News/Markets/Policy Updates: Nov. 22, 2024

— Matt Gaetz took himself out as AG nominee, citing his potential to distract from the Trump/Vance transition; Trump picks Pam Bondi as new nominee. The withdrawal follows intense scrutiny and opposition from lawmakers, including Republicans, due to longstanding allegations of sexual misconduct and drug use, including an unresolved investigation into allegations of sex with a minor and drug use during his time in Congress. Gaetz’s resignation from Congress last week coincided with his nomination announcement, which further intensified the controversy. Trump, expressing continued support for Gaetz, stated that the decision was made to avoid unnecessary distractions. Gaetz’s nomination faced significant bipartisan resistance, with some senators hinting at a tough confirmation process ahead. The House Ethics Committee’s investigation into Gaetz remains unresolved, with a deadlock on whether to release its findings after his departure from Congress. Rep. Sean Casten (D-Ill.) welcomed Gaetz’s withdrawal but said he wouldn’t cancel his plans to force a votex on releasing the House Ethics Committee’s investigative report into Gaetz. The numbers: At least five Senate Republicans were planning to vote against Gaetz and had communicated to other senators and those close to Trump that they were unlikely to be swayed, according to NBC. The “no” votes included Sens. Mitch McConnell of Kentucky, Lisa Murkowski of Alaska, Susan Collins of Maine and Markwayne Mullin of Oklahoma, and Sen.-elect John Curtis of Utah. Some 20 to 30 Senate Republicans were said to be very uncomfortable about having to vote for Gaetz on the Senate floor. Of note: While Gaetz resigned from this Congress, he could return to the new Congress next year if he wants to as he was elected to that chamber. Gaetz’s resignation letter said he didn’t intend to take the oath for the new Congress in January. However, Gaetz could still be sworn in if he alerts the clerk of the House that he now intends to serve as a member come Jan. 3. It’s not clear what Gaetz will decide. Yet if Gaetz does return, he will come under the jurisdiction of the Ethics Committee once again. (Unconfirmed rumors has Gaetz perhaps filling the Florida Senate slot vacated by current Sen. Marco Rubio.) Gaetz’s withdrawal had a market impact. Writes Tom Essaye of The Sevens Report: “The Gaetz nomination, along with a few others, threatened to fracture the Republicans’ unity towards a pro-growth agenda. And it was looking potentially likely that President-elect Trump would have to spend significant political capital to get those unorthodox nominations through. Gaetz’s removal from the process means Trump will have more political capital to actually push pro-growth initiatives across the finish line and that’s why financials, industrials and energy rallied and lead the market higher. For this reason, looking forward, the market will further embrace the progress of more ‘traditional’ Cabinet appointments and welcome any additional withdrawals from other unorthodox choices (Hegseth, Gab-bard and Kennedy) as the market views them as distracting Republicans from the pro-growth agenda. Finally, the next major decision for the Cabinet is Treasury Secretary and the more ‘mainstream’ the choice, the better for markets (at least between now and year-end).” Trump announced his new AG nominee: Pam Bondi, 59, a prominent American attorney, lobbyist, and Republican politician who has made significant contributions to Florida’s legal and political landscape. Bondi served as the 37th Attorney General of Florida from 2011 to 2019, making history as the first woman elected to this position. During her tenure, she focused on various critical issues: Prior to her role as Attorney General, Bondi spent over 18 years as a prosecutor, trying cases ranging from domestic violence to capital murder. After her term as Attorney General, Bondi has remained active in legal and political spheres: She served as one of President Donald Trump’s defense lawyers during his first impeachment trial in 2020. She currently leads the legal arm of the America First Policy Institute, a Trump-aligned organization. She is also a partner at Ballard Partners, a powerhouse lobbying firm where Trump’s incoming White House chief of staff Susie Wiles once worked — where her clients included General Motors (labor and tax policy), Amazon (cloud computing and trade) and Uber (the gig economy). Bottom line: A new face, but the same goal: a shake-up of the Justice Department. “For too long, the partisan Department of Justice has been weaponized against me and other Republicans — Not anymore,” Trump wrote in announcing her selection. — The Senate is expected to confirm most of Donald Trump’s other Cabinet nominees, though some controversial picks are facing significant resistance. Given the slim GOP Senate majority, just four Republican defections — assuming Democrats unanimously oppose — could block a nomination. Key highlights include: • Health and Human Services: Robert F. Kennedy Jr. faces bipartisan concerns over his controversial views on vaccines, food safety, and fluoride. “He’s got to talk to us about that [vaccines],” Sen. Mike Rounds (R-S.D.) said. “I firmly believe in the vaccination programs. We’ve saved millions of lives. But he’s gonna have to talk to us about it and explain his position. The same with… abortion.” The Senate Finance Committee oversees processing the HHS nominee, and the Senate Health, Education, Labor and Pensions Committee gets a courtesy hearing. Conversely, several nominees have broad support and are likely to be confirmed: — Trump’s potential picks for financial regulators. Trump is reportedly considering several candidates for key financial regulatory roles. Federal Reserve Governor Michelle Bowman is being discussed for the vice chair of supervision position, currently held by Michael Barr. Jonathan Gould, a Jones Day partner, is a potential candidate to head the Office of the Comptroller of the Currency, while Todd Zywicki, a George Mason University law professor, is being floated for leadership of the Consumer Financial Protection Bureau, according to Semafor. — Casey concedes Pennsylvania Senate race to Republican McCormick. Democrat Bob Casey says he called Republican David McCormick to concede the Pennsylvania Senate race, according to a video Casey posted on X. The race had gone to a recount earlier this month, though the Associated Press had already called the race for McCormick. Republicans will control the Senate 53-47, picking up four seats. Of note: The recount is still going on and results are expected next Wednesday. This is Pennsylvania’s fourth recount since 2004. None of the previous ones changed the outcome. — Republicans currently have won a 219-213 House majority in the new Congress beginning Jan. 3, with three races yet to be called. Here’s a breakdown of these races and their likely outcomes: 2. California’s 13th Congressional District 3. California’s 45th Congressional District — Quick election analysis from The Cook Political Report: — Gensler resigns as SEC chair, paving way for Trump’s pick. Securities and Exchange Commission (SEC) Chair Gary Gensler will step down on Jan. 20, the agency announced Thursday. Gensler, who led the SEC since 2021, oversaw ambitious but controversial regulatory initiatives, particularly around cryptocurrencies. His departure clears the path for President-elect Donald Trump to nominate a potentially more Wall Street- and crypto-friendly successor. While Gensler’s term could have extended to 2026, his resignation aligns with expectations. He praised SEC staff for their dedication to investor protection and market integrity in his farewell statement. — Trump’s search for a Treasury secretary continues, with the president-elect telling allies and advisers in recent days that he’s yet to be completely sold on the candidates he’s interviewed so far. Hedge fund executive Scott Bessent, Apollo Global Management Inc. executive Marc Rowan and former Federal Reserve Governor Kevin Warsh remain among the leading contenders for the post. Each met Wednesday with Trump, with Rowan flying from Hong Kong. Of note: Trump has floated selecting financier Kevin Warsh as his Treasury secretary with the understanding that he could later be nominated to lead the Federal Reserve to succeed Jay Powell when the Fed chair’s term is up in 2026. Meanwhile, Trump still has not announced his choices for U.S. Trade Representative, Labor Secretary, USDA Secretary, Small Business administrator, or the head of his Council of Economic Advisers. |

| MARKET FOCUS |

— Equities today: Asian and European stock markets were mixed overnight. U.S. stock indexes are pointed toward lower openings. There is one Fed speaker today, Bowman (6:15 p.m. ET), but she shouldn’t move markets. In Asia, Japan +0.7%. Hong Kong -1.9%. China -3.1%. India +2.5%. In Europe, at midday, London +0.8%. Paris -0.2%. Frankfurt +0.1%.

U.S. equities yesterday: All three major indices finished higher with strong gains in the Dow. The Blue Chip index was up 461.88 points, 1.06%, at 43,870.35. The Nasdaq rose 6.28 points, 0.03%, at 18,972.42. The S&P 500 gained 31.60 points, 0.53%, at 5,948.71.

— DirecTV has decided to walk away from its proposed merger with rival Dish Network. The New York Times says the deal fell apart after Dish bondholders balked at the terms of the transaction, which would have seen them take a loss on their holdings as part of a debt exchange. Its failure raises questions about the fates of both of the debt-laden satellite-TV operators, which had hoped to combine to gain more leverage with content providers.

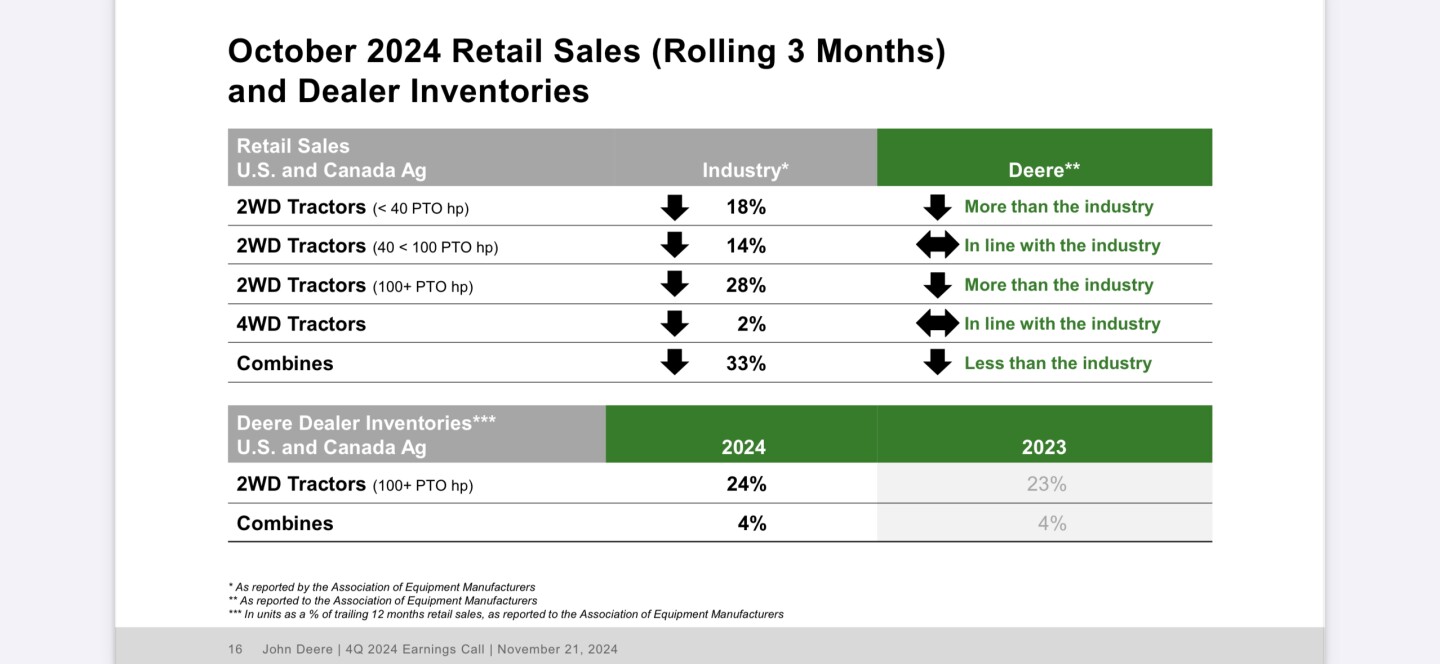

— A more extensive look at Deere earnings released Thursday morning. Deere & Company’s earnings announcement revealed a mixed picture, with some positive results overshadowed by significant challenges and a cautious outlook.

Earnings beat expectations. Deere reported fourth-quarter earnings of $4.55 per share, surpassing analysts’ expectations of $3.87 to $3.90 per share. The company’s revenue of $11.14 billion for the quarter also exceeded the consensus estimate of $9.2 billion to $9.335 billion.

Significant declines. Despite beating estimates, Deere experienced substantial year-over-year declines:

• Net income fell 47% to $1.245 billion for the fourth quarter.

• Net sales and revenues decreased 28% to $11.143 billion.

• Full-year net income dropped to $7.1 billion from $10.166 billion in fiscal 2023.

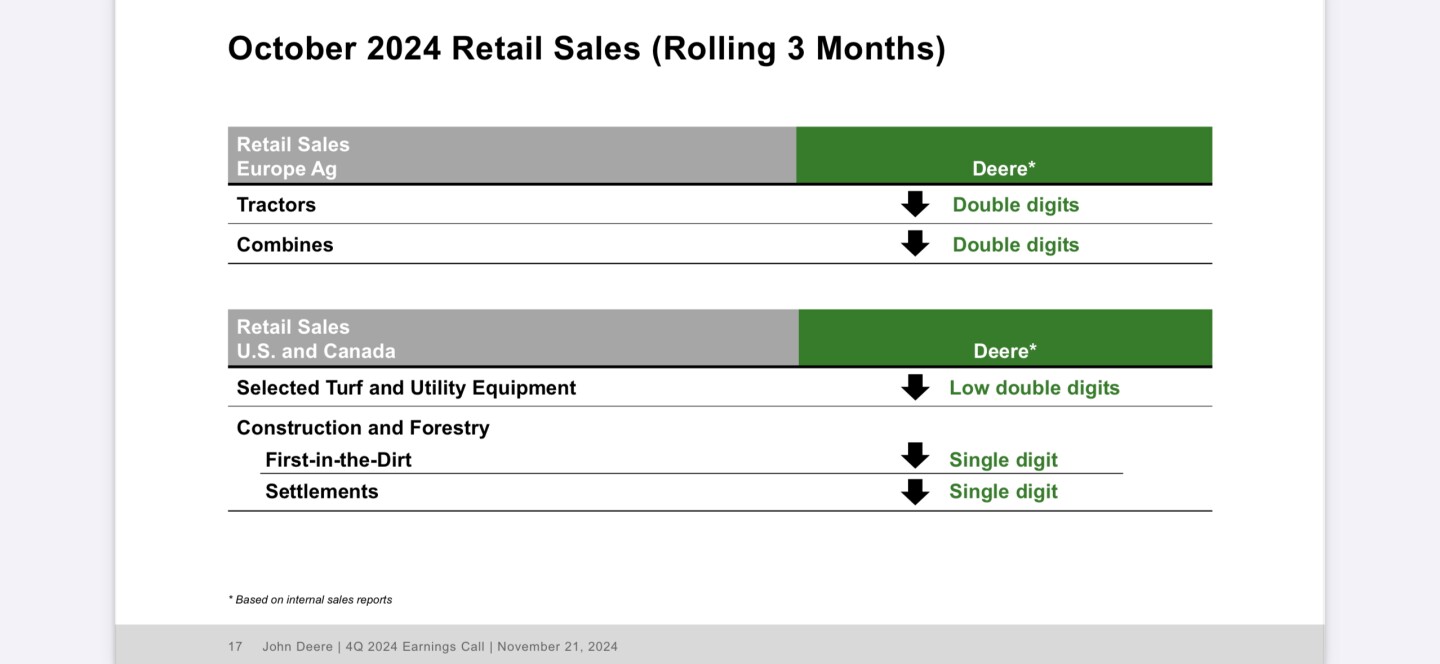

Segment performance. All of Deere’s equipment divisions reported sales decreases for the quarter:

• Production & Precision Agriculture sales fell 38% to $4.305 billion.

• Small Agriculture & Turf sales decreased 25% to $2.306 billion.

• Construction & Forestry sales declined 29% to $2.664 billion.

Challenges and headwinds. Deere faces several ongoing challenges:

• Weakened demand for its products.

• High interest rates affecting customers.

• The company implemented deep job cuts across major production facilities this year.

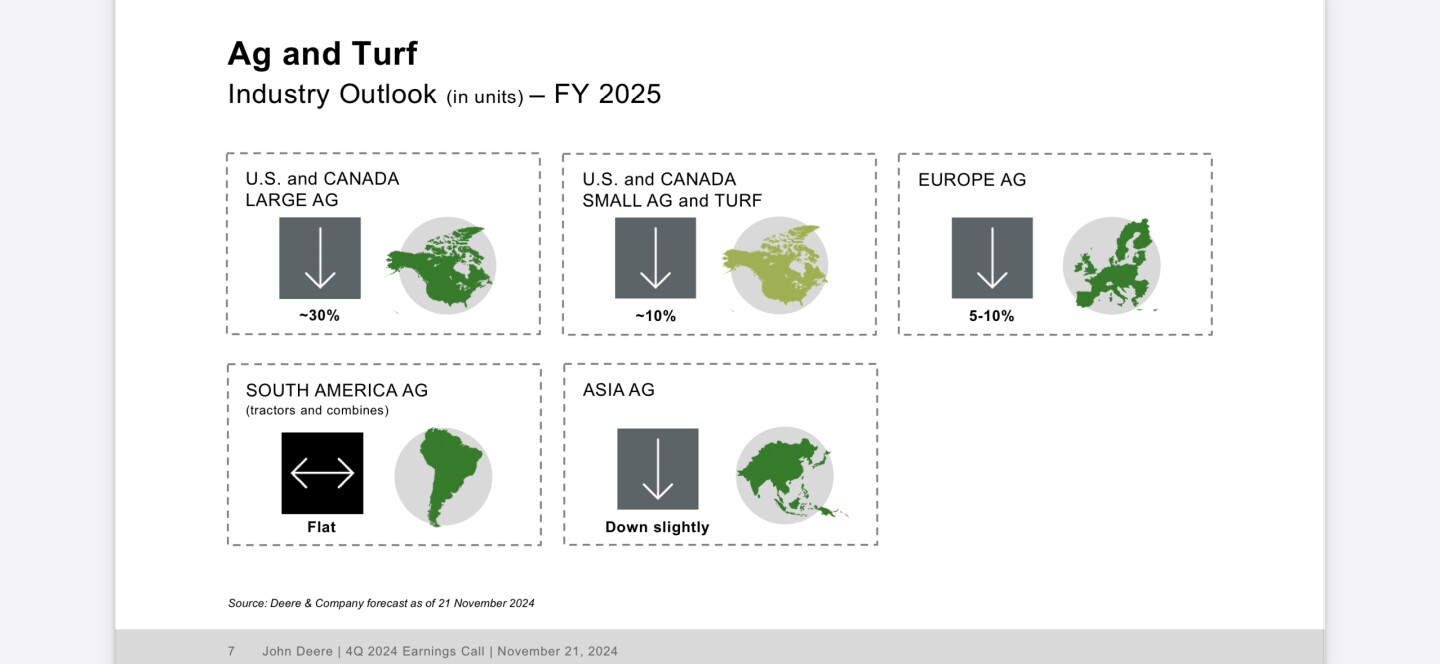

Cautious outlook. Deere provided guidance for fiscal 2025 that disappointed analysts:

• Projected net income range of $5 billion to $5.5 billion, below the FactSet expectation of $5.8 billion.

• Forecasted continued declines in all equipment division sales for fiscal 2025.

Management’s response. CEO John May acknowledged the challenges, stating, “Amid significant market challenges this year, we proactively adjusted our business operations to better align with the current environment.” He emphasized the company’s commitment to making meaningful investments in the future while navigating ongoing headwinds. While Deere’s stock initially responded positively to the earnings beat, rising just over 8% in Thursday trading, the overall picture suggests a company grappling with significant market challenges and preparing for a potentially difficult year ahead.

Bottom line: Deere earnings are closely tied to U.S. net farm income, and they are riding that wave down.

— Oil prices surged almost 2% on Thursday due to heightened tensions between Russia and Ukraine, sparking concerns about global crude supply disruptions. Brent crude rose $1.42 (1.95%) to $74.23 per barrel, while U.S. WTI crude climbed $1.35 (2%) to $70.10. The increase followed Russian President Vladimir Putin’s announcement of a hypersonic missile strike on a Ukrainian military site, coupled with a warning of potential retaliation against Western military facilities if their weapons were deployed against Russia.

— Ag markets today: Corn, soybeans and wheat held in relatively tight trading ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, soybeans were 1 to 3 cents lower, SRW wheat was around a penny lower, HRW wheat was fractionally higher and HRS wheat was 2 to 3 cents higher. The U.S. dollar index was around 650 points higher, surging to a two-year high, while front-month crude oil futures were around 70 cents lower.

After topping $37.00 earlier this week, the spread between Choice and Select wholesale beef prices has narrowed a little but remains wider than normal. Choice beef firmed 40 cents to $306.79 on Thursday, while Select rose $1.93 to $272.92, tightening the spread to $33.87.

The CME lean hog index is down another 39 cents to $87.44 as of Nov. 20, extending the recent price slide. December lean hog futures finished Thursday $6.64 below today’s cash quote, implying traders expect seasonal pressure to build into mid-December when the contract is settled against the cash index. The five-year average from now until mid-December is a $3.20 decline in the cash index.

— Agriculture markets yesterday:

• Corn: December corn fell 3 1/2 cents to $4.26 3/4, closing near the session low.

• Soy complex: January soybean futures plunged 12 3/4 cents to $9.77 3/4 and settled on session lows. January meal futures sunk $1.90 to $289.40, near session lows. January bean oil futures dropped 108 points to 42.28 cents.

• Wheat: March SRW wheat fell 2 3/4 cents to $5.69 1/2 and near the daily low. March HRW wheat dropped 5 1/2 cents to $5.67 1/4 and nearer the session low. March spring wheat futures slid 5 cents to $6.02 1/4.

• Cotton: March cotton futures rose 15 points to 70.43 cents and closed above the 10-day moving average.

• Cattle: December live cattle fell 70 cents to $185.60, near the daily low. January feeder cattle rose $1.125 to $253.45, nearer the session high and hit a 3.5-month high. November feeder futures went off the board at $255.125.

• Hogs: Nearby December futures edged up 22.5 cents to $80.80.

— Estate and gift tax updates for 2025. Key changes in estate and gift tax exemptions and valuation rules for 2025 offer expanded benefits, but some are temporary:

• Estate and gift tax exemption: The lifetime exemption rises to $13,990,000 in 2025 but is slated to drop to about $7 million after that unless extended by Congress. Given recent GOP election victories, the current higher exemption may remain or increase.

• Farm and business real estate valuation: Up to $1,420,000 of qualifying real estate can receive a special discounted valuation based on current use instead of market value. To qualify, real estate must meet specific estate and usage thresholds.

• Installment payment breaks: Estates with closely held businesses exceeding 35% of total value can defer up to $760,000 in taxes at a 2% interest rate.

• Annual gift tax exclusion: The exclusion rises to $19,000 per donee in 2025. For example, married couples with multiple relatives can gift up to $266,000 in total without triggering a gift tax return.

— EV tax credit considerations

• Current credits: New EVs may qualify for up to $7,500 if they meet rules on minerals, components, and North American assembly. Used EVs can qualify for up to $4,000.

• Price and income limits: Price caps are $55,000 for cars and $80,000 for SUVs, vans, and trucks. Income limits for buyers are $300,000 for joint filers and $150,000 for singles.

• Potential changes: Republican initiatives, including those by Donald Trump, may aim to reduce or eliminate the EV tax credit.

Market perspectives:

— Outside markets: The U.S. Dollar Index is currently trading at 106.52, showing a slight decrease of 0.09% from the previous session. The dollar has strengthened recently, underpinned by expectations that Trump’s policies could fuel inflation, potentially limiting future Federal Reserve interest rate cuts. The yield on the 10-year U.S. Treasury note fell, trading around 4.40%, with a negative tone in global government bond yields. Crude oil futures have seen some volatility. WTI Crude Oil is trading at $70.18 per barrel, down 0.30% from the previous close. Brent Crude is at $74.04 per barrel, showing a 0.24% decrease. The oil market has been influenced by escalating tensions between Russia and Ukraine and anticipation of the upcoming OPEC+ meeting. Gold futures have surged to $2,701.60 per ounce, representing a 0.99% increase. The precious metal has been boosted by safe-haven demand amid geopolitical uncertainties. Silver futures are also on the rise, trading at $31.295 per ounce, up 1.14% from the previous session. The Gold/Silver ratio stands at 85.87, indicating the number of silver ounces needed to equal the value of one ounce of gold.

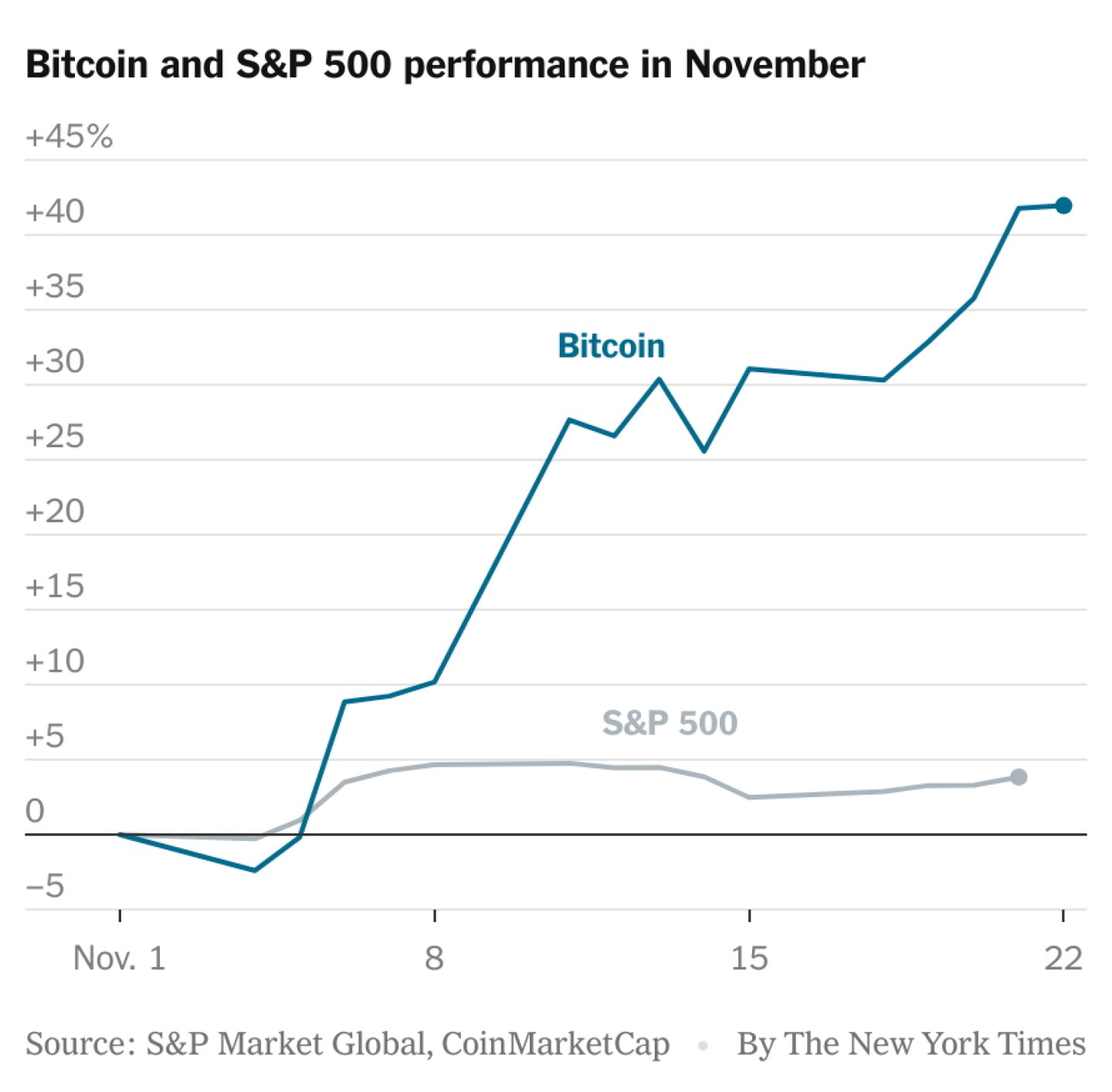

— Bitcoin surges toward $100k amid political shifts favorable to crypto. Bitcoin is shattering price records, nearing the $100,000 milestone this morning. Adding to the euphoria in the cryptocurrency sector is the departure of SEC Chair Gary Gensler, set for January, and the arrival of President-elect Donald Trump, who has shown openness to crypto innovation. Kristin Smith, CEO of the Blockchain Association, expressed optimism, saying, “Woo, Gary’s gone,” in response to the news. The association has submitted a list of priorities to Trump and Congress, advocating for a regulatory framework tailored to crypto, including provisions for stablecoin trading and curbing SEC enforcement against crypto firms. Trump’s proposal to establish a crypto advisory council has fueled a post-election surge in digital assets, giving the industry hope for a more favorable regulatory environment.

— Gold is seeing new momentum, rallying 5.4% so far this week, the best performance since October 2023. The precious metal has surged around 30% so far this year, supported by healthy central bank buying, increasing safe-haven demand and the Fed’s cycle of cutting interest rates.

— Diesel prices hit lowest level since 2021. For the week ending Nov. 18, the U.S. average diesel price dropped by 3.0 cents to $3.491 per gallon, marking a 71.8-cent decrease compared to the same week last year. This is the third consecutive weekly decline, and the lowest price recorded since Oct. 4, 2021, when diesel was $3.477 per gallon.

Outlook: According to the Energy Information Administration’s (EIA) November Short Term Energy Outlook (link), the diesel price is expected to average $3.66 per gallon in fourth quarter 2024 — up 4 cents from the previous quarter and up 2 cents from EIA’s October forecast. U.S. diesel prices are projected to average $3.59 per gallon in 2025 — down 17 cents from EIA’s 2024 forecasted price of $3.76 per gallon.

— Winter rail logistics and grain shipments. USDA’s Grain Transportation Report highlights (link) the critical period ahead for railroads and shippers following the completion of the corn and soybean harvests. “During the winter months — when rail-service demand is heaviest — inclement weather tends to pose the most challenges to service,” the report states. The interplay of high demand and reduced shuttle services, particularly by BNSF, may drive up premiums in the secondary market for shuttles this winter. However, improved performance in shuttle services into 2025 could alleviate long-term concerns.

— USDA daily export sale:

• 198,000 MT soybeans to unknown, 2024-25 marketing year

— Nov. 1 feedlot inventory expected to be slightly below year-ago. Analysts expect USDA’s Cattle on Feed Report this afternoon to show the large feedlot (1,000-plus head) inventory down 0.1% from year-ago at 11.944 million head as of Nov. 1. The report is expected to show a 3.8% increase in the number of cattle moved into feedlots last month, while marketings are anticipated to be up 5.2% from October 2023.

— Brazil is currently facing significant domestic pressures that could impact its sales of used cooking oil (UCO), particularly in the context of its growing biodiesel industry. As the country ramps up its biodiesel blending mandates, the demand for soybean oil — of which UCO is a crucial component — has surged. This shift in focus towards meeting domestic biodiesel needs may lead to a reduction in the availability of UCO for export.

Factors influencing Brazil’s UCO sales: Biodiesel demand and blending mandates

• Brazil’s biodiesel blending mandate is set to reach 14% (B14) in 2024, with projections to increase to 15% by 2025. This represents the highest blending requirement in the country’s history.

• The growing domestic consumption of soybean oil for biodiesel production is expected to significantly reduce the volume available for export. In fact, soybean oil accounted for 72% of raw materials used for biodiesel in 2024, up from 69% in 2023.

Impact on exports

• The increased domestic demand has already begun to affect export levels. In the 2023-2024 period, Brazilian soybean oil exports fell by 22.2% compared to previous years, despite an overall increase in production.

• Analysts suggest that if Brazil does not enhance its soybean crushing capacity or diversify its feedstock sources, it may stop exporting soybean oil altogether within a few years.

The U.S. ag attaché in Brazil projected 5.6 million metric tons of soybean oil would be used to make biodiesel in 2024 with 630,000 MT from tallow, 165,000 MT palm oil, 100,000 MT UCO and 820,000 MT of other feedstocks (link).

Cumulative biodiesel production from January through June 2024 reached 4.2 billion liters, a 27% increase over the same period in 2023 (3.3 billion liters). Soybean oil accounted for 73% of the total. Tallow accounted for 6% of biodiesel production and palm oil for 1%. The remaining 15% came from fats and 5% from various feedstocks, including chicken fat, pork fat, cottonseed oil, rapeseed/canola oil, used cooking oil, and corn oil.

Economic considerations. The Brazilian government has also introduced measures that could further complicate the export landscape. For instance, recent tax changes aimed at restricting tax credits for certain exports could raise costs for grain and oilseed exporters, adding pressure to the already strained market.

Additionally, with U.S. imports of used cooking oil from Brazil now authorized and increasing due to favorable biofuel policies in the U.S., Brazil’s domestic market dynamics may shift further towards prioritizing local biodiesel production over exports.

Bottom line: Brazil’s amendments to its domestic policies and increasing biodiesel mandates are likely to reduce the availability of used cooking oil for export, potentially reshaping its role in the global biofuel market.

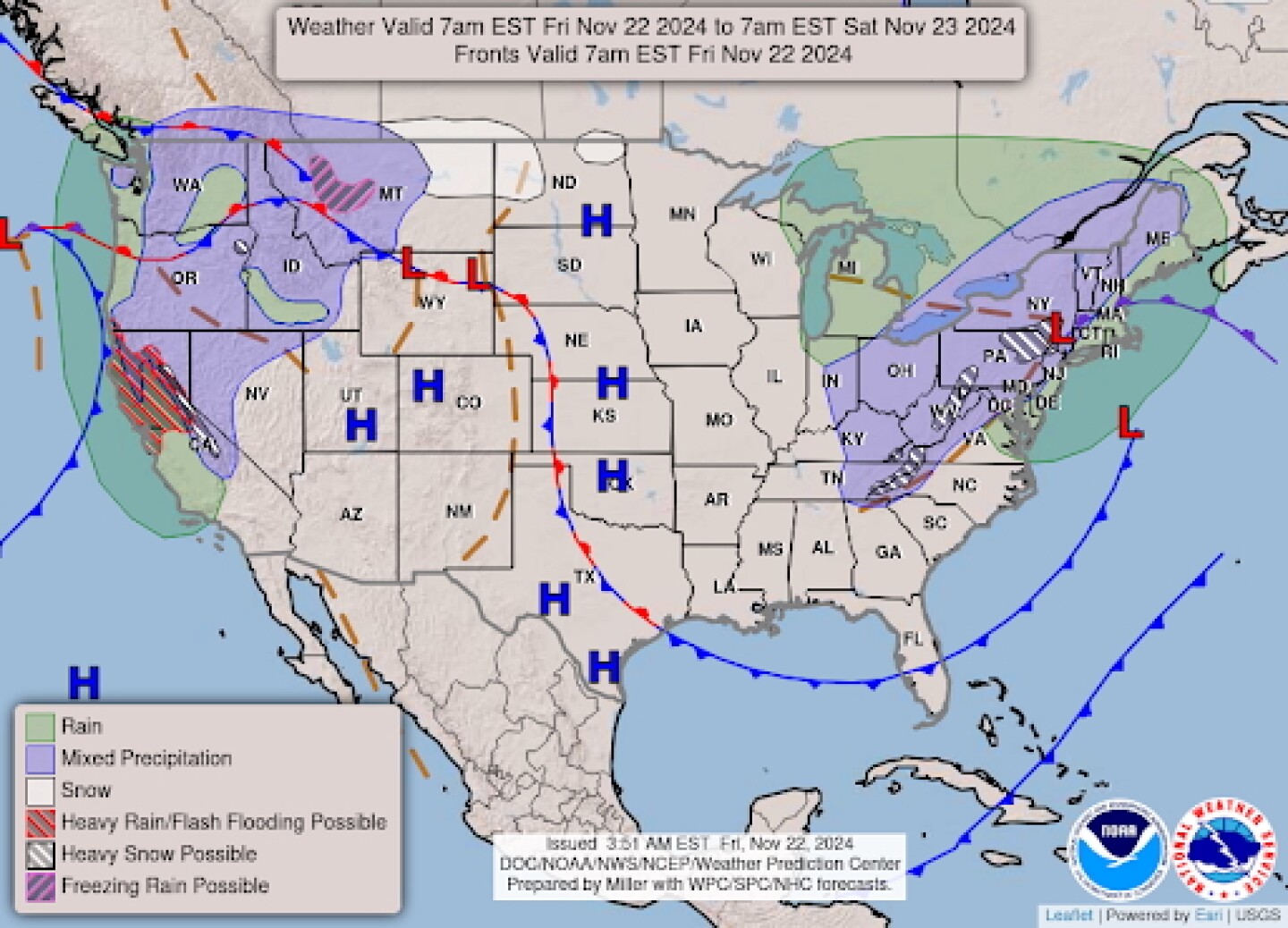

— NWS outlook: Atmospheric river will produce one last round of heavy rain/mountain snow and strong wind gusts across the Pacific Northwest today... ...Moderate to heavy snow for portions of the Central Appalachians today... ...Above average temperatures expand across the Central U.S. this weekend.

Items in Pro Farmer’s First Thing Today include:

• Quiet overnight grain trade

• Choice/Select beef spread still wide

• Traders narrowing discount in December hogs

• Western Australia on track for unexpectedly large wheat crop

• French wheat conditions unchanged, above year-ago

• Eurozone PMI falls to 10-month low

| CONGRESS |

— GOP skepticism over Biden’s disaster aid request. Republicans are scrutinizing President Joe Biden’s nearly $99 billion supplemental disaster aid request following Hurricanes Helene and Milton. While generally supportive of aid, lawmakers, including Rep. Tom Cole (R-Okla.), expressed concerns about non-disaster-related provisions, such as education and climate change initiatives, included in the proposal. Cole emphasized that Democrats, controlling the White House, remain key players in negotiating the final package.

Of note: Some farm-state lawmakers may want to add policy-related language to the disaster measure that would boost reference prices and some crop insurance incentives. Those policy changes could find their way into a stopgap spending bill into March that is expected to be approved sometime in December.

— Mayorkas and Wray skip Senate testimony, angering lawmakers. Homeland Security Secretary Alejandro Mayorkas and FBI Director Chris Wray declined to attend an annual Senate hearing on global threats to the U.S., breaking a 15-year tradition. Senate Homeland Security Chairman Gary Peters (D-Mich.) criticized the absence as a “shocking departure” that undermines public accountability. While DHS and the FBI offered classified briefings instead, lawmakers like Sen. Rand Paul (R-Ky.) argued that the public deserves transparency. Disagreements over whether the testimony should occur in a public or classified setting further delayed discussions, with Rep. Mark Green (R-Tenn.) expressing flexibility but logistical hurdles in scheduling. Peters maintained that open testimony is crucial for oversight and public trust.

— Republicans scramble for leadership of House Rules Panel amid challenges. The retirement of current House Rules Committee Chairman Mike Burgess (R-Texas) has sparked a race among Republicans to secure Speaker Mike Johnson’s (R-La.) support for the influential role. Potential candidates include current committee members Reps. Michelle Fischbach (Minn.) and Nick Langworthy (N.Y.), former Chairman Pete Sessions (Texas), and other lawmakers like Rep. Guy Reschenthaler (Pa.) and Education and Workforce Chairwoman Virginia Foxx (N.C.).

The Rules Committee, critical for controlling legislative debate and votes, has faced obstacles due to the slim Republican majority and internal divisions, with hardline conservatives complicating legislative processes. These dynamics have forced reliance on bipartisan suspension votes for major bills. The next chair will likely contend with the same challenges as Burgess, with hardliners like Rep. Chip Roy (Texas) advocating for maintaining a conservative influence on the panel.

Democrats, led by Ranking Member Jim McGovern (Mass.), remain critical of the committee’s effectiveness under Republican leadership, signaling potential gridlock ahead.

— McConnell to chair key Senate committees, emphasizing defense and U.S. leadership. Senate Minority Leader Mitch McConnell (R-Ky.) announced he will chair the Senate Appropriations Committee’s Defense Subcommittee and the Senate Rules Committee in the 119th Congress. Known for prioritizing foreign policy, McConnell aims to leverage these roles to advocate for increased defense spending amid heightened global security threats. “America’s national security interests face the gravest array of threats since the Second World War,” McConnell stated, emphasizing the need for U.S. leadership.

Of note: McConnell’s move to chair the Rules Committee bypasses Sen. Deb Fischer (R-Neb.), reflecting his seniority within the Senate.

| POLICY UPDATE |

— GT Thompson and Speaker Mike Johnson discuss disaster aid, economic assistance challenges. House Agriculture Chair GT Thompson (R-Pa.) told Bloomberg Government he met with House Speaker Mike Johnson (R-La.) Wednesday afternoon to discuss the path forward for disaster aid and possible economic assistance, though spending parameters for both remain up in the air. Senate Ag ranking member John Boozman (R-Ark.) agreed “there’s a lot of discussion about” both disaster and economic assistance for farmers, but said the biggest barrier to getting something done is time.

Thompson said he briefed his Republican panel colleagues about the Johnson meeting, which also addressed the farm bill. “We reassured him we’d be prepared for a one-year (2018 Farm Bill) extension,” Thompson said.

| CHINA UPDATE |

— Brazil, China close to signing pork offal export protocols. Brazil is close to finalizing protocols for exporting pork offal and fish to China, two people familiar with the matter told Reuters. The sources said negotiations for both protocols were advanced and should be completed soon, but declined to give a specific timeframe. A deal could impact exports of U.S. pork products, as China imports around half of all U.S. pork offal shipments.

— China expands EU dairy subsidy investigation. China has notified the European Union (EU) of an expanded anti-subsidy investigation into EU dairy imports, targeting additional subsidy programs in Denmark, France, Italy, and the Netherlands. Despite this broadened scrutiny, the probe remains focused on cheese, milk, and cream products. The investigation considers claims made during consultations with EU representatives on Nov. 19. This move follows the EU’s Oct. 30 decision to impose duties on Chinese electric vehicles (EVs).

— The Biden administration plans to add 29 Chinese companies to a blacklist for alleged links to forced labor in the Xinjiang region, marking the largest expansion of the ban list since its implementation in 2022. This move will increase the total number of banned entities to over 100. Most of the newly targeted companies operate in the agricultural sector, but the blacklist also includes entities from industries like mining and smelting of metals such as aluminum and lithium.

— China willing to work with U.S. and Trump to support bilateral trade. China is willing to conduct active dialogue with the United States based on the principles of mutual respect and promote the development of bilateral economic and trade relations, vice commerce minister Wang Shouwen said. China is also willing to “expand areas of cooperation and manage differences” with Washington. Wang, also China’s International Trade Representative, said China would be able to “resolve and resist” the impact of external shocks, responding to a question about the impact of potential tariffs from U.S. President-elect Donald Trump.

— China will reduce or cancel export tax rebates for a range of commodities and other products, including used cooking oil (UCO), effective Dec. 1. That could slow Chinese UCO exports to the U.S. and increase demand for domestic soyoil. The policy change is set to have significant impacts on global markets, particularly in the biofuel sector, influencing trade flows, pricing, and demand for alternative feedstocks.

Details: China’s Ministry of Finance and State Taxation Administration jointly issued a document on Nov. 15 outlining the following changes:

• Cancellation of export tax rebates for 59 products, including aluminum, steel, and used cooking oil (UCO).

• Reduction of export tax rebates from 13% to 9% for 209 products, including solar photovoltaic panels, lithium batteries, and certain non-metallic mineral products.

Impact on Used Cooking Oil (UCO) exports. The cancellation of the 13% export tax rebate for UCO is expected to have several consequences:

• Increased export costs: The export cost of UCO is estimated to rise by approximately $103/MT.

• Price fluctuations:

— UCO North Asia prices jumped by around $100/MT to $1,000/MT between Nov. 19-21, 2024.

— UCO FOB Straits prices increased from $905/MT to $950/MT in the same period.

— Conversely, local prices (UCO ex-mill North China) fell from $930/MT to $841/MT.

• Contract renegotiations: Some Chinese UCO bulk suppliers have reportedly breached contracts, forcing buyers to seek alternative sources.

• Shift in trade flows: Attention may shift to alternative UCO sources in Southeast Asia, particularly Malaysia.

Implications for U.S. markets. The policy change could have several effects on U.S. markets:

• Potential reduction in UCO imports: China shipped 2.12 MMT of UCO in the first nine months of 2024, surpassing the 1.406 MMT exported in the entire 2023 calendar year. The new policy may slow this trend.

• Increased demand for domestic soyoil: U.S. soyoil futures rallied 2% following China’s announcement, closing at 45.35 cents per pound for December contracts.

• Impact on biofuel producers: Many U.S. biofuel makers use UCO as a low-cost feedstock alternative to domestically produced soyoil.

• Pricing dynamics: While Chinese UCO exports may decrease, they could still remain competitive due to significant pricing flexibility.

China’s domestic biofuel push. The policy change aligns with China’s renewed focus on its biofuels sector:

• Sustainable Aviation Fuel (SAF) targets: China aims for a 2% SAF blend by 2025, increasing to 15% by 2030, potentially requiring over 3 MMT of UCO as feedstock.

• Marine biofuel plans: China is planning its first export quota for B24 biodiesel-blended marine bunker fuel for 2025.

• Domestic UCO utilization: The policy change is expected to increase domestic UCO availability, potentially boosting China’s UCO-based biofuels competitiveness.

Upshot: While the full impact of this policy shift remains to be seen, it will reshape global trade flows in the UCO and biofuel markets, potentially benefiting U.S. soyoil producers while challenging biofuel makers who rely on imported UCO.

| TRADE POLICY |

— Mexico disrupting U.S. dry edible beans, other commodities at the border. A contact confirms there is a stoppage of U.S. dry edible beans at Mexico border crossings. There are two border crossings available for edible beans entering Mexico and both are experiencing problems. Other bulk U.S. commodities are affected too. We were told by one source Mexico has guaranteed its producers a price for their beans that is higher than the U.S. price and that that is likely the reason U.S. exports are being blocked. The combination of border crossing issues, Mexican agricultural policies and price guarantees is creating significant challenges for U.S. dry bean exports to Mexico.

President Claudia Sheinbaum aims to boost bean production by approximately 30% over the next six years. The emphasis on domestic agriculture reflects a broader trend in Mexican policy that could challenge existing trade agreements and alter the dynamics of agricultural exports between the two countries.

— EU urged to engage with Trump transition team on trade. European Union member states are pressing for a swift engagement with Donald Trump’s transition team to mitigate potential trade disruptions and tensions with the U.S., its largest trading partner. During a recent meeting in Brussels, EU trade ministers discussed strategies to prepare for Trump’s anticipated protectionist policies, including proposed tariffs ranging from 10% to 20%.

The EU is considering areas for enhanced cooperation, such as increasing liquefied natural gas imports from the U.S. and aligning efforts to counteract China’s trade practices. However, the bloc is also preparing retaliatory measures should the Trump administration implement tariffs that affect European businesses.

Trade chief Valdis Dombrovskis emphasized the importance of a coordinated response to any new trade disputes. The EU’s stance is one of unity and proactivity, with Poland advocating for strong transatlantic relations, particularly in security matters, as it prepares to assume the EU’s rotating presidency in January.

| ENERGY & CLIMATE CHANGE |

— Trump’s oil and gas allies shift focus: ‘Drill, Baby, Drill’ meets Realpolitik. Donald Trump’s rallying cry for oil companies to “drill, baby, drill” may resonate with his populist base, but it doesn’t fully align with the priorities of his fossil-fuel backers, the Wall Street Journal reports (link). Instead of ramping up drilling, these influential donors are pushing for policies that lock in long-term demand for fossil fuels, including streamlining permits for pipelines and opposing Biden-era EV policies.

Despite record oil and gas production under President Biden, concerns about peak gasoline consumption and shifting energy markets loom. Trump has already begun rewarding industry allies, nominating fracking advocate Chris Wright to lead the Energy Department. However, industry skepticism persists as Wall Street pressures companies to prioritize shareholder returns over production expansion.

Exporting liquefied natural gas (LNG) presents a key opportunity, with donors urging Trump to lift Biden’s moratorium on new LNG terminals. Yet balancing trade policies — such as potential tariffs — will challenge Trump’s ambitions for energy dominance. Environmental regulations remain a battleground, as smaller firms push for reduced methane oversight, while larger companies worry about losing appeal in green-conscious markets.

Bottom line: For Trump’s administration, energy policy will require a careful balance between bolstering domestic production and managing global trade and environmental expectations.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— Butterball’s Cook from Frozen Turkey: A Thanksgiving game-changer. Butterball’s new Cook from Frozen Premium Whole Turkey revolutionizes Thanksgiving meal prep by eliminating the need to thaw the bird, saving time and reducing stress. It goes straight from freezer to oven, freeing up refrigerator space.

— FSIS sets public meetings on salmonella framework for raw poultry. USDA’s Food Safety and Inspection Service (FSIS) announced two public meetings to gather industry input on its proposed Salmonella Framework for Raw Poultry Products. The meetings will focus on different components of the framework (link):

• Dec. 3: Discussion on Component Three, which involves final product standards determining whether poultry products are adulterated based on Salmonella levels and serotypes.

• Dec. 5: Review of Component Two, addressing regulatory amendments to enhance process control monitoring in poultry slaughter establishments.

Component One outlines a non-regulatory approach to reducing Salmonella risks, while Component Two proposes updated regulations for contamination prevention throughout the slaughtering process.

FSIS has extended the public comment deadline for the proposed rule to Jan. 17, 2025.

| OTHER ITEMS OF NOTE |

— Cotton AWP falls. The Adjusted World Price (AWP) for cotton declined to 55.91 cents per pound, effective today (Nov. 22), down from 58.20 cents per pound the prior week, and the lowest since the week of Aug. 23 when it was 55.90 cents per pound. The AWP still is nearly 4 cents above the 52-cent level that would trigger an LDP. Meanwhile, USDA announced Special Import Quota #6 will be established Nov. 29 for the import of 31,716 bales of upland cotton, applying to supplies purchased no later than Feb. 25 and entered into the no later than May 26.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |