News/Markets/Policy Updates: Jan. 17, 2025

Other topics in today’s dispatch include: (1) China’s economy grew 5% in 2024, fueled by fourth quarter; (2) Netanyahu announces truce agreement with Hamas; (3) Houthis signal pause on Red Sea ship attacks after Gaza truce; (4) President Trump nominated four individuals for USDA posts; (5) Xi to skip Trump’s inauguration, sends Vice President Han Zheng; (6) Alexis Taylor is headed to the International Fresh Produce Association; (7) Fed official signals possible early 2025 rate cuts amid encouraging inflation data; (8) Brazilian corn exports to Egypt surged by 174% in 2024; (9) Bloomberg: South Korea may consider more U.S. ag imports in bow to Trump; (10) Argentine farmer groups ask for tax relief amid ‘critical’ situation; (11) Oil prices dip amid geopolitical and economic developments; (12) Some Republican lawmakers are furious with Speaker Mike Johnson; (13) Bird flu update; (14) Major changes approved for Federal Milk Marketing Orders (FMMOs); (15) USTR investigation sets stage for new tariffs on Chinese shipbuilding; (16) World Bank warns U.S. tariffs could reduce global growth outlook; (17) Dr. Joe Glauber: Farmers brace for a new round of trade wars; (18) China shifts food sourcing to Global South amid geopolitical shifts; and (19) China’s pork output falls for first time in four years.

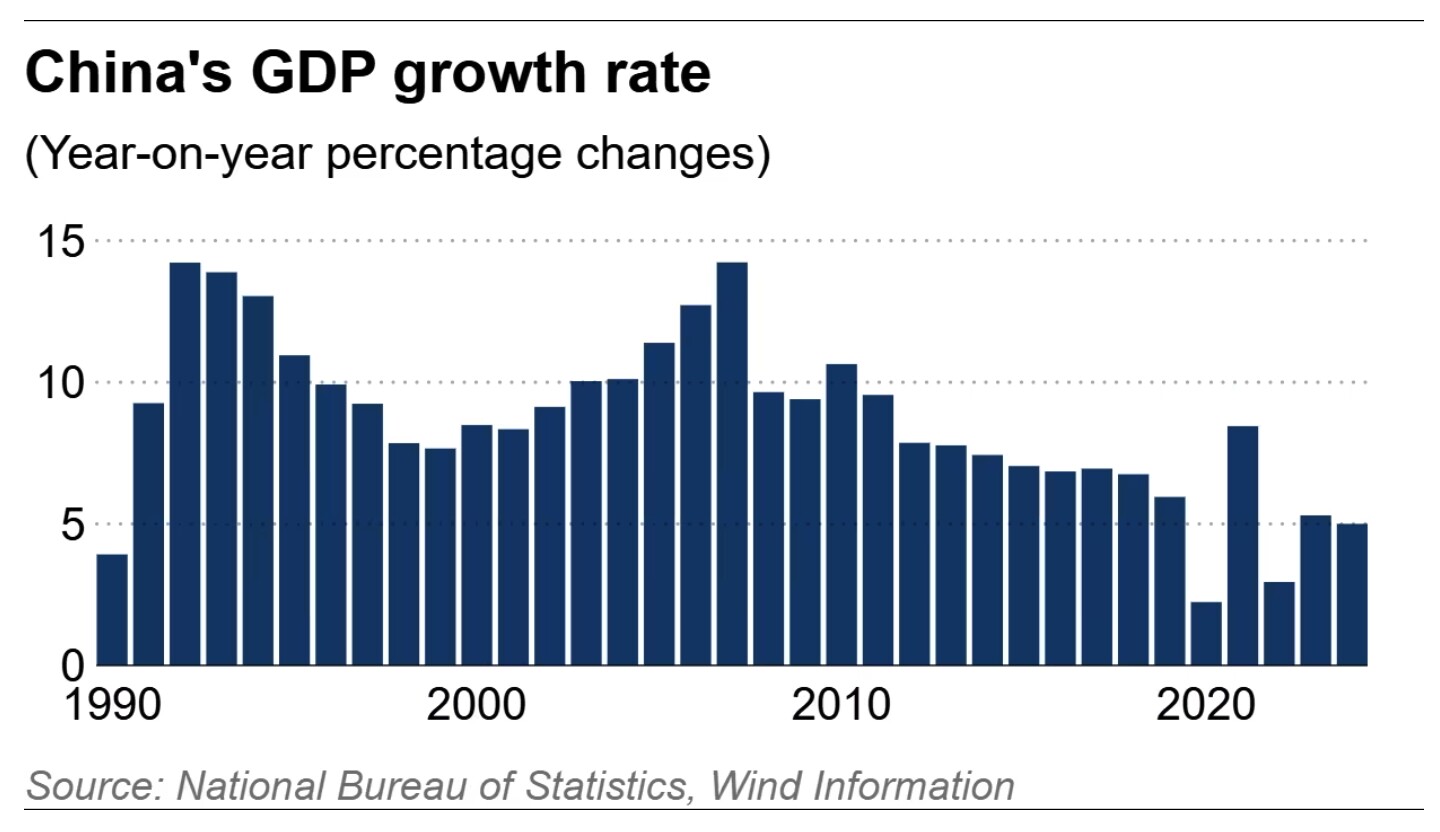

— Treasury nominee Bessent defends Trump policies in Senate testimony; would press China to resume its ag purchases per Phase 1 agreement (link). Treasury Secretary nominee Scott Bessent testified before the Senate Finance Committee, elaborating on Trump administration priorities, including taxes, tariffs, and sanctions. Key takeaways: · Fed independence: Bessent reaffirmed his support for Federal Reserve independence, disputing claims that President-elect Trump opposes it, despite Trump’s past remarks on monetary policy. — Sen. Young: Trump administration signals targeted tariff strategy. Sen. Todd Young’s (R-Ind.) recent comments to reporters shed light on the Trump administration’s evolving approach to tariffs. Based on conversations with Treasury Secretary-designate Scott Bessent, Young said the administration appears poised to adopt a more targeted approach rather than the sweeping tariffs initially suggested during the campaign. Highlights: — China’s economy grew 5% in 2024, fueled by fourth quarter. China’s economy achieved 5% growth in 2024, hitting the government’s target largely due to a stronger-than-expected fourth quarter. The National Bureau of Statistics said a string of stimulus measures since September helped lift confidence and eventually put the country on track to achieve the growth target. Analysts say exporters front-loading their orders ahead of potential hike in U.S. tariffs also played a role in boosting the fourth-quarter growth. Despite gains in factory output (+5.8%) and retail sales (+3.5%), the economy showed signs of deflation for a second consecutive year. Challenges persist with fixed-asset investment missing targets, a shrinking population for the third year, and a 5.1% jobless rate. Housing market conditions improved slightly, though construction remains subdued. Chinese stocks were mixed after the data was released in the morning, but extended their gains during the afternoon session. The government expressed optimism about 2025, though investor confidence remains cautious. The average forecast by economists polled by Nikkei Asia is for China to grow 4.4% this year, before slowing further to 4.1% next year. China is expected to unveil its official growth target at an annual legislative meeting set to take place in March. — Netanyahu announces truce agreement with Hamas. Israeli Prime Minister Benjamin Netanyahu has confirmed that a truce agreement with Hamas has been finalized, expected to take effect on Sunday. Israel’s full security cabinet will hold a vote Saturday on the Gaza ceasefire and hostage release deal. The agreement entails Hamas releasing 33 hostages, Israel withdrawing its troops from populated areas in Gaza, and the release of approximately 1,000 Palestinian prisoners. Netanyahu has called a meeting of his security cabinet today to secure approval for the agreement. — Houthis signal pause on Red Sea ship attacks after Gaza truce. The Houthi leader, Abdulmalik Al-Houthi, announced a pause in attacks on commercial ships in the Red Sea, following the recently agreed ceasefire between Israel and Hamas. While the Houthis pledged to honor the truce, they warned of immediate military action if Israel breaches the agreement. This creates lingering uncertainty for shipping firms operating in the Red Sea and Gulf of Aden. The Gaza agreement, brokered with U.S. support, is scheduled to begin on Sunday, pending Israel’s approval (see previous item). Of note: Despite a newly announced ceasefire between Hamas and Israel, global shipping giants Maersk and Hapag-Lloyd have announced no immediate plans to return to the Red Sea. See details in Transportation section below. — Doug Burgum’s confirmation hearing: Key takeaways. Burgum appeared before the Senate Energy and Natural Resources Committee on Thursday (Jan. 16) for his confirmation as Secretary of the Interior. Here are the main highlights: Energy policy Of note: Burgum warned the U.S. risks forfeiting a global competition to dominate artificial intelligence if it doesn’t build a more reliable, always-on electricity supply. Public lands management. Burgum showed openness to limiting the size of National Monuments and stressed balanced land management without committing to specific strategies. Multiple use of federal lands. Burgum stressed the importance of finding a balance in federal land management. He acknowledged that while some federal lands, particularly national parks, require full protection, others might have “multiple pathways” of use, including development. This approach aligns with the concept of multiple use, which aims to accommodate various activities on public lands, such as recreation, conservation, and resource extraction. The nominee suggested considering land swaps between federal and private lands to better utilize both areas, especially in cases where federal lands abut urban areas. This proposal indicates Burgum’s willingness to explore creative solutions for land management while addressing concerns about housing and development. Colorado River collaboration. Burgum committed to working towards consensus on water reductions. He emphasized the importance of partnerships in driving solutions for federal land policy, rather than creating obstacles. This approach is crucial given the ongoing challenges facing the Colorado River basin, which serves as a vital water source for several Western states. The development and implementation of Colorado River water reduction measures would likely involve extensive consultation with states, tribes, and other stakeholders if Burgum is confirmed as Interior Secretary, as is anticipated. Climate change. While acknowledging climate change, he avoided discussing Trump’s “hoax” comments, focusing instead on innovation and technology for environmental issues. Ethical concerns. He addressed questions about his oil and gas industry ties, pledging to divest from family leases if confirmed. Bipartisan reception. The hearing was largely cordial, with some Democrats commending his experience and support for conservation. — EPA nominee Zeldin comments on year-round E15, RFS, WOTUS and acknowledges climate change is real. Zeldin commented on year-round E15 during his confirmation hearing for EPA administrator. During the hearing, Sen. Pete Ricketts (R-Neb.) asked Zeldin to ensure access to year-round E15, but he did not make a definitive commitment, responding cautiously. Zeldin stated that while he couldn’t prejudge the outcomes of any processes, he acknowledged the €mportance of the issue to Sen. Ricketts and President Trump. His exact words were: “Senator, while I can’t prejudge outcome of processes to follow across the board, I know how important this issue is to you and I know how important this is to President Trump.” Despite this non-committal response, leaders of ethanol industry groups, including the American Coalition for Ethanol and Growth Energy, expressed appreciation for Zeldin’s commitment to doing his part to ensure nationwide availability of year-round E15. Zeldin’s stance on ethanol has been a point of interest, given his previous opposition to ethanol usage mandates during his time in Congress. Zeldin was asked about upholding legal deadlines for new Renewable Volume Obligations (RVO) standards, which are part of the RFS program. Ricketts criticized the Biden administration for setting RVOs below industry production levels and not meeting the law’s deadlines. Zeldin expressed his commitment to implementing the Renewable Fuel Standard (RFS) as written by Congress. He stated, “If confirmed, I commit to you that I will faithfully execute the law as written by Congress.” This statement was seen as an attempt to reassure senators from agricultural states who are concerned about the EPA’s implementation of biofuel policies. Zeldin addressed his past opposition to ethanol usage mandates. He acknowledged that his views on the issue have evolved since his time in Congress. Zeldin stated, “My position has evolved. I’m not in the same place I was years ago.” He explained that his perspective has changed due to conversations he’s had with farmers, producers, and others in the industry. Zeldin emphasized that he now has a better understanding of the importance of ethanol to rural economies and energy security. To further illustrate his evolving stance, Zeldin mentioned that he has visited ethanol plants and spoken with industry stakeholders. He said, “I’ve learned a lot more about ethanol. I’ve visited plants. I’ve talked to a lot of people in the industry.” The EPA nominee has been vocal about his opposition to the Waters of the United States (WOTUS) rule. He expressed strong criticism of the Biden administration’s decision to reinstate and expand the WOTUS rule. Zeldin argued that the WOTUS rule represents federal overreach and places an undue burden on farmers, landowners, and local governments. He stated that the rule would negatively impact agriculture, construction, and other industries by expanding federal authority over water bodies and wetlands. The congressman emphasized that the expanded definition of WOTUS would lead to increased regulations and permitting requirements for activities on private property. He contended that this expansion of federal control would hinder economic growth and development in rural areas. In his statement, Zeldin called for the repeal of the WOTUS rule, advocating for a more limited interpretation of federal jurisdiction over water bodies. He supported efforts to restrict the Environmental Protection Agency’s (EPA) authority in implementing the rule, arguing that states should have more control over their water resources. Zeldin’s position on WOTUS aligns with many Republican lawmakers who view the rule as an example of government overreach and excessive environmental regulation. His statements reflect a broader debate about the balance between environmental protection and economic development in water resource management. Zeldin made notable comments regarding EPA staff. He criticized EPA employees for what he described as their attempts to undermine the Trump administration’s policies. Specifically, Zeldin accused some EPA staff members of leaking information to the media and actively working against the administration’s agenda. He expressed concern that these actions were hindering the implementation of policies and creating unnecessary obstacles for the agency’s leadership. The congressman’s remarks were part of a broader discussion on government accountability and the role of career civil servants in executing administration directives. Zeldin emphasized the importance of loyalty to the current administration’s goals, regardless of personal political beliefs. As for his position on climate change, the hearing showed the political dynamics and implications surrounding the issue considering President-elect Donald Trump’s stance, particularly as seen through an exchange involving Zeldin with Sen. Bernie Sanders (I-Vt.) and Sheldon Whitehouse (D-R.I.). Sanders emphasized the existential threat of climate change, framing it as a matter transcending politics. Whitehouse voiced concern about Zeldin’s ability to resist fossil fuel industry influence. Zeldin stated, “I believe that climate change is real,” marking a departure from previous EPA leaders during the first Trump administration and from President-elect Trump, who has previously labeled climate change a “hoax.” Regarding EPA’s role in regulating carbon dioxide emissions, Zeldin referenced a 2007 Supreme Court decision, noting that while the ruling grants the EPA the authority to regulate greenhouse gases, it does not mandate such action. He emphasized that the agency is “authorized, not required” to regulate carbon dioxide emissions. When pressed on specific climate policies, such as reducing reliance on fossil fuels, Zeldin refrained from committing to particular actions. He expressed a desire to collaborate with scientists and policymakers, stating, “I don’t sit before you as a scientist.” In response to inquiries about campaign donations from fossil fuel companies, Zeldin asserted that financial contributions would not influence his decisions, emphasizing his commitment to impartiality in his role as EPA Administrator. Of note: Throughout the hearing, Zeldin underscored the importance of protecting the environment without hindering economic development. He stated, “We can, and we must, protect our precious environment without suffocating the economy.” — President Trump nominates four individuals for USDA posts: Richard Fordyce to serve as the Undersecretary for Farm Production and Conservation (FPAC); Dudley Hoskins to serve as the USDA Undersecretary for Marketing and Regulatory Programs (MRP); Luke Lindberg to serve as the Undersecretary for Trade and Foreign Agricultural Affairs (TFAA); and Michael Boren, a businessman and former firefighter, to be Undersecretary for Natural Resources and Environment. They all require Senate confirmation. We have profiles of them in the Trump 2.0 administration section below. — Xi to skip Trump’s inauguration, sends Vice President Han Zheng. Chinese President Xi Jinping will not attend President-elect Donald Trump’s inauguration on Monday, opting to send Vice President Han Zheng in his place. China’s Foreign Ministry emphasized its desire for a “stable, healthy, and sustainable relationship” with the U.S., signaling openness to collaboration with the new administration. Trump’s invitation to Xi was viewed as historically unconventional, as no foreign head of state has attended a U.S. inauguration in over a century. Instead, dignitaries such as ambassadors and senior officials — like Japan’s Foreign Minister Takeshi Iwaya — are set to attend, along with high-profile business leaders like Mark Zuckerberg and TikTok CEO Shou Chew. The participation of Vice President Han is seen as a conciliatory gesture amid strained U.S./China relations, exacerbated by Trump’s campaign threats of steep tariffs on Chinese goods. China will also monitor Taiwan’s presence, as the island sends a delegation of lawmakers led by Legislative Speaker Han Kuo-yu, maintaining its delicate diplomatic approach. — Alexis Taylor is headed to the International Fresh Produce Association. The outgoing USDA undersecretary for trade and foreign agricultural affairs will be the association’s chief global policy officer. |

| FINANCIAL MARKETS |

— Equities today: Asian and European stock markets were mixed to higher overnight. U.S. stock indexes are set to open firmer. In Asia, Japan -0.3%. Hong Kong +0.3%. China +0.2%. India -0.6%. In Europe, at midday, London +1.2%. Paris +1%. Frankfurt +1.1%.

Several important Chinese economic reports beat estimates overnight including GDP (5.4% vs. € 5.0%), Industrial Production (6.2% vs. € 5.4%) and Retail Sales (3.7% vs. € 3.5%).Those reports boosted hopes for an economic acceleration that would help global growth.

— Rio Tinto and Glencore held talks about combining their companies. If successful, it would be the largest-ever mining deal. Reports say the talks have ended. Rio shares were up 1.2% in London, while Glencore rose 2.8%.

Equities yesterday: All three major indicates finished Thursday lower, with the Dow down 68.42 points, 0.16%, at 43,153.13. The Nasdaq lost 172.94 points, 0.89%, at 19,338.29. The S&P 500 was down 12.57 points, 0.21%, at 5,937.34.

— Fed official signals possible early 2025 rate cuts amid encouraging inflation data. Federal Reserve Governor Christopher Waller suggested that interest rate cuts might begin in the first half of 2025 if favorable inflation trends persist. Speaking on CNBC, Waller expressed optimism following December’s inflation report, which showed cooling price pressures. He indicated that a rate cut as early as March could not be ruled out, with further reductions possible later in the year.

Waller noted that the Fed could enact three or four cuts this year if inflation data remains favorable, though fewer cuts may occur if inflation proves more persistent. Traders have adjusted expectations, with the May meeting viewed as uncertain and the first cut fully priced in for July.

The yield on two-year Treasury notes fell to 4.25% after Waller’s remarks, reflecting increased market anticipation of rate easing. The Fed, which targets 2% inflation, has previously slashed rates three times in 2024 and penciled in two additional cuts for 2025. Waller emphasized that future policy decisions will remain data dependent.

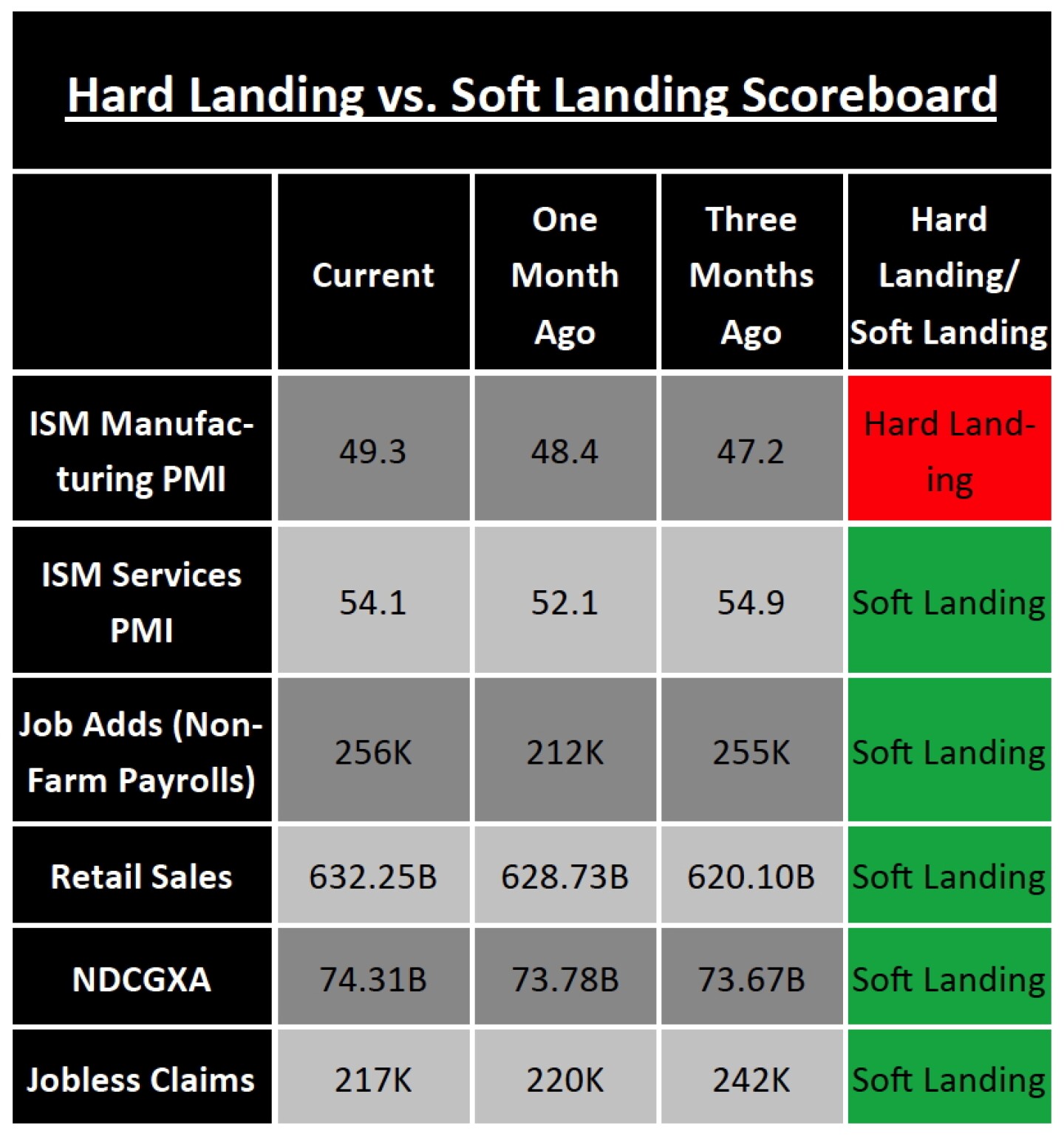

— Hard Landing/Soft Landing Scoreboard from the Sevens Report:

| AG MARKETS |

— MLK Jr. Day schedule. Grain and livestock markets will observe normal trading hours today. All markets and government offices are closed Monday, Jan. 20, for Martin Luther King Jr. Day. Grain markets resume trading with the overnight session at 7:00 p.m. CT on Monday. Livestock markets reopen at 8:30 a.m. CT. on Tuesday, Jan. 21.

— Ag markets today:

Corn and beans firmer, wheat mixed overnight. Corn and soybeans posted mild gains overnight, while wheat had a varied tone. As of 7:30 a.m. ET, corn futures were trading a penny higher, soybeans were 1 to 2 cents higher, winter wheat markets were unchanged to 2 cents lower and spring wheat futures were 2 to 4 cents higher. The U.S. dollar index was around 120 points higher, and front-month crude oil was anchored near unchanged this morning.

Cash cattle trade steady, but ideas of a short-term top. Packers have paid mostly steady prices for cash cattle this week and it appears weaker values are likely near-term. After weeks of chasing supplies, packers appear to have near-term needs relatively well covered.

Cash hog index firms, pork cutout slips. The CME lean hog index is up another 9 cents to $81.91 as of Jan. 15, marking the fourth consecutive daily gain though the net advance has been only 76 cents and has lessened each day. The pork cutout slipped 44 cents to $90.39.

— Ag trade: Jordan Thailand purchased 195,000 MT of feed wheat – 67,000 MT to be sourced from the U.S. or Australia and 128,000 MT to be sourced from Australia.

— Agriculture markets yesterday:

• Corn: March corn fell 4 ¼ cents to $4.74 ½, closing nearer the session low.

• Soy complex: March soybean futures plunged 23 ¾ cents to $10.19, on session lows. March meal futures closed $7.60 lower to $294.40, near session lows. March bean oil futures sunk 124 points to 45.03 cents.

• Wheat: March SRW wheat fell 9 ½ cents to $5.37 ½, near the daily low. March HRW wheat lost 9 ¼ cents to $5.48 ¼ and near the daily low.

• Cotton: March cotton futures closed 104 points lower to 66.73 cents, near session lows.

• Cattle: February live cattle fell $1.925 to $196.60 and nearer the session low. March feeder cattle lost $2.075 to $267.725, near mid-range.

• Hogs: Modest cash and wholesale strength seemed to undercut premiums in hog futures Thursday, with nearby February falling 82.5 cents to $82.30.

— Brazilian corn exports to Egypt surged by 174% in 2024. Brazilian corn exports to Egypt skyrocketed by 174.2% in 2024, reaching $1.103 billion and positioning Egypt as Brazil’s top corn buyer. Agribusiness trade drove this surge, with Egypt importing $3.3 billion in Brazilian agribusiness products, marking a 91.4% annual increase. Corn purchases constituted 33.3% of Egypt’s imports, complemented by significant sugar and beef imports.

Egypt exported $559.3 million worth of goods to Brazil, dominated by fertilizers ($406.8 million) and horticultural products. Brazil’s agribusiness trade surplus with Egypt reached $3.16 billion in 2024, up 92.3% from 2023.

The data highlights Arab countries’ growing role in Brazilian agribusiness, with six Arab nations ranking among Brazil’s top 25 agricultural export markets, collectively accounting for nearly 10% of the sector’s exports.

— Cotton AWP edges lower. The Adjusted World Price (AWP) for cotton is at 53.98 cents per pound, effective today (Jan. 17), down from 54.66 cents per pound the prior week. This is the lowest AWP mark since the week of Aug. 2, 2024, when it was 53.94 cents per pound. However, it is still nearly 2 cents above the level that would trigger an LDP. The last time an LDP was able to be paid was Oct. 9, 2020, when it was 52 cents per pound.

— Bloomberg: South Korea may consider more U.S. ag imports in bow to Trump. South Korea may consider a plan to increase U.S. ag imports to help reduce the trade imbalance between the two countries should it emerge as a point of tension with the incoming Trump administration, people familiar with the matter told Bloomberg. The idea is part of contingency plans Seoul has been crafting as it prepares for Trump’s return to the White House next week. For agricultural imports, the government could expedite talks on certain pending imports or temporarily reduce or suspend duties to encourage greater purchases, the people said. South Korea is the sixth largest market for U.S. ag shipments. South Korea’s trade ministry and ag ministry both said Seoul is not considering ramped-up U.S. ag imports.

— Argentine farmer groups ask for tax relief amid ‘critical’ situation. Argentina’s largest agricultural groups on Thursday asked the government to offer tax relief for the sector, which they said was in a “critical” situation due to a drought and low crop prices. The leaders of four major agricultural groups requested a meeting with the ag secretary and the economy ministry to discuss potential tax cuts and a lifting of export taxes. Argentina’s government taxes soybean exports at 33%, soy products at 31% and corn and wheat at 12%.

| FARM POLICY |

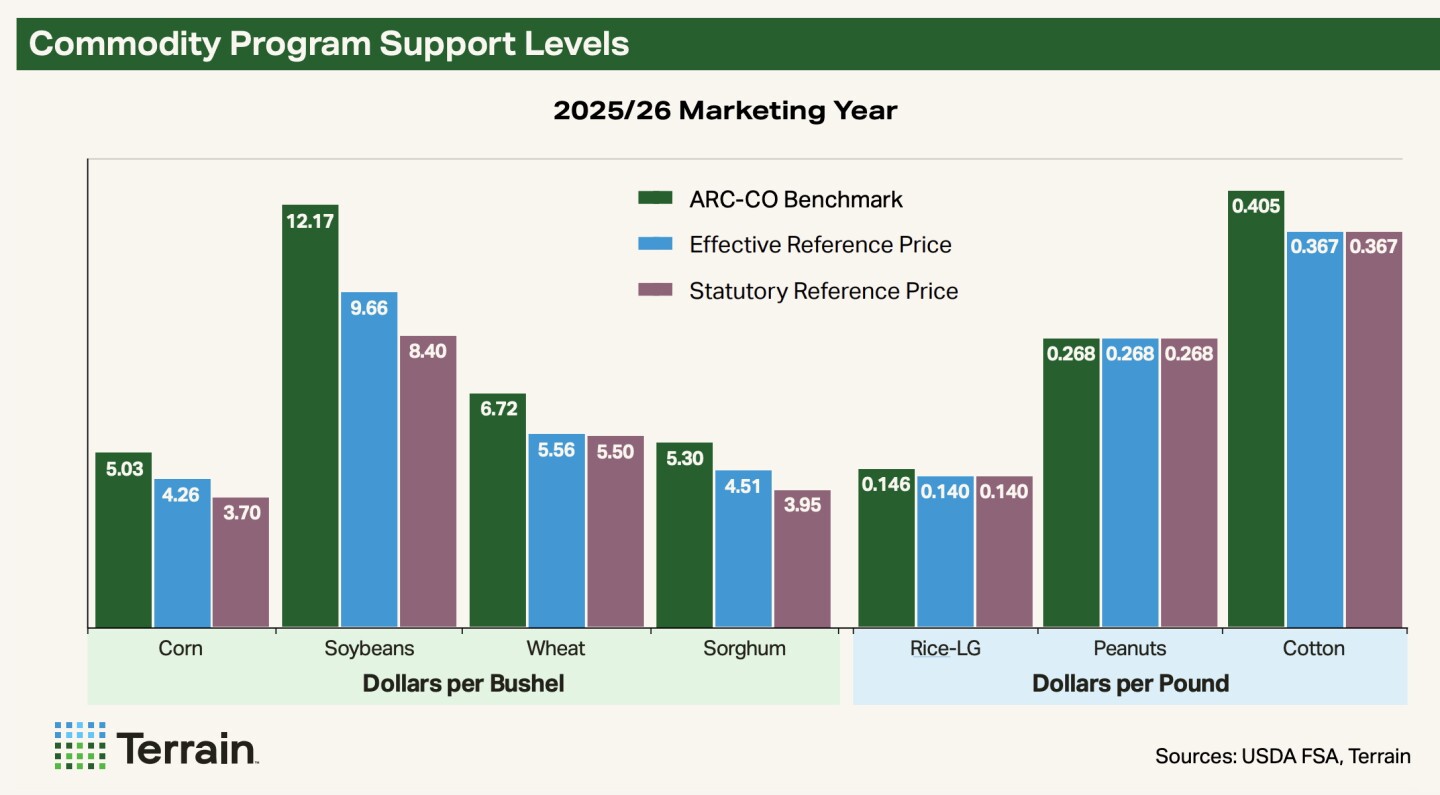

— New Terrain report: ARC and PLC to offer higher support (for some) in 2025. With Congress authorizing another one-year extension of the 2018 Farm Bill through Sept. 30, 2025 (besides more than $30 billion in ad hoc assistance to agricultural producers experiencing natural and economic disasters), crop farmers across the country now know what risk management tools are available to them for the new crop year.

For some crops such as corn, soybeans and wheat, coverage levels will increase to levels at or near all-time highs. In addition to crop insurance, crop farmers with eligible base acres may enroll in Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) on a commodity-by-commodity basis.

Below are highlights for several major crops:

- Corn ARC-CO: $5.03/bu.

- Corn PLC: $4.26/bu.

- Soybean ARC-CO: $12.17/bu.

- Soybean PLC: $9.66/bu.

- Wheat ARC-CO: $6.72/bu.

- Wheat PLC: $5.56/bu.

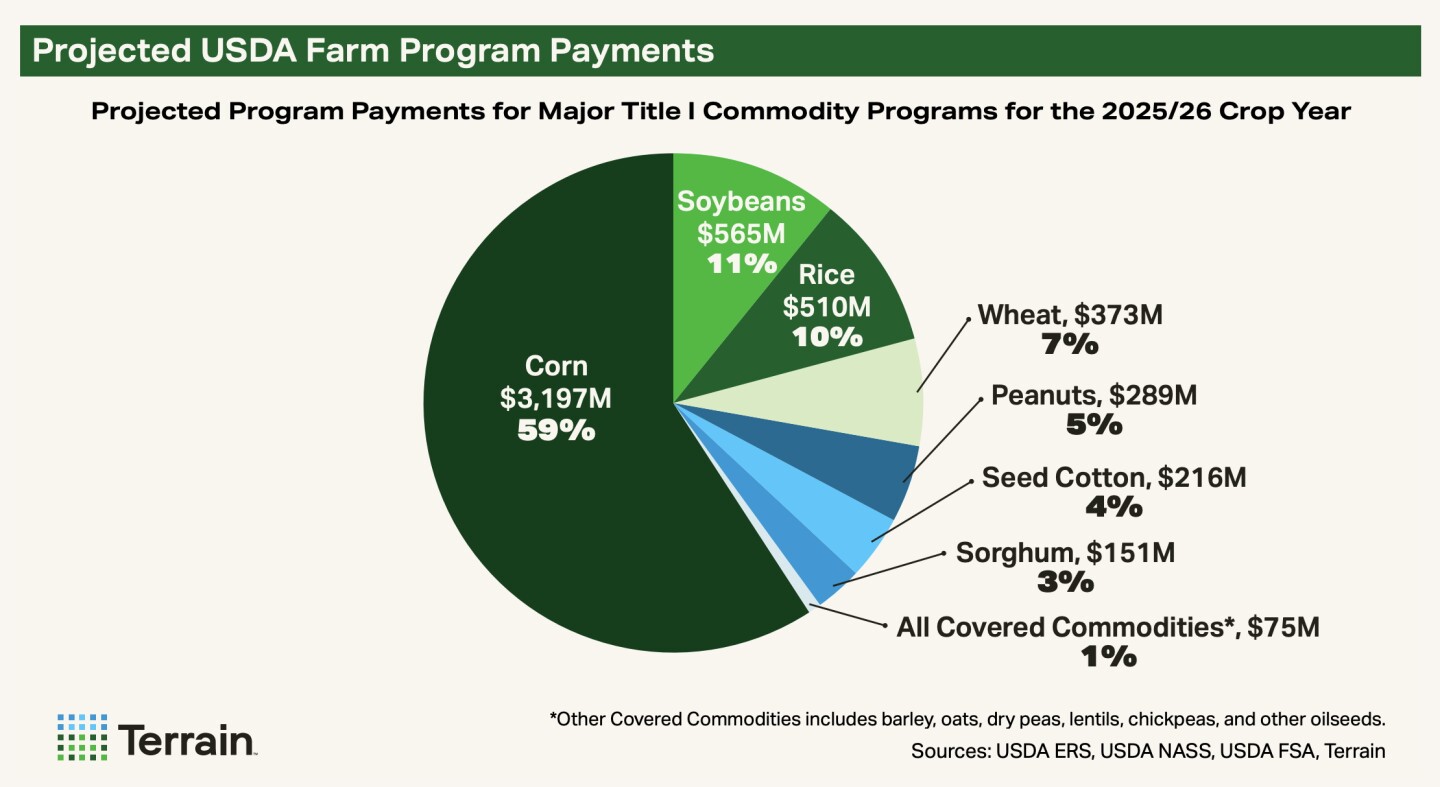

According to the CBO, total program payments for the 2025/26 crop year are projected at $5.4 billion.

The full analysis from Terrain is available here.

| ENERGY MARKETS & POLICY |

— Oil prices dip amid geopolitical and economic developments. Oil prices dropped on Thursday, with Brent crude closing at $81.29 per barrel (-0.9%) and WTI falling to $78.68 (-1.7%), after hitting multi-month highs on Wednesday. The decline came as Yemen’s Houthi militia indicated a pause in Red Sea attacks, potentially easing shipping disruptions. However, uncertainties persist as the Houthis monitor Gaza’s ceasefire, threatening to resume hostilities if breached. Market dynamics were also influenced by strong U.S. retail sales data, initially raising concerns of delayed Federal Reserve rate cuts. These fears eased following dovish remarks from Fed Governor Christopher Waller, who suggested inflation might cool faster than anticipated. Meanwhile, new Biden administration sanctions on Russian oil have disrupted global flows, increasing shipping costs. With President-elect Donald Trump preparing to take office, his approach to sanctions and OPEC+ relations remains a critical market focus.

— USDA publishes technical guidelines for climate smart agriculture (CSA) practices for biofuel production. USDA today published the interim final rule (link) in the Federal Register on technical guidance for climate smart agriculture (CSA) practices for commodities relative to biofuel production. The rules will be finalized by the Trump administration and as noted, there are several areas that USDA wants feedback on, including expanding the number of commodities that would be included in the effort.

| CONGRESS |

— Trump vs. the budget hawks: GOP fiscal tensions loom over Wall Street. Rising bond yields and a ballooning federal debt are intensifying challenges for President-elect Donald Trump as he prepares to take office. Federal debt has doubled since his first term, and deficits have surged, placing mounting pressure on Congress to rein in spending. A growing divide within the GOP — driven by the fiscal hawks of the House Freedom Caucus — threatens to complicate Trump’s plans for renewed tax cuts and economic reforms.

The Freedom Caucus demands significant spending cuts as a prerequisite for new fiscal legislation, setting the stage for tense negotiations. Meanwhile, bond markets signal investor concern, with yields climbing and the cost of federal debt nearing $1 trillion annually. Balancing Trump’s tax ambitions with fiscal discipline will test Congress, with potential repercussions for Wall Street, bond markets, and the broader economy. Investors are bracing for volatility amid uncertain fiscal policy.

— House Freedom Caucus proposes $4 trillion debt ceiling increase. The House Freedom Caucus unveiled a proposal for a $4 trillion debt ceiling increase tied to a two-track reconciliation process, a move opposed by Republican leaders. The plan pairs spending cuts with increased funding for defense and border security, including $100 billion for border initiatives and $200 billion for defense over four years.

Targeting Biden administration policies, the proposal includes rescissions from the IRS and stricter Medicaid and SNAP work requirements. The group argues their approach limits Democratic leverage in government funding negotiations and could secure enough GOP votes to pass without Democratic support.

Rep. Chip Roy (R-Texas) emphasized the urgency, stating, “We have got to move.” The plan faces opposition from GOP leaders favoring a single reconciliation measure addressing taxes, immigration, and defense spending. Lawmakers face a summer deadline to address the debt limit.

— Some Republican lawmakers are furious with Speaker Mike Johnson (R-La.) after he ousted one of their own, Rep. Mike Turner (R-Ohio), now the former chair of the Intelligence Committee. Erosion of trust within the GOP ranks is seen as injurious for the Speaker, whose legislative and political headaches are piling up, The Hill reports (link).

| TRUMP 2.0 ADMINISTRATION |

— Richard Fordyce appointed USDA Undersecretary for Farm Production and Conservation. Fordyce, a Missouri farmer with previous experience in agricultural leadership roles, is not new to USDA or to agricultural policy. He previously served as the administrator of the Farm Service Agency (FSA) during the first Trump administration, a role he assumed in May 2018. As FSA administrator, Fordyce was responsible for overseeing the agency’s efforts to support agricultural production across the country through a network of over 2,100 county and 50 state offices.

Career highlights

- Fourth-generation farmer: Fordyce brings hands-on agricultural experience to his roles, being a fourth-generation farmer from Missouri.

- State-level leadership: Prior to his federal appointments, Fordyce served as the director of the Missouri Department of Agriculture, demonstrating his capability in agricultural policy at the state level.

- FSA administrator: In his role as FSA Administrator, Fordyce was involved in implementing agricultural policies, administering credit and loan programs, and managing conservation, commodity, disaster, and farm marketing programs.

New role and responsibilities. As the undersecretary for farm production and conservation, Fordyce will be taking on a broader role within the USDA. This position is part of the Farm Production and Conservation (FPAC) mission area, which is the Department’s focal point for the nation’s farmers and ranchers and other stewards of private agricultural lands and non-industrial private forest lands. In this capacity, Fordyce will likely be involved in overseeing:

- Implementation of farm safety net programs

- Conservation efforts

- Crop insurance programs

- Lending initiatives

- Disaster relief program

Bottom line: Fordyce’s selection for this role suggests a continuation of policies and leadership familiar with the needs and challenges of the American ag sector. His experience as both a farmer and an administrator positions him to understand the practical implications of USDA policies on farming communities across the nation.

— Luke Lindberg appointed USDA Undersecretary for Trade and Foreign Agricultural Affairs (TFAA). In this capacity, he spearheads efforts to refine international trade policies and promote U.S. agricultural products globally. The TFAA oversees the Foreign Agricultural Service, focusing on market intelligence, trade policy, capacity building, and trade promotion programs.

Before this role, Lindberg was President and CEO of South Dakota Trade, a public-private partnership advancing international trade in South Dakota. He also served as Chief of Staff and Chief Strategy Officer at the Export-Import Bank of the United States, driving initiatives on “China and Transformational Exports” and global 5G deployment.

A graduate of the University of Maryland, Lindberg holds an MBA, an MPP, and a BA in Government & Politics. He lives in Harrisburg, South Dakota, with his wife, Brittany, and their two children.

— Dudley Hoskins nominated as USDA Undersecretary for Marketing and Regulatory Programs (MRP). Hoskins has an extensive background in agricultural policy and has held several significant positions within USDA and related organizations. He served as Chief of Staff for the Marketing and Regulatory Programs at USDA before being promoted to Senior Advisor to then-Secretary Sonny Perdue, focusing on MRP, natural resources, and environmental issues.

Prior to his tenure at USDA, Hoskins worked as Public Policy Counsel at the National Association of State Departments of Agriculture, Manager of Regulatory Policy at CropLife America-RISE, and Director of Health and Regulatory Affairs at the American Horse Council.

In April 2023, Hoskins joined the Senate Ag Committee as professional staff and counsel. In this role, he managed a portfolio that includes forestry, fertilizer, hemp, and pesticides, and serves as lead counsel on agriculture security, animal health, biotechnology, livestock, poultry, dairy, food safety, organics, research, and specialty crops.

— Trump nominates Michael Boren for USDA role. President-elect Donald Trump has nominated Michael Boren as Undersecretary for Natural Resources and Environment at the USDA. Boren, a successful entrepreneur and founder of Clearwater Analytics, brings both business expertise and hands-on experience as a volunteer firefighter with the Sawtooth Valley Rural Fire Department.

Trump emphasized Boren’s potential to “revitalize Forest Management,” highlighting his dual background in business and firefighting as assets for addressing wildfire and land management challenges. Idaho Governor Brad Little praised the nomination, calling Boren a “visionary leader” and a boon for rural America and western states.

However, Boren’s past involvement in a legal dispute over a controversial airstrip in Idaho may raise concerns during his Senate confirmation process. His appointment reflects Trump’s focus on transforming land and fire management policies in the western U.S.

— Texas border czar Mike Banks tapped as next U.S. border patrol chief. Mike Banks, Texas’ first-ever border czar, has been selected to serve as the 27th U.S. Border Patrol chief under the Trump administration, sources told the New York Post Thursday.

Banks, a seasoned former border agent with over three decades of federal law enforcement experience, will replace the well-regarded Jason Owens. While Owens was appreciated by agents, some expressed optimism about Banks’ leadership, with one source stating, “An outside chief that wasn’t a career ladder climber might be exactly what we need.”

Previously appointed by Texas Governor Greg Abbott in 2023 to tackle the state’s border crisis, Banks has been a vocal critic of President Biden and Vice President Kamala Harris’ handling of immigration. In his role as Texas border czar, Banks claimed a significant reduction in illegal immigration within the state, emphasizing his commitment to securing the border. The Post said it reached out to Trump’s team for comment on the appointment.

| POLITICS & ELECTIONS |

— DeSantis to appoint Moody to replace Rubio in Senate. Florida Governor Ron DeSantis announced his intention to appoint Attorney General Ashley Moody to fill Sen. Marco Rubio’s soon-to-be-vacant seat. Rubio is expected to be confirmed as Secretary of State early next week. Moody, 49, a former circuit court judge and two-term attorney general, has been a staunch supporter of President-elect Donald Trump. She is known for her work on illegal immigration, the opioid crisis, and human trafficking. Moody pledged to champion Trump’s “America First” agenda in the Senate.

She may face primary challenges in 2026, with Reps. Cory Mills and Kat Cammack expressing interest in the seat. DeSantis, citing concerns about the House majority, opted against appointing a current representative.

Of note: The move comes as Ohio Governor Mike DeWine faces criticism for delaying his decision on filling Vice President-elect JD Vance’s Senate seat.

| HPAI/BIRD FLU |

— Bird flu update. The CDC announced Thursday it is recommending hospitals quickly sequence flu specimens from patients to more rapidly detect any avian influenza infections. The CDC has not changed its assessment that the bird flu risk to the general public is low, CDC Principal Deputy Director Nirav Shah told reporters. But the agency is urging all hospitalized patients with any influenza A virus — especially those in the intensive care unit — to have samples tested for avian influenza within 24 hours of admission. “This policy change does not alter the volume of the subtyping that is done, but we continue to recommend that it should be done in all patients,” Shah said. “What it does is accelerate that train.”

USDA recently implemented new measures to combat the ongoing avian influenza epidemic that has devastated the poultry industry. In response to the significant losses and repeated outbreaks, USDA has introduced a requirement for biosecurity audits for poultry operations seeking compensation for bird flu losses.

New biosecurity requirements. Under the new interim final rule, poultry farms affected by highly pathogenic avian influenza (HPAI) must pass a biosecurity audit before they can:

- Restock their poultry

- Be eligible for future indemnity payments

This measure aims to ensure that farmers are taking adequate precautions to prevent future outbreaks and reduce the spread of the virus.

Impact of the Avian flu epidemic. The current HPAI outbreak, which began in February 2022, has had a severe impact on the U.S. poultry industry:

- 128 million birds have been lost to the virus

- 1,200 poultry producers have received federal indemnity payments

- 67 producers have experienced at least two infections

- These 67 repeat-outbreak operations account for $365 million of the $1.1 billion in total indemnity payments

Indemnity program and compensation. When bird flu is detected in a flock, producers are required to euthanize their entire flock to prevent further spread of the virus. To encourage rapid reporting and containment, the government compensates farmers for the market value of the birds they had to cull.

Rationale for new measures. USDA’s decision to implement biosecurity audits is driven by several factors:

- Repeated outbreaks: Some farms have experienced multiple infections, indicating potential biosecurity weaknesses.

- Financial burden: The government has already spent $1.1 billion on indemnity payments.

- Prevention focus: Biosecurity is considered the most effective strategy to combat HPAI.

Additional actions. Besides the biosecurity audits, USDA is taking other steps to control the spread of avian influenza:

- Requiring biosecurity audits for commercial poultry premises within a 4.35-mile radius of infected zones

- Denying indemnity for flocks moved onto premises in active infected zones if they become infected within 14 days of the control area’s dissolution

- Continuing to work with state animal health officials on surveillance efforts

Indemnity payments for poultry producers affected by HPAI are calculated based on several factors:

Fair market value. The primary basis for indemnity payments is the fair market value of the birds at the time they are taken for disease control purposes, assuming disease-free status. This value is determined using:

- Standardized indemnity tables specific to the industry segment and species

- The number of live birds in the flock inventory at the time HPAI is detected

Calculation method. The basic formula for calculating indemnity payments is:

Indemnity payment = Number of live birds × Value per bird

USDA uses nationally recognized data sources to establish the per-bird values, including:

- USDA Agricultural Marketing Service (AMS)

- USDA National Agricultural Statistics Service (NASS)

- Livestock Marketing Information Center (LMIC)

Additional considerations

- Egg production: For laying hens, the indemnity value includes the hen’s projected future egg production.

- Bird age: The value is depreciated to account for reduced egg production in older hens.

- Eggs: Separate standardized values are used for table eggs and hatching eggs.

- No lost income: The indemnity does not include anticipated lost income or losses due to business interruptions.

Compensation for other costs. Besides the indemnity for birds, producers may receive compensation for:

- Destruction and disposal of infected or exposed poultry

- Cleaning and disinfection activities

USDA makes flat-rate compensation payments for virus elimination activities based on a per-bird rate, with separate rates for caged versus floor-raised birds.

Appeal process. If a producer disagrees with the initial indemnity valuation, they can appeal within 15 days of receiving the estimate. The appeal must be supported by an independent, third-party appraisal meeting specific standards.

Of note: Indemnity payments are only made for live birds at the time of depopulation. Birds that died from HPAI before depopulation are not eligible for indemnity.

Bottom line: These measures reflect the USDA’s commitment to mitigating the impact of avian influenza on the poultry industry and reducing the financial burden on taxpayers while ensuring the safety of the nation’s food supply.

| DAIRY |

— Major changes approved for Federal Milk Marketing Orders (FMMOs). Dairy producers have endorsed significant updates to the Federal Milk Marketing Orders (FMMOs), marking a pivotal shift in U.S. dairy pricing policy. Link. Following a comprehensive USDA-led review, the modifications include:

- Reversal of 2018 Farm Bill changes: Returning to the “higher-of” Class I skim milk price formula to address losses exceeding $750 million under the previous system.

- Updated manufacturing allowances: New rates per pound set for cheese, butter, nonfat dry milk, and dry whey.

- Adjusted skim milk composition factors: Revised standards include 3.3% true protein, 6.0% other solids, and 9.3% nonfat solids.

- Removal of barrel cheese pricing: Excludes 500-pound barrel cheddar cheese prices from federal surveys.

- New ESL product class: Introduces an average-based adjustment for extended shelf-life products.

Most changes will take effect on June 1, 2025, with some delayed until Dec. 1, 2025. This overhaul, supported by dairy farmers across all 11 FMMOs, aims to stabilize pricing, improve farmer incomes, and enhance market dynamics.

| FOOD INDUSTRY |

— Calorie labels have limited impact on food choices, study finds. A recent review by the UK nonprofit Cochrane (link) reveals that calorie labels in supermarkets and restaurants result in only a modest reduction of 1.8% in calorie consumption — equivalent to removing two almonds from a 600-calorie meal. The study, which analyzed data from 25 studies across the U.S., UK, and France, raises questions about the effectiveness of labeling as a standalone strategy to combat obesity.

Researchers suggest combining labeling with measures such as taxes and marketing restrictions for greater impact. Although calorie labeling is mandatory in several countries, including the UK, critics point out that it may harm individuals with eating disorders and emphasize that it is not a “silver bullet” solution. Experts advocate for a broader range of coordinated policies, including portion size control and pricing strategies, to improve dietary habits and public health.

| TRANSPORTATION & LOGISTICS |

— Shipping giants await Red Sea stability before returning. Despite a newly announced ceasefire between Hamas and Israel, global shipping giants Maersk and Hapag-Lloyd have announced no immediate plans to return to the Red Sea. Both companies stress the need for sustained regional stability before resuming operations, according to Reuters (link).

Hapag-Lloyd and Maersk spokespeople highlighted ongoing safety concerns, with Maersk emphasizing it remains “too early to speculate about timing.” Previously, Hapag-Lloyd had flagged the risks of attacks from Houthi militants, noting the logistical challenges of schedule adjustments that could take weeks.

Persistent Middle East disruptions have forced vessels to bypass the Suez Canal, opting for longer, costlier routes around Africa’s Cape of Good Hope. These changes have contributed to higher freight rates and global shipping disruptions.

— USTR investigation sets stage for new tariffs on Chinese shipbuilding. The U.S. Trade Representative’s (USTR) office has concluded that China’s shipbuilding industry benefits from unfair subsidies, disadvantaging American competitors and undermining global market competition. This investigation, initiated in March following a petition by labor unions, cites Chinese practices such as labor rights violations, forced labor, and state-driven excess production capacity as contributors to their dominance in the sector. Link to USTR report.

The report compares the findings to the Section 301 probe during Donald Trump’s first term, which led to tariffs on billions of dollars of Chinese imports. Labor leaders have welcomed the findings, urging decisive actions to revive U.S. shipbuilding. China, however, rejected the accusations, calling them unilateral and protectionist.

The decision comes as Trump prepares to return to office, with the next steps likely involving new tariffs. While American companies rarely purchase ships directly from Chinese yards, tariffs may target other goods to pressure China on shipbuilding. This marks the latest escalation in the ongoing U.S./China trade conflict, which now includes shipbuilding alongside industries like semiconductors and electric vehicles.

| TRADE & TRADE POLICY |

— World Bank warns U.S. tariffs could reduce global growth outlook. The World Bank on Thursday kept global economic growth at 2.7% for both 2025 and 2026 but warned that U.S. across-the-board tariffs of 10% promised by Trump could reduce that by 0.3 point next year if trading partners retaliate. Such tariffs could cut U.S. growth, forecast to reach 2.3% in 2025, by 0.9% if retaliatory measures are imposed, the bank said. But it noted that U.S. growth could also increase by 0.4 percentage point in 2026 if U.S. tax cuts were extended.

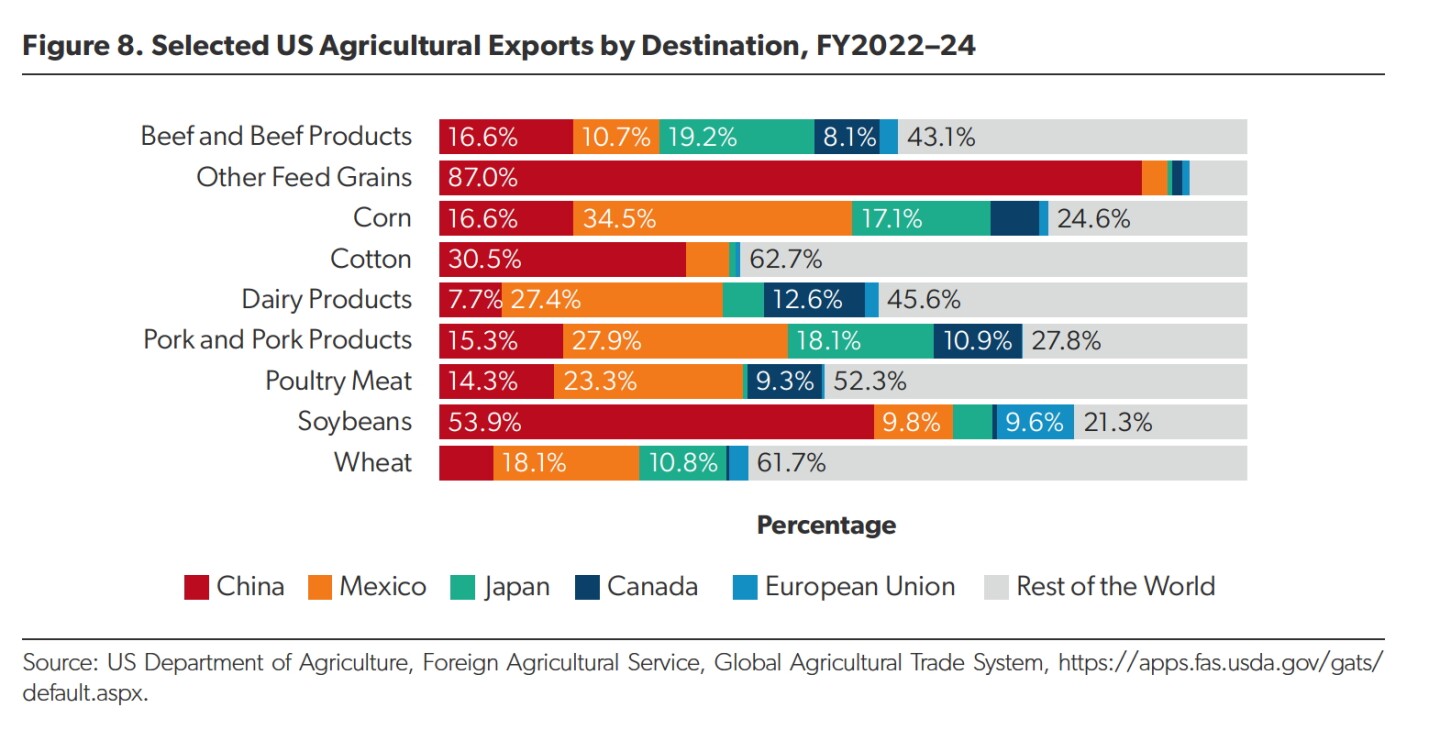

— Dr. Joe Glauber: Farmers brace for a new round of trade wars. Glauber is a former USDA top economist who is now a nonresident senior fellow at the American Enterprise Institute, and concurrently, a senior research fellow at the International Food Policy Research Institute. In his report, he emphasizes that the agricultural sector must carefully monitor and prepare for the potential consequences of renewed trade conflicts under Trump’s policy direction. Link to his report.

Key Points

- Growing Concerns Among Farm Interest Groups

U.S. farm interest groups are alarmed by the Trump administration’s potential moves to impose sweeping tariffs on imports from major trading partners. These actions could negatively impact U.S. agricultural exports, leading to declines in crop and livestock prices. Producers are also worried about higher costs for key inputs like fertilizer and feeder cattle due to import tariffs. - Retaliatory Trade Measures from Past Experience

The concerns are rooted in the history of trade disputes during the previous Trump administration. Retaliatory measures from trading partners targeted U.S. agricultural exports, including soybeans, hogs, and corn, causing significant price drops and economic strain for U.S. farmers. - Long-Term Trade Implications

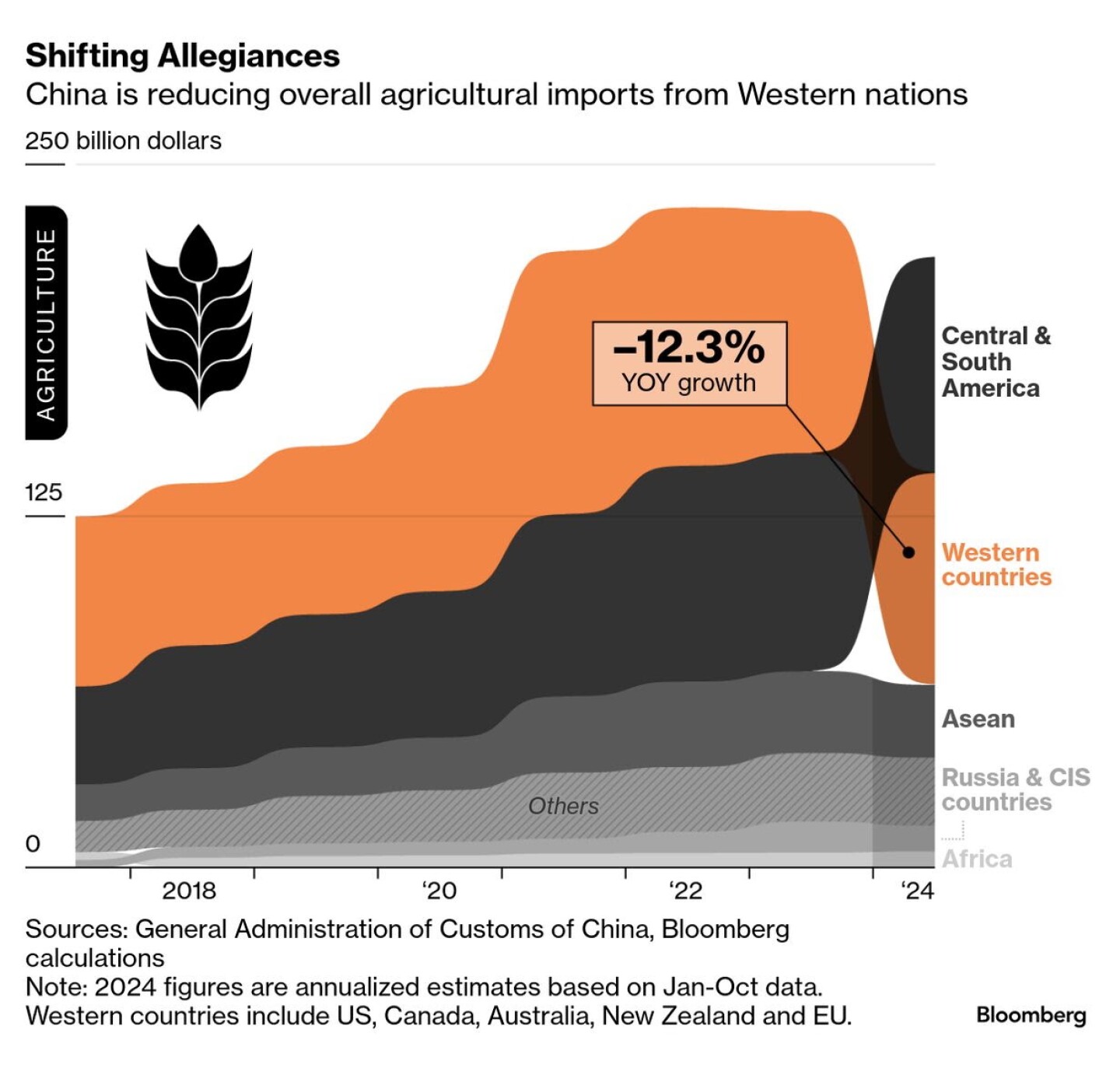

Beyond immediate export losses, the U.S. agricultural sector fears a long-term erosion of trade opportunities. Major importers like China may further pivot to alternative suppliers such as Argentina and Brazil, viewed as more stable sources of grains and oilseeds for food and animal feed.

— Record Brazilian exports to the U.S. mark 2024 milestone amid trade uncertainties. Brazilian exports to the United States reached a historic $40.3 billion in 2024, driven by industrial goods and key commodities such as crude oil, coffee, and beef. This 9.2% increase outpaced Brazil’s global export performance, which declined by 0.8%. The milestone comes just before Donald Trump’s return to the White House, with anticipated shifts in global trade policy.

While bilateral trade flows hit $80.9 billion, concerns loom over Trump’s protectionist agenda and its potential to strain U.S./Brazil relations under President Lula’s administration. Projections for 2025 suggest sustained trade growth, but experts urge caution given geopolitical uncertainties.

| CHINA |

— China shifts food sourcing to Global South amid geopolitical shifts. China is intensifying efforts to diversify its food imports, moving away from traditional Western suppliers, according to a Bloomberg report (link). This strategy, driven by a desire to secure food security and mitigate reliance on U.S.-allied nations, has opened opportunities for countries in the Global South. Key beneficiaries include agricultural powerhouses like Brazil, which has captured a larger share of the corn and soybean markets previously dominated by the U.S.

China’s approach also extends beyond staple crops, showcasing its commitment to developing new trade partnerships across a broader range of products. This shift reflects Beijing’s strategic response to vulnerabilities exposed during the U.S./China trade war under President-elect Donald Trump, further emphasizing the geopolitical realignment of global trade blocs.

— Cofco forced to resell wheat cargoes as Beijing shields farmers. China’s biggest state-run crop trader has been forced to resell at least two cargoes of imported wheat, as Beijing extends curbs on foreign purchases to bolster the domestic industry, Bloomberg reported. Cofco Corp. this month resold the shipments of Australian wheat due to arrive in China during January to April to countries including Indonesia and Thailand, according to people familiar with the sales. Chinese authorities asked traders and processors last year to buy less grain from overseas to support the local industry.

— China’s pork output falls for first time in four years. China produced 57.06 MMT of pork in 2024, down 1.5% from 2023 and the first annual decline in four years. Hog slaughter totaled 702.56 million head last year, down 3.3% from 2023. In the fourth quarter, pork production fell 1.8% from year-ago to 14.66 MMT. China’s hog herd totaled 427.43 million head at the end of December, down 1.6%. China’s beef output rose 3.5% to 7.79 MMT in 2024, while poultry output increased 3.8% to 26.6 MMT and lamb and mutton decreased 2.5% to 5.18 MMT.

| WEATHER |

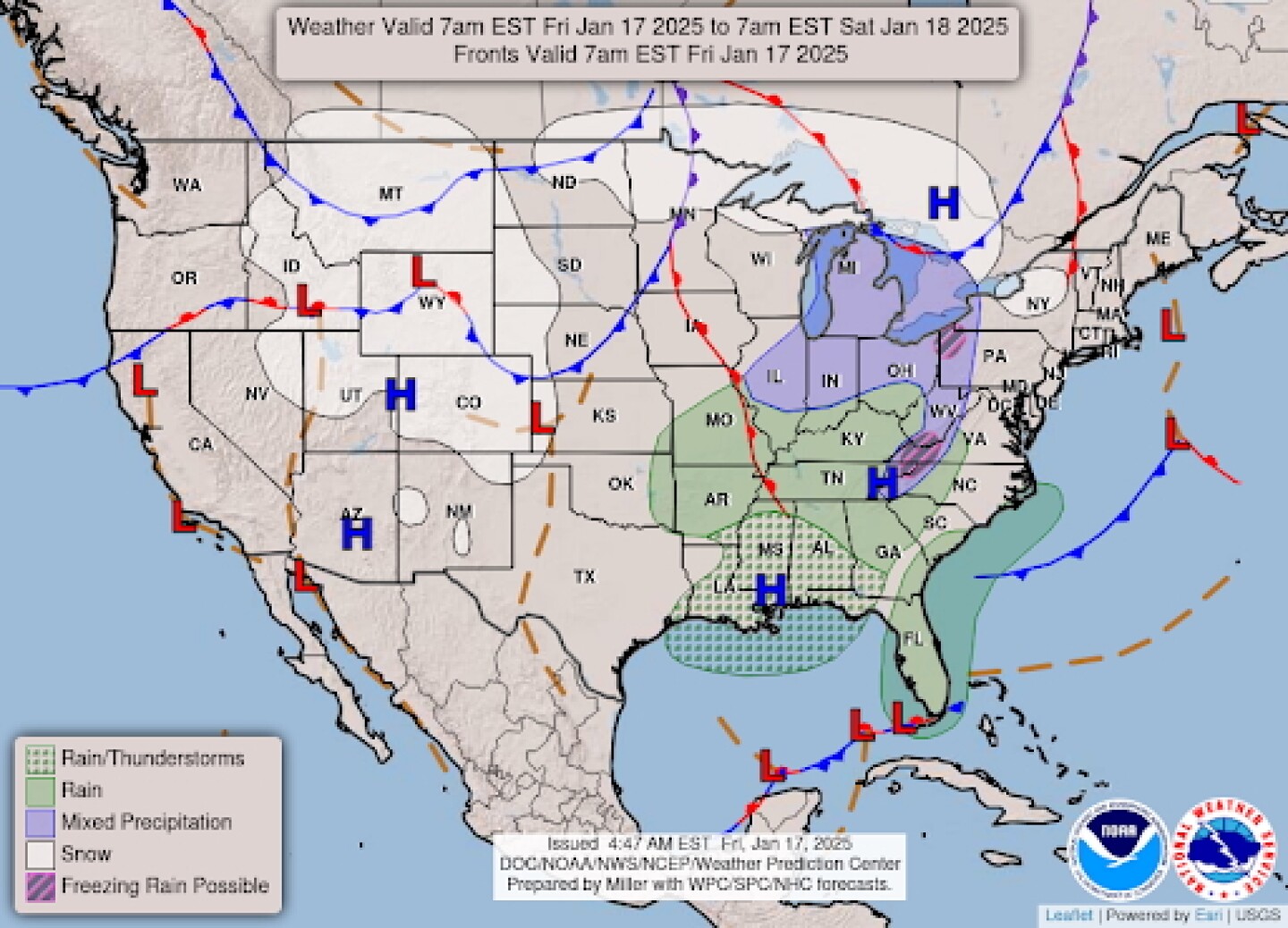

— An Arctic blast is forecast to give President-elect Donald Trump the coldest inauguration in 40 years. The temperature in Washington, DC, at noon on Monday is expected to be in the low-20s as Trump stands up in front of the Capitol to take his oath of office. It will likely be the coldest Inauguration Day since President Ronald Reagan’s second inauguration in 1985, when the noon temperature was 7 degrees.

— The untimely demise of William Henry Harrison: Re-evaluating history. William Henry Harrison, the ninth President of the United States, holds the unfortunate distinction of having the shortest presidency in U.S. history, lasting just one month. He passed away on April 4, 1841, exactly 30 days after his inauguration. For years, it was widely believed that Harrison’s death was due to pneumonia, brought on by delivering his lengthy two-hour inaugural address outdoors in cold, rainy weather without proper attire. However, recent research challenges this narrative:

- Weather conditions: Reports suggest the inauguration day temperature was around 48°F (9°C)—chilly, but not severe.

- Timing of illness: Harrison became ill weeks later, on March 26, after a rainy morning walk without adequate clothing.

- Cause of death: Modern analysis points to enteric fever, such as typhoid, likely caused by contaminated water in Washington, D.C.'s unsanitary conditions.

Bottom line: Although the cold weather may not have directly caused his death, it likely weakened his immune system. Combined with his age (68), the stresses of office, and exposure to poor sanitary conditions, these factors culminated in his premature passing.

— NWS outlook: Arctic front begins to bring hazardous cold to much of the nation this weekend... ...Wintry mix for the Midwest/Northeast and rain for the Southeast Friday into Saturday... ...Snow showers with some moderate accumulations expected through the Northern/Central Rockies and adjacent High Plains.

| KEY DATES IN JANUARY |

20: Inauguration Day

20: College football national championship

24: USDA Food Price Outlook

26: AFC and NFC football championships

27: First day IRS will begin accepting 2024 federal tax returns

28: Florida’s 1st and 6th special primaries

31: Employers and financial institutions should send out W-2 and 1099 tax forms

31: Federal Open Market Committee meets

31: USDA Cattle

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |