News/Markets/Policy Updates: Sept. 17, 2024

|

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 50 points higher, while Treasuries and the dollar are steady. In Asia, Japan -1%. Hong Kong +1.4%. China closed. India +0.1%. In Europe, at midday, London +0.8%. Paris +0.9%. Frankfurt +0.9%.

U.S. equities yesterday: The Dow ended up 228.30 points, 0.59%, at 41.622.08. The Nasdaq declined 91.85 points, 0.52%, at 17,592.13. The S&P 500 was up 7.07 points, 0.13%, at 5,633.09.

— TikTok defends against U.S. ban in court, citing first amendment concerns; judges skeptical. TikTok argued in federal court that its algorithm isn’t controlled by China, as it challenges a U.S. ban ordered by President Biden over national security concerns. Judges questioned both TikTok’s claims and the government’s First Amendment implications. The judges signaled skepticism with TikTok’s legal effort to prevent the U.S. gov’t from forcing the popular social-media app to sever ties with China to keep operating in this country. A three-judge panel of the U.S. Court of Appeals for the District of Columbia Circuit repeatedly questioned TikTok’s challenge to legislation that requires its parent company, Beijing-based ByteDance, to sell the platform by Jan. 19. If there is no sale, TikTok would be effectively banned from mobile apple stores in the U.S. Meanwhile, ByteDance is developing its own AI chip to reduce reliance on U.S. tech amid growing AI competition in China.

— Microsoft’s announcement of a new $60 billion stock buyback program, along with a 10% increase in its quarterly dividend, signals strong confidence in its financial health and future growth prospects. This buyback plan matches the largest in the company’s history, reflecting its commitment to returning capital to shareholders. The company’s recent success has been bolstered by its integration of AI technologies, largely driven by its partnership with OpenAI. By infusing AI into its product lines, Microsoft has positioned itself as a leader in the rapidly evolving tech landscape, further enhancing its profitability and shareholder value.

— Kroger/Albertsons merger faces legal challenges in ongoing trials. The legal battle over Kroger’s proposed acquisition of Albertsons continues as multiple trials unfold. While the trial in Portland, Oregon concludes today, two more are set for this month — in Seattle and Colorado. The Federal Trade Commission (FTC) and several states argue that the merger would harm shoppers and negatively affect unionized grocery workers. Kroger has spent over $860 million on merger costs this year, insisting the union will lead to lower prices and higher wages, while warning that blocking the deal would benefit non-unionized competitors like Walmart and Amazon. Opponents claim the merger would stifle competition, raise prices, and lead to store closures.

— Oil prices were higher Monday. More than 12% of crude production and 16% of natural gas output in the U.S. Gulf of Mexico remained offline in the aftermath of Hurricane Francine, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) said. WTI traded up $1.44 or 2.1% to close at $70.09. Brent traded up $1.14 or 1.59% to close at $72.75.

— Ag markets today: Corn, soybeans and wheat held in tight trading ranges during a quiet overnight session. As of 7:30 a.m. ET, corn futures were trading mostly unchanged, soybeans were a penny lower and wheat futures were 2 to 4 cents higher. The U.S. dollar index was around 100 points lower, and front-month crude oil futures were trading just above unchanged.

Beef packers still cutting in the black. The average cash cattle price firmed 93 cents last week to $182.11, ending a six-week decline. Wholesale beef prices dropped 34 cents for Choice and $2.03 for Select on Monday. While packer margins have tightened, they remain in the black, which could encourage higher cash prices again, though active trade won’t likely come until late in the week.

Traders narrow hog futures discount to cash index. October lean hog futures posted strong gains on Monday, while the cash hog index continues to decline seasonally. October hogs finished yesterday at a $4.455 discount to today’s cash quote of $83.48, which is down another 49 cents and reflects the price on Sept. 13. That suggests traders anticipate prices will continue to drop over the next month.

— Agriculture markets yesterday:

• Corn: December corn fell 2 1/2 cents to $4.10 3/4, a near-mid range close.

• Soy complex: November soybean futures sunk 1 3/4 cents to $10.04 1/2, settling nearer session lows. October meal futures climbed $1.70 to $320.10 and closed nearer session highs. October bean oil futures firmed 22 points to 39.75 cents.

• Wheat: December SRW wheat fell 16 1/4 cents to $5.78 1/2. December HRW wheat fell 19 1/2 cents to $5.80 1/2. Both markets finished nearer their session lows. December spring wheat futures closed down 15 3/4 cents at $6.19 3/4.

• Cotton: December cotton rose the 300-point limit to 72.82 cents, closing above the 100-day moving average and at the highest level since July 1.

• Cattle: October live cattle fell 42 1/2 cents to $177.225 and nearer the session low. October feeder cattle lost 12 1/2 cents to $239.00 and nearer the session low.

• Hogs: October live cattle fell 42 1/2 cents to $177.225 and nearer the session low. October feeder cattle lost 12 1/2 cents to $239.00 and nearer the session low.

— Of note:

• Fed funds futures now imply a 65% chance of a half-point cut to the Fed’s target rate on Wednesday, and a 35% shot of a quarter-point cut. That’s a flip from just one week ago.

• Comments from Bill Dudley, the former president of the New York Fed, amplified the shift to a half-point cut. “The logic supporting a 50-basis-point cut is compelling,” Dudley wrote in a column for Bloomberg (link). "...I expect the Fed will do 50. I believe Chair Powell favors an aggressive approach.”

• Biden adviser downplays inflation risk, shifts focus to job market and housing costs. National Economic Council Director Lael Brainard, in remarks Monday at the Council on Foreign Relations in Washington, emphasized that inflation is stabilizing near normal levels, and the focus is shifting toward protecting labor market gains. She highlighted housing as the biggest driver of price increases, noting that lower interest rates could improve affordability. Brainard urged more home construction and called on Congress to support initiatives, stressing the importance of bipartisan action to address housing shortages.

• Fertilizer protection. “It’s important for us to have a diverse supply chain and make sure we’re not dependent on other countries for this really important chemical.” — Jigar Shah of the U.S. Department of Energy, on a $1.56 billion federal commitment to a large ammonia project in Indiana.

— U.S. retail sales edge up 0.1% in August, beating expectations despite sectoral declines. U.S. retail sales rose 0.1% month-over-month in August 2024, following a stronger 1.1% increase in July and surpassing forecasts of a 0.2% decline. This indicates continued resilience in consumer spending. Increases were noted in miscellaneous stores (1.7%), nonstore retailers (1.4%), and health and personal care stores (0.7%). However, declines occurred in key sectors like gasoline stations (-1.2%), electronics (-1.1%), and food and beverage (-0.7%). Sales excluding certain categories used to calculate GDP rose by 0.3%, reflecting broader economic strength despite inflationary pressures.

— U.S. retailers to add 520,000 seasonal jobs for holidays, lowest in two years. U.S. retailers plan to hire around 520,000 seasonal workers for the upcoming holiday season, down from 564,200 in 2023, according to a report by Challenger, Gray & Christmas provided to Reuters. The decline reflects tightening consumer spending and slowing job growth. Andrew Challenger, the firm’s senior vice president, noted that seasonal hiring needs may fluctuate based on economic conditions, with the possibility that retailers may either struggle to fill positions or reduce hiring if the economy cools further. If the forecast holds, this would be the lowest seasonal hiring since 2022 and the second lowest since 2009, raising concerns about the broader U.S. economic outlook.

— Eurozone economic sentiment tumbles. The ZEW Indicator of Economic Sentiment for the euro zone continued to plummet in September, dropping 8.6 points to an 11-month low of 9.3. That was the third consecutive month of deterioration in the morale gauge amid ongoing uncertainty about the economic outlook and the direction of monetary policy. In September, 60.9% of surveyed analysts expected no changes in economic activity, 24.2% predicted an improvement and 14.9% anticipated a deterioration. In the meantime, the indicator of the current economic situation fell by 8 points to -40.4 and inflation expectations went up by 10.6 points to -28.5.

— Cuba reduces subsidized bread ration amid worsening economic crisis. Cuba has reduced its subsidized daily bread ration from 80 grams to 60 grams (roughly the size of an average cookie), reflecting the nation’s deepening economic crisis and food shortages. The government cites a shortage of wheat flour, worsened by the U.S. trade embargo, as the reason for the cutback. This comes amid widespread shortages of food, fuel, and medicine, high inflation, and a devalued peso. The crisis has led to a mass exodus, with nearly 500,000 Cubans emigrating to the U.S. between 2021-2023. With 89% of families in extreme poverty, many struggle to afford bread, even as the government attempts to secure basic rations through 2024.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly weaker, with the euro and Japanese yen both firmer against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.61%, with a mostly lower tone in global government bond yields. Crude oil futures were higher, with U.S. crude around $70.35 per barrel and Brent around $72.85 per barrel. Gold and silver futures were weaker ahead of US market action, with gold around $2,606 per troy ounce and silver around $31.12 per troy ounce.

— Potential strike update. The contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) is set to expire on Sept. 30. Negotiations between the two parties have stalled, raising concerns about a possible strike starting Oct. 1. The main points of contention are wage increases and limits on port automation. Negotiations broke down in July after the ILA learned that APM Terminals and Maersk were using automated technology to process trucks without union labor.

A strike would affect East Coast and Gulf Coast ports, which handle 43% of U.S. imports. It could disrupt $3.7 billion worth of trade per day. The strike would impact retailers, manufacturers, and farmers by delaying shipments and potentially shutting down production lines.

Many companies have been redirecting shipments to West Coast ports. Some businesses have brought in products earlier to frontload the peak shipping season. Air freight is being considered as an alternative for time-sensitive or high-value goods.

Outlook: As of mid-September, the two sides appear far apart in negotiations. The ILA has voted unanimously to support a strike if their demands are not met. There are calls for both parties to return to the negotiating table to avoid disruption. The parties could resume negotiations and potentially extend the current contract. President Biden could use his influence to encourage negotiations or appoint a federal mediator. As a last resort, the President could invoke the Taft-Hartley Act to implement an 80-day cooling-off period.

— Ag trade update: Japan is seeking 123,012 MT of milling wheat in its weekly tender.

— ABM: Neutral ENSO conditions likely to continue. Sea surface temperatures (SSTs) in the central equatorial Pacific Ocean and atmospheric patterns remain within ENSO-neutral thresholds. While some atmospheric indicators such as pressure, cloud and trade wind patterns over the Pacific have been more La Niña-like over the past few weeks, according to the Australian Bureau of Meteorology (ABM), though it’s uncertain if these conditions will be sustained or build. ABM says, “It is possible a La Niña may develop in coming months but if so, it is forecast to be relatively weak (in terms of the strength of the SST anomaly) and short-lived.”

— Barge traffic to Bolivian and Brazilian ports on the Paraguay River has almost ground to a halt due to low water levels north of Paraguay’s capital Asuncion, said Raul Valdez, chairman of shipping trade group CAFyM. Navigation has almost completely halted in the northern sections of the Paraguay River. Over half of the river’s shipping capacity is either stopped or delayed, according to Paraguay’s main shipping association. Vessels are forced to carry smaller loads to avoid becoming stranded, extending travel times and causing delays.

This situation is severely impacting:

• Agricultural exports: Paraguay relies on rivers to transport 80% of its agricultural exports.

• Local economies: 1,600 fishermen have been left unemployed due to the low water levels.

• Regional trade: The Paraguay-Paraná waterway is crucial for transporting grains, corn, soybeans, and other goods across South America.

Outlook: No significant rainfall is forecasted soon. Experts worry this could establish a new norm for the region. The upcoming October-November rainy season is not expected to be sufficient to restore river levels to normal.

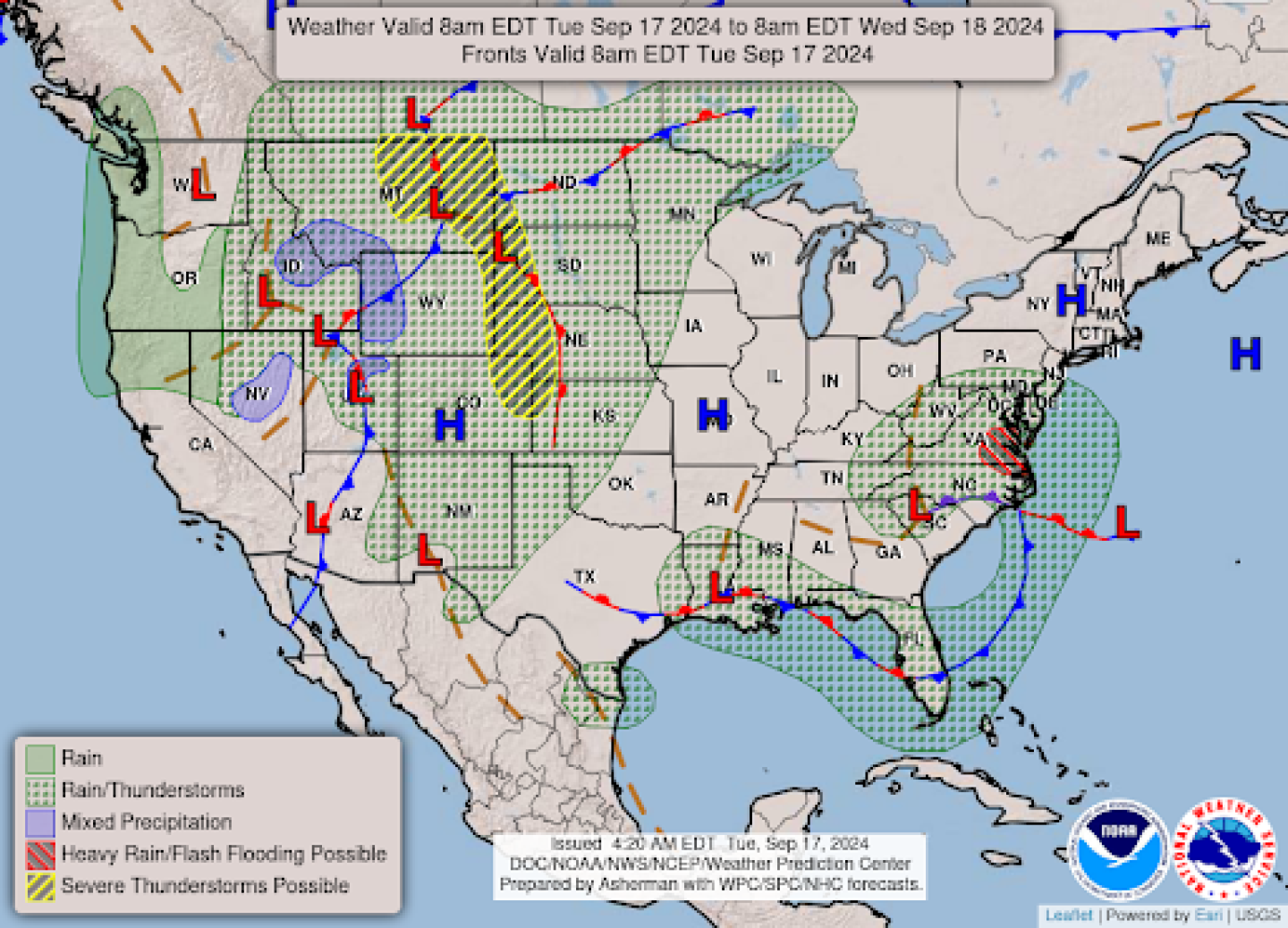

— NWS outlook: A coastal low will bring a threat of flash flooding to the Mid-Atlantic today... ...A strong low-pressure system will bring unsettled weather to the Rockies and Plains with severe thunderstorms in the northern and central High Plains.

Items in Pro Farmer’s First Thing Today include:

• Quiet overnight grain trade

• Cordonnier lowers U.S. soybean yield, production forecast

• Soybean CCI rating declines, corn holds steady

• France cuts wheat production forecast

| CONGRESS |

— Houses faces hurdles on stopgap spending bill as conservatives push for 2025 deadline. House GOP leaders are struggling to pass a stopgap spending bill needed to avoid a gov’t shutdown as the Sept. 30 deadline approaches for the beginning of fiscal year (FY) 2025. Conservatives pressured House Speaker Mike Johnson (R-La.) to extend the spending deadline to March 2025, hoping Donald Trump will be president by then. Johnson also agreed to include the SAVE Act, aimed at preventing noncitizens from voting. However, he withdrew the proposal due to opposition within his party. Some Republicans oppose short-term spending deals, while others argue it could harm military readiness. Johnson is working to rally support, but next steps remain uncertain, as Trump urges rejection of any deal without voting-security measures which Democrats mostly oppose and the White House says it would veto.

| RUSSIA/UKRAINE |

— EU plans €40 billion loan for Ukraine as G7 frozen asset scheme stalls amid Orbán’s block. The EU is preparing a €40 billion (approximately $44.05 billion) loan package for Ukraine to maintain financial stability, bypassing the need for unanimity among member states, as Hungary blocks a G7 plan to use frozen Russian assets. Concerns grow in Brussels that Budapest, under Viktor Orbán, may delay a decision until after the U.S. election. Despite this, the EU aims to support Ukraine’s financial needs through loans before year-end, addressing Kyiv’s projected $38 billion gap in 2025.

— Ukraine’s grain exports slow in September as winter crop seeding progresses. Ukraine’s grain and oilseed exports reached 1.99 million metric tons (MMT) from Sept. 1-15, down from 2.48 MMT in the same period in August, according to the Ukrainian Grain Association (UGA). The shipments included 1.28 MMT of wheat, 164,000 metric tons of corn, and 416,000 metric tons of rapeseed, with barley exports dropping sharply to 50,000 metric tons compared to 272,000 metric tons in August. Meanwhile, the Ukrainian Agriculture Ministry reported that 360,300 hectares of winter grains had been sown by Sept. 16, 6.9% of the planned total. Winter wheat seeding covered 340,300 hectares, with expectations that the area could exceed 5 million hectares as rapeseed plantings decline.

| PERSONNEL |

— Former Senate Ag Committee economist John Newton joins Terrain as executive head. John Newton, former chief economist for Senate Republicans on the Ag Committee, has left to lead research and analytics at Terrain, an economics service for Farm Credit associations. He succeeds Don Close and brings extensive experience from roles at the American Farm Bureau Federation and USDA. Close will remain with Terrain, focusing on cattle and beef. Terrain provides insights across a broad range of agricultural sectors and rural economic trends. Newton is a native of Kentucky and holds two master’s degrees and a doctoral degree from Ohio State University.

| TRADE POLICY |

— WTO Director-General Ngozi Okonjo-Iweala is seeking a second term as the rule enforcer for international commerce faces rising protectionism from some of its founding members.

— WTO Chief Okonjo-Iweala advocates global carbon pricing to prevent trade disputes. WTO Director-General Ngozi Okonjo-Iweala has called for a global carbon pricing framework to prevent trade disputes over environmental measures, such as the EU’s Carbon Border Adjustment Mechanism (CBAM), set to take effect in 2026. Collaborating with organizations like the IMF, OECD, and UN, the WTO aims to create an interoperable system that could mitigate litigation risks. Okonjo-Iweala warned that without a global approach, unilateral carbon taxes could lead to trade friction. She emphasized that coordinated carbon pricing is crucial for decarbonizing global supply chains and ensuring certainty for businesses and developing countries.

— Australia has successfully negotiated a comprehensive trade agreement with the United Arab Emirates (UAE), marking a significant milestone in their economic relationship. This deal, known as the Australia-United Arab Emirates Comprehensive Economic Partnership Agreement, is expected to have far-reaching benefits for both nations.

Tariff reductions and export boost. The agreement will eliminate tariffs on over 99% of Australian products entering the UAE market. This is projected to result in substantial tariff savings, estimated at A$135 million (approximately $91 million) in the first year alone, increasing to A$160 million ($108 million) annually once fully implemented. The deal is expected to boost Australian exports by A$678 million ($458 million) per year.

Agricultural and food sector benefits. Australian farmers and food producers stand to gain significantly from this agreement. The deal is estimated to provide tariff savings of A$50 million ($34 million) annually for food and agriculture exports. Key Australian exports to the UAE include meat, dairy, oil seeds, seafood, canola seeds, nuts, honey, chickpeas, and lentils.

Mining and resources. The Australian mining industry will benefit from tariff cuts on exports, particularly for alumina, which was valued at A$1 billion ($676 million) in exports to the UAE in 2023. The agreement also includes provisions to encourage investment in critical minerals and sectors supporting Australia’s energy transition.

Investment opportunities. One of the most promising aspects of this agreement is the potential for increased investment from the UAE’s sovereign wealth funds, which are among the largest in the world. This could significantly boost Australia’s ambitions in renewable energy and critical minerals sectors.

Two-way investment. The agreement is expected to substantially increase two-way investment between Australia and the UAE, which totaled A$20.6 billion ($13.9 billion) in 2023.

First Nations trade. This agreement is Australia’s first to include a dedicated chapter on First Nations trade, providing preferential market access and rules for First Nations businesses seeking to export to the UAE.

Consumer benefits. Australian households and businesses are expected to save around A$40 million ($27 million) annually due to reduced import tariffs on UAE-produced goods such as furniture, copper wire, glass containers, and plastics.

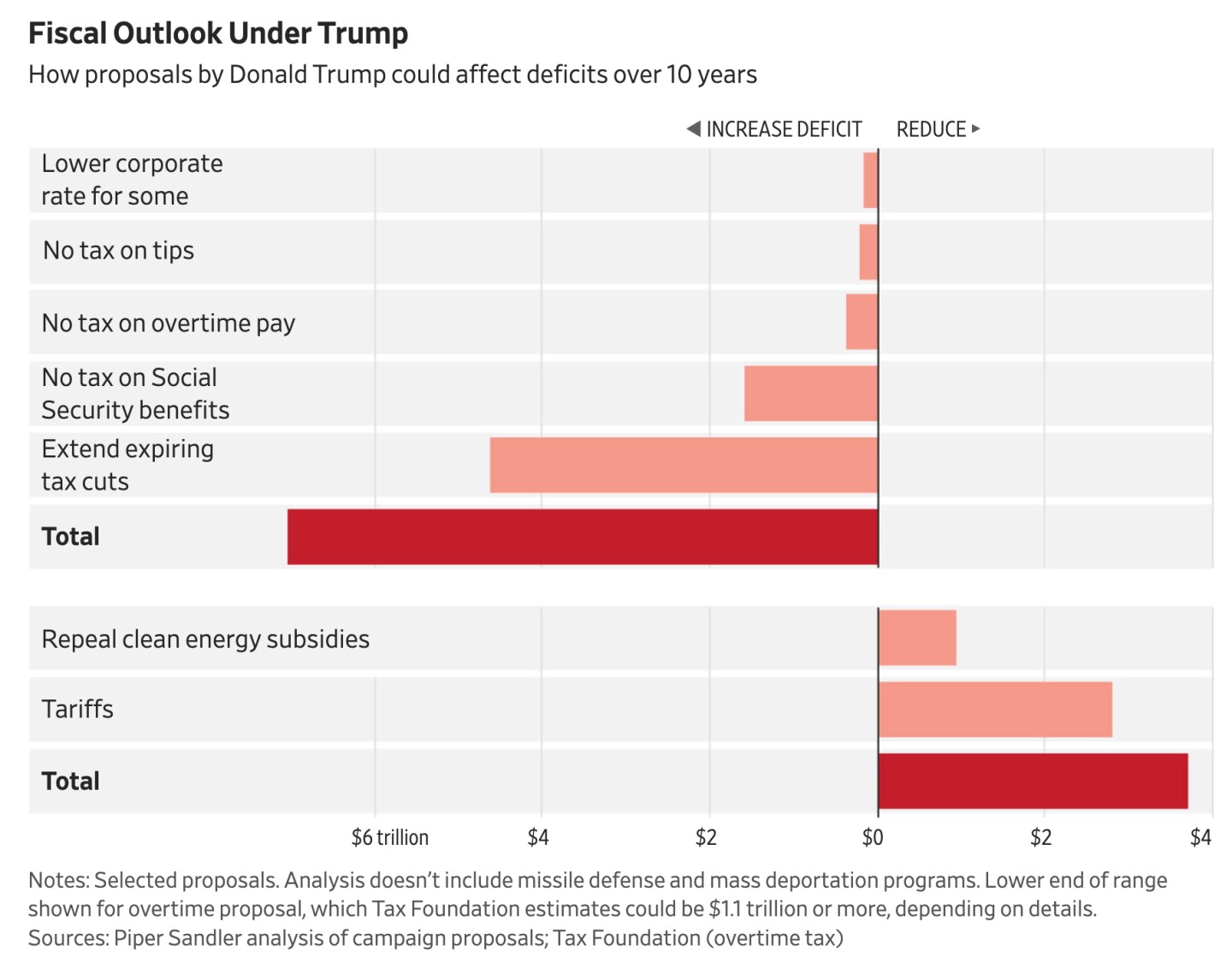

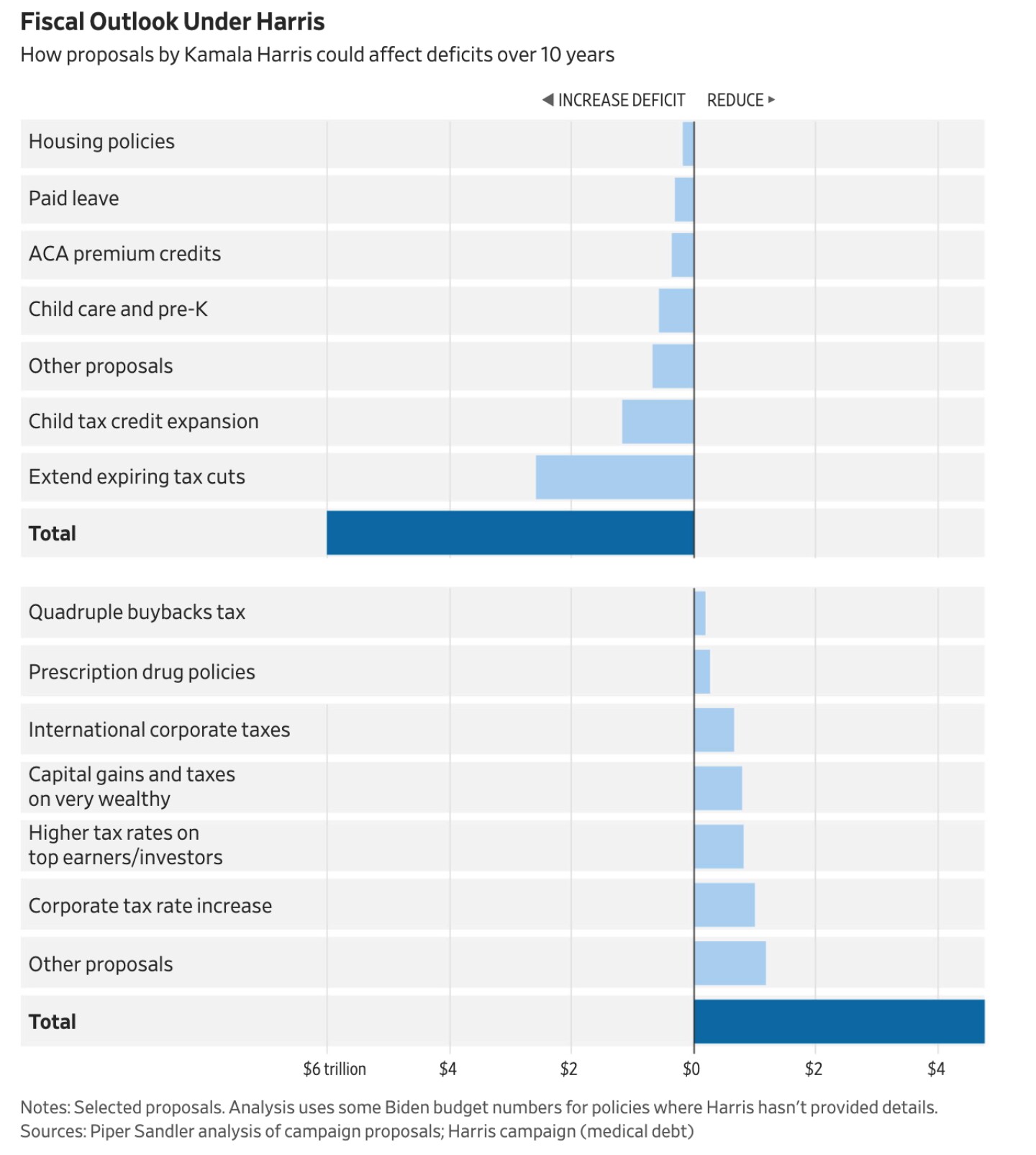

— Tariffs take center stage in Trump/Harris debate, highlighting key differences on U.S./China trade. In last week’s presidential debate, tariffs emerged as a crucial policy distinction between Kamala Harris and Donald Trump. Trump proposed tariffs over 60% on Chinese goods and a 10% tariff on most global imports, signaling a drastic escalation of protectionism. Harris, however, dodged a direct response on why the Biden administration maintained Trump’s China tariffs, reflecting the broader U.S. shift toward protectionism in response to China’s growing economic and military challenge.

Impact: Some trade analysts note that while protectionism is now embraced across the political spectrum, Trump’s extreme tariff plans could upend the U.S./China trade relationship, possibly igniting a tariff war that U.S. allies, like Japan, are wary of. This tension is further complicated by the Biden administration’s delay in approving a $15 billion bid from Japan’s Nippon Steel to acquire U.S. Steel, raising questions about the U.S.'s commitment to a united economic front with its allies.

Of note: “The primary reason for the U.S. turn to protectionism is the growing economic and military challenge from China,” Bob Davis writes in “How Washington Learned to Stop Worrying and Embrace Protectionism” (link). The turn also reflects a profound change in ideology, Davis writes, as the gains from trade “are no longer seen by many political leaders as worth the downsides in the loss of manufacturing jobs, dependence on imports from adversaries such as China and Russia, and political polarization.”

| ENERGY & CLIMATE CHANGE |

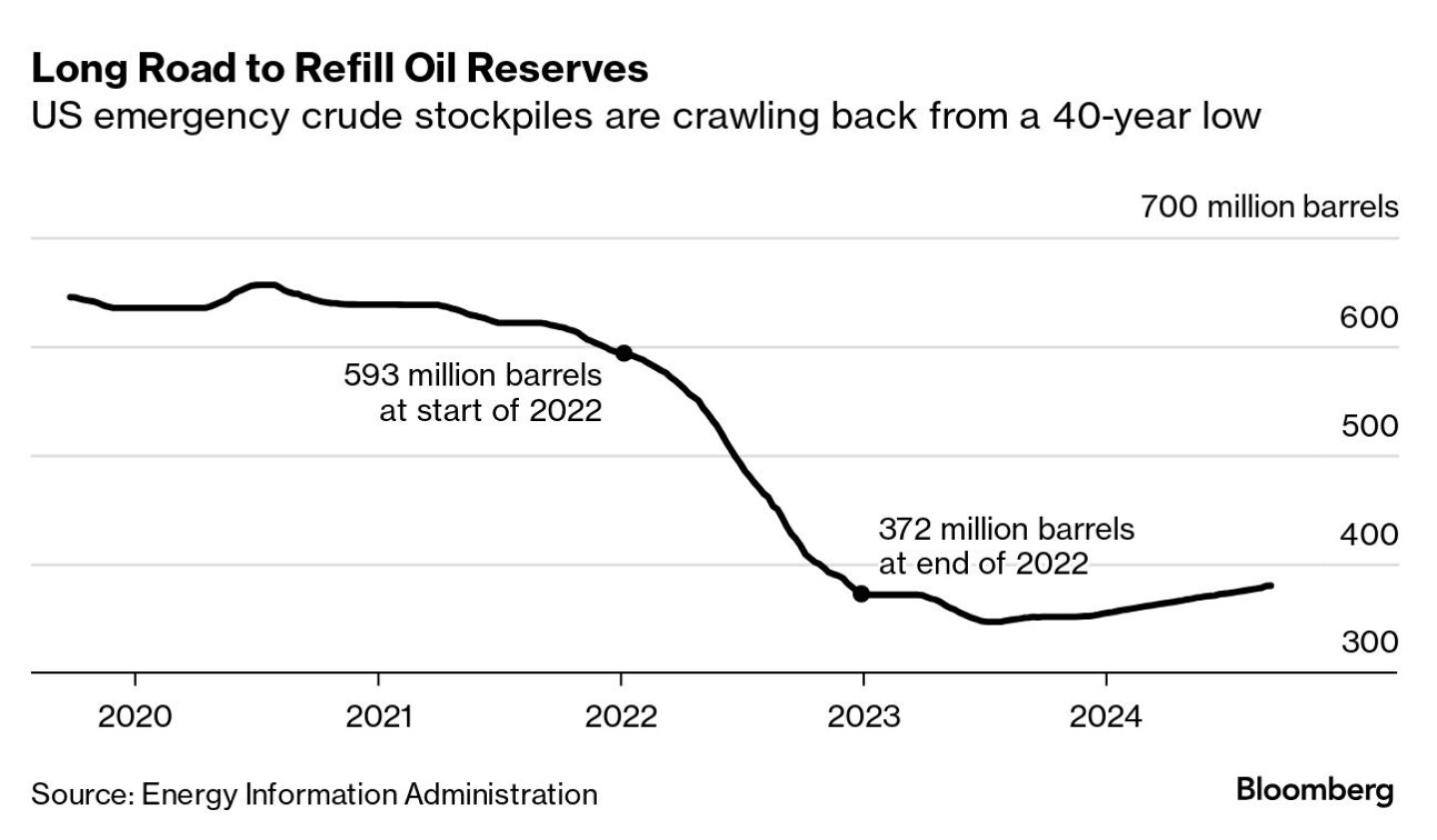

— U.S. faces funding shortfall in effort to refill Strategic Petroleum Reserve (SPR). With oil prices hovering around $70 per barrel, the U.S. could benefit from replenishing its depleted SPR. However, the Biden administration faces a significant challenge, according to Bloomberg: the crude-procurement fund is down to about $841 million, which would only cover around 12 million barrels — far short of the 320-million-barrel shortfall. The SPR, currently at a four-decade low, was heavily drawn down in 2022 when the Biden administration sold 180 million barrels to lower gasoline prices in response to Russia’s invasion of Ukraine. Despite favorable oil prices, limited funding hampers efforts to refill the reserve.

Of note: The U.S. has sold about 290 million barrels under Biden. Part of that has been through sales mandated by Congress, which uses the cash for roads, drugs, deficit reduction and other things that don’t necessarily have anything to do with energy.

— Court dismisses price-fixing lawsuit against oil giants. The U.S. Court of Appeals for the Ninth Circuit has dismissed a lawsuit accusing oil companies, including ExxonMobil and Chevron, of conspiring with the Trump administration, Russia, and Saudi Arabia to reduce oil production and inflate prices. The court ruled that the case involved political issues beyond its jurisdiction and found no substantial evidence of price-fixing by the oil companies or their industry groups.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— California’s Proposition 12, which went into full effect on Jan. 1, 2024, has had several significant impacts:

Implementation and enforcement. Proposition 12 requires farm owners, operators, and distributors of covered farm animals (egg-laying hens, commercial breeding pigs, and veal calves) to provide more humane living conditions. Key aspects of implementation include:

• Covered entities must register with the California Department of Food and Agriculture and undergo on-site inspections.

• The law applies to both in-state and out-of-state entities selling products in California.

• Violations are considered misdemeanors with fines up to $1,000.

Economic impact on consumers. The law has led to increased prices for affected animal products in California:

• Egg prices have risen by an estimated $0.25 to $0.73 per dozen. This translates to an annual loss for consumers of $223 million to $664 million for eggs alone.

• Pork prices are estimated to have increase dby about 25 cents per pound.

• Overall, consumers are expected to pay $1.1 million more for regulated egg and pork products in the first year.

Impact on producers. The law has created challenges and opportunities for producers:

• Pork producers face significant costs to comply, with an estimated $3.5 million investment needed to retrofit pens on an average farm.

• Some producers view Prop 12 as opening a new market, while others resist California dictating production methods.

• The law may lead to consolidation in the pork industry and a potential shrinking of the national hog herd.

Legal and political implications. Proposition 12 has faced legal challenges and sparked political debates:

• The U.S. Supreme Court upheld the law in May 2023, rejecting claims that it violated the dormant Commerce Clause.

• Some industry groups continue to oppose the law, pushing for federal legislation to ban state-level confinement standards.

• The Biden administration has expressed concerns about potential “chaos” in the pork industry due to the law.

Broader impact. Proposition 12 has influenced animal welfare policies beyond California:

• Several other states, including Massachusetts, Arizona, Colorado, and Ohio, have passed similar laws addressing farm animal confinement.

• The law has sparked discussions about potential federal grants to help producers comply with the new standards.

| POLITICS & ELECTIONS |

— Trudeau faces setback as liberals lose Montreal stronghold in special election. Canadian Prime Minister Justin Trudeau’s political future faces heightened uncertainty after his Liberal Party lost a key special election in Montreal, a historically secure district. The defeat in LaSalle-Emard-Verdun follows another loss in a Toronto Liberal stronghold just months earlier, signaling growing discontent in Trudeau’s urban voter base. The Bloc Quebecois’ Louis-Philippe Sauve narrowly won the Montreal race by 248 votes, with the Liberals coming in second. The losses put increased pressure on Trudeau to consider stepping down, especially as the Conservative Party, under Pierre Poilievre, gains significant momentum ahead of the next national election.

| OTHER ITEMS OF NOTE |

— U.S. faces unprecedented defense threats, needs urgent strategy and spending overhaul, commission warns. The July 2024 report (link) from the Commission on the National Defense Strategy highlighted several key points about the current state of U.S. national defense:

Serious threats. The report states that the United States faces “the most serious and the most challenging threats since the end of World War II.” It warns that the U.S. could potentially be drawn into a major war across multiple theaters against peer and near-peer adversaries, and could lose such a conflict.

Outdated strategy. The commission found that the 2022 National Defense Strategy is already outdated, as it does not adequately account for ongoing wars in Europe and the Middle East or the possibility of a larger war in Asia. The current strategy, resources, and bureaucratic approach are deemed insufficient to meet present threats.

Insufficient military capacity. The report concludes that U.S. military capacity and capabilities are “insufficient to meet the current requirements at acceptable risk”. It calls for a new force sizing construct that would enable the U.S. to lead coalitions capable of defeating both China and Russia while maintaining deterrence elsewhere.

Industrial base concerns. The commission describes the U.S. defense industrial base as “hollow” and “brittle.” It emphasizes the need to strengthen domestic industrial capacity and supply chains, calling for greater collaboration between the Department of Defense and the private sector.

Spending recommendations. The report recommends significant increases in defense spending, suggesting a return to late Cold War levels of around 5% of GDP. It calls for 3-5% real annual increases in the defense budget.

Public awareness. The commission expressed concern that the American public does not fully appreciate the current threat environment or understand the necessity of a strong defense. It calls for a bipartisan effort to educate the public on these issues.

Whole-of-government approach. The report advocates for an “all elements of national power” approach to national security, recommending increased spending and coordination across various national security agencies.

According to the Commission’s report, the most serious threats identified are:

1. The potential for near-term major war across multiple theaters. The report states that “The United States could in short order be drawn into a war across multiple theaters with peer and near-peer adversaries, and it could lose.”

2. China and Russia are identified as the primary threats. The report criticizes the current National Defense Strategy for underestimating the threat from Russia by calling it an “acute” rather than “chronic” threat.

3. Growing cooperation between adversaries across regions, particularly the partnership between China and Russia.

4. Ongoing conflicts in Ukraine and the Middle East, which the current National Defense Strategy does not adequately account for.

5. Threats from other actors like Iran and rogue states.

6. The report emphasizes that these threats are “the most serious and the most challenging threats since the end of World War II.”

7. An inadequate U.S. defense industrial base, described as “hollow” and “brittle,” which is seen as insufficient to confront the dual threats of Russia and China.

The Commission concludes that the U.S. is currently unprepared to face these threats, stating “The nation was last prepared for such a fight during the Cold War, which ended 35 years ago. It is not prepared today.” The report calls for urgent and major changes to address what it sees as a critical national security situation.

Bottom line: The commission paints a sobering picture of the current state of U.S. national defense and calls for urgent, major changes in strategy, spending, and public engagement to address what it sees as a critical national security situation.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |