News/Markets/Policy Updates: Jan. 8, 2025

Modified report today as I am en route to Nashville for a speech to GreenPoint Ag.

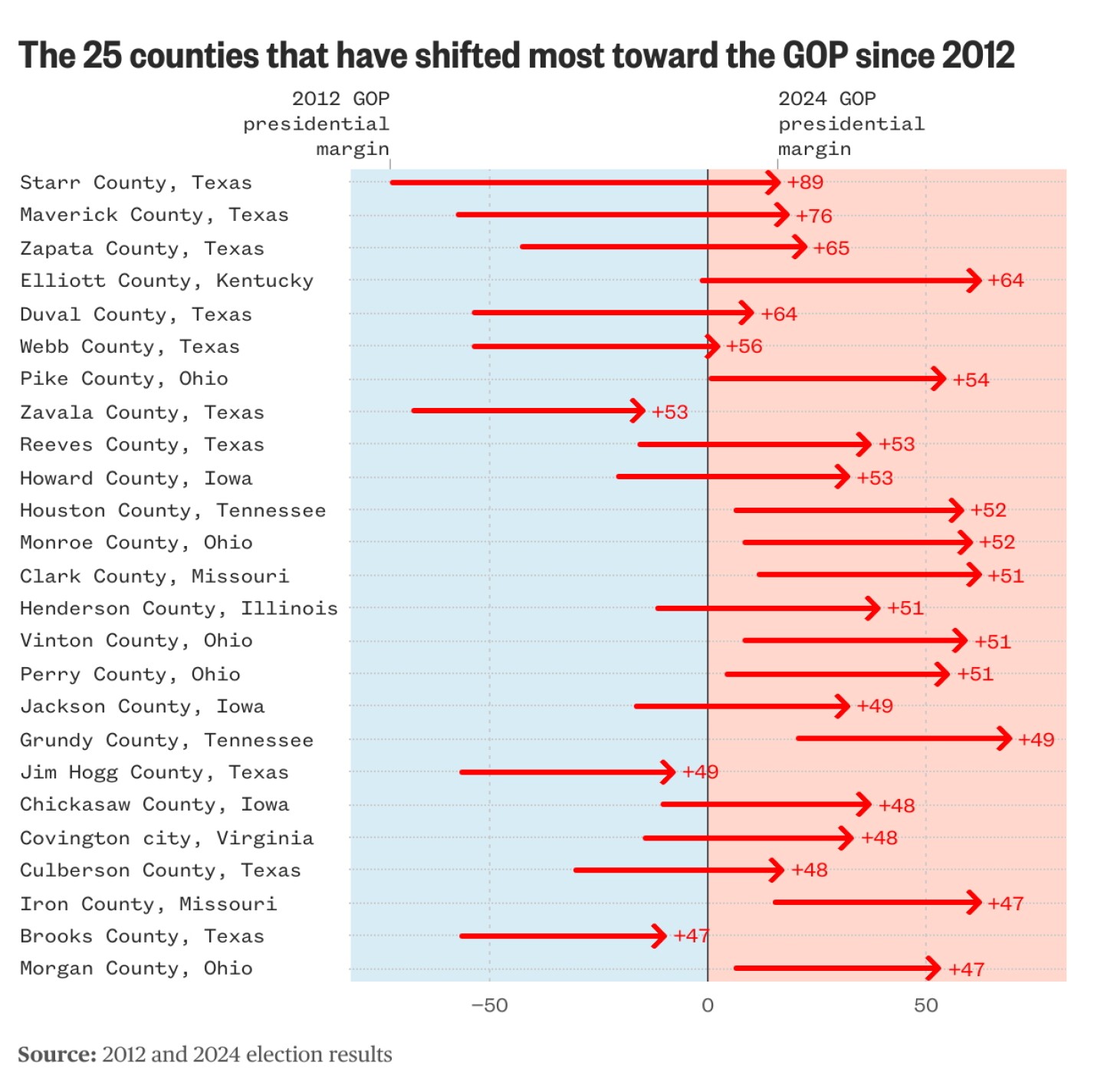

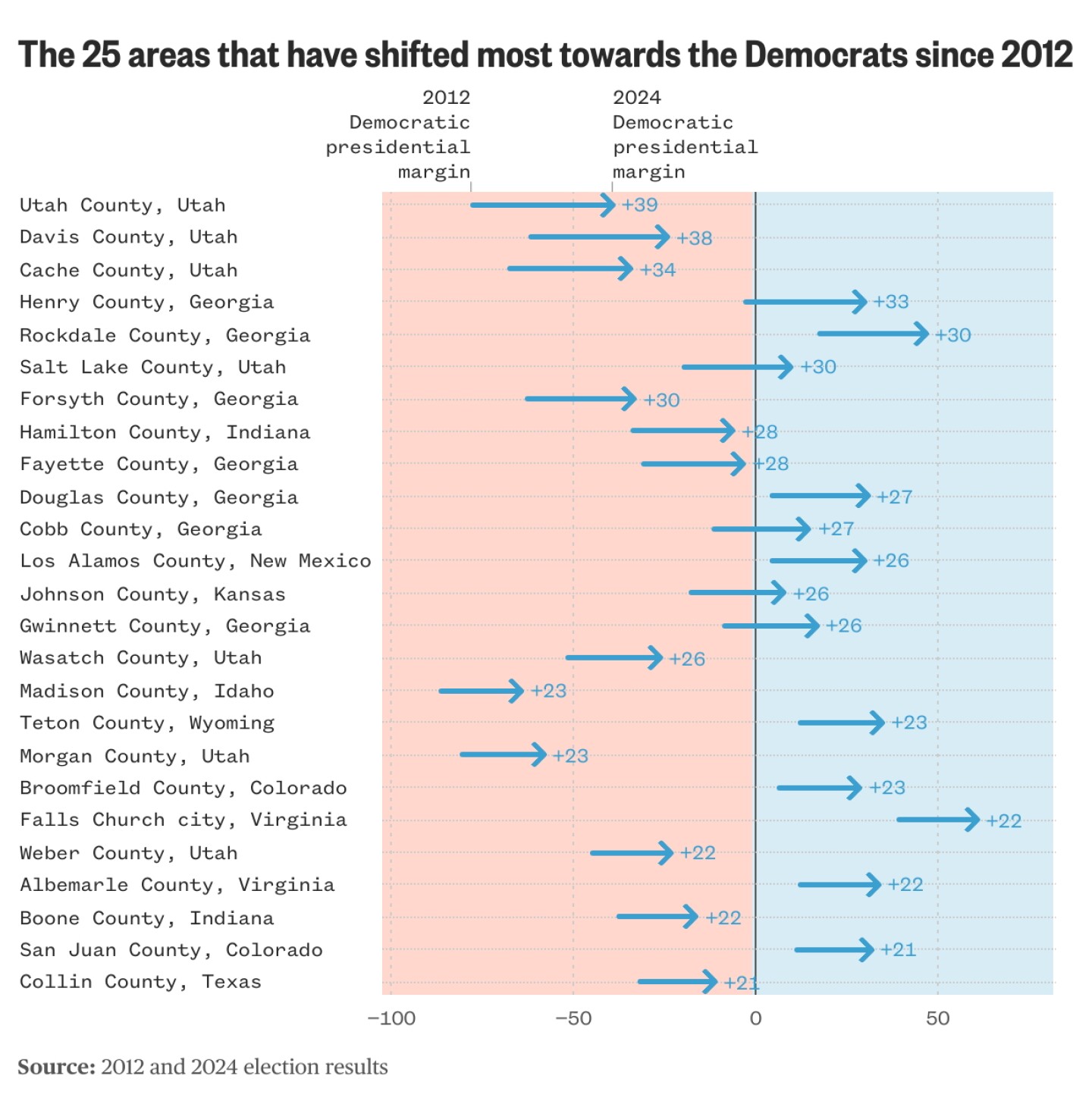

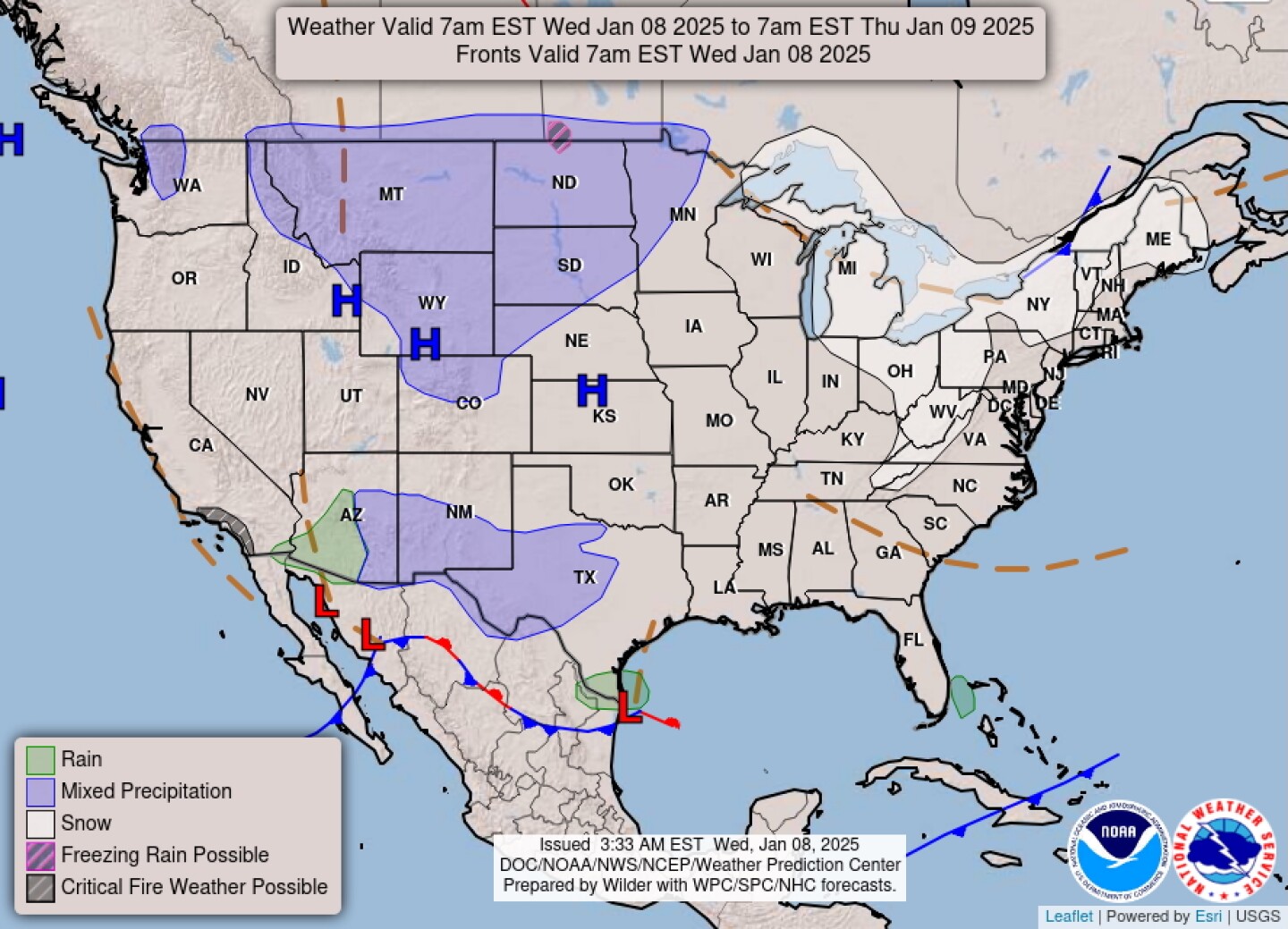

— Equities on Tuesday. U.S. stock indices finished the session lower. The Dow fell 178.20 points, 0.42%, at 42,528.36. The Nasdaq was down 375.30 points, 1.89%, at 19,489.68. The S&P 500 lost 66.35 points, 1.11%, at 5,908.03. Cal-Maine Foods reports record-breaking Q2 Fiscal 2025. Key drivers of success This remarkable performance mirrors rising egg prices nationwide, influenced heavily by avian flu’s ongoing impact on supply and pricing dynamics. — Dollar strengthens on robust U.S. economic data. The U.S. dollar gained momentum after strong economic indicators reinforced expectations that the Federal Reserve will take a cautious approach to cutting interest rates. November job openings hit a six-month high, while the ISM services index for December exceeded forecasts, highlighting a sharp rise in input prices. These developments reduced market expectations of a March rate cut. The Fed’s December meeting minutes out today, which signaled a slower pace of rate cuts, could further bolster the dollar. — Bond market outlook: Rising yields and heightened concerns. The bond market is facing significant headwinds as analysts highlight several factors shaping an increasingly volatile environment: Upshot: These intertwined challenges suggest a turbulent road ahead for the bond market in 2025, prompting caution among analysts and investors alike. — Oil prices edge higher on supply concerns and demand uptick. Oil prices rose during the early Asian trading session, driven by expectations of tightening supply from Russia and Iran due to Western sanctions. Some note increased demand for Middle Eastern oil, reflected in Saudi Arabia’s recent price hike for Asia — the first in three months. WTI crude futures rose 0.6% to $74.67 per barrel, while Brent crude futures climbed 0.4% to $77.35 per barrel. Oil futures on Tuesday settled at their highest level since October. — Sources: Mexican border is expected to open for feeder cattle the week of January 20.Imports will be slow at first to provide time to implement and test new protocols. Live animal movements are expected to resume fully sometime after the initial reopening. Link to our special report on Tuesday. — USDA expands livestock import restrictions amid screwworm threat. USDA intensified its livestock import restrictions due to the growing presence of New World Screwworm (NWS) in Central America. Following a confirmed case in Belize on Dec. 26, 2024, the USDA’s Animal and Plant Health Inspection Service (APHIS) suspended livestock imports from the country. This marks the latest measure in a broader regional response to the resurgence of NWS, which has affected several Central American nations since 2023, including Panama, Costa Rica, Nicaragua, Honduras, Guatemala, and Mexico. · Belize restrictions: Livestock imports from Belize are suspended. Exceptions include dogs with health certificates and horses meeting strict treatment and quarantine conditions. NWS larvae infest open wounds, feeding on living tissue and posing severe risks to livestock, wildlife, and humans. USDA is maintaining heightened biosecurity measures to prevent the reintroduction of this pest, eradicated in the U.S. in 1966, while educating stakeholders about detection and prevention strategies. — Grassley criticizes EPA’s UCO import verification process. Sen. Chuck Grassley (R-Iowa) intensified his criticism of the Environmental Protection Agency (EPA) over its method for verifying used cooking oil (UCO) imports. With a record 3.2 billion pounds of UCO imported through August 2024 — enough to displace 270 million bushels of soybeans — concerns are mounting about the impact on American farmers, the renewable fuel industry, and broader trade and environmental issues. Key concerns Grassley stated: “The EPA shouldn’t resort to blind faith when determining the validity of foreign feedstocks, especially when 40% of the supplies come from China.” The issue also raises concerns about trade relations with China, potential links to deforestation if mislabeled palm oil is involved, and the stability of the domestic agricultural market. Grassley and other senators are demanding a more robust and transparent verification process to ensure the integrity of the RFS and safeguard American interests. — John Deere unveils advanced autonomous equipment at CES 2025. John Deere has showcased its latest autonomous technology lineup at CES 2025, focusing on addressing labor shortages in agriculture, construction, and landscaping. Building on its 2022 innovations, the company unveiled a second-generation autonomy kit featuring cutting-edge AI, computer vision, and cameras. New autonomous offerings Advanced technology and management. John Deere’s equipment integrates its second-generation autonomy kit powered by Nvidia GPUs, AI, and 16 cameras for full environmental awareness. Machines are managed via the John Deere Operations Center Mobile app, allowing users to start equipment remotely, monitor live video, and receive maintenance alerts. Tackling labor shortages. By addressing critical workforce gaps — 2.4 million unfilled farm jobs, 88% of contractors struggling to find skilled labor, and 86% of landscapers facing hiring challenges — John Deere says it is positioning itself as a leader in automation for traditionally labor-intensive industries. — Confirmations: Rollins and Kennedy meet key senators. USDA nominee Brooke Rollins will continue her Capitol Hill rounds today, meeting with Republican Sens. Mitch McConnell (Ky.), Jerry Moran (Kan.), Susan Collins (Maine), and Cynthia Lummis (Wyo.), as well as Democratic Senators Tina Smith (Minn.) and Elissa Slotkin (Mich.). Having already met nearly 20 senators in December, Rollins is preparing for her Senate Ag Committee confirmation hearing on Jan. 15, just days before Trump’s inauguration. With bipartisan support, including a firm endorsement from Sen. John Fetterman (D-Pa.), Rollins is expected to clear the Senate easily. Kennedy’s rounds: Sen. Chuck Grassley (R-Iowa), a key agricultural advocate, will meet HHS secretary nominee Robert F. Kennedy Jr. on Thursday to discuss concerns over Kennedy’s stance on pesticides and GMOs. While these issues fall outside HHS jurisdiction, Grassley expects them to influence Kennedy’s broader policy approach. Kennedy is also courting Senate Democrats this week to solidify support for his nomination. — China expands trade-in program to spur domestic spending amid export challenges. China is expanding its consumer goods trade-in program to include more products in 2025, aiming to boost domestic consumption as external uncertainties weigh on exports. The National Development and Reform Commission announced new state subsidies covering microwave ovens, water purifiers, dishwashers, rice cookers, and select electronics like mobile phones, tablets, and smartwatches. Subsidies will cover 15% of eligible product costs under 6,000 yuan (about $819), with a yearly cap of 1,500 yuan per person. The initiative aligns with Beijing’s December pledge to prioritize consumption recovery. However, markets reacted tepidly, with Chinese and Hong Kong indexes declining. Economic pressures, including potential U.S. tariff hikes and sluggish consumer confidence, remain significant hurdles. While China has reduced its dependence on exports, economists warn of broader risks if other countries follow suit with trade restrictions. Domestic demand recovery appears uncertain without larger-scale stimulus measures. Officials are expected to outline more fiscal support at the annual legislative session in March, possibly including increased government borrowing to fund discounted business loans and consumer subsidies. Of note: China’s currency hit a 16-month low on Trump tariff fears. — Brazil’s beef market: Key trends for 2025. Brazil’s beef industry is poised for significant expansion in 2025, driven by a 30.4% export surge in 2024, according to the National Agriculture and Livestock Confederation (CNA). With R$13 billion (approximately $2.10 billion) in revenue last year, the sector aims to further capture Asian markets, including Japan, Vietnam, Turkey, and South Korea, which account for 30% of global beef consumption. Key trade agreements with these countries are in advanced stages, though some hurdles remain, particularly with South Korea. Domestically, the industry will benefit from newly enacted tax reforms, exempting beef from taxes under Brazil’s staple food basket program. This reform aligns with President Lula’s campaign promise to lower beef prices, ensuring greater accessibility for Brazilian consumers, who account for 75% of the country’s beef consumption. Forecast: With robust infrastructure, favorable livestock cycles, and strategic reforms, Brazil’s beef market is set to achieve a projected 6.2% growth in 2025, reaching R$453.3 billion ($74.62 billion) in production. — Trump is preparing to invite the entire Senate Republican conference to Mar-a-Lago for a celebratory “mega-MAGA party” in the coming weeks, according to Axios, citing sources familiar with the plans. Trump views his victory as historic and aims to honor the senators who supported him while fostering trust and camaraderie to advance his ambitious legislative agenda. “Mar-a-Lago is special to the president. He’s at ease there. Everyone is,” a Trump adviser shared. “It’s team bonding. Trump is very much the player-coach.” Though final details remain unsettled, the party is expected to take place before Trump’s inauguration, serving as a lighter follow-up to his upcoming policy meeting with GOP senators this evening. This week, Trump is also hosting governors and various House groups at Mar-a-Lago, including the Freedom Caucus, committee chairs, and lawmakers from high-tax states. Politico was the first to report the meeting with governors. — Speaker Johnson urges House Republicans to engage early in reconciliation talks. Speaker Mike Johnson (R-La.) pressed House Republicans on Tuesday to engage early in reconciliation discussions, emphasizing the importance of voicing concerns promptly to shape the final package. Johnson advocates for one large reconciliation package, potentially giving Republicans a singular opportunity to advance their priorities but leaving little room for error. Johnson revealed plans to tie the debt limit to the reconciliation package, avoiding a standalone vote and sidestepping reliance on Democrats. However, Johnson acknowledged internal GOP disagreements on handling the debt limit, signaling tough negotiations ahead. Meanwhile, President-elect Donald Trump on Tuesday said he is pushing to raise the debt ceiling to avoid default, not to spend more. “Debt ceiling is not about raising a lot of money,” Trump said at a news conference. Trump noted he is fine with spending cuts. Johnson emphasized the need for fiscal responsibility while reassuring that entitlement programs like Social Security and Medicare would not face benefit cuts. “The Republican Party is not going to cut benefits,” Johnson stated, while highlighting the broader mission to curb government spending and restore fiscal stability. — Trump proposes economic pressure to make Canada the 51st state. President-elect Donald Trump has amplified his controversial remarks about integrating Canada into the United States, suggesting the use of “economic force” during a press conference at Mar-a-Lago. Trump proposed imposing “substantial” tariffs on Canadian goods, claiming the move would enhance national security and eliminate what he called an “artificially drawn line” between the two countries. Trump argued that the U.S. “subsidizes” Canada, referencing a disputed $200 billion figure tied to trade imbalances. He criticized reliance on Canadian products, including timber and dairy, advocating instead for ramping up domestic production of goods like lumber and cars. Canadian Prime Minister Justin Trudeau said on X: “There isn’t a snowball’s chance in hell that Canada would become part of the United States.” Conservative leader Pierre Poilievre, a frontrunner in Canada’s upcoming election, rejected the notion of statehood outright. Trump dismissed Poilievre’s remarks, stating, “I don’t care what he says.” The Canadian dollar has dipped against the U.S. dollar amid these tensions, reflecting market unease over the economic fallout of Trump’s tariff threats. — Trump proposes renaming Gulf of Mexico to “Gulf of America.” On Tuesday, Jan. 7, President-elect Donald Trump announced his intention to rename the Gulf of Mexico to the “Gulf of America” during a press conference at Mar-a-Lago. Trump described the proposed name change as “appropriate” and reflective of the U.S. role in the region, claiming, “We do most of the work there, and it’s ours.” The announcement aligned with a broader critique of the Biden administration’s policies, including offshore drilling regulations. Trump also addressed Mexico’s immigration policies, threatened tariffs on Mexico and Canada, and reiterated past aspirations for U.S. territorial expansion, referencing Greenland and the Panama Cana (see related item). Renaming an international body of water, however, would require consensus among bordering nations, including Mexico and Cuba, making unilateral action by the U.S. improbable. The proposal underscores Trump’s push for assertive rebranding of U.S. influence in the region. — Trump hints at potential military moves for Greenland and Panama Canal. President-elect Donald Trump has refused to rule out using military force to acquire Greenland and the Panama Canal, citing their importance to American economic and national security. When a reporter pressed Trump to rule out economic or military coercion to gain control of Greenland and the Panama Canal, Trump said, “I’m not gonna commit to that. No. It might be that you’ll have to do something.” He added: “We need Greenland for national security purposes.” Trump has long expressed interest in purchasing Greenland, a Danish territory, describing it as “absolutely necessary” for U.S. security. He also raised concerns over the Panama Canal, claiming its current operation by Chinese interests undermines American control of a critical trade route. Trump took aim at Denmark, threatening the country with high tariffs as part of his push to bring Greenland under U.S. control. Danish Prime Minister Mette Frederiksen and Panamanian President José Raúl Mulino rebuffed Trump’s remarks, emphasizing their nations’ sovereignty. Greenland, which became self-ruling in 1979, remains staunchly opposed to any sale. Similarly, Mulino declared Panama’s control of the canal “non-negotiable.” Of note: The king of Denmark has changed the royal coat of arms for the first time in more than 500 years to more prominently feature Greenland. Bottom line: As global competition intensifies in the Arctic and strategic maritime zones, Trump’s comments signal a potential shift in U.S. foreign policy priorities. — Why Trump wants Greenland: Strategic resources and geopolitical ambitions. President-elect Donald Trump’s renewed interest in Greenland reflects its growing strategic importance. Beyond its symbolic value, the world’s largest island offers critical rare earth minerals essential for defense, electronics, and renewable energy. These resources, coupled with Greenland’s Arctic location, present the U.S. an opportunity to counter China’s dominance in rare earth supplies and assert a stronger presence in a region increasingly accessible due to climate change. Trump’s stance underscores U.S. strategic priorities in the Arctic, including military readiness, resource security, and diminishing reliance on Beijing. Though the idea of acquiring Greenland isn’t new — dating back to U.S. attempts in 1867 and 1946 — Trump’s bold approach reignites debates over Arctic sovereignty, environmental challenges, and international diplomacy. — Axios: Senate Dems delay Gabbard’s confirmation hearing. Senate Democrats are postponing Tulsi Gabbard’s confirmation hearing as President-elect Donald Trump’s nominee for Director of National Intelligence, citing incomplete vetting materials. Republicans accuse them of politicizing the process, Axios first reported. Democratic concerns: Senate Intelligence Committee Vice Chair Sen. Mark Warner (D-Va.) states Gabbard’s FBI background check, ethics disclosure, and pre-hearing questionnaire are overdue. Committee rules require these materials at least a week before a hearing. Republican pushback: Republicans argue Gabbard’s active security clearance and recent submissions should expedite the process. Intel Committee Chair Tom Cotton (R-Ark.) aims to hold hearings before Inauguration Day. Upshot: The delay highlights growing partisan conflict over Trump’s cabinet nominees, with accusations of political gamesmanship. — House passes “Laken Riley Act” with bipartisan support; next stop is Senate. The House approved the “Laken Riley Act” on Tuesday in a 264-159 bipartisan vote, with 48 Democrats joining 216 Republicans in favor. The Senate is set to consider the legislation later this week. The bill grants law enforcement increased authority to detain illegal immigrants accused of theft-related crimes. It is named after Georgia nursing student Laken Riley, who was tragically murdered earlier this year by Jose Ibarra, an illegal immigrant now serving a life sentence without parole. Sponsored by Rep. Mike Collins (R-Ga.), the bill reflects his commitment to Riley’s family. “I promised Laken’s family that I would fight for this bill like she fought for her life,” Collins wrote on X before the vote. — Trump targets wind power in second term plans. President-elect Donald Trump announced plans to block the construction of wind farms during his second term, potentially jeopardizing billions of dollars in renewable energy projects. Speaking at Mar-a-Lago, Trump criticized wind power as costly, environmentally harmful, and unpopular, specifically referencing a 200-turbine project off New Jersey’s coast. Trump’s proposed executive actions could impact major developers such as EDF Renewables, Shell PLC, Orsted AS, and others, intensifying challenges already faced by the U.S. wind industry amid rising costs and supply chain disruptions. — Trump criticizes transition process as reports highlight contrasting views. President-elect Donald Trump has expressed dissatisfaction with the transition process, accusing the Biden administration of undermining his incoming administration with last-minute policy actions. Trump’s comments, made at Mar-a-Lago, highlighted issues such as offshore drilling bans and accelerated spending on climate initiatives. However, contrasting reports, including statements from Trump’s incoming Chief of Staff Susie Wiles, describe the Biden administration as cooperative and professional. Transition experts and officials emphasize the normalcy of an outgoing president pursuing their agenda until their term ends, framing Biden’s actions as typical rather than obstructive. The delays in Trump’s transition agreements and vetting of key staff have added to challenges, with Senate leaders awaiting necessary background checks for confirmation processes. Trump has signaled a focus on fiscal responsibility and federal workforce accountability as key priorities for his administration. — Japan prepares for Xi Jinping’s potential state visit; Tokyo to invite Chinese Foreign Minister Wang Yi for February meeting. The Japanese government is working to pave the way for a state visit by Chinese President Xi Jinping by inviting Chinese Foreign Minister Wang Yi to Japan next month. This move follows previous visits to Beijing by Japanese Foreign Minister Takeshi Iwaya and national security adviser Takeo Akiba. Japan aims to improve strained relations with China, particularly over disputes in the East and South China Seas. Officials see Xi’s visit as essential to fostering dialogue and stability in East Asia amid geopolitical challenges, including U.S. policy uncertainties under President-elect Donald Trump and regional tensions over Taiwan. The proposed visit, postponed since 2020 due to Covid-19, would include high-level meetings and a banquet at the Imperial Palace. However, unresolved issues — such as military provocations and detentions of Japanese nationals in China — remain points of concern for Japanese officials. — FOMC minutes. The Federal Open Market Committee (FOMC) today releases the minutes from its mid-December monetary-policy meeting. The FOMC cut the federal-funds rate at that meeting by a quarter of a percentage point, to 4.25%-4.5%. — Parts of the U.S.that have seen the biggest political shifts during the Trump era, according to NBC News: — NWS weather: Moderate to heavy lake-effect snow downwind from the Great Lakes on Wednesday... ...A developing Winter Storm will produce snow and rain/freezing rain, icing, over parts of the Southern Plains and Lower Mississippi Valley late Wednesday night into Thursday... ...Light to moderate snow over parts of the Northern Rockies/Northern Plains and Southern Rockies/Southern High Plains on Wednesday: Light snow over parts of the Upper Midwest on Thursday... ...There is a Critical Risk of fire weather over parts of Southern California on Wednesday. KEY DATES IN JANUARY 8: First Social Security benefit checks of the year; cost of living adjustment is 2.5%. |