News/Markets/Policy Updates: Nov. 15, 2024

— Trump says he will nominate North Dakota Governor Doug Burgum to be Interior Secretary. Burgum visited Mar-a-Lago on Thursday, Nov. 14, according to sources. Trump has praised Burgum in the past, calling him “great” and “a high-quality person.” Burgum was also on Trump’s shortlist for vice president earlier in the year. As governor of North Dakota, the third-largest oil-producing state in the country, Burgum has relevant experience for an Interior Secretary role. North Dakota also has more than 4 million acres under federal oversight. Burgum would manage the more than 500 million acres of federal land as well as the fossil fuels and minerals that lie beneath the surface — making him a critical component in Trump’s promise to boost oil and gas output. He will most likely help to open federal lands and waters to drilling. — Trump taps RFJ Jr. to lead HHS, which has 80,000 employees. President-elect Donald Trump, in announcing his intent to nominate Kennedy, 70, said: “For too long, Americans have been crushed by the industrial food complex and drug companies who have engaged in deception, misinformation, and disinformation when it comes to Public Health,” Trump wrote on social media. Kennedy’s proposals, including banning ultra-processed foods, cracking down on food dyes, and barring food stamps from purchasing processed foods, have generated significant controversy among nutritionists, food industry officials, and federal health agencies. Critics, including public health experts, worry that Kennedy’s anti-vaccine stance and proposals to fire FDA nutritionists could undermine scientific and public health efforts. Meanwhile, supporters see an opportunity to root out industry influence and push for stricter food safety standards. Kennedy’s alignment with Trump on the “Make America Healthy Again” initiative suggests a potential shift in food regulation priorities. “RFK Jr. has championed issues like healthy foods and the need for greater transparency in our public health infrastructure,” said Sen. Bill Cassidy (R-La.), who is slated to lead the Senate committee that will consider the nomination. “I look forward to learning more about his other policy positions and how they will support a conservative, pro-American agenda.” Donna Shalala, who led HHS during the Clinton administration, called RFK Jr. “totally unqualified” for the role. “This is a very dangerous appointment,” she said. “He’s dangerous to people’s health in our country and around the world.” Kennedy insists he is not anti-vaccine and claims he has never told the public to avoid vaccination. RFK has promised not to “take away anybody’s vaccines,” but he has repeatedly made his opposition to vaccines clear. He said on a podcast “there’s no vaccine that is safe and effective” and has urged people to resist CDC guidelines on when kids should get vaccinated. He said he wants to fire 600 employees at the National Institutes of Health, which oversees vaccine research, and replace them with 600 new employees. Kennedy has suggested barring drugmakers from advertising on TV, a multibillion-dollar enterprise that accounts for most of the industry’s marketing dollars. He’s also proposed eliminating fees that drugmakers pay the FDA to review their products, allowing the agency to hire extra scientists to speed up their work. Replacing those funds would require billions in new appropriations from the federal budget, the Associated Press notes. Shares of vaccine makers fell sharply after Trump nominated RFK Jr. Moderna’s shares dropped over 5%, Novavax fell more than 7%, and Pfizer declined by 2%. Investors are concerned that Kennedy’s appointment could amplify anti-vaccine rhetoric, potentially reducing vaccination rates and negatively impacting pharmaceutical companies. Link to our special report released Nov. 14. In that assessment wondered whether the RFJ Jr. nomination would impact Trump’s choice for USDA secretary. Some sources signal that candidate was in Mar-A-Lago on Thursday. Of note: Key to whether RFJ Jr. can get approved by the Senate if whether any Democrats will vote for him and if so, how many. Kennedy is likely to receive little support from Democrats. Sen. Ron Wyden (D-Ore.) issued a statement late Thursday calling Kennedy’s views “outlandish.” — Other nominees announced Thursday by President-elect Trump: — One person who didn’t make the cut: Jamie Dimon, the JPMorgan Chase CEO. He was speculated as a potential Treasury secretary. Dimon’s response: “I just want to tell the president: I haven’t had a boss in 25 years and I’m not about ready to start.” — Thune signals cautious support for Gaetz and RFK Jr. nominations. Incoming Senate Majority Leader John Thune (R-S.D.) in an interview with Brett Baier expressed cautious support for President-elect Trump’s nominees, Matt Gaetz for attorney general and Robert F. Kennedy Jr. for Health and Human Services secretary, amid some GOP skepticism. Thune stated that “all options are on the table” to confirm the nominees, potentially bypassing Senate confirmation if needed. Gaetz, who recently resigned from the House, faces scrutiny due to an ethics investigation, while Kennedy’s nomination raises concerns due to his controversial health views. Thune pledged a thorough vetting process and discussions on advancing Trump’s border agenda. Thune told Baier his guess is that a House Ethics Committee report on Gaetz, who has denied wrongdoing, would come out, adding that confirmation hearings tend to be “fairly comprehensive.” “I don’t know the answer to that just yet,” said Thune when asked if Gaetz would get confirmed. He said Republicans who wouldn’t vote for a nominee might not vote to put the Senate into a recess either and the House would also have to agree to that move, which would allow Trump to bypass Senate confirmation to install his officials as recess appointments. “I always believe that you defer to a president when it comes to the people they want in their in their cabinet and to do a lot of these important jobs,” Thune said. “But obviously there is a process whereby we get down and scrub all these nominees and figure out whether or not one they’re qualified, and are they people who are fit to hold these offices.” Separately, Thune said he and House Speaker Mike Johnson (R-La.) have been discussing funding Trump’s border and immigration agenda via so-called budget reconciliation procedures that require just a simple Senate majority. “We’re looking at those options right now,” he said. Thune said he and Trump speak regularly, and he praised the Republican’s government efficiency effort headed by Elon Musk and Vivek Ramaswamy. “This is long overdue, honestly,” he said, adding that some agencies could be moved out of Washington. — Powell signals patience on interest rate cuts amid economic strength. Federal Reserve Chair Jerome Powell on Thursday emphasized a cautious approach to lowering interest rates, citing a strong economic backdrop. Speaking in Dallas, Powell stated that current economic strength allows the Fed to deliberate carefully on rate reductions as inflation remains on a gradual path toward the 2% target. This marks his first public statement since the Fed’s recent 0.25 percentage point rate cut. Powell pointed to 3% real gross domestic product growth last year and 2.5% growth this year, noting that consumer spending remains elevated, supported by wage growth and strong household balance sheets, while business investment has accelerated over the past year. Housing-related costs, however, remain high. He said the U.S. labor market has cooled from the overheated postpandemic rebound to normal levels more consistent with the Fed’s employment mandate. Hiring and quits both slowed to prepandemic levels or below, and October’s 4.1% unemployment rate remains historically low. Meanwhile, Boston Fed President Susan Collins told the Wall Street Journal in an interview that a 25-basis-point reduction in the Fed funds rate at the December 17-18 FOMC meeting “is on the table, but it’s not a done deal.” She pointed to additional data arriving ahead of the December session and said the Fed will “have to continue to weigh what makes sense.” CME Fed funds futures fell from being at an over 80% probability of a 25-basis-point cut to rates at the December meeting to just over 62% at the end of trading Thursday, with just over a 37% probability for a steady rate decision. — Sen. Sherrod Brown (D-Ohio) didn’t rule out running to fill the remainder of JD Vance’s term. Brown lost his re-election bid to Republican challenger Bernie Moreno. Ohio Governor Mike DeWine will appoint someone to fill the seat temporarily. A special election will be held in 2026 to determine who will serve the remainder of Vance’s term until 2028. With Moreno’s victory over Brown, both of Ohio’s Senate seats will be held by Republicans for the first time since 2007. — China’s retail sales increased 4.8% in October from a year ago, the strongest growth since February and exceeding all estimates. See China section for details. — Mexico’s credit outlook was lowered to negative from stable by Moody’s, which said recent constitutional changes risk hurting Latin America’s second-biggest economy. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened 175 to 200 points lower. In Asia, Japan +0.3%. Hong Kong -0.1%. China -1.5%. India -0.1%. In Europe, at midday, London +0.1%. Paris -0.1%. Frankfurt +0.1%.

U.S. equities yesterday: All three major indices finished lower on Thursday. The Dow was down 207.33 points, 0.47%, at 43,750.86. The Nasdaq fell 123.07 points, 0.64%, at 19,107.65. The S&P 500 was down 36.21 points, 0.60%, at 5,949.17.

— Oil prices closed slightly higher on Thursday after a large draw in U.S. fuel stocks offset oversupply and demand concerns. Brent rose 28 cents (0.4%) to $72.56 a barrel, while U.S. WTI gained 27 cents (0.4%) to $68.70. Both briefly dipped into negative territory during the session. For the week, Brent was set to lose about 1.7%, while WTI was on track for a 2% weekly drop, driven by a stronger U.S. dollar and rising supply concerns.

— Ag markets today: Corn, soybeans and wheat firmed amid light corrective buying during the overnight session. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny higher, soybeans were 7 to 9 cents higher, winter wheat markets were 2 to 3 cents higher and spring wheat was 4 to 5 cents higher. The U.S. dollar index was around 150 points lower, and front-month crude oil futures were down about 25 cents.

Cash cattle activity so far this week has been mostly around $185.00, both in the Southern Plains and northern market. That was down around $1.50 from last week’s five-area weighted average. Packers’ purchase volume could be light again this week, as feedlots resisted actively moving cattle at the lower prices.

The pork cutout fell $3.19 to $94.07 on Thursday, the lowest level since Sept. 24, pressured by a $20.78 plunge in primal belly prices. Belly prices have plummeted $46.46 from their Nov. 1 peak to the lowest level since Sept. 25.

— Agriculture markets yesterday:

• Corn: December corn fell 7 1/2 cents to $4.19, closing below the 10-day moving average.

• Soy complex: January soybean futures plunged 20 1/4 cents to $9.87 1/2, settling near session lows. December meal futures made a new contract low, closing $4.60 lower to $287.00. December bean oil futures gave up early gains and closed 74 points lower to 44.44 cents.

• Wheat: December SRW wheat fell 10 3/4 cents to $5.30 1/4, near the daily low and hit a 2.5-month low. December HRW wheat fell 7 3/4 cents to $5.33 and near the session low. December spring wheat futures closed 3 1/4 cents lower to $5.67 3/4.

• Cotton: December cotton futures sunk 58 points to 68.32 cents, settling on today’s lows.

• Cattle: December live cattle fell $1.075 to $182.95, nearer the session low and hit a seven-week low. January feeder cattle fell 45 cents to $243.20 and nearer the session low.

• Hogs: Diving pork prices likely undercut hog futures Thursday, with nearby December tumbling $1.775 to $80.10 at the close.

— GAO recommends enhancements to H-2A visa program amid rapid growth. The H-2A visa program, enabling U.S. agricultural employers to hire foreign workers for temporary jobs, has expanded significantly over recent years, with a 50% increase in approved jobs and visas between fiscal years 2018 and 2023. In FY 2023 alone, nearly 310,000 H-2A visas were issued. Key states — California, Florida, Georgia, North Carolina, and Washington — accounted for over half of these jobs, with most positions being for farmworkers and laborers in crop and greenhouse operations. Link to GAO report.

To improve the program, GAO advises:

• Electronic processing: DHS should implement end-to-end electronic processing to enhance efficiency and program accountability.

• Back wage recovery: DOL should explore ways to reduce the resource strain on its Wage and Hour Division to more effectively locate workers owed back pay.

Both Department of Homeland Security and Department of Labor agree with the recommendations. Notably, while application volumes surged by 72%, processing times have remained steady at around 27-29 days. Most H-2A workers are young, married Mexican men.

— U.S. ag and food industry groups are expressing significant concerns about Donald Trump’s proposed mass deportation plans. These groups worry that such actions could have severe consequences for the U.S. food system and economy.

Key concerns

• Labor shortage: The U.S. agricultural sector heavily relies on immigrant labor, with estimates suggesting that 50% to 70% of farmworkers are undocumented. Mass deportations would dramatically reduce the available workforce, potentially crippling agricultural production.

• Economic disruption: Farmers and industry advocates argue that a crackdown on undocumented immigrants could bring their businesses to a halt. The American Farm Bureau Federation has stated that “Enforcement-only immigration reform would cripple agricultural production in America.”

• Food supply disruption: There are concerns that mass deportations could “decimate our nation’s food supply and economy,” according to some politicians and advocates.

• Rising food prices: A reduction in the agricultural workforce could lead to unharvested crops and decreased food production, potentially driving up food prices for consumers.

• Broader economic impact: The loss of millions of workers would not only affect agriculture but could disrupt the nation’s economy.

Ag industry groups recognize the crucial role that immigrant workers play in the U.S. food system. They emphasize that these workers often take on physically demanding jobs that many American-born workers are unwilling to do. The Farm Bureau has noted the difficulty in finding American workers attracted to farm jobs, which are often challenging, seasonal, and transitory.

Small farmers and urban farmers also express concern, highlighting the importance of immigrant labor in maintaining the current food system. They worry that mass deportations would make it extremely difficult to find workers willing to perform the necessary labor under often difficult conditions.

If mass deportations were to occur, industry groups foresee several potential outcomes:

• Reduced agricultural production and possible food shortages of some commodities

• Increased reliance on food imports, making the U.S. more vulnerable to price fluctuations and international trade policies

• Accelerated adoption of automation in agriculture, which comes with its own set of challenges and potential job losses

• Economic instability in rural communities that heavily depend on agricultural jobs

Market perspectives:

— Outside markets: The U.S. dollar index was lower, with the euro and British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note dipped slightly, trading around 4.44%, with a negative tone in global government bond yields. Crude oil futures were weaker, with US crude around $68.65 per barrel and Brent around $72.45 per barrel. Crude was under pressure in Asian trading, with US crude around $67.70 per barrel and Brent around $71.55 per barrel. Gold and silver futures were firmer, with gold shifting between losses and gains. Gold was around $2,573 per troy ounce and silver was around $30.74 per troy ounce.

— Gold is on track for its steepest weekly drop since June 2021, down nearly 5% on week. The decline reflects a surge in risk appetite after the Republican win in the U.S. presidential elections, which sparked a stock-market rally and damped gold demand\

— Ag trade update: South Korea purchased 134,000 MT of optional origin corn.

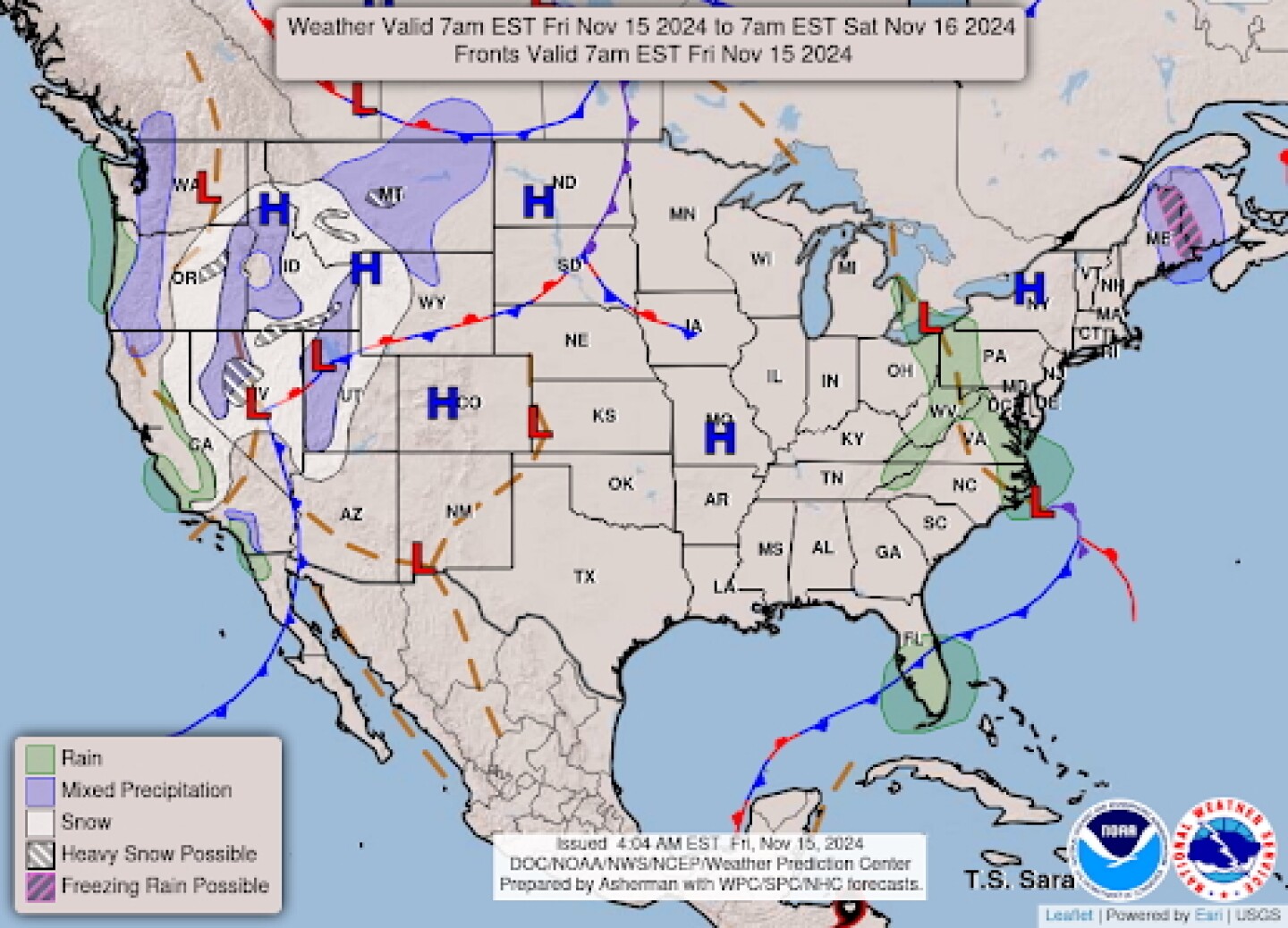

— NWS outlook: Unsettled weather persists throughout much of the West today before the next strong storm system enters the Pacific Northwest on Saturday... ...Elevated fire weather concerns continue across parts of the Northeast... ...Next round of heavy rain and severe weather potential to develop over the Southern Plains late Sunday.

Items in Pro Farmer’s First Thing Today include:

• Light corrective buying in grains overnight

• Cash cattle trade lower

• Bellies pressure wholesale pork prices

• All-time high NOPA crush expected for October

• France’s winter wheat seeding accelerates

• British economy unexpectedly contracts in September, slowing quarterly growth

| POLICY UPDATE |

— Trump may not like this: A provision in the pending House farm bill would prohibit the incoming Trump administration from using USDA’s Commodity Credit Corporation (CCC) to buffer farmers from retaliatory trade tariffs.

A farm policy contact says, “The House provision is meant as an offset to pay for a certain and effective safety net under the commodity title and crop insurance. While perhaps not optimal, it makes good sense absent other ‘acceptable’ offsets (most all have been shot down) sufficient to provide producers with a meaningful safety net, especially since the CCC has not really been used over the past four years for its major purpose of directly helping farmers and ranchers but has been used for other things. This contrasts with the first Trump administration which did focus CCC support toward actual producers. If not necessary as an offset, interest in CCC as an offset goes away.”

Background. The trade war that erupted in 2018 and 2019 as the Trump administration hit U.S. trading partners with tariffs resulted in significant declines in U.S. agricultural exports, primarily to China as the country retaliated against those and other commodities with tariffs that limited their access to the Chinese market. The Trump administration deployed Section 5 of the Commodity Credit Corporation (CCC) authority at USDA to make aid payments to farmers that totaled some $28 billion.

— As new farm bill stalled in Congress by Stabenow, farm groups push $21 billion aid amid high costs and low prices. Farm bill talks continue but sources say outgoing Senate Ag Chairwoman Debbie Stabenow (D-Mich.) shows little to no give on entrenched farm bill positions. The focus is now on a proposed $21 billion ag aid/price mitigation bill.

• Stalled farm bill negotiations: The farm bill continues to confront a political impasse. Stabenow is being accused by Republicans of hindering progress, although partisan disagreements run deeper, involving proposed cuts to SNAP (food assistance) and climate-related provisions.

• High costs & economic strains on farmers: U.S. farm groups and their representatives cite rising costs, declining commodity prices, natural disasters, and inflation pressures as factors eroding farm income, making immediate financial aid critical. A coalition of over a dozen farm organizations backs a bailout bill (FARM Act) proposed by Rep. Trent Kelly (R-Miss.) reflecting the urgent need for financial relief.

• Timing constraints and political priorities: The current lame-duck Congress faces time constraints with an approaching deadline to fund the government (Dec. 20), creating competition between multiple legislative priorities. Analysts suggest that only one major piece of farm-related legislation may be feasible before January.

• Potential solutions & bipartisan efforts: While both Republicans and Democrats recognize the urgency of passing farm-related relief, they diverge on specifics. Emergency aid may be tied to broader disaster relief, but crafting a comprehensive new farm bill appears more challenging due to unresolved policy issues. With Republicans poised to take control of the Senate in January, leadership changes may also shape legislative outcomes.

Bottom line: Failure to complete a farm bill this year may very well mean a new measure through budget reconciliation or some other process. Most farm bill analysts say it is best to complete a farm bill this year.

— Potential GOP tax plans for 2025: Three scenarios, according to the New York Times:

1. Maintaining the status quo: Republicans are considering simply extending the 2017 Trump-era tax cuts, which reduced income-tax rates and taxes for many businesses. The Congressional Budget Office projects a cost of $4.6 trillion over the next decade if these cuts are extended, potentially adding to the already significant national debt. Proposed spending cuts to offset this cost face internal opposition within the party.

2. Minor adjustments: Trump’s campaign proposals include new tax cuts, such as exempting tips and overtime pay from taxation and reducing taxes for domestic manufacturers. These ideas, however, could further inflate the cost of legislation. Limited versions of these cuts may be passed to manage expenses, such as partially lifting the cap on state and local tax deductions.

3. Comprehensive overhaul: Trump’s full fiscal agenda could lead to deeper corporate tax cuts, the repeal of Biden’s Inflation Reduction Act, and the introduction of tariffs on imported goods. Such tariffs would mark a significant shift in U.S. fiscal policy, potentially offsetting some tax cut costs but creating higher costs for consumers and deeper long-term economic impacts.

| CHINA UPDATE |

— China’s retail sales beat expectations amid real estate woes. China’s retail sales grew by 4.8% in October, exceeding forecasts, while industrial production and fixed asset investment fell short of expectations due to deepening real estate struggles. Industrial output rose 5.3%, missing the 5.6% estimate, and fixed asset investment growth slowed. Real estate investment saw a sharper decline, dropping 10.3% year-to-date. The unemployment rate fell slightly to 5%. Despite recent stimulus measures and infrastructure spending, domestic demand remains soft, though retail sales and Singles Day festival spending offered a boost. China targets 5% GDP growth for 2024.

— Sales of U.S. soybeans, sorghum, cotton, and beef to China continue. USDA export sales activity for the week ended Nov. 7 for 2024-25 to China included net sales of 74,300 metric tons of sorghum, 1,181,104 metric tons of soybeans, 18,950 running bales of upland cotton, with no activity for corn or wheat. Activity for 2024 included net sales of 1,417 metric tons of beef and net reductions of 91 metric tons of pork.

| TRADE POLICY |

— Biden’s U.S. trade chief advocates targeted tariffs against China. U.S. Trade Representative Katherine Tai emphasized the need for targeted tariffs to protect key sectors from a potential “China Shock 2.0,” warning against a repeat of economic turmoil from China’s WTO entry in 2001. Speaking in Lima, Peru, Tai highlighted tariffs as part of a strategic defense alongside investments to bolster industries such as clean energy, semiconductors, and cars. Tai cautioned against broad, sweeping tariffs and called for a focused approach to strengthen the U.S. economy and counter China’s market dominance.

— Mexico to enshrine non-GMO white corn protections, citing biodiversity and cultural heritage preservation. President Claudia Sheinbaum of Mexico announced plans to introduce constitutional protections for non-genetically modified (non-GMO) white corn grown in Mexico. This initiative aims to safeguard the country’s biodiversity, public health, and cultural heritage.

Key points of the plan

• Constitutional protection: Sheinbaum intends to enshrine protections for non-GMO white corn in the Mexican constitution, considering it the best defense for biodiversity and health.

• Focus on native varieties: Mexico has more than 60 native varieties of corn, which have been cultivated by indigenous people for thousands of years.

• Continuation of previous efforts: This plan builds on efforts by former President Andres Manuel Lopez Obrador to limit imports of genetically modified yellow corn.

• Scope of protection: The initiative specifically targets white corn, which is primarily used for human consumption and is central to Mexican cuisine, particularly in making tortillas.

Rationale and implications

• Biodiversity preservation: The protection of native corn varieties is seen as crucial for maintaining Mexico’s agricultural biodiversity.

• Cultural significance: Corn holds immense cultural importance in Mexican history and cuisine.

• Health concerns: The government cites potential health risks associated with GMO crops as a reason for this protection.

• Agricultural self-sufficiency: Sheinbaum has expressed a goal for Mexico to be self-sufficient not only in white corn but also in beans and other crops.

Challenges

• Trade agreement tensions: This initiative may face challenges under the United States-Mexico-Canada Agreement (USMCA) trade pact.

• Ongoing dispute: A USMCA panel is expected to rule on Mexico’s restrictions on genetically modified corn imports by Nov. 29.

• Future negotiations: The USMCA is up for revision in 2026, which could lead to negotiations between Sheinbaum’s administration and the U.S. government.

• Import considerations: While Mexico is self-sufficient in white corn, it imports genetically modified yellow corn from the United States, primarily for livestock feed.

Of note: President Sheinbaum has emphasized that this constitutional safeguard is an “obligation” to ensure that white corn cultivated in Mexico remains non-genetically modified. The plan is expected to be presented to the lower house of Congress in the coming days, marking a significant step in Mexico’s ongoing efforts to protect its native corn varieties and agricultural heritage.

| ENERGY & CLIMATE CHANGE |

— Biofuel industry pushes for tax credit extension amid regulatory delays. The biofuel industry is urging lawmakers to extend the blenders tax credit due to delays in Treasury guidance for the new Section 45Z credit, set to replace it next year. The 2022 tax law’s new clean fuel production credit bases incentives on carbon intensity scores, but producers lack clarity on compliance, causing market disruptions and plant closures. Clean Fuels Alliance America, joined by 10 associations, has petitioned Congress for a one-year extension, highlighting widespread confusion and economic risks.

— OMB to host first meeting on EPA’s proposed RFS waiver for cellulosic fuel. The Office of Management and Budget (OMB) will hold its first meeting on Nov. 22 regarding the EPA’s proposed rule for a “Partial Waiver of 2024 Cellulosic Biofuel Volume Requirement and Extension of 2024 Compliance Deadline” under the Renewable Fuel Standard (RFS). The American Fuel and Petrochemical Manufacturers (AFPM), who requested the waiver, argue that there is a 115 million RIN shortfall for 2024. AFPM’s earlier petition to reduce 2023 cellulosic biofuel requirements was denied by the EPA, citing sufficient RINs availability to meet the standards.

| HEALTH UPDATE |

— Obesity crisis: Three-quarters of U.S. adults now overweight or obese. A new study published in The Lancet shows that nearly 75% of U.S. adults are overweight or obese, marking a dramatic increase since 1990. The rise is linked to various metabolic and chronic health risks, including diabetes and heart disease, and is now seen as a public health crisis. Obesity rates have particularly surged among young people, with significant implications for future generations. Experts stress the need for aggressive reforms and systemic solutions, from promoting healthy food access to better medical interventions, to curb this growing epidemic.

| OTHER ITEMS OF NOTE |

— Cotton AWP moves higher. The Adjusted World Price (AWP) for cotton is at 58.20 cents per pound, effective today (Nov. 15), up from 57.96 cents per pound the prior week. While this marks the fifth straight week the AWP has been below 60 cents, it still remains well above the level of 52 cents that would trigger an LDP. Meanwhile, USDA announced that Special Import Quota #5 will be established Nov. 21 for the import of 31,716 bales of upland cotton, applying to supplies purchased no later than Feb. 18 and imported into the U.S. no later than May 19.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |