’s Tyne Morgan

· Kroger & Albertsons pause merger as they fight efforts against $20 billion deal

· Barron’s: ‘Tech stocks rotation shows market confusion; why it may be time to bail’

· Ag markets today

· HRS tour forecasts record North Dakota yield

· NWS outlook

· Pro Farmer First Thing Today items

CONGRESS

· EPA gets more funding under Senate bill

ISRAEL/HAMAS CONFLICT

· Harris affirms commitment to Israel; voices concern over Gaza suffering

· Netanyahu to meet with Donald Trump in Florida today

POLICY

· One chart shows why a new farm bill is needed this year

· Testimony at House Ag hearing Tuesday captures downturn and anxiety in ag sector

CHINA

· China expands EV factories in EU to skirt tariffs

· China’s 10-Year yield hits record low, testing PBOC’s patience

· China’s rate cuts sequence hints at reduced role for MLF

TRADE POLICY

· USTR sets specific allocations for FY 2025 sugar TRQ

ENERGY & CLIMATE CHANGE

· NGFA submits recommendations to USDA re: climate-smart ag practices

· NCGA urges fair criteria for farming practices to qualify for tax credits for SAV fuels

· Exxon Mobil enters into carbon capture and storage agreement with CF Industries

· Whitmer vetoes E15 rebate program

LIVESTOCK, NUTRITION & FOOD INDUSTRY

· Three more human cases of H5N1 in Colorado

· Study: Avian flu spreads from birds to cows and other mammals in U.S.

· USDA projects smallest rise in grocery prices for 2025 since 2018

· 1481 Meats in Upham joins North Dakota State Meat Inspection Program

· Brazil to declare end to the Newcastle disease outbreak in Rio Grande do Sul

POLITICS & ELECTIONS

· Latest developments in Harris/Trump presidential race

OTHER ITEMS OF NOTE

· Train attacks mar opening day of the Paris Olympics

· Cotton AWP moves lower

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 150 points higher and is currently up around 550 points. In Asia, Japan -0.5%. Hong Kong +0.1%. China +0.1%. India +1.6%. In Europe, at midday, London +0.7%. Paris +0.9%. Frankfurt +0.3%.

U.S. equities yesterday: The Dow managed to post a gain on a strong reading on second quarter GDP while pressure on tech shares weighed on the Nasdaq and S&P 500. The Dow gained 81.20 points, 0.20%, at 39,935.07. The Nasdaq fell 160.69 points, 0.93%, at 17,181.72. The S&P 500 lost 27.91 points, 0.51%, at 5,399.22. On the big tech front, Meta Platforms and Nvidia each declined 1.7%. Microsoft slumped 2.5%, while Alphabet and Advanced Micro Devices saw losses of more than 3% and 4%, respectively. With investors bailing on tech for the second day, the Russell 2000 surged higher, rising 1.26%.

— Barron’s headline: “Tech stocks rotation shows market confusion; why it may be time to bail.” Link to item.

— John Deere speaks about layoffs. John Deere recently laid off 103 workers in Iowa as part of ongoing workforce reductions, with Cory Reed, President of Worldwide Agriculture & Turf Division, speaking about the layoffs in an exclusive interview with U.S. Farm Report’s Tyne Morgan. He attributed the cuts to decreased demand due to lower net farm income, higher interest rates, and market volatility. Reed emphasized that the job cuts are unrelated to the 2021 strike by production workers. The latest AEM report highlighted significant drops in ag equipment sales, including a 31% decrease in combine sales and a 16% drop in farm tractor sales in June. Despite the current challenges, Reed remains optimistic about agriculture’s long-term prospects and reassures farmers of Deere’s commitment to quality and innovation. Additionally, Deere is addressing cost concerns by reducing the prices of some new technologies, like the See & Spray retrofit kit. Comments: During the strike, some said Deere was privately saying the union workers were shooting themselves in the foot... and would drive jobs to Mexico. That UAW deal with John Deere was the mold for Ford and GM. It will be interesting to see if they make cuts next. |

— Kroger and Albertsons merger paused amid antitrust scrutiny. The proposed $25 billion merger between Kroger and Albertsons, two of the largest supermarket chains in the United States, has been temporarily put on hold due to significant antitrust concerns raised by both federal and state authorities. Kroger and Albertsons announced their intention to merge in October 2022. The companies argued that the merger would enable them to lower prices and offer better services to consumers by leveraging economies of scale. The Federal Trade Commission (FTC), along with several state attorneys general, have raised substantial concerns about the merger’s potential impact on competition. The FTC’s administrative complaint alleges that the merger would reduce competition, leading to higher prices for consumers, lower product quality, and diminished incentives for innovation. The FTC also highlighted that the merger would likely harm workers by reducing their bargaining power, potentially leading to lower wages and poorer working conditions. To address these concerns, Kroger and Albertsons proposed divesting several hundred stores to C&S Wholesale Grocers. However, the FTC criticized this divestiture plan as inadequate, arguing that it involved a “hodgepodge of unconnected stores” that would not effectively mitigate the loss of competition. The FTC pointed to past failures in similar divestiture efforts, such as the 2014 merger between Albertsons and Safeway, which led to the bankruptcy of the buyer, Haggen.

The merger is also facing multiple legal challenges. Kroger and Albertsons have defended the merger, arguing that it would benefit consumers by lowering prices and increasing choices. They have also claimed that blocking the merger would harm consumers and workers by empowering larger competitors like Walmart and Amazon. The companies have expressed their commitment to contesting the FTC’s decision and defending the merger in court.

— Apple has dropped out of the top five smartphone sellers in China for the first time in four years, according to research firm Canalys. The company is losing market share to domestic brands like Vivo, Huawei, and Xiaomi, which offer cheaper handsets. Additionally, a government crackdown on iPhones is impacting sales.

— Ag markets today: Wheat futures rebounded amid corrective buying overnight, while the corn and soybean markets pulled back from gains earlier this week. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 5 to 6 cents lower, winter wheat markets were 1 to 3 cents higher and spring wheat was mostly 7 cents higher. The U.S. dollar index was modestly firmer, while front-month crude oil futures are mildly weaker.

Cash cattle strengthen. After light trade at steady prices earlier in the week, cash cattle activity picked up as prices firmed around $2.00 in the Southern Plains on Thursday. Bids remained scarce in the northern market, where supplies are tighter, though solidly firmer prices are now expected there.

String of cash hog gains extends. The CME lean hog index is up another 62 cents to $91.39 as of July 24, the highest since June 13. That’s the ninth straight day of gains in which the index has risen $3.01. The pork cutout value firmed $1.19 to $105.95 on Thursday, the highest since Aug. 18, 2023.

— Agriculture markets yesterday:

• Corn: December corn rose 2 3/4 cents to $4.20 3/4, closing nearer the session high.

• Soy complex: November soybean futures surged 15 1/2 cents to $10.79 1/2, though nearby August futures only climbed a nickel to $11.16. Each settled nearer session highs. August soymeal jumped $9 to $352.40, closing on session highs.

• Wheat: December SRW wheat fell 8 1/2 cents to $5.62 1/2 and near the session low. December HRW wheat lost 5 3/4 cents to $5.78 and near mid-range. September spring wheat futures sunk 7 cents to $6.03 3/4.

• Cotton: December cotton futures firmed 25 points to 68.90 cents, settling nearer session highs.

• Cattle: August live cattle rose $2.00 to $188.90, near the session high and hit a nine-month high. August feeder cattle closed up $1.50 at $258.625 and nearer the session high.

• Hogs: Hog futures rebounded strongly from mid-session losses Thursday, with nearby August futures ending the day unchanged at $93.775.

— Quotes of note:

• Inside the house. Stu Sjouwerman, CEO and founder of security company KnowBe4, in a recent blog post recounts the tale of a new hire who, to their surprise, ended up being a North Korean hacker who attempted to load malware on their systems. No illegal access was gained, the company said, but the saga highlights growing fears of a shadow workforce of thousands of North Korean IT workers targeting companies. Link for details.

• JPMorgan Chase has introduced an in-house generative AI tool, LLM Suite, for its asset and wealth management staff. Similar to ChatGPT, LLM Suite assists employees with writing, idea generation, and document summarization. Described as a “research analyst” offering information and advice, the tool is part of JPMorgan’s broader AI strategy. CEO Jamie Dimon noted that while AI might reduce some job roles, it could also create new ones. “Think of LLM Suite as a research analyst that can offer information, solutions and advice on a topic,” JPMorgan said in an internal memo.

— Federal Reserve’s key inflation gauge rises 2.5% in June, meeting expectations. The Federal Reserve’s key inflation gauge, the Personal Consumption Expenditures (PCE) price index, rose 2.5% in June 2024 compared to a year ago, meeting economists’ expectations. This data point is significant as it provides further evidence that inflation is continuing to moderate and move closer to the Federal Reserve’s 2% target.

Key details from the June PCE report include:

- Overall PCE index: Rose 0.1% month-over-month and 2.4% year-over-year

- Core PCE index (excluding food and energy): Increased 0.2% month-over-month and 2.5% year-over-year

These figures align closely with economists’ forecasts and represent a slight improvement from May’s readings, where the year-over-year increases were 2.6% for both overall and core PCE.

Factors contributing to inflation moderation

- Supply chain improvements: The resolution of supply chain disruptions has helped ease pricing pressures, particularly for durable goods.

- Housing market cooling: While shelter costs remain elevated, there are signs of moderation in housing inflation.

- Energy prices: Falling gas prices have helped push down the overall PCE reading.

- Medical services: Prices for medical and hospital services decreased in June, contributing to softer core inflation.

Implications for Federal Reserve policy

The June PCE report is likely to be viewed positively by the Federal Reserve, as it provides further evidence that inflation is on a sustainable path back to the 2% target. This data, combined with other recent encouraging inflation readings, is increasing confidence among Fed officials that their efforts to control inflation are working.

Market expectations for future Fed actions include:

- A near-certainty that rates will be held steady at the July meeting

- High probability (around 90%) of a 0.25% rate cut in September, according to CME FedWatch Tool data

- Expectations for multiple rate cuts by the end of 2024

Inflation data comes alongside other important economic indicators:

- GDP growth rebounded to 2.8% in Q2 2024, surpassing expectations of 2% growth

- Personal consumption expenditures grew at a 2.3% rate in Q2, up from 1.5% in Q1

- Jobless claims fell to 235,000 in the week ending July 20, indicating continued labor market strength

Comments: While the inflation trend is encouraging, the stronger-than-expected GDP growth and robust labor market may give the Fed reason to remain cautious about cutting rates too quickly. Of note: The Core PCE Price Index is the key, not the headline index. And the Core Index stayed at 2.6% when expectations were for it to decline. Fed officials have said there has been progress on inflation, but more was needed to show inflation was sustainably moving toward their goal. This report does not provide that signal.

Market perspectives:

— Outside markets: The U.S. dollar index was higher ahead of U.S. inflation data, with the euro, yen, British pound and most foreign currencies higher against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 4.25%, with a mixed tone in global government bond yields. Crude oil futures were lower, with US crude around $77.95 per barrel and Brent around $80.95 per barrel. Gold and silver were mixed, with gold higher around $2,373 per troy ounce and silver weaker around $27.89 per troy ounce.

— HRS tour forecasts record North Dakota yield. Scouts on the annual Wheat Quality Council HRS tour found an average yield of 54.5 bu. per acre after sampling fields across North Dakota the past three days. That’s the highest yield since tour records began in 1992. The yield was well above last year’s tour average of 47.4 bu. per acre and the five-year average (excluding 2020) of 42 bu. per acre.

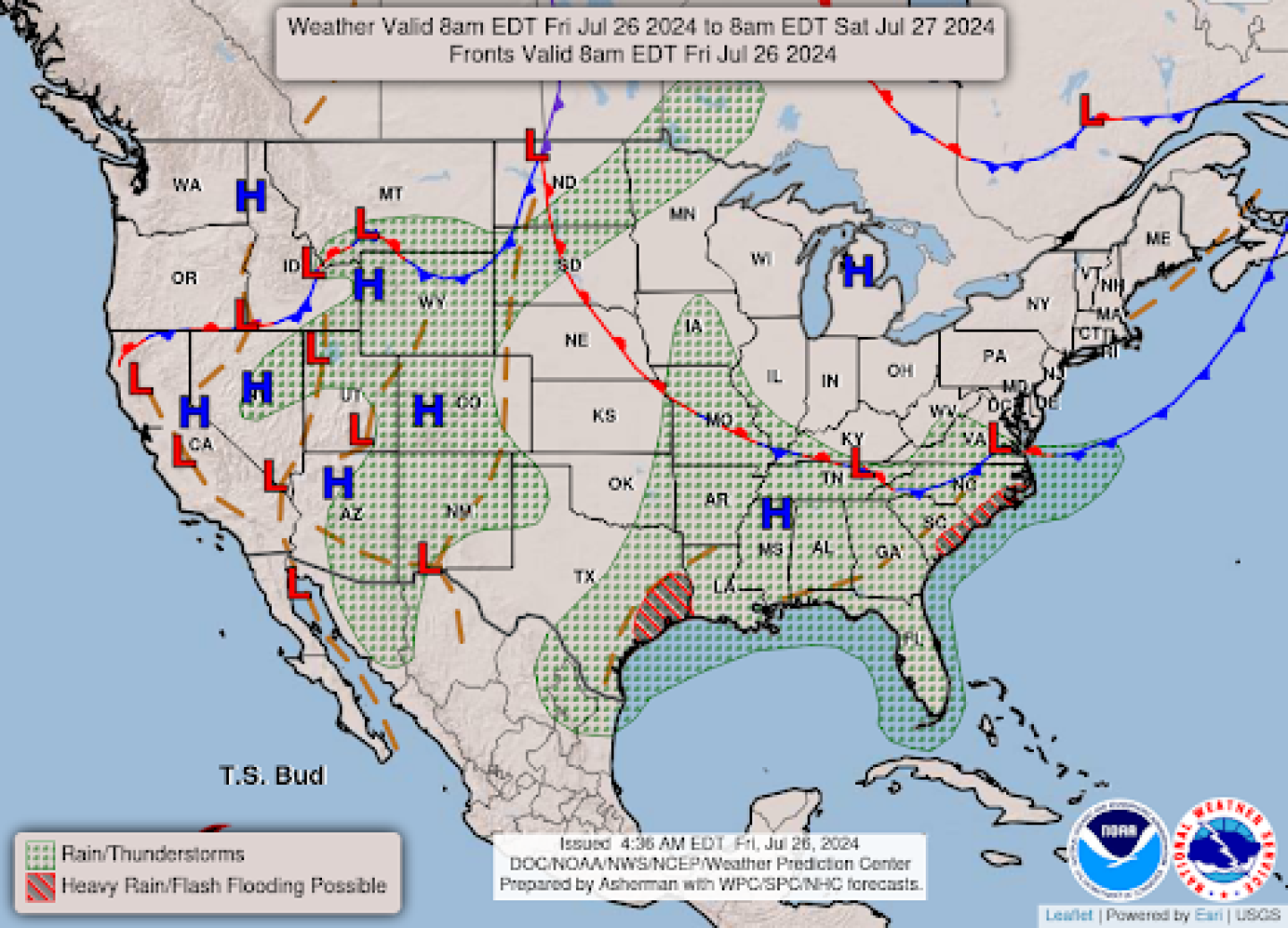

— NWS outlook: Scattered showers and thunderstorms continue across much of the South with a risk for flash flooding Friday in the coastal Carolinas and southeastern Texas... ...Storm chances for portions of the Upper Midwest and Northern Plains heading into the weekend with severe weather possible Saturday... ...Monsoonal thunderstorms continue for portions of the Intermountain West with isolated flash flooding possible.

Items in Pro Farmer’s First Thing Today include:

- Wheat firmer, corn and beans weaker overnight

- French wheat crop ratings drop again, harvest lags

- Eurozone consumer inflation expectations stabilize

| CONGRESS |

— EPA gets more funding under Senate bill. The Senate Appropriations Committee approved a $44.6 billion fiscal year (FY) 2025 Interior/Environment appropriations bill, surpassing the House version by $6 billion. The bill allocates $15.8 billion to the Interior Department, $9.3 billion to the EPA (compared to the House bill’s $7.4 billion), and $6.5 billion to the Forest Service. It also includes $4.1 billion for wildfire suppression and nearly $12.7 billion for tribal programs, with $8.5 billion for the Indian Health Service. Both the Senate and House agree on boosting funding for Indian Country programs.

| ISRAEL/HAMAS CONFLICT |

— Harris affirms commitment to Israel; voices concern over Gaza suffering after meeting Netanyahu. After meeting with Israeli Prime Minister Binyamin Netanyahu, Vice President Kamala Harris affirmed her “unwavering commitment” to Israel but expressed concern over the “scale of human suffering in Gaza.” She also condemned “hate-fueled” anti-Israel protests in Washington. Earlier, Netanyahu had a meeting with President Joe Biden.

— Israeli Prime Minister Benjamin Netanyahu is set to meet with former President Donald Trump in Florida today. This follows his Thursday visit to the White House, where President Joe Biden strongly urged Israel to accept a Gaza ceasefire agreement. Vice President Kamala Harris also met with Netanyahu, emphasizing the need for a ceasefire deal.

| POLICY UPDATE |

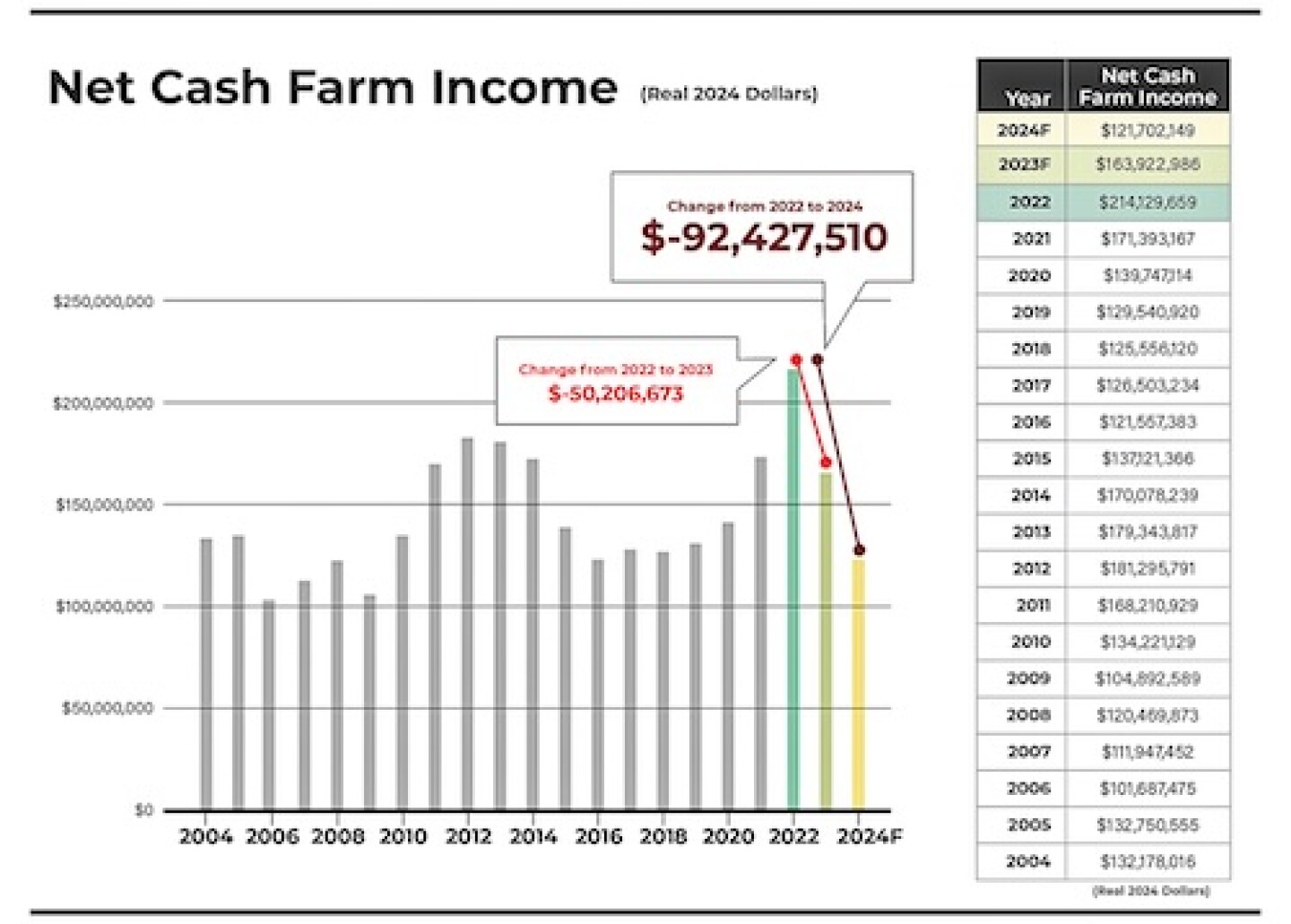

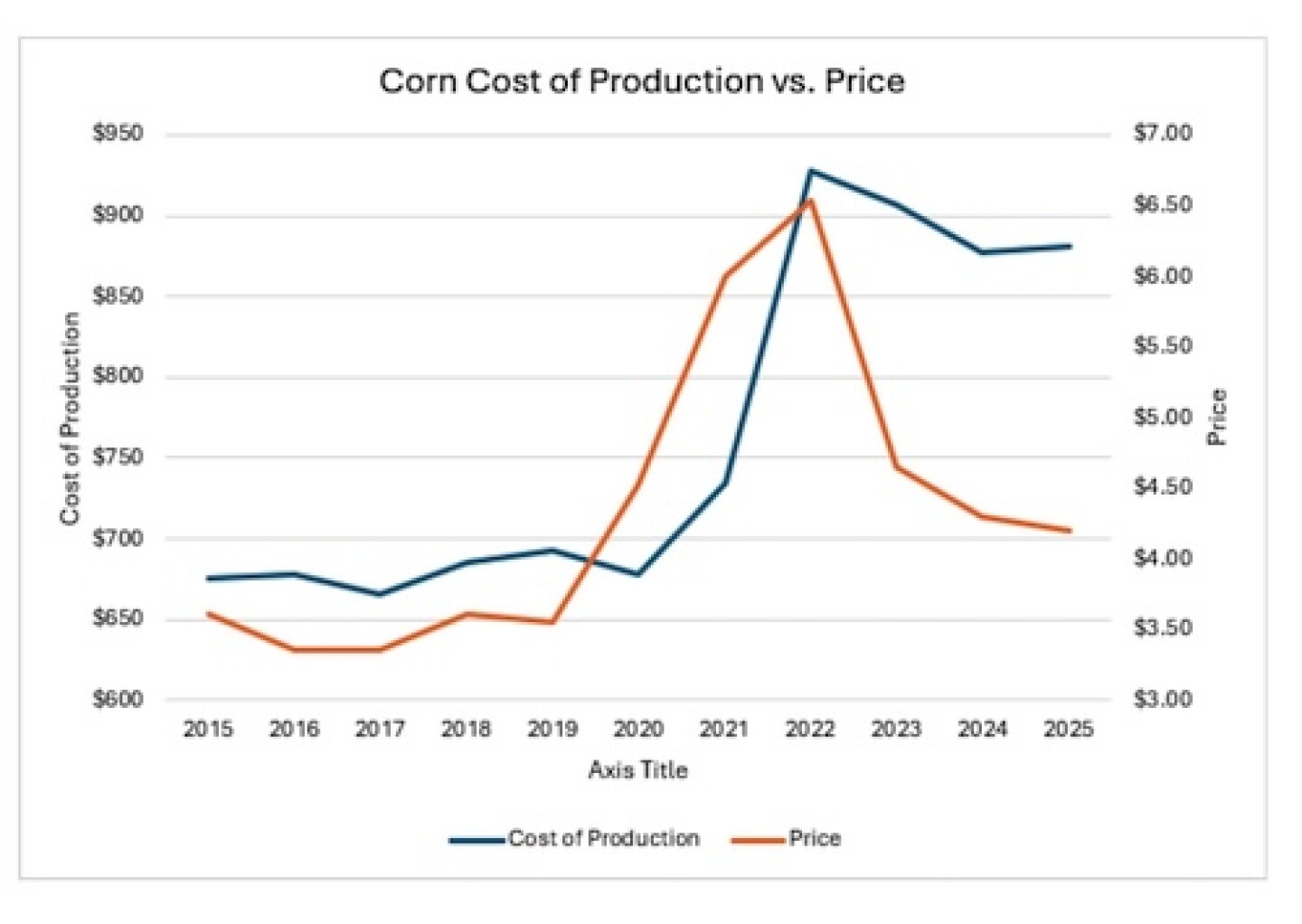

— One chart shows why a new farm bill is needed this year:

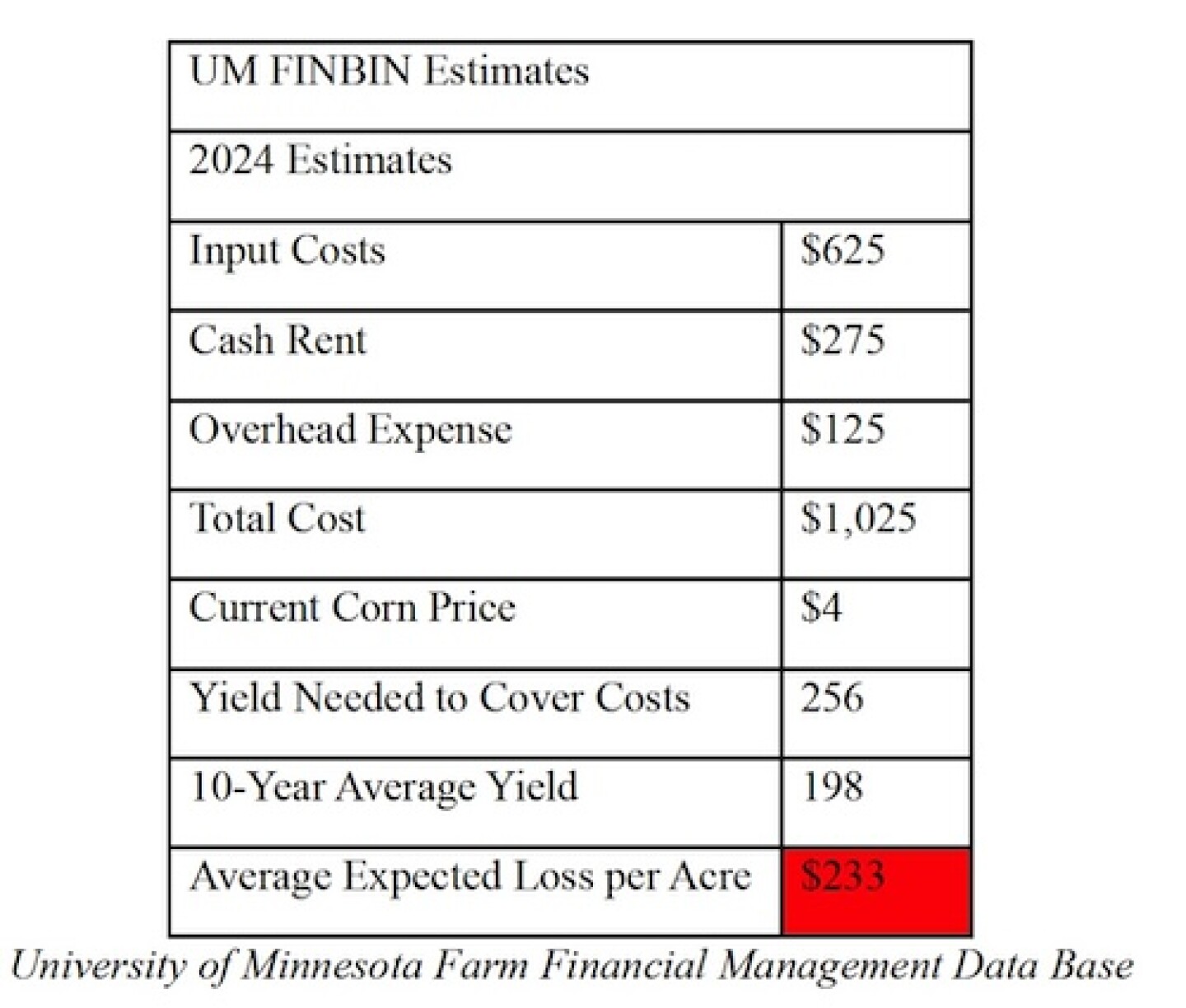

— Testimony at House Ag hearing Tuesday captures the downturn and anxiety in the ag sector. Dana Allen-Tully (PhD) gave insightful comments (link) to a House Ag panel hearing Tuesday that captures the anxiety and price downturn in U.S. agriculture She and her family run a diversified farm in Eyota, Minnesota, producing dairy, corn, soybeans, and alfalfa. She also serves as President of the Minnesota Corn Growers Association, representing 7,000 farm families across the state.

She discussed the importance of passing a stronger farm bill this year, and shared the economic challenges producers are facing. We’re heading into a “perfect storm” of plummeting crop prices, high production costs, rising interest rates, natural disasters, and tightening credit, leading to depleted working capital, she stressed.

She noted recent analyses by the Federal Reserve Bank and the Farm Bureau highlight the brewing trouble, with John Deere’s layoffs as an early warning sign. An extension of the current farm bill won’t prevent economic issues, she informed, and a new farm bill, while essential, may not be timely enough. She said Sen. Martin Heinrich (D-N.M.) recently emphasized the need for a disaster supplemental to address these challenges.

Allen-Tully cited USDA estimates projecting a drastic fall in farm income this year, marking the largest year-to-year drop ever recorded. From 2022 to 2024, net farm income will have fallen by 40%, explaining the declining farmer sentiment and increased mental health issues in rural America.

For farmers to break even this year, she detailed, national average corn yields must be 219 bushels per acre, and soybeans 56 bushels per acre — both significantly higher than the past 10-year average. Losses per acre are projected to be over $150, with even higher losses in Minnesota.

Her bottom line: Farm and ranch families need help. The Commodity Title and Crop Insurance provisions in the House farm bill, she concluded, provide a meaningful safety net, with a $4.10 PLC/ARC reference price and improved revenue thresholds. These measures are crucial, especially under current conditions, she said. While she supports these provisions in the next farm bill, she added it’s important to resume ERP payments for 2022 and consider a disaster supplemental for near-term assistance.

Beyond the farm bill, Allen-Tully noted issues like trade deficits and flawed regulations impact farm families. She urged new trade agreements and better rules for biofuels to support domestic producers. “We face high stakes in farming, risking everything annually for thin margins. This discourages young people from farming, posing a problem for food security. Policies must reflect modern farming realities to address global hunger.”

| CHINA UPDATE |

— China expands its EV factories in EU to skirt tariffs. China’s electric vehicle (EV) makers are expanding in Europe to blunt the impact of tariffs meant to weaken their price advantage over the region’s ailing legacy manufacturers, Bloomberg reported. With the EU hiking duties on Chinese EVs to as much as 48%, China’s new generation of green car manufacturers is teaming up with local industry, so their cars are considered homegrown. Without these measures, Chinese EVs could become thousands of euros more expensive for consumers, or else unprofitable. The arrival of China’s EV makers is a risk for European auto giants, which have little choice but to strike partnerships and make space for their upstart rivals as they face shuttering some of their own sites to adjust to faltering global sales growth.

— China’s 10-Year yield hits record low, testing PBOC’s patience. China’s benchmark government bond yield fell to a record low, testing policymakers’ resolve to stem the move. The yield on the 10-year sovereign note fell to 2.17% on Friday, below the 2.18% hit on July 1. Recent interest rate cuts by the People’s Bank of China (PBOC) to boost a flailing economy have undermined its efforts to guide longer-dated bond yields higher. The central bank sees excessively low yields as endangering financial stability and weighing on the yuan. A Bloomberg survey had suggested 2.25% was a red line for PBOC for the benchmark 10-year note.

— China’s rate cuts sequence hints at reduced role for MLF. PBOC surprised markets this week by first cutting several key rates including loan prime rate (LPR) and reverse repo rate on Monday. It then conducted an unscheduled medium-term lending facility (MLF) lending operation on Thursday, at steeply lower rates. The series of moves show PBOC’s monetary framework has changed, Reuters reported, with the short-term repo rate becoming the primary signal and a diminished role for MLF. That would be a departure from the past as MLF rate changes have historically been a precursor to LPR and deposit rate changes. The central bank also introduced a new cash management tool earlier this month in the form of temporary bond repurchase (repo) agreements and reverse repos. PBOC is moving away from targeting money supply and towards the price of money. That means controlling short-term repo rates rather than the MLF, as the latter is used more to bridge funding shortfalls at banks.

| TRADE POLICY |

— USTR sets specific allocations for FY 2025 sugar TRQ. The Office of the U.S. Trade Representative (USTR) has published (link) country-specific allocations under the Fiscal Year (FY) 2025 tariff-rate quota (TRQ) for raw cane sugar, refined and specialty sugar, and sugar-containing products. USTR in June announced an in-quota quantity of the TRQ for raw cane sugar for FY 2025 of 1,117,195 metric tons raw value (MTRV), the minimum quantity. As for the refined sugar TRQ, USTR said it is allocating 10,300 MTRV to Canada, 2,954 MTRV to Mexico, and 7,090 MTRV to be administered on a first-come, first-served basis. USTR said that relative to the 64,709 metric tons of the TRQ for imports of certain sugar-containing products, 59,250 metric tons are allocated to Canada with the remainder (5,459 metric tons) available for other countries on a first-come, first-served basis. Link to Federal Register notice with details of country allocations.

| ENERGY & CLIMATE CHANGE |

— NGFA submitted recommendations to USDA regarding climate-smart agriculture practices and their impact on greenhouse gas (GHG) emissions for biofuel feedstocks. These recommendations respond to USDA’s request for information aimed at establishing voluntary standards for such feedstocks, as announced on June 27. These standards are part of the 2008 Food, Conservation, and Energy Act and aim to support clean transportation fuel policies, including the 45Z tax credit.

NGFA supports standards that encourage voluntary adoption of climate-smart practices and create additional revenue for farmers and agribusinesses. They highlighted the importance of U.S. leadership in global sustainable transportation fuel markets and made several key recommendations:

- Broad and science-based incentivization of all types of carbon reductions.

- Avoiding arbitrary bundling of practices when quantifying GHG emissions.

- Limiting farmer data collection to essential information for verification.

- Allowing farmers to market climate-smart commodities throughout the value chain.

- Implementing traceability standards that accommodate the mass balance system used in commodity handling.

— NCGA urges Biden administration set fair criteria for farming practices to qualify for tax credits for sustainable aviation fuels. National Corn Growers Assn. (NCGA) President Harold Wolle emphasized the importance of ethanol in reducing greenhouse gas emissions and the need for a level playing field for farmers. The tax credits, part of the Inflation Reduction Act, require biofuel producers to lower their carbon intensity score, which can be achieved through climate-smart agriculture practices. Corn growers are concerned about rigid standards that may not be feasible in all regions, which could hinder their contribution to climate goals.

— Exxon Mobil entered into a significant carbon capture and storage (CCS) agreement with CF Industries, a major ammonia producer. This partnership aims to reduce carbon dioxide emissions from CF Industries’ Yazoo City, Mississippi complex. Here are the key details of the agreement:

Project overview

- Exxon Mobil will transport and permanently store up to 500,000 metric tonnes per year of captured CO2 from CF Industries’ Yazoo City complex.

- The project is expected to reduce the site’s CO2 emissions by approximately 50%.

- The startup for this CCS initiative is planned for 2028.

Impact and significance

- Brings Exxon Mobil’s total committed CO2 storage for customers to 5.5 million metric tonnes annually.

- Emissions reduction is equivalent to replacing about 2 million gasoline-powered cars with electric vehicles.

- Project represents CF Industries’ second major decarbonization effort using CCS technologies, and their second collaboration with Exxon Mobil.

CF Industries’ investment and benefits

- CF Industries will invest approximately $100 million in its Yazoo City Complex to build a CO2 dehydration and compression unit.

- Project is expected to qualify for tax credits under Section 45Q of the Internal Revenue Code.

- Once operational, the Yazoo City Complex will be able to manufacture products with a substantially lower carbon intensity compared to conventional ammonia production sites.

Details:

- The Yazoo City complex produces ammonia, which is a key ingredient in nitrogen fertilizer used in about half of the world’s food production.

- Ammonia is also emerging as a potential low-carbon energy carrier for sectors like marine transportation.

- This CCS project aligns with both companies’ goals to reduce emissions and contribute to decarbonization efforts in hard-to-abate industries.

Exxon Mobil’s CCS expertise

- Exxon Mobil has over 30 years of experience in carbon capture and owns and operates the largest CO2 pipeline network in the United States.

- This agreement demonstrates Exxon Mobil’s commitment to expanding carbon capture solutions for industrial customers.

Bottom line: This partnership between Exxon Mobil and CF Industries represents a significant step towards reducing carbon emissions in the fertilizer production industry while maintaining the critical role of ammonia in global food security and potential future energy applications.

— Whitmer vetoes E15 rebate program. Michigan Governor Gretchen Whitmer (D) recently vetoed a $3 million grant program that aimed to incentivize the sale of E15 fuel by providing a 5 cent-a-gallon rebate to fuel retailers. This decision has sparked significant disappointment among Michigan’s agricultural and environmental groups. E15 is a blend of gasoline that contains 15% ethanol and 85% gasoline. It is known for burning cleaner than pure gasoline, thereby reducing greenhouse gas emissions and improving air quality. The U.S. Environmental Protection Agency (EPA) has approved E15 for use in light-duty vehicles from model year 2001 and newer.

Background. The vetoed program was designed to expand the availability of E15 in Michigan by offering financial incentives to fuel retailers. Specifically, it proposed a 5 cent-per-gallon rebate for E15 sold, with a cap of $100,000 per retailer. The program was expected to support both environmental and economic goals by:

- Reducing carbon emissions through higher biofuel usage

- Supporting the agricultural economy by increasing demand for ethanol, which is primarily produced from corn

- Providing consumers with a cheaper fuel alternative

Reactions. The veto has been met with disappointment from various stakeholders:

- Michigan Corn Growers Association: Executive Director Jim Zook expressed that the veto is a setback for farmers who are struggling with low prices and need increased demand for ethanol. He described the veto as a “slap in the face” to farmers.

- Growth Energy: CEO Emily Skor highlighted that higher biofuel blends like E15 are crucial for decarbonization efforts and can help reduce fuel costs for consumers.

- Michigan Agri-Business Association: President Chuck Lippstreu criticized the veto as a missed opportunity to promote higher biofuel blends, which could reduce reliance on oil and support the rural economy.

Governor Whitmer defended her decision by stating that the veto was a result of a lack of negotiation on the budget items. She indicated openness to future discussions, suggesting that the door is not entirely closed on the possibility of revisiting the program.

Implications. The veto means that only 23 fuel retailers in Michigan currently offer E15, limiting the fuel’s availability and potential environmental benefits. Additionally, the agricultural sector misses out on a potential boost in ethanol demand, which could have helped stabilize corn prices and support farm incomes.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Three more human cases of H5N1 in Colorado. The Colorado Dept. of Public Health and Environment reported three more bird flu cases among farm workers in Weld County, Colorado. The workers, who were culling birds with highly pathogenic avian influenza (HPAI) at an egg farm, are receiving antiviral treatment. This brings the total confirmed human cases of HPAI to 13 this year, with cases in Colorado, Michigan, and Texas. The cases include four workers from dairy farms and nine from poultry farms.

— Study: Avian flu spreads from birds to cows and other mammals in U.S. A recent study published in Nature (link) provides evidence of avian influenza (H5N1) spreading from birds to dairy cattle and subsequently from cattle to other mammals, including cats and a raccoon, across several U.S. states. This marks one of the first documented instances of efficient and sustained mammalian-to-mammalian transmission of this highly pathogenic virus, according to Diego Diel, associate professor of virology at Cornell University. Whole genome sequencing of the virus did not show mutations enhancing its transmissibility in humans, though the occurrence of mammal-to-mammal transmission is concerning as it may adapt further. Thirteen human cases in the U.S. have been reported, primarily linked to cattle and poultry farms, including a recent outbreak in Colorado, suggesting the virus may have originated from dairy farms in the same county. The study involved extensive genomic sequencing and epidemiological modeling, revealing cow-to-cow transmission and spread to other mammals, likely through environmental contamination or direct consumption of raw milk from infected cows. The research was conducted by a team from Cornell University and Texas A&M Veterinary Medical Diagnostic Laboratory.

— USDA projects the smallest rise in grocery prices for 2025 since 2018. Initial forecasts show a 2.0% increase in all food prices, a 0.7% rise in grocery prices, and a 3.0% hike in restaurant prices. For 2024, USDA maintains its prediction of a 2.2% increase in all food prices, with a 1.0% rise in grocery prices and a 4.3% increase in restaurant prices.

Details: Key grocery categories like fish, seafood, eggs, dairy products, and fresh fruits and vegetables are expected to see price drops in 2024 and further decreases in 2025. If realized, these forecasts would mark the smallest rises in food prices since 2019 for all food and since 2018 for grocery and restaurant prices.

Bottom line: USDA’s projections indicate a continued moderation in food price inflation compared to recent years.

— 1481 Meats in Upham joins North Dakota State Meat Inspection Program. 1481 Meats in Upham has become the newest North Dakota company to operate under the State Meat and Poultry Inspection Program, as confirmed by Agriculture Commissioner Doug Goehring. Owners Tyler and Kelani Welstad began custom exempt processing in September 2023 and officially started state-inspected operations on May 24, 2024. Their facility, named for its location at Highway 14 and 81st St. N., provides beef processing and sells retail jerky, sticks, and fresh meats. State-accredited meat processing plants can sell products wholesale within North Dakota, and after three months of official state operation, they can apply for the Cooperative Interstate Shipment Program to ship products nationwide. The NDDA meat inspection staff assisted the Welstads in meeting regulatory requirements, including a HACCP plan and SSOPs for plant sanitation. Currently, 19 North Dakota companies operate under the state program, with seven approved for interstate shipments, and 76 custom exempt facilities process private game and livestock.

— Brazil is set to declare an end to the Newcastle disease outbreak in Rio Grande do Sul, according to the Estadao newspaper, quoting Carlos Goulart, Secretary of Agricultural Defense. Goulart stated that technical data confirms the outbreak is over, and Brazil will notify the World Organization for Animal Health (WOAH) and share details with the international community. Following the first reported case since 2006, Brazil had imposed a voluntary export ban on poultry to certain countries. Normal export activities are expected to resume pending clearance from the affected countries. The agriculture ministry has not commented on the situation.

Background of the outbreak. The outbreak was first detected on a commercial poultry farm in the municipality of Anta Gorda, Rio Grande do Sul. The disease, which affects both domestic and wild birds, causes severe respiratory problems and can lead to death. The last confirmed cases in Brazil occurred in 2006 in subsistence birds in the states of Amazonas, Mato Grosso, and Rio Grande do Sul.

Impact on poultry exports. The outbreak led to significant disruptions in Brazil’s poultry export sector. Brazil, the world’s largest poultry exporter, voluntarily imposed an export ban on poultry products to certain countries, including China, Argentina, and Mexico. This precautionary measure was aimed at ensuring transparency and maintaining trust with international trading partners.

| OTHER ITEMS OF NOTE |

— Just hours before the opening ceremony of the Paris Olympics, France’s high-speed rail network was hit by a series of coordinated arson attacks, causing significant disruptions to some of the country’s busiest rail lines. The national railway company, SNCF, reported that vandals targeted installations along routes connecting Paris to western, northern, and eastern regions of France. The attacks led to widespread cancellations and delays, with some delays ranging from 30 to 90 minutes. SNCF chairman Jean-Pierre Farandou estimated that around 800,000 travelers were affected. Officials warned that the disruptions were likely to continue throughout the weekend, with normal service not expected to resume until Monday, July 29. Transport Minister Patrice Vergriete strongly condemned the “coordinated” acts, describing them as criminal. Sports Minister Amélie Oudéa-Castera called the attacks “completely appalling” and stated that “to target the games is to target France.”

— Cotton AWP moves lower. The Adjusted World Price (AWP) for cotton declined to 55.02 cents per pound, effective today (July 26), down from 56.42 the prior week and the seventh week below 60 cents. But it remains above the level that would trigger any farm program benefits — 52 cents per pound. Meanwhile, USDA announced Special Import Quota #15 would be established Aug. 2 for 42,137 bales of Upland Cotton, applying to supplies purchased not later than Oct. 29 and entered into the U.S. not later than Jan. 27.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |