Updates: Policy/News/Markets, Feb. 14, 2025

— Presidents Day schedule: Grain and livestock markets will observe normal trading hours today. All markets and gov’t offices are closed on Monday, Feb. 17, for Presidents Day. Grain markets reopen with the overnight session at 7:00 p.m. CT on Monday. Livestock markets resume trading at 8:30 a.m. CT on Tuesday, Feb. 18. — Reciprocal tariffs… maybe coming early April. Link to our special report on the topic released Thursday. Some highlights and updates: — More responses regarding Trump’s reciprocal tariff announcement: · National Retail Federation Executive Vice President of Government Relations David French: “While we support the president’s efforts to reduce trade barriers and imbalances, this scale of undertaking is massive and will be extremely disruptive to our supply chains. It will likely result in higher prices for hardworking American families and will erode household spending power. We encourage the president to seek coordination and collaboration with our trading partners and bring stability to our supply chains and family budgets. The University of Michigan monthly consumer sentiment index continues to decline, suggesting consumers are alarmed about trade war uncertainty.” — Musk’s role in Trump’s government faces legal challenge; lawsuits claim Musk’s power is unconstitutional. Elon Musk is facing significant legal scrutiny over his involvement in the Trump administration, with two lawsuits filed by Democratic officials and federal employees alleging that Musk’s authority in the Department of Government Efficiency (DOGE) is unconstitutional. The lawsuits, filed in Washington and Maryland, argue that President Trump has delegated powers to Musk that require Senate confirmation, including cutting federal spending, reducing workforce size, and accessing sensitive agency data. Plaintiffs claim Musk’s actions violate the Constitution’s Appointments Clause and invoke the major-questions doctrine — a legal precedent used to limit executive overreach. Judges will determine whether Musk’s role and DOGE’s actions should be overturned. These lawsuits are part of a broader challenge to Musk’s expanding influence in federal governance. — RFK Jr. confirmed as HHS Secretary, sparking uncertainty. Robert F. Kennedy Jr., a long-time vaccine critic and political outsider, was confirmed as U.S. Health and Human Services (HHS) Secretary in a narrow 52-48 Senate vote. All Democrats and Republican Sen. Mitch McConnell opposed his confirmation. Despite his controversial views on vaccines and chronic disease, Kennedy was swiftly sworn in by President Trump, who tasked him with leading a commission on chronic disease. Link for details. Of note: He will now have influence over the U.S. Centers for Disease Control and Prevention, which makes recommendations for vaccine use and public health, as well as the Food and Drug Administration. Kennedy, known for his slogan “Make America Healthy Again” (MAHA), steps into a turbulent role at a time when federal health agencies are facing funding threats, mass layoffs, and significant upheaval. His confirmation process was marked by tense questioning over his pseudoscientific positions, including his refusal to fully retract claims linking vaccines to autism. Critics, including Sen. Ron Wyden (D-Ore.), expressed concern about his lack of knowledge on federal health programs and his potential influence on U.S. public health policy. Kennedy, who has largely promoted plans to end the chronic illness epidemic in the country, was sworn in by Supreme Court Justice Neil Gorsuch. His wife Cheryl Hines, Trump, and other members of Kennedy’s family also attended the ceremony. “For 20 years I’m up every morning on my knees and praying that God would put me in a position where I can end the childhood chronic disease epidemic in this country,” Kennedy said in his remarks. “God sent me President Trump.” Kennedy has promised to support vaccines and maintain scientific independence at HHS, but his past leadership in the anti-vaccine movement leaves many skeptical. Working alongside nominees like Dave Weldon at the CDC and Mehmet Oz at CMS, Kennedy will play a pivotal role in shaping U.S. health policy. Whether his tenure will lead to a reformed approach to chronic disease or an erosion of scientific standards remains to be seen. Photographer: Jason C. Andrew/Politico — Brooke Rollins was sworn in as the 33rd USDA Secretary by Associate Justice of the U.S. Supreme Court Clarence Thomas in a private ceremony Thursday at the Supreme Court building. The Senate voted overwhelmingly, 72-28, to confirm Rollins. Here are the 28 Democrats who voted against Rollins. Note that her nomination was moved out of the Senate Ag Committee via unanimous vote, but three voted against her on the Senate floor. Angela Alsobrooks (D-Md.) Comments: Rollins has some important issues to focus on immediately, including (1) Reviewing the various USDA grants and other funding that remain frozen; (2) Getting ag disaster ($21 billion) and economic aid ($10 billion) payments made to eligible producers; (3) Working with NEC Director Kevin Hassett and others on the bird flu situation; (4) Monitoring the impact of Trump tariffs on the U.S. ag sector and any need for a farmer aid program; (5) Advising key congressional members on a new farm bill; (6) Working with Treasury/IRS, EPA and Energy Dept. personnel on finalizing information regarding the 45Z program; (7) Informing President Trump and others about the impact on farm country from mass deportations relative to border security action; (8) Checking on and working with other agencies and departments regarding food aid; (9) Working with her new staff and other key USDA personnel as they officially come into USDA; (10) Getting ready for fiscal year 2026 budget matters for USDA; (11) Working with EPA and the Dept. of Energy on the 2026 RFS RVOs; (12) Dealing with a smaller USDA workforce via buyouts and other actions to reduce the number of government workers; and (13) Addressing issues raised by the GAO relative to operation of the SNAP/food stamps program and other operational aspects of the program should they see any major alternations under budget reconciliation. Of note: Rollins already held a meeting at 4 p.m. CT Thursday at USDA on bird flu, gathering who she said were “some of the most brilliant professionals I’ve encountered. Their insights were invaluable.” Rollins will be very visible in the days ahead, she said on X that she will be in four states, give six speeches, attend the National Farm Machinery Show in Louisville and “so much more.” — The Senate is expected to hold votes next week on Trump’s picks for FBI director, Small Business administrator and secretary of Commerce. — There are concerns about potential budget cuts and their impact on National Resources Conservation Service (NRCS) operations. If workforce reductions occur, they could have significant consequences: Upshot: While NRCS has recently focused on expanding its workforce to meet increased demands, the agency remains vulnerable to potential budget cuts and policy changes. The full impact of any government worker reduction push on NRCS will depend on future policy decisions and funding allocations. — OPM directs agencies to fire government workers still on probation. Office of Personnel Management (OPM) officials met with agency leaders across government Thursday and directed them to begin firing employees still in their probationary period a year or more after being hired. There are roughly 200,000 employees hired by the federal government within the past two years to whom the directive might apply, though it was not immediately clear how many would be affected because some, such as those in public safety and law enforcement jobs, were exempted. |

| FINANCIAL MARKETS |

— Equities today: Asian and European shares were mixed in trading overnight. U.S. stock indexes are set to open weaker. In Asia, Japan -0.8%. Hong Kong +3.7%. China +0.4%. India -0.3%. In Europe, at midday, London -0.3%. Paris +0.2%. Frankfurt -0.4%. India’s benchmark indexes fell on Friday as investors fretted over the implications of U.S. President Donald Trump’s plans to impose reciprocal tariffs, which analysts said could hurt the country the most among its Asian peers.

Equities yesterday: All three major indices ended higher, scoring gains in the final two hours of trading after the tariff announcements from the White House. The Dow gained 342.87 points, 0.77%, at 44,711.43. The Nasdaq rose 295.69 points, 1.50%, at 19,934.64. The S&P 500 was up 63.10 points, 1.04%, at 6,115.07.

— Trump’s call to halve military spending jolts defense stocks. President Donald Trump stunned markets Thursday by suggesting that U.S. military spending could be cut in half, contingent on agreements with Russia and China. Defense stocks tumbled following his comments, with major players such as Lockheed Martin falling nearly 1.6%. General Dynamics, Northrop Grumman, and L3Harris Technologies also saw significant declines.

Trump’s remarks came during a news conference where he outlined his vision for global military budget reductions, signaling upcoming talks with Chinese President Xi Jinping and Russian President Vladimir Putin. “One of the first meetings I want to have is with President Xi and President Putin. I want to say, let’s cut our military budget in half,” said Trump.

The U.S. currently spends around $1 trillion annually on defense, roughly 3.4% of GDP, compared to the European Union’s 1.6%. While the White House did not comment, the market’s reaction underscores investor uncertainty, with Lockheed shares down nearly 20% since Trump’s re-election.

The newly formed Department of Government Efficiency (DOGE), led by Tesla CEO Elon Musk, is reviewing government spending, including Pentagon operations. Despite Defense Secretary Pete Hegseth’s push to maintain defense spending at no less than 3% of GDP, Trump’s cost-cutting ambitions have already caused ripples across the defense sector.

— Cal-Maine Foods stock has done egg-ceptionally well — but cracks may be forming. A Barron’s article (link) notes that egg stocks have been on a roll thanks to surging prices caused by an egg shortage driven by avian flu. Cal-Maine Foods, the largest U.S. egg producer, has seen its stock soar 90% over the past 12 months. The question is: Can this momentum last, or will the stock crack under pressure?

Cal-Maine’s recent earnings benefited from elevated egg prices and strong holiday demand. Despite trading at just six times this fiscal year’s earnings estimates, analysts caution that this low valuation may not last. “Egg prices and revenue are expected to drop 30% next year,” potentially leading to a 70% plunge in 2026 earnings compared to fiscal 2024.

Only two Wall Street analysts cover Cal-Maine, a rarity for a company of its size. While Consumer Edge Research’s Alex Jarombek gives it a Buy rating with a $108 target, that’s less than 1% upside from current levels. Stephens’ Pooran Sharma rates it a Hold, with a $97 target — about 10% below the current price. Meanwhile, Vital Farms (VITL) offers a more diversified approach by selling butter in addition to eggs. Its stock has more than doubled over the past year and trades at a higher 29 times earnings. Still, with seven out of eight analysts rating it a Buy, its $48 price target suggests a 35% upside.

As Barron’s concludes, while neither stock is an obvious bargain at these levels, Vital Farms seems to have the stronger growth potential compared to the more volatile outlook for Cal-Maine.

| AG ECONOMY |

— U.S. sales of ag tractors & combines drop during January 2025. The Association of Equipment Manufacturers has just released the January 2025 Ag Tractor/Combine Sales report. The report (link) reflects:

- U.S. sales of Ag tractors dropped 15.8% compared to January 2024

- U.S. sales of combines fell 78.9% compared to January 2024

- Canadian sales of Ag tractors dropped 3.1% compared to January 2024

- Canadian sales of combines fell 82.9% compared to January 2024

— Farmland values steady amid weak ag economy and rising credit strain. Agricultural real estate values across the Kansas City Federal Reserve District (link) remained largely unchanged through 2024, while credit conditions modestly worsened. Nonirrigated farmland values rose less than 1%, with variations across states and declining sales volumes as high farm loan interest rates and weak crop prices weighed on the market.

Despite subdued conditions, ranchland values grew 5% over the year, and USDA forecasts for 2025 project potential recovery fueled by disaster relief payments. However, the outlook for farmland values remains cautious, with 40% of lenders expecting a slight decline in 2025. Credit conditions tightened further, with farm loan repayment rates falling at the fastest pace since 2020, driven by lower farm income and rising demand for non-real estate financing.

Farmers reduced capital spending, particularly on equipment, but household expenses remained under pressure. While drought and declining grain prices hit row crop producers hard, cattle operations fared better, maintaining stronger liquidity. Emerging energy practices like solar and carbon sequestration saw increased adoption but limited impact on farmland demand.

Lenders remain watchful of evolving credit and income trends as 2025 unfolds.

Background: A total of 125 banks responded to the Fourth Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District — an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri.

Of note: Here is a link to the Seventh Federal Reserve District states of Illinois, Indiana, Iowa, Michigan and Wisconsin.

| AG MARKETS |

— Ag markets today:

- Grains solidly higher overnight. Corn, soybeans and wheat built on Thursday’s gains during the overnight session and are trading near their session highs early this morning. As of 7:30 a.m. ET, corn futures were trading mostly 4 cents higher, soybeans were 6 to 9 cents higher and wheat futures were 10 to 12 cents higher. The U.S. dollar index was around 330 points lower, and front-month crude oil futures were about 50 cents higher.

- Choice beef continues to fall, packer margins fall deeper into the red. Choice boxed beef weakened another $1.86 to $317.40 on Thursday, while Select firmed 70 cents to $309.84. Cash cattle prices have pulled back from their recent historic levels, but the drop in wholesale beef prices has been even more aggressive, driving already poor packer margins deeper into the red.

- Cash hog index gaining steam. The CME lean hog index is up another 98 cents to $88.06 as of Feb. 12, marking the biggest daily gain in the seasonal climb for a second straight day. The index is $7.63 off the seasonal low on Jan. 9 and at the highest level since Nov. 18. February lean hog futures, which expire today and are settled against the index on Feb. 19, finished Thursday $1.315 above today’s quote. April hogs finished yesterday at a $5.04 premium to the index.

— Ag trade: South Korea purchased 60,000 MT of soymeal expected to be sourced from the U.S., South America or China.

— USDA daily export sale:

· 100,000 MT of corn to Colombia for 2024-25.

— Japan to tap emergency rice supplies amid price surge. Japan will release 210,000 tons of rice from its emergency reserves to ease soaring prices. This amount is about 3% of the country’s forecasted annual demand. The price for a 5-kilogram bag of rice surged 82% year-over-year to 3,688 yen ($24) in late January 2025. The Japanese government heavily regulates its rice market with high import tariffs, limiting foreign competition. Despite an improved harvest last year, distribution issues contributed to rising prices. The first tender for 150,000 tons of rice will be held in early March, with delivery expected mid-March. The government may expand the amount if necessary. Increased demand was partly driven by panic buying after the government warned in August 2024 about a potential devastating earthquake in the Nankai Trough. The Bank of Japan cited rising rice prices as one factor in its upward revision of inflation forecasts and its recent interest rate increase in January 2025. While Japan faces record-high prices, global rice prices are declining. For instance, Thai white rice prices — a key regional benchmark — have dropped to their lowest since 2022.

— Indian buyers of chickpeas from top exporter Australia are defaulting on cargoes or trying to renegotiate prices after an influx of supply.

— Western Australia’s wheat harvest bigger than expected. The Grain Industry Association of Western Australia (GIWA) said the state’s wheat production was approximately 1.6 MMT than its December forecast. Western Australia produced 12.45 MMT of wheat, GIWA said in its final report of the 2024-25 growing season. GIWA attributed the high production to a warm winter, effective farm management, and a decline in sheep numbers, which have freed up more land for cropping. Yields in other Australian states also exceeded expectations, leading analysts to raise their national production estimates to between 32 MMT and 35.5 MMT.

— Agriculture markets yesterday:

• Corn: March corn rose 3 1/4 cents to $4.93 1/2, a one-week high close.

• Soy complex: March soybean futures closed 2 1/4 cents higher to $10.30, nearer session highs March meal futures fell $1.40 to $292.70, nearer session lows. March bean oil rallied 59 points to 46.25 cents.

• Wheat: March SRW wheat rose 3 1/2 cents to $5.77 3/4 and near mid-range. March HRW wheat rose 6 3/4 cents to $5.98 1/4, nearer the daily high. March spring wheat futures climbed 2 cents to $6.16 3/4.

• Cotton: March cotton futures closed 64 points lower to 66.83 cents and settled near session lows.

• Cattle: April live cattle rose 80 cents to $196.525 and near mid-range. March feeder cattle rose $3.00 to $267.975 and near the session high.

• Hogs: Long liquidation likely undercut hog futures Thursday, with the expiring February contract slipping 7.5 cents to $89.375. Most active April futures fell $1.225 to $93.10.

| FARM POLICY |

— Will there be a new farm bill this year? That is a more complex question than most realize. Here are some possibilities:

- Some farm-state lawmakers want to put most if not all of a new farm bill in a budget reconciliation measure. Problems: Will House and Senate Republicans agree on a plan? If so, will GOP leaders want to put another major bill into an already hard-to-get reconciliation measure that includes key Trump agenda items? Will GOP House and Senate Ag Committee leaders demand the farm bill be part of any reconciliation measure to get their votes?

- Stand-alone farm bill. While a solo farm bill could possibly pass the Senate, the fate in the House is unclear. Reason: Some 60 or more House Republicans could vote against the measure based on history. That means votes from Democrats would be needed. But getting Dems to vote for a farm bill will largely be based on how Republicans alter the SNAP/food stamp program. If it takes the House approach, Dems will not go along; they could go along with a more moderate GOP Senate approach.

- If the 2018 Farm Bill is extended again, another ad hoc ag economic aid package will be pushed.

Simple, huh?

| ENERGY MARKETS & POLICY |

— Oil prices rise amid trade optimism and strong demand. Oil prices rebounded on Friday, set to end a three-week decline, driven by stronger fuel demand and hopes that U.S. tariff measures would be delayed until April, reducing trade war fears. Brent crude rose 0.8% to $75.61 per barrel, while U.S. West Texas Intermediate (WTI) climbed 0.7% to $71.76, with both benchmarks heading for weekly gains of around 1%. U.S. President Donald Trump ordered officials to study reciprocal tariffs, with recommendations due by April 1, boosting market sentiment. Meanwhile, global oil demand reached 103.4 million barrels per day, up 1.4 million from last year, according to JPMorgan, driven by increased mobility, heating fuel use, and a shift from gas to oil due to soaring gas prices in Europe. The International Energy Agency (IEA) noted that Russian oil exports could remain stable if workarounds to sanctions are found.

— Oil prices held steady Thursday amid Russia/Ukraine talks and U.S. tariff optimism. Oil prices stabilized on Thursday after recovering from earlier losses of over 1%. Brent crude futures dropped slightly by 2 cents (0.02%) to $75.16 per barrel, while WTI rose by 1 cent (0.1%). Market uncertainty eased following reports that new U.S. tariffs could be delayed until April, giving time for negotiations. Additionally, a larger-than-anticipated build in U.S. crude inventories, as reported by the EIA, added downward pressure on prices.

— Malaysia to crack down on used cooking oil (UCO) fraud amid Western scrutiny. Malaysia is planning stricter measures to combat fraud in the export of used cooking oil (UCO) to address concerns from Western countries that the shipments may contain palm oil, Deputy Plantation and Commodities Minister Chan Foong Hin told Reuters. The government aims to strengthen enforcement and ensure traceability throughout the supply chain to uphold industry credibility and Malaysia’s reputation as a responsible exporter. “The center of this issue is the traceability,” Chan said, emphasizing the need for a fully transparent supply chain. He noted that 87% of Malaysian palm oil plantations are sustainably certified under the Malaysian Sustainable Palm Oil standards. The U.S. and European Union have both expressed concerns about the possibility of virgin palm oil being mixed with UCO, raising sustainability and compliance issues.

— ACE applauds reintroduction of year-round E15 legislation. The American Coalition for Ethanol (ACE) welcomed the reintroduction of the bipartisan, bicameral Nationwide Consumer and Fuel Retailer Choice Act, led by Sens. Deb Fischer (R-Neb.) and Tammy Duckworth (D-Ill.) in the Senate, along with Reps. Adrian Smith (R-Neb.) and Angie Craig (D-Minn.), Sharice Davids (D-Kan.), Dusty Johnson (R-S.D.), Nikki Budzinski (D-Ill.), and Mariannette Miller-Meeks (R-Iowa) in the House.

The bill aims to extend the Reid vapor pressure (RVP) volatility waiver, enabling the year-round, nationwide sale of ethanol blends up to 15% (E15). The legislation, called the Nationwide Consumer and Fuel Retailer Choice Act, would remove what the ag industry terms an obsolete policy that prevents the sale of E15 during the summer months.

ACE CEO Brian Jennings praised the effort, emphasizing the growing support for year-round E15 in Congress and noting the organization’s commitment to advocating for the bill’s passage during their upcoming DC fly-in. He stated, “We’re grateful to bipartisan leaders in the House and Senate for reintroducing this critically important legislation, which would once and for all ensure nationwide and permanent E15 availability.”

The National Corn Growers Association (NCGA) also applauded the development. “Extending nationwide consumer access to E15 would save drivers money at the pump while boosting the farm economy,” said Illinois farmer and National Corn Growers Association President Kenneth Hartman Jr. “We applaud our allies in the House and Senate for sponsoring and co-sponsoring this legislation.”

The current policy preventing summer sales of E15 has left corn growers who rely on the sale of ethanol with a great deal of uncertainty. Drivers have also been faced with higher gas prices during the summer vacation season.

Of note: EPA has issued waivers over the last few years. But growers and many Midwest governors have called for a permanent fix to the problem. The proposed legislation would offer that solution.

“Congress has an opportunity to finally get this legislation across the finish line,” Hartman said. “This is extremely important to corn growers and rural communities and comes at no cost to the federal government. We encourage Congress to move quickly to pass this legislation and send it to Pres. Trump for signature.”

Comments: The road to year-round E15 has been a curvy one, sometimes with ice. Language in the current legislation was originally included in a continuing resolution to fund the government in December but was struck before that legislation was passed. Corn grower leaders at the time expressed their dismay with that development but are now more optimistic about the chances of advancing this legislation.

— Indonesia expects to reach full implementation of B40 biodiesel in March. Indonesia expects its B40 biodiesel program will reach full implementation next month after delays at the start of the year, energy ministry official Eniya Listiani Dewi said. Indonesia had planned to launch the mandatory B40 mix, containing 40% of palm oil fuel, on Jan. 1 but faced some delays due to regulatory issues, so fuel distributors were given until the end of February as a transition period.

| HPAI/BIRD FLU |

— Highly pathogenic avian influenza detected in a commercial turkey flock in Buena Vista County Iowa. The Iowa Department of Agriculture and Land Stewardship and USDA’s Animal and Plant Health Inspection Service (APHIS) detected a case (H5N1 HPAI) in a commercial turkey flock in Buena Vista County, Iowa. This is Iowa’s third detection of H5N1 HPAI within domestic birds in 2025.

— U.S. HPAI response disrupted in early weeks of Trump administration. The Trump administration has disrupted the U.S. response to the highly pathogenic avian influenza (HPAI) outbreak, leading to confusion and concern among federal staff, state officials, veterinarians and health experts, multiple sources told Reuters. Since Trump took office on Jan. 20, two federal agencies responsible for monitoring and responding to the epidemic have withheld HPAI reports and canceled congressional briefings and meetings with state health officials, the sources said. Trump’s decision to withdraw the U.S. from the World Health Organization has also hampered information sharing that enables officials to track outbreaks and strains of the virus in other countries, three sources said.

— Bird flu crisis spurs regional emergency and hours-of-service waivers for relief transport. The Federal Motor Carrier Safety Administration (FMCSA) has declared a regional emergency due to the spread of highly pathogenic avian influenza (HPAI), which has led to significant losses in chicken flocks and caused an egg supply shortage. In response, FMCSA has waived maximum driving time regulations for commercial motor vehicle operators transporting live chickens from affected areas to unaffected regions. This emergency declaration follows similar actions taken by the governors of California, Iowa, and Louisiana.

Key requirements for carriers and drivers:

- Drivers must not drive more than 16 hours within a 24-hour period.

- All driving must cease by midnight each day.

- A minimum 6-hour sleeper berth break is required before resuming driving.

- Drivers must use and maintain paper records of duty status (RODS) for six months.

- Carriers must also ensure they comply with all U.S. Department of Agriculture and state regulations, securing necessary approvals and documentation for transport.

This emergency declaration remains in effect until March 10, 2025, or until the crisis is resolved.

— California scrambles to contain egg shortage amid bird flu outbreak. California is facing a severe egg shortage as a devastating outbreak of bird flu has decimated chicken populations, sending prices skyrocketing and leaving grocery store shelves sparse, the Los Angeles Times reports (link). Grocery chains like Trader Joe’s and Kroger have begun limiting customers to two cartons of eggs per visit as the crisis worsens.

The average price for a dozen eggs hit $4.95 in January, a record high according to the U.S. Bureau of Labor Statistics. California’s prices are even steeper, often surpassing $9 per dozen. “This virus is historically unprecedented,” said Sanjay Sharma, an adjunct professor at USC’s Marshall School of Business. “The reason for the egg shortage is very clear. Birds are getting this flu and they have to be culled as quickly as possible.”

The bird flu outbreak has led to the deaths of over 21 million chickens, with 13 million culled in December alone, according to USDA. Whole flocks are being killed to prevent the spread, and California’s reliance on its own egg production — 40% of its egg consumption — is compounding the problem. “Everybody likes fresh eggs, so we typically eat the eggs we produce,” Sharma explained. “Right now, that’s presenting a problem.”

Dominick Miserandino, CEO of RetailWire, warned that the scarcity might last longer than many expect. “It can take months to raise a new flock of chickens,” he said. “If the next flock is infected as well, then we need a real systemic solution. I don’t think that there is one out there.”

The panic-buying behavior seen during the Covid-19 toilet paper shortage may be resurfacing. Sharma said he’s heard of instances of shoppers buying as many as 500 eggs from Costco in one trip. He suspects they are reselling them to restaurants and bakeries at a lower price than other suppliers.

Experts urge consumers not to hoard eggs despite the restrictions. “It’s a human instinct, but it’s a self-defeating cycle,” Sharma said. “It’s absolutely better for everybody if people don’t hoard.”

Meanwhile, grocery prices continue to climb across the board. Labor Department data shows that several staples, such as ground beef, milk, and fresh chicken, are more expensive than last year.

Of note: The Trump administration is working on a plan to address the bird flu issue, White House National Economic Council Director Kevin Hassett said Wednesday in an interview on CNN. “Very soon everyone is going to see a plan to get ahead of this thing,” he said. As previously noted, USDA Secretary Brooke Rollins late Thursday convened a USDA-held session of experts on bird flu. “Supply chain challenges could put additional upward pressure on food prices in the near term,” said Andy Harig, vice president of tax, trade, sustainability and policy development at FMI — The Food Industry Association. “The impact of wildfires out West, cold weather in the Midwest, and the ongoing avian flu outbreak bear keeping an eye on in the months to come. It also remains to be seen whether and how potential tariffs may affect the price of food and household goods.”

| CONGRESS |

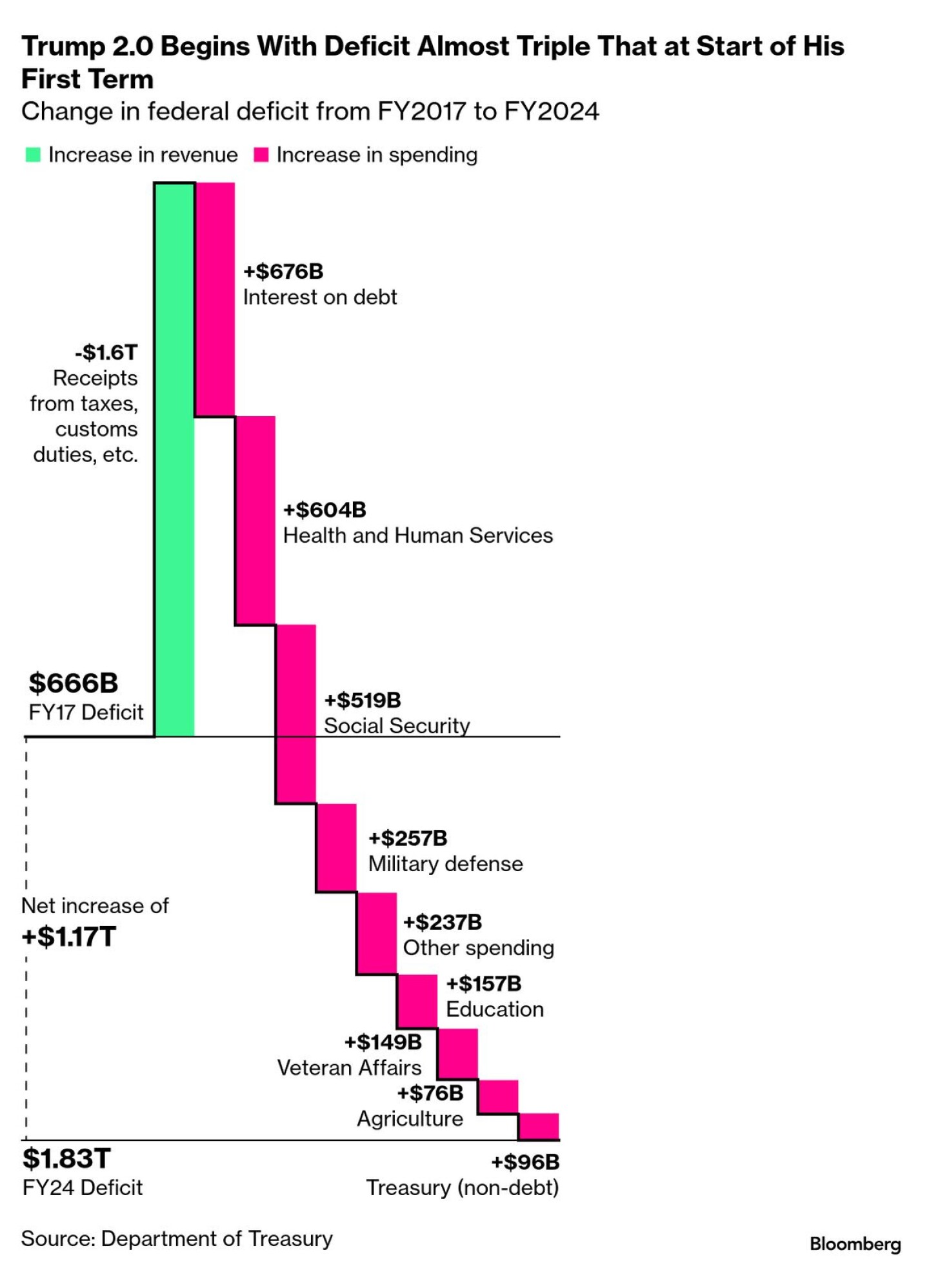

— House Budget advances after deal with Freedom Caucus holdouts; GOP strikes agreement on deeper spending cuts in exchange for expanding tax cuts. House Republicans cleared a key hurdle in a vote of 21-6 after striking a deal with the Freedom Caucus, securing deeper spending cuts in exchange for broader tax relief. The compromise paved the way for Budget Committee approval of the fiscal year (FY) 2025 blueprint, essential for unlocking a filibuster-proof reconciliation bill to enact significant parts of the GOP agenda, including extensions of the 2017 tax cuts, energy incentives, immigration enforcement, and increased defense spending.

Under the agreement, committees must deliver at least $2 trillion in savings over 10 years or face reductions in the Ways and Means Committee’s $4.5 trillion allowance for deficit-expanding measures. Surpassing the savings goal could raise the tax cut threshold beyond $5 trillion.

The budget’s fate remains uncertain on the House floor due to tight margins and opposition from some members, like Rep. Victoria Spartz (R-Ind.), who demands deeper cuts and opposes a $4 trillion debt ceiling increase.

Upshot: The GOP’s broader goal of making the 2017 tax cuts permanent could hinge on securing broader party unity in both chambers.

| RECALLING PRESIDENT CARTER’S PUSH FOR ZERO-BASED BUDGETING |

— Former President Jimmy Carter advocated for zero-based budgeting (ZBB) as part of his efforts to reform government spending during his presidency (1977–1981). Zero-based budgeting requires agencies to justify all expenses from a “zero base” each fiscal year, rather than simply adjusting previous budgets. Carter had successfully implemented it as governor of Georgia and believed it would bring efficiency and accountability to the federal government.

Carter faced significant resistance from members of his own Democratic Party, especially in Congress, for a few key reasons:

- Established budget practices: Many congressional Democrats were accustomed to the traditional incremental budgeting process. They found ZBB overly complex and burdensome for large federal agencies.

- Congressional turf wars: Carter’s push for ZBB was seen as part of his broader effort to reduce government waste and consolidate power in the executive branch. Some legislators viewed this as an infringement on their budgetary authority.

- Ideological differences: While some Democrats supported budget reform, others were concerned that Carter’s approach might lead to cuts in social programs. These legislators were wary that ZBB could become a tool for reducing funding to vital initiatives.

- Bureaucratic complexity: Zero-based budgeting was difficult to implement on the federal level due to the sheer size and complexity of the government. Even agencies struggled with the additional administrative burden.

Outcome: Although Carter succeeded in introducing ZBB into some parts of the federal government, it was never fully adopted across all agencies. The practice fell out of favor after he left office. However, his focus on budget discipline and showed how to approach government efficiency.

Jimmy Carter’s advocacy for zero-based budgeting: In a 1977 town hall meeting in Clinton, Massachusetts, President Carter explained: “Zero-based budgeting means that every year you start from scratch. And when the budget is put together, ordinarily, the only thing that the President and the Congress look at is the new things that are added on. Anything that has been there all the time is not even looked at. Under zero-base budgeting you start from zero, and you not only look at the new things but you look at all the old things.”

Reflecting on his tenure as Governor of Georgia, Carter stated: “I think for the first time in any government, zero-based budgeting, where we automatically weeded out old and obsolescent programs. We established renewed priorities every year to make sure we spent the money or other resources on things that were of highest need in that particular year.”

James McIntyre, Director of the Office of Management and Budget under Carter, acknowledged the complexities of implementing ZBB: “The paperwork was enormous. The time involved was substantial, and I doubt that it would be carried forward by most administrations because it’s very time consuming. The payoff is not that significant.”

A study by the Brookings Institution suggested limitations of ZBB: “Zero-based budgeting was ill-suited for dealing with most of the federal budget and actually reduces the chances for large cutbacks in old programs.”

| USAID & FOOD AID |

— Congressional oversight (or lack of it) of USAID. Several congressional committees and subcommittees are responsible for overseeing the U.S. Agency for International Development (USAID). Their stated goals are ensuring accountability and efficiency in its foreign aid programs, but current developments are signaling the panels failed to make USAID account for the way they used taxpayer funding.

Senate Committees

- Senate Foreign Relations Committee: Oversees foreign aid programs, including USAID.

- Subcommittee on State Department and USAID Management, International Operations, and Bilateral International Development: Focuses on USAID management and policy.

- Subcommittee on State, Foreign Operations, and Related Programs (SFOPs): Manages USAID funding, poverty-focused development, and global health programs.

- Senate Appropriations Committee

House Committees

- House Foreign Affairs Committee: Oversees foreign aid programs.

- Subcommittees on International Development, Africa, Global Health, and Human Rights are involved.

- Subcommittee on State, Foreign Operations, and Related Programs (SFOPs): Similar to its Senate counterpart, it controls USAID funding.

- House Appropriations Committee

- House Oversight Committee: Conducts investigations into USAID operations.

Other oversight mechanisms

· USAID Office of Inspector General (OIG): Provides independent oversight of USAID programs and personnel.

Upshot: These committees are supposed to ensure proper governance, review budgets, and evaluate the effectiveness of U.S. foreign assistance programs.

— Federal judge extends block on USAID employee leave. A federal judge has extended a temporary block on the Trump administration’s plan to place thousands of U.S. Agency for International Development (USAID) employees on leave. This decision comes as the judge, U.S. District Judge Carl Nichols, considers whether a further pause is warranted. Judge Nichols extended the block through February 21, 2025. The judge intends to rule on a preliminary injunction before that date. Unions representing government employees sued to stop the shutdown of USAID operations.

— The current status of U.S. food aid release is complex and largely disrupted, despite some attempts to mitigate the situation. The implementation of U.S. food aid programs remains severely hampered due to the Trump administration’s actions regarding USAID. House Republicans brought the receipts to this week’s “USAID Betrayal” hearing exposing the U.S. international aid agency’s widespread waste and abuse of American tax dollars.

Despite waivers issued by Secretary of State Marco Rubio for emergency food aid and “lifesaving” programs, the delivery of food assistance remains largely stalled. This is due to:

- An uncertain payment system

- Loss of critical staff needed to manage and deliver aid

- Bureaucratic and payment problems created by the administration

A significant amount of food aid is currently in limbo:

- $489 million worth of food is sitting at ports, in transit, and in warehouses

- Over 500,000 metric tons of food is on ships or ready to be shipped abroad

- This food is at risk of spoilage, unanticipated storage needs, and potential diversion

While there have been efforts to resume some food aid shipments, these have been largely ineffective:

- Secretary Rubio issued waivers for emergency food assistance and “lifesaving” programs

- Some reports indicate that food assistance under Title II programs has recently resumed. However, the impact of these measures has been limited due to: (1) Slow processing of waivers, (2) Frozen payment systems, (3) Loss of critical staff and operational capacity

Some aid organizations have been forced to suspend their programs.

| TRADE POLICY |

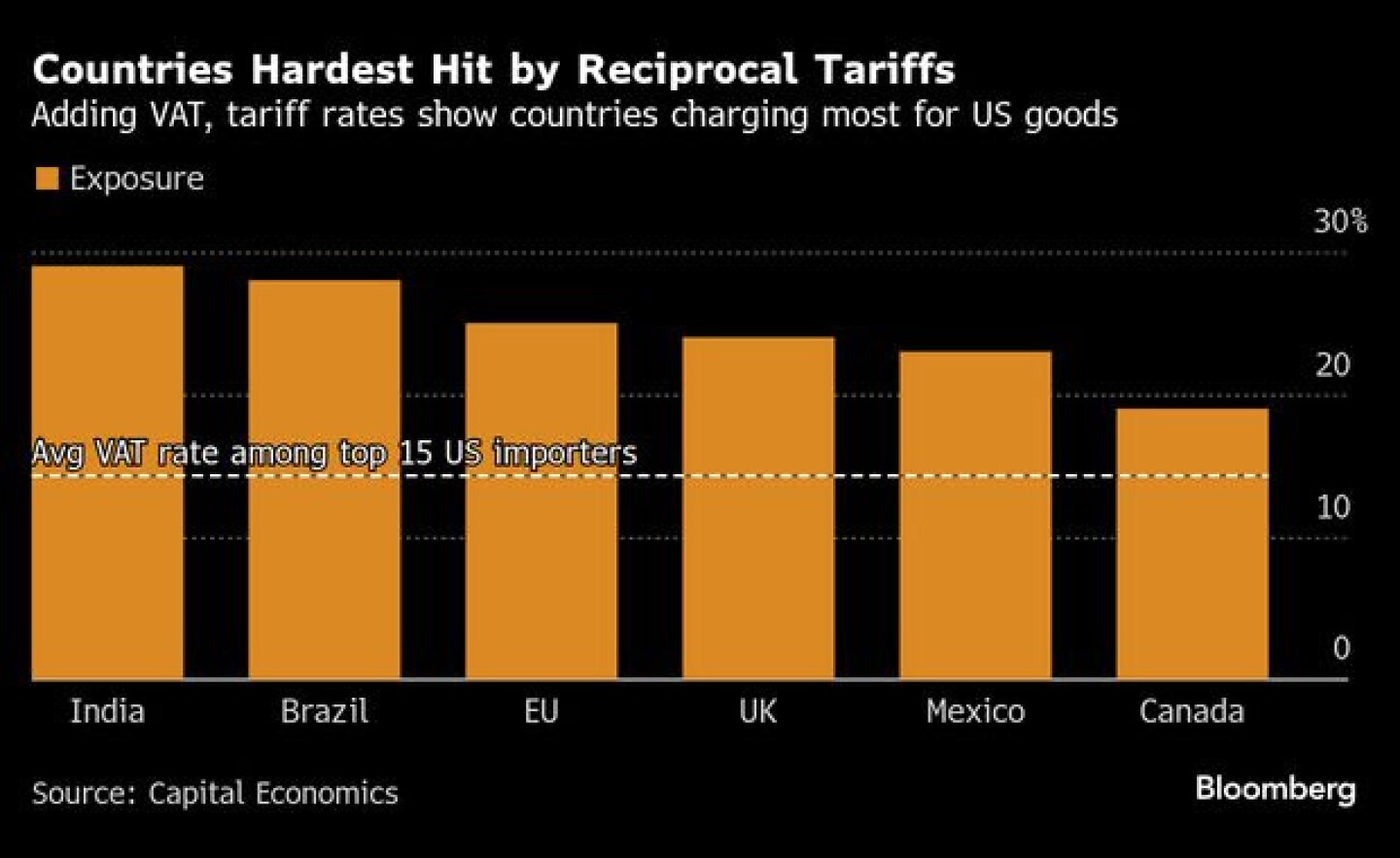

— Trump and Modi discuss trade and tariffs amid strained economic ties. During a press conference at the White House, President Donald Trump announced that Indian Prime Minister Narendra Modi agreed to launch trade negotiations to address the U.S. trade deficit. This came hours after Trump unveiled sweeping reciprocal tariffs set to take effect as early as April. Trump criticized India’s high tariffs, vowing to match them dollar for dollar.

While both leaders highlighted plans to boost energy and defense exports, concrete trade deals remain elusive. Modi emphasized expanding cooperation in semiconductors and artificial intelligence while aiming to double bilateral trade to $500 billion by 2030.

Despite warm diplomatic gestures, tensions linger over tariffs and US allegations of bribery against Indian tycoon Gautam Adani. Modi’s visit holds high stakes as India seeks to secure market access to the U.S. while navigating internal economic challenges.

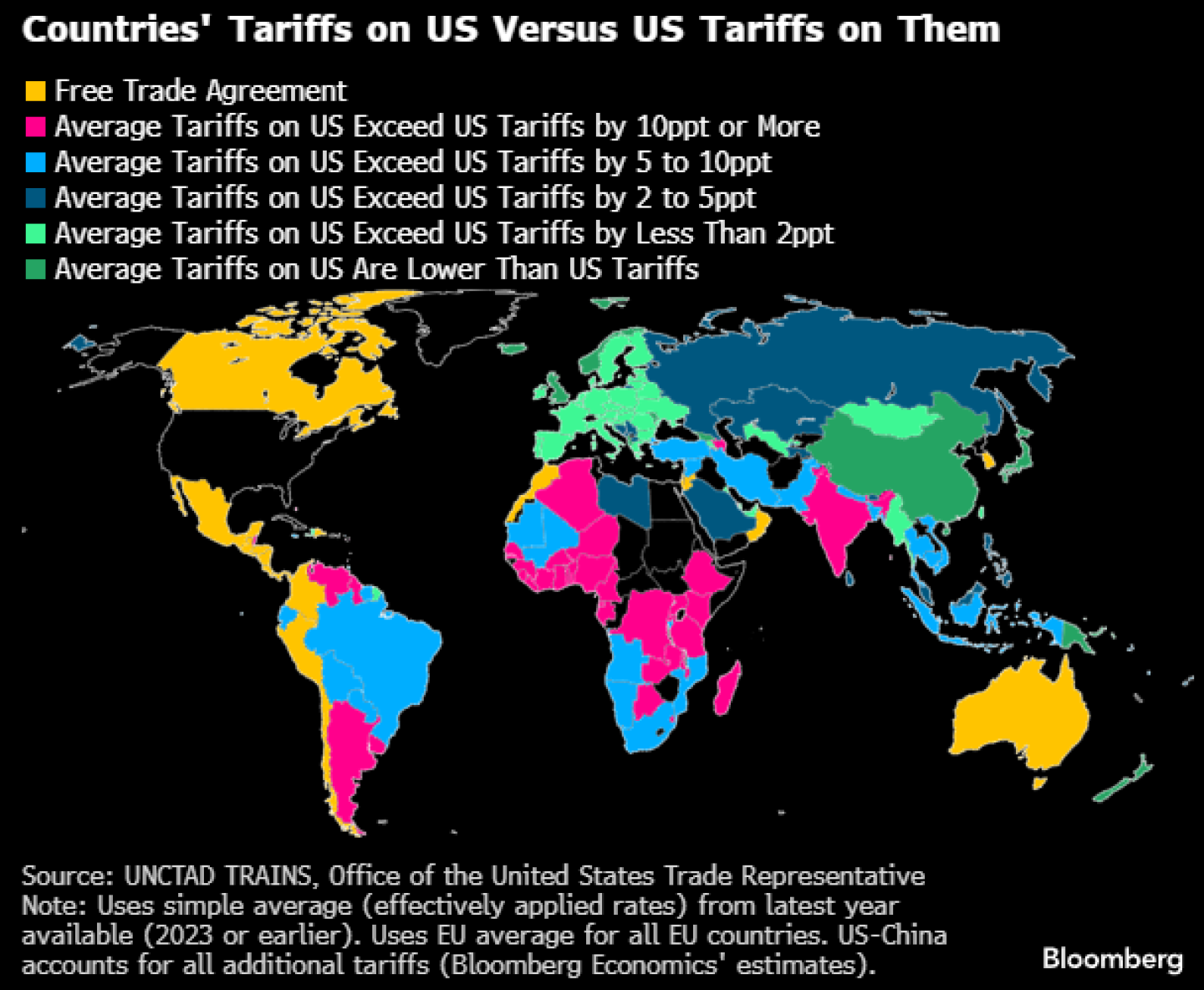

— Initial U.S. trade policy targets. A fact sheet (link) from the White House outlined examples of trade policies and actions by other countries that would be targeted via this reciprocal tariff action. A few examples:

- Brazil: “The U.S. tariff on ethanol is a mere 2.5%. Yet Brazil charges the U.S. ethanol exports a tariff of 18%. As a result, in 2024, the U.S. imported over $200 million in ethanol from Brazil while the U.S. exported only $52 million in ethanol to Brazil,” the fact sheet said.

- India: The fact sheet noted the U.S. has Most Favored Nation (MFN) tariffs on agricultural goods that average 5%, but India has an applied MFN tariff of 39%. The fact sheet also cited motorcycles from India as a case where they charge at 100% tariff while the US level is 2.4%.

- EU: The European Union (EU) was noted for its tariffs on US shellfish, cars, and other goods.

Bottom line: “A 2019 report found that across 132 countries and more than 600,000 product lines, United States exporters face higher tariffs more than two-thirds of the time,” the release noted.

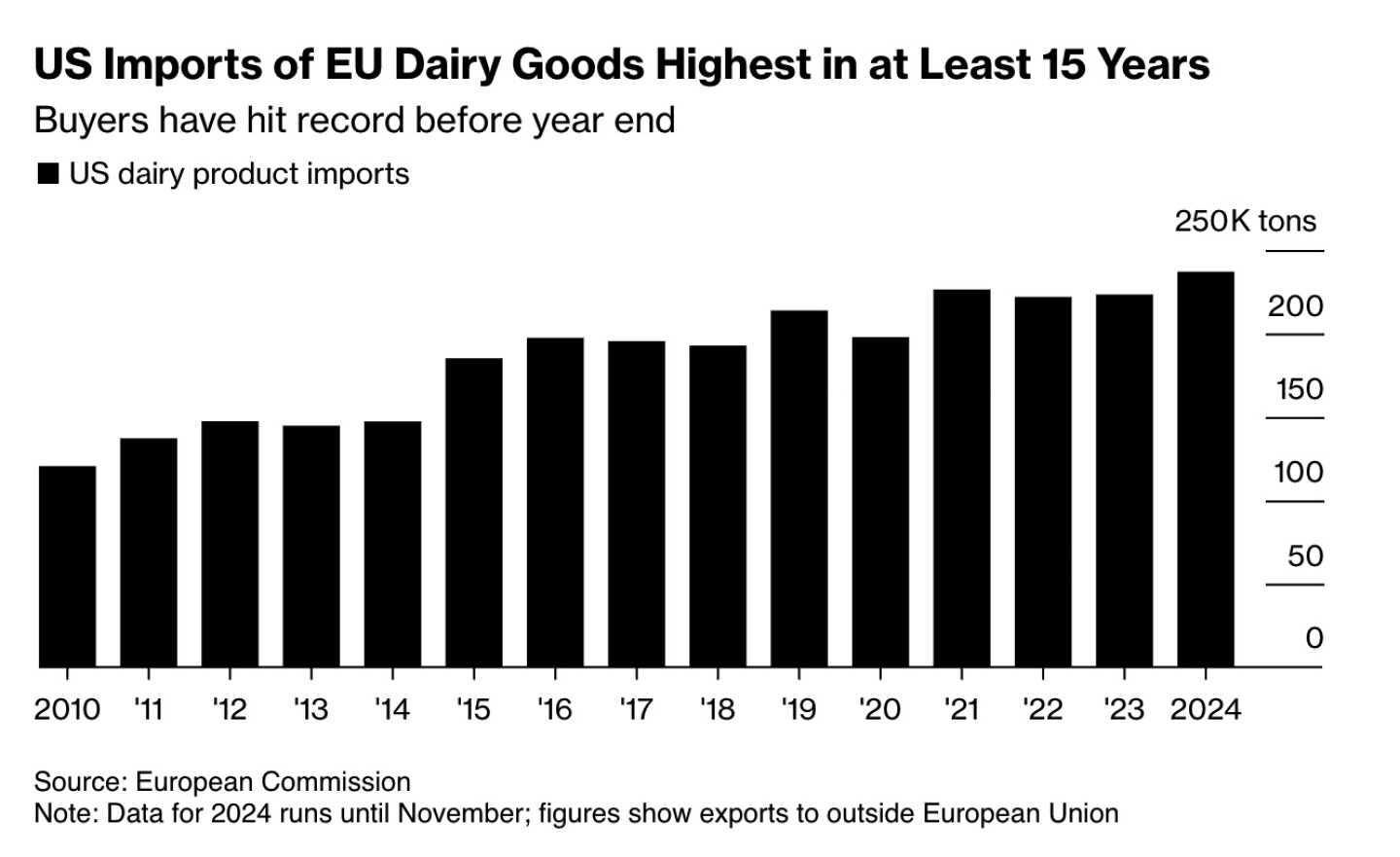

— Europe’s wine and butter sellers rush to the U.S. to dodge potential tariffs. European producers of wine and dairy are racing to ship goods to the U.S. ahead of possible tariffs by President Trump. While no specific measures have been detailed, fears of trade disruptions have caused a significant spike in exports, Bloomberg reports (link).

French wines and Irish butter are among the top items being stockpiled by U.S. importers to avoid higher costs, with European dairy exports hitting a 15-year high. The U.S. is Europe’s second-largest agri-food export market, with €27 billion ($28.05 billion) billion worth of goods exported in 2023.

For Europe’s farmers, new tariffs could compound existing struggles like high energy costs and unpredictable weather. Meanwhile, American consumers may soon face higher prices on luxury staples such as cheese and wine. Previous tariffs under the Trump administration cost the European wine industry €1 billion ($1.039 billion), and producers warn that it would take significant time to find alternative markets.

| RUSSIA & UKRAINE |

— Vice President JD Vance threatened to hit Russia with sanctions and military action if Vladimir Putin doesn’t guarantee Ukraine’s long-term independence in a peace deal. Vance offered the Trump administration’s strongest-yet support for Kyiv in the face of Russian demands that it disarm and replace the current government. Vance is scheduled to meet with Ukrainian President Volodymyr Zelenskyy today at the high-level Munich Security Conference in Germany.

| CHINA |

— China to develop gene-editing tools, new crop varieties in biotech initiative. China issued guidelines to promote biotech cultivation, focusing on gene-editing tools and developing new wheat, corn, and soybean varieties, as part of efforts to ensure food security and boost agriculture technology. The 2024-2028 plan aims to achieve “independent and controllable” seed sources for key crops, with a focus to cultivate high-yield, multi-resistant wheat, corn and high-oil, high-yield soybean and rapeseed varieties. The document pledged to research and develop precision gene-editing tools with independent intellectual property and enhance key cultivation technologies. Additionally, efforts will be made to breed high-performance livestock, including pigs with strong reproductive capacity and high feed conversion rate and disease-resistant broiler chickens.

| POLITICS & ELECTIONS |

— Minnesota seat opens as Sen. Tina Smith announces retirement. Minnesota Sen. Tina Smith will not seek a second full term, creating an open seat in a Democratic-leaning state that Republicans see as a possible target.

“This decision is not political. It is entirely personal,” said Smith, 66, in a video on social media, citing her desire to spend more time with her family, including her father, who turns 95 this summer. However, she emphasized the ongoing need for “strong, progressive leadership.”

Smith’s retirement marks the second Democratic Senate seat to become open this cycle, following Michigan’s Gary Peters. While Minnesota leans Democratic, Republicans could mount a competitive campaign with the right candidate, especially given Donald Trump’s relatively narrow 4-point loss in the state during the last presidential election.

A veteran of Democratic-Farmer-Labor politics, Smith was appointed to the Senate in 2018 following Al Franken’s resignation and later won a special election. In 2020, she secured a full term by a 5-point margin. Known for her work on women’s rights and mental health, Smith earned praise from her colleague Sen. Amy Klobuchar, who called her “the velvet hammer” for her quiet yet effective style.

The race to succeed Smith is expected to draw several Democratic candidates, with Smith expressing confidence in the state’s deep bench of political talent. Reports have surfaced that Minnesota Gov. Tim Walz is considering a run. Meanwhile, Minnesota Lt Gov. Peggy Flanagan has announced her intention to run.

Meanwhile, Republicans see an opportunity to expand their influence in a state where they haven’t won a Senate race since 2002.

| WEATHER |

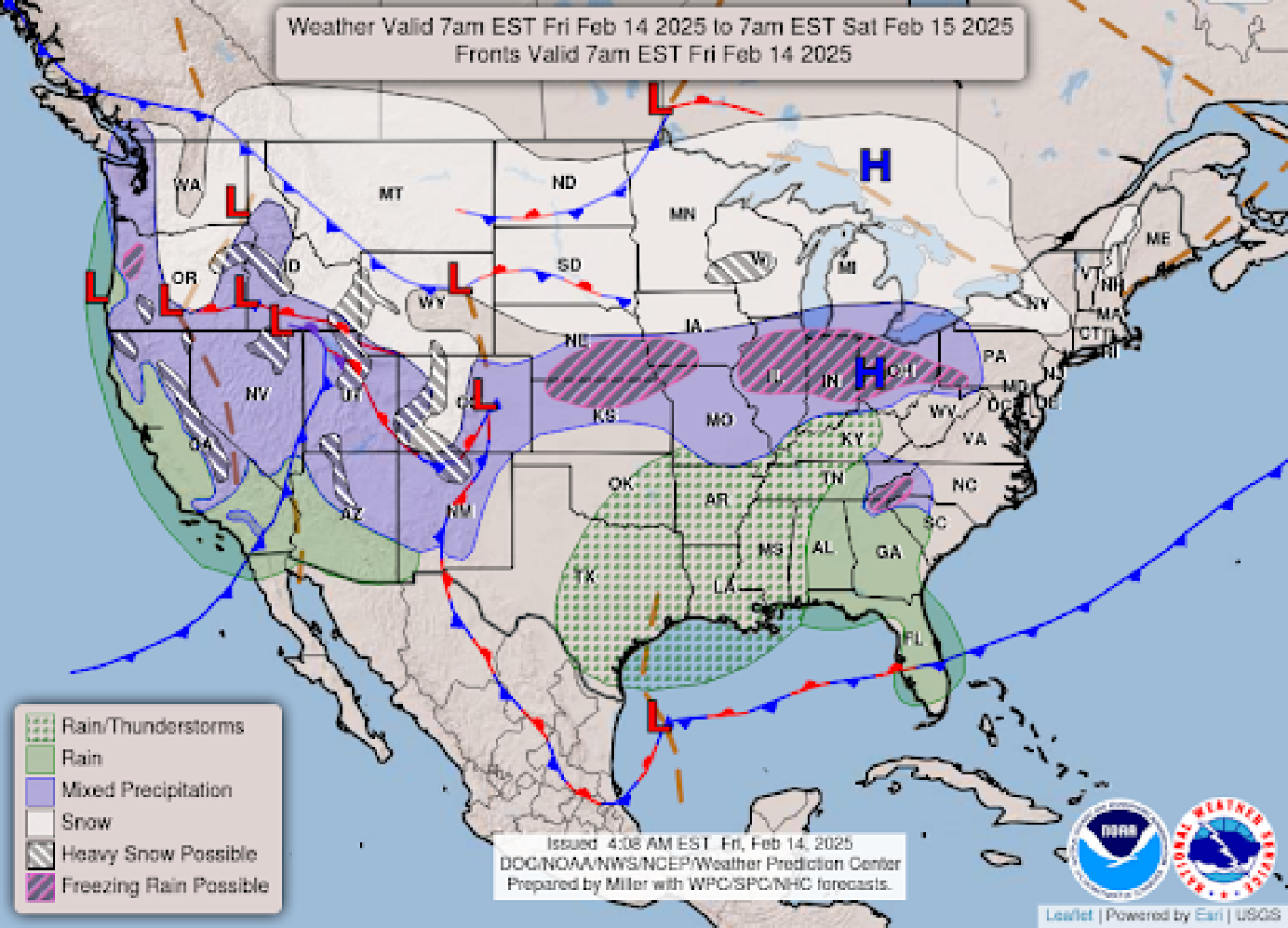

— NWS outlook: A western U.S. storm system bringing heavy rain into California and widespread winter weather impacts across the Intermountain West... ...An impactful heavy rain and flooding event emerges over the Ohio Valley, Tennessee Valley, and parts of the Appalachians this weekend with severe thunderstorms across the Deep South... ...Widespread 6 to 10 inches snowfall expected from the upper Midwest tonight, then through the Great Lakes into New England this weekend with a swath of sleet/ice just to the south... ...Temperatures will be down to around 5-10 degrees below average across much of the eastern U.S. followed by a more intense shot of arctic air

into the northern High Plains later this weekend.

| KEY DATES IN FEBRUARY |

14: Retail Sales | Valentine’s Day

16: Daytona 500

17: Presidents Day; U.S. gov’t and market holiday

21: Univ. of Michigan Consumer Sentiment | Existing Home Sales | USDA Cattle on Feed

25: Consumer Confidence | USDA Food Price Outlook

27: Durable Goods Orders | GDP | USDA Outlook Forum | Outlook for U.S. Agricultural Trade report

28: Personal Income and Outlays (PCE Price Index) | International Trade in Goods | USDA Outlook Forum concludes

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |