President Donald Trump’s new tariffs on imports from Canada, Mexico, and China went into effect at 12:01 a.m. ET on March 4, marking a significant escalation in global trade tensions. The implementation of these tariffs marks one of the largest increases in U.S. tariffs since the 1930s, impacting roughly $1.5 trillion in annual imports. As global markets continue to react and trading partners retaliate, the full economic consequences of this trade war remain to be seen. Stocks in Europe retreated on concern the region could be next to face U.S. tariffs. Chinese equities edged higher on speculation the country is taking a measured approach with its retaliatory tariffs, stopping short of a full-blown trade war. Stakeholders will get a chance to hear more from Trump as he addresses Congress this evening. Here are the key details and initial reactions and impacts:

TARIFF IMPLEMENTATION:

- A 25% tariff on most imports from Canada and Mexico

- A 10% tariff on Canadian energy products

- An increase from 10% to 20% on Chinese imports. With this increase, U.S. trade-weighted tariffs on Chinese imports are nearing 38%, comparable to a repeal of Permanent Normal Trade Relations (PNTR).

- Only difference on tariffs from the prior notification is that the de minimis exemption is available until the Commerce Secretary says there is a system in place to collect tariffs on those shipments.

- The tariffs on Canada (link) and Mexico (link) were effective at 12:01 am ET March 4 with the notices to be published March 6. The steel and aluminum tariffs are effective 12:01 am ET March 12 and are to be published March 5 (link).

- President Trump appeared to change his terms, saying that Canada and Mexico needed to relocate auto factories and other manufacturing to the United States. “What they have to do is build their car plants, frankly, and other things in the United States, in which case they have no tariffs,” he said.

Other U.S. tariffs expected

- Coming April 2: Besides the long-promised tariffs, President Trump said the U.S. would impose duties on foreign agricultural products starting April 2. President Trump on Monday told U.S. farmers to get ready to focus on the domestic market ahead of the April 2 tariffs. “To the Great Farmers of the United States: Get ready to start making a lot of agricultural product to be sold INSIDE of the United States,” Trump wrote. “Tariffs will go on external product on April 2nd. Have fun!”

- U.S. lumber tariffs threaten industry and homebuilding costs. The Trump administration has proposed nearly tripling anti-dumping duties on Canadian softwood lumber to 20.07%, adding to the existing 6.74% countervailing duty. Combined with President Trump’s announced 25% tariffs on most Canadian and Mexican goods, total import taxes could reach 51.81%. The move raises concerns about rising U.S. homebuilding costs and the survival of Canada’s forestry sector. Lumber futures surged, while shares of Canadian lumber companies fell. British Columbia Premier David Eby warned of economic hardship for the province.

- EU: President Trump has recently made strong statements regarding his intention to impose tariffs on European Union (EU) imports, particularly targeting cars and other goods. He has signaled a 25% tariff, citing what he perceives as unfair trade practices by the EU. Trump claims that the EU was “formed to screw the United States,” arguing that the bloc exploits America through trade surpluses and restrictive policies on U.S. agricultural and automotive exports. Trump’s justification for these tariffs centers on his belief that the EU imposes higher barriers on U.S. goods, such as a 10% tariff on American cars compared to the 2.5% tariff the U.S. applies to European passenger vehicles (However, the U.S. applies a significantly higher 25% tariff on imported pickup trucks.) He also criticized the EU for not accepting U.S. agricultural products while benefiting from unrestricted access to the American market. The European Union has responded firmly, rejecting Trump’s claims and emphasizing its role as the world’s largest free market, which it argues has benefited U.S. businesses significantly. The EU has vowed to retaliate decisively against any unjustified tariffs, potentially targeting American industries such as bourbon, motorcycles, and jeans.

RETALIATION

Canada:

- Immediate 25% tariffs on over $20 billion in U.S. imports

- Additional tariffs on $86 billion worth of U.S. goods to be implemented in three weeks

- Total retaliatory tariffs on approximately $107 billion of U.S. goods

China:

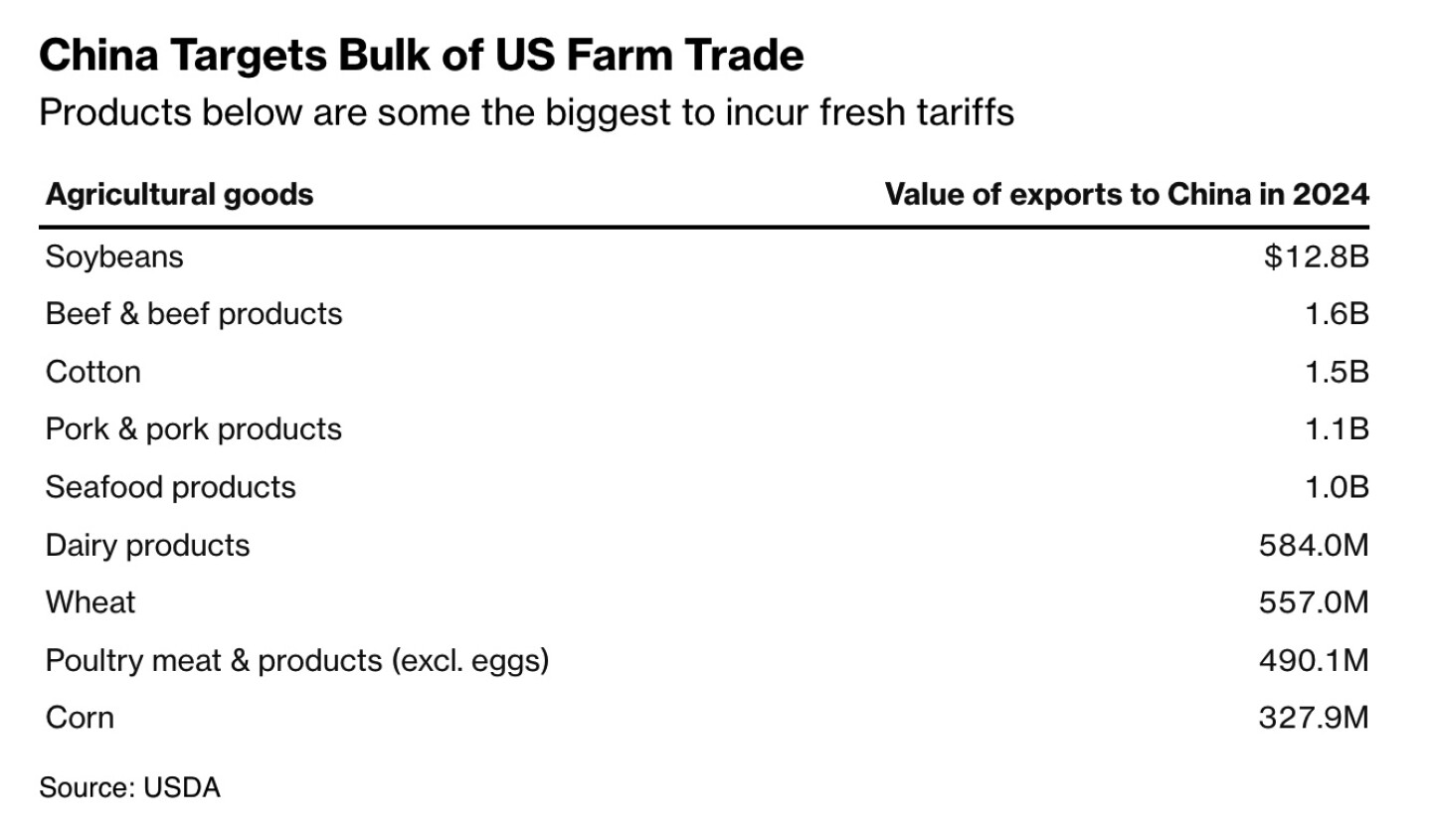

- Imposing new tariffs on agricultural products and expanding the Unreliable Entities List to include more companies. China’s Ministry of Commerce announced that 10 new companies were added to the list, which has little immediate impact but opens them up to restrictions, including possible bans on investment and trade with China.

- Effective on March 10, the following tariffs will be implemented:

- An additional 15% tariff will be imposed on chicken, wheat, corn and cotton.

- An additional 10% tariff will be imposed on sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables and dairy products.

- China slaps new tariffs on $21 billion worth of U.S. agricultural exports. New Chinese tariffs on American agricultural goods will impact approximately $21 billion worth of U.S. exports, according to a Reuters analysis of U.S. Census data. The hardest hit will be the U.S. soybean trade — America’s largest agricultural export to China — which faces a 10% tariff on nearly $13 billion in exports. The tariffs span 740 items (link), including vegetables, aquatic products, pork, and beef, affecting both fresh and frozen goods.

- The new 25% tariff hikes on Mexico will hamper Chinese efforts to reroute exports.

- China’s Ministry of Commerce announced it was expanding its export controls on dual use items — items which can be used for both civilian and military purposes — to target several U.S. defense contractors, including Leidos, General Atomics Aeronautical Systems and General Dynamics Land Systems.

- Chinese authorities also announced they were banning imports of genetic sequencing machines made by U.S. biotech firm Illumina. The ban comes almost a month after Illumina was added to an “unreliable entity list” along with Calvin Klein parent company PVH Group. At the time Beijing accused the companies of “cutting normal transactions with Chinese enterprises and adopting discriminatory measures against Chinese firms.”

- Beijing also filed a lawsuit with the World Trade Organization challenging the new tariffs. The ministry said the White House’s latest tariff increase seriously violates the rules of the WTO and undermines the basis for economic and trade cooperation between China and the U.S. In February, China also challenged at the WTO the U.S.’s previous move to add a 10% tariff on Chinese goods. However, the WTO’s mechanism for resolving trade disputes has been effectively inoperative since President Trump’s first term.

- China’s Foreign Ministry hinted on Tuesday that the country might curtail cooperation with the U.S. in fighting fentanyl as part of retaliating against tariffs. “This will deal a heavy blow to counternarcotics cooperation,” said Lin Jian, a spokesman, at the ministry’s daily briefing. “The root cause of the fentanyl issue lies in the U.S. itself,” a spokesman said at the ministry’s daily briefing.z

Mexico:

· Details on countermeasures not immediately available. Mexican President Claudia Sheinbaum said “composure, serenity, and patience” was needed and her country has a “Plan A, Plan B, Plan C, and even Plan D” in place, without offering much detail about the contingency plans. Sheinbaum is expected to address the issue at her usual weekday news conference Tuesday morning.

IMPACTS

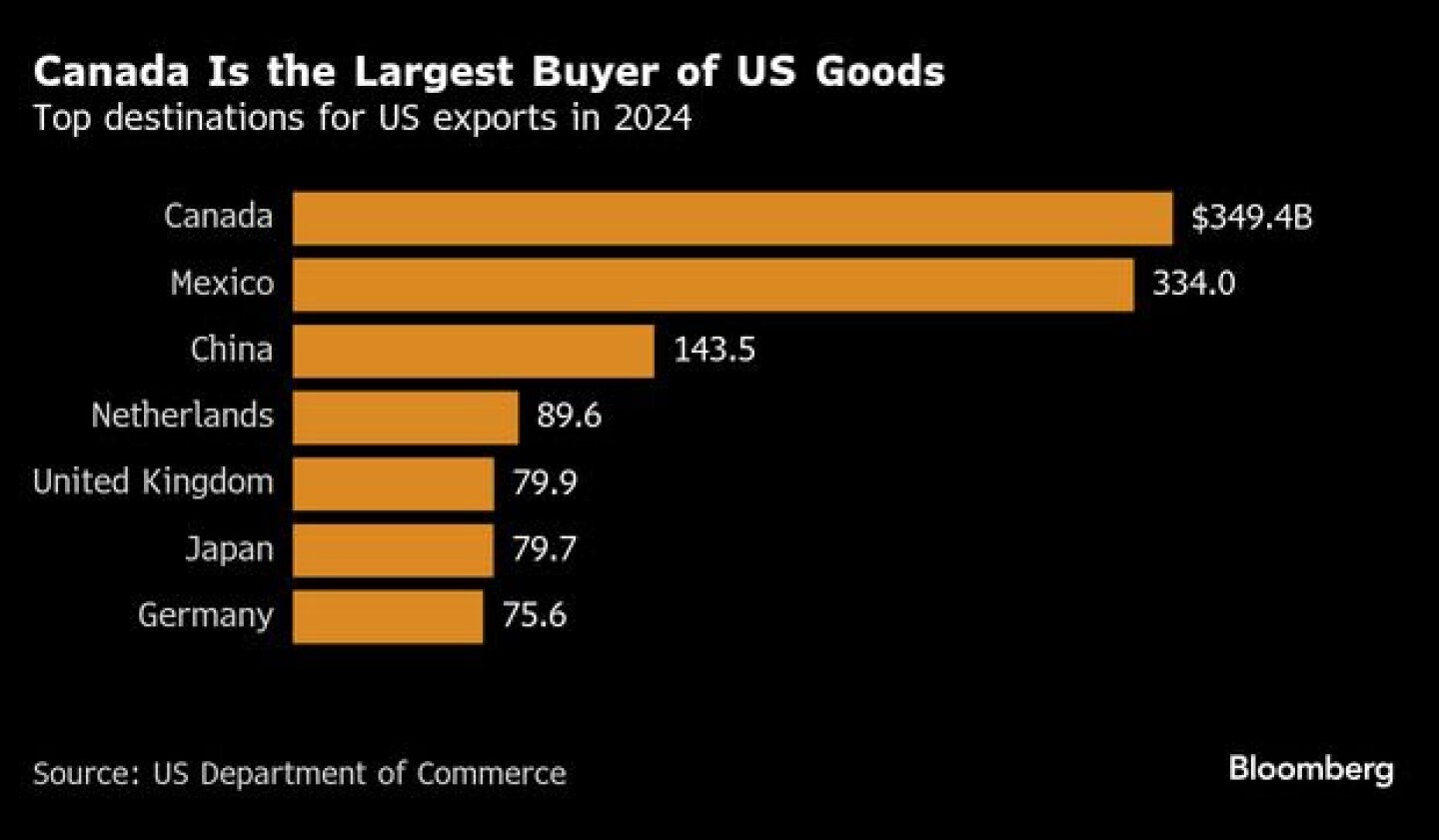

Bottom line: Economists have estimated that the tariffs will lower economic growth throughout North America, but that they will hit Canada and Mexico the hardest, given that those countries send roughly 80% of their exports to the United States. In contrast, China sends only about 15% of its exports to the U.S., so it is much less exposed to the tariffs.

— U.S. reduces dependence on Chinese imports. The U.S. has significantly reduced its reliance on Chinese imports since the 2017 peak, with the share of goods imported from China dropping from one in five before the pandemic to less than one in seven in 2024. This shift reflects restructured supply chains and could help mitigate the negative price impacts of proposed new tariffs.

— Canadian Prime Minister Justin Trudeau emphasized that Canada’s tariffs would remain until the U.S. withdrew its trade actions. The escalating trade war threatens the $900 billion annual trade relationship between the two nations, with Canadian officials also exploring non-tariff measures and border security enhancements. Immigration Minister Marc Miller said Monday that there’s “no question” tariffs will be painful for the Canadian economy. “We will have to bring the fight and it will hurt Americans as well. It’s important to reiterate that 35 of those states, their primary trading partner is Canada, so it will hurt them. And we hope the logic will prevail.” Trudeau warned Americans would need to cough up more cash for everyday products. “Americans will pay more for groceries, gas, and cars, and potentially lose thousands of jobs. Tariffs will disrupt an incredibly successful trading relationship,” he said.

Steve MacKinnon, Canada’s employment minister, said on Monday that the government would move to introduce extra wage supports for workers who are left jobless because of the tariffs.

“Today’s reckless decision by the U.S. administration is forcing Canada and the U.S. toward recessions, job losses and economic disaster,” Canadian Chamber of Commerce CEO Candace Laing said in a statement. She said the U.S. tariffs will fail to usher in a “golden age” coveted by Trump but instead raise costs for consumers and producers and disrupt supply chains. “Tariffs are a tax on the American people.”

— Increased fertilizer costs for U.S. farmers who rely heavily on imported fertilizers, particularly potash from Canada.

- 80% of U.S. potash supply comes from Canada, making it a crucial import for American agriculture.

- The 25% tariff on Canadian goods is likely to increase fertilizer prices substantially, adding to the financial strain on farm families already dealing with high supply costs.

Some agricultural and energy products Canada imports from the United States

Link: United States-Canada agriculture and agri-food trade 2023

Link: Canada-United States agriculture and agri-food trade 2023

Ethanol: Canada remained the top importer of U.S. ethanol, with volumes reaching 655 million gallons during the 2023-2024 marketing year, up 11% from the previous year.

Pork: U.S. pork exports reached record highs in both volume and value in 2024.

Energy products

Crude Oil: U.S. crude oil imports from Canada reached a record of 4.3 million barrels per day (b/d) in July 2024. In the 12 months ending November 2024, U.S. crude oil imports from Canada reached a record 4.0 million barrels per day (Mb/D), accounting for 61% of total U.S. crude oil imports.

Natural Gas: In the first six months of 2024, net U.S. pipeline imports from Canada averaged 5.4 Bcf/d, an increase of 11% (0.5 Bcf/d) compared with the same period in 2023.

Electricity:

U.S. electricity imports from Canada decreased to 27,220,531 megawatt-hours in 2024, down from 33,225,087 megawatt-hours in 2023.

U.S. electricity exports to Canada increased to 17,768,851 megawatt-hours in 2024, up from 18,384,320 megawatt-hours in 2023.

STRAINS ON TRADE AGREEMENTS

Trump’s tariffs will test the strength of existing trade agreements that farmers rely on. For example, the U.S.–Mexico–Canada Agreement (USMCA), which replaced NAFTA, had solidified North America as a tariff-free zone for most agricultural goods. Imposing 25% duties on Mexico and Canada essentially undermines USMCA’s benefits, introducing steep barriers where free trade was the norm. Farm leaders point out that Mexico and Canada have been vital partners, helping grow U.S. agricultural exports by nearly 300% over recent decades under free trade agreements.

TARIFF AID FOR U.S. FARMERS?

USDA Secretary Brooke Rollins has pledged to support U.S. farmers in the event of a trade war resulting from tariffs. Rollins has promised to be “in the room” to protect farmers from economic repercussions of Trump’s sweeping tariff threats. She has committed to aiding farmers who are targets of retaliation due to Trump’s tariff threats, like what former USDA chief Sonny Perdue did during the first Trump administration. Rollins has acknowledged the “potential devastating impact” of tariffs on farmers and ranchers, stating that USDA would be prepared to provide financial aid to those affected by a new trade war. Rollins has emphasized that working with the White House to “close those holes” for farmers and ranchers under any tariff execution would be a top priority.

Rollins assured that President Trump “will not forget our farmers when he’s negotiating with foreign leaders.” At her confirmation hearing, Rollins told senators that USDA would be prepared to again provide aid to farmers if they face retaliatory tariffs because of Trump’s trade policies.