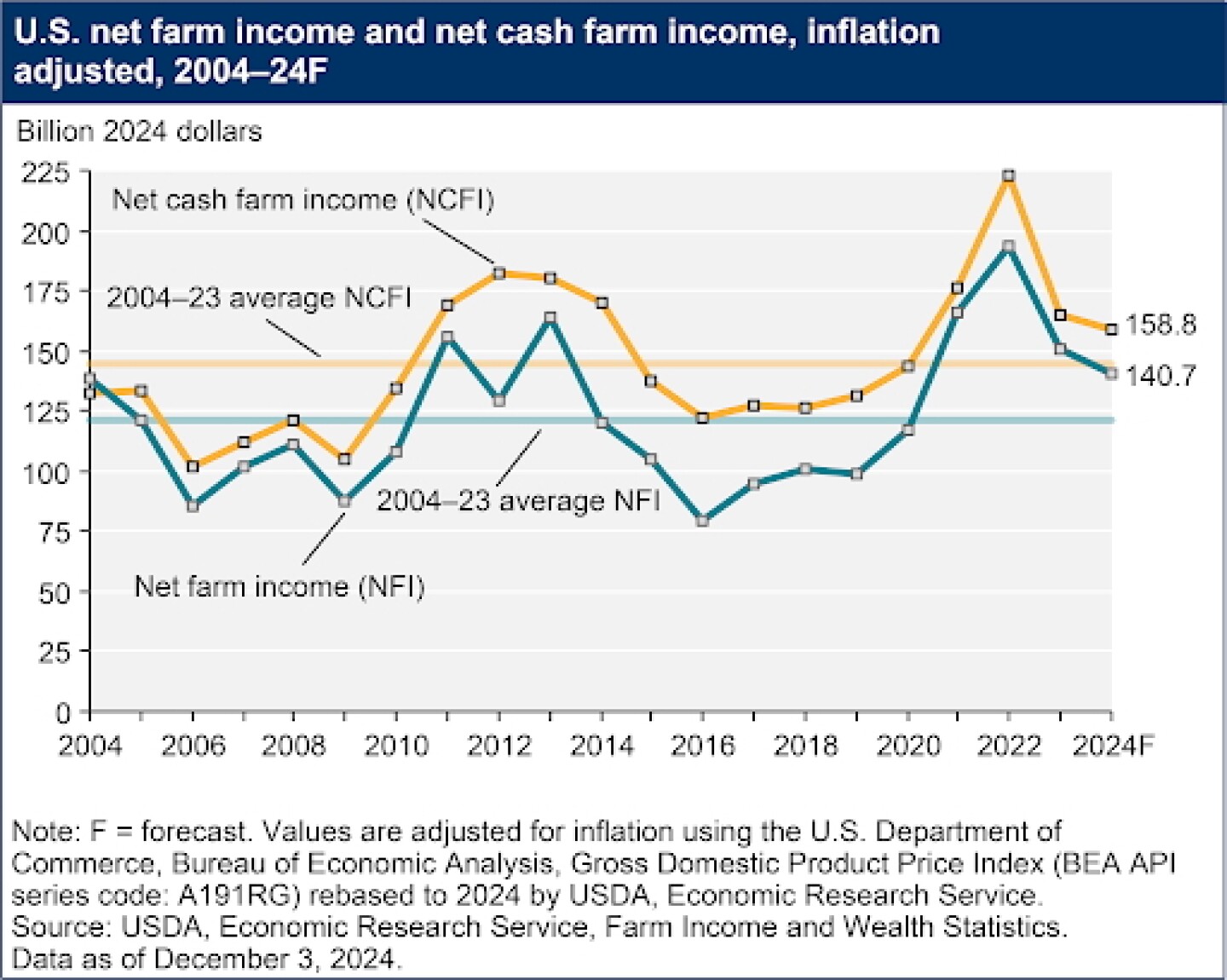

USDA is forecasting net farm income at $140.7 billion for 2024, not adjusted for inflation, a fall of $6.0 billion from 2023, and when adjusted for inflation a decline of $9.5 billion is forecast. Net cash farm income is pegged at $158.8 billion, down $1.8 billion from 2023, and when adjusted for inflation would be down $5.7 billion. Despite this downturn, projections have improved slightly since September. Key Highlights:

• Crop receipts: Forecast to fall by $25 billion, with steep declines in corn (33%), soybeans (35%), and wheat (42%).

• Livestock receipts: Expected to rise by $21 billion, bolstered by gains in dairy (65%), hogs (29%), and poultry (19%).

• Expenses: Production costs will be $453.9 billion in 2024, a decline of $8 billion, mainly due to lower feed costs, while labor and interest expenses increase. Lower feed costs are a key as they are expected at $69.5 billion ($70 billion in September), down $10.5 billion from 2023. As for areas that will increase from 2023, USDA noted that labor costs are seen at $51.8 billion, up $3 billion from 2023, while interest expenses are put at $29.8 billion ($30 billion in September), up from $28.5 billion in 2023.

• Government payments: Total payments drop but conservation program funding sees a boost. Direct government payments are now forecast at $10.6 billion, a slight uptick from $10.4 billion in September, but still down $1.7 billion from 2023.

USDA said the year-over-year difference is due to lower Dairy Margin Coverage (DMC) program payments and lower payments from supplemental and ad hoc disaster assistance, particularly from the Emergency Relief Program (ERP).

Conservation payments are pegged at $4.4 billion in 2024, up $806.9 million from 2023, “due to a marginal increase in Conservation Reserve Program enrolled acres, an increase in payments from NRCS programs, and some expected payments from the Inflation Reduction Act funds allocated for USDA’s conservation programs.”

Payments under the Agricultural Risk Coverage (ARC) program are now forecast for 2024 at $461 million, up from $270.4 million in 2023 and up from $123.3 million in September. Price Loss Coverage (PLC) payouts in 2024 are only forecast at $1.9 million, down from $7.9 million in 2023, but up from $1.3 million forecast in September.

• Financial health: Debt-to-asset and debt-to-equity ratios are at their lowest since 2016, indicating strong financial positioning despite declining working capital. USDA is now forecasting total far sector assets in 2024 to be at $4.2 trillion, up from $4.0 trillion in 2023, with total debt at $542.5 billion, up from $519.0 billion in 2023. That would put farm sector equity at $3.7 trillion, up from $3.5 trillion in 2023. That puts the debt-to-equity ratio at 14.75% versus 14.85% in 2023, and the debt-to-asset ratio at 12.86% versus 12.93% in 2023.

Of note is working capital, which USDA now sees at $123.6 billion, down from $132.7 billion in 2023, but also down from $127.2 billion in September. That drawdown puts the current forecast for working capital to be down 6.9% from 2023 and 7.3% from 2022.

Upshot: With the first 2025 outlook due in February, these trends will shape farm policy discussions, including the delayed new farm bill. Livestock gains are cushioning crop-related losses, but the sector faces continued challenges as working capital shrinks and agricultural equipment demand declines.