News/Markets/Policy Updates: Dec. 31, 2024

— U.S. stock markets will close Jan. 9, in observance of a National Day of Mourning for former President Jimmy Carter. Cboe Global Markets also said its equities exchanges would be closed for trading during all sessions next Thursday, while its options and futures exchanges would be closed during regular trading hours. Its digital exchange will operate as normal. CME Group will alter its hours, with its agricultural and interest-rate markets closing at 12:15 p.m. CT next Thursday. Its BrokerTec U.S. Repo and Treasury products will have an early close of 2:30 p.m. CT and 1:30 p.m. CT, respectively, while its cryptocurrency, energy, foreign-exchange and metals markets will operate with normal trading hours. — Equities today: Asian and European stock indexes were mixed overnight. In Asia, Japan closed. Hong Kong +0.1%. China -1.6%. India -0.1%. In Europe, at midday, London +0.7%. Paris +0.7%. Frankfurt closed. U.S. stock indexes are pointed toward firmer openings. With one trading session to go, all three averages are well ahead on the year, with the Dow up 13%, the S&P 500 up 24% and the Nasdaq Composite up 30%. The S&P 500 is on pace for its best two-year gain since 1998. Stocks will trade for a full, normal session through 4:00 p.m. ET but the bond market closes early today (2:00 p.m. ET). Equities yesterday: Major U.S. stock indexes declined. The Dow closed at 42,573.73, down 418.48 points, 0.97%. The S&P 500 ended at 5,906.94, down 63.90 points, 1.07%. The Nasdaq closed at 19,486.78, down 235.25 points, 1.2%. — ADM faces shareholder pressure amid accounting scandal fallout. Archer-Daniels-Midland Co. (ADM) is under intensified scrutiny as a shareholder and former executive, Hartwig Fuchs, calls for CEO Juan Luciano’s resignation. This follows a year-long probe into ADM’s accounting practices, which has erased $12 billion in market value. Fuchs criticized the lack of transparency and failure to restore investor confidence, stating, “If a highly paid CEO... cannot manage to provide clarity... then he has to go.” ADM has faced setbacks, including share declines, further accounting errors, and canceled earnings calls, culminating in a 30% stock drop this year. Despite efforts to restore credibility through leadership changes and financial corrections, the company remains mired in challenges, reminiscent of its price-fixing scandal in the 1990s. — Boeing faces turbulence amid crises. Boeing’s stock plunged Monday after a 737-800 crash in South Korea killed 179 people. South Korean authorities ordered safety inspections for all domestic 737-800s as investigators probe the disaster. The jet model accounts for 17% of the global commercial fleet, underscoring Boeing’s critical role in air travel. The crash adds to a challenging year for the U.S. aerospace giant, which has faced regulatory scrutiny after a mid-flight door panel failure in January, CEO resignation, a failed space mission, worker strikes, and third-quarter losses exceeding $6 billion. — Brazil’s real plummets amid fiscal woes, central bank steps in; the real loses 22% in 2024, the worst among major currencies. Brazil’s central bank made another intervention on the final trading day of the year to stabilize the real, which has plunged nearly 22% against the U.S. dollar in 2024 — the worst performance among 31 major currencies tracked by Bloomberg. Despite spending $20 billion in reserves this month, including $1.8 billion in spot sales on Monday, the currency remains under pressure, reflecting investor skepticism over President Luiz Inácio Lula da Silva’s ability to address Brazil’s ballooning budget deficit, now at 10% of GDP. The selloff has spread across markets, with bond yields hitting their highest levels since 2016 and the Ibovespa ranking among the worst-performing equity indexes globally. Analysts caution that without meaningful fiscal reforms, the real may weaken further, with projections of a 13% drop by early 2026. — U.S. manufacturing sector in contraction mode. The U.S. manufacturing sector continues to face challenges, with key indices reflecting a sixth consecutive month of contraction as of December 2024. Key indicators: · S&P Global U.S. Manufacturing PMI: Dropped to 48.3 in December, down from 49.7 in November. Contributing factors Outlook: While manufacturers are optimistic about future recovery tied to new product launches and sector growth in semiconductors and automobiles, concerns over demand weakness and higher costs persist. The ISM Manufacturing PMI is projected to return to growth territory by March 2025, though uncertainties, including potential tariff threats, weigh on the outlook. The sector’s current state underscores a continued period of contraction despite hints of eventual stabilization. — Oil and gas prices rise on colder weather forecasts. Oil prices edged higher on Monday amid thin year-end trading, fueled by colder weather forecasts in the U.S. and Europe, which are expected to drive up diesel demand. A report by The Weather Co. and Atmospheric G2 that said January could be colder than usual on the East Coast and around the Great Lakes. Brent crude futures settled at $74.39 a barrel, up 0.3%, while U.S. West Texas Intermediate (WTI) crude climbed 0.6% to $70.99 a barrel. U.S. ultra-low sulfur diesel futures surged 2.5% to $2.30 per gallon, the highest since early November. Natural gas futures spiked 17%, reaching their highest levels since January 2023, supported by cold weather predictions and growing export demand. Declining U.S. crude stockpiles, projected to have dropped by 3 million barrels last week, also boosted prices. Both Brent and WTI gained 1.4% last week as refiners increased activity to meet holiday fuel demand. — European energy security at risk: Gas transit deal nears expiration. As the expiration of a crucial gas transit agreement between Russia and Ukraine approaches, European natural gas prices are climbing amid supply concerns and geopolitical uncertainty. Price surge: Anticipation of disrupted gas flows has pushed European gas prices for February delivery up by 2.2%. Political deadlock: Ukrainian President Zelenskyy opposes any renewal of the deal, while Russian President Putin has dismissed the possibility of a timely agreement. Energy security risks: Austria, Hungary, and Slovakia are particularly vulnerable to supply disruptions. EU preparedness: The European Union claims it can manage without Ukrainian transits, citing reduced gas consumption and expanded LNG options. Exploration of alternatives: Countries like Slovakia are actively pursuing solutions to secure Russian gas post-expiration, albeit amid criticism over potential indirect support for Russia.

— Treasury confirms hack by China-backed actor. The U.S. Treasury Department reported a cyberattack by a China-backed actor, targeting employee workstations and unclassified documents via a compromised third-party service, BeyondTrust. Officials assured lawmakers that there is no evidence of continued access to Treasury systems. The breach, disclosed in a Senate Banking Committee letter, prompted immediate collaboration with Cybersecurity and Infrastructure Security Agency, which is a part of the Department of Homeland Security (DHS), and law enforcement to assess the impact. Treasury emphasized its strengthened cyber defenses and ongoing efforts to safeguard the financial system against such threats. The letter addressed to leaders on the Senate Banking Committee says that on Dec. 8 BeyondTrust, a provider of cloud security services, alerted Treasury to a breach where hackers had obtained a key used to secure a cloud-based service for remotely supporting Treasury Departmental Offices users. Using the stolen key, the attacker bypassed the service’s security, remotely accessed Treasury workstations and retrieved certain unclassified documents stored by those users. “The compromised BeyondTrust service has been taken offline and there is no evidence indicating the threat actor has continued access to Treasury systems or information,” the agency said in a statement. China responds: Beijing says claims a Chinese state-sponsored actor was behind the cyber-security breach are “groundless” and “lack evidence.” Bottom line: Intrusions of this kind are considered “major cybersecurity incidents,” according to Treasury policy, and the agency said it would share more details in a supplemental report to be made available in 30 days. — North Korean hackers set record with $1.3 billion cryptocurrency theft in 2024. North Korean hackers stole a record $1.3 billion in cryptocurrency in 2024, accounting for more than half of the estimated $2.2 billion stolen globally from crypto platforms this year. According to a blockchain analysis company, just 47 attacks by North Korean groups were responsible for this massive theft. Earlier in December, the U.S. Department of Justice indicted 12 North Koreans for alleged money laundering and fraud, accusing them of stealing $88 million while masquerading as remote IT workers for U.S. companies. Of note: For years, officials have warned that Pyongyang sponsors hacking groups to circumvent international sanctions, with cryptocurrency theft becoming a key strategy, Bloomberg reported.

— Ag markets today: Traders covered more short positions in the soybean and wheat markets overnight, while corn rebounded from Monday’s losses. As of 7:30 a.m. ET, corn futures were trading 2 cents higher, soybeans were 3 to 4 cents higher and wheat futures were 2 to 3 cents higher. The U.S. dollar index was modestly weaker and front-month crude oil futures are mildly firmer. Cash cattle, beef fundamentals remain supportive. Cash cattle averaged $194.81 last week, up 8 cents from the previous week and the sixth straight weekly gain. Boxed beef prices jumped $2.99 for Choice to $325.37 and $3.63 for Select to $294.76 on Monday. While there’s risk of long liquidation pressure to close out the year, cash fundamentals remain supportive for futures, especially given February live cattle’s discount to the cash market and the looming winter storm. February hogs extend discount to cash index. February lean hog futures faced heavy long liquidation pressure on Monday, resulting in the contract violating support at the November low. With managed money accounts long more than 117,000 futures contracts as of Dec. 24 and yesterday’s technical breakdown, February hogs could face more year-end selling. As of yesterday’s close, February hogs held a $2.725 discount to the cash index, which is down 50 cents to $84.35 as of Dec. 27. — Ag trade: Jordan passed on a tender to buy up to 120,000 MT of feed barley and issued a tender to buy 120,000 MT of wheat. — Agriculture markets yesterday: — 2024 beef cattle market review: strong market ends the year with optimism. According to Josh Maples (Mississippi State University) and James Mitchell (University of Arkansas), cattle markets in 2024 remained robust, driven by declining cattle inventories — a trend that began in 2014 and peaked in 2019 at 31.69 million head of beef cows. Since then, annual inventory declines have averaged 2.3%, sustaining upward pressure on prices. In the Southern Plains, prices for 500–600-pound steers rose by approximately $40 per CWT between early October and mid-December. Key contributors to this surge included improved rainfall, reduced calf numbers, and import restrictions on Mexican feeder cattle during a season when imports typically peak. Fed cattle markets also ended the year strongly, with fed steer prices reaching $195 in mid-December and steer dressed weights near a historic 960 pounds. Lower corn prices have enabled longer feeding periods, though seasonal declines in weights remain likely as 2025 begins. The analysts note that as herd contraction continues, USDA data confirms a decline in cattle numbers for 2024, with beef cow slaughter down 18% year-to-date but still exceeding levels indicative of herd expansion. Similarly, heifer slaughter has shown no significant retention, signaling limited prospects for herd rebuilding. Market fundamentals remain bullish for 2025, according to the analysts, with no signs of increased calf supplies or producer-driven herd expansion despite record 2024 prices. Adjusted for inflation, revenues remain below the peak purchasing power of 2014-2015, leaving room for further price growth and optimism as the new year begins.

— FAPRI’s analysis of farmer relief payments. U.S. farmers will get $9.7 billion in market relief payments to addresses declining market prices which aims to sustain farmers until a new farm bill is enacted. According to a FAPRI analysis, key allocations and distribution led by: Texas: $965 million, benefiting its status as the largest cotton producer; Iowa: $846 million, with strong support for corn and soybean farmers; Illinois: $790 million; and Kansas: $787 million. Link to our special report for details.

— Trump endorses Johnson as speaker ahead of critical House vote. President-elect Donald Trump has offered his “complete and total endorsement” of Speaker Mike Johnson (R-La.) as the House prepares to vote on Johnson’s speakership this Friday. “Speaker Mike Johnson is a good, hardworking, religious man. He will do the right thing, and we will continue to WIN. Mike has my Complete & Total Endorsement. MAGA!” Trump declared on Truth Social. Johnson faces challenges within his party, with some GOP members, including Rep. Thomas Massie (R-Ky.), voicing opposition. Johnson’s handling of issues like the end-of-year funding package has fueled intra-party dissatisfaction, complicating his path to securing the speakership. With a slim GOP majority, Johnson can lose no more than one Republican vote, assuming full attendance and participation in the vote. Johnson responds. “The American people demand and deserve that we waste no time,” Johnson says in a post on X, thanking President-elect Donald Trump for his support to remain on the job. The House is scheduled to vote for its speaker on Jan. 3. The Wall Street Journal, in a commentary (link), said: “The vote will test whether House Republicans are serious about governing or whether they’ll descend again into political masochism.” The commentary also noted: “The trouble is a rump, blow-it-all-up GOP faction that wants to make statements more than law. They’re threatening to take down Mr. Johnson, though they don’t have an alternative. Kentucky Rep. Thomas Massie has declared that he’ll oppose Mr. Johnson, and Mr. Massie opposes just about everything. This means the Speaker has to keep everyone else on side if all Members are voting on Friday.” The WSJ concludes: “Voters expect results, and the GOP won’t be able to dodge responsibility now that they’re in charge. If Republicans can’t even elect a Speaker without a meltdown, it will bode ill for the next two years. Down that disruptive path lies Democratic Speaker Hakeem Jeffries in 2027, if not sooner, and the effective end of the second Trump Presidency.” Massie responds. “I respect and support President Trump, but his endorsement of Mike Johnson is going to work out about as well as his endorsement of Speaker Paul Ryan,” Massie wrote on X. Bottom line: To become speaker, a candidate has to win 218 votes in the House if every member is present and votes for someone. Republicans won 220 seats in November, but will hold 219 when the new Congress is sworn in Friday because Rep. Matt Gaetz (R-Fla.) resigned. In 2023, after a handful of Republican critics joined with Democrats and voted to oust Speaker Kevin McCarthy (R-Calif.), it took about three weeks to pick Johnson, during which the House conducted no official business. A similar delay could affect certifying the electoral vote on Jan. 6 or Trump’s inauguration on Jan. 20.

— USDA updates indemnity rules for poultry farms amid ongoing avian influenza outbreak. USDA’s Animal and Plant Health Inspection Service (APHIS) has introduced an interim final rule updating indemnity requirements for poultry facilities affected by Highly Pathogenic Avian Influenza (HPAI). Moving forward, farmers must pass a biosecurity audit before restocking their poultry and receiving future indemnity payments, aiming to curb the spread of HPAI through stricter biosecurity measures. The rule follows data from the 2022-2024 HPAI outbreak showing the effectiveness of strong biosecurity in preventing reinfections, which have cost over $365 million in indemnity payments for repeat cases. APHIS will also require audits for farms in buffer zones and limit indemnity for flocks introduced into active infection areas. The interim rule takes effect upon publication in the Federal Register, with public comments open until March 3, 2025.

— FDA announces uniform compliance date for food labeling regulations (2025–2026). The U.S. Food and Drug Administration (FDA) has established Jan. 1, 2028, as the uniform compliance date for food labeling regulations finalized between Jan. 1, 2025, and Dec. 31, 2026. This measure aims to streamline compliance efforts, minimizing economic disruptions for the food industry. While companies are encouraged to adopt new labeling requirements promptly, all products introduced into interstate commerce on or after Jan. 1, 2028, must adhere to these regulations. FDA may set alternate compliance dates for specific cases with unique circumstances. Link to Federal Register notice. Link to labeling & nutrition guidance documents & regulatory information.

— Suez Canal revenue plunges amid Red Sea disruptions. The Suez Canal has seen a staggering 60% drop in toll revenue this year, translating to a $7 billion loss for Egypt. The decline is attributed to attacks on shipping in the Red Sea and escalating regional tensions, President Abdel Fattah al-Sisi revealed without elaborating further. In 2023, canal tolls accounted for $9.4 billion, approximately 15% of Egypt’s foreign currency income. Meanwhile, the Suez Canal Authority announced the success of a two-way vessel transit test, part of a dredging project aimed at increasing canal capacity. This initiative could mitigate risks of future shutdowns, such as the 2021 Ever Given incident. Since late 2023, Houthi attacks on vessels in the Red Sea have forced major shipping operators to divert routes around the Horn of Africa, significantly increasing costs and boosting shipping rates. A multinational naval force has since patrolled the area, providing some security. However, the Iran-backed Houthis have shifted focus to targeting Israel amidst the Israel/Hamas conflict. Observers anticipate the resumption of Red Sea shipping services no earlier than mid-2025.

— U.S. announces $5.9 billion aid package for Ukraine in final Biden push. Key highlights: · $2.5 billion allocated for military aid, including $1.25 billion in weapons from U.S. stockpiles. Final funds under current Ukraine aid programs come as President-elect Donald Trump signals a potential shift in policy. The latest aid includes military support with air defense and artillery, alongside budgetary aid to maintain critical services amid intensifying Russian attacks. Treasury Secretary Janet Yellen emphasized the importance of economic assistance for Ukraine’s resilience, while the Pentagon highlighted concerns over U.S. readiness due to heavy reliance on stockpile withdrawals. Since Russia’s invasion of Ukraine in February 2022, the U.S. has committed substantial resources to support Ukraine: Total aid approved: Military aid: Economic and non-military aid: Breakdown by type: Defense-related priorities: $119.9 billion (66.3%) Direct aid to Ukraine’s government: $109.4 billion.

— China’s economy shows resilience amid mixed sector performance. China’s economy is closing out 2024 with signs of recovery, supported by robust growth in the services sector and steady manufacturing expansion. Here’s a breakdown of the latest economic indicators: Services sector surge. China’s services activity expanded at the fastest pace in nine months, fueled by Beijing’s stimulus measures, which have boosted local demand. Manufacturing sector performance. Manufacturing grew for the third consecutive month, though at a slower rate than anticipated. December’s PMI of 50.1 remains above the threshold for expansion. GDP growth projection. President Xi Jinping projects GDP growth of around 5% for 2024, aligning with the government’s target despite ongoing challenges. Stock market performance. Mainland stocks dipped on the year’s final trading day, with the CSI 300 Index down 0.6%, while the Hang Seng Index edged higher. Both markets are poised for annual gains of approximately 18-19%. Economic outlook and challenges. While stimulus measures have shown results, challenges like weak consumer demand, a property sector slump, and deflationary pressures persist. Beijing plans to enhance fiscal support in 2025, focusing on boosting consumption and social welfare. As the new year begins, China’s proactive economic management is expected to continue. — China approves more GM crops to boost yields, ensure food security. China approved safety certificates for 17 crop varieties, including five gene-edited crop varieties and 12 types of genetically modified (GM) soybeans, corn and cotton. The approved gene-edited crops include two soybean varieties, and one each of wheat, corn and rice. The safety certificates for the newly approved varieties are valid for five years, starting from Dec. 25, according to the ag ministry. China also authorized the import of an insect-resistant and herbicide-tolerant GM soybean variety from BASF exclusively as a processing material. — China to lower dollar, euro and yen weightings in CFETS yuan basket in 2025. China’s central bank will adjust the weightings of its yuan China Foreign Exchange Trade System (CFETS) basket in 2025, the country’s foreign exchange trade platform said. From Jan. 1, the central bank will lower the U.S. dollar’s weighting in the CFETS currency basket to 18.903% from 19.46%, cut the euro’s weighting to 17.902% from 18.08% and reduce the yen’s weighting to 8.584% from 8.963%. It will add Macau’s pataca to the basket, bringing the total number of currencies in the CFETS basket to 25 next year.

— Mexico’s new agricultural vision: Sheinbaum’s push for food sovereignty. Mexico’s President Claudia Sheinbaum has launched an ambitious agricultural plan to bolster domestic food production and enhance food sovereignty. Inspired by policies from the 1980s, the strategy emphasizes key goals, government-led initiatives, and social improvements but faces notable challenges. Agricultural production goals: Government initiatives: Challenges and criticisms: Environmental and social aspects: Bottom line: While the plan aims to address Mexico’s food security and social equity, its success hinges on overcoming market realities and adapting to economic pressures.

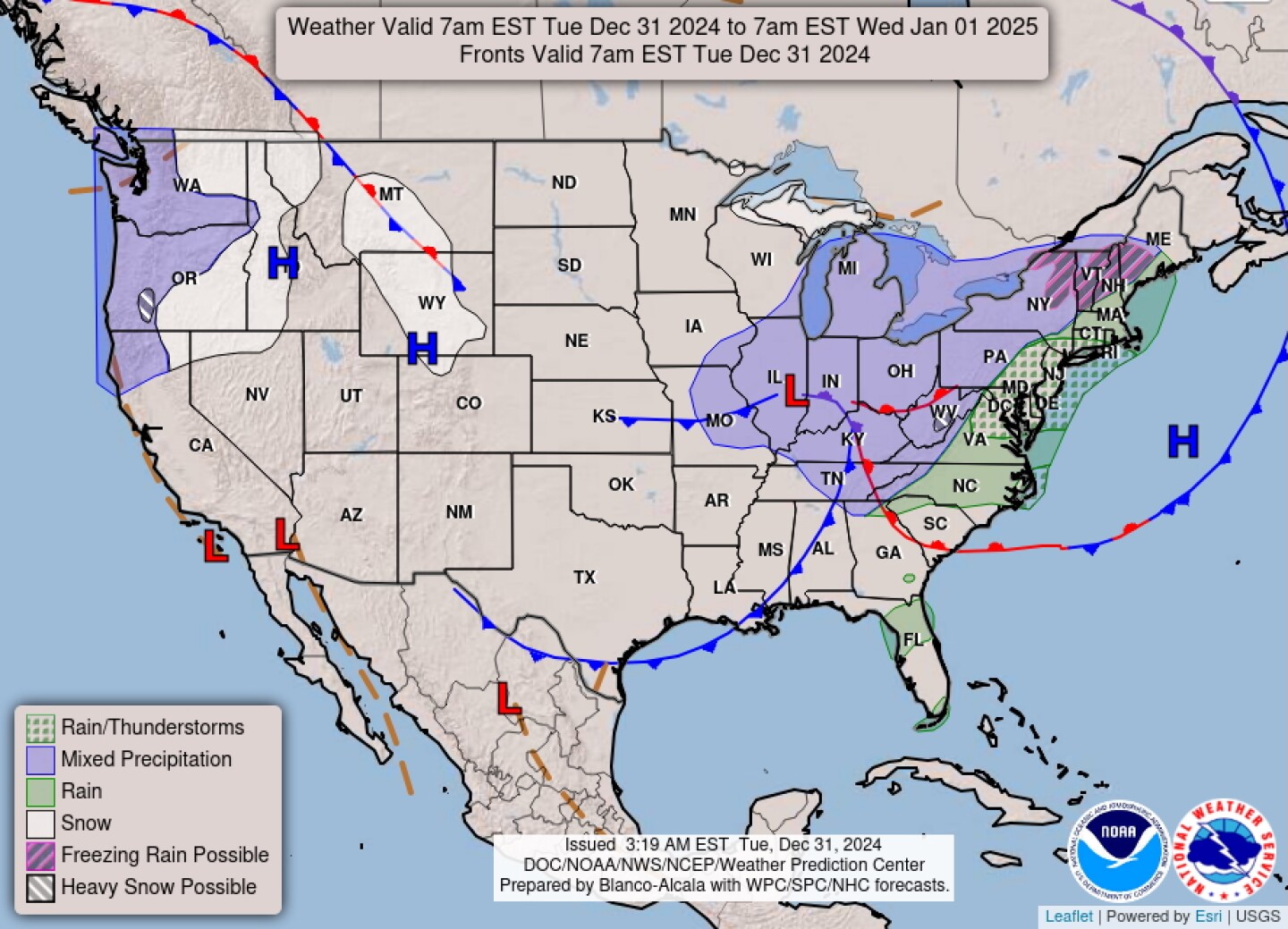

— NWS outlook: Cooling trend spreads from West to East this week.... ...Fire Weather concerns for portions of southern California and Texas

1: New Year’s Day (federal gov’t, banks, markets closed) |

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |