News/Markets/Policy Updates: Jan. 22, 2025

Other topics in this dispatch include: (1) Trump says EU has troubling trade surpluses with U.S.; (2) Why the Feb. 1 start date on Trump-threatened tariffs could be delayed; (3) Trump rallies Hill GOP for recess appointments and debt limit strategy; (4) RFK Jr. confirmation hearing delayed past January; (5) Trump’s executive order reshapes federal environmental permitting rules; (6) Trump to visit hurricane-hit Asheville before stops in Los Angeles and Nevada; (7) Xi and Putin commit to strengthening strategic partnership in 2025; (8) Trump sharply criticizes Russian President Vladimir Putin; (9) SEC establishes crypto task force for regulatory framework; (10) Trump unveils $500 billion AI initiative with SoftBank, OpenAI, and Oracle; (11) S&P Global forecasts increase in corn plantings, reduced soybean acres (12) India’s rice exports steady in 2024 despite restrictions; (13) Citi raises 2025 oil price outlook amid geopolitical risks; (14) DOE resumes LNG export license review and extends comment period; (15) Trump’s executive orders on energy policy; (16) Six senators reintroduced the Farm to Fly Act; (17) California State Sen. Jerry McNerney proposes bill to strengthen renewable energy incentives; (18) Trump pressures Canada and Mexico for early USMCA renegotiation; (19) Agricultural trade under the spotlight amid tariff discussions; (20) New Senate members sworn in to replace Vance and Rubio; (21) Senate Finance Committee favorably reported the nomination of Scott Bessent to be Treasury secretary; (22) Fiscal 2025 spending talks gain momentum: (23) Ted Cruz to lead Senate hearing Jan. 28 on Panama Canal’s strategic importance; (24) Key ag policy veterans join Brooke Rollins’ team; (25) Reuters: Brazilian soy shipments to China from five firms halted; (26) China’s record beef imports risk trade curbs amid price slump; (27) China’s ‘comprehensive’ rural revitalization plan for 2024-27; (28) China eases rules to boost stock market; (29) Georgia reports HPAI outbreak; trade concerns mount; (30) Refugee flights canceled amid new U.S. policy; (31) Impact of mass deportations on U.S. agriculture.

— Trump still considering 10% tariff on China amid fentanyl concerns. President Donald Trump reaffirmed his consideration of imposing a 10% tariff on all Chinese imports, citing concerns over fentanyl trafficking. This comes after he refrained from immediately targeting China with tariffs during his second term’s first days. While Trump has previously imposed tariffs on China, he opted for a more measured approach this time, focusing on global trade practices and China’s compliance with prior agreements. The tax that Trump says he’s looking at now for China is lower than the 60% tariff he threatened to impose on Beijing last year but consistent with the 10% tax he pledged. Trump has highlighted the economic benefits of his past tariffs and continues to advocate for a tough stance on China, which he views as a critical issue for U.S. interests. Chinese Vice Premier Ding Xuexiang said Tuesday China would expand its imports, saying the country did not seek a “trade surplus.” — Trump said the EU also has troubling trade surpluses with the United States. “The European Union is very, very bad to us,” he said, repeating comments made Monday. “So, they’re going to be in for tariffs. It’s the only way... you’re going to get fairness.” European Central Bank President Christine Lagarde urged Europe to prepare for potential trade tariffs under Trump. Speaking at the World Economic Forum in Davos, Lagarde praised Trump’s avoidance of immediate blanket tariffs, calling it a “smart approach,” but warned that selective tariffs may follow. Meanwhile, EU economy commissioner Valdis Dombrovskis pledged a “proportionate” response if the bloc’s interests are threatened. — Why the Feb. 1 start date on Trump-threatened tariffs could be delayed. Trump signed a trade memorandum ordering federal agencies to complete detailed reviews of several trade issues by April 1. Key focus areas: Proposed remedies: Of note: The reviews aim to resolve internal disagreements among Trump’s Cabinet on his broader tariff policies, including potential 60% duties on Chinese goods. Analysts suggest Trump is adopting a slower, more calculated approach to establish a strong legal foundation and maximize leverage in trade negotiations. This indicates a strategic pivot by Trump toward a more measured application of trade policy while addressing internal and external challenges. — Trump rallies Hill GOP for recess appointments and debt limit strategy. President Donald Trump on Tuesday met with congressional GOP leaders to emphasize party unity and push for bold moves on his legislative priorities. During the White House meeting, Trump raised the possibility of recess appointments for stalled nominees and suggested trading California wildfire aid for a debt limit increase, Politico reports. While Trump expressed confidence in Senate Majority Leader John Thune’s (R-S.D.) handling of nominations, he kept the option of recess appointments open as a contingency. Discussions also addressed the GOP’s divided approach to advancing its policy agenda, with Trump favoring a single massive bill via reconciliation, a stance not uniformly shared by Senate and House Republicans. Trump wants quick legislative action, urging leaders to “stick together” and deliver results. However, debates over strategy, including how to handle the looming debt limit and March 14 funding deadlines, revealed continued divisions within the party. Speaker Mike Johnson (R-La.), who has pushed for a single reconciliation bill encompassing border security, defense, tax cuts and more, sounded optimistic that an agreement may be close at hand. “Well, we’re having extended conversations about it,” he said Tuesday night. “But stay tuned, it’s all going to come together.” Trump, at a later news conference, said simply, “I think we have a good situation,” when asked about reconciliation talks. — RFK Jr. confirmation hearing delayed past January. The Senate Finance Committee is unlikely to hold a confirmation hearing for Robert F. Kennedy Jr., President Donald Trump’s nominee for Secretary of Health and Human Services, by the end of January. Senator Mike Crapo (R-Idaho), chair of the Finance Committee, indicated that an initial plan to schedule the hearing for the week of Jan. 27 is unlikely due to delays in receiving the Office of Government Ethics report and other necessary documentation. — Trump’s executive order reshapes federal environmental permitting rules. President Donald Trump issued an executive order effectively abolishing federal environmental permitting rules established under the National Environmental Policy Act (NEPA), fulfilling a Republican goal of drastically shortening approval timelines. The order revokes a 1977 Carter-era directive empowering the Council on Environmental Quality (CEQ) to issue regulations, replacing them with non-binding guidance. Legal challenges are expected, but Trump’s authority to rescind regulations complicates potential lawsuits. The decision aligns with a recent D.C. Circuit ruling limiting CEQ’s regulatory powers, marking a significant shift in U.S. environmental policy. — Trump to visit hurricane-hit Asheville before stops in Los Angeles and Nevada. President Trump plans to travel to Asheville, N.C., on Friday, marking his first trip as president to the hurricane-affected region. He will then head to Los Angeles and Nevada, where he intends to thank voters for his electoral victory in the state. — Xi and Putin commit to strengthening strategic partnership in 2025. In a video chat on Tuesday, Chinese President Xi Jinping and Russian President Vladimir Putin reaffirmed their commitment to deepening bilateral relations and strategic coordination. Xi accepted Putin’s invitation to attend Victory Day celebrations in Moscow on May 9, while Putin is expected to attend China’s commemoration of the 80th anniversary of victory over Japan in Beijing on Sept. 3. The Chinese readout emphasized Xi’s vision of using the stability of China/Russia relations to navigate global uncertainties and jointly promote development, resilience, and international justice. Both leaders agreed on the importance of safeguarding their nations’ legitimate interests, enhancing practical cooperation, and upholding the principles of the United Nations Charter. Of note: Putin and Xi reached an agreement to continue strengthening BRICS as an instrument of ensuring a multipolar world order, Russian Presidential Aide Yury Ushakov told reporters. — Trump sharply criticized Russian President Vladimir Putin shortly after receiving glowing praise from the Kremlin for his second inauguration. While Putin hailed Trump’s “courage” and “convincing victory,” Trump accused Putin of “destroying Russia” with his prolonged war in Ukraine, describing it as a disastrous strategy. Despite the tension, Trump suggested a willingness to engage with Putin, hinting at potential talks aimed at ending the conflict. |

| FINANCIAL MARKETS |

— Equities today: Asian and European stock markets were mixed overnight, with Asian shares mostly down and European shares mostly up. U.S. stock indexes are set to open firmer. In Asia, Japan +1.6%. Hong Kong -1.6%. China -0.9%. India +0.8%. In Europe, at midday, London +0.4%. Paris +0.9%. Frankfurt +1.2%.

Equities yesterday: U.S. equities opened the holiday-shortened week with gains on reduced worries over a Trump trade war. The Dow gained 537.98 points, 1.24%, at 44,025.81. The Nasdaq rose 126.58 points, 0.64%, at 19,756.78. The S&P 500 gained 52.58 points, 0.88%, at 6,049.24.

— SEC establishes crypto task force for regulatory framework. The Securities and Exchange Commission (SEC) has formed a crypto task force under acting Chairman Mark Uyeda, chaired by Commissioner Hester Peirce. Its mission is to create a clear regulatory framework for crypto assets, addressing registration, disclosure rules, and enforcement strategies. The task force will work with other financial regulators, including the Commodity Futures Trading Commission, state, and international authorities, and adhere to Congress’ statutory framework. Paul Atkins, the SEC-chair nominee, is expected to integrate the task force into his agenda after confirmation.

— Netflix posts record subscriber gains in Q4 2024. Netflix is surging 15% premarket after it closed 2024 with a historic subscriber surge, adding 18.9 million customers in Q4 — its largest quarterly gain ever — boosted by live events like a Jake Paul vs. Mike Tyson boxing match, the FIFA Women’s World Cup, and the return of its hit series Squid Game. This leap brought Netflix’s global subscriber base to over 300 million, surpassing Wall Street expectations. The company reported a 16% revenue increase, reaching $10.2 billion for the quarter. It also announced price hikes in several markets, including the U.S., and forecasted a 14% annual revenue growth for 2025, targeting $44.5 billion. Netflix plans to shift investor focus from subscriber numbers to financial metrics like revenue and profit, discontinuing subscriber reporting after this quarter. Despite skepticism about the lasting benefits of its password-sharing crackdown, Netflix netted 41 million new subscribers in 2024, its best year ever.

— Trump unveils $500 billion AI initiative with SoftBank, OpenAI, and Oracle. Japanese tech giant SoftBank, alongside OpenAI and Oracle, will invest $500 billion in U.S.-based AI infrastructure under a new joint venture named Stargate, President Donald Trump announced Tuesday at the White House. Hailed as the “largest AI infrastructure project in history,” the initiative kicks off with a massive data center in Abilene, Texas. An initial $100 billion investment will scale to $500 billion over four years, with a focus on keeping cutting-edge technology development within the U.S.

“This is money that normally would have gone to China,” Trump stated, emphasizing the administration’s commitment to AI innovation and deregulation. The announcement, featuring SoftBank CEO Masayoshi Son, OpenAI CEO Sam Altman, and Oracle CTO Larry Ellison, sent shares of Oracle and SoftBank soaring, closing up 7.17% and 4.10%, respectively.

| AG MARKETS |

— Ag markets today:

Corn and beans weaker, wheat mixed overnight. Corn and soybeans pulled back from strong gains the two previous days during overnight trade, while wheat pivoted around unchanged in choppy trade. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 4 to 7 cents lower and wheat futures were a penny lower to 1 cent higher. The U.S. dollar index was modestly weaker, while front-month crude oil futures were tethered near unchanged.

Packers better positioned on cattle purchases. Packers bought a large amount of cattle again last week, including some “with time,” according to cash sources. Packers are thought to be well positioned on near-term needs, reducing their urgency to actively bid for cattle. Of course, that’s what cash sources indicated last week, too, only to see cash prices jump to another record high. Cash negotiations will likely be pushed deep into the week, which is typical when there is a Cattle on Feed Report.

Cash hog index continues to rise. The CME lean hog index is up another 6 cents to $81.46 as of Jan. 20, the seventh straight daily gain. While prices have only risen $1.03 during that span, there are increasing signs a seasonal low is in place. The pork cutout fell $1.49 on Tuesday to $90.82 as all cuts except bellies declined. While the cutout is nearly $3.00 off its January low, prices are tethered in the low-$90.00 area.

— Ag trade: South Korea purchased 136,000 MT of optional origin corn and 65,000 MT of feed wheat that can be sourced from optional origins excluding Russia, Argentina, Pakistan, Denmark and China. Japan tendered to buy 65,000 MT of feed wheat and 25,000 MT of feed barley from unspecified origins. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat. Thailand tendered to buy 195,000 MT of optional origin feed wheat.

— USDA daily export sale:

· 136,000 MT corn to unknown destinations for 2024-25.

— S&P Global forecasts increase in corn plantings, reduced soybean acres. S&P Global Commodity Insights projects U.S. farmers will plant 93.5 million acres of corn in 2025, up 700,000 acres from its December forecast and 2.9 million acres more than last year. The firm projects soybean plantings at 83.3 million acres, down 700,000 acres from its December forecast and 3.8 million acres less than 2024.

— India’s rice exports steady in 2024 despite restrictions. India exported 17.8 MMT of rice last year, just marginally lower than the 17.86 MMT shipped in 2023, despite export curbs put in place for most of the year by the government. Basmati rice exports in 2024 surged 16.3% to a record 5.7 MMT, while non-basmati shipments fell 6.9% to 12.1 MMT.

— Agriculture markets yesterday:

• Corn: March corn futures rose 5 3/4 cents to $4.90, at the session high and hit a seven-month high.

• Soy complex: March soybeans surged 33 1/4 cents to $10.67 1/4, marking a 15-week high close. March soymeal rallied $13.80 to $311.00, notching a close above the 100-day moving average. March soyoil rose 8 points to 45.77 cents.

• Wheat: March SRW futures surged 20 cents to $5.58 3/4 and closed on session highs. March HRW futures closed 27 cents higher to $5.75 1/2, a more-than two-month high close.

• Cotton: March cotton rose 6 points to 67.66 cents but closed nearer the session low.

• Cattle: Nearby February live cattle rose 30 cents to $197.05, while expiring January feeders gained 90 cents to $274.40. But most-active March feeders fell 80 cents to $267.25.

• Hogs: February lean hogs closed up 7 1/2 cents to $81.20, nearer the daily low.

| ENERGY MARKETS & POLICY |

— Oil prices dip amid oversupply concerns and U.S. energy policy. Oil prices fell on Tuesday as oversupply fears and record U.S. crude production weighed on the market. Brent crude futures dropped 86 cents, 1.1%, to $79.29 per barrel, while U.S. West Texas Intermediate (WTI) February contracts declined $1.99, 2.6% to $75.89 in their final trading session. The more-active March WTI contract settled at $75.83, down 2%. The U.S. Energy Information Administration (EIA) projected continued price declines due to robust global production and weakening demand, emphasizing demand weakness as the primary market challenge. President Donald Trump’s energy policies, including a national energy emergency declaration and potential tariffs on Canadian and Mexican oil, added uncertainty but had limited immediate impact. Trump signaled a potential halt to Venezuelan oil imports and a focus on refilling the Strategic Petroleum Reserve, while reduced Red Sea shipping disruptions were expected as Yemen’s Houthis scaled back attacks tied to Gaza ceasefire conditions.

— Citi raises 2025 oil price outlook amid geopolitical risks. Citi revised its oil price outlook for 2025, citing heightened geopolitical risks involving Russia and Iran. The bank now forecasts Brent crude to average $67 per barrel, up from a prior $62, and WTI crude to average $63 per barrel. Quarterly projections for Brent range from $75 in Q1 to $60 in Q4.

While oil prices are expected to ease in the latter half of the year, the geopolitical landscape, including tensions tied to Iran and the Russia-Ukraine conflict, could eliminate the anticipated 2025 oil surplus. The Trump administration’s energy policies, including sanctions on Russian tankers and a rollback of environmental protections, are also shaping the market outlook.

Citi predicts a 2025 oil surplus of 0.8 million barrels per day but highlights that policy timing and actions by President Trump may have a significant impact on market dynamics.

— DOE resumes LNG export license review and extends comment period. The Department of Energy (DOE) has announced that its Office of Fossil Energy and Carbon Management will resume reviewing pending applications for liquefied natural gas (LNG) export licenses to countries with which the United States has free trade agreements (FTAs). Additionally, the Biden administration has extended the public comment period on its LNG export study from Feb. 18 to March 20. This decision aligns with directives issued through executive orders by President Donald Trump on Jan. 20. The review of LNG export licenses will occur concurrently with a multi-agency review under the National Environmental Policy Act (NEPA) to enhance efficiency in regulatory processes.

— Trump’s executive orders on energy policy:

National Energy Emergency

- Grant agencies emergency powers to approve new energy projects, including on federal land, and expedite the completion of existing projects

- Direct agencies to identify and use emergency authorities to bypass endangered species or environmental permitting requirements

- Direct the Environmental Protection Agency to consider emergency fuel waivers to allow for year-round sale of E15 gasoline

Wind Projects

- Order a freeze on all offshore wind energy leases within the outer continental shelf

- Pause all onshore and offshore approvals, including renewals, until a review of federal wind leasing and permitting practices is completed

- Order Interior Department to review options for terminating or amending existing wind energy leases

- Note: The Biden administration approved permits for 11 offshore wind projects; of those, one is complete, three are under construction offshore, and two have begun onshore work. The move affects the “wind belt” states like Texas, Kansas, and Iowa, where wind energy forms a significant share of electricity production. Critics argue the pause could raise energy costs for consumers in these regions, which heavily rely on wind power. Offshore wind energy, a nascent industry in the U.S., is also hit by the order. Currently, only three large-scale offshore projects are operational, but over 20 are in the permitting process. Opposition to wind energy, citing aesthetic and environmental concerns, has grown in recent years, complicating efforts to expand renewable energy infrastructure.

Clean Energy Funds and Rules

- Order a pause on all spending authorized by Democrats’ 2022 climate-and-tax law and the 2021 bipartisan infrastructure law, including money to install electric vehicle charging stations (Note: This does not include the 45Z tax incentive program, which would take legislative action. However, Trump signed an executive order freezing all federal regulations pending a 60-day review. Some say this includes the 45Z Clean Fuels Production credit from the Inflation Reduction Act, although a recent program update did not have to be published in the Federal Register. But the Trump administration has authority to alter the recent 45Z program updated rules.)

- Direct agencies to eliminate electric vehicle and appliance efficiency rules

- Require review of all rules that burden U.S. domestic energy production

- Attempts to withdraw California’s waiver authority that allowed the state to phase out new gas-powered car sales by 2035, a policy that 12 other states have adopted since it was passed in 2022. Revoking that authority likely requires lengthy administrative processes and long court battles.

- Note: During President Biden’s term, the Inflation Reduction Act (IRA) channeled significant federal funding — hundreds of billions of dollars — into clean energy, electric infrastructure, and climate-related initiatives. Notable allocations included over $170 billion in Department of Energy grants and loans for renewable energy projects, hydrogen technology, and electric vehicles. The Environmental Protection Agency also utilized the majority of its IRA funding, reporting 93% of grant funds distributed. However, as Trump campaigned on a promise to rescind any unspent IRA funds, federal agencies accelerated their disbursements in the final weeks before the new president’s inauguration, ensuring minimal leftover funds that could be clawed back.

Oil and Gas Leasing

- Reverse Biden decision to protect 625 million acres of U.S. waters from oil and gas leasing (Note: Decision likely to be challenged in court; unclear whether Trump has legal authority)

- Reverse Biden restrictions on oil and gas development in Alaska

Natural Gas Exports

· Lift a pause on new US licenses to widely export liquefied natural gas implemented by Biden

Executive Actions

· Rescind Biden orders directing agencies to: confront climate change; address climate-related financial risks; achieve carbon-free electricity by 2030, among other zero-emission goals; and implement energy and infrastructure provisions of Democrats’ climate-and-tax law

Climate Accord

· Withdraw the U.S. from the Paris Agreement, in which countries committed to reduce emissions and fight climate change; process of leaving agreement will take one year

Key unknown: A critical issue will be whether Trump reduces support for biofuel and renewable energy, which could impact demand for crops like corn and soybeans.

— Six senators reintroduced the Farm to Fly Act, aimed at accelerating the production and development of sustainable aviation fuel (SAF) through existing USDA programs. The bill, cosponsored by Sens. Jerry Moran (R-Kan.), Chuck Grassley (R-Iowa), Tammy Duckworth (D-Ill.), Pete Ricketts (R-Neb.), Amy Klobuchar (D-Minn.), and Joni Ernst (R-Iowa), seeks to expand markets for American agricultural crops and support the growth of the aviation biofuels sector.

Key provisions of the Farm to Fly Act. The legislation includes several important provisions:

- Clarification of SAF eligibility: The bill would require USDA to clarify that sustainable aviation fuels are eligible for existing USDA bioenergy programs.

- Collaboration on aviation biofuels: It would encourage policymaking collaboration on aviation biofuels throughout USDA agency mission areas, increasing private sector partnerships.

- Common SAF definition: The act would affirm a common definition of sustainable aviation fuel for USDA purposes, enabling U.S. crops to contribute more effectively to aviation renewable fuels.

The reintroduction of the Farm to Fly Act has garnered significant support from various industry stakeholders:

- Renewable Fuels Association: President Geoff Cooper praised the senators for reintroducing the legislation, emphasizing its critical role in positioning SAF for takeoff by ensuring the use of the best available science and modeling tools to calculate the carbon benefits of homegrown renewable fuels.

- Ag sector: The bill is expected to expand markets for American farmers, potentially creating new economic opportunities in rural communities.

- Aviation industry: By promoting the development of SAF, the legislation aims to support the aviation sector’s efforts to reduce its carbon footprint and increase energy security.

— California State Sen. Jerry McNerney proposes bill to strengthen renewable energy incentives. McNerney introduced legislation to expand state tax incentives for renewable energy and energy conservation projects. The move directly counters President Trump’s recent federal cuts to clean energy funding and his administration’s push for fossil fuel development. McNerney, a former U.S. House Representative with two decades of clean energy industry experience, aims to safeguard California’s climate leadership. The bill, co-sponsored by State Treasurer Fiona Ma, seeks to bolster the state’s tax incentive programs to mitigate the effects of federal policy changes, including halts on funding from the Inflation Reduction Act and Infrastructure Investment and Jobs Act.

| TRADE POLICY |

— Trump pressures Canada and Mexico for early USMCA renegotiation. President Trump is pushing for an early renegotiation of the U.S.-Mexico-Canada Agreement (USMCA), set for statutory review on July 1, 2026, by threatening to impose 25% tariffs on imports from Canada and Mexico as soon as Feb. 1. His administration aims to revise automotive rules to encourage U.S. manufacturing and address broader trade issues, the Wall Street Journal reported (link). Trump officials want to tighten the pact’s rules governing the auto sector, to try to discourage auto factories from leaving the United States, they said. They are also seeking to block Chinese companies making cars and auto parts from being able to export to the United States through factories in Mexico. Speaking at the Detroit Economic Club in October, Trump said that “Mexico is becoming the second China… When China comes in, they take over everything, and you’d have no car manufacturing anymore,” he added. The New York Times reports (link) that members of the Trump team believe that Mexico has been violating the terms of a separate agreement to limit metal exports to the U.S., and they are eager to show the Mexican government that they mean to take action against such trade violations.

Of note: Trump signed an executive order on Monday evening directing various agencies to study a wide variety of trade issues. One provision directed trade officials to assess the impact of the North American trade deal on workers, farmers and other businesses and “make recommendations regarding the United States’ participation in the agreement.” It also directed them to begin soliciting public comments in preparation for the July 2026 review of the trade deal.

The tariff move, which could disrupt the $2 trillion trade framework, has drawn sharp responses.

- Canadian Prime Minister Justin Trudeau promised “robust” retaliation, potentially targeting U.S. goods and energy exports. Canadian officials are mulling retaliatory tariffs on up to $150 billion of U.S. products, depending on what Trump does. Canada has also threatened to add an export tax on the 4 million barrels a day of oil it sends to U.S. refiners, which could ultimately boost the cost of gasoline to U.S. customers. “Everything is on the table,” Trudeau said. He acknowledged that tariffs on U.S. goods and services would also hurt Canadian consumers and businesses, and said the government is ready to provide financial support to households and businesses to cushion the blow. “We know that if the United States is going to see an increase in jobs, manufacturing and economic growth, they’re going to require more energy, more inputs, everything from lumber and concrete to steel and aluminum to critical minerals that are the essential ingredients in the economy of the future,” Trudeau said. Canada’s prime minister said he supports the idea of dollar-for-dollar matching tariffs.

- Mexican President Claudia Sheinbaum urged calm but hinted at possible countermeasures. Sheinbaum said that she would emphasize Mexico’s sovereignty and independence and would respond to U.S. actions “step by step.” But she added that the USMCA was not up for renegotiation until 2026. Economists warn that these tariffs could trigger a recession in Canada and further strain U.S./Mexico relations. Gabriela Siller, director of economic analysis at Mexico’s Banco Base, said on X on Tuesday that it is “highly unlikely that Trump will impose a general 25% tariff on all products from Mexico, at least not for a long period of time… A 25% tariff would be equivalent to leaving the USMCA,” she said. “This would mean a structural change for the Mexican economy that would result in a severe recession, job losses, an increase in [employment] informality to rates above 60% and an increase in public insecurity,” Siller said. She also warned that a 25% tariff on Mexican exports to the U.S. would result in “increases in the exchange rate to historic maximums,” i.e. a significant weakening of the Mexican peso against the US dollar. For the United States, a 25% tariff on Mexican exports “would mean supply change disruptions, a sharp rise in inflation, a higher interest rate and lower economic growth,” Siller said.

Of note: Trump plans to finalize his economic team before advancing these measures, with his nominees for key trade roles still awaiting confirmation. Handling the eventual USMCA renegotiations will be Howard Lutnick, Commerce secretary nominee, and Jamieson Greer, Trump’s nominee to be the U.S. Trade Representative. Trump signed a wide-ranging trade memorandum that instructed the USTR to take the lead on reviewing the effect of the USMCA on workers, farmers and ranchers — and make recommendations on U.S. participation in the agreement.

U.S. corn growers are concerned about U.S. tariffs and retaliatory duties disrupting trade with Mexico, their top export customer for corn, and with Canada, the top export customer for U.S. corn-derived ethanol. “We understand that he is a negotiating type of person,” Illinois farmer Kenny Hartman Jr, board president of the National Corn Growers Association, said of Trump. “We’re just hoping that we can come out of this where we don’t lose the exports — we don’t lose that corn going to Mexico or that ethanol going to Canada.”

Trump tariffs threaten U.S./Canada oil partnership, disrupting the longstanding U.S./Canada energy partnership, driving up gasoline prices and creating uncertainty for refiners and consumers. Canada, America’s largest foreign oil supplier, sends more than 60% of U.S. crude imports, benefiting American refineries designed for heavier oil.

While critics argue tariffs would undermine U.S. energy goals and inflate costs, Canadian officials are bracing for impacts and considering countermeasures.

— Agricultural trade under the spotlight amid tariff discussions. As the Trump administration signals a possible shift in trade policy through the implementation of tariffs, agricultural trade faces heightened scrutiny. According to a farmdoc report (link), tariffs on imports could not only raise food costs for U.S. consumers but also provoke retaliatory measures that might affect U.S. agricultural exports. Key insights from the state of agricultural trade are outlined below based on the farmdoc report:

Overall agricultural trade trends

- U.S. agricultural imports and exports have grown over time, with imports now exceeding exports since 2013.

- Imports, driven by horticultural products like fresh fruits and vegetables, reached $215 billion in 2024. Tariffs on these goods could inflate consumer prices.

- Canada, Mexico, and the European Union are the largest suppliers of U.S. agricultural imports.

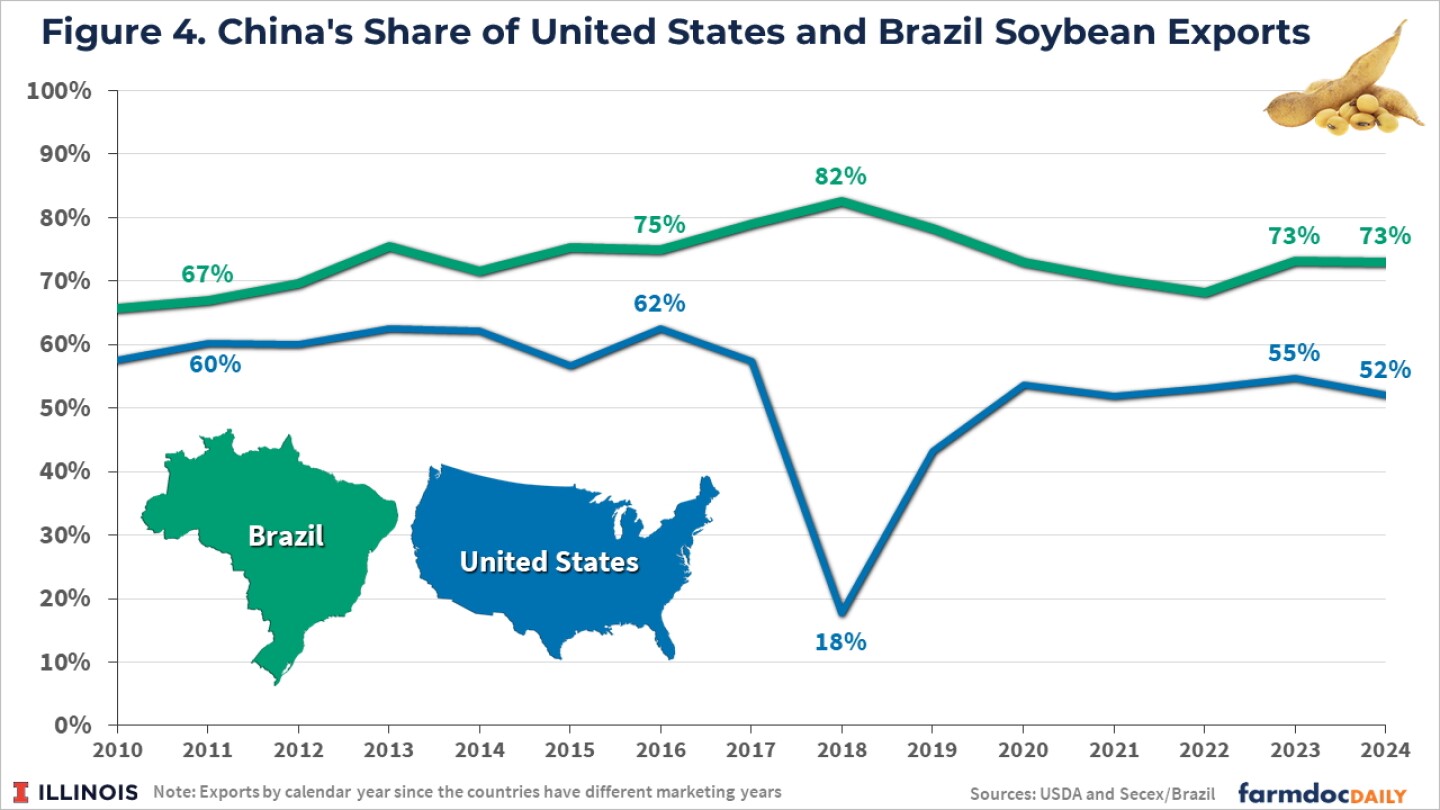

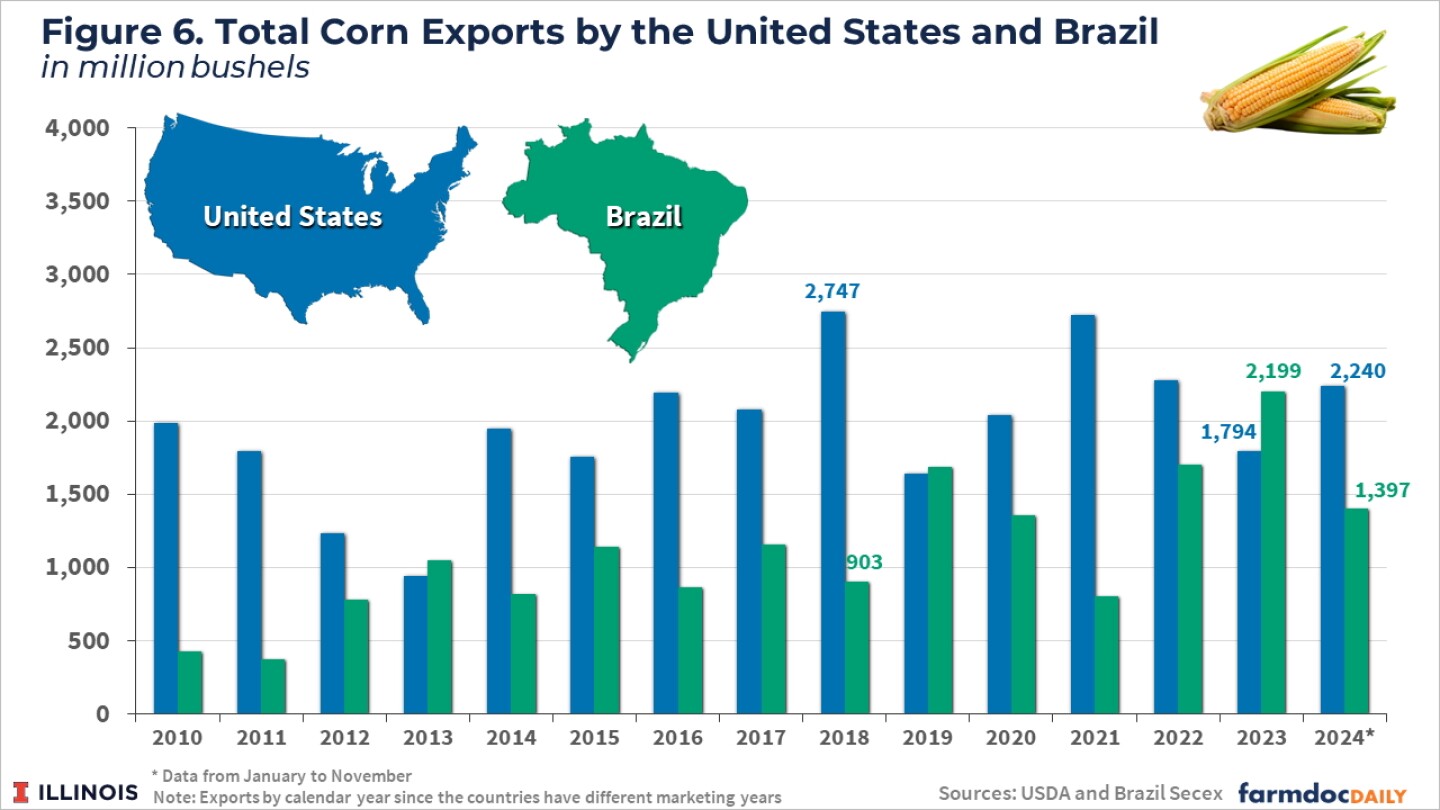

Soybean and corn trade

- Soybeans and corn, critical exports for states like Illinois, depend heavily on foreign markets.

- Soybean exports rebounded after the 2018 trade war but remain below peak levels. Brazil, a significant competitor, has overtaken the U.S. in soybean production since 2017.

- Corn exports, while smaller as a percentage of production than soybeans, face competition from Brazil, which surpassed the U.S. in corn exports in 2023.

Implications of tariffs

- Tariffs could disadvantage U.S. agricultural products, reducing their competitiveness globally.

- Retaliatory tariffs from major partners like China, Canada, and Mexico could further erode demand for U.S. exports, benefiting competitors such as Brazil.

Bottom line: The report’s authors say that while no specific tariff actions have been implemented, the potential for disruption underscores the importance of agricultural trade to both consumers and producers. Tariff-driven trade disputes could have significant implications for U.S. agriculture’s global position.

| CONGRESS |

— New Senate members sworn in to replace Vance and Rubio. John Husted of Ohio and Ashley Moody of Florida were officially sworn into the U.S. Senate Tuesday evening. Husted, previously Ohio’s lieutenant governor, was appointed by Governor Mike DeWine to replace outgoing Sen. J.D. Vance. Florida Governor Ron DeSantis selected Ashley Moody, formerly the state’s attorney general, to succeed Marco Rubio, who was recently confirmed as Secretary of State. These appointments bolster the Republican majority in the Senate to 53-47.

— Senate Finance Committee favorably reported the nomination of Scott Bessent to be Treasury secretary. The vote was 16-11 in favor, with Democratic Sens. Mark Warner of Virginia and Maggie Hassan of New Hampshire joining all committee Republicans in supporting Bessent.

— Fiscal 2025 spending talks gain momentum. Republican appropriators, led by Senate Appropriations Chair Susan Collins (R-Maine), are preparing a topline spending proposal for fiscal year (FY) 2025, aiming to send it to Democrats this week. The goal is to resolve differences and finalize spending bills before the March 14 deadline under the current continuing resolution.

The two chambers remain $90 billion apart, with Republicans proposing cuts to domestic and foreign aid programs while capping defense spending at a 1% increase. Senate Democrats, backed by bipartisan support, seek higher boosts for both defense and nondefense budgets. Despite the gap, this marks the first sign of progress in months. Senate Appropriations ranking member Patty Murray (D-Wash.) expressed optimism about reaching a bipartisan agreement to meet the deadline.

— Ted Cruz to lead Senate hearing Jan. 28 on Panama Canal’s strategic importance. Sen. Ted Cruz (R-Tex.), Chair of the Senate Committee on Commerce, Science, and Transportation, will hold a full committee hearing on Jan. 28 to assess the Panama Canal’s role in U.S. trade and national security. The session will address the canal’s economic significance, challenges like capacity limitations and rising fees, and concerns over foreign influence, including China’s alleged involvement.

| USDA PERSONNEL |

— Key ag policy veterans join Brooke Rollins’ team. USDA announced several senior staff appointments on Tuesday, highlighting key ag policy experts and veterans from Capitol Hill and the Trump administration. These roles, announced ahead of Rollins’ Senate Ag Committee confirmation hearing on Thursday, do not require Senate confirmation.

- Kailee Tkacz Buller: Chief of Staff to USDA Secretary nominee Brooke Rollins, formerly CEO of the National Oilseed Processors Association and a USDA alum from Trump’s first term.

- Preston Parry: Deputy Chief of Staff, previously Rollins’ assistant at the America First Policy Institute and Domestic Policy Council.

- Jennifer Tiller: Chief of Staff to Deputy Secretary nominee Stephen Vaden and Senior Adviser for Food, Nutrition, and Consumer Services, was Deputy Staff Director for the House Ag Committee.

- Ralph Linden: Principal Deputy General Counsel, a USDA veteran who served in various capacities in the Office of the General Counsel from 1982 until 2021, including serving as an Acting Deputy General Counsel during the first Trump administration.

- Audra Weeks: Deputy Director of Communications, previously a USDA Deputy Press Secretary and consultant for food and agriculture clients.

- Dominic Restuccia: White House Liaison, a former legislative director and recent Michigan state House candidate.

| CHINA |

— Reuters: Brazilian soy shipments to China from five firms halted. China has stopped receiving Brazilian soybean shipments from five firms after cargoes did not meet phytosanitary requirements, two sources with direct knowledge of the matter told Reuters. From Jan. 8, shipments to China were suspended from Terra Roxa Comercio de Cereais, Olam Brasil and C.Vale Cooperativa Agroindustrial. On Jan. 14, Chinese customs suspended shipments from Cargill Agricola S A and ADM do Brasil. There were concerns after some cargoes had been found with chemical contamination, pests or insects, sources said. It was not clear how long the suspension would last, although traders said they expect it to be short-term.

— China’s record beef imports risk trade curbs amid price slump. China’s record-breaking beef imports in 2024, totaling 2.87 million tons, have coincided with a significant drop in wholesale beef prices, now at their lowest levels since 2019. While demand for the red meat has surged over decades, consumption declined last year as consumers cut back on spending. According to a Bloomberg report (link), the combination of rising imports, increased domestic production, and falling prices has put significant pressure on Chinese cattle farmers, with two-thirds reportedly operating at a loss. The Ministry of Commerce is investigating whether these imports are harming local producers, a move that could lead to trade restrictions within eight months.

Impacts. Brazil, which supplies nearly half of China’s beef imports, along with Argentina, Australia, and the U.S., would be most affected by any protectionist measures. While boosting imports from the US could ease trade tensions, China appears more focused on protecting its farmers and ensuring food security.

— China’s ‘comprehensive’ rural revitalization plan for 2024-27. China aims to achieve substantial progress in all-around rural revitalization and promote the modernization of agriculture and rural areas to a new stage by 2027, according to a plan issued by the Central Committee of the Communist Party of China and the State Council. China will vigorously implement the national soybean and oilseed production capacity enhancement program, state news agency Xinhua reported, citing a “comprehensive rural revitalization” plan issued by the government. Under the plan, which will be implemented from 2024 to 2027, China will increase support for grain production, enhance grain production subsidies, implement minimum purchase price policy and coordinate market-based grain purchasing and policy-oriented reserve storage. The country will also optimize market regulation mechanisms for live pigs, cotton and sugar, according to Xinhua. It will accelerate research on core seed technologies, strengthen the leading role of enterprises in technological innovation and cultivate large-scale seed industry enterprises.

— China eases rules to boost stock market. China rolled out a basket of measures to stabilize its stock market, including plans to boost the amount pensions can invest in the nation’s listed companies. Beijing issued a directive to “steady the stock market, and clear bottlenecks for the introduction of mid-long-term capital,” according to a notice posted by the China Securities Regulatory Commission. The securities watchdog also said the country will guide big state-owned insurers to raise A-share investment and prompt listed companies to increase their share repurchases. Mutual funds will be encouraged to issue more equity-focused fund products. Institutions including mutual funds, insurers, pensions, as well as wealth management units at banks will be allowed to participate in listed firms’ share placements as strategic investors. Authorities will guide listed firms to tap more into the central bank’s relending tool to boost share repurchases and stake increases. The government will extend the horizon of state-backed insurers’ performance evaluation mechanism and lower the weighting of annual return on assets.

| HPAI/BIRD FLU |

— Georgia reports HPAI outbreak; trade concerns mount. A flock of 45,500 breeder chickens tested positive for highly pathogenic avian influenza (HPAI) last week in Elbert County, Georgia, near the border with South Carolina, USDA said. This was Georgia’s, the leading U.S. chicken producer, first confirmed case of the disease in a commercial operation.

The USA Poultry & Egg Export Council said the outbreak was likely to trigger trade restrictions from major meat importers. It said Mexico, the biggest importer of U.S. poultry products, will likely halt purchases from Georgia for about two to four weeks, until it revises the ban to apply to the county. Taiwan, the third-biggest importer of U.S. poultry, will block poultry imports from Georgia for six to eight months, the export council estimated. South Korea will likely impose a ban on Georgia’s poultry that should be lifted 28 days after the virus has been eliminated, a process that will likely take three to four months, the council said.

The confirmation brings the total number of commercial flocks affected so far in January to 29 with 26 backyard flocks for a total of 8.38 million birds affected. Over the past 30 days, there have been 89 confirmed flocks (49 commercial, 40 backyard) for a total of 12.97 million birds.

| BORDER, IMMIGRATION, DEPORTATION & LABOR |

— Refugee flights canceled amid new U.S. policy. Refugees scheduled to travel to the United States have had their flights abruptly canceled following a State Dept. memo linked to President Trump’s executive order suspending refugee admissions. The order, citing national security concerns, effectively halts the U.S. Refugee Admissions Program (USRAP), suspends case processing, and cancels pre-departure activities. Exceptions are made for Special Immigrant Visa holders and refugees already in the U.S., who can continue receiving services. The memo has raised concerns for refugees at risk of expiring medical or security clearances. The suspension, intended to align with the administration’s immigration agenda, takes effect immediately.

— Impact of mass deportations on U.S. agriculture. President Trump’s promise of large-scale deportations of undocumented immigrants could have significant consequences for the U.S. agricultural industry.

Labor shortages. The ag sector relies heavily on immigrant labor, with undocumented workers making up a substantial portion of the workforce. According to estimates:

- Nearly half of all farmworkers are undocumented.

- Undocumented immigrants constitute about 41.2% of hired crop farmworkers as of 2020.

- In some states like Idaho, up to 90% of dairy workers were born outside the U.S.

Mass deportations would remove a significant portion of this labor force, potentially leading to severe worker shortages in an industry already struggling with labor issues.

Economic impact. The loss of undocumented agricultural workers could have far-reaching economic consequences:

- It may lead to a reduction in agricultural production and output.

- The American Immigration Council estimates that the agriculture sector’s output could decrease by $30-$60 billion if mass deportations occur.

- The overall U.S. economy could shrink by 4.2% to 6.8% due to mass deportations across all sectors.

Food prices and supply. The labor shortages resulting from mass deportations could affect food production and prices:

- A study by the Peterson Institute found that mass deportation could lead to a 10% increase in food prices.

- Reduced agricultural labor could result in crops being left unharvested and lower yields.

- The U.S. food supply chain could face significant disruptions.

Industry adaptation. Farmers and agricultural businesses may need to adapt in several ways:

- Increased reliance on the H-2A visa program for legal temporary agricultural workers, despite its higher costs.

- Potential acceleration of mechanization and automation in farming.

- Possible shift towards less labor-intensive crops or reduced production.

Regional and sector-specific impacts. The effects of mass deportations would not be uniform across the country:

- States with large agricultural sectors, such as California, Texas, and Florida, could be particularly hard hit.

- Certain agricultural subsectors, like dairy farming, which requires year-round labor, may face more severe challenges.

The long-term effects of mass deportations on U.S. agriculture could include:

- Potential increase in food imports as domestic production decreases.

- Structural changes in the agricultural labor market and farming practices.

- Possible consolidation of smaller farms into larger operations better able to absorb increased labor costs.

Bottom line: President Trump’s proposed mass deportations could significantly disrupt the U.S. ag industry, potentially leading to labor shortages, increased food prices, reduced production, and long-lasting changes to the structure of American farming. The full extent of these impacts would depend on the scale and implementation of the deportation plans.

| WEATHER |

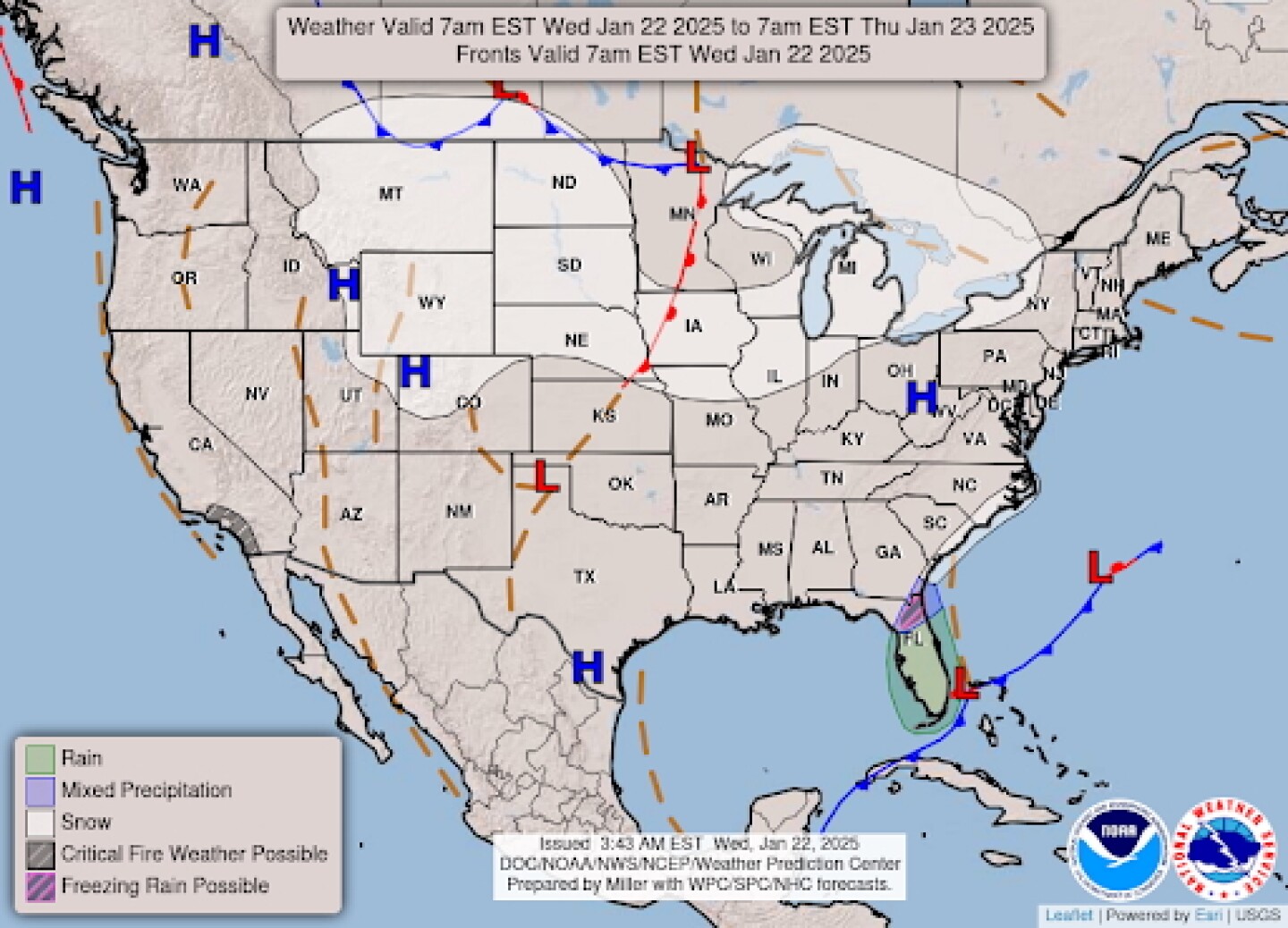

— NWS outlook: Impacts continue from the historic winter storm along the Gulf Coast and Southeast... ...Dangerously cold temperatures and wind chill values will linger for much of the South and eastern U.S.... ...Critical Risk of Fire Weather for Southern California through Thursday.

| KEY DATES IN JANUARY |

24: USDA Food Price Outlook

26: AFC and NFC football championships

27: First day IRS will begin accepting 2024 federal tax returns

28: Florida’s 1st and 6th special primaries

31: Employers and financial institutions should send out W-2 and 1099 tax forms

31: Federal Open Market Committee meets

31: USDA Cattle

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |