News/Markets/Policy Updates: Aug. 13, 2024

— The much-anticipated interview between former President Donald Trump and Elon Musk, held on the social media platform X, was marred by significant technical difficulties. (A similar snafu disrupted Ron DeSantis’s announcement of his presidential candidacy on X last year.) The Musk/Trump interview, which was supposed to start at 8 p.m. Eastern Time, was delayed by over 40 minutes due to what Musk described as a “massive” denial-of-service attack, although no concrete evidence was provided to support this claim. Once the interview commenced, it unfolded as a largely unchallenging conversation, with Musk avoiding adversarial questions. The discussion began with Trump recounting an assassination attempt against him at a rally in Butler, Pennsylvania, a narrative he shared at Musk’s request. Musk praised Trump’s composure during the incident, showcasing his support for the former president. The interview marked Trump’s first major appearance on X since his account was reinstated by Musk in late 2022. The conversation then shifted to familiar Trump talking points, including criticisms of illegal immigration and the Biden administration’s handling of the U.S./Mexico border. Trump also attacked Vice President Kamala Harris, labeling her the “border tsar” and criticizing her policies. Musk and Trump shared mutual concerns about immigration, with Musk identifying himself as a “legal immigrant” and emphasizing the importance of a secure border. Trump attacked Harris, labeling her as responsible for the influx of illegal migrants, and criticized President Joe Biden’s handling of the Ukraine crisis. He also described Biden’s exit from the presidential race as a “coup” by Democrats. Energy and climate change: The conversation touched on energy production and climate change, with Musk suggesting a balanced approach to sustainability. Trump expressed skepticism about climate change, focusing instead on issues like nuclear threats. Musk sees EVs as a crucial element of a sustainable future and supports policies that promote their adoption, while Trump remains critical of government mandates for EVs, focusing instead on traditional automotive and energy sectors. Despite these differences, Musk’s support for Trump seems to be driven by strategic business considerations rather than alignment on EV policies. Throughout the interview, Musk remained largely supportive of Trump, even suggesting that he could play a role in a future Trump administration — Musk pitched himself for a role to cut federal spending if Trump were to win in November. Trump praised the idea, calling Musk “the greatest cutter.” The conversation touched on various topics, including climate change and the conflict in Ukraine, with Trump reiterating his usual rhetoric from campaign rallies. — Kamala Harris hasn’t yet offered many specifics on what she’d do as president. Excitement over the abrupt presidential election plot twist has boosted her appeal. The upcoming Democratic National Convention may boost it further. But at some point, Harris will have to offer at least a sketch of her policy plans, analysts note. Campaign expectations have already been upended once by a debate. That could happen again when Harris and Trump square off. — Israel has observed Iran and Hezbollah preparing for a possible attack but is uncertain about the timing and is proceeding cautiously. The U.S. has shared intelligence on Iran’s shifting military posture, though it’s insufficient to predict when an attack might occur. In response, the U.S., UK, Germany, France, and Italy issued a joint statement urging Iran to refrain from making military threats. Meanwhile, Hamas announced Sunday that it has no interest in the U.S.-brokered “final round of negotiations” for a Gaza cease-fire. According to the Wall Street Journal: “Vice President Kamala Harris echoed the administration’s urgency for a deal on the campaign trail, and leaks from ‘senior officials’ in the U.S. and Israel indicate that the Biden Administration is willing to blame Israel if a deal fails to materialize. That’s what Hamas likes to hear.” — The U.S. government is facing a significant fiscal deficit, running $1.52 trillion in the red just ten months into the fiscal year, with more deficits expected before the fiscal year ends on Sept. 30. According to the Treasury Department’s July report, the government’s total receipts so far amount to $4.09 trillion, with major contributions from individual income taxes, social insurance, retirement programs, and corporate income taxes. However, government outlays have reached $5.6 trillion, with substantial spending on Social Security, net interest, Medicare, and national defense. The Treasury projects the full-year deficit to hit $1.87 trillion, a staggering figure during peacetime without a recession or national emergency. Despite the alarming numbers, many politicians in Washington seem indifferent. The growing deficit and national debt are expected to become significant issues in the 2024 election, especially for Vice President Kamala Harris, who may have to defend the substantial spending under President Biden’s administration and the resulting inflation. Harris, the presumptive Democratic candidate, continues to promote elements of Biden’s Build Back Better agenda, promising expanded government services without clearly addressing the costs or how they will be funded. — Could Dem VP nominee Tim Walz win his old Minnesota district seat? A New York Times article raises questions about that. Major reason: he turned too liberal. Link — Democrats are gearing up for their national convention in Chicago next week, where Harris will formally accept her party’s nomination for president on Thursday night. — A judge in New York ruled that Robert Kennedy junior, a third-party candidate for president, could not appear on the state’s ballot because he had used a “sham” address on his nominating petitions. The decision could imperil his appearance on ballots in other states. Kennedy’s campaign said it would appeal. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mostly firmer overnight. U.S. Dow opened up around 150 points. The U.S. data points of the week are the July producer price index today (see below) and the consumer price index for July on Wednesday. In Asia, Japan +3.5%. Hong Kong +0.4%. China +0.3%. India -0.9%. In Europe, at midday, London -0.2%. Paris -0.3%. Frankfurt -0.1%.

U.S. equities yesterday: The Dow closed down 140.53 points, 0.36%, at 39,357.01. The Nasdaq was up 35.31 points, 0.21%, at 16,780.61 (thanks to Nvidia climbing 4%). The S&P 500 edged up 0.23 points, 0.00%, at 5,344.39.

— Whoops… On this day in 1979, BusinessWeek’s cover proclaimed THE DEATH OF EQUITIES: “Only the elderly, who have not understood the changes in the nation’s financial markets, or who are unable to adjust to them, are sticking with stocks.”

— Home Depot reported better-than-expected quarterly earnings but warned of a cautious consumer, signaling weaker sales for the second half of the year. The retailer now expects full-year comparable sales to decline by 3% to 4%, a sharper drop than the previously projected 1% decline.

— Starbucks has announced a significant leadership change, appointing Brian Niccol, the former CEO of Chipotle Mexican Grill, as its new chairman and chief executive officer. This decision comes as Laxman Narasimhan steps down from his role as CEO, a position he held since March 2023. The change in leadership is reportedly influenced by pressure from activist investors, who have been pushing for strategic changes at Starbucks. Brian Niccol is recognized for his successful tenure at Chipotle, where he led the company through a period of substantial growth and innovation. Under his leadership, Chipotle saw a significant increase in revenue, expansion of its restaurant footprint, and a notable rise in its stock value. Niccol’s experience in the food and beverage industry, particularly his previous roles at Taco Bell and Pizza Hut, makes him a well-suited candidate to lead Starbucks. His track record of driving operational excellence and innovation is expected to align with Starbucks’ goals of enhancing customer experience and expanding its market presence.

— Oil prices rallied Monday, rising for a fifth consecutive session on expectations of a widening Middle East conflict. The U.S. Defense Department said over the weekend that it will send a guided missile submarine to the Middle East as the region braces for chaos. WTI traded up $3.22, 4.2%, to close at $80.06. Brent traded up $2.64, 3.3%, to close at $82.30.

The rally in crude oil, driven by a supply shortfall, eased today as an energy watchdog forecast that global inventories would grow next year. The International Energy Agency predicted that growth in demand for crude would soften as the summer U.S. driving season ended in coming weeks, and be further covered when planned production increases hit the market later this year.

— Ag markets today: Corn and spring wheat futures were unable to build on Monday’s gains during the overnight session, while soybeans and wheat faced followthrough selling. As of 7:30 a.m. ET, corn futures were trading 2 cents lower, soybeans were 14 to 15 cents lower, winter wheat was 3 to 5 cents lower and spring wheat was 1 to 3 cents lower. The U.S. dollar index was modestly firmer, while front-month crude oil futures are marginally lower.

Cash cattle drop, wholesale beef strengthens. Cash cattle averaged $191.34 last week, down $3.11 from the previous week and the lowest price since the first week of June. Wholesale beef prices firmed $3.12 for Choice to $315.83 and $1.58 for Select to $300.17 on Monday. Falling cash prices and rising wholesale values will improve packer margins, though they remain solidly in the red.

Cash hog index accelerates decline. The CME lean hog index is down 98 cents to $90.92 as of Aug. 9, extending the recent decline to six straight days during which price drops have accelerated each day. August lean hog futures, which expire Wednesday and are settled against the index on Friday, ended Monday at an 89.5-cent discount today’s cash quote.

— Agriculture markets yesterday:

• Corn: December corn rallied 6 1/2 cents to $4.01 1/2, ending the session above the 10-day moving average.

• Soy complex: November soybeans sunk 16 1/2 cents to $9.86, though strength in corn helped close prices off intraday lows. September meal futures plunged $5.70 to $306. September bean oil dropped 94 points to 41.48 cents.

• Wheat: December SRW wheat fell 6 cents to $5.59 3/4 and near mid-range. December HRW wheat fell 7 cents to $5.63 1/2 and near mid-range. September spring wheat futures firmed 2 1/2 cents to $5.91 1/4.

• Cotton: December cotton rose 73 points to 69.07 cents, a low-range close after notching a near two-week intraday high early on.

• Cattle: October live cattle fell $1.125 to $180.025 and near the session low. October feeder cattle closed down $2.05 at $237.725 and nearer the session low.

• Hogs: October lean hog futures firmed 35 cents to $74.325 and settled nearer session highs. August futures rose 22.5 cents to $90.025, while deferred contracts posted losses.

— Quotes of note:

• $28 billion: AccuWeather’s preliminary estimate of the total damage and economic loss from Hurricane Debby.

• “There’s more pressure on the top line. Consumers are pushing back on prices that are moving too high.” — Keith Lerner of Truist Advisory Services, on the retail economy.

• Commodity prices have fallen sharply over the past month, even as U.S. stocks have rebounded. Crude oil futures dropped 14% from July 5 to Aug. 5, and copper futures are down nearly 12%. This broad decline in commodities may indicate underlying weaknesses in the global economy, as commodities, particularly copper, are often seen as economic indicators, according to analysts at Wolfe Research and TD Securities.

— In July 2024, the Producer Price Index (PPI), a key measure of wholesale inflation, rose by 0.1%, which was below the anticipated 0.2% increase. This moderation in wholesale inflation comes after an unexpected increase in June, where the PPI rose by 0.2%. The lower-than-expected rise in July suggests a potential easing of inflationary pressures at the wholesale level.

The PPI is an important indicator as it reflects the average change over time in the selling prices received by domestic producers for their output. It is often considered a precursor to consumer inflation, as changes in wholesale prices can eventually be passed on to consumers.

The July PPI report is significant as it may influence the Federal Reserve’s monetary policy decisions, especially if consumer inflation metrics also show signs of easing.

The slower-than-expected rise in wholesale inflation can be attributed to several factors:

• Stability in Core PPI components: The core PPI, which excludes volatile categories such as food, energy, and trade margins, saw a modest increase of 0.3% in July. This suggests that the underlying inflation pressures in the wholesale sector were relatively stable.

• Volatility in specific sectors: Certain sectors experienced price volatility that contributed to the overall PPI dynamics. For instance, while wholesale beef prices had risen significantly in due to seasonal factors and strong demand, other categories like wholesale poultry saw price decreases due to higher production levels.

• Economic conditions and expectations: Broader economic conditions, including expectations of a potential interest rate cut by the Federal Reserve, may have influenced pricing strategies among producers. The anticipation of lower interest rates could have tempered price increases as businesses adjusted their expectations for future economic activity.

• Supply chain adjustments: Adjustments in supply chains, such as changes in production levels and inventory management, could have also played a role. For example, the used-vehicle market saw an increase in wholesale prices due to tighter supply conditions, which may have offset price stability in other sectors.

Despite the moderation in wholesale inflation, inflation remains a primary concern for businesses. According to a survey by the National Federation of Independent Business (NFIB), inflation was the top issue for small business owners in July, with 25% citing it as their most significant operational challenge. This indicates that while wholesale inflation may be stabilizing, the broader economic environment still presents challenges related to cost pressures for businesses.

— Study: 40% chance the U.S. already is in recession. Economists Pascal Michaillat and Emmanuel Saez have developed a new recession indicator that suggests there is a 40% probability that the U.S. is already in a recession, potentially beginning as early as March 2024. This indicator builds on the Sahm rule, which traditionally uses the difference between the three-month moving average of the unemployment rate and the past 12-month low to signal a recession. Michaillat and Saez’s approach enhances this by incorporating job vacancy data alongside unemployment data, creating a two-sided measure.

The new indicator is triggered when there is a significant change in both unemployment and job vacancy rates. Specifically, if the difference in these rates reaches 0.3 percentage points, it suggests a recession may have started, and a difference of 0.8 points confirms a recession. As of July 2024, this indicator showed a difference of 0.5 percentage points, indicating a 40% chance of a recession.

This method offers a more comprehensive view than the traditional Sahm rule by considering both sides of the labor market — unemployment and job vacancies — thereby potentially providing earlier and more accurate recession signals. The authors claim that their model can detect recessions more quickly and has a better historical track record, identifying all recessions since 1930, whereas the Sahm rule is only reliable from 1960 onward.

— The German ZEW Economic Expectations Index, a key measure of investor sentiment, experienced a significant decline in August 2024. The index fell to 19.2 points from 41.8 points in July, marking a steep drop of 22.6 points. This decline was more severe than anticipated, as analysts had predicted a reading of around 32 points. Several factors contributed to this downturn in economic sentiment:

• Global trade slowdown: Germany’s export-driven economy has been affected by weakening demand in key markets, particularly China. This slowdown in global trade has put additional pressure on Germany’s economic outlook.

• Market uncertainty: Ambiguous monetary policies, disappointing business data from the U.S., and escalating tensions in the Middle East have all contributed to heightened uncertainty. This uncertainty has been reflected in turmoil across international stock markets.

• Sector-specific declines: The sentiment has worsened across most major sectors, with particularly sharp declines in retail, consumer goods, electronics, and chemicals. These sectors have been impacted by concerns over weakening consumer demand amid high inflation and rising interest rates.

— De-dollarization. Rising protectionism and the impact of geopolitical tensions on supply chains are leading to a retreat from free trade and capital flows. Some observers say this shift could push the world toward economic autarky, with trade blocs based on geopolitical and industrial complementarities, reducing the demand for the dollar as the dominant currency.

In 2023, nearly 3,000 trade restrictions were imposed globally, five times the number in 2015. The broader trend may be toward trade blocs. Rather than geographical groupings, these may be between geopolitically like-minded and industrially complementary trading partners; for example, Russia (rich in natural resources) and China (a manufacturing powerhouse). This reduces the need for a dominant reserve currency, splintering demand into multiple currencies needed to support specific trade and investment flows. The expansion of the BRICS, redenomination of some trade and establishment of non-dollar payment systems are tentative moves in this direction.

Debtor countries, such as the U.S., may find it more difficult to fund budget & trade deficits. Dollar interest rates may rise, affecting borrowers globally. Foreign exchange markets will exhibit greater volatility. For creditor countries, existing investments may lose value.

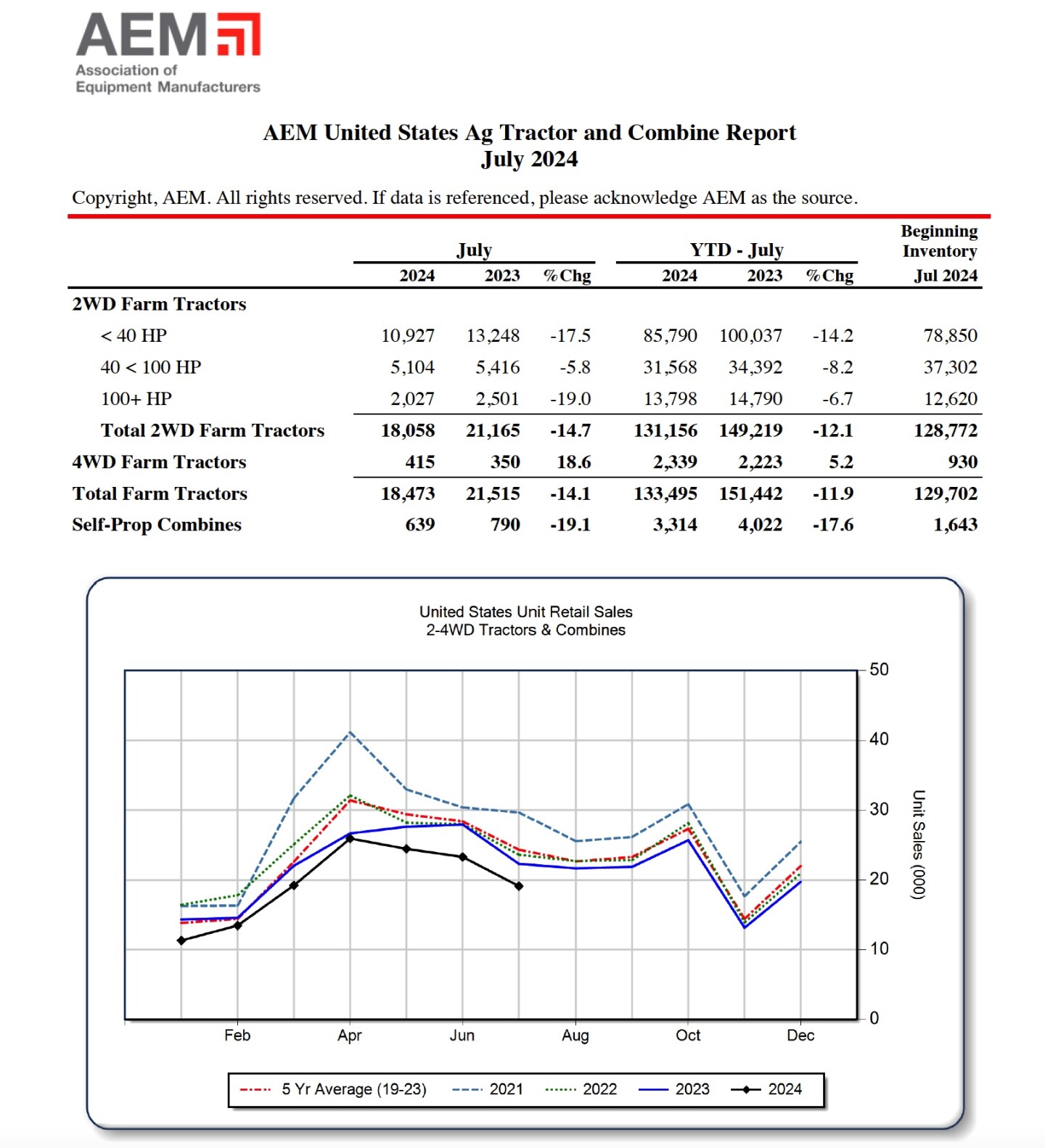

— Sales of farm tractors and self-propelled combines in the United States have experienced a significant decline in the first seven months of 2024 compared to the same period in 2023. According to data from the Association of Equipment Manufacturers (AEM), this downturn is evident across various categories of agricultural equipment.

The decline in sales is attributed to several factors:

• Economic conditions: The agricultural equipment market is experiencing a slowdown after a robust five-year period. This is partly due to low crop prices and high interest rates, which have reduced farmers’ willingness to invest in new machinery.

• Inventory challenges: There is an oversupply of unsold tractors and combines, leading to price reductions and incentives to move inventory. This situation is exacerbated by declining farm income and high inventory levels.

Regional differences: While the U.S. market is experiencing a downturn, the situation in Canada is more positive. Canadian sales of four-wheel-drive tractors and combines have shown growth, with significant year-to-date increases. This contrast highlights regional variations in agricultural equipment demand.

Market perspectives:

— Outside markets: The U.S. dollar index was steady ahead of inflation data, with the euro steady and many other foreign rival currencies firmer against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.89%, with a lower tone in global government bond yields. Crude oil futures were lower, with U.S. crude around $79.50 per barrel and Brent around $81.70 per barrel. Gold and silver were narrowly mixed ahead of wholesale inflation data with gold firmer around $2,505 per troy ounce and silver weaker around $27.84 per troy ounce.

— USDA daily export sales:

• 132,000 metric tons soybeans to China, 2024-2025 marketing year

• 137,160 metric tons corn to Mexico, 2024-2025 marketing year

— Soybean futures fell to their lowest price in nearly four years after USDA forecast a record fall harvest. Soybean production saw an increase, with USDA raising its first survey-based estimate by 154 million bushels compared to July, exceeding expectations by 120 million bushels. The estimated yield is a record 53.2 bushels per acre, with record yields expected in states like Illinois and Indiana. The U.S. season-average soybean price for 2024-25 is forecast at $10.80 per bu., down $0.30 from last month. The soybean meal price was forecast at $320 per short ton, down 10 dollars. The soybean oil price forecast is unchanged at 42 cents per pound.

USDA’s first survey-based corn production estimate for the year increased by 47 million bushels from July, surpassing analysts’ expectations by 35 million bushels. The estimated yield is a record 183.1 bushels per acre, with record yields forecasted in several states, including Illinois, Indiana, and Iowa. However, harvested acreage is slightly down from previous estimates. The season-average corn price received by producers was lowered 10 cents to $4.20 per bushel.

USDA reduced its all-wheat production forecast by 26 million bushels from last month, with winter wheat production slightly up but other spring wheat and durum estimates down. The wheat yield estimate was slightly raised to 52.2 bushels per acre, but harvested area was reduced by 900,000 acres. The season-average farm price was unchanged at $5.70 per bushel.

The U.S. cotton crop estimate was significantly lowered by 1.892 million bales from July, contrary to traders’ expectations. The estimated yield is 840 pounds per acre, with harvested area reduced by over 1 million acres. he 2024-25 season average upland farm price was reduced 2 cents from the July USDA forecast to 66 cents per pound.

The first USDA survey-based 2024-25 rice production forecast reduced total rice production by 0.9 mil. cwt to 220.8 mil. with most of the reduction in long-grain. Projected 2024-25 all rice ending stocks were lowered by 2.4 million cwt to 43.6 mil., still up 14% from last year. The 2024-25 all rice season-average farm price is unchanged at $15.60 per cwt.

— IEA holds 2024 oil demand growth steady; cuts 2025 outlook due to China’s slowdown. The International Energy Agency (IEA) maintained its forecast for 2024 oil demand growth at 970,000 barrels per day (bpd) but slightly reduced its outlook for 2025 to 950,000 bpd, a decrease of 30,000 bpd from previous estimates. The IEA notes that current oil supply is struggling to meet peak summer demand, leading to a market deficit, with OPEC+ supply cuts contributing to the tightness.

China’s weak economic growth, following its post-Covid surge in 2023, is now significantly dragging on global oil demand. In contrast, U.S. demand during the summer driving season has reached its highest level since the pandemic, partially offsetting declines elsewhere. The IEA also predicts that non-OECD countries’ share of demand growth will drop to about one-third in 2024, compared to two-thirds in 2023, largely due to China’s slowdown.

— Copper and nickel made in China flooded overseas into warehouses tracked by the London Metal Exchange last month, as tepid domestic demand triggers a wave of exports that has weighed on global prices. Link for details via Bloomberg.

— A railway strike in Canada appears imminent after the Canada Industry Relations Board (CIRB) cleared a key hurdle, raising the threat of a lockout if no agreement is reached between the Teamsters Canada Rail Conference and CN and CKCP railways by Aug. 22, according to realagriculture (link) Kyle Larkin, executive director of Grain Growers of Canada, warns that a dual railway strike could have devastating effects, particularly on the agriculture industry, as 94% of all grain in Canada moves by rail. Larkin outlines three government options to prevent or end the strike: back-to-work legislation, binding arbitration, or a “maintenance of activities” designation, though the success of each varies.

— The recent strike by oilseed workers in Argentina, which had caused significant disruptions at the country’s main grain ports, is beginning to see resolution following government intervention. The Argentine government issued a compulsory conciliation order, requiring the workers to suspend their strike for 15 days. This action was aimed at alleviating the shipping disruptions that had affected over 40 ships, particularly at ports along the Parana River near Rosario, where more than 80% of Argentina’s agricultural exports are handled.

Background. The strike, initiated by two industrial unions, was a response to demands for wage increases that would keep pace with the country’s high inflation rates. The industrial action had paralyzed exports from Argentina’s top grain ports, significantly impacting the nation’s economy, which relies heavily on foreign currency from grain exports. The government’s intervention has led to the normalization of port activities, with shipping activities gradually returning to normal.

An initial meeting between the involved parties is scheduled for Wednesday to further address the situation and negotiate terms to prevent future disruptions. The resolution of this strike is crucial for Argentina, a major global exporter of soybean oil and meal, as it seeks to stabilize its economy and strengthen its central bank reserves through continued agricultural exports.

— Ag trade update: Egypt purchased 280,000 MT of wheat from its tender for 3.8 MMT – 180,000 MT of Ukrainian and 100,000 MT of Bulgarian wheat.

— Tropical Storm Ernesto has developed in the Atlantic and is quickly advancing toward the Caribbean, including Puerto Rico. The storm is expected to bring heavy rain, strong winds, and rough seas as it moves through the region. Today, the Leeward Islands will experience these tropical storm conditions, with the Virgin Islands and Puerto Rico likely to be affected by the end of the day. There are concerns that the storm’s impact could exacerbate Puerto Rico’s already fragile electrical infrastructure. Although Ernesto is not expected to follow the same path as the earlier storm, Debby, which was headed toward the continental U.S., it is anticipated to strengthen into a hurricane due to the warm ocean waters. This intensification could potentially pose a threat to Bermuda.

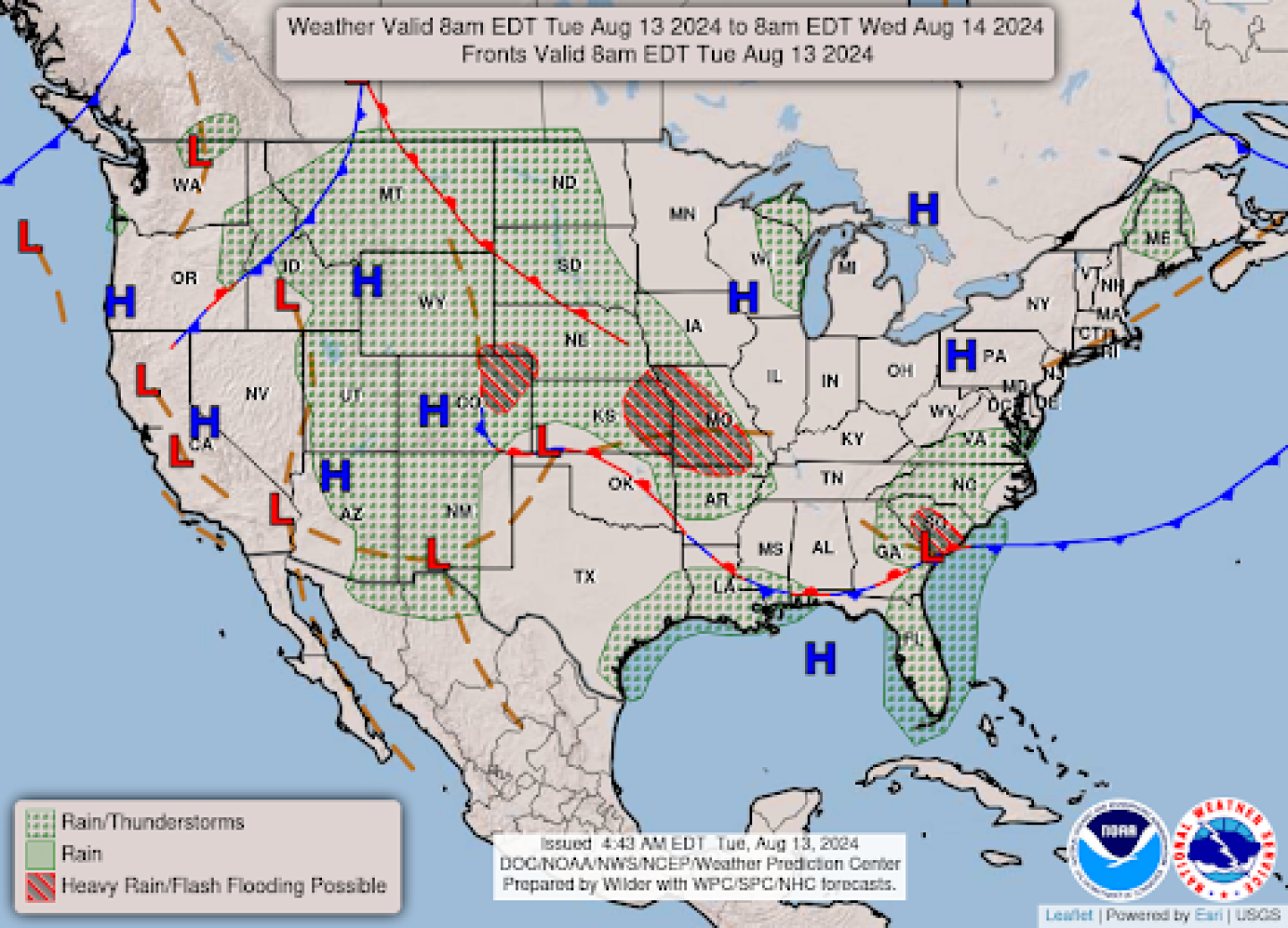

— NWS outlook: Heavy rain and flash flooding threat forecast to stretch from the central Plains to the Midwest over the next few days... ...Potentially dangerous heat anticipated across the southern Plains, lower Mississippi Valley, and Gulf Coast... ...Fire weather concerns and poor air quality continues for portions of the Pacific Northwest, Northern Rockies, and Great Basin.

Items in Pro Farmer’s First Thing Today include:

• Grains lower overnight

• Cordonnier raises U.S. yield, production forecasts

• Assessing August acreage data

• Corn, bean CCI ratings slip while HRS crop modestly improves

| ISRAEL/HAMAS CONFLICT |

— Russian President Vladimir Putin today is expected to host Palestinian President Mahmoud Abbas in Moscow. This meeting is significant as it marks their first face-to-face encounter since 2021. Abbas arrived in Moscow on Monday for this official visit, which was initially scheduled for November 2023 but was postponed due to the situation in Gaza. The discussions between Putin and Abbas are expected to focus on efforts to end the fighting in Gaza and facilitate the delivery of humanitarian aid to the besieged region. The death toll in Gaza has risen dramatically, with nearly 40,000 casualties reported, primarily women and children, due to the ongoing Israeli offensive that began in October 2023.

Russia’s involvement in the Israel-Palestine conflict is part of its broader strategy to assert influence in the Middle East. Unlike the United States and the European Union, Russia has not designated Hamas as a terrorist organization and has maintained diplomatic relations with various Palestinian factions, including Hamas. This approach is seen as an effort to solidify Russia’s presence in the Arab world by demonstrating support for the Palestinian cause, contrasting with the U.S. support for Israel.

During the meeting, Abbas is also expected to express gratitude to Putin for Russia’s support for Palestine. The Kremlin has consistently criticized Western nations for their backing of Israel and has used its veto power in the UN Security Council against proposals concerning Gaza. Despite these actions, analysts suggest that Russia’s influence over the conflict remains limited, and the meeting is likely to hold more symbolic than practical significance.

Following his visit to Russia, Abbas is scheduled to travel to Turkey for talks with Turkish President Recep Tayyip Erdogan, indicating ongoing diplomatic efforts to address the crisis.

| RUSSIA/UKRAINE |

— Ukrainian forces have launched a significant cross-border incursion into Russian territory, resulting in the control of dozens of Russian villages and approximately 386 square miles of land. This unexpected advance by Ukraine has prompted Russian President Vladimir Putin to vow to “kick the enemy out” and instruct his security chiefs to remove Ukrainian forces from Russian territory. The incursion has led to a large-scale evacuation from the affected border regions. Around 180,000 people have been ordered to evacuate, with an estimated 121,000 already having left, according to Aleksey Smirnov, the acting head of the Kursk region. This development marks a notable escalation in the ongoing conflict between Ukraine and Russia.

| POLICY UPDATE |

— Paul Neiffer (Farm CPA Report, link) was on AgriTalk on Monday with Chip Flory (link). They discussed the following topics:

• Negative scoring of the House Ag farm bill proposal by the CBO;

• Issues with USDA clawing back 2022 ERP payments due to immaterial acres not covered by crop insurance;

• Discussion last week on R&D tax credit promoters touting incorrect tax credits for farmers;

• Sen. Elizabeth Warren’s (D-Mass.) proposal to increase estate taxes.

Negative scoring of the House Ag farm bill proposal by the CBO

The Congressional Budget Office (CBO) has evaluated the House Agriculture Committee’s farm bill proposal and determined that it would increase deficit spending by approximately $33 billion. This negative scoring suggests that the proposed bill exceeds the budgetary limits set for agricultural spending, raising concerns about its fiscal sustainability and potential impacts on the federal deficit.

USDA clawing back 2022 ERP payments

USDA’s Emergency Relief Program (ERP) for 2022 aims to assist agricultural producers affected by natural disasters. However, there have been issues with the USDA reclaiming payments from producers due to “immaterial acres” not covered by crop insurance. This clawback has caused frustration among farmers who believed they were eligible for relief but are now facing demands to return funds.

R&D tax credit issues

There have been discussions about the misuse of the Research and Development (R&D) Tax Credit in the agricultural sector. Some promoters have been incorrectly touting tax credits that farmers may not qualify for, leading to potential audits and financial discrepancies. The complexity of agricultural research and the stringent eligibility criteria for the R&D Tax Credit pose significant challenges for farmers trying to claim these benefits.

Sen. Elizabeth Warren’s proposal to increase estate taxes

Sen. Elizabeth Warren has proposed increasing estate taxes as part of a broader effort to address wealth inequality. Her proposal includes a 2% tax on net worth between $50 million and $1 billion, with an additional 1% surtax on wealth above $1 billion. This initiative aims to generate significant revenue by targeting the wealthiest households, potentially impacting farmers with substantial estates.

| PERSONNEL |

— Rod Snyder, the director of the EPA’s agriculture and rural affairs office, announced his departure after nearly three years as the agency’s agriculture adviser. EPA Administrator Michael Regan praised Snyder’s transformational impact, highlighting his role in establishing the Office of Agriculture and Rural Affairs and strengthening ties between the EPA and rural communities. Snyder, who will leave the agency on Wednesday, expressed pride in his work with agricultural and rural communities. Before his appointment in 2021, Snyder led sustainability efforts at Field to Market and held executive roles at the National Corn Growers Association and CropLife America.

| CHINA UPDATE |

— China’s Huawei Technologies is close to introducing a new AI chip, overcoming U.S. sanctions. Huawei told potential clients that the chip is comparable to Nvidia’s H100, which isn’t directly available in China, the Wall Street Journal reported (link).

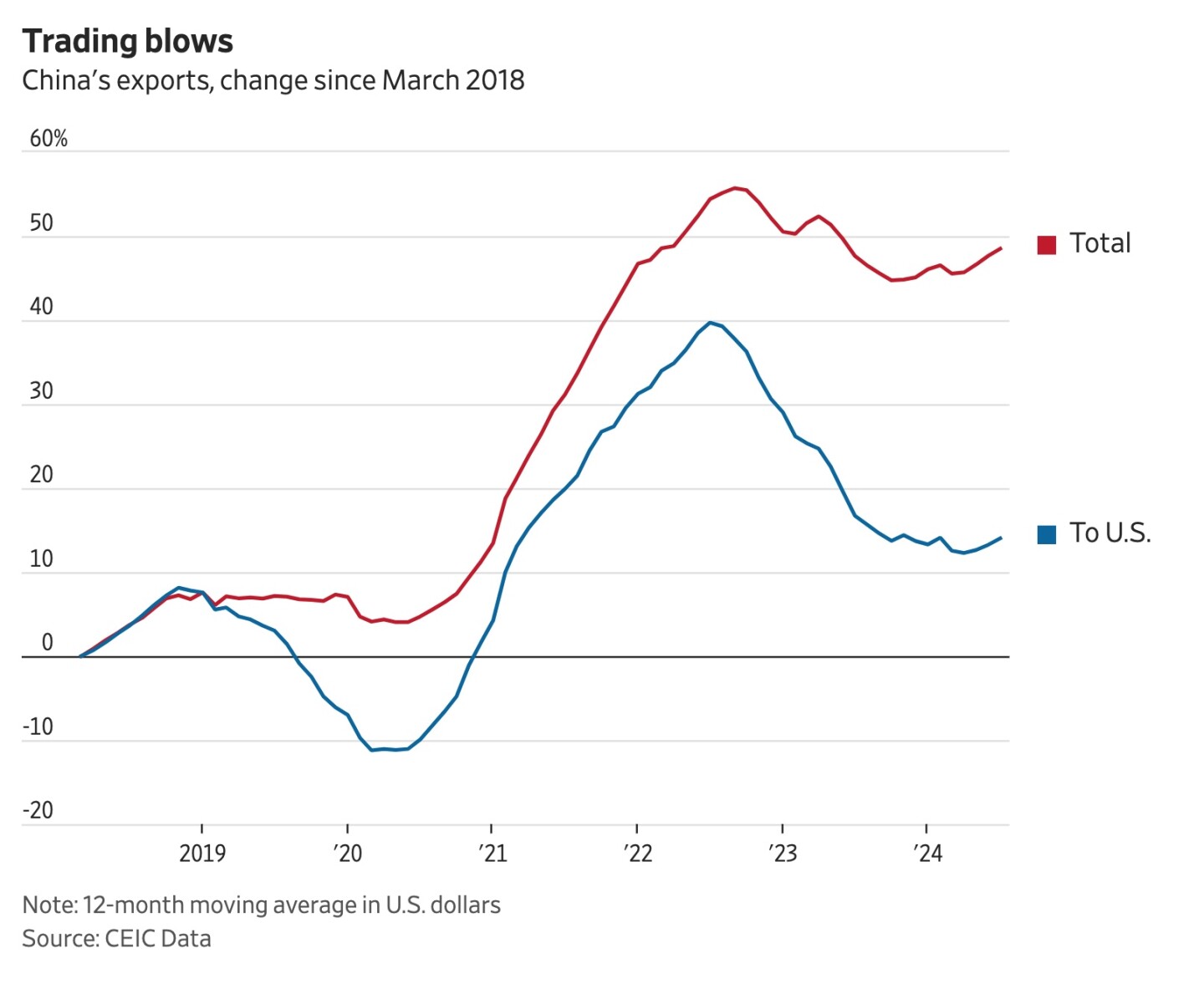

— Trump’s potential 60% tariffs could deepen China’s economic vulnerability. China managed to recover from the economic impact of the trade war with the U.S. during President Donald Trump’s administration. However, if Trump wins the upcoming presidential election, the next round of the trade conflict is expected to be much more challenging for China, the Wall Street Journal reports (link). Trump has proposed raising tariffs on Chinese imports to 60% or more, which would significantly hurt China’s economy.

China’s economy is currently more vulnerable, relying heavily on manufacturing and exports, with a recent surge in exports being one of the few positive economic indicators. However, this reliance makes China more susceptible to further escalation in the trade war. Although China has been increasing its exports to developing economies since 2018, countries like India, Brazil, and Mexico are starting to push back due to concerns about their own domestic industries and jobs. The economic consequences for China could be severe if this trade conflict intensifies.

— China’s central bank pledges $14 billion for flood recovery amid crop damage. The People’s Bank of China (PBOC) pledged 100 billion yuan (around $14 billion) to support recovery and rebuilding efforts in areas affected by recent floods and extreme weather. The funding will be directed to provinces and regions like Fujian, Guangdong, Henan, and others, as well as to farmers, small businesses, and households. This comes after some 6 million acres of crops were damaged. The PBOC has already issued 2.61 trillion yuan in re-lending quotas to assist small companies and the agricultural sector. There is growing speculation that these disasters might increase China’s demand in the global market to secure crop and food supplies.

— China’s bank loan gauge contracts for first time in 19 years. China’s yuan-denominated bank loans that exclude those extended to financial institutions shrank by 77 billion yuan ($10.7 billion) at the end of July from a month ago, according to data from the People’s Bank of China. That marked the first drop since July 2005, as more debt was repaid than taken out, which could exacerbate deflation and slowed growth. Non-financial companies took out just 152 billion yuan of loans in July, the smallest amount since October 2019. Aggregate financing, a broad measure of credit, increased 771 billion yuan last month, according to Bloomberg calculations, falling short of a 1 trillion-yuan median forecast by economists. A gauge of new loans, which includes borrowing by financial firms, rose 268 billion yuan, also worse than the 427 billion yuan forecast.

| TRADE POLICY |

— U.S. dairy industry and lawmakers urge action against Colombia’s powdered milk tariff threat. The U.S. dairy industry and bipartisan lawmakers are urging action against Colombia’s investigation into U.S. powdered milk imports, which could lead to tariffs. The Colombian government’s investigation, prompted by domestic producers’ claims of harm from subsidized U.S. imports, is viewed by U.S. dairy interests as baseless and protectionist. The potential tariffs threaten $70 million in annual U.S. exports to Colombia, jeopardizing a key market established under the 2012 Colombia Trade Agreement. U.S. dairy leaders and lawmakers are calling on the Biden administration to challenge the investigation, emphasizing that U.S. milk powder is not subsidized, and that the investigation relies on outdated data. They warn that tariffs would harm both U.S. and Colombian dairy sectors, and they seek a resolution rooted in accurate economic analysis.

| ENERGY & CLIMATE CHANGE |

— Grain Belt Express transmission line faces major setback as Illinois court overturns state approval. The Grain Belt Express, a proposed 780-mile high-voltage transmission line intended to deliver wind energy from Kansas to Indiana, has encountered a significant legal setback. An Illinois appellate court recently overturned the state’s approval for the project, casting doubt on its future. The court’s decision was based on the finding that Invenergy, the Chicago-based developer of the project, failed to demonstrate its capability to finance the project, despite being one of the largest private energy developers in the U.S.

This ruling has implications for the eastern half of the transmission line, which was planned to cross Illinois. The decision has intensified discussions in Washington, D.C., about the need for a comprehensive overhaul of energy permitting processes, including those for transmission projects. There is a bipartisan bill in Congress aimed at updating these processes to facilitate such infrastructure projects.

The Grain Belt Express has faced various challenges over the years, including resistance from landowners, particularly in Missouri, where the company has been involved in legal proceedings to acquire land through eminent domain. Despite these challenges, the project had secured significant voluntary easements in Missouri and Kansas, covering about 65% of the route in those states.

The recent court ruling in Illinois adds to the complexity of the project, highlighting the difficulties faced by large-scale transmission projects in navigating regulatory and legal hurdles. The developer, Invenergy, plans to appeal the court’s decision, which could further delay the project’s timeline and increase its costs.

— Supply of clean ammonia, which is key to decarbonizing fertilizers, may grow as much as 30-fold by the end of this decade, driven by subsidies and rising demand in Europe and Asia. Clean ammonia accounts for 92% of new supply until 2030 in BloombergNEF’s outlook, and it may potentially make up 13% of global production by then. At least a third of this clean ammonia could be exported, increasing opportunities for the global trade. Link for more via Bloomberg.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— KFC is expanding its $5 Value Menu to include chicken nuggets and Famous Bowls in a bid to attract price-sensitive consumers and compete with McDonald’s successful $5 Meal Deal. Starting Sept. 5, KFC will also offer free delivery on Thursdays through its app and website, timed with the start of football season. This move follows similar value meal offerings from competitors like Wendy’s and Burger King, all aiming to capitalize on McDonald’s success in boosting foot traffic by drawing customers away from rival chains.

| POLITICS & ELECTIONS |

— Harris addresses party dissent as Ilhan Omar faces primary challenge amid Gaza policy debate. As Kamala Harris works to address dissent within the Democratic Party over the Biden administration’s stance on Israel’s war in Gaza, attention is focused on Minnesota’s fifth-congressional-district primary. Progressive Congresswoman Ilhan Omar, known for her criticism of Israel, faces a challenger who previously came close to unseating her. While two other members of the “Squad” have lost recent primaries, the Minnesota race has not attracted significant funding from pro-Israel groups.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |