News/Markets/Policy Updates: Oct. 23, 2024

— Robert F. Kennedy Jr.'s endorsement of Donald Trump has sparked a new initiative aimed at reshaping the MAGA movement into what he calls “Make America Healthy Again” (MAHA). This effort seeks to address chronic health issues in the United States by targeting chemical pollutants in food and the environment, which Kennedy claims are contributing to rising rates of diseases like obesity, diabetes, and cancer. Kennedy’s decision to support Trump comes with the promise that a second Trump administration would focus on removing harmful substances from America’s food and water systems. “We will restore health to Americans,” Kennedy declared, emphasizing the need for regulatory bodies free from corporate influence. Despite Trump’s previous record of rolling back environmental protections, Kennedy believes that Trump has assured him of a different approach if re-elected. “He said to me when we met, he said, ‘The last time I came into office, in 2016, I had no idea how to govern,’” Kennedy recounted. “He said, ‘We’re not going to do that this time.’” Trump himself has expressed support for Kennedy’s ideas, albeit with some reservations. At a recent event, Trump remarked, “We’re going to let him go wild for a little while, then I’m going to have to maybe rein him back, because he’s got some pretty wild ideas but most of them are really good, I think.” Of note: Trump was scheduled to join Kennedy and former Rep. Tulsi Gabbard in a digital town hall on Tuesday, but the session was canceled on short notice due to “changes in Trump’s schedule.” It was the second time the town hall has been called off, reported Politico. “America’s current ag policy is destroying America’s health on every level,” said Kennedy in a video posted on the internet last week. “It destroys the health of America’s soil and water by tilting the playing field in favor of more chemicals, more herbicides, more insecticides, more concentrated mono-crops and feedlots, and finally, it destroys the health of consumers.” The answer is to “encourage sustainable, regenerative farming,” “ban the worst agricultural chemicals,” and produce more “natural, unprocessed foods” to replace ultra-processed foods, said Kennedy. He has made similar videos calling for sweeping change at the Environmental Protection Agency and the Food and Drug Administration. Trump’s campaign has incorporated the MAHA concept into its platform, aiming to appeal to voters concerned about health and wellness issues. The MAHA initiative has not only become a talking point for Trump and Kennedy but has also influenced discussions among Republicans on Capitol Hill. Some GOP members have begun echoing concerns about corporate influence on public health policies. However, skepticism remains among scientists and environmental advocates who question the feasibility of Trump and Kennedy’s plans given past policies and actions. Some U.S. farmers are concerned about Kennedy’s potentially having influence at USDA if Donald Trump wins the presidency for several reasons: |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight, with Asian shares mostly firmer and European stocks mostly weaker. U.S. Dow opened around 230 points lower. In Asia, Japan -0.8%. Hong Kong +1.3%. China +0.5%. India -0.2%. In Europe, at midday, London -0.4%. Paris -0.7%. Frankfurt -0.3%. U.S. equity futures are under pressure again this morning as the 10-Yr yield continues to edge further beyond 4.20%, the highest readings since July, while traders await more important earnings releases today and into the weekend.

What is pushing yields higher? According to Tom Essaye of The Sevens Report: “I’m a big fan of Occam’s razor, which is a principle of logic that states that the simplest explanation is usually the best. So, with that in mind, consider:

• Economic growth since the Fed rate cut has been almost universally better than expected, including the September jobs report, retail sales, ISM Services PMI and GDP now.

• Inflation has firmed up as the September CPI report was stronger than expected, implying the decline in inflation is slowing.

• Fed rate cut expectations have declined from (possibly) 75 bps of cuts in November and December to 50 bps of cuts, and now possibly no cut in November and just a 25 bps in December.”

U.S. equities yesterday: The Dow finished slightly lower along with the S&P 500 while the Nasdaq managed a modest gain. The Dow fell 6.71 points, 0.02%, at 42,924.89. The Nasdaq was up 33.12 points, 0.18%, at 18,573.13. The S&P 500 eased 2.78 points, 0.05%, at 5,851.20.

— McDonald’s: Quarter Pounder hamburgers have been linked to a deadly E. coli outbreak. Shares slid 6% in off-hours trading. Details below. It’s the latest tough news for McDonald’s, which is still dealing with the political fallout from Donald Trump’s campaign appearance at a location in Pennsylvania.

— Coca-Cola reported quarterly earnings and revenue that topped analysts’ expectations. Shares of the company rose less than 1% in premarket trading. The company reported adjusted earnings of 77 cents per share compared with 74 cents per share estimated by an LSEG survey of analysts. Revenue was $11.95 billion which topped the $11.60 billion analysts predicted.

— Coffee retailer Starbucks pre-reported fourth quarter profit of 80 cents a share, missing forecasts for $1.03, on sales of $9.1 billion, which was also below estimates. It will suspend guidance as it begins to chart a new course under CEO Brian Niccol, who said Starbucks needs to fundamentally change its strategy, including a review of its pricing and marketing and the amenities available in its stores. Store sales are expected to be down 7% for the fiscal fourth quarter, the third consecutive quarterly decline. That was driven by a sharp slowdown in North America and China. Starbucks hopes that getting the bad news out a week earlier than scheduled could temper investors’ expectations and give Niccol more time to get a grip on what needs to be fixed. Starbucks is expected to release its full earnings on Oct. 30.

— Boeing’s financial results for the third quarter of 2024 reveal significant challenges and losses. The company reported a net loss of $6.1 billion, which is a substantial increase compared to the $1.44 billion loss in the previous quarter. This loss was driven by several factors, including a prolonged strike by machinists, production limitations, and customer dissatisfaction. Revenue for the quarter was $17.8 billion, showing a 5.8% increase from the previous quarter but still falling short of analyst expectations.

The company’s core loss per share was reported at $10.44, aligning with Wall Street predictions. Boeing’s commercial airplane division faced an operating deficit of $4 billion, largely due to the strike that affected production in the last two weeks of the quarter. The space and defense sector also reported an operating loss of $2.4 billion, though this was not impacted by the strike.

Boeing’s CEO, Kelly Ortberg, who took over in August 2024, has emphasized the need for a cultural transformation and stabilization of operations to restore Boeing’s legacy as a leading aerospace firm. The company has also taken steps to secure its financial position by entering into a $10 billion credit agreement and planning to sell up to $25 billion in securities.

— Ag markets today: Corn and soybeans pulled back overnight from corrective gains the two previous days, while wheat more than erased Tuesday’s price strength. As of 7:30 a.m. ET, corn futures were trading mostly a penny lower, soybeans were 3 to 5 cents lower, winter wheat markets were 7 to 8 cents lower and spring wheat was 4 to 5 cents lower. The U.S. dollar index was nearly 350 points higher, and front-month crude oil futures were around $1.35 lower.

Choice beef continues higher. Choice boxed beef prices firmed another $1.10 to $323.96 on Tuesday, while Select fell $1.41 to $294.80. Movement totaled 142 loads, including 87.5 loads of Choice beef. Strong retailer demand for Choice beef continue to strengthen packer margins, giving cash sources hopes of steady/firmer cash cattle prices for a seventh consecutive week.

Traders narrowing hog discount to cash index. The CME lean hog index is up 11 cents to $84.34 as of Oct. 21, marking the third straight daily gain. After Tuesday’s gains, the discount December lean hog futures hold to the cash index declined to $5.215.

— Agriculture markets yesterday:

• Corn: December corn futures rose 7 cents to $4.16 1/2 and near the session high.

• Soy complex: November soybeans rallied 10 3/4 cents to $9.91 3/4, closing near the session high. December soymeal fell 60 cents to $317.70. December soyoil surged 130 points to 43.69 cents, marking a close above the 100-, 10- and 20-day moving averages.

• Wheat: December SRW futures rallied 3 3/4 cents to $5.76 and closed nearer session highs. December HRW futures climbed 4 1/4 cents to $5.86 1/2, settling nearer session highs. December spring wheat rose 2 3/4 cents to $6.16 3/4.

• Cotton: December cotton fell 12 points to 72.08 cents but marked a high-range close.

• Cattle: December live cattle futures climbed $1.30 to $188.125 and settled near session highs. November feeder cattle futures rallied $2.325 to $248.925.

• Hogs: December lean hogs rose 85 cents to $79.125, nearer the session high and hit at six-month high.

— Quotes of note:

• Bank of America’s chief wants Fed interest-rate cuts to be measured, and the head of Blackstone said that no matter who wins the election, the US will avoid a recession.

• Goldman Sachs said the euro could drop as much as 10% versus the dollar if Trump and the Republicans win next month’s U.S. elections and enact high global tariffs and generous domestic tax cuts.

• Treasury Secretary Janet Yellen told the IMF and World Bank annual meetings that achieving global development goals of eradicating extreme poverty, strengthening health systems, and protecting the planet will require stronger partnership and new ways to achieve climate outcomes, increase pandemic preparedness, and maximize capital.

— The IRS announced several updated tax provisions for 2025. The IRS has announced updates to several tax provisions for the year 2025, which will affect tax returns filed in 2026. Key changes include adjustments to income tax brackets, standard deductions, and estate and gift tax exemptions.

Federal income tax brackets for 2025. The IRS has adjusted the income thresholds for each federal income tax bracket to account for inflation. The tax rates remain the same, ranging from 10% to 37%. For 2025, the top tax rate of 37% will apply to individuals with taxable income above $626,350 and married couples filing jointly with incomes over $751,600.

Standard deduction for 2025 will increase significantly:

• Single filers: $15,000

• Married couples filing jointly: $30,000

These increases are designed to provide some relief from inflation by reducing taxable income.

Capital gains tax brackets. The IRS also increased the thresholds for long-term capital gains tax brackets. These apply to assets held for more than one year. For the 2025 tax year, the IRS has adjusted the capital gains tax brackets to account for inflation. Here are the updated thresholds for long-term capital gains taxes:

0% rate:

• Unmarried individuals: Up to $48,350

• Married individuals filing jointly: Up to $96,700

• Heads of households: Up to $64,750

15% rate:

• Unmarried individuals: Over $48,350

• Married individuals filing jointly: Over $96,700

• Heads of households: Over $64,750

20% rate:

• Unmarried individuals: Over $533,400

• Married individuals filing jointly: Over $600,050

• Heads of households: Over $566,700

These adjustments reflect an approximate increase of 2.8% due to inflation, allowing taxpayers to potentially benefit from lower tax rates on their capital gains if their income remains constant or grows slower than inflation.

Estate and gift tax exemptions have been raised to $13.99 million per person in 2025, up from $13.61 million in 2024. This change allows individuals to transfer more wealth tax-free during their lifetime or at death.

These adjustments reflect the IRS’s efforts to account for inflation and provide taxpayers with updated guidelines for financial planning.

Post-2025 changes: Unless new legislation is enacted, the exemption is set to decrease significantly on Jan. 1, 2026, reverting to approximately $5 million per person, adjusted for inflation. If Congress does nothing, the exemption will automatically revert to about $7 million for individuals (approximately $14 million for married couples), reflecting pre-TCJA levels adjusted for inflation. Some proposals suggest reducing the exemption even further to $3.5 million per person and introducing higher progressive tax rates ranging from 55% to 65%, with an additional surtax for estates over $1 billion. Another option could be setting a middle-ground exemption figure between the current and proposed lower levels, possibly coupled with a slight increase in tax rates.

Given these potential changes, individuals with substantial estates should consider reviewing their estate plans:

• Maximize current exemptions: It may be beneficial to utilize the current higher exemption levels before they decrease after 2025. This could involve making significant lifetime gifts to reduce taxable estates.

• Consult professionals: Estate planning is complex, and individuals should consult with tax advisors or estate planning professionals to tailor strategies specific to their circumstances and maximize available exemptions.

— Putin hails BRICS summit as sign of emerging ‘multipolar world.’ Russian President Vladimir Putin declared that the expansion of the BRICS group signifies the creation of a “multipolar world,” challenging the U.S.-led global order. Speaking at the BRICS summit in Kazan, Russia, Putin emphasized that the organization “meets the aspirations of the main part of the international community, the so-called world majority.” He noted that BRICS is “especially in demand in the current conditions, when truly dramatic changes are taking place in the world.”

This summit marks the first gathering since BRICS expanded to include nine members, with new additions such as the United Arab Emirates, Iran, Egypt, and Ethiopia joining Brazil, Russia, India, China, and South Africa. The expansion reflects growing interest from over 30 nations, including Thailand and Algeria. However, existing members remain divided on further enlargement. “It would be wrong to ignore the unprecedented interest of the countries of the Global South and East in strengthening contacts with BRICS,” Putin stated, while also stressing the need to “maintain a balance.”

Putin is set to meet with Turkish President Recep Tayyip Erdogan and Iran’s Masoud Pezeshkian during the summit. The influence of BRICS is increasing, with its members representing 26% of the global economy and 45% of the world’s population. This contrasts with the Group of Seven’s 44% share of global GDP and 10% of its population.

Push to alter dollar’s significance. Amid unprecedented sanctions from the U.S. and its G7 allies due to Russia’s invasion of Ukraine in February 2022, Putin is advocating for BRICS nations to reduce reliance on the dollar by increasing trade in national currencies. While some BRICS members support this shift, others like India, South Africa, and the UAE are cautious about any anti-U.S. perception.

Market perspectives:

— Outside markets: The U.S. dollar index was firmer, with the euro and British pound both weaker against the U.S. currency. The yield on the 10-year U.S. Treasury note has climbed further above 4.2%, trading around 4.24%, with a mixed tone in global government bond yields. Crude oil futures remain lower, with U.S. crude around $70.50 per barrel and Brent around $74.80 per barrel. Gold and silver futures are narrowly mixed ahead of US market action, with gold firmer around $2,763 per troy ounce and silver weaker around $34.68 per troy ounce.

— Gold hit another record high overnight, at $2,772.60, basis December Comex futures. Safe-haven demand is a major reason for the big rally in gold prices. High tensions in the Middle East and the approaching U.S. presidential elections are creating keener uncertainty in the marketplace.

— Canadian National Railway reports higher revenue but slight profit drop amid labor disputes and wildfires. Canadian National Railway posted Q3 revenue of C$4.11 billion ($2.972 billion), up 3%, with profit dipping to C$1.09 billion ($790.36 million) due to labor issues and wildfires. Strong growth in petroleum, chemicals, and grain offset declines in other segments.

— India ends export tax on parboiled rice, removes price floor on non-basmati white rice exports. India decided to eliminate the export tax on parboiled rice, a move aimed at boosting exports amid rising inventories and expectations of a bumper crop due to favorable monsoon rains. This decision follows a previous reduction in the export duty from 20% to 10% last month, which was part of an effort to enhance sales. The removal of the export tax is expected to increase India’s rice shipments, thereby enhancing global rice supplies and potentially reducing international prices. This could compel other major rice-exporting countries like Pakistan, Thailand, and Vietnam to lower their rates as well. Additionally, the decision is likely to benefit price-sensitive markets, particularly in Africa, where Indian parboiled rice remains a popular choice due to its competitive pricing.

Alongside parboiled rice, India has also scrapped the 10% export duty on husked brown rice and rice paddy. In September, India had resumed exports of non-basmati white rice with a set minimum export price of $490 per metric ton. The order removed the price floor of $490 per metric ton on non-basmati white rice. The country exported 5.1 million metric tons (MMT) of parboiled rice through August, down 13% from year-ago marks.

— USDA daily export sales:

• 130,000 MT soybeans to China, 2024-2025 marketing year.

• 100,000 MT corn to unknown destinations, 2024-2025 marketing year.

• 259,000 MT soybeans to unknown destinations, 2024-2025 marketing year.

— Ag trade update: Jordan tendered to buy up to 120,000 MT of optional origin milling wheat. Bangladesh tendered to buy 50,000 MT of optional origin milling wheat.

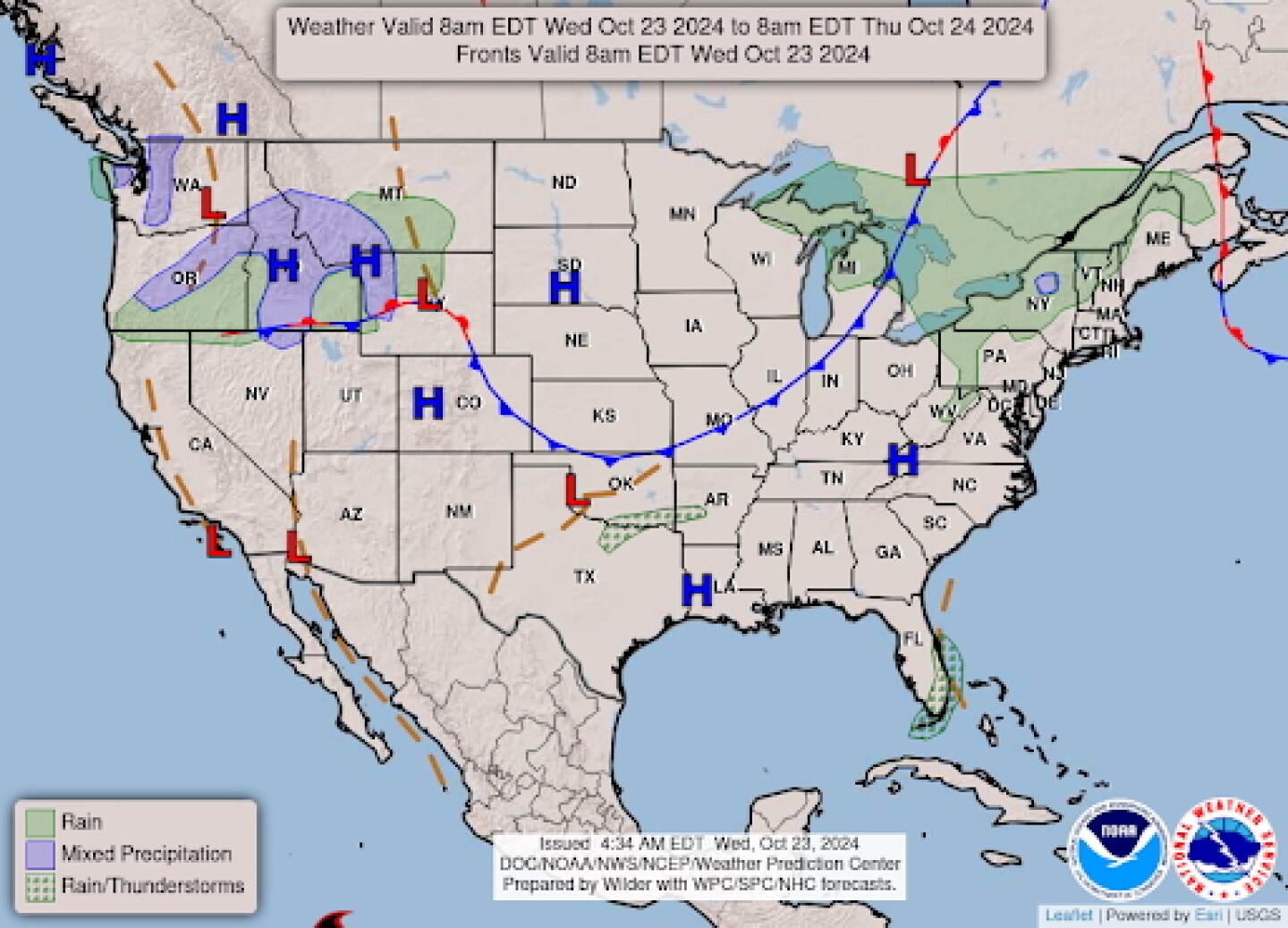

— NWS outlook: Very pleasant weather continues across most of the country through the end of the week... ...Well above-average temperatures continue over the Central and Eastern U.S.

| ISRAEL/HAMAS CONFLICT |

— Hezbollah launched rockets at Tel Aviv for the second consecutive day, amid ongoing tensions in the region. This escalation coincided with U.S. Secretary of State Antony Blinken’s visit to Israel, where he urged for a measured response from Israel to Iran’s ballistic missile strikes on Oct. 1, when Iran launched a large-scale ballistic missile attack on Israel, marking one of the most significant escalations in the ongoing Iran-Israel conflict. This attack was reportedly in retaliation for Israel’s assassination of key figures within Hezbollah and Hamas, including Hezbollah’s Secretary General Hassan Nasrallah. The Israeli response has included airstrikes targeting Hezbollah positions in Lebanon, further escalating tensions.

In response to Israeli actions, Hezbollah has increased its military activities, including firing rockets at Israeli military installations near Tel Aviv and Haifa. The group claimed responsibility for targeting an Israeli intelligence base and a naval base, emphasizing their capability and intent to continue such operations.

Amid these developments, Israel confirmed the killing of Hashem Safieddine, who was expected to succeed Hassan Nasrallah as the leader of Hezbollah. This operation was part of a broader Israeli campaign targeting Hezbollah’s leadership and infrastructure in Lebanon. The elimination of Safieddine is seen as a significant blow to Hezbollah, potentially impacting its organizational stability and future leadership dynamics.

Antony Blinken’s visit aimed to de-escalate the situation and promote a ceasefire between Israel and militant groups in Gaza and Lebanon. However, his efforts faced significant challenges due to ongoing hostilities and the complex geopolitical landscape involving Iran’s support for Hezbollah. The U.S. continues to emphasize its commitment to Israel’s security while advocating for increased humanitarian aid to Gaza amid the conflict.

Bottom line: The situation remains volatile, with potential implications for broader regional stability. Both sides have shown little willingness to back down, raising concerns about further escalation that could involve additional regional actors.

| RUSSIA/UKRAINE |

— U.S. Defense Secretary Lloyd Austin has confirmed that North Korean troops are present in Russia, although their specific activities remain unclear. This development has raised significant concerns internationally, particularly in South Korea and Ukraine, as it could signify a deeper involvement of North Korea in the ongoing conflict between Russia and Ukraine.

Austin’s confirmation comes amid reports and allegations from South Korea and Ukraine that North Korean soldiers are being trained in Russia for potential deployment to Ukraine. The presence of these troops is considered a “very, very serious issue” if their intention is to participate in the war.

South Korea has warned that it might reconsider its stance on providing arms to Ukraine. This marks a potential shift from its previous position of supplying only non-lethal aid. South Korea’s National Intelligence Service reported that approximately 1,500 North Korean special forces have already been sent to Russia, with more expected.

Russia’s Kremlin spokesperson Dmitry Peskov referred to the claims as “contradictory” but did not categorically dismiss them, emphasizing the sovereign right to enhance relations with North Korea. Meanwhile, South Korea has demanded the immediate withdrawal of North Korean troops from Russia, citing significant security threats.

— UK warns of food threat after Russia steps up attacks on Ukrainian ports. An increase in Russian attacks on Ukrainian port infrastructure in recent weeks threatens food shipments to needy destinations from Gaza to southern Africa, the UK warned. British intelligence detected a “noticeable increase in Russian risk appetite,” leading to at least four merchant ships being damaged during attacks on Black Sea ports between Oct. 5 and Oct. 14, UK Prime Minister Keir Starmer’s office said. The UK, which alongside Norway is leading efforts to protect a maritime corridor in the Black Sea, described the affected shipments as “collateral damage” in Russian President Vladimir Putin’s campaign against Ukraine. On Tuesday, Ukrainian Infrastructure Minister Oleksiy Kuleba said the government will strengthen defense measures in every Black Sea port.

— Kazakhstan aims to export 12 MMT of grains and oilseeds. Kazakhstan officials say the country plans to export 12 MMT of the roughly 26.5 MMT of grain and oilseed production in 2024-25. That would include 7 MMT to 7.5 MMT of wheat, 1.3 MMT to 1.4 MMT of barley, 300,000 MT of corn and 1 MMT of oilseeds. The country has not published official data on exports for 2023-24, but USDA estimated them at 10.5 MMT. Nearby Central Asian countries and Afghanistan will remain the main export markets, but Kazakhstan also wants to increase exports to Europe, Middle East and China, and reach the markets of Southeast Asia. Kazakhstan is also promoting its wheat to Pakistan, Indonesia, Brazil and Malaysia.

| POLICY UPDATE |

— Sen. Chuck Grassley (R-Iowa) has expressed skepticism about the likelihood of passing a new farm bill in 2024, suggesting that it might be more realistic to expect a new bill in 2025 or later. This delay is attributed to several factors, including political dynamics and legislative priorities in Congress.

One major issue is the upcoming elections, which could significantly alter the composition of Congress, potentially bringing in new lawmakers and shifting party control. Such changes often lead to delays as new members take time to settle into their roles and committee assignments are restructured. Additionally, the current political climate, marked by contentious negotiations and potential government shutdowns, complicates efforts to pass significant legislation like the farm bill.

If progress on the farm bill is not made soon, another extension of the 2018 Farm Bill is necessary. This would provide some level of continuity for farmers but would not address current economic challenges or update safety net programs to reflect modern conditions.

Despite these challenges, there are ongoing efforts by some ag groups and others to push for a new farm bill before year’s end, emphasizing the financial difficulties faced by farmers due to outdated policies. Still, even some of these supporters provide odds of only 15% that a new farm bill will be completed this calendar year. Higher odds are given for an ag disaster aid program for 2023 and 2024, and a financial mitigation measure.

| CHINA UPDATE |

— Brazil considers joining China’s Belt and Road Initiative amid global trade tensions. Agriculture Minister Carlos Favaro has advocated for Brazil to join China’s Belt and Road Initiative (BRI) as a strategy to counteract protectionist measures from the United States and the European Union, Bloomberg reports (link). This proposal has sparked debate within President Luiz Inacio Lula da Silva’s administration, which is focused on attracting new investments to Latin America’s largest economy.

The suggestion to participate in China’s major global trade and infrastructure program has divided opinions within the leftist Lula government. Some ministers see it as essential for securing substantial new investments, while others worry it might strain Brazil’s existing relationships with the U.S. and EU.

Ag minister comments. Speaking at the Bloomberg New Economy Forum at B20 in Sao Paulo, Favaro emphasized that Brazil could join the initiative without “creating disputes with anyone.” He stated, “We need to have a great relationship with the United States and the European Union, but also some protectionist measures must be fought with an expansion of the range of trading partners.” He highlighted that strengthening ties with China and other countries presents an “opportunity to overcome trade barriers” that have been imposed on Brazil.

President Lula is navigating a complex global landscape, balancing relations between the world’s two largest economies while seeking investments to boost Brazil’s economy, enhance infrastructure, and support green transition plans. Favaro has been instrumental in fostering closer ties with China. Last year, he led a delegation of agribusiness executives to China to expand agricultural connections. Since then, Brazil has signed agreements to increase exports of beef and other products to China.

Favaro also mentioned ongoing negotiations with Beijing for approval of additional meat processing plants to export to China. He anticipates an announcement regarding 10 to 15 new facilities could occur during the upcoming Group of 20 meeting in Brazil.

Meanwhile, the U.S. and Brazil continue their longstanding rivalry over agricultural exports like soybeans, corn, and cotton. At the same event, White House Deputy National Security Adviser Jonathan Finer acknowledged the growing competition with China but rejected claims that the U.S. is losing influence in Latin America. “This is a region that’s going to make its own decisions,” Finer stated, emphasizing respect for regional sovereignty.

Additionally, tensions between Brazil and the EU have risen over a new European law aimed at combating global deforestation. Brazil has criticized this legislation, arguing it could negatively impact farmers and exports. The European Commission recently delayed implementing the law after pushback from commodity-producing nations. Favaro reiterated Brazil’s opposition, asserting that it was enacted “unilaterally” without considering other nations’ sovereignty. “Brazil will ‘never agree’ with the law,” he declared.

— China’s stimulus measures not enough, Yellen and IMF chief economist say. China’s latest stimulus measures will not meaningfully boost domestic demand, U.S. Treasury Secretary Janet Yellen and International Monetary Fund chief economist Pierre-Olivier Gourinchas said. The two said separately they had not seen any announcement so far from China’s central bank and its finance ministry that would boost demand enough to absorb excess production and boost growth.

— China think tank proposes major stock market stabilization fund. A Chinese policy think tank has called for Beijing to issue 2 trillion yuan ($280 billion) of special treasury bonds to set up a stock market stabilization fund, the 21st Century Business Herald reported. Such a fund could steady the market through buying and selling blue-chips and exchange-traded funds (ETFs), according to the proposal by the Institute of Finance & Banking, affiliated to the Chinese Academy of Social Sciences (CASS). The proposal is part of a quarterly report by the institute on China’s economy.

| TRADE POLICY |

— ECB’s Lagarde defends fair trade amid tariff proposals. European Central Bank President Christine Lagarde has openly challenged former President Donald Trump’s campaign platform by emphasizing the critical role of international commerce. During meetings of the International Monetary Fund (IMF) and World Bank in Washington, Lagarde addressed Trump’s promises to increase tariffs, arguing against the notion that such measures would benefit the U.S. economy.

In an interview with Bloomberg Television’s Francine Lacqua, Lagarde stated, “Fair trade is a key boost for growth, for employment, for innovation, for productivity. It’s something that we should not throw away because in any period of time where this country, the United States, has thrived were periods of trade — not periods of ‘I’m going to retire behind my boundaries and play at home.’ No.”

Trump, the Republican candidate, has proposed imposing tariffs of 60% on Chinese goods and up to 20% on imports from other countries. Economists warn that such actions could result in the most significant trade disruption since the Smoot-Hawley Act, which exacerbated the Great Depression in the 1930s.

The IMF has recently lowered its global growth forecast for the upcoming year and cautioned about increasing risks from geopolitical conflicts and trade protectionism. Lagarde has previously highlighted that the euro area’s economy is particularly susceptible to systemic shocks due to its global interconnectedness and potential supply chain disruptions.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— The CDC issued a safety alert over a McDonald’s staple: the fast-food chain’s iconic Quarter Pounder. Health officials said McDonald’s Quarter Pounders have been linked to E. coli outbreaks in at least ten states. They said 49 people have become sick and one person has died in connection with the outbreak. Most of the illnesses have been reported in Nebraska and Colorado.

The CDC said, so far, it appears the onions used as a topping on the burgers are the likeliest source of the outbreak. McDonald’s has now stopped using the onions and is not serving the Quarter Pounder in affected states. In a statement, the company said it believes the onions came from a single supplier that serves three distribution centers.

Symptoms of E. coli infection often include severe stomach cramps, diarrhea, and vomiting, typically appearing three to four days after exposure. While most individuals recover without medical intervention within a week, some cases can lead to severe complications like hemolytic uremic syndrome (HUS), which affects the kidneys. The CDC advises anyone experiencing symptoms after consuming a Quarter Pounder to seek medical attention immediately.

— TreeHouse Foods Inc. has initiated a voluntary recall of several frozen waffle products due to potential contamination with Listeria monocytogenes. This decision was made after routine testing at one of their manufacturing facilities revealed the presence of the bacteria. The recall affects a wide range of products distributed across the United States and Canada, including those sold under various brand names at major retailers such as Walmart, Target, Publix, and others.

Details of the recall:

• Products involved: The recall includes more than 600 varieties of frozen waffles, as well as pancakes and Belgian waffles. These products are sold under numerous brand names including Kodiak Cakes, Simple Truth, and store brands like Walmart’s Great Value and Target’s Good & Gather.

• Retailers affected: The recalled items were available at many grocery chains including Aldi, Dollar General, Food Lion, Giant Eagle, Hannaford, H-E-B, PriceChopper, Schnucks, Southeastern Grocers, Tops, and more.

• Distribution: The affected products were distributed throughout the U.S. and Canada.

Health risks: Listeria monocytogenes can cause serious infections known as listeriosis. While healthy individuals may experience mild symptoms such as fever and diarrhea, the infection poses significant risks to pregnant women, newborns, older adults, and individuals with weakened immune systems. In severe cases, it can lead to complications like meningitis or septicemia.

Consumer guidance: TreeHouse Foods advises consumers to check their freezers for any recalled products. Affected items should be disposed of or returned to the place of purchase for a refund. Consumers can identify the recalled products by checking the UPC codes and “Best By” dates listed on the packaging. As of now, there have been no confirmed reports of illness linked to these products.

— USDA weakened order to prevent spread of H5N1 in dairy cattle after industry pushback. USDA weakened an emergency order last spring designed to prevent the spread of the H5N1 virus among the nation’s dairy cattle after pushback from state and industry officials, according to state and federal records seen by Reuters. USDA’s order, released in April after H5N1 cases were discovered in cows in eight states, requires milk-producing dairy cattle moving across state lines to secure a negative test no more than seven days prior to travel. It also allows non-producing cattle headed to slaughter to cross state lines without a veterinarian’s clean bill of health. USDA had initially contemplated more stringent requirements, including a three-day time frame for testing, but responded to industry feedback urging leniency before releasing the order, according to documents contained in the records request. Relaxing the order may have enabled more spread of the virus, two veterinarians and one dairy industry representative told Reuters. They noted logistical constraints to testing animals in the shorter window.

— Advisory panel’s draft dietary guidelines for 2025-2030: plant-focused, limit red meat; industry pushback. The Dietary Guidelines Advisory Committee (DGAC) is responsible for reviewing current nutrition science and providing recommendations for the Dietary Guidelines for Americans, which are updated every five years. The draft report for the 2025-2030 guidelines emphasizes several key dietary recommendations:

• Emphasize consumption of certain foods: The committee recommends increasing the intake of fruits, vegetables, legumes, whole grains, nuts, and seafood. These foods are associated with numerous health benefits, including reduced risk of chronic diseases such as heart disease and diabetes.

• Limit certain foods: The draft guidelines suggest limiting the consumption of red and processed meats, refined grains, foods high in saturated fats, and salty snacks. These dietary components are linked to negative health outcomes when consumed in excess.

The committee’s approach involves systematic reviews and food pattern modeling to assess the relationship between diet and health across different life stages. Additionally, a focus on health equity ensures that the guidelines are relevant to diverse populations, considering factors like socioeconomic status, race, ethnicity, and culture.

Julie Anna Potts, the president and CEO of the Meat Institute, expressed concerns about the draft recommendations. She described these recommendations as “alarming” and “disappointing,” arguing that they contradict some of the Committee’s other findings regarding nutritional deficiencies. Potts’ criticism likely stems from the guidelines’ emphasis on reducing the consumption of red and processed meats, which she believes could lead to nutritional gaps if not properly addressed. The Meat Institute has historically advocated for the role of meat in a balanced diet, emphasizing its nutritional benefits. Potts’ comments reflect a broader industry concern that reducing meat consumption could overlook the importance of meat as a source of essential nutrients, such as protein, iron, and B vitamins. The guidelines’ focus on plant-based foods and limiting red meat may be seen by industry representatives as potentially neglecting these nutritional aspects.

| POLITICS & ELECTIONS |

— The U.S. Oil and Gas Association (OGA) has been critical of Vice President Kamala Harris’ energy policy, particularly in relation to her comments on oil production and fracking. Harris has faced scrutiny for her shifting stance on these issues. Initially, she advocated for investigating and penalizing oil companies for their role in climate change and pollution. However, during her vice presidency, she has also highlighted the significant increase in domestic oil production under the Biden administration, which she credits to efforts to reduce reliance on foreign oil.

The OGA has criticized Harris for taking credit for the increase in domestic oil production, arguing that it was achieved despite what they describe as a hostile regulatory environment created by the Biden administration. The association claims that numerous regulatory actions were designed to undermine the oil and gas industry. They have also mocked Harris’s changing positions on fracking, pointing out inconsistencies in her statements over time.

Harris’ campaign has attempted to clarify her position, stating that while she does not support expanding fossil fuel drilling, she also does not advocate for a ban on fracking. This nuanced stance reflects an attempt to balance environmental concerns with energy needs. Despite these clarifications, the OGA and other industry representatives remain skeptical of her policies, viewing them as contradictory and politically motivated.

— Trump secures interview with Joe Rogan as candidates adapt to podcast media. Donald Trump has canceled several campaign events but made time for an interview with Joe Rogan, aiming to tap into the podcaster’s vast following. Both Trump and Vice President Kamala Harris have pursued appearances on Rogan’s show, given its influence among younger voters. While Rogan has criticized both politicians in the past, his podcast remains a key platform for reaching a highly coveted demographic — he has 14.5 million followers on Spotify alone, and at least as many on Instagram and YouTube. About 80% of listeners are believed to be male, and roughly half are under 35. Harris has also appeared on other popular podcasts like Call Her Daddy to discuss key issues. The candidates’ shift toward new media reflects the growing impact of podcasts in shaping voter engagement.

— Donald Trump accused the UK’s Labour Party of interfering in the U.S. presidential election by aiding Kamala Harris’ campaign. His campaign filed a complaint with the Federal Election Commission (FEC), alleging that Labour strategists were assisting Harris, which could potentially constitute illegal foreign contributions. The complaint is based on reports and a now-deleted LinkedIn post by Sofia Patel, Labour’s head of operations, which indicated that nearly 100 current and former Labour staff members were traveling to the U.S. to support Harris in key swing states like North Carolina, Nevada, Pennsylvania, and Virginia. The Trump campaign argues that these activities represent “blatant foreign interference” and calls for an investigation.

However, according to U.S. campaign finance laws, foreign nationals are allowed to volunteer for U.S. campaigns if they do not receive compensation, which complicates the argument that these actions violate legal boundaries. Keir Starmer, the UK Prime Minister and leader of the Labour Party, has stated that these volunteers are acting in their personal capacity during their spare time and that their activities are not officially organized or funded by the Labour Party.

The controversy has sparked tensions between Trump’s campaign and one of America’s closest allies, but Starmer has emphasized his intention to maintain a good relationship with Trump regardless of the allegations.

— U.S. intel warns of Russian, Iranian efforts to incite unrest after presidential election. Recent reports from U.S. intelligence officials indicate that Russia and Iran may attempt to incite violence or disruptive protests in the United States following the upcoming presidential election. This warning comes from a declassified memo released by the Office of the Director of National Intelligence, which highlights concerns about foreign interference aiming to exacerbate societal divisions, cast doubt on election results, and complicate the transition of presidential power.

Both Russia and Iran are believed to be engaging in strategies that could involve covertly organizing protests or encouraging participation in existing ones. These efforts are primarily conducted through online channels, such as social media, to spread disinformation and propaganda that could incite violence. The memo references previous attempts by Russian military intelligence to recruit an American citizen to organize protests, illustrating a pattern of such activities. Similarly, Iran has been accused of supporting protests against U.S. policies, particularly those related to its support for Israel.

The primary aim of these foreign actors is to deepen divisions within U.S. society and undermine trust in the democratic process. By doing so, they hope to influence the election’s outcome and weaken civic unity. Russia, for instance, is seen as favoring former President Donald Trump due to his past favorable stance towards Russian President Vladimir Putin.

Intelligence officials have noted that Russia might respond more aggressively if Vice President Kamala Harris wins the election. This is part of a broader strategy to disrupt the political landscape in the U.S., leveraging increased polarization and distrust among the populace.

| OTHER ITEMS OF NOTE |

— EPA has banned the herbicide Dacthal, also known as DCPA, due to its significant health risks, particularly to unborn babies. This decision marks the first time in nearly 40 years that the EPA has used its emergency powers to halt the use of a pesticide. It is primarily applied to vegetables such as broccoli, brussels sprouts, cabbage, onions, cilantro, kale and mustard greens. Additionally, DCPA has been found on other crops like collard greens and green onions.

The primary concern leading to the ban was the herbicide’s potential to harm fetal development. Studies indicated that exposure to DCPA could disrupt fetal thyroid hormone levels, resulting in severe long-term effects such as:

• Low birth weight

• Impaired brain development

• Reduced IQ

• Decreased motor skills

These effects are potentially irreversible and could pose lifelong challenges for children exposed in utero.

EPA said its decision was driven by robust scientific evidence showing thyroid toxicity linked to DCPA. The agency highlighted that even with protective measures, exposure levels could be unsafe for pregnant women and their unborn children. The chemical was found to persist in treated fields at harmful levels for more than 25 days after application.

EPA had been in discussions with AMVAC Chemical Corporation, the sole manufacturer of DCPA, for over a decade, requesting comprehensive health impact data. However, the data provided by AMVAC was deemed insufficient until a critical thyroid study was submitted in August 2022. Despite this, EPA determined that immediate action was necessary to protect public health.

Following the emergency suspension of DCPA, AMVAC announced its intention to voluntarily cancel all remaining pesticide products containing DCPA. This decision was seen as a significant step towards safeguarding public health and preventing further exposure risks.

— The Svalbard Global Seed Vault, often referred to as the “Doomsday” seed vault, recently received a significant addition of 30,000 new seed samples. This marks the largest influx of deposits since the vault’s inception in 2008. The new deposits came from 21 countries, including first-time contributions from Bolivia and Chad, as well as seeds from the occupied Palestinian territories.

Located on the Norwegian island of Spitsbergen in the Svalbard archipelago, the vault serves as a secure backup facility for the world’s crop diversity. It is designed to protect against the loss of seeds due to various threats such as mismanagement, natural disasters, and conflicts. The facility is opened only two or three times a year to minimize exposure to the stored seeds.

The vault has played a crucial role in preserving agricultural biodiversity. For instance, between 2015 and 2019, seeds were withdrawn to help rebuild collections during the Syrian war. As of May 2024, the vault houses over 1.3 million seed varieties and has the capacity to store up to 4.5 million varieties or approximately 2.5 billion seeds.

The Svalbard Global Seed Vault is managed through a collaboration between the Norwegian government, the Crop Trust, and the Nordic Genetic Resource Center (NordGen). It acts as a global insurance policy for food security by safeguarding genetic material that could be vital for developing new crop strains resilient to future challenges like climate change.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |