News/Markets/Policy Updates: July 29, 2024

— Vice President Kamala Harris raised $200 million in the week since entering the 2024 presidential race, signaling strong enthusiasm among Democrats for their new presumptive nominee. This fundraising surge helps counteract a Republican blitz that saw Donald Trump leading in financial contributions. Harris’s campaign reported the figures on Sunday, with communications director Michael Tyler describing the amount as “record-shattering.” Notably, 66% of the donations came from first-time donors, highlighting widespread support. This follows an impressive $81 million raised in the first 24 hours after President Joe Biden’s withdrawal, which the campaign noted as the largest single-day fundraising total for any candidate in history. — Next 99 days: Race for the White House. With just 99 days left until the election, the race has already been tumultuous, with major events shaking up the presidential landscape. Key points to watch in the coming months, according to The Hill (link) include: • Harris’ VP pick. Vice President Kamala Harris, now the Democratic frontrunner after President Biden’s withdrawal, is expected to select her running mate soon. Contenders include Pennsylvania Governor Josh Shapiro, Arizona Senator Mark Kelly, Kentucky Governor Andy Beshear, and Minnesota Governor Tim Walz. This choice will be crucial in shaping the Democratic campaign against Senator JD Vance, Trump’s running mate. — Former President Donald Trump recently stirred controversy with remarks made during a speech to a Christian conservative audience at the Believers Summit hosted by Turning Point Action in West Palm Beach, Florida. Trump suggested that if Christians voted for him in the upcoming election, they would not need to vote again in the future because he would “fix” everything within his next term. Specifically, he stated, “Christians, get out and vote just this time. You won’t have to do it anymore. Four more years. You know what? It’ll be fixed.” These comments were met with immediate backlash from Democrats and other critics, who interpreted them as a threat to democratic processes. Vice President Kamala Harris’s campaign quickly responded, framing Trump’s remarks as a “vow to end democracy.” Harris’s spokesperson, James Singer, emphasized that the election is about preserving freedom and accused Trump of wanting to revert to a politics of “hate, chaos, and fear.” Sen. Tom Cotton (R-Ark.) attempted to mitigate the damage by claiming in a CNN interview that Trump was “obviously making a joke.” However, the interpretation that Trump was hinting at authoritarian intentions or a desire to undermine future elections persisted among his critics. Rep. Adam Schiff (D-Calif.) and other Democratic lawmakers echoed these concerns, warning that Trump’s rhetoric suggested a move towards dictatorship . The Trump campaign sought to clarify his comments, stating that Trump was emphasizing themes of faith, national unity, and prosperity rather than suggesting an end to voting. Campaign spokesperson Steven Cheung explained that Trump was highlighting the importance of faith and unity in contrast to the divisive political climate. — This week’s headline economic news will focus on the monetary policy decisions of three G7 nations. The Bank of Japan and the U.S. Federal Open Market Committee will announce their rate-setting decisions on Wednesday, followed by the Bank of England’s Monetary Policy Committee on Thursday. The Federal Reserve is currently evaluating when to reduce interest rates after raising them to a 23-year high of 5.25-5.5% in response to the inflation shock from the pandemic. The decision-making process has been complicated by last week’s unexpectedly high GDP growth figures, but it is anticipated that the Fed will keep rates steady this week. Observers will closely watch for any comments that either confirm or temper the prevailing expectation of a rate cut at the Fed’s September meeting… with Friday’s Employment report helping start building additional info for the next FOMC meeting Sept. 17-18. We have several perspectives below on the Fed’s interest-rate possibilities. |

| Today’s Digital Newspaper |

MARKET FOCUS

· Dr. Vince Malanga sizes up U.S. economy

· WSJ article: A Fed rate cut is finally within view

· U.S.-listed fixed-income ETFs have attracted nearly $150 billion by late July

· McDonald’s experienced its first global sales decline since 2020

· Yellen vs Trump on strong dollar

· Oil trades near six-week low

· Ag markets today

· India to decide soon on sugar selling price, ethanol use

· Ag trade update

· NWS outlook

· Pro Farmer First Thing Today items

CONGRESS

· House Republicans failed to pass all 12 annual spending bills before August recess

CHINA

· Beijing’s ag ministry (MARA) now focusing on beef and dairy sectors facing oversupply

· China’s hog slaughter eases slightly in first half

· China’s industrial profits strengthen in June

· China’s bond yields continue to drop, testing PBOC’s tolerance

· Citi cuts China’s 2024 GDP growth forecast

TRADE POLICY

· South Africa likely to maintain preferential trade access U.S. market

· U.S. and China clash over industrial subsidies at WTO, focus on IRA

ENERGY & CLIMATE CHANGE

· U.S. upbeat about Canadian efforts to block Chinese EV loophole

LIVESTOCK, NUTRITION & FOOD INDUSTRY

· USDA to unveil proposed rule declaring salmonella an adulterant

· Two-thirds of U.S. dairy farms vanish, yet milk production rises by a third

POLITICS & ELECTIONS

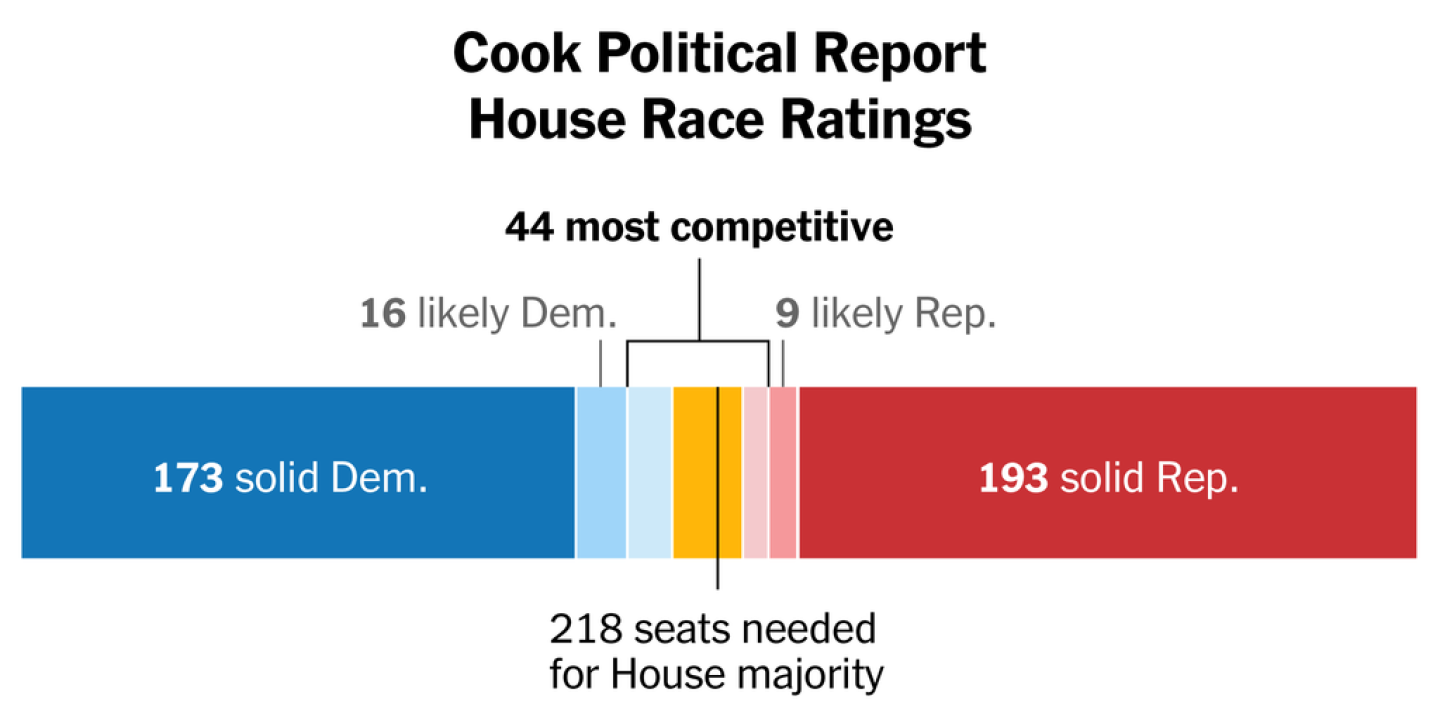

· House Republicans have slight advantage in upcoming elections

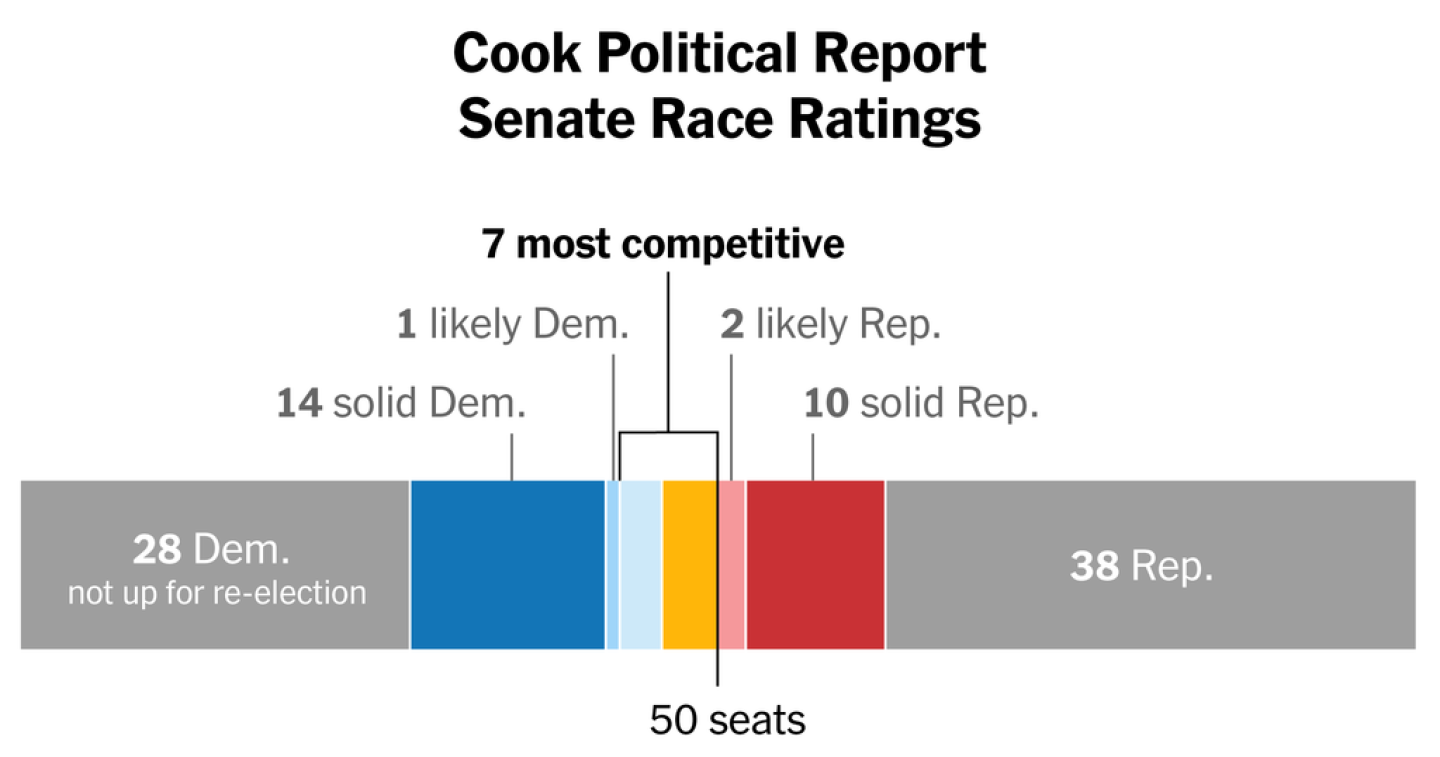

· Senate presents a challenging election landscape for Democrats

· President Biden set to propose a significant overhaul of Supreme Court today

· In Venezuela’s presidential election, both candidates claim victory

OTHER ITEMS OF NOTE

· Internet cables across southern and eastern France were cut overnight

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mostly firmer overnight. U.S. Dow opened around 80 points higher but then went lower. In Asia, Japan +2.1%. Hong Kong +1.3%. China flat. India flat. In Europe, at midday, London +0.7%. Paris -0.4%. Frankfurt +0.3%.

U.S. equities Friday and for the week: All three major indices closed higher Friday in the wake of updated inflation data, but the Nasdaq and S&P 500 both registered another week of losses while the Dow edged higher. For the week, the Dow gained 0.7%, the Nasdaq fell 2.1% and the S&P 500 lost 0.8%. On Friday, the Dow was up 654.27 points, 1.64%, at 40,589.34. The Nasdaq rose 176.16 points, 1.03%, at 17,357.88. The S&P 500 gained 59.88 points, 1.11%, at 5,459.10.

— U.S.-listed fixed-income ETFs have attracted nearly $150 billion by late July, setting a record for this time of year. Combined with mutual funds, taxable bond funds accounted for nearly 90% of net U.S. fund inflows in the first half of the year, according to Morningstar.

— McDonald’s experienced its first global sales decline since 2020, as higher prices deter consumers worldwide. In the three months ending in June, comparable sales dropped 1% year-over-year, affecting both international locations and the U.S. CEO Chris Kempczinski noted that consumers are now “more discriminating with their spend.” Despite quarterly revenue holding steady at $6.49 billion, net profit fell 12% to $2.02 billion, missing Wall Street expectations. The cost of eating out has risen significantly, with a U.S. index showing a 30% increase since mid-2019. McDonald’s prices have also risen, with a Big Mac Meal now averaging $9.29 in the U.S., up 27% since 2019. In response, McDonald’s and its competitors are offering discounts to attract customers. A $5 meal deal introduced in the U.S. has boosted foot traffic. McDonald’s, which operates over 40,000 restaurants in more than 100 countries, saw U.S. sales fall 0.7% and international sales drop over 1% in the second quarter. The company cited the Gaza conflict and decreased sales in China and France as contributing factors. Investor confidence has waned, with McDonald’s shares down 15% year-to-date.

— Ag markets today: Soybean futures faced heavy pressure overnight after Friday’s sharp losses. Corn and wheat traded mildly lower overnight. As of 7:30 a.m. ET, corn futures were trading 2 to 3 cents lower, soybeans were 15 to 24 cents lower, SRW wheat was mostly 4 cents lower, HRW wheat was fractionally lower and HRS wheat was 2 to 3 cents lower. The U.S. dollar index was nearly 200 points higher, and front-month crude oil futures were 45 cents lower.

Wholesale beef prices firm, though movement slows. Wholesale beef prices firmed $1.31 for Choice to $313.77 and $2.35 for Select to $297.26 on Friday, though movement slowed to 101 loads. The slowdown in movement amid the higher prices suggests retailers may become more selective buyers after recent strong purchases.

Cash hog index continues to strengthen. The CME lean hog index is up another 46 cents to $91.85 as of July 25, extending the string of gains to 10 days. During that span, the cash index has risen $3.47 and is just 44 cents below the mid-May peak. The pork cutout dropped 78 cents on Friday to $105.17.

— Agriculture markets Friday and for the week:

• Corn: December corn futures plunged 10 3/4 cents to $4.10, though still eked out a 9 1/4 cent gain on the week.

• Soy complex: November soybeans plunged 31 cents to $10.48 1/2 but managed to gain 12 1/2 cents on the week. December soymeal closed $4.50 lower but marked a week-over-week gain of $17.20. September soyoil fell 218 points to 43.01 cents and closed down 264 points on the week, marking the third straight weekly decline.

• Wheat: December SRW wheat futures fell 14 cents to $5.48 1/2, near the session low and closed at a contract low close. For the week, December SRW fell 19 1/2 cents. December HRW wheat futures dropped 16 cents to $5.62, near the session low and closed at a contract low close. For the week, December HRW lost 24 3/4 cents. December spring wheat futures slid 14 1/2 cents to $6.07 1/2 and closed down 22 cents on the week.

• Cotton: December cotton fell 91 points to 67.99 cents, and for the week lost 271 points.

• Cattle: August live cattle fell 32 1/2 cents to $188.575, nearer the session low after hitting a nine-month high early on. For the week August live cattle rose a solid $5.475. August feeder cattle futures rose $1.075 to $259.70, near mid-range and hit a three-week high. For the week, August feeders gained $4.10.

• Hogs: Nearby August futures slipped 30 cents to $93.475. That marked a weekly gain of $1.625. Most deferred contracts posted modest gains.

— Of note:

- Defining a philanthropist. “Well, the people you just named have not been very philanthropic yet. They use their voice, and they use their megaphones, but I would not call those men philanthropists.” — Melinda French Gates, drawing a distinction between longtime donors to charity such as herself, her former husband Bill Gates and Warren Buffett, and outspoken activist billionaires like Elon Musk.”

- Trade crimes. “This legislation puts real teeth into combating trade crimes that are undermining U.S. manufacturers, workers and supply chains, and will ensure that those facilitating these crimes will be held accountable.” — Kim Glas, president & chief executive of the National Council of Textile Organizations, on newly introduced legislation targeting trade crimes by China-based companies.

- $6,934: Spot rate for container shipping from Shanghai to Los Angeles the week ending July 25, down 7.2% from the week before in the first weekly decline since the week ending May 2, according to the Drewry World Container Index.

— WSJ article: A Fed rate cut is finally within view. The upcoming Federal Reserve meeting, while not expected to result in an immediate interest rate cut, is crucial as officials may signal a likely reduction in September, according to a Wall Street Journal article (link). Key reasons for this anticipated shift include:

- Inflation progress: Underlying inflation, excluding food and energy, fell to 2.6% in June from 4.3% a year earlier. This broad-based decline suggests the Fed’s 2% target is attainable.

- Labor market cooling: The unemployment rate rose to 4.1% in June from 3.7% at the end of last year, indicating a slowdown in hiring. This reduces the pressure for significant wage increases, which could sustain higher inflation.

- Risk management shifts: With inflation decreasing and the labor market stabilizing, the Fed must balance the risks of acting too soon versus waiting too long. The Fed’s previous delay in raising rates, which led to rapid hikes starting in 2022, underscores the importance of timely decisions.

Perspective: While officials like New York Fed President John Williams and Chicago Fed President Austan Goolsbee highlight the improved economic indicators, they also stress the need for caution and additional evidence before making any rate changes. The meeting’s outcome will likely influence the Fed’s approach to managing the delicate balance between controlling inflation and maintaining economic stability.

— Malanga: Spring quarter GDP growth improves to 2.8% but underlying weaknesses persist. The U.S. gov’t reports that real GDP growth in the spring quarter was at an annual rate of 2.8%, improving from the prior quarter’s 1.4% rate. Inflation was reported at 2.3%, yielding a 5.1% output rate. However, Dr. Vince Malanga, president of LaSalle Economics, says this growth is only barely sufficient to generate significant profit expansion without strong productivity and is insufficient to generate the revenue needed to address the government’s large budget deficit.

Despite the headline GDP rate, there are underlying weaknesses, Malanga notes. While consumption, business investment, and government spending rose faster than in the winter quarter, the trade balance and residential construction deteriorated. A significant portion of the GDP rise came from inventory investment, with real final sales rising at only a 2% rate, he details. Result: Increased inventories across the economy could ease price pressures through markdowns but could also lead to reduced production schedules and weakened labor demand if the inventory is unwanted.

The jobless rate has climbed above 4% for two consecutive quarters. Jobless claims have been trending upward over the past six weeks, with continuing claims above 1.8 million. Small business hiring is slowing, and the quit rate is no longer rising, indicating less job security for workers. This has weakened consumer confidence and expectations, causing the Fed to give equal weight to labor market conditions and inflation in its policy considerations, even though inflation remains above the Fed’s 2% target.

Malanga believes the Fed is struggling to maintain its stance of guiding policy solely on economic conditions amid increasing political pressure. Republicans warn against cutting rates close to the election, while Democrats express concern over the deteriorating labor market and suggest the Fed is late in reducing rates.

Advocates for an early rate cut argue it would stabilize real estate markets, the dollar exchange rate, and the overall economy while assisting the Treasury in financing its massive debt. Malanga observes that historically, the Fed has postponed cutting rates until market conditions demand it. With recent commodity price collapses and sector-specific price weaknesses, some analysts are demanding a rate cut at this week’s FOMC meeting, with many forecasting a rate-cutting cycle beginning at the Sept. 17-18 FOMC. Chair Powell is likely to support this timeline, Malanga concludes, emphasizing the Fed’s non-political stance, though he adds Powell’s past inaction may complicate this position.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and British pound weaker against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.16%, with a lower tone in global government bond yields. Crude oil futures were under pressure, with US crude around $76.80 per barrel and Brent around $79.95 per barrel. Gold and silver were firmer, with gold around $2,386 per troy ounce and silver around $28.19 per troy ounce.

— Yellen vs Trump on strong dollar. Treasury Secretary Janet Yellen recently challenged former President Donald Trump’s assertion that a strong dollar is negatively impacting U.S. manufacturers. In an interview with Bloomberg News (link), Yellen emphasized that the relationship between currency strength and manufacturing performance is more nuanced than Trump’s view suggests. Yellen’s perspective on the strong dollar includes several key points:

- Broader context: She argues that the impact of a strong dollar needs to be considered within a wider economic framework, rather than viewed in isolation.

- Market-set exchange rates: Yellen consistently adheres to the Group of Seven (G7) commitment to allowing exchange rates to be determined by market forces.

- Downplaying international trade impact: The Treasury Secretary has minimized the role of international trade in the decline of American factory jobs, suggesting that other factors may be more significant.

In contrast, Donald Trump has been vocal about his desire for a weaker dollar, believing it would benefit U.S. manufacturers and boost exports. However, some Wall Street economists have pointed out a potential contradiction in Trump’s stance:

- Strong-dollar platform: Despite advocating for a weaker dollar, Trump’s proposed policies for a potential second term, including tariffs on trade partners and tax cuts, could actually strengthen the dollar.

- Economic impact: These policies could potentially lead to higher inflation and interest rates, which typically contribute to a stronger currency.

— Oil traded near a six-week low as positive Chinese economic data and renewed tension in the Middle East were overshadowed by doubts over global demand. Brent futures were below $80 a barrel.

- OPEC: OPEC has maintained its forecast for global oil demand growth, projecting an increase of 2.25 million barrels per day (bpd) in 2024 and 1.85 million bpd in 2025.

- International Energy Agency (IEA): The IEA has slightly revised its 2024 oil demand forecast upward, predicting a growth of 1.7 million bpd in the first quarter of 2024. However, the agency also notes a slowdown in demand growth to 1.3 million bpd for the year, down from 2.3 million bpd in 2023. This deceleration is attributed to efficiency improvements and the adoption of electric vehicles.

- U.S. Energy Information Administration (EIA): The EIA forecasts a global consumption increase of 1.1 million bpd in 2024 and 1.8 million bpd in 2025, with most demand growth coming from non-OECD countries.

Price forecasts

- Short-term outlook: Analysts expect oil prices to remain volatile, with potential increases in the second half of 2024 as supply cuts and geopolitical risks play out. The EIA forecasts Brent crude prices to average $89 per barrel for the remainder of 2024.

- Long-term outlook: Over the next few years, oil prices are expected to face downward pressure due to efficiency gains and the transition to renewable energy sources. Some forecasts suggest that prices could decline towards $60-65 per barrel by 2026 before potentially rebounding.

— India set to decide soon on sugar selling price, ethanol use. India will decide on sugar industry calls for a hike in the minimum selling price (MSP) in the coming days, a senior government official said, adding that ethanol policies would be set before the start of the next season. The sugar-processing industry has been demanding an increase in the minimum selling price, saying the government has raised the mandatory procurement price of sugarcane in recent years while the MSP has remained unchanged since 2019. India restricted the use of sugar in ethanol production during the 2023-24 marketing year that ends on Sept. 30 and prohibited exports to keep a lid on domestic prices.

— Ag trade update: Taiwan tendered to buy 65,000 MT of corn from the U.S., Brazil, Argentina or South Africa. Tunisia tendered to buy 125,000 MT of soft milling wheat and 50,000 MT of durum – all optional origin.

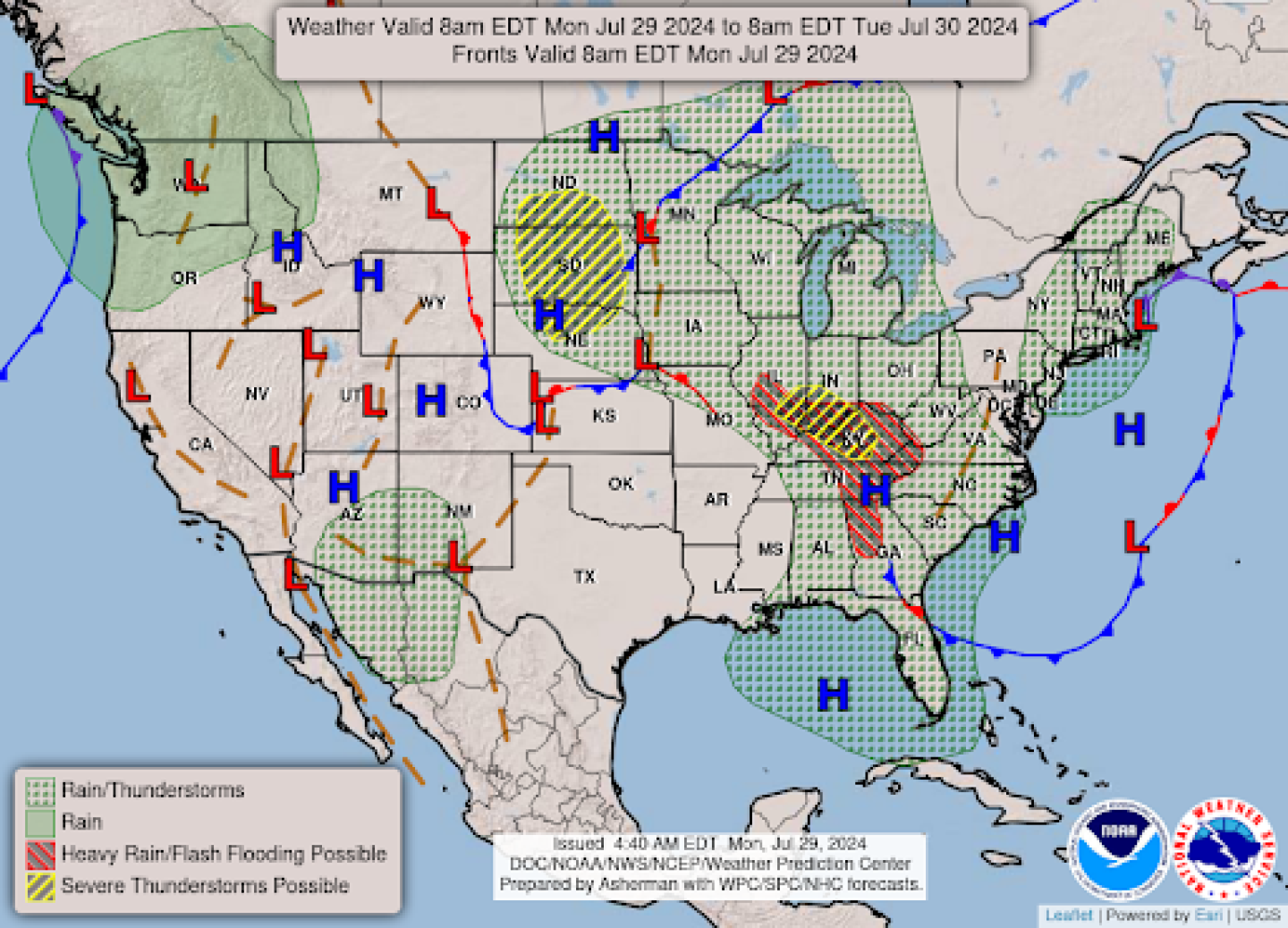

— NWS outlook: Flash flooding possible in the Ohio/Tennessee Valleys and central/southern Appalachians through early this week... ...Scattered severe thunderstorms forecast across portions of the Northern Plains Monday and Upper Midwest Tuesday... ...Dangerous mid-summer heat wave to begin expanding across the central U.S. on Monday.

Items in Pro Farmer’s First Thing Today include:

• Active followthrough selling in soybeans overnight

• Generally favorable weather outlook for U.S. crops

| CONGRESS |

— House Republicans failed to pass all 12 annual spending bills before the August recess, forcing a scramble to avoid a gov’t shutdown. House Speaker Mike Johnson (R-La.) did not meet his promise to finish the bills, with key appropriations like energy and agriculture funding stalling due to internal resistance. As Congress approaches a Sept. 30 deadline, a partial gov’t shutdown looms without new legislation. A stopgap bill, or continuing resolution (CR), is widely expected to be necessary, though even its details are contentious. The House will have only 13 days in session post-recess to resolve the issue.

Only five of the necessary 12 spending bills passed the House and zero in the Senate.

| CHINA UPDATE |

— With the hog sector back to profitability, Beijing’s agriculture ministry (MARA) is now focusing on the beef and dairy sectors facing oversupply issues. Chief Veterinary Officer Wang Leijun announced a 6.4% year-on-year reduction in slaughter-ready pigs by the end of June, resulting in pig farms earning RMB 400 profit per pig due to cuts in the breeding sow population. However, beef and dairy sectors are struggling, with beef and fresh milk prices dropping 12.1% and 12.5% year-on-year in the first half of the year. Despite efforts to expand livestock supply for food security, the expected post-pandemic consumption surge hasn’t occurred, leading to oversupply.

MARA plans to support farmers by optimizing beef and dairy herds through culling older, lower-yielding animals and pushing for local relief measures like subsidies, cheap loans, and insurance. The ongoing production and reluctance to cull herds due to credit obligations mean that beef and dairy prices are likely to continue falling for several months.

— China’s hog slaughter eases slightly in first half. China slaughtered 160.35 million head of hogs in the first half of the year, down 0.7% from the same period last year. China’s sow herd stood at 40.38 million head at the end of June, down 6.0% from last year.

— China’s industrial profits strengthen in June. Profits earned by China’s industrial firms increased 3.6% annually in June, much faster than a 0.7% rise in May. Industrial profits rose 3.5% from year-ago to 3,511.03 billion yuan in the first six months of 2024. The latest figures came amid a fragile economic recovery in the face of sluggish domestic demand, deflation risks and a persistent property weakness. Profits by state-owned enterprises added 0.3% after falling 2.4% in the first five months of the year while those in private sector increased 6.8%.

— China’s bond yields continue to drop, testing PBOC’s tolerance. China’s Yields on sovereign debt fell on Monday, with the rate on 30-year bonds dipping below 2.4% for the first time in nearly two decades and the benchmark 10-year sliding to a record low. The declines have sent yields way below levels where traders once suspected the People’s Bank of China (PBOC) would intervene by borrowing and selling bonds to reverse the moves.

— Citi cuts China’s 2024 GDP growth forecast. Investment bank Citi revised down its forecast on China’s 2024 economic growth to 4.8% from 5% previously, after China’s growth missed analyst estimates in the second quarter. Data suggests that economic activity momentum softened further in July, Citi said in a note, adding it expects more property support from this week’s Politburo meeting.

| TRADE POLICY |

— South Africa is likely to maintain its preferential trade access to the U.S. market despite some strained relations, according to Stavros Nicolaou, head of strategic trade at Aspen Pharmacare Holdings Ltd. Nicolaou, who represented South Africa at a recent forum in Washington, noted that the signals from U.S. counterparts were positive. He emphasized that the Americans understand the need for South Africa to maintain its sovereignty and independence while nurturing the long-standing partnership between the two nations, which benefits both sides.

The Biden administration has been working to strengthen ties with South Africa to counterbalance the influence of Russia and China. However, U.S. lawmakers have been critical of South Africa after it brought accusations of genocide against Israel to the International Court of Justice amid the war in Gaza. This criticism led the U.S. House to pass a defense policy bill with an amendment calling for a review of South Africa’s national security risks to the U.S. The bill still requires approval from the Senate and the White House, and if passed, it could complicate the duty-free status of thousands of South African products under the African Growth and Opportunity Act (AGOA) and the Generalized System of Preferences (GSP).

In 2022, South Africa shipped goods worth over $14 billion to the U.S., with about 25% of these goods entering duty-free under AGOA and GSP. The U.S. Trade Representative has not commented on this issue yet, but a briefing is scheduled for Monday.

Maintaining favorable trade ties with the U.S. is crucial for South Africa, especially as the country’s economy has struggled to grow over the past decade. The new coalition government in South Africa is keen to bolster economic ties with the U.S. The Government of National Unity and the commerce delegation, led by the new minister of trade, industry, and competition, Parks Tau, were well received at the AGOA forum. Nicolaou noted an improved tone from the delegates compared to last year.

AGOA is set to expire in 2025, but there is momentum to extend the program. In April, senators introduced a bill to extend AGOA until 2041, and President Biden has called on Congress to reauthorize and modernize the act quickly. African Trade Ministers have also called for a swift renewal of AGOA for at least 16 years with minimal changes to stabilize trade and investment relations and preserve regional value chains.

— U.S. and China clash over industrial subsidies at WTO, focus on Inflation Reduction Act (IRA). China has requested a dispute panel to review the tax credits provided under the IRA, which it claims are the largest subsidy program ever enacted. According to a trade official in Geneva, China argues that some IRA provisions, favoring domestic goods over imports, violate international trade laws and the WTO principle of non-discrimination.

The U.S., however, has blocked the establishment of the dispute panel. Washington defends the IRA as crucial for addressing the global climate emergency, and accuses China of hypocrisy due to its own extensive domestic subsidies and non-market practices that allegedly harm other WTO members.

Additionally, the WTO has criticized China for its lack of transparency regarding its industrial subsidies, particularly in sectors like electric cars and semiconductors. The IRA, touted by the White House as the largest single investment to combat climate change, includes approximately $374 billion in energy and climate-related provisions, such as tax credits for electric vehicles and incentives for clean energy projects.

| ENERGY & CLIMATE CHANGE |

— U.S. ambassador to Canada optimistic about Canadian efforts to block Chinese EV loophole. The U.S. ambassador to Canada, David Cohen, is optimistic regarding the Canadian government’s efforts to close a loophole that could potentially allow Chinese-backed electric vehicles (EVs) to enter the US market via Canada, thereby circumventing U.S. tariffs. This loophole has raised concerns about the influx of Chinese EVs into the North American market, which could undermine local industries due to the competitive pricing enabled by China’s extensive subsidies and non-market practices.

The primary issue revolves around the possibility that Chinese EV manufacturers, such as BYD Co., could exploit the relatively lower tariffs and regulatory environment in Canada to gain access to the U.S. market. This situation is particularly concerning for the US, which has implemented stringent tariffs on Chinese-made EVs to protect its domestic industry. The US tariffs on Chinese EVs have been significantly increased, with rates as high as 102.5%.

In response to these concerns, Prime Minister Justin Trudeau’s government has been considering several measures to deter the entry of Chinese-made EVs into the Canadian market. These measures include:

· Imposing tariffs on imported Chinese EVs.

· Blocking Chinese investment in new Canadian EV manufacturing facilities.

· Making Chinese-made EVs ineligible for federal consumer incentives.

· Addressing data privacy and security concerns related to connected vehicles and infrastructure.

The Canadian government has initiated formal consultations to gather feedback from stakeholders, including labor unions and automotive industry groups, on these proposed measures. These consultations are set to run until Aug. 1, 2024.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA to unveil proposed rule declaring salmonella an adulterant. USDA’s Food Safety and Inspection Service (FSIS) is set to propose a rule declaring salmonella an adulterant in raw chicken, chicken parts, ground chicken, and ground turkey products if present above specific levels. This follows a previous rule that declared salmonella an adulterant in breaded, stuffed raw chicken products. The proposed limit is 10 colony forming units (CFU) per gram, targeting three salmonella serotypes of public health significance. Once published in the Federal Register, there will be a 60-day comment period. The Office of Management and Budget (OMB) completed its review of the FSIS plan on July 26, paving the way for the announcement. It remains uncertain if the rule will be finalized before the end of the Biden administration.

— Two-thirds of U.S. dairy farms vanish, yet milk production rises by a third. California and Wisconsin continue to lead U.S. milk production, making up one-third of the total output, but the dairy industry has undergone significant changes over the past 20 years, according to USDA analysts (link). The number of dairy herds dropped from 70,375 in 2003 to 26,290 in 2023, while milk production increased from 170.3 billion pounds to 226.4 billion pounds, a 33% rise.

Texas and Idaho have grown to be among the top five dairy states, each contributing 7% to U.S. production. California’s production share decreased from 21% to 18%, and Wisconsin’s share rose to 14%.

Nationwide, there are fewer dairy cows, but they produce more milk. Large dairy farms with over 2,000 cows now provide 39% of the milk supply, with larger farms being more common in the West. These farms have become more specialized, focusing mainly on dairy production and relying more on purchased feeds. The Economic Research Service report highlighted that larger farms are also more likely to adopt advanced technologies and management practices.

| POLITICS & ELECTIONS |

— House Republicans have a slight advantage in the upcoming elections, with The Cook Political Report favoring them in 210 seats compared to Democrats in 203 seats. To control the House, 218 seats are needed. There are 44 competitive races, and Democrats need to win most to gain a majority. Among 22 tossup seats, both parties currently control half. Republicans must retain eight of their 11 tossup seats and avoid losing their favored districts to win the House. These races are expected to be extremely close, with the majority potentially hinging on a few thousand voters across several districts. A narrow Republican majority could lead to continued legislative gridlock.

— The Senate presents a challenging landscape for Democrats, who currently hold a slim 51-49 majority. One of these seats, in West Virginia, is expected to turn Republican due to Independent Sen. Joe Manchin’s decision not to run for re-election in the heavily Republican state. This shifts the starting point to a 50-50 Senate split, where the Vice President’s tie-breaking vote becomes crucial.

The key battlegrounds are seats currently held by Democrats in Michigan, Montana, Ohio, and Nevada. Republicans need to flip just one of these to gain control of the Senate. Ohio and Montana have shown a strong Republican voting pattern in recent elections.

The margin of control in the Senate is significant. A narrow majority has previously led to critical legislative compromises, such as the reduction of President Biden’s Build Back Better bill to the smaller Inflation Reduction Act due to moderate Democratic Sens. Joe Manchin and Kyrsten Sinema (I-Ariz.). Similarly, moderate Republicans thwarted Trump’s efforts to repeal ObamaCare in 2017.

Outlook: Future policy changes, such as Trump’s potential severe immigration restrictions, deeper tax cuts, or cuts to programs like Medicaid and food stamps, could depend on whether Republicans win a single Senate seat or secure a larger majority.

— President Joe Biden is set to propose a significant overhaul of the Supreme Court today, including the implementation of term limits for justices. However, the feasibility of these reforms faces a substantial challenge in the form of the Republican-controlled House of Representatives. Link to Biden op-ed on topic in the Washington Post.

Key elements of Biden’s proposed Supreme Court reforms include:

· Term limits: Biden supports an 18-year term limit for Supreme Court justices, with a new justice appointed every two years.

· Ethics code: The president is calling for a binding code of conduct for justices, requiring them to disclose gifts, refrain from political activities, and recuse themselves from cases where they or their spouses have conflicts of interest.

· Constitutional amendment: Biden is advocating for a “No One Is Above the Law Amendment” to limit presidential immunity from criminal prosecution.

Hurdles. While these proposals align with growing Democratic frustration over the Supreme Court’s conservative majority and recent controversial rulings, their passage faces significant hurdles:

· Congressional divide: With a narrowly divided Congress and Republicans controlling the House, passing any legislation to reform the Supreme Court is highly unlikely.

· Constitutional amendment challenge: Enacting a constitutional amendment requires a two-thirds majority in both houses of Congress or a convention called by two-thirds of state legislatures, followed by ratification by 38 out of 50 states. This process is exceptionally difficult and rare.

· Republican opposition: GOP lawmakers have expressed resistance to court reforms, arguing that Democrats only began criticizing the court when it became more conservative.

· Limited time: With less than 100 days until the upcoming election, the window for passing such significant reforms is extremely narrow.

Despite these obstacles, Biden’s proposal serves several political purposes:

· Energizing the Democratic base: The reforms appeal to Democrats frustrated with recent Supreme Court decisions on issues like abortion rights and affirmative action.

· Setting an agenda: By proposing these reforms, Biden is outlining priorities for his party and potential future Democratic administrations.

· Framing the election debate: The proposals help shape the narrative around judicial issues for the upcoming election.

— In Venezuela’s presidential election, both President Nicolás Maduro and his political opponents have claimed victory. With 80% of votes counted, the National Electoral Council reported Maduro winning over 51% of the vote, while opposition candidate Edmundo González Urrutia received more than 44%. However, opposition leader María Corina Machado claimed González had secured 70% of the vote against Maduro’s 30%. If confirmed, Maduro would start a third consecutive six-year term. The U.S. and several regional nations have expressed skepticism about the official results.

| OTHER ITEMS OF NOTE |

— Internet cables across southern and eastern France were cut overnight in the latest attack on the nation’s infrastructure during the Olympics.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |