The Week Ahead: March 2, 2025

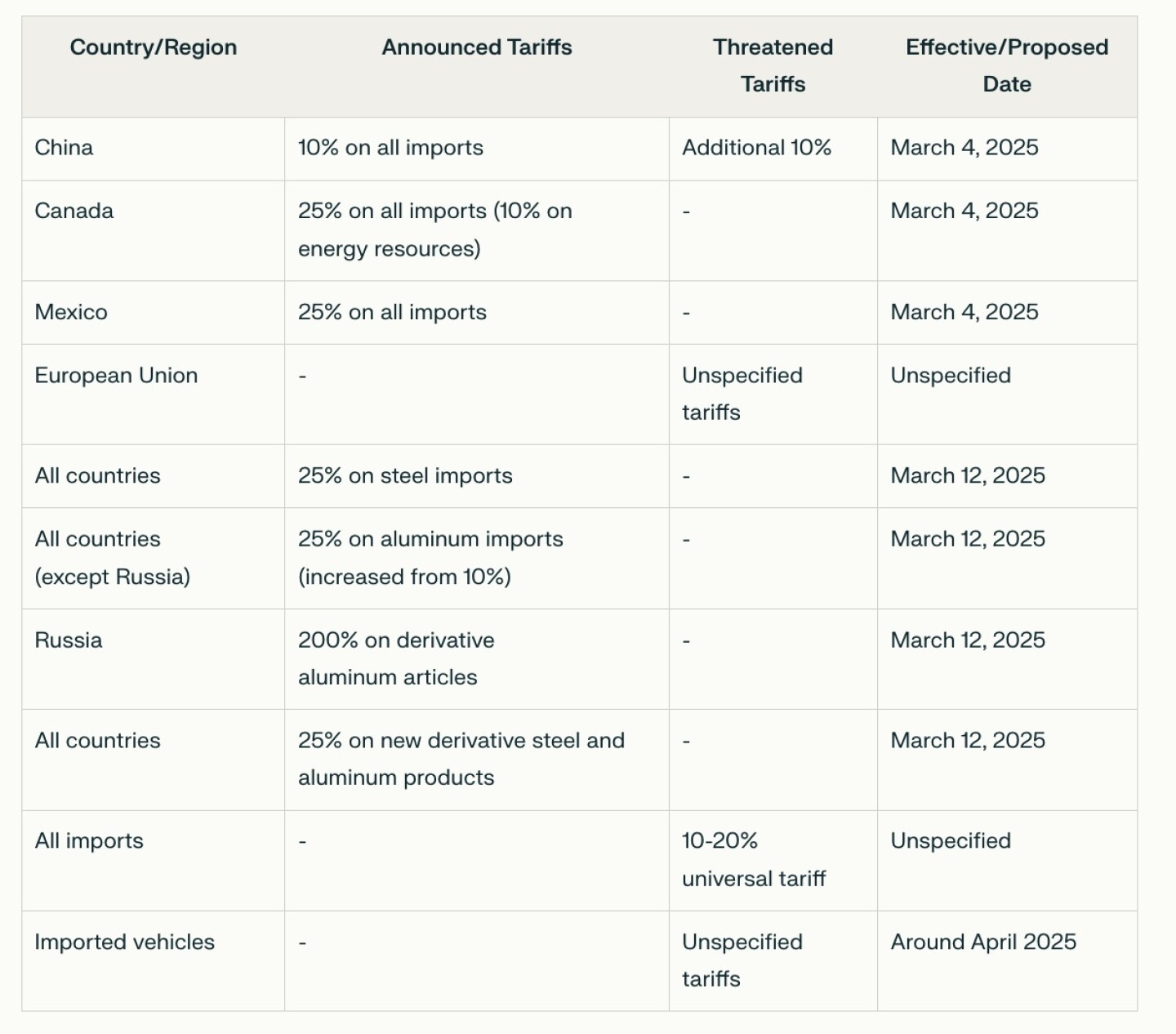

— The Trump address scheduled for Tuesday, March 4, is not officially a State of the Union address, but rather a joint address to Congress. While it serves a similar purpose and closely resembles a State of the Union, it is not designated as such because it is President Trump’s first major speech of his second term. Newly inaugurated presidents typically do not deliver an official State of the Union address in their first year. Since Ronald Reagan in 1981, presidents have given early speeches to Congress that serve the same purpose but are not technically called a State of the Union. The U.S. Constitution requires the president to update Congress on the state of the nation, but it does not specify how or when this should be done. This speech is referred to as an “address to a joint session of Congress” rather than a State of the Union address. The address will allow President Trump to share his “America First vision for our legislative future” and discuss his agenda for his second term. So, while the impact and format of the speech are similar to a State of the Union address, it is technically distinct due to its timing early in the president’s term. — Bessent confident inflation will hit Fed’s 2% target soon. Treasury Secretary Scott Bessent expressed optimism that U.S. inflation will quickly reach the Federal Reserve’s 2% target, citing falling mortgage rates and lower Treasury yields as key indicators. Speaking on CBS News’ Face the Nation, Bessent outlined a “holistic approach” involving tariffs, deregulation, and cheaper energy to curb price increases. A CBS News poll showed 82% of Americans want President Donald Trump to prioritize inflation, though only 29% believe he is doing so. — Trump orders investigation into lumber ahead of likely tariffs. President Donald Trump directed the Commerce Department to assess potential national security risks from lumber imports, focusing on Canada, Germany, and Brazil. The probe may lead to 25% tariffs on lumber, targeting alleged dumping and foreign subsidies. The executive order, “Freeing our Forests,” aims to streamline timber harvesting regulations. The move aligns with Trump’s stance on forest management and could strain U.S./Canada trade relations, particularly in the softwood lumber sector. — Canada adopts bold border measures to avert Trump’s tariff threats. In response to President Donald Trump’s impending 25% tariffs on Canadian products, Prime Minister Justin Trudeau’s government has adopted a more aggressive approach to border security. Emphasizing strength with initiatives like “Operation Blizzard” and appointing a “fentanyl czar,” Canada aims to demonstrate its commitment to combatting the fentanyl crisis. While U.S. data shows minimal fentanyl entering from Canada, Trudeau’s administration is focusing on optics, showcasing border agents, helicopters, and drug-sniffing dogs to appeal to Trump’s preference for visible enforcement. Trudeau reaffirmed his government’s dedication to border security to prevent the tariffs, set to take effect on March 4. Meanwhile, Canada said it is open to matching U.S. tariffs on China. Canadian Foreign Affairs Minister Mélanie Joly stated in Vancouver on Feb. 28 that Canada is “open” to discussing the possibility of aligning its tariffs on China with the recent U.S. measures. The comments come as President Trump announced a new 10% tariff on Chinese goods entering the U.S., adding to existing levies. Finance Minister Dominique LeBlanc may engage in talks with U.S. Treasury Secretary Scott Bessent, who suggested that matching tariffs could create a “Fortress North America” against Chinese imports. Mexico has already proposed a tariff on China to match the one imposed by the U.S, according to U.S. Treasury Secretary Scott Bessent. During an interview on Bloomberg Television on Feb. 28, Bessent cited Mexico’s example to urge Canada to follow suit. Comments: See a table below of the Trump tariffs, both threatened and already in place, along with actions Mexico and Canada are taking to avoid tariffs. — Speaker Johnson suggests Zelenskyy may need to resign after tense White House Meeting. House Speaker Mike Johnson (R-La.) in remarks on NBC News’ Meet the Press, suggested Sunday that Ukrainian President Volodymyr Zelenskyy might need to step down if he cannot approach peace negotiations with “gratitude” toward the U.S. His comments followed a heated Oval Office exchange between President Donald Trump, Vice President JD Vance, and Zelenskyy over a U.S.-brokered deal on Ukraine’s rare earth minerals. Johnson argued that Trump’s proposed mineral rights agreement would ensure economic and security benefits for Ukraine and stressed the need for a pragmatic approach to peace talks. (Johnson on whether he thinks Russian President Vladimir Putin should step down too: “I’d like to see Putin defeated, frankly. He is an adversary of the United States.”) Meanwhile, National security adviser Mike Waltz on the ultimate cease-fire deal, on State of the Union: “This will clearly be some type of territorial concession for security guarantees going forward. …This needs to be a permanent end, not a temporary end. This needs to be European-led security guarantees going forward. Part of that is Europe’s contribution to its own defense. …And then, you know, let’s not get too far ahead of ourselves — what type of support we provide or not is to be negotiated. But one thing is clear: We do not see Ukraine being a member of NATO.” — European countries pledge more support for Ukraine. Declaring that “we are at a crossroads in history,” Prime Minister Keir Starmer of Britain said that European countries would increase their military spending and assemble a coalition to defend Ukraine. — Cal-Maine family cashes out amid egg price surge. The Financial Times reports that the family controlling Cal-Maine Foods, the largest U.S. egg seller, is cashing out as bird flu drives egg prices to record highs. The heirs of founder Fred R Adams Jr. agreed to convert their super-voting shares to common shares, relinquishing control ahead of a “potential diversification” of their portfolios, according to a securities filing. The family’s stake, valued at nearly $532 million, is held through Daughters LLC. Simultaneously, Cal-Maine announced a $500 million share buyback program, its first in two decades, which may include repurchasing some of the family’s shares. Critics argue the company has used the crisis to boost profits and market power. — Egg market shows signs of stabilization amid easing demand and slowing avian flu outbreaks. Wholesale egg prices are beginning to stabilize as demand eases and avian influenza outbreaks slow. The national price for loose, White Large shell eggs dropped $0.10 to $8.05 per dozen, while the California benchmark rose slightly to $9.22 per dozen. Though supplies remain tight, regional opportunities for recovery are emerging, offering hope for improvement in the egg deficit situation. Grocers continue to manage limited supplies with purchase limits and diverse size offerings, while egg product manufacturers seek spot market opportunities. The overall shell egg inventory rose nearly 4%, showing early signs of market recovery. — Egg diplomacy: Importing eggs to combat price surge. Facing skyrocketing egg prices — up to $8 a dozen from $2.25 last fall — the Trump administration is exploring importing eggs as a short-term solution. However, logistical challenges, avian flu concerns, and conflicting tariff policies could hinder efforts to stabilize prices. With only 420 million eggs promised by Turkey (barely a day’s supply for the U.S.), experts warn that billions of imports would be needed to make a real impact. Meanwhile, potential investigations into the egg industry’s pricing practices loom. — Former New York Gov. Andrew Cuomo launched his campaign for mayor of New York City on Saturday, setting up a high-profile challenge to incumbent Eric Adams in an increasingly crowded race. A state report concluded Cuomo sexually harassed 11 women. He denied the claims. — China’s key political gathering set to focus on economic challenges. The third session of the 14th Chinese People’s Political Consultative Conference (CPPCC) National Committee will begin on March 4 in Beijing. This annual event, part of China’s “two sessions” along with the National People’s Congress (NPC), will bring together over 2,000 members. The agenda includes reviewing work reports, discussing key national policies, and focusing on economic development amid ongoing challenges, including a trade war with the United States. Delegates from Hong Kong are also expected, with discussions likely on further integration with mainland China. — Warning sign. “With 3 million federal employees potentially worrying about their jobs and 6 million federal contractors worrying about their jobs, the risks are rising that households may begin to hold back purchases of cars, computers, washers, dryers, vacation travel plans, etc.,” Torsten Slok, Apollo’s chief economist, wrote in a research note. Sentiment, he added, is “bad.” |

| WASHINGTON FOCUS |

Another week, another dose of tariff talk and possible action. More information should be known by the time President Donald Trump addresses a joint session of Congress on Tuesday evening (as noted above, it’s not officially a State of the Union address.

Avoiding tariffs. Commerce Secretary Howard Lutnick said Sunday that both Canada and Mexico have been working hard on controlling the border, but fentanyl was still an issue and the tariffs were contingent on both being resolved. “They have done a lot, so he’s sort of thinking about right now how exactly he wants to play with Mexico and Canada and that is a fluid situation,” Lutnick said on Fox News’ Sunday Morning Futures, speaking of Trump. “There are going to be tariffs on Tuesday on Mexico and Canada, exactly what they are, we’re going to leave that for the president and his team to negotiate.”

Mexican negotiators are in Washington to meet with Lutnick and Jamieson Greer, the U.S. Trade Representative, in a bid to reach a last-minute deal to avoid 25% U.S. tariffs. Here are the three main areas Mexico is working on to avoid the tariffs:

1. Curbing Migration

- Increased border security: Mexico deployed 10,000 additional National Guard troops to the U.S. border, a move praised by Trump.

- Migrant detentions: Mexico detained about 475,000 migrants in late 2024, more than double earlier in the year.

- Significant impact: Migrant crossings have plummeted, with daily encounters dropping to historic lows.

- Border control measures: Mexico has been intercepting migrant caravans and relocating migrants deeper into its interior.

2. Targeting Cartels

- Fentanyl crackdown: Mexico has ramped up efforts against cartels, focusing on fentanyl seizures and arrests.

- Seizure highlights: Recent operations include capturing 800 kilograms of fentanyl and arresting U.S. fentanyl traffickers.

- Collaboration with the U.S.: Mexico extradited nearly 30 cartel operatives and welcomed intelligence support from the CIA.

- Avoiding U.S. pressure: These actions aim to stave off U.S. tariffs and potential military interventions.

3. Countering China

- Trade relations shift: Mexico is rethinking its relationship with China, its second-largest trading partner.

- Tariffs and crackdowns: Actions include raiding Chinese counterfeit goods, imposing a 35% tariff on Chinese apparel, and targeting Chinese e-commerce platforms.

- Strategic moves: Mexico might further align with U.S. trade interests by reducing imports of Chinese semiconductors and automobiles.

Bottom line: Overall, Mexico’s strategies align closely with Trump administration priorities on migration, drug trafficking, and trade, likely to avoid economic and political repercussions from the U.S.

Canada is also ramping up efforts to avert U.S. tariffs, but prepares retaliation. Canada is working to avoid impending 25% U.S. tariffs set for March 4, 2025. Prime Minister Justin Trudeau remains hopeful for a diplomatic solution while preparing retaliatory measures. Canada has engaged in negotiations, enhanced border security, launched fentanyl control initiatives, and committed $1.3 billion to a border plan. Last October, the Canadian government imposed 100% tariffs on Chinese-made electric vehicles and 25% tariffs on a list of Chinese steel and aluminum products. “We will continue to work to ensure to do everything we can to make sure that there are no tariffs on Tuesday, but if ever there were tariffs on Tuesday, as we have all seen — as we were ready to do last time — we will have a strong unequivocal and proportional response as Canadians expect,” Trudeau said Sunday. Should U.S. tariffs proceed, Canada is ready with a two-step retaliatory tariff plan targeting C$155 billion ($107.14 billion) of U.S. goods.

Trump is also planning other streams of tariffs based on reports due to him by April 1. One is for so-called “reciprocal tariffs,” under which Trump will charge country-by-country rates, based on calculations such as another country’s tariffs, trade barriers and tax regimes. It’s not clear whether the “reciprocal” calculation would include any tariffs already in place, such as the Mexico and Canada measures that Trump has tied to border security. “We are going to evaluate that and give them an opportunity to remedy that, so we could either see a ratcheting up in tariffs, or if our trading partners want to remedy what has been unfair trade, then we can see the tariffs come off,” Bessent said on CBS’s Face the Nation.

Another stream is a series of tariffs on specific sectors. That includes a 25% tariff on steel and aluminum due to take effect March 12, and which would heavily affect Canada and Mexico.

Trump is also planning sectoral tariffs on autos, semiconductor chips and pharmaceutical drugs, all of which could be imposed as soon as April 2. He launched an investigation that could lead to new copper tariffs later this year. And on Saturday, as noted above, he ordered the Commerce Department to investigate the national security harm posed by lumber imports, laying the legal groundwork for new tariffs — ones that again appear aimed at Canada.

— Democrats back unlikely Trump nominee for Labor secretary, confirmation expected this week. In a surprising move, Senate Democrats helped advance Lori Chavez-DeRemer’s nomination for Labor secretary, despite opposition from the conservative wing of the GOP. Chavez-DeRemer, a moderate former House Republican, gained Democratic support due to her union-friendly record, including backing the PRO Act. With union leaders like Teamsters President Sean O’Brien in her corner, Chavez-DeRemer may be the best option for labor interests under Trump’s administration. The full Senate vote is expected this week.

— Another year, another Commodity Classic, this time in Denver. The Commodity Classic is an annual trade show convention for the grain, oilseed, sorghum, and farm equipment industries. This year it takes place from March 2-4. Key discussions are expected to focus on President Trump’s trade policies, potential impacts on U.S. agricultural exports, and the administration’s government downsizing initiatives. USDA Secretary Brooke Rollins will address attendees, likely again outlining strategies to support farmers amid trade uncertainties and proposed policy shifts. But rather than talk, farmers want to see specific timelines on when the $10 billion in economic aid and $21 billion in ag disaster aid will be paid, and in the case of disaster aid, the method of doing so. She will also likely talk about the Trump administration’s new approach to HPAI and getting egg prices lower.

Of note: The $10 billion economic aid is over at the Office of Management and Budget. A Notice of Funding Availability (NOFA) is coming on the topic.

House Ag Chairman GT Thompson (R-Pa.) told attendees of the National Association of State Departments of Agriculture (NASDA) Winter Policy Conference that more economic assistance will be needed if a farm bill is not completed this year.Thompson stated, “If we wait any longer than June to get this farm bill done, I’m going to have to be back with leadership, I’m actually convinced, in December begging for more economic relief.” But will a far more deficit-focused Congress (Republicans) be as willing to provide a second tranche of multibillion-dollar taxpayment aid? Instead, sources say Thompson should insist to GOP leadership that new farm bill language be included in a forthcoming compromise budget reconciliation measure.

— Thompson to introduce bill addressing agricultural labor challenges. House Ag Chairman GT Thompson (R-Pa.) will soon introduce legislation incorporating recommendations from the bipartisan Agricultural Labor Working Group (ALWG). The bill will likely focus on H-2A program reforms, wage policy changes, administrative improvements, and enhanced worker protections. Key proposals include streamlining hiring processes, expanding year-round labor access, reforming wage calculations, and establishing heat exposure standards for H-2A workers. Thompson has emphasized the urgency of the issue, aiming to address labor shortages and improve conditions for farmers, workers, and producers.

— Republicans propose deep Medicaid cuts, not Medicare. Proposals include reducing federal funding for Medicaid expansion, implementing per capita caps or block grants, and imposing work requirements. House Republicans are considering $880 billion in cuts or limiting its growth over the next decade, potentially resulting in millions losing coverage or facing reduced benefits. While Medicaid is targeted, President Trump has pledged not to cut Medicare or Social Security.

— Trump declares border ‘invasion’ over as apprehensions hit historic low. President Donald Trump announced that the “invasion of our country” is over, citing a record low of 8,326 illegal immigrant apprehensions at the U.S./Mexico border in February 2025, his first full month in office. This marks a sharp contrast to the Biden administration, where monthly apprehensions peaked at 300,000. Trump’s strict enforcement policies, including ending “catch and release,” deploying troops, and shutting down the CBP One app, were credited for the decline. The Department of Homeland Security reported over 20,000 interior arrests in the past month, signaling a robust crackdown on illegal immigration.

Of note: Around 3,000 additional U.S. troops are set to deploy to the U.S. southern border in the next few weeks as part of President Trump’s expanding border security mission. About 80% of people caught bringing fentanyl through U.S. border crossings from 2019 to 2024 were U.S. citizens, according to data compiled by the Washington Office on Latin America, or WOLA. Since Operation Northern Border kicked off on Feb. 5, Mexico’s national guard has seized more than 26,000 pounds of drugs, the majority of it methamphetamines. They also detained 819 migrants. Regarding fentanyl, most observers say real progress can come only if Americans curb their appetites for the drug.

| OTHER EVENTS & HEARINGS |

Monday, March 3

- Federal Reserve. St. Louis Fed President Alberto Musalem scheduled to speak.

- National Association of Counties legislative conference, through Tuesday, Washington DC.

- Economic policy. The National Association for Business Economics (NABE) 2025 Economic Policy Conference with remarks from Congressional Budget Office Director Phillip Swagel and others; runs through Wednesday.

- China legislative preview. Center for Strategic and International media conference call briefing “to preview China’s annual legislative gathering known as the ‘Two Sessions.’”

- German government outlook. American/German Institute discussion on “Transatlantic Challenges for the Next German Government.”

- Housing and DOGE actions. House Financial Services Ranking Member Maxine Waters (D-Calif.) hand-delivers a letter to HUD Secretary Turner requesting critical information for congressional oversight and discuss how “Trump and DOGE’s actions will worsen our nation’s housing and homelessness crisis and exacerbate discrimination in housing.”

- U.S./Iran relations. Johns Hopkins University School of Advanced International discussion on “Iran and the U.S.: What Comes Next?”

Tuesday, March 4

- President Donald Trump delivers an address to a joint session of Congress. Moderate Sen. Elissa Slotkin (D-Mich.) delivers the Democratic response. Slotkin outperformed former VP Kamala Harris by more than a full percentage point in all but 28 of the state’s 83 counties, according to a Detroit News analysis.

- Federal Reserve. New York Fed President John Williams scheduled to speak.

- State of the U.S. livestock industry. House Agriculture Livestock, Dairy, and Poultry Subcommittee hearing on “The State of the Livestock Industry: Producer Perspectives.”

- International Food Policy Research Institute webinar, “Biofuels and the Global Vegetable Oil Market.”

- Nomination hearing: State, others. Senate Foreign Relations Committee hearing on the nominations of Christopher Landau to be deputy secretary of State; Michael Rigas to be deputy secretary of State for management and resources; and Matthew Whitaker to be US permanent representative on the Council of the North Atlantic Treaty Organization.

- Supply chain resilience. Asia Society Policy Institute virtual discussion on “That’s What (Economic) Friends Are For: Working with Indo-Pacific Partners to Enhance Supply Chain Resilience.”

- German economic outlook. American/German Institute virtual discussion on “The German Elections and the Future of the Economy.”

- Monetary policy. House Financial Services Task Force on Monetary Policy, Treasury Market Resilience, and Economic Prosperity Subcommittee hearing on “Examining Monetary Policy and Economic Opportunity.”

- FEMA outlook. House Homeland Security Emergency Management and Technology Subcommittee hearing on “Future of FEMA: Perspectives from the Emergency Management Community.”

- Air traffic control. House Transportation and Infrastructure Aviation Subcommittee hearing on “America Builds: Air Traffic Control System Infrastructure and Staffing.”

- Immigration enforcement. House Oversight and Government Reform Cybersecurity, Information Technology, and Government Innovation Subcommittee hearing on “Leveraging Technology to Strengthen Immigration Enforcement.”

- Endangered Species Act. House Natural Resources Oversight and Investigations Subcommittee hearing on “Understanding the Consequences of Experimental Populations Under the Endangered Species Act.”

- South Korea government situation. Center for Strategic and International Studies virtual discussion on “When Will the Korean Impeachment Crisis End?”

- Elections and AI. Government Executive Media Group, the American Council for Technology-Industry Advisory Council and the National Academy of Public Administration virtual discussion on “Election Security and AI.”

- Antitrust actions. Information Technology and Innovation Foundation virtual discussion on “Competition Policy in a New Administration: Conservative Antitrust and the FTC.”

- AI and government. Government Executive Media Group and Microsoft virtual discussion on “Efficiency Through Innovation: Embracing AI for a Future-Ready Government.”

- India-China relations. United States Institute of Peace virtual discussion on “India’s Perceptions of China’s Nuclear Advancement.”

- Foreign policy. Council on Foreign Relations virtual discussion on “Common Sense and Strategy in Foreign Policy,” focusing on “how history helps us to understand the present, how the past affects the decisions nations make about their interests and strategies, and why alliances matter in a changing world order.”

- India/China maritime relations. George Washington University Elliott School of International Affairs holds a discussion on “India-China Maritime Relationship.”

Wednesday, March 5

- Nomination hearing: EPA. Senate Environment and Public Works Committee hearing on the nomination of David Fotouhi to be deputy EPA administrator; and Aaron Szabo to be an assistant EPA administrator.

- Nomination hearing: OMB. Senate Budget Committee hearing on the nomination of Dan Bishop to be deputy director of the Office of Management and Budget.

- USMCA trade issues. Brookings Institution’s United States Mexico Canada Agreement (USMCA) Initiative event to launch its United States Mexico Canada Agreement (USMCA) Forward Report: “Navigating North American trade amid global changes.”

- U.S./China situation. Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party and the Coalition for a Prosperous America, news conference on “the growing threat of China’s unfair trade practices, including intellectual property theft, trade fraud, and the circumvention of U.S. tariffs.”

- Tax reform. American Enterprise Institute for Public Policy Research discussion on tax reform, with House Ways and Means Committee Chairman Jason Smith (R-Mo.).

- Communications and the FCC. America’s Communications Association Connects holds its 2025 summit with the theme “Imagine the Possibilities,” focusing on gaining “valuable insight from policymakers, the FCC, and industry leaders who have their fingers on the pulse of emerging opportunities and potential challenges.”

- Asia-Pacific maritime security. Wilson Center virtual discussion on “Protecting Maritime Security and Stability in the Indo-Pacific: Challenges for the United States and Japan.”

- China cyber actions. House Select Committee on the Chinese Communist Party hearing on “End the Typhoons: How to Deter Beijing’s Cyber Actions and Enhance America’s Lackluster Cyber Defenses.”

- Sanctuary city policies. House Oversight and Government Reform Committee hearing on sanctuary cities policies.

- China and U.S. national security. House Homeland Security Committee hearing on “Countering Threats Posed by the Chinese Communist Party to U.S. National Security.”

- Electricity supply. House Energy and Commerce Energy Demand and Grid Reliability Subcommittee of House Energy and Commerce Committee hearing on “Scaling for Growth: Meeting the Demand for Reliable, Affordable Electricity.”

- U.S. relations in the Western Hemisphere. Senate Foreign Relations Committee hearing on “Advancing American Interests in the Western Hemisphere.”

- House Appropriations subcommittee member day. House Appropriations Financial Services and General Government Subcommittee hearing on “FY 2026 Member Day.”

- House Appropriations subcommittee member day. House Appropriations Labor, Health and Human Services, Education, and Related Agencies Subcommittee hearing on “Member Day.”

- Energy and the environment. United States Energy Association virtual media briefing on “Energy and Environment: The Trump Challenge.”

- U.S. electricity supply AI. Center for Strategic and International virtual discussion on “The Electricity Supply Bottleneck on US AI Dominance.”

- Government workers. National Treasury Employees Union “Standing Strong to Serve the Nation” rally to protest the Trump administration’s “attacks on federal employees.”

- Climate and energy policy. Council on Foreign Relations discussion on “The Future of U.S. Climate and Energy Policy.”

- Biden broadband efforts. House Energy and Commerce Communications and Technology Subcommittee hearing on “Fixing Biden’s Broadband Blunder.”

- Small business issues. Senate Small Business and Entrepreneurship Committee hearing on “Golden Age of American Innovation: Reforming SBIR-STTR (Small Business Innovation Research-Small Business Technology Transfer) for the 21st Century.”

Thursday, March 6

- Federal Reserve. Fed Governor Christopher Waller to speak on Economic Outlook in New York. Atlanta Fed President Raphael Bostic scheduled to speak.

- Forestry policy. Senate Ag Conservation, Forestry, Natural Resources, and Biotechnology Subcommittee hearing on HR 471, the “Fix Our Forests Act” and “Options to Reduce Catastrophic Wildfire.

- Nomination hearing: FDA. Senate Health, Education, Labor and Pensions Committee hearing on the nomination of Martin Makary to be commissioner of Food and Drug Administration.

- Nomination hearing: Treasury. Senate Finance Committee hearing on the nomination of Michael Faulkender to be deputy Treasury secretary.

- Nomination hearing: Labor. Senate Health, Education, Labor and Pensions Committee markup to vote on the nomination of Keith Sonderling, to be deputy Labor secretary.

- SEC issues. Investment Adviser Association 2025 Investment Adviser Compliance Conference, with the theme “Effective Strategies & Best Practices.” Securities and Exchange Commissioner Hester Peirce delivers remarks. Runs through Friday.

- Ukraine future. Council on Foreign Relations discussion on “Securing Ukraine’s Future.”

- Industrial maritime base. Hudson Institute discussion on “Rebuilding America’s Maritime Industrial Base.”

- Trump economics. Quincy Institute for Responsible Statecraft virtual discussion on “Will Trumponomics Shrink or Expand U.S. Influence in the Global South?”

- Iran outlook. Hudson Institute discussion on “Iran on the Brink: Resistance, Repression, and Global Power Shifts.”

Friday, March 7

- Federal Reserve. Fed Chair Jerome Powell to peak on the Economic Outlook in New York; Fed Governor Michelle Bowman to have a Discussion of “Monetary Policy Transmission Post-COVID” in New York; Fed Governor Adriana Kugler to speak on The Rebalancing of Labor Markets Across the World in Lisbon, Portugal; Fed Governor Lisa Cook to speak on Monday Policy in Lisbon Portugal.

- Congressional trade agenda. The Washington International Trade Association (WITA) holds its 2025 Congressional Trade Agenda.

- Economic outlook. The American Bankers Association’s (ABA) Economic Advisory Committee virtual news conference to present the latest consensus economic forecast.

| ECONOMIC REPORTS & EVENTS |

U.S. employers likely added 160,000 jobs in February, a modest improvement from January’s 143,000 gain but still softer than late 2024, according to Bloomberg’s survey of economists. The unemployment rate released Friday is expected to hold steady at 4%. Federal government layoffs and slowing consumer spending are contributing to a more cautious economic outlook. The February jobs report may reflect early impacts of a federal hiring freeze and policy changes under Elon Musk’s Department of Government Efficiency. Economists warn that recent data could challenge the narrative of U.S. economic resilience.

Monday, March 3

- Federal Reserve. St. Louis Fed President Alberto Musalem scheduled to speak.

- PMI Manufacturing | Construction Spending | ISM Manufacturing Index

- National Association for Business Economics holds policy conference in Washington, through March 4

Tuesday, March 4

- Federal Reserve. New York Fed President John Williams scheduled to speak.

- Motor Vehicle Sales

Wednesday, March 5

· ADP Employment Report | PMI Composite Final | Factory Orders | ISM Services Index | Beige Book

Thursday, March 6

- Federal Reserve. Fed Governor Christopher Waller to speak on Economic Outlook in New York. Atlanta Fed President Raphael Bostic scheduled to speak.

- Fed Balance Sheet

- Money Supply

Friday, March 7

· Federal Reserve. Fed Chair Jerome Powell to peak on the Economic Outlook in New York; Fed Governor Michelle Bowman to have a Discussion of “Monetary Policy Transmission Post-COVID” in New York; Fed Governor Adriana Kugler to speak on The Rebalancing of Labor Markets Across the World in Lisbon, Portugal; Fed Governor Lisa Cook to speak on Monday Policy in Lisbon Portugal.

| KEY USDA & INTERNATIONAL AG & ENERGY REPORTS & EVENTS |

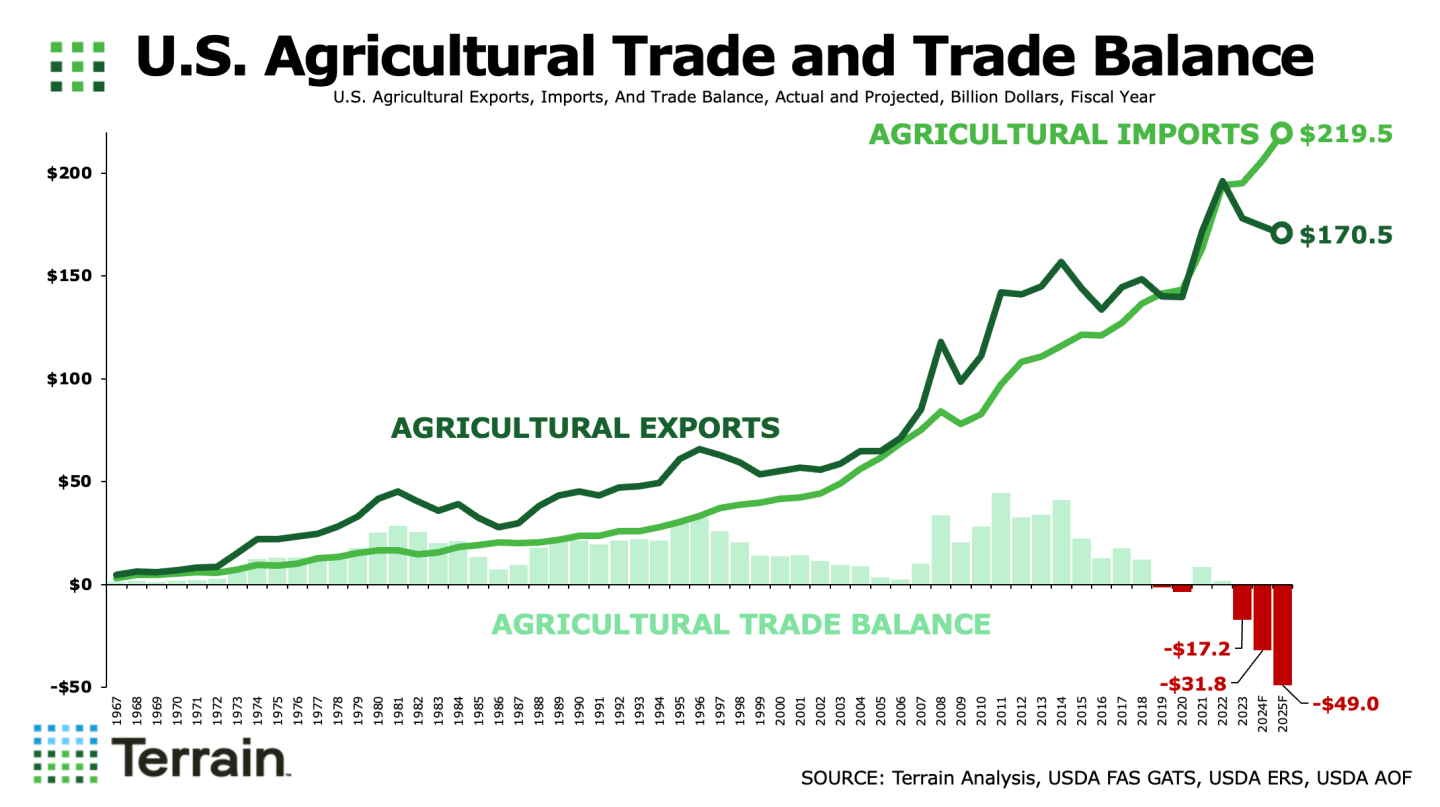

On Friday, USDA is out with its U.S. Agricultural Trade Data report. For fiscal year (FY) 2025, the forecast ag trade deficit has ballooned to $49 billion. Meanwhile, the United Nations’ monthly food price index will be released on March 7.

Monday, March 3

Ag reports and events:

- India wheat milling conference, Goa, day 1

- Export Inspections

- Cotton System Consumption and Stocks

- Cotton System Consumption and Stocks Annual

- Fats and Oils: Oilseed Crushings - Annual

- Fats and Oils: Oilseed Crushings, Production, Consumption

- Grain Crushings and Co-Products Production

Energy reports and events:

- International Atomic Energy Agency board meeting, Vienna; runs through Friday

- Holiday: South Korea, Greece, Angola, Panama, Venezuela, Brazil, Argentina

Tuesday, March 4

Ag reports and events:

- ABARES Outlook 2025 conference, Canberra, day 1

- AGIC Asia 2025 conference, Bangkok chapter

- EU weekly grain, oilseed import and export data

- India wheat milling conference, Goa, day 2

- Purdue Agriculture Sentiment

- Dairy Products

Energy reports and events:

- API US inventory report

- Brent April options expire

- Holiday: Brazil, Argentina

- Earnings: Saudi Aramco holiday, Angola, Brazil, Panama, Venezuela, Argentina

Wednesday, March 5

Ag reports and events:

- ABARES Outlook 2025 conference, Canberra, day 2

- Malaysia’s March 1-5 palm oil exports

- Weekly Weather: State Stories

- United States and Canadian Cattle

- United States and Canadian Hogs

- Broiler Hatchery

Energy reports and events:

- EIA Petroleum Status Report

- Weekly Ethanol Production

- ICE gasoil March options expire

- Genscape weekly crude inventory report

- Holiday: Panama; India; Kuwait

Thursday, March 6

Ag reports and events:

- AGIC Asia 2025 conference, Shanghai chapter

- Export Sales

- Slaughter Weekly

Energy reports and events:

- EIA Natural Gas Report

- Singapore onshore oil product stockpile weekly data

- North Sea loading programs (April)

- Earnings: Harbour Energy; Canadian Natural Resources

Friday, March 7

Ag reports and events:

- CFTC Commitments of Traders

- Livestock and Meat International Trade Data

- U.S. Agricultural Trade Data Update

- Peanut Prices

- United Nations’ FAO food price index and monthly grains report

- AMIS Market Monitor

- China’s 1st batch of trade data, including soybean, edible oil, rubber and meat imports, and fertilizer exports

- FranceAgriMer weekly crop conditions report

Energy reports and events:

- BTC Azeri loading program (April)

- ICE weekly Commitments of Traders report for Brent, gasoil

- Baker-Hughes Rig Count

| KEY DATES IN MARCH |

4: Mardi Gras

5: Ash Wednesday

7: Employment report

8-20: FOMC blackout where Fed officials cannot comment on monetary policy or the economy.

9: Daylight saving time starts

11: USDA WASDE, Crop Production

12: CPI

13: PPI-FD

13: Purim Fun Jewish holiday

14: Final day of current continuing resolution (CR)

15: Tax filing deadline for partnerships and S corporations

18: NCAA men’s basketball finals

18-19: FOMC meets (interest rates)

20: Spring equinox

20: NCAA women’s basketball finals

21: USDA Chicken & Eggs report | Cattle on Feed | Milk Production

25: USDA Cold Storage report | USDA Food Price Outlook

27: USDA Hogs & Pigs report

27: MLB Opening Day

28: Personal Consumption Expenditures Price Index

29: Last day of Ramadan

31: USDA Prospective Plantings, Grain Stocks and Rice Stocks reports | Ag Prices

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | NEC task force on HPAI, egg prices | Options for HPAI/Egg prices |Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |