News/Markets/Policy Updates: Dec. 16, 2024

— 2018 Farm Bill extension negotiations trigger partisan bargaining over aid and policy goals. A one-year extension of the 2018 Farm Bill, tied to the continuing resolution (CR), has sparked intense negotiations over economic assistance to farmers. Initially, leaders considered diverting Inflation Reduction Act (IRA) funds intended for the National Resources Conservation Service in exchange for farmer aid. However, House Speaker Mike Johnson (R-La.) opposed this, aligning with President-elect Donald Trump’s intent to dismantle the IRA in the next Congress. Sensing an opening, Democrats pushed for concessions in return for their support, proposing initiatives like 100% federal funding for Baltimore’s Francis Scott Key Bridge, duty-free trade benefits for Haiti and Africa, funding for museums honoring women and Hispanics, and re-entry support for former inmates under the Second Chance Act. Of note: Farm-state lawmakers, pushed by farm group lobbyists, said they would not support a CR without farmer aid. American Farm Bureau Federation publicly called on lawmakers to oppose the stopgap bill if it doesn’t include farm aid. “I call on members of Congress who represent ag to stand with farmers by insisting the supplemental spending bill include economic aid for farmers and voting it down if it doesn’t,” AFBF President Zippy Duvall said Saturday. The dilemma: Democrats know Johnson wants farmer aid language and must rely on them to help pass it, perhaps a majority of votes. House GOP leaders may have to take the CR up under suspension, meaning it will need a two-thirds majority to pass. If congressional leaders release CR bill text today, the House may not vote until Thursday. If so, the Senate could follow on Thursday or more likely on Friday. Unlocking the farm aid package is the key to a broader CR deal. Both sides want to get aid to farmers, but they differ on the funding mechanisms. Republicans rejected a Democratic offer to include about $10 billion in aid to farmers while moving several conservation/climate programs into the farm bill baseline, which technically scores as deficit neutral. Republican leaders opposed continuing the conservation programs beyond their 2031 expiration, as they’d like to claw back as much of the 2022 law’s climate-related spending as possible once they have full control of the House, Senate and White House next year. Democrats in turn rejected a GOP counteroffer of $12 billion in unoffset economic aid, saying it came at the expense of some of Biden’s requested $21 billion in emergency agricultural assistance for farmers and ranchers impacted by natural disasters. — USDA delays Mexican cattle imports until 2025 amid screwworm control efforts. Despite earlier speculation, USDA clarified Friday that Mexican cattle imports under new protocols won’t resume until early 2025. USDA Undersecretary Jenny Lester Moffitt initially suggested inspections “before the holidays,” but Chief Veterinary Officer Dr. Rosemary Sifford later confirmed shipments will start incrementally after the New Year. USDA issued a statement that no cattle were likely to come into the U.S. via the new protocols until early in 2025. “Shipments will likely resume incrementally after the New Year, with full resumption of live animal movements sometime after that,” Dr. Sifford said in a statement. “While the United States continues to work very closely with Mexico and has agreed to protocols, it will take some time to implement these due to multiple steps needed to resume trade.” USDA is allocating $165 million from the Commodity Credit Corporation to combat New World Screwworms, a critical step in resuming trade. Industry experts had anticipated delays due to the complexity of implementing the agreed protocols. The recent resurgence of New World Screwworm (NWS) in Central America and Mexico has severely impacted the cattle trade between the United States and Mexico. USDA halted cattle imports from Mexico after detecting early 2025. Mexico’s Agriculture Ministry is actively addressing the outbreak, having inspected over 116,000 cattle and established new inspection protocols with USDA. Efforts to combat the screwworm include the use of the Sterile Insect Technique (SIT) and the crucial work of the Panama-United States Commission for the Eradication and Prevention of Screwworm (COPEG), which produces 100 million sterile flies weekly to maintain a biological barrier in Panama. The outbreak has resulted in nearly 23,000 cases in Panama, 12,000 in Costa Rica, and over 6,000 in Nicaragua. USDA has allocated $165 million to enhance surveillance, enforce movement controls, and expand public education to combat the pest. — Former GOP Rep. Kelly Armstrong is now the governor of North Dakota. Armstrong secured a decisive victory to be North Dakota’s governor on Nov. 5 with 68.26% of the vote, continuing the Republican Party’s three-decade hold on the governor’s office. Armstrong was sworn in on Friday. His resignation from Congress means the House ratio is currently 219 Republicans to 211 Democrats with five vacancies. The reduced Republican majority in the House presents challenges for Speaker Mike Johnson and the GOP leadership. With such a narrow margin, every vote becomes crucial, and the party can afford to lose very few votes on any given piece of legislation. This situation may necessitate more compromise and bipartisan cooperation to advance the Republican agenda, including potential initiatives proposed by President-elect Donald Trump. As the political landscape continues to evolve, the upcoming special election to fill Armstrong’s vacant congressional seat will be closely watched. The outcome of this election, along with the other vacancies, could further impact the balance of power in the House and influence the dynamics of legislative processes in the coming months. — China official: Economic growth on track to hit 5% target in 2024. China is set to achieve its annual growth target of around 5%, with major economic goals for 2024 on track, according to Han Wenxiu, a senior official from the Central Financial and Economic Affairs Commission. Speaking at an economic forum in Beijing, Han highlighted stable employment, controlled prices, and foreign exchange reserves exceeding $3.2 trillion as key indicators of progress. Recent stimulus measures have revived growth, particularly in the real estate sector, and have boosted social confidence. Economic planners are shifting to more active fiscal policies and moderately loose monetary strategies to sustain growth, with specific policy details to be unveiled in March. Policymakers aim to enhance domestic demand, strengthen the private sector, and manage local government debt, ensuring a sustainable growth trajectory amid global economic uncertainties. — Robert F. Kennedy Jr.’s attempt to win over Capitol Hill starts this week with a strategy to play down the topic of vaccines, adhere closely to Donald Trump’s messaging on abortion and talk up healthy food. Link to a backgrounder we had in The Week Ahead. Kennedy will meet with more than two dozen senators this week alone. Today’s sessions will include Markwayne Mullin (R-Okla.). Other GOP senators RFK Jr. meet this week include: Bill Hagerty (Tenn.), Cindy Hyde-Smith (Miss.), James Lankford (Okla.), Josh Hawley (Mo.), Katie Britt (Ala.), Lindsey Graham (S.C.), Lisa Murkowski (Alaska), Mike Crapo (Idaho), Marsha Blackburn (Tenn.), Rand Paul (Ky.), Rick Scott (Fla.), Roger Marshall (Kan.), Ron Johnson (Wis.), Shelley Moore Capito (W.Va.), Steve Daines (Mont.), Ted Budd (N.C.), Ted Cruz (Texas), Tim Scott (S.C.), Tom Cotton (Ark.), Tommy Tuberville (Ala.) and Dan Sullivan (Alaska). Also on RFK’s list for the week: incoming Senate Majority Leader John Thune (S.D.)and incoming Senate Majority Whip John Barrasso (Wyo.). |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed but mostly lower overnight. U.S. stock indexes are pointed toward firmer openings. In Asia, Japan flat. Hong Kong -0.9%. China -0.2%. India -0.5%. In Europe, at midday, London -0.3%. Paris -0.8%. Frankfurt -0.3%. French stocks and bonds fell after Moody’s cut the country’s credit rating, adding to pressure on officials to resolve an impasse and cut the deficit. The new prime minister is meeting leaders today to try to form a government. In Germany, Chancellor Olaf Scholz spoke to German lawmakers today and called for massive new investment into infrastructure and defense, hitting on key campaign themes ahead of a vote in parliament that will pave the way for a snap federal election in just over two months.

U.S. equities Friday and for the week: The Nasdaq was able to register a rise Friday while the Dow and S&P 500 ended lower, leaving the Dow and S&P lower for the week while the Nasdaq moved higher. The Dow was down 1.82% with the Nasdaq up 0.33% and the S&P 500 down 0.64%. On Friday, the Dow fell 86.06 points, 0.20%, at 43,828.06. The Nasdaq rose 23.88 points, 0.12%, at 19,926.72. The S&P 500 eased 0.16 point, 0.00%, at 6,051.09.

Earnings season is nearly complete, allowing investors to shift their attention to the upcoming Federal Reserve meeting (Dec. 17-18). Markets are confidently predicting a 0.25% rate cut, which seems almost certain. Looking ahead to next year, uncertainty looms over the Fed’s response to persistent inflation and fluctuating concerns about economic growth.

The “Santa Claus Rally,” a historical trend in the S&P 500, refers to an average gain of 1.3% during a specific period: the last five trading days of the year and the first two trading days of the new year. This year, that period starts on Dec. 24. Historically, the S&P 500 has closed higher during this stretch 77% of the time, reflecting a strong seasonal pattern of positive returns.

— Oil prices hit three-week high amid geopolitical tensions and demand optimism. Oil prices surged about 2% on Friday, reaching their highest levels in three weeks due to expected supply constraints from sanctions on Russia and Iran, coupled with optimism about increased fuel demand driven by potential interest rate cuts in Europe and the U.S. Brent crude closed at $74.49 per barrel, up 1.5%, while U.S. West Texas Intermediate (WTI) climbed 1.8% to $71.29. Weekly gains were notable, with Brent up 5% and WTI up 6%. Market sentiment was bolstered by the EU’s sanctions targeting Russia’s shadow tanker fleet and possible measures against Iran’s nuclear activities. Meanwhile, Chinese crude imports rose in November for the first time in seven months, and the International Energy Agency raised its 2025 demand growth forecast to 1.1 million barrels per day, citing China’s economic stimulus efforts.

— Ag markets today: Corn, soybeans and wheat firmed overnight while holding in relatively tight trading ranges. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were 1 to 3 cents higher and wheat futures were mostly 3 to 5 cents higher. The U.S. dollar index was trading just below unchanged, and front-month crude oil futures were about 70 cents lower.

Cash cattle prices rose for a fourth consecutive week, despite negative packer margins, suggesting they were short bought on needs through year-end. With holiday-shortened slaughters in two of the next three weeks, cash sources say packers could pull back the reins on cash bids this week. Of course, they’ve been warning of that happening the past couple of weeks.

The CME lean hog index is down a penny to $83.90 as of Dec. 12, though the index rose in three of the last eight days. The pork cutout firmed $2.30 to $94.61 on Friday amid gains in all but ribs and is $5.97 off its Dec. 5 low.

— Agriculture markets Friday and for the week:

• Corn: March corn futures settled 1 1/2 cents lower to $4.42, up 2 cents on the week.

• Soy complex: January soybeans lost 7 1/2 cents to $9.88 1/4, marking a 5 1/2-cent loss on the week. January meal futures fell $3.3 to $286.2 and marked a fresh contract low. January bean oil futures fell 6 points to 42.61 cents.

• Wheat: March SRW wheat futures fell 6 1/4 cents to $5.52 1/4 and near the daily low. For the week March SRW lost 5 cents. March HRW wheat fell 5 3/4 cents to $5.57, nearer the daily low and on the week up 3 1/4 cents.

• Cotton: March cotton futures fell 82 points to 69.27 cents, near the daily low and a three-week-low close. For the week, March cotton lost 84 points.

• Cattle: Expiring December live cattle rose $1.525 to $193.65 Friday, while most-active February futures climbed $1.175 to $192.025. That marked a weekly surge of $5.85. January feeder futures fell 90 cents to $257.65, which represented a weekly rise of $1.825.

• Hogs: Cash hog and wholesale pork strength powered fresh gains in hog futures. The December contract expired 17.5 cents higher at $83.725. February futures surged $1.125 to $85.60 at the close. That represented a weekly drop of $1.725.

— Labor market rebound in November: key observations from Dr. Vince Malanga. November’s labor market report highlighted a recovery from October’s weather-affected downturn, with “a rebound expected after hurricanes and work stoppages biased the October data downward.” Despite this, Dr. Vince Malanga, president of LaSalle Economics, noted, “employment as measured by the Household survey fell in November and was at the same level recorded in May.” This mixed signal raises questions about the overall strength of the labor market.

Malanga also discussed potential economic activity drivers in the coming months, emphasizing the influence of inventory adjustments ahead of possible tariff implementations. “If tariffs bring about reciprocal agreements, they could even be deflationary,” he remarked, balancing this against his expectation of declining oil prices. “Our bet is that inflation will head lower during 2025,” he added.

Turning to fiscal policy, Malanga highlighted the ambitious goals of DOGE, calling it “a presumed attack on the administrative state.” He contrasted these efforts with past approaches like the Gramm-Rudman-Hollings Act, noting that this time, “the whole of government and the regulatory state” are targeted while Medicare and Social Security remain untouched. Public sentiment, he observed, might support such measures, pointing to “a general revulsion to fiscal excess gaining steam globally.”

Finally, Dr. Malanga identified deregulation and its impact on public sector payrolls as a critical indicator. “Reversing steady public sector growth since Covid would be a firm straw in the wind,” he concluded.

Market perspectives:

— Outside markets: The U.S. dollar index was near steady. Nymex crude oil futures prices are lower and trading around $70.50 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently 4.377%.

— Bitcoin rose to a fresh record high above $106,000, fueled by ongoing optimism over Donald Trump’s support for crypto. Software company MicroStrategy, a big buyer of the digital currency, is being added to the Nasdaq 100 Index.

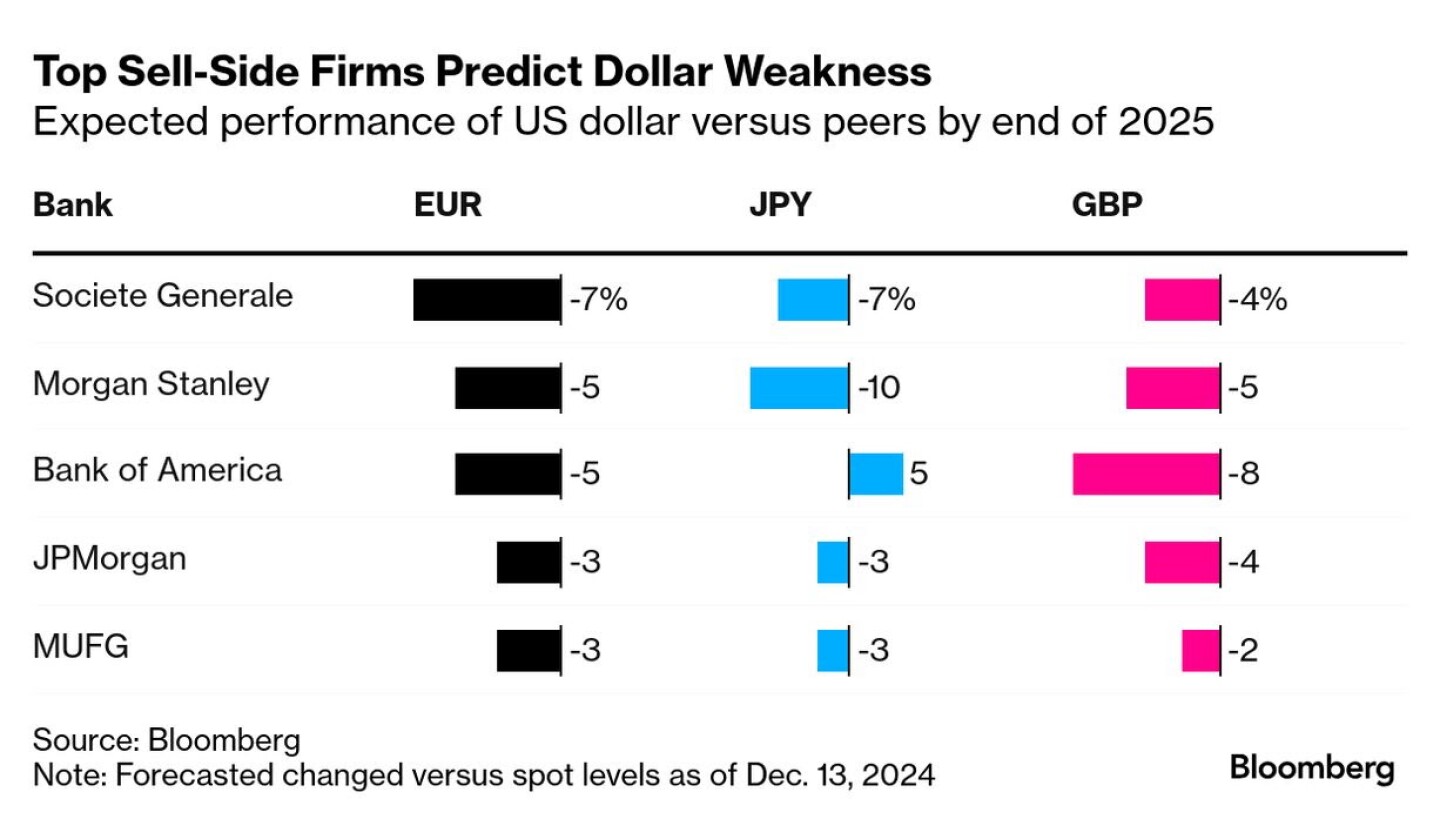

— U.S. dollar rally faces challenges ahead, analysts warn. The U.S. dollar, currently experiencing its biggest rally since 2015, may face significant headwinds late next year, according to leading Wall Street strategists. Fueled by President-elect Donald Trump’s policies and robust economic data, the greenback surged 6.3% this year, driven by expectations of tariffs, tax cuts, and reduced Fed rate cuts. However, analysts from Morgan Stanley and JPMorgan Chase project the dollar will peak by mid-2025 before weakening, with Societe Generale forecasting a 6% decline in the ICE U.S. Dollar Index by year-end 2025. Societe Generale’s Kit Juckes described the currency’s current valuation as “stomach churning,” signaling unsustainability over the long term. Factors like falling real U.S. interest rates and improved global risk appetite are expected to contribute to the dollar’s eventual decline, according to Morgan Stanley’s strategists.

One big risk to bearish dollar forecasts: The Fed could end up keeping rates higher for even longer, which would make it more lucrative to keep dollars in the bank. In a note dated Sunday, Goldman Sachs said it no longer expects the central bank to lower rates in January. The bank expects the Fed to deliver a message this week that the pace of further easing will slow. Over at Apollo Global Management, Chief Economist Torsten Slok is warning that the Fed may even end up raising rates in 2025 to forestall the risk of a re-acceleration in price pressures.

— Commodity trader and ag industry analyst Richard Crow on cattle market: “Cattle market surged to new highs on the move. The managed money added 3,900 contracts as of Tuesday, plus more on Wednesday and Friday. Any way one wants to look at the beef market, the demand curve has shifted upward and to the right. Demand has been nothing but phenomenal. The forward supply remains questionable. Feeder supplies for the calendar year 2025 are expected to be well over a 1 million head smaller. Mexico supplies will be limited for several weeks. Almost every time the cattle market trades like it is ready to break, the buying shows. Middle meat demand is weakening, but the increase in hamburger prices has more than offset the net value.”

— Ag trade update: Saudi Arabia purchased 804,000 MT of optional origin hard milling wheat.

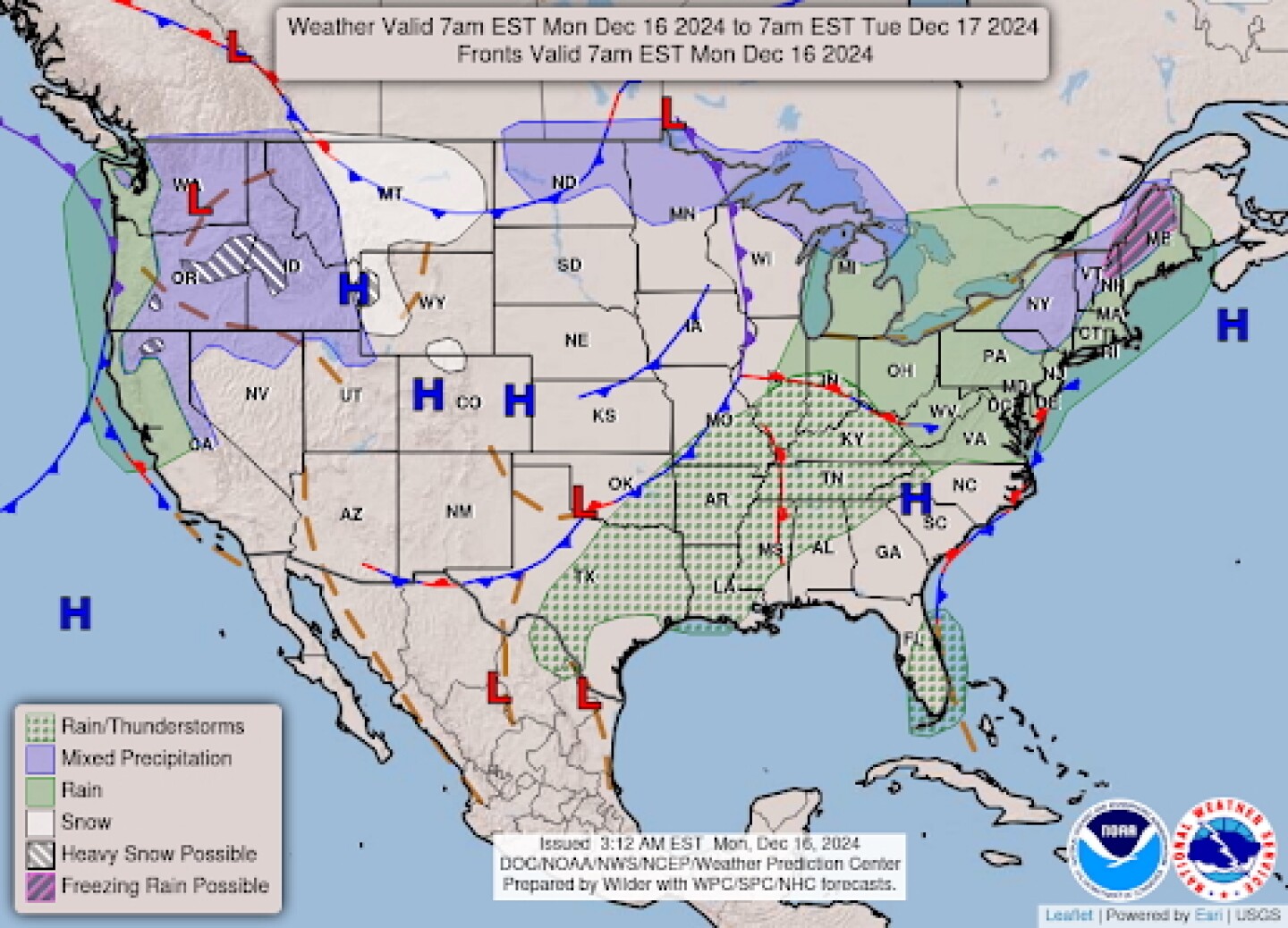

— NWS outlook: Modest atmospheric river activity to bring unsettled weather to the Northwest, including heavy rains for the coastal ranges and accumulating snow for the higher elevations... ...Wet conditions expected for much of the eastern half of the country the next couple of days... ...Above average temperatures, mild conditions expected for much of the country to start the week.

Items in Pro Farmer’s First Thing Today include:

• Grains firmer to open the week

• Eyes on cash cattle trade

• Signs cash hog fundamentals stabilizing

• Favorable conditions for Brazil’s crop development

• NOPA crush expected to decline from all-time high but still be a Nov. record

• Decline in Eurozone business activity eases in December

| ISRAEL/HAMAS CONFLICT |

— Netanyahu and Trump discuss Gaza conflict. Israeli Prime Minister Benjamin Netanyahu described a “very warm” phone call with U.S. President-elect Donald Trump. Their discussion included Israel’s ongoing war on Hamas in Gaza, where nearly 45,000 Palestinians have been killed. The leaders addressed Israel’s efforts to prevent Hezbollah from rearming, its position on Syria, and the need to secure victory in Gaza. Netanyahu also highlighted efforts to rescue the remaining hostages in Gaza, where approximately 100 individuals are believed to be held by Hamas and other groups. Of these, around half are thought to still be alive following their capture during the Oct. 7, 2023, attacks.

| CHINA UPDATE |

— China faces urgency to boost consumer spending amid slowdown. China’s retail sales grew by only 3% in November, marking the slowest pace in three months and undershooting forecasts, signaling the need for stronger consumer-focused policies. This slowdown comes despite modest improvements in the housing market and a 5.4% rise in industrial output, which outperformed but remains unsustainable as a growth driver.

Retail challenges: Subsidy programs have bolstered sales of home appliances and cars, but discretionary spending on goods like cosmetics, clothing, and jewelry has plummeted.

Economic context: Fixed-asset investment slowed to 3.3% in the first 11 months, while property investment fell 10.4%. The jobless rate held steady at 5%.

Policy shifts: Policymakers elevated boosting consumption to a top priority for 2025, but detailed plans remain unclear. Economists call for targeted fiscal measures and direct consumer support, yet President Xi Jinping remains wary of “welfarism.”

Bottom line: Despite limited successes in stabilizing property markets and modest growth in industrial production, the data underscores a critical need for Beijing to reinforce private consumption, particularly with looming risks like U.S. tariffs and global economic headwinds.

— China to boost direct fiscal support to consumers. China will promote stable growth in household income in 2025 by stepping up direct fiscal support to consumers and boosting social security, state-run Xinhua news agency said. To boost consumption, China will “greatly increase” funds from ultra-long special bonds to support the industrial upgrades and consumer goods trade-in scheme next year, Xinhua reported, quoting an official of the Central Financial and Economic Affairs Commission. Steps will focus on boosting household income through greater fiscal spending on consumption, better social security, job creation, wage growth mechanisms, higher pensions for retirees, better medical insurance subsidies and policies to spur childbirth, Xinhua said. This year, 150 billion yuan ($20.60 billion) from such bonds was allocated to support consumer goods, including fridges and TVs trade-ins, with overall sales revenue driven by the scheme topping 1 trillion yuan so far. Policymakers are weighing inclusion of more products in high demand and with potential for replacement in the scheme.

— China’s housing sector remains weak. China’s new home prices in 70 cities shrank 5.7% from last year in November, following the steepest decline in over nine years of 5.9% the previous month. This marked the 17th consecutive month of decreases, suggesting that Beijing’s attempts to mitigate the prolonged downturn in the property sector had yet to reverse conditions. Separate official figures showed home sales picked up, while real estate investment continued to decline.

| TRADE POLICY |

— WTO chief urges global unity to combat poverty through open trade. Global poverty will rise unless the world maintains a stable and open trading system, warned WTO Director General Ngozi Okonjo-Iweala in a recent interview in Rome cited by Bloomberg (link). Speaking after meeting Pope Francis, she emphasized the critical role of trade in feeding the world, noting that one in four calories consumed globally comes through trade. “We need multilateralism and cooperation; no country can solve global problems alone,” she said. Despite challenges such as protectionist policies and potential trade wars, she highlighted opportunities in services and green trade, which are rapidly growing sectors.

Recounting her experience during the Nigeria-Biafra war, Okonjo-Iweala underlined her lifelong commitment to lifting people out of poverty. She called for urgent reforms to the WTO and open dialogue among nations to address global conflicts and inequalities. “Children are searching for food in rubbish dumps, yet we are spending millions on arms,” Pope Francis told her, reflecting shared concerns over global disparities.

| ENERGY & CLIMATE CHANGE |

— Supreme Court to weigh California’s vehicle emission standards authority. The Supreme Court agreed to hear a pivotal case that could reshape California’s ability to set stricter vehicle emission standards under the Clean Air Act. This comes as the Environmental Protection Agency (EPA) is reportedly planning to grant California a waiver enabling the state to ban the sale of new gas-powered vehicles by 2035. Since 1967, California has received over 75 EPA waivers, granting it the authority to set stricter standards than federal regulations. The EPA reinstated a prior waiver in 2022, after its revocation during the Trump administration. The Clean Air Act uniquely empowers California to implement these regulations due to its significant air pollution challenges.

Fuel producers are challenging California’s standards, questioning the EPA’s authority to grant such waivers. The Supreme Court case could determine whether these producers have legal standing to contest California’s emission policies.

EPA’s planned waiver is expected to authorize California to:• Ban new gasoline-powered vehicle sales by 2035.• Implement stricter emission limits than federal benchmarks.

Fuel producers argue the regulations exceed EPA authority and risk economic harm to the fossil fuel sector. The ruling could influence (1) Other states’ ability to adopt California’s standards, (2) The pace of the automotive industry’s shift to electric vehicles, and (3) State and federal climate policies.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA expands electronic identification (EID) tag program for livestock in FY 2025. USDA’s Animal and Plant Health Inspection Service (APHIS) is distributing an additional 3 million electronic identification (EID) tags to states in fiscal year 2025, following the 8 million tags provided in 2024. This effort supports a nationwide traceability program aimed at improving the tracking of livestock and enhancing responses to disease outbreaks.

Mandated animals:

• Sexually intact cattle and bison (18+ months)

• Dairy cattle of all ages

• Cattle and bison used for rodeos, shows, and exhibitions

Both visually and electronically readable ear tags are required for interstate movement.

Since 2020, APHIS has provided free EID tags to encourage adoption. The system supports:

• Disease management: Rapid tracing of sick/exposed animals to minimize economic losses.

• Trade protection: Establishing disease-free zones to maintain domestic and international market access.

• Data integration: Enhancing collaboration among federal, state, and industry stakeholders.

Of note: While Congress allocated $15 million for the program in 2024, some states, like North Dakota, reported tag shortages. The additional tags for 2025 aim to alleviate these gaps, though producers may need to source tags independently if supplies are depleted.

— Avian flu resurgence in Iowa: wild birds and poultry flocks impacted. The Iowa Department of Natural Resources (DNR) on Friday reported a sharp rise in avian influenza cases among wild birds after nearly a year without detections. This resurgence coincides with outbreaks in commercial poultry operations in Sioux, Palo Alto, and Sac counties, where over 6 million chickens and 76,000 turkeys face depopulation. While no direct link between wild and domestic cases has been confirmed, further genetic analysis may provide clarity. Hunters and the public are urged to avoid sick birds, report unusual deaths, and practice caution to prevent disease spread.

Of note: The Iowa Department of Agriculture and USDA announced a case of highly pathogenic avian influenza (HPAI) in a commercial layer flock in O’Brien County. This is Iowa’s eighth detection of HPAI within poultry in 2024 and the fifth in the past week.

— Food prices surge amid isolated disruptions and persistent inflation. Recent months have seen a sharp rise in food prices, with eggs, beef, coffee, and orange juice leading the charge. November egg prices soared 8.2%, while wholesale egg prices spiked 55%. Experts attribute these increases to isolated incidents such as avian flu, extreme weather, and reduced cattle inventory, rather than systemic inflationary trends.

Although overall grocery inflation remains moderate compared to pandemic-era peaks, food prices are still significantly higher than pre-pandemic levels — eggs, for example, are up 81% since 2020. Analysts stress stabilization is the best-case scenario, as a return to 2019 prices is unlikely.

Restaurants and consumers are feeling the pinch. Many are absorbing rising costs to avoid passing them on to customers. However, proposed tariffs and policy changes under President-elect Trump could further disrupt supply chains and push prices higher.

| OTHER ITEMS OF NOTE |

— Guinness craze sparks supply worries for British pubs. British pubs are grappling with a potential Guinness shortage as the Irish stout’s popularity surges, especially among younger consumers and women. Diageo, the brand’s owner, has implemented allocation limits to manage the extraordinary demand. Pubs like London’s Sheephaven Bay report Guinness now accounts for over half of their beer sales, driven by social media influencers and strategic marketing campaigns. Globally, Guinness has defied beer industry trends with a 15% increase in net sales for fiscal year 2024, supported by promotions featuring celebrities like Jason Momoa and partnerships with major sporting events. However, pub owners are nervous about keeping up with demand during the crucial holiday season. The phenomenon isn’t confined to the UK, as Guinness continues to gain traction in the U.S. and beyond, with its low-calorie appeal and unique flavor profile winning over new audiences.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |