News/Markets/Policy Updates: Sept. 12, 2024

— USDA September crop reports out at noon ET. USDA will update its corn and soybean crop estimates at noon ET, which will include its first objective field data. Analysts expect little change to those crop estimates from the initial forecasts last month, with the average pre-report estimates at 15.076 billion bu. for corn (15.147 billion bu. in August) and 4.589 billion bu. for soybeans (unchanged from August). Analysts expect slightly smaller corn and soybean ending stocks estimates for 2023-24. For 2024-25, projected ending stocks are expected to decline for corn and wheat, while a modest increase is anticipated for soybeans. — This too shall pass. The significant downturn in portions of the ag sector has more than a few stakeholders in a pessimistic and anxious mood. Ag markets have a clear history of ups and downs, with some extreme volatility at both ends of the price spectrum. Some farmers can’t understand why Congress can’t get a new and better safety net farm bill accomplished when it is so obvious to them legislation is needed. Southern Ag Today writers (in this case, Dr. Joe Outlaw and Dr. Bart Fischer) take on this topic in a personal and interesting manner. Link to their report. Of note: There at least is some news regarding a new farm bill. The Policy Section includes a letter from House Ag Ranking Member David Scott (D-Ga.) on the matter. — Around 67 million people watched the presidential debate Tuesday between Vice President Kamala Harris and former President Donald Trump, according to Nielsen data. Around 51 million tuned in to the debate between Trump and President Joe Biden in June. — Independent voters had mixed reactions to the Sept. 10 debate between Kamala Harris and Donald Trump. Some independent voters were supportive of Trump on certain issues: However, other polls and voter reactions favored Harris: Many independent voters remained undecided or unswayed: |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mostly firmer overnight. U.S. DOW opened slightly higher. In Asia, Japan +3.4%. Hong Kong +0.8%. China -0.2%. India +1.8%. In Europe, at midday, London +0.8%. Paris +0.8%. Frankfurt +1.2%.

U.S. equities yesterday: All three major indices managed to finish higher after working in negative territory with the Dow making it into positive territory not long before the close. The Dow was up 124.75 points, 0.31%, at 40,861.71. The Nasdaq advanced 369.65 points, 2.17%, at 17,395.53. The S&P 500 rose 58.61 points, 1.07%, at 5,554.13.

— Oil prices were higher Wednesday, trading up as Hurricane Francine was barreling through towards Louisiana. The U.S. Bureau of Safety and Environmental Enforcement said 39% of crude oil production in the Gulf of Mexico was shut by Wednesday as companies evacuated crews out of Francine’s path. The bureau also said 49% of natural gas production from the Gulf was shut by the storm. WTI traded up $1.56 or 2.37% to close at $67.31. Brent traded down $1.42 or -2.05% to close at $70.61.

— Kroger beats profit estimates despite slight sales miss in Q2. Kroger Co.'s stock rose 1% in premarket trading on Thursday after the grocery chain exceeded profit expectations for the second quarter. Net income was $466 million, or 64 cents per share, compared to a loss of $180 million, or 25 cents per share, in the same quarter last year. Adjusted earnings per share (EPS) came to 93 cents, surpassing the 91-cent consensus from FactSet. Sales slightly missed expectations, rising to $33.912 billion, just below the $34.089 billion forecast. Same-store sales, excluding fuel, grew by 1.2%, edging past the expected 1.1% rise. CEO Rodney McMullen reaffirmed the company’s commitment to completing its merger with Albertsons, despite regulatory challenges. The statement comes as the company faces: (1) A federal court hearing on the Federal Trade Commission’s request for a preliminary injunction to block the deal; (2) Concerns from consumer groups and labor unions about potential price increases and job losses; and (3) Scrutiny from state attorneys general in multiple states.

— General Mills in talks to sell North American Yogurt Business for $2 billion, including the popular Yoplait brand, Bloomberg reports (link). The deal would see the U.S. and Canadian yogurt businesses potentially sold to French dairy giants Groupe Lactalis and Sodiaal, Bloomberg said, according to sources familiar with the matter. This move aligns with General Mills’ strategy to shift focus towards faster-growing segments such as premium pet food and organic snacks. Heightened competition from Danone and Chobani has prompted the company to reconsider its position in the U.S. yogurt market. General Mills’ U.S. yogurt business generated $1.4 billion in sales over the past year.

— Norfolk Southern terminates CEO Alan Shaw following policy violations. Norfolk Southern’s board has dismissed CEO Alan Shaw after an internal investigation revealed he violated company policies by engaging in a consensual relationship with the company’s chief legal officer, Nabanita Nag, who was also terminated. Shaw, a 30-year company veteran, had faced challenges during his leadership, including a toxic train derailment in East Palestine, Ohio, and criticism from activist investor Ancora Holdings over the company’s financial performance. Shaw will be succeeded by CFO Mark George, with interim leadership roles filled as the company maintains its financial guidance.

— Ag markets today: Wheat futures led followthrough buying in the grain and soy markets during the overnight session. As of 7:30 a.m. ET, corn futures were trading mostly 4 cents higher, soybeans were 7 to 8 cents higher, and wheat was mostly 8 to 10 cents higher. Front-month crude oil futures were around $1.25 higher, and the U.S. dollar index was trading just above unchanged.

Feedlots passing on weaker cash cattle bids. Feedlots in the Southern Plains reportedly passed on $1.00 lower bids from packers on Wednesday, sparking speculation the six-week drop in cash cattle prices may be coming to an end. Packers have solidified margins in the black with the string of lower cash prices, giving them some room to raise bids if needed.

Seasonal slide continues for hog/pork fundamentals. The CME lean hog index is down another dime to $85.46 as of Sept. 10, the lowest level since April 2. The pork cutout dropped $1.89 to $92.91 on Wednesday, the lowest since March 21.

— Agriculture markets yesterday:

• Corn: December corn rose 3/4 cent to $4.05, marking a near mid-range close.

• Soy complex: November soybeans rose 3 1/2 cents to $10.00 3/4. December soybean meal closed up $2.50 at $322.30. Both markets closed near mid-range. December soybean oil fell 36 points to 39.27 cents, nearer the session low and hit a three-week low.

• Wheat: December SRW wheat rose a nickel to $5.79 1/4, while December HRW rose 4 1/4 cents to $5.88 1/4, each closing nearer the session high. December HRS futures closed 6 1/2 cents higher at $6.16 1/2.

• Cotton: December cotton rose 140 points to 69.61 cents and nearer the daily high.

• Cattle: October live cattle futures rallied 62.5 cents to $176.95, while most-active October feeder futures surged $2.10 to $237.075.

• Hogs: October lean hog futures climbed $1.20 To $79.75 and settled near session highs.

— Quotes of note:

• Fed officials are expected to focus heavily on labor market conditions when they meet next week, said Michael Pearce, Oxford Economics deputy chief U.S. economist. Pearce believes the recent reacceleration in housing costs over the past two months is likely temporary noise rather than the start of a new upward trend. He noted that “The economy appears to be slowing, albeit at only a gradual pace.” As inflation rates decrease and the Federal Reserve prepares to adjust its policies, Pearce suggests we may be seeing the end of the so-called “vibecession” — a period of economic uncertainty and negative sentiment despite relatively strong economic data. Pearce’s comments indicate he sees the economy and labor market cooling gradually, rather than experiencing a sharp downturn. This aligns with the Federal Reserve’s goal of achieving a “soft landing” as they look to begin cutting interest rates. His analysis suggests the Fed will likely take a measured approach in adjusting monetary policy, balancing concerns about inflation with the desire to avoid overly constraining economic growth and employment.

• Markets are betting that Fed officials will lower interest rates by a quarter-point next Wednesday, giving that a probability of 86%. Some traders are putting a 14% probability that the Fed moves by a half-point, according to the CME’s FedWatch tool.

• “This battle against inflation is more or less done.” — Laura Veldkamp of Columbia University, after consumer inflation in the U.S. cooled to 2.5% annual growth in August.

• Analysts warn markets may be overestimating Europe’s economic resilience. Fixed income fund managers Raffaele Prencipe and Andre Figueira de Sousa from Degroof Petercam Asset Management caution that markets may be overly optimistic about Europe’s economic strength. In a note, they highlight structural challenges such as low productivity, aging populations, and labor shortages in key sectors, which could lead to a faster economic slowdown in Europe than in the U.S. While markets expect a shift from restrictive to neutral monetary policy, the analysts suggest that worsening economic data might prompt a more accommodative policy response.

• Morgan Stanley says bond yields are well-priced for expected U.S. rate cuts. Morgan Stanley Investment Management notes that bond yields are already well-priced for anticipated U.S. interest-rate cuts. Markets are expecting the Federal Reserve to lower rates by over 200 basis points by the end of 2025, potentially completing the full rate-cut cycle. With U.S. policy rates projected to drop to 3.5%, bond yields around 4% or lower seem adequately priced, particularly in a soft-landing scenario. Given the limited returns from duration, Morgan Stanley has shortened its duration exposure in response.

— U.S. producer prices rose more than expected in August, driven by services costs. U.S. producer prices rose by 0.2% in August, slightly above the forecasted 0.1%, due to a rebound in service costs, according to the Bureau of Labor Statistics. Year-over-year, the producer price index (PPI) increased by 1.7%. Excluding food and energy, the PPI climbed 0.3% from July and 2.4% year-over-year. The report showed a 0.4% increase in service costs, particularly in guestroom rentals, while goods prices remained unchanged, held back by a drop in energy costs.

Despite this uptick, stock index futures and Treasury yields remained stable, with investors still expecting a quarter-point interest-rate cut by the Federal Reserve at its upcoming meeting. This follows similar inflation signals from the consumer price index, reflecting diminishing cost pressures.

— ECB delivers second rate cut amid sluggish growth and cooling inflation. The European Central Bank (ECB) reduced its deposit rate by a quarter-point on Thursday, the second such cut this year. This widely expected move follows slow economic growth and inflation falling closer to the ECB’s 2% target in August. Attention now shifts to the ECB’s next steps, with economists divided on whether the central bank will pause in October or proceed with another rate cut in December. The decision precedes a likely rate-cutting cycle from the U.S. Federal Reserve, with the first expected cut coming Sept. 18.

— Social Security COLA for 2025 forecasted at 2.5%, lowest since 2021. Social Security beneficiaries are projected to see a modest 2.5% cost-of-living adjustment (COLA) in 2025, according to The Senior Citizens League (TSCL). This increase would raise the average monthly benefit by about $48. TSCL highlights that recent years saw higher COLA due to inflation (8.7% in 2023). However, the 2025 forecast signals a return to typical adjustment levels. Rising costs of essentials such as food and housing remain a concern for seniors, with 80% reporting increased expenses. The official COLA will be announced by the Social Security Administration in October.

— Atlanta Fed’s Bostic violated trading rules, OIG finds no profiteering from inside information. The Federal Reserve’s Office of the Inspector General (OIG) found that Atlanta Fed President Raphael Bostic violated trading rules multiple times between 2018 and 2023. The violations occurred during blackout periods ahead of Federal Open Market Committee (FOMC) meetings. The trades, made by third-party managers on Bostic’s behalf, did not result in profits from insider information, according to the OIG. While Bostic was not directly involved in the trades, the OIG noted that he should have been aware of the violations, which created the appearance of a conflict of interest. The case is closed, though the Atlanta Fed is reviewing the matter. Similar controversies led to the retirement of Fed presidents from Dallas and Boston.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with most foreign rival currencies also higher against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 3.68%, with a higher tone in global government bond yields. Crude oil futures were rising ahead of U.S. trading, with U.S. crude around $68.60 per barrel and Brent around $71.90 per barrel as traders monitored the situation in the Gulf. Gold and silver futures were firmer, with gold around $2,547 per troy ounce and silver around $29.15 per troy ounce.

— U.S.-bound imports surge ahead of potential East and Gulf Coast ports strike. U.S. import volumes remain elevated in anticipation of a potential strike at East and Gulf Coast ports, according to the latest Port Tracker report. With the current labor contract set to expire on Sept. 30 and no significant progress in negotiations, retailers are rushing shipments and shifting to alternate ports. Import volumes in August were up 20.9% year-over-year, with concerns about a strike adding to supply chain challenges as the holiday season approaches.

— Global oil demand slows as China’s economy cools, prices hit three-year low. The International Energy Agency (IEA) reports a sharp slowdown in global oil demand growth, driven by China’s economic cooling and the rise of electric vehicles. Oil consumption grew by just 800,000 barrels per day in the first half of 2024, significantly lower than the same period in 2023. Oil prices fell below $70 per barrel, the lowest since 2021, despite supply cuts from OPEC+. The IEA predicts global oil demand will peak by the end of the decade, with further contraction expected next year. Non-OPEC+ producers like the U.S., Brazil, and Canada are expected to outpace demand growth, threatening a supply glut.

— Argentine farmers to plant more soybeans instead of corn. Argentine farmers are expected to plant more soybeans for 2024-25 as corn faces concerns with dry weather and fears of disease carried by the leafhopper insect, the Rosario Grain Exchange said. The exchange forecasts soybean planted area at 17.7 million hectares, up 7.5% from last year, which would likely produce a crop of 52 MMT to 53 MMT. Corn plantings could fall 21% to 8 million hectares, which would project a crop of 51 MMT to 52 MMT.

— India’s refiners shift to soyoil instead of palm oil. India’s palm oil imports fell 26% in August from July to 797,482 MT, the Solvent Extractors’ Association of India (SEA) said. Imports of soyoil rose 16% to 454,639 MT, while sunflower oil imports fell 22.5% to 284,108 MT, it said. The drop in imports of palm and sunflower oils lowered the country’s total edible oil imports by 17% to 1.53 MMT.

— USDA daily export sale:

• 118,626 MT corn to unknown destinations, 2024-2025 marketing year.

— Ag trade update: Egypt purchased 430,000 MT of Russian wheat.

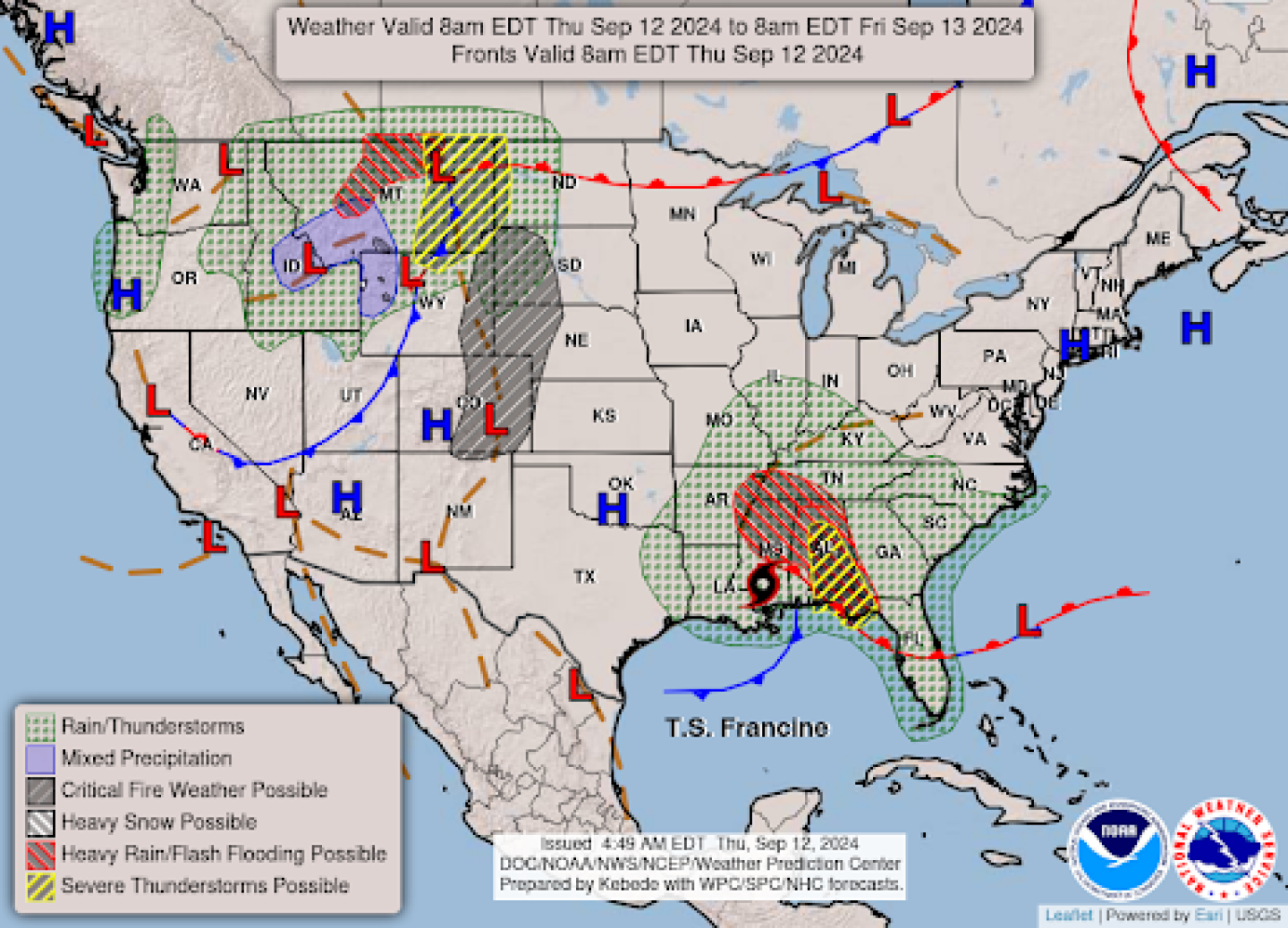

— Francine made landfall yesterday as a Category 2 hurricane about 60 miles southwest of New Orleans, before weakening to Category 1. A state of emergency is in effect for Louisiana and Mississippi. New Orleans is under a shelter-in-place order after evacuation windows closed. The storm’s center is moving north through Louisiana. Officials are warning of potential tornadoes and dangerous storm surge. Francine is expected to continue into Mississippi today, with flood warnings extending to Florida. Francine brought hurricane-force winds, heavy rainfall, and storm surge to coastal Louisiana. New Orleans reported wind gusts of 78 mph as the eyewall passed through. This marks Louisiana’s first hurricane landfall since the devastating Hurricane Ida in 2021.

Impacts: The Bureau of Safety and Environmental Enforcement (BSEE) said that as of Sept. 11, personnel were evacuated from 171 production platforms in the Gulf, 46% of the 371 manned platforms in operation there. People have been evacuated from three non-dynamically positioned (DP) rigs, equivalent to 60% of the five rigs of that type operating, with a total of four DP rigs have been moved out of the path of the storm, 20% of the 20 DP rigs operating in the Gulf. BSEE estimates that approximately 38.56% of the current oil production and 48.77% of the current natural gas production in the Gulf of Mexico has been shut-in.

Barge traffic has also been interrupted, with Mike Steenhoek of the Soy Transportation Coalition noting that barge companies are not sending barge flotillas into the region until the storm has moved on.

USDA reported that as of Sept. 8, 72% of cotton bolls were open in Louisiana, 69% in Mississippi, 83% in Arkansas, 46% in Alabama, and 44% in Georgia, leaving those fields susceptible to damage from heavy rains and wind.

Several port locations have also been shuttered with Port Fourchon, Louisiana, closed to vessel traffic along with ports of New Orleans, Plaquemines, Cameron, Lake Charles and Houma.

— NWS outlook: Heavy rainfall from Francine will spread into the Mid-South, Tennessee Valley, and Southeast today while the severe weather threat shifts east into Alabama and the Florida Panhandle... ...A round of moderate to heavy rain and strong thunderstorms with move across the northern High Plains with high-elevation snow in the northern Rockies... ...Elevated to critical fire weather concerns extend across much of the High Plains and into portions of the central Great Basin.

Items in Pro Farmer’s First Thing Today include:

• Grains firmer overnight

• Firm forecasts EU wheat production at 12-year low

• China to cut rates on $5 trillion mortgages

| CONGRESS |

— House Speaker Mike Johnson canceled a planned vote on a six-month government funding bill due to opposition from House Republicans, just 19 days before a potential government shutdown. The bill faced criticism from GOP members and a White House veto threat. With limited time left, Johnson’s (R-La.) failure to unite his party leaves the House struggling to find a path forward on federal spending, while Democrats push for bipartisan negotiations on a continuing resolution.

— House subcommittee examines Supreme Court’s Sackett decision impact on WOTUS Rule and regulatory uncertainty. The House Transportation and Infrastructure Water Resources and Environment Subcommittee held a hearing on Sept. 11, to discuss the implications of the Supreme Court’s Sackett decision on the Waters of the United States (WOTUS) rule implementation. The hearing focused on the impact of the decision on water quality protections, regulatory clarity, and economic development. The recent developments in Clean Water Act (CWA) implementation following the Sackett v. EPA Supreme Court decision have created significant uncertainty for landowners and industries.

Regulatory uncertainty. The Environmental Protection Agency (EPA) and the U.S. Army Corps of Engineers are struggling to provide clear guidance on CWA implementation after the Sackett ruling. This lack of clarity is leaving landowners and industries unsure about what activities are permissible on their properties without violating federal law.

Impact of Sackett v. EPA. The Supreme Court’s decision in Sackett v. EPA significantly narrowed the definition of “waters of the United States” (WOTUS) under the CWA. This ruling limits federal jurisdiction over wetlands, requiring them to have a “continuous surface connection” to traditionally navigable waters to fall under CWA protection.

Concerns from stakeholders. Representatives from agriculture and other industries expressed frustration to lawmakers about the lack of clear guidance. They argue that federal agencies are not providing a “roadmap” for compliance with the new interpretation of the CWA. “The federal agencies are not faithfully adhering to the Supreme Court’s holdings, and the regulated public has been stiff-armed on implementation guidance,” Vince Messerly, president of the Streams and Wetlands Foundation, a non-profit wetlands mitigation bank based in Ohio, testified. As a mitigation banker working in partnership with home builders to navigate the Clean Water Act’s Section 404 permitting process, Messerly told lawmakers that uncertainties and delays in permitting are increasing housing costs and causing developers and builders to abandon projects at a time when more housing is desperately needed to address America’s affordability challenges.

Courtney Briggs, chairman of the Waters Advocacy Coalition, said: “They’re not giving our members a roadmap on how they’re expected to follow the law. That’s really all my members want to know — what is in and what is out.” Briggs emphasizes that stakeholders are seeking clarity on what falls under the jurisdiction of the Clean Water Act and what does not.

The hearing focused on experiences and perspectives related to the implementation of the WOTUS rule. Representatives from state environmental agencies and industry coalitions were present to provide their insights on the challenges and impacts of the new regulatory landscape.

Ongoing challenges:

• Interpretation issues: The agencies are grappling with how to interpret and apply the Sackett decision consistently across different scenarios.

• State-level variations: The implementation of CWA regulations now varies by state due to ongoing litigation, adding to the complexity.

• Regulatory amendments: The EPA and Army Corps have issued amendments to conform with the Sackett ruling, but these changes are still being processed by stakeholders.

The issue of secret guidance was a major point of criticism, emphasizing the need for greater transparency and consistency in the implementation of the WOTUS rule. Witnesses called for clear and publicly accessible guidance to ensure effective water quality protections while supporting economic growth and property rights.

— House passes bill to boost oversight of foreign farmland purchases, targeting China and other adversaries. The House of Representatives on Wednesday (Sept. 11) approved the Protecting American Agriculture from Foreign Adversaries Act, aimed at increasing oversight of farmland purchases by foreign investors, particularly those from China, Russia, Iran, and North Korea. The legislation passed, 269-149, garnering support from 55 Democrats. Only one Republican voted against it — Rep. Tom McClintock (R-Calif.). The legislation builds on previous efforts to monitor foreign ownership of U.S. agricultural land, including the Agricultural Foreign Investment Disclosure Act (AFIDA) of 1978.

Key aspects of the legislation include:

• Adding the Secretary of Agriculture to CFIUS: The bill permanently adds the U.S. Secretary of Agriculture to the Committee on Foreign Investment in the United States (CFIUS) for transactions related to agricultural land, biotechnology, and other agriculture-related industries.

• Increased scrutiny: It provides a mechanism for the USDA to notify CFIUS of particularly sensitive agricultural transactions, requiring the interagency process to determine whether a review is appropriate.

• Focus on foreign adversaries: The bill specifically targets oversight of purchases made by adversaries like China, North Korea, Russia, and Iran.

Proponents of the bill argue that it addresses several key concerns:

• National security: The legislation aims to protect U.S. national security by scrutinizing foreign investments in critical agricultural assets.

• Food security: Supporters emphasize that food security is an essential component of national security.

• Economic protection: The bill seeks to safeguard economic opportunities for American farmers and prevent foreign adversaries from gaining control over U.S. agricultural resources.

Congressional comments:

Rep. Dan Newhouse (R-Wash.), who introduced the bill, stated, “Food security is national security, and for too long, the federal government has allowed the Chinese Communist Party (CCP) to put our security at risk by turning a blind eye to their steadily increasing purchases of American farmland.”

Sen. Joe Manchin (I-W.Va.), who introduced a companion bill in the Senate, described it as “an essential tool for safeguarding our nation’s agricultural resources from foreign threats.”

Outlook: With its passage in the House, the bill now moves to the Senate for consideration. If enacted, it would represent a significant step in increasing federal oversight of foreign investments in U.S. agriculture, particularly from countries deemed adversarial to American interests.

Of note: The White House announced Wednesday that it opposes the bill, calling it “unnecessary” because the changes are already included in the appropriations package.

| RUSSIA/UKRAINE |

— Russian missile strikes grain ship bound for Egypt after leaving Ukrainian waters. President Volodymyr Zelenskyy reported that a ship transporting wheat to Egypt was hit by a Russian missile immediately after exiting Ukrainian territorial waters on Thursday. Fortunately, there have been no casualties reported from the incident. Ukraine, a key grain exporter, has seen its agricultural export facilities frequently targeted by Moscow since the invasion in 2022. President Zelenskyy emphasized the importance of protecting food supplies, stating, “Wheat and food security must never be a target for missiles,” and called for an international response to the attack.

— Blinken pledges $717 million in aid to Ukraine amid U.S. debate on war strategy. During a visit to Kyiv, U.S. Secretary of State Antony Blinken announced $717 million in aid for Ukraine. Meanwhile, reports suggest tensions between President Joe Biden and U.S. intelligence over Ukraine’s desire to use U.S. weapons for strikes on Russia, which experts argue may not be decisive without coordinated ground maneuvers. The U.S. is also pushing Ukraine to adopt more pragmatic war goals, as a complete victory would require substantial financial backing that may be beyond Washington and Europe’s capacity.

Of note: A growing number of Democratic lawmakers are urging President Joe Biden to relax restrictions on Ukraine’s use of U.S.-supplied weapons, specifically to allow strikes deeper into Russian territory. Most recently, Sen. Jeanne Shaheen (D-N.H.) joined other senior figures, like Senate Foreign Relations Committee Chairman Ben Cardin (D-Md.), in advocating for these restrictions to be lifted.

— Ukraine farmers group sees corn production lower than ag ministry. The Ukrainian Agrarian Council says Ukraine’s corn production could more than the ag ministry forecasts. The head of the farmers union said production could be as much as 8 MMT to 9 MMT below last year’s crop of more than 31 MMT, which would be well below the ag ministry’s forecast of no less than 25 MMT. The main reason for the expected drop is extremely high temperatures that hit all of Ukraine since pollination.

| POLICY UPDATE |

— House Ag ranking member David Scott (D-Ga.) wrote a letter (link) to rank-and-file members on options to pass a farm bill. Scott suggested considering a two-year ad hoc package to bolster the farm safety net for 2024 and 2025 crop years if a new farm bill can’t pass this year. Some agriculture groups are pushing for such an ad hoc package, along with a one-year farm bill extension, likely through the appropriations process. Agriculture groups argue that another extension would leave farmers with an outdated safety net not reflective of current economic conditions.

Of note: House Ag Chair GT Thompson (R-Pa.) has opposed Speaker Mike Johnson’s (R-La.) plan to attach a farm bill extension to a continuing resolution (CR), according to Scott’s letter. Thompson believes there is still a path to passing a full five-year farm bill this year, signaling confidence in achieving a bipartisan agreement before the end of Congress. Scott suggested the bill could be tied to must-pass legislation like the National Defense Authorization Act or a year-end omnibus, and emphasized that any final bill must be bipartisan to pass through the Democratic Senate and White House.

— EU report calls for major overhaul of farm subsidies, shifting focus to farmer income. A Brussels-commissioned report recommends a “major overhaul” of EU farm subsidies, proposing that farmers be paid based on income rather than land size, according to the Financial Times (link). The report, prompted by consultations with stakeholders following farmer protests, urges that current subsidy practices are unsustainable and should support “active farmers” based on their financial status. The findings were presented to European Commission President Ursula von der Leyen on Sept. 4.

Proposed changes to farm subsidies. The report recommends moving away from the current system of subsidies based on land size to one focused on farmer income. This shift aims to:

• Target support to farmers who need it most, particularly small and mixed farms, young farmers, and those in areas with natural constraints.

• Ensure a more effective use of the €387 billion CAP budget.

• Address criticisms that the current system disproportionately benefits large landowners

Environmental and sustainability focus. The report also emphasizes the need for greater environmental sustainability:

• It calls for a “new sustainability benchmarking” system to standardize assessments of sustainable practices.

• The proposal includes increasing the portion of direct payments linked to environmental measures.

• A temporary off-budget fund is suggested to assist farmers in transitioning to more sustainable practices.

Now what? Von der Leyen has committed to studying the recommendations carefully. She plans to present a roadmap for agriculture and food policy within the first 100 days of her next mandate.

Bottom line: This is a potential paradigm shift in how the EU approaches farm subsidies and agricultural policy, aiming to balance economic support for farmers with environmental sustainability goals.

| CHINA UPDATE |

— Export sales figures for China reflect end of 2023-24 marketing year for U.S. corn, soybeans, sorghum. USDA weekly Export Sales data for the week ended Sept. 5 reflected shifts relative to the end of the 2023-24 marketing year, with no sales activity for corn and sorghum reported, and net reductions of 104 metric tons of soybean. For 2024-25, activity included net sales of 71,916 metric tons of sorghum, 962,620 metric tons of soybeans, and net reductions of 26,322 running bales of upland cotton. Activity for 2024 included net sales of 556 metric tons of beef and 1,970 metric tons of pork.

— Chinese cargo cranes at U.S. ports raise espionage and security concerns. A yearlong congressional investigation has found that Chinese-manufactured cargo cranes used at U.S. seaports contain embedded technology that could potentially allow Beijing to access and disrupt operations, according to the Wall Street Journal (link). The report, led by Republican lawmakers, highlighted that ZPMC, the crane manufacturer, had pressured port operators to allow remote access to cranes for maintenance purposes. This remote access, facilitated by cellular modems, could be exploited by the Chinese government, as China’s national-security laws require companies to cooperate with state intelligence agencies.

While some ports resist such access, others have allowed it, seeking lower costs or stronger warranties. The report emphasized that the cranes pose a significant national security risk, especially considering a potential U.S.-China conflict over Taiwan. In response to these concerns, the Biden administration has proposed investing over $20 billion to replace foreign-made cranes at U.S. ports.

ZPMC denied responsibility for installing modems and has delayed responding to congressional inquiries due to Chinese legal requirements. China’s embassy dismissed the concerns as protectionism. Despite the findings, the American Association of Port Authorities claims there have been no known security breaches due to the cranes.

— China again raises 2023-24 soybean import forecast. China’s ag ministry raised the country’s 2023-24 (Oct.-Sept.) soybean import forecast by 3.92 MMT to 102.29 MMT, as declining global prices boosted demand. The ministry raised its 2023-24 soy crush forecast by 1.35 MMT to 97.5 MMT. In the last two months, the ministry raised the import forecast a total of 6.19 MMT and now sees soybean arrivals topping year-ago by 4.79 MMT. The ministry made no changes to its 2024-25 production or import forecasts for soybeans or corn. It expects 2024-25 soybean imports to decline 7.69 MMT (7.5%) to 94.6 MMT, while corn imports are projected to plunge 10 MMT (43.5%) to 13 MMT.

— China asks its carmakers to keep key EV technology at home. China has strongly advised its carmakers to make sure advanced electric vehicle technology stays in the country, people familiar with the matter told Bloomberg, even as they build factories around the world to escape punitive tariffs on Chinese exports. Beijing is encouraging Chinese automakers to export so-called knock-down kits to their foreign plants, the people said, meaning key parts of a vehicle would be produced domestically and then sent for final assembly in their destination market. China’s commerce ministry held a meeting in July with more than a dozen automakers, who were also told they shouldn’t make any auto-related investments in India, the people said.

| TRADE POLICY |

— ITA finds Spanish olives sold below normal value, subsidy investigation ongoing. The U.S. Department of Commerce’s International Trade Administration (ITA) released preliminary findings indicating that certain Spanish olive producers/exporters sold olives at less than normal value between August 2022 and July 2023. The ITA also found that some companies received countervailable subsidies during 2022. However, the agency rescinded the administrative review for Plasoliva and three other firms. This development continues a longstanding trade dispute between the U.S. and the European Union over Spanish olives, with no resolution in sight.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Vilsack testifies at joint hearing on food aid shortages impacting tribal and elderly communities; lawmakers demand accountability. USDA officials, including Secretary Tom Vilsack, testified at a rare joint subcommittee hearing to address the ongoing food aid shortages affecting tribal and elderly communities. The hearing was held jointly by the House Ag Appropriations subcommittee and the House Ag Nutrition, Foreign Agriculture, and Horticulture Subcommittee.

Background: USDA had to rebid a $177 million, five-year food distribution contract due to federal regulations. Previously, two contractors had handled the distribution, but during the rebid, only one company — Paris Brothers Inc., based in Kansas City — was deemed acceptable by a technical evaluation board of USDA experts. Paris Brothers, one of the original contractors, had a good track record and assured USDA that they could increase their workforce to manage the expanded contract. But shortly after Paris Brothers began fulfilling the contract in April, issues arose. By May, USDA received reports of delays and disruptions, indicating potential problems with the company’s ability to meet the contract’s demands, despite their previous reliability and assurances.

Vilsack admitted that communication missteps contributed to the food aid shortages. USDA first learned about delays in deliveries to tribal and senior food assistance programs in May, but senior staff, including Vilsack, were not informed until later. Vilsack said he was not informed of the problem until late July. “Whoever didn’t tell you earlier should not be holding a job at USDA,” Rep. Andy Harris (R-Md.), chair of the House Appropriations Ag-FDA Subcommittee, said, adding that not providing the food is an abridgement of U.S. obligations to the tribes under treaties.

“Is Paris Brothers going to be liable for this?” Harris asked. “If somebody’s head doesn’t roll over this, the American taxpayer should be furious.” Harris said he believes the next time USDA officials will testify on this matter will be at next year’s appropriations hearing.

The shortages affected two major programs:

1. The Food Distribution Program on Indian Reservations (FDPIR)

2. The Commodity Supplemental Food Program (CSFP)

Over 770,000 individuals who rely on these programs were impacted by the shortages.

Tribal leaders and lawmakers from both parties demanded answers from the Biden administration about the crisis.

USDA took emergency measures using a total of $47 million in funding from the Commodity Credit Corporation (CCC) to address the situation, including: • Executing an emergency contract with Americold on August 26, 2024, to provide urgent supplemental capacity;

• Planning to expedite food deliveries to new warehouses.

Of note: Rep. Chellie Pingree (D-Maine) said that the use of the CCC to deal with the problem shows that Congress should not interfere with the secretary’s authority to spend CCC funds. Republicans have proposed restricting the Ag secretary’s authority over the CCC in the next farm bill.

Committee members expressed frustration with USDA’s handling of the situation. Harris called it a “tragic situation” and criticized the lack of accountability. Rep. Tom Cole (R-Okla.) highlighted the dire consequences of USDA’s decisions, which left communities hungry. Rep. Brad Finstad (R-Minn.) described the situation as an “avoidable, but devastating situation” caused by “unelected D.C. bureaucrats.”

The hearing took place one day before a scheduled USDA tribal consultation on the FDPIR crisis.

— Boar’s Head deli meat linked to deadly listeria outbreak amid poor plant conditions. Nearly two years before a deadly listeria outbreak tied to recalled deli meat, inspectors at a Boar’s Head plant in Virginia noted alarming conditions that “could pose an imminent threat,” according to USDA inspection reports. The outbreak, affecting 18 states, has hospitalized at least 57 people and resulted in nine deaths, marking the largest listeria outbreak since 2011. Inspection reports described unsanitary conditions such as insects, mold, and blood on the floors. USDA’s investigation is ongoing.

— Consumer support for regenerative agriculture drops if costs rise, Purdue survey shows. A Purdue University survey (link) revealed that while most consumers support regenerative agriculture practices, their enthusiasm wanes if food prices increase. Although 72% of the 1,200 respondents supported regenerative farming methods after learning about them, fewer than half were willing to pay an extra 50 cents for snacks produced using these climate-friendly practices. Price remains a significant factor, with 53% opting for cheaper conventionally produced snacks over pricier regenerative options.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |