Updates: Policy/News/Markets, March 4, 2025

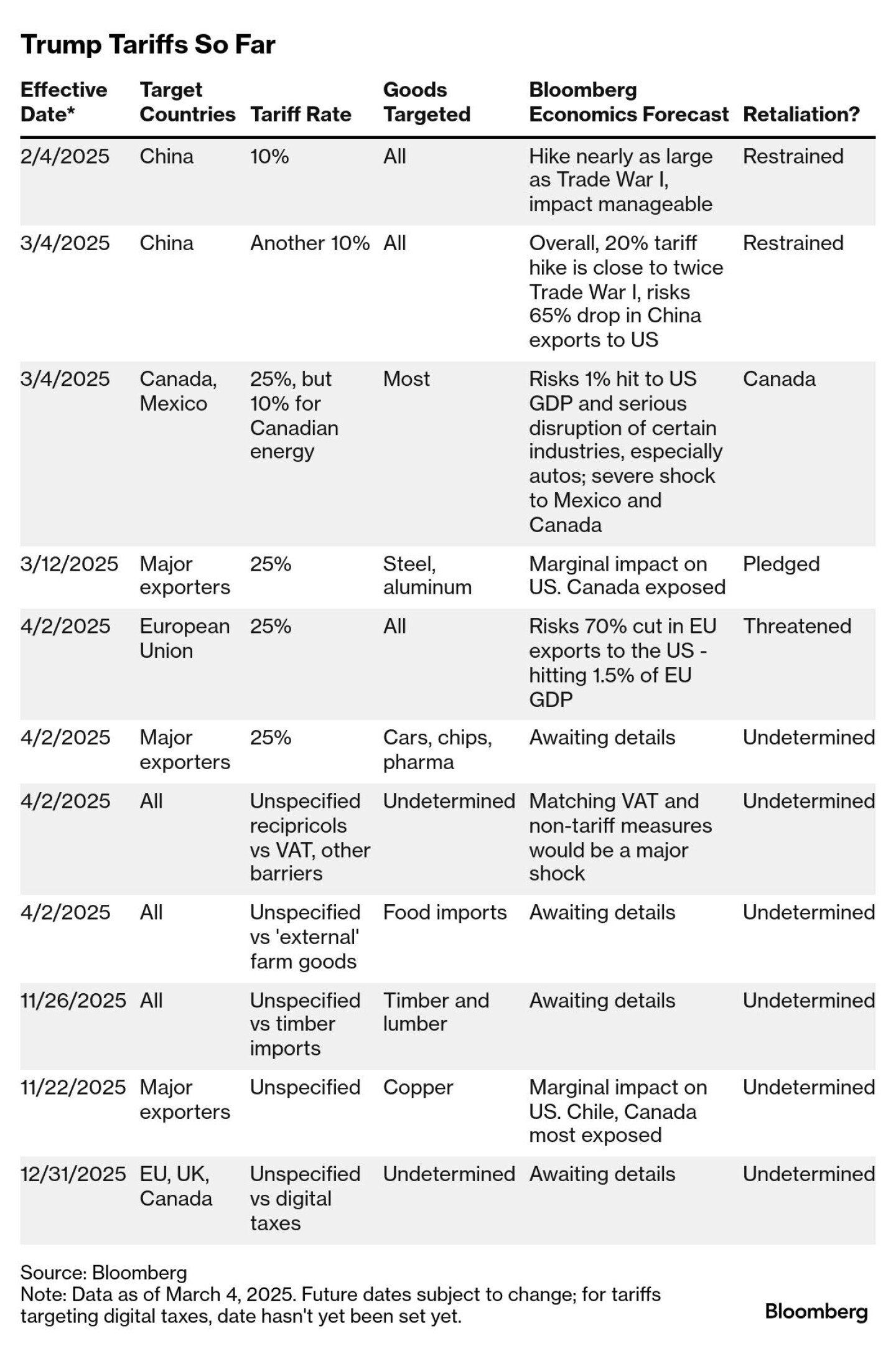

— The tit-for-tat tariff trade wars have begun. Link to our special report for details. — Mexico on Sunday to announce retaliatory tariffs as Trump imposes sweeping trade measures. The delay could signal Mexico still thinks there is a way to avoid the U.S. tariffs. President Trump implemented broad tariffs at midnight on goods imported from Canada and Mexico, while also increasing duties on Chinese imports. Mexico’s President Claudia Sheinbaum announced that Mexico will introduce retaliatory tariffs this Sunday. Economists warn the aggressive trade moves could spark global inflation and negatively impact consumers. The S&P 500 on Monday saw a sharp drop of 1.8%, its worst day since December. Hit especially hard today were the shares of European automakers, including Volkswagen, BMW, and Daimler Truck. Levies could hit the sector, which is highly dependent on a complex cross-border supply chain. The CBOE volatility index, Wall Street’s fear gauge popularly known as the VIX, jumped, posting its biggest one-day spike this year. The sell-off also extended to cryptocurrencies and the U.S. dollar. Of note: Tariffs that were just imposed on Canada and Mexico are related to the flow of opioids, and so those countries need to take actions that would lead to a visible decline in drug-related deaths in the U.S. to get rid of the levies, U.S. Commerce Secretary Howard Lutnick told CNBC. — China slaps new tariffs on $21 billion worth of U.S. agricultural exports. New Chinese tariffs on American agricultural goods will impact approximately $21 billion worth of U.S. exports, according to a Reuters analysis of U.S. Census data. The hardest hit will be the U.S. soybean trade — America’s largest agricultural export to China — which faces a 10% tariff on nearly $13 billion in exports. The tariffs span 740 items (link), including vegetables, aquatic products, pork, and beef, affecting both fresh and frozen goods. — Trump’s tariff gamble: Balancing ‘America First’ with potential isolation. Despite acknowledging potential economic pain, Trump imposed steep tariffs — 25% on Canada and Mexico, and another 10% on China — to push his “America First” agenda. He aims to leverage these tariffs to pressure these countries into combating drug trafficking. However, some analysts note the move risks damaging U.S. interests, potentially driving Canada and Mexico toward alternative trade partners, including China, and leaving America more isolated globally. — Says one Washington insider about Trump’s tariffs: “How long do the White House and the Ag Secretary think farmers want to get government payments instead of from the market? What about the remaining 94% of the rural population and the agriculture chain that will not be receiving payments under any USDA scheme with many, many employees’ jobs at risk? They didn’t get payments last time and they weren’t passed back to them or on to Main Street. The 70+ percent of the rural population that voted for the president seems to be being told that even though they voted at the highest percentages of anyone for the president, their jobs, businesses and the people they employ do not matter. Other sectors and jobs are more important. And the plan is to grow and use more here? How’s that work with the folks in the party wanting to get rid of the renewables provisions? How’s that work with cattle numbers down and meat and poultry exports now getting hit with multiple tariffs in other countries….” — Says another Washington insider: “Trump has talked about tariffs since his 2016 presidential campaign. We are running a $1 trillion trade deficit, our ag trade deficit has ballooned to almost $50 billion. Nobody likes tariffs but something must be done to open up ag markets both in terms of tariffs and non-tariff trade barriers. We simply can’t afford to continue down the path of growing the overall trade and ag trade deficits. Both need to be addressed aggressively.” — How will next USDA WASDE report assess the impact of the tariffs? Besides world production numbers, this will now be another impact traders, analysts and farmers will focus on. — Fed meeting takes center stage as tariff fallout unfolds. With President Trump’s tariff actions now detailed and retaliatory measures emerging, eyes will be on the Federal Reserve as they meet on March 18-19 to determine monetary policy. Fed Chair Jerome Powell has emphasized the need for concrete details before deciding on a response. Meanwhile, Trump is set to address Congress tonight, likely framing the tariffs as a move to combat fentanyl entering the U.S. and to deal with unfair restrictions on U.S. exports. — Key question: How long will the trade wars last? Some optimism — at least on China. “We view Beijing’s responses as still strategic and restrained,” Xiangrong Yu, Citigroup’s chief China economist, said in a research note this morning. He said a trade deal was still “plausible.” The Shanghai composite index closed slightly higher today. — A North Dakota farmer asked this writer: “How long will Trump’s trade experiment last before we know if it is a success or failure?” While trade policy implications usually take years to analyze, a political answer would be before 2026 elections. A protracted fight could dent global growth and accelerate inflation, all of which could “hamstring the Fed,” Mark Haefele, the chief investment officer at UBS Global Wealth Management, told Bloomberg Television this morning. — U.S. pauses military aid to Ukraine amid tensions between Trump and Zelenskyy. The U.S. halted all military aid to Ukraine until President Trump is satisfied with Ukrainian President Volodymyr Zelenskyy’s commitment to peace negotiations with Russia. The decision follows a contentious meeting between the two leaders at the White House and signals a significant shift in U.S. support for Ukraine. Since Russia’s invasion three years ago, the U.S. has provided over $120 billion in aid, including $67.3 billion in military assistance. The pause has divided Republicans, with some supporting the move as a push for peace and others warning of the risks to European stability. The White House has not clarified what conditions might lead to a resumption of aid. — Trump’s approach to foreign policy is causing friction internationally. European officials are questioning America’s status as a friend, Canadians are growing more nationalistic and anti-American, and Mexico is pushing a “Made in Mexico” campaign. The immediate fallout includes the collapse of a U.S./Ukraine minerals deal following a heated exchange between Trump and Ukrainian President Volodymyr Zelenskyy, which led Ukraine to prioritize its own interests over aligning with American goals. — Putin agrees to help Trump broker nuclear talks with Iran. Russia has agreed to assist President Donald Trump’s administration in engaging with Iran on its nuclear program and its support for regional anti-U.S. proxies, Bloomberg reports, citing sources familiar with the situation. Trump conveyed his interest to Russian President Vladimir Putin in a February phone call, followed by discussions between U.S. and Russian officials in Saudi Arabia. While neither Russia nor Iran has publicly confirmed or denied this development, the Kremlin indicated its support for negotiations. Iran’s response was cautious, with officials stating it is “natural” for countries to offer assistance in such matters. The potential collaboration comes amid Trump’s efforts to restore relations with Putin and negotiate an end to Russia’s ongoing war in Ukraine. — The real concern with GMOs: Herbicide exposure. A Washington Post article (link) challenges common misconceptions about GMOs, highlighting that the primary concern isn’t the genetic modification itself, but rather the potential herbicide exposure associated with GMO farming practices. Key points: Quotes from the article: The article suggests a nuanced approach to GMO consumption, particularly for vulnerable groups: “GMOs are likely fine for adults to consume, especially if you minimize ultra-processed foods, which are generally linked to adverse health outcomes and are a common source of GMO corn and soy. For pregnant women and young children, it would be very reasonable to minimize consuming GMOs and ultra-processed foods whenever possible.” — USDA employees ordered back to office by March 10. USDA has instructed many of its employees to return to in-person work by March 10, according to internal emails obtained by Bloomberg Government. The directive impacts remote workers not covered by union contracts within the Farm Service Agency and revokes telework arrangements previously negotiated under union agreements. The move follows a Jan. 20 executive order from President Donald Trump mandating in-person work for federal employees. |

| TRADE POLICY |

— Trump’s tariffs usher in new era of protectionism. In a Wall Street Journal article (link) titled “Trump Tariffs Usher In New Era of Protectionism,” authors Konrad Putzier and Justin Lahart outline the significant economic shifts resulting from President Trump’s recent tariff implementations on imports from Mexico, Canada, and China. The article highlights the uncertainty and disruption these tariffs are causing in various industries and markets.

The authors note that as of 12:01 a.m. on Tuesday, March 4, 2025, the U.S. economy entered a new phase with the implementation of these tariffs, marking “the end of decades of free trade among the three countries.” The tariffs include a 25% levy on most imports from Mexico and Canada, with a reduced 10% tariff on energy products such as crude oil and natural gas.

The article emphasizes the potential long-term impacts of these tariffs on U.S. trade relationships and the economy. As Putzier and Lahart state, “If the tariffs remain in place, they have the potential to profoundly reshape relations between the U.S. and two of its biggest trading partners, abruptly reversing America’s decadeslong project of expanding free trade with its allies.”

The immediate effects of the tariffs are already being felt across various sectors:

- Manufacturing: The uncertainty is slowing business orders and complicating company planning. One respondent to the Dallas Fed’s February manufacturing survey noted, “Tariff threats and uncertainty are extremely disruptive.”

- Stock Market: U.S. stocks tumbled on Monday, with the Nasdaq Composite declining 2.6%.

- Auto Industry: Ford Motor’s CEO Jim Farley warned that prolonged 25% tariffs against Canada and Mexico “would have a huge impact on our industry, with billions of dollars of industry profits wiped out.”

- Small Businesses: Companies like The Penny Ice Creamery in California are struggling to prepare for potential price increases on imported ingredients.

Economists warn of potential long-term consequences, including the risk of “stagflation” — a combination of slow economic growth and high inflation. Michael Feroli, chief U.S. economist at JPMorgan Chase, suggests that if tariffs remain in effect, they could push up inflation in the coming months as firms raise prices to compensate for higher import costs.

The article concludes by drawing historical parallels, noting that while the U.S. has raised tariffs on major trading partners in the past, increases of this magnitude and scope are unprecedented in modern times.

| FINANCIAL MARKETS |

— Equities today: Asian and European stock markets were mixed to weaker overnight. U.S. Dow is currently down around 420 points. In Asia, Japan -1.2%. Hong Kong -0.3%. China +0.2%. India -0.1%. In Europe, at midday, London -0.5%. Paris -1.3%. Frankfurt -2.2%.

Equities yesterday: All three indices registered losses to open the week, falling into negative territory earlier in the session and ending with sizable declines. The Dow lost 649.47 points,1.48%, at 43,191.24. The Nasdaq declined 497.09 points, 2.64%, at 18,350.19. The S&P 500 fell 104.78 points, 1.76%, at 5,849.72.

— Economic outlook for 2025 clouded by policy uncertainties: NRF economist. Despite strong economic momentum from 2024, National Retail Federation (NRF) Chief Economist Jack Kleinhenz warns that policy debates on immigration, tariffs, deregulation, and taxes could blur the economic outlook for 2025. While deregulation and tax cuts may boost growth, immigration restrictions and tariffs pose risks. Consumer spending remains robust, but uncertainty around government policies could dampen business and consumer confidence. Inflation concerns persist, with the Federal Reserve unlikely to cut interest rates soon.

— Target exceeds expectations but braces for tough Q1. Target surpassed Wall Street’s fourth-quarter expectations on both revenue and earnings but warned of a challenging first quarter ahead. This cautious outlook aligns with broader retail concerns, as Walmart and economic data signal weakening consumer confidence. While Target’s struggles are often self-inflicted, its guidance offers insight into broader consumer spending trends due to its wide customer base.

— Trump warns Japan and China against currency manipulation amid tariff escalation. President Donald Trump warned the leaders of Japan and China against reducing the value of their currencies, calling it unfair to the United States. His comments, along with new 25% tariffs on Mexican and Canadian imports and doubled duties on Chinese goods, intensified global trade tensions. The yen surged, and Japan’s Nikkei index dropped nearly 2%. Despite Trump’s claims, Japanese and Chinese officials denied pursuing currency devaluation policies. Analysts suggest Trump’s remarks could pressure the Bank of Japan to consider further interest rate hikes.

| AG MARKETS |

— Ag markets today:

- Grains extend losses as trade war erupts. Corn, soybeans and wheat faced followthrough selling overnight in reaction to the start of a tariffs war with major trading partners. As of 7:30 a.m. ET, corn futures were trading 3 to 5 cents lower, soybeans were 11 to 13 cents lower and wheat futures were 4 to 7 cents lower. The U.S. dollar index was down around 850 points, and front-month crude oil futures were more than $1.00 lower this morning.

- Cattle in liquidation mode. Live cattle futures and feeders faced more long liquidation pressure on Monday, as traders lightened their long exposure amid the trade uncertainty. While both markets finished well off their session lows, there is risk of additional liquidation pressure amid trade concerns.

- Cash hog fundamentals strengthen. The CME lean hog index is up 50 cents to $89.94 as of Feb. 28. Over the last eight days, the index has risen and fallen four times each, though there was a net $1.04 decline during that span. The pork cutout firmed $1.37 to $99.79 on Monday, as all cuts except ribs strengthened.

— Ag trade: Japan is seeking 94,282 MT of milling wheat via its weekly tender.

— USDA daily export sales:

- 130,000 MT white wheat to South Korea for 2024-25

- 20,000 MT of soyoil to unknown destinations for 2024-25

— Agriculture markets yesterday:

• Corn: May corn fell 13 1/4 cents to $4.56 1/4, the lowest close since Dec. 24.

• Soy complex: May soybeans fell 14 1/4 cents to $10.11 1/2, marking the lowest close since Jan. 9, while May soymeal fell $2.20 to $298.00, ending nearer the session low. May soyoil slipped 63 points to 43.49 cents.

• Wheat: May SRW wheat fell 8 cents to $5.47 3/4, near the daily low and hit a five-week low. May HRW wheat lost 11 cents to $5.62, near the daily low and hit a five-week low. May HRS futures fell 6 1/2 cents to $5.91 1/4.

• Cotton: May cotton rose 26 points to 65.51 cents but still ended near the session low.

• Cattle: April live cattle fell 40 cents to $192.25 and nearer the session high. May feeder cattle fell 92 1/2 cents to $270.20 and nearer the session high.

• Hogs: April lean hogs rose 2 1/2 cents to $83.70, nearer the daily low and hit a five-month low early on.

| FARM POLICY |

— USDA Secretary Brooke Rollins stated that farmers will no longer be required to submit tax returns for financial aid. During her speech at Commodity Classic in Denver, Rollins announced changes to the disaster aid distribution process, saying, “Gone are the days of progressive factoring. No longer will you be required to turn in your tax returns.” She emphasized that this marks “a new day at USDA” and that the distribution of the $21 billion in disaster aid would be based strictly on need, regardless of skin color or geographic location.

| ENERGY MARKETS & POLICY |

— Oil prices slide as OPEC+ boosts output and U.S. tariffs kick in. Oil prices continued to decline on Tuesday as OPEC+ announced an output increase in April and new U.S. tariffs on Canada, Mexico, and China came into effect. Brent crude fell 1.8% to $70.35 a barrel, while U.S. West Texas Intermediate dropped 1.6% to $67.27. Analysts pointed to OPEC+'s surprising production hike, the U.S. tariffs, and President Trump’s pause on military aid to Ukraine as key factors contributing to market volatility. The combination of geopolitical maneuvers and trade tensions has intensified a “perfect storm” for crude oil, experts warn.

— Oil prices on Monday dropped to 12-week low as OPEC+ confirms production increase. Oil prices fell about 2% on Monday, reaching their lowest levels since early December. Brent settled at $71.62 (-1.6%), and WTI closed at $68.37 (-2.0%). The decline followed OPEC+'s decision to proceed with easing supply cuts in April, signaling confidence in market stability despite recent price drops. Market sentiment was further pressured by impending U.S. tariffs on Canada and Mexico, along with escalating trade tensions with China. Economic data showing rising inflation also raised concerns about potential impacts on energy demand.

— EPA calls for probe into $20 billion greenhouse gas fund mismanagement. EPA has requested an internal investigation into potential financial mismanagement, conflicts of interest, and allegations of taxpayer funds being awarded to unqualified recipients under a Biden-era grant program. EPA head Lee Zeldin aims to scrutinize the Greenhouse Gas Reduction Fund, established by the 2022 Inflation Reduction Act (IRA/Climate Act), which allocated nearly $27 billion in grants for decarbonization projects. Concerns include alleged self-dealing, lack of financial oversight, and $2 billion granted to a nonprofit linked to Stacey Abrams. The Office of Inspector General may recommend reforms or refer cases to the Department of Justice if criminal conduct is identified.

| PERSONNEL |

— HHS spokesman resigns amid measles outbreak and tensions with RFK Jr. Thomas Corry, the assistant secretary for public affairs at the Department of Health and Human Services (HHS), resigned abruptly following reported clashes with Secretary Robert F. Kennedy Jr. and his team. Corry’s departure comes as the agency faces criticism over its handling of a measles outbreak in Texas, which has infected at least 146 people and resulted in the first measles-related death in a decade. Kennedy, a longtime vaccine critic, has been scrutinized for not taking a stronger stance on vaccination during the crisis.

| CONGRESS |

— Rep. Thomas Massie (R-Ky.) (aka as Rep. No) said he will oppose both the rule and the continuing resolution (CR) for fiscal year (FY) 2025 expected to get action next week. If so, Speaker Mike Johnson (R-La.) can’t lose another Republican vote.

Johnson is preparing a CR to fund the government through the rest of FY 2025, ahead of the March 14 deadline. While billed as a “clean” CR, details remain unclear.

| CHINA |

— China suspends soybean imports from three exporters. China’s customs authority suspended the soybean import qualifications from three U.S exporters and halted the imports of U.S. lumber, effective immediately. The three U.S. companies affected are CHS Inc, Louis Dreyfus Company Grains Merchandising LLC and EGT. CHINA’s customs says it detected ergot and seed treatment agent-treated soybeans in imported U.S. soybeans and pests in U.S. log shipments.

| FOOD & FOOD INDUSTRY |

— Steak ‘n Shake has announced a major change to its beloved shoestring fries, and they say the inspiration partially came straight from the new Trump administration’s Health and Human Services Secretary, Robert F. Kennedy Jr. Starting in March, all Steak ‘n Shake locations will cook their fries in beef tallow instead of vegetable oil. The company broke the news on X with a post declaring; “By March 1 ALL locations. Fries will be RFK’d!”

| WEATHER |

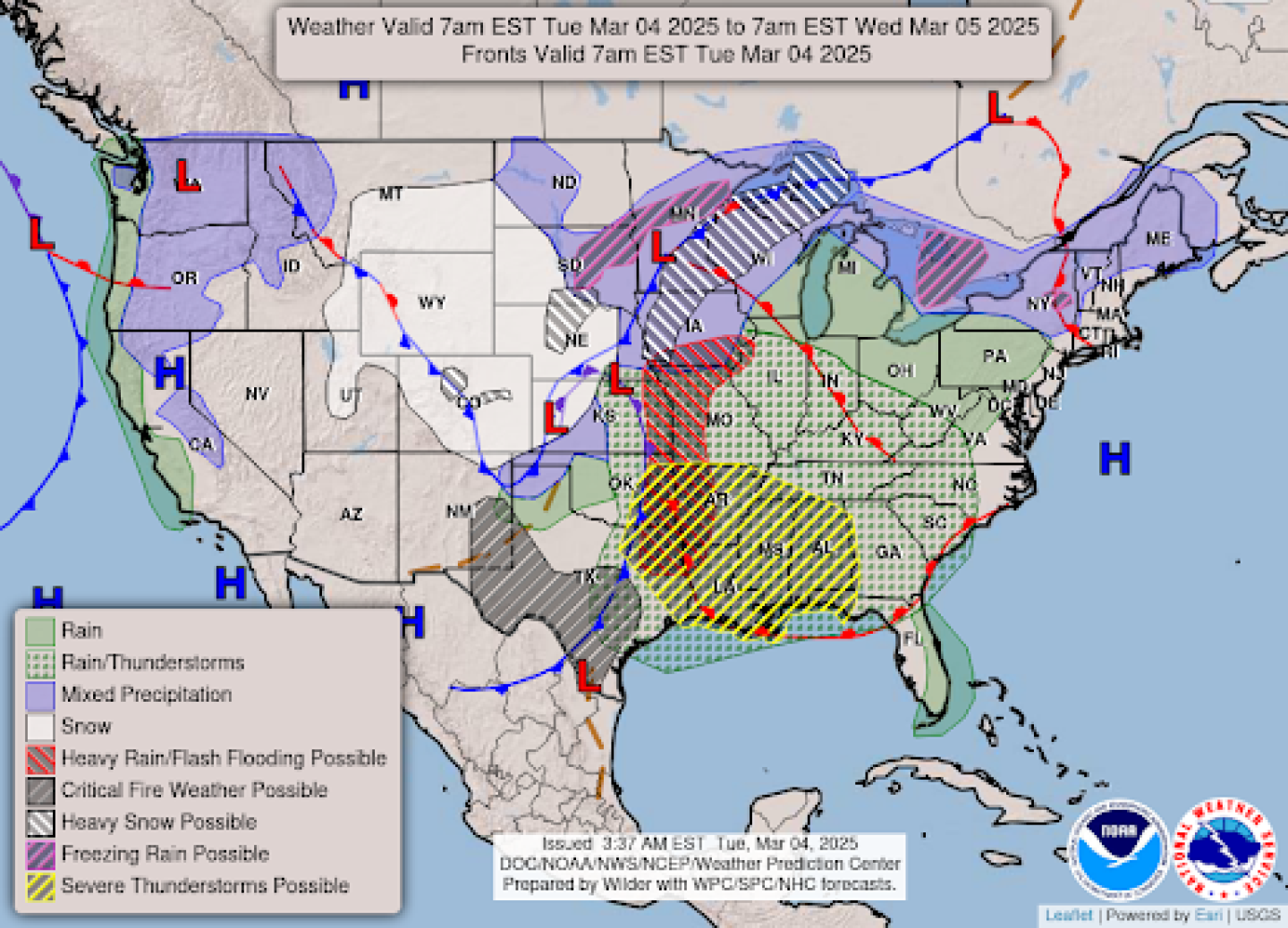

— NWS outlook: A major winter storm ejecting out into the Central U.S. will bring widespread hazards going through midweek including damaging high winds, blizzard conditions, severe weather, and a concern for some flash flooding... ...There is critical to extreme fire weather danger across much of the Southern High Plains going through the early to middle part of the week... ...Much above normal temperatures across the Midwest will move into the Eastern U.S. by midweek, with below normal temperatures over the West gradually reaching the Plains... ...New Pacific storm system to arrive on Wednesday across California.

| KEY DATES IN MARCH |

4: Mardi Gras

5: Ash Wednesday

7: Employment report

8-20: FOMC blackout where Fed officials cannot comment on monetary policy or the economy.

9: Daylight saving time starts

11: USDA WASDE, Crop Production

12: CPI

13: PPI-FD

13: Purim Fun Jewish holiday

14: Final day of current continuing resolution (CR)

15: Tax filing deadline for partnerships and S corporations

18: NCAA men’s basketball finals

18-19: FOMC meets (interest rates)

20: Spring equinox

20: NCAA women’s basketball finals

21: USDA Chicken & Eggs report | Cattle on Feed | Milk Production

25: USDA Cold Storage report | USDA Food Price Outlook

27: USDA Hogs & Pigs report

27: MLB Opening Day

28: Personal Consumption Expenditures Price Index

29: Last day of Ramadan

31: USDA Prospective Plantings, Grain Stocks and Rice Stocks reports | Ag Prices

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | NEC task force on HPAI, egg prices | Options for HPAI/Egg prices | Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |