Updates: Policy/News/Markets, Feb. 20, 2025

— President Trump says a trade deal with China is possible and touted his “great” relationship with Xi Jinping. Trump suggested a fresh trade agreement with China could be possible, signaling a willingness to ease tensions between Washington and Beijing. Speaking to reporters aboard Air Force One, Trump praised Chinese President Xi Jinping but provided no details on a potential deal. Trump said he expected Xi to visit the United States, though he did not give a timeline for the trip. Xi last travelled to the U.S. in November 2023, in his fifth visit to the country as Chinese president, for a summit with then U.S. President Joe Biden, resulting in agreements to resume military-to-military communications and curb fentanyl production. Trump’s remarks come despite his administration’s tariffs and criticism of China’s trade practices. Markets reacted mildly positively, with the Chinese yuan and stocks recovering some losses. Analysts remain cautious, noting Trump’s comments were likely off the cuff and that significant hurdles remain. — EU seeks to avoid U.S. trade war. The European Union is open to negotiating lower tariffs on automobiles and other goods to prevent a trade conflict with the United States, according to Trade Commissioner Maros Sefcovic. Speaking in Washington, Sefcovic emphasized the EU’s commitment to de-escalation but warned that if the U.S. follows through on tariff threats, the bloc will respond “firmly and swiftly.” Sefcovic met with U.S. counterparts — Commerce Secretary Howard Lutnick, Trump’s nominee to be U.S. Trade Representative Jamieson Greer and National Economic Council director Kevin Hassett — in Washington on Wednesday to discuss the various tariffs facing U.S. trading partners. More in Trade Policy section below, including upcoming visits by leaders from Japan and Argentina to avoid U.S. tariffs. — Ukraine update. The UK and France are reportedly drafting plans for a “reassurance force” that would see less than 30,000 European troops deployed to the nation, contingent on U.S. protection. The UK PM reaffirmed his support of Zelenskyy after Trump labeled the Ukrainian president a “dictator.” Meanwhile, President Trump told reporters he could make a deal with Russia over the war in Ukraine. “We can make a deal with Russia to stop the killing,” Trump said, adding he thought the Russians wanted to see the war end. “I think they have the cards a little bit because they’ve taken a lot of territory so they have the cards,” Trump said. — House to vote on budget plan next week following Trump endorsement. According to Punchbowl News, the House will vote next week on its budget resolution after former President Donald Trump backed the chamber’s “one-bill” strategy. House Majority Leader Steve Scalise (R-La.) called on Senate Republicans to abandon their competing measure, emphasizing that the House’s version meets all of Trump’s priorities. “If [the Senate bill] came over [to the House], we’d just change the whole thing anyway,” Scalise said. Scalise said that committees will have all of March to assemble the policy particulars for the reconciliation package. And then the House will seek to pass the package in April. The House plan includes $4.5 trillion in tax cuts and at least $1.5 trillion in spending cuts, while also increasing the debt ceiling by $4 trillion. The package is expected to include Medicaid cuts, putting moderate Republicans in a difficult spot. Meanwhile, Senate Republicans had proposed a narrower resolution focused on Pentagon and border security funding, but Trump’s endorsement of the House approach effectively settled the internal GOP debate. Vice President JD Vance came to the Capitol to have lunch with Senate Republicans Wednesday. He gave them the blessing to go ahead with their budget resolution even though he informed them of Trump’s preference for the House version. Senate Republicans view their version as a fallback plan in the event that House Republicans are unable to move their larger version forward. — Awaiting the Trump administration’s HPAI/egg plan. Kevin Hassett, the National Economic Council Director, is expected to release his plan to address the highly pathogenic avian influenza (HPAI) outbreak and egg prices by the end of this week. Hassett previously mentioned that he is currently editing the plan with his team, suggesting it is in its final stages of preparation. The plan is expected to be ready for President Donald Trump this week. Hassett and USDA Secretary Brooke Rollins are working with experts from government and academia to have the plan ready for President Trump. The plan aims to implement a “smart perimeter” approach with improved biosecurity measures and medication strategies to control the spread of avian flu without resorting to mass culling of chickens. — U.S. egg imports rose by 38% in December 2024 compared to the previous month, indicating a broader trend of increased imports from multiple countries. U.S. firms have been seeking alternative import markets due to supply constraints, suggesting that other countries besides Turkey may have increased their egg sales to the U.S. As Turkey is redirecting some of its exports from other markets to the U.S., it’s possible that those markets are now sourcing eggs from different countries, potentially creating a ripple effect in global egg trade. Top egg exporters globally include: Other significant egg exporters include: — Iowa leaders push for faster bird flu vaccine approval amid export concerns. Iowa Gov. Kim Reynolds, along with U.S. Sens. Chuck Grassley (R-Iowa) and Joni Ernst (R-Iowa), are urging USDA to accelerate the approval of animal vaccines for bird flu. However, poultry trade groups oppose the move, arguing that vaccines could mask symptoms, prompting trade bans on U.S. poultry exports. Many countries, including China and the European Union, ban poultry imports from nations that vaccinate against avian influenza. The concern is that vaccinated birds can still carry and spread the virus asymptomatically. That makes it harder to detect and control outbreaks. If the U.S. poultry industry widely adopted vaccination, it could risk losing access to billions of dollars in export revenue. They also cite the high cost and logistical challenges of mass vaccination — Most avian flu vaccines require individual injections, making them impractical for large-scale poultry farms in the U.S., where flocks can number in the tens or even hundreds of thousands of birds. Of note: Between 2013 and 2022, about 17% of U.S. chicken production was sent to other countries, making it the most export-focused poultry product. In 2024, U.S. poultry meat exports (excluding eggs) were worth around $5.53 billion, with an average of $5.66 billion over the past three years. Sen. Joni Ernst and Sen. John Fetterman (D-Pa.), along with other lawmakers, sent a letter to USDA advocating for: · A vaccination strategy for affected laying hens and turkeys. Meanwhile, Leaders of the Congressional Chicken Caucus said in a letter to USDA Secretary Brooke Rollins last week that while the egg industry has lost the most birds, the broiler industry could bear a disproportionate share of the costs of any policy change. According to USDA figures 77.5% of the nearly 159 million commercial birds lost to avian influenza since February 2022 have been layers, or over 123 million. That compares to 13.7 million broilers, or 8.6%, and 18.7 million turkeys, or 11.8%. — The Senate voted 52-46 to confirm Kelly Loeffler as Small Business administrator. Loeffler, a former Senate Republican from Georgia, is the 18th of President Donald Trump’s senior-level picks approved this year. — U.S. labels drug cartels as terrorist organizations. The U.S. State Department officially designated eight Latin American drug cartels as terrorist organizations, following an executive order signed by President Donald Trump on his first day in office. The groups, including Tren de Aragua, Mara Salvatrucha, and the Sinaloa Cartel, are accused of threatening national security, foreign policy, or the economy. The designation, based on a post-9/11 order from President George W. Bush, allows the U.S. to freeze cartel assets and prohibit financial dealings with them. — Zeldin uncovers $2 billion EPA stash for Abrams-linked climate group. EPA Administrator Lee Zeldin revealed that the Biden administration quietly allocated $2 billion to Power Forward Communities, a nonprofit linked to Stacey Abrams, before leaving office. The funds, part of a larger $20 billion EPA pool from the Inflation Reduction Act (IRA/Climate Act), were held at Citibank, allegedly to prevent recovery by the incoming Trump administration. Zeldin, citing concerns over transparency and oversight, pledged to investigate ways to reclaim the funds. — Kremlin confirms U.S./Russia prisoner swap talks are ongoing. The Kremlin has acknowledged that discussions regarding a potential new prisoner exchange between Russia and the United States are on the agenda, following recent diplomatic engagements aimed at improving bilateral relations. Kremlin spokesman Dmitry Peskov stated that U.S./Russia talks in Riyadh on Tuesday contributed to a broader diplomatic thaw. This follows Russia’s recent release of American citizen Kalob Byers, as well as an earlier exchange involving U.S. teacher Marc Fogel for Russian cybercriminal Alexander Vinnik. At least 10 Americans remain imprisoned in Russia, including some labeled as “wrongfully detained” by Washington. The topic of further exchanges remains active as diplomatic ties continue to be reassessed. — Rollins meets with wildland firefighters to discuss support and preparedness. USDA Secretary Brooke Rollins hosted a roundtable with U.S. Forest Service wildland firefighters to express gratitude for their service during the recent California fires and to discuss ways to better support them. During the discussion, Rollins commended the firefighters for their bravery and sought their recommendations on fire prevention and response strategies. She met with members of the Mark Twain National Forest Veteran’s Crew from Missouri and firefighters from the Angeles National Forest in California — both of whom played key roles in battling recent wildfires. Rollins reaffirmed her commitment to strengthening resources and preparedness for wildland firefighting forces, emphasizing the importance of frontline perspectives in shaping policy. |

| DOGE |

— Trump weighs “DOGE dividend” for Americans Amid Cost-Cutting Drive. President Donald Trump announced that his administration is considering returning 20% of the savings identified by Elon Musk’s Department of Government Efficiency (DOGE) initiative to American citizens. Speaking at a finance and tech summit in Miami, Trump also mentioned using another 20% of the savings to reduce federal debt. The idea, dubbed the “DOGE dividend,” originated from investor James Fishback, who suggested distributing $400 billion—if DOGE achieves its $2 trillion savings target — as $5,000 checks to tax-paying households. Musk endorsed reviewing the proposal, and Fishback is now in discussions with the administration. Musk’s cost-cutting effort has reportedly saved $8.5 billion so far, though some experts question its broader effectiveness.

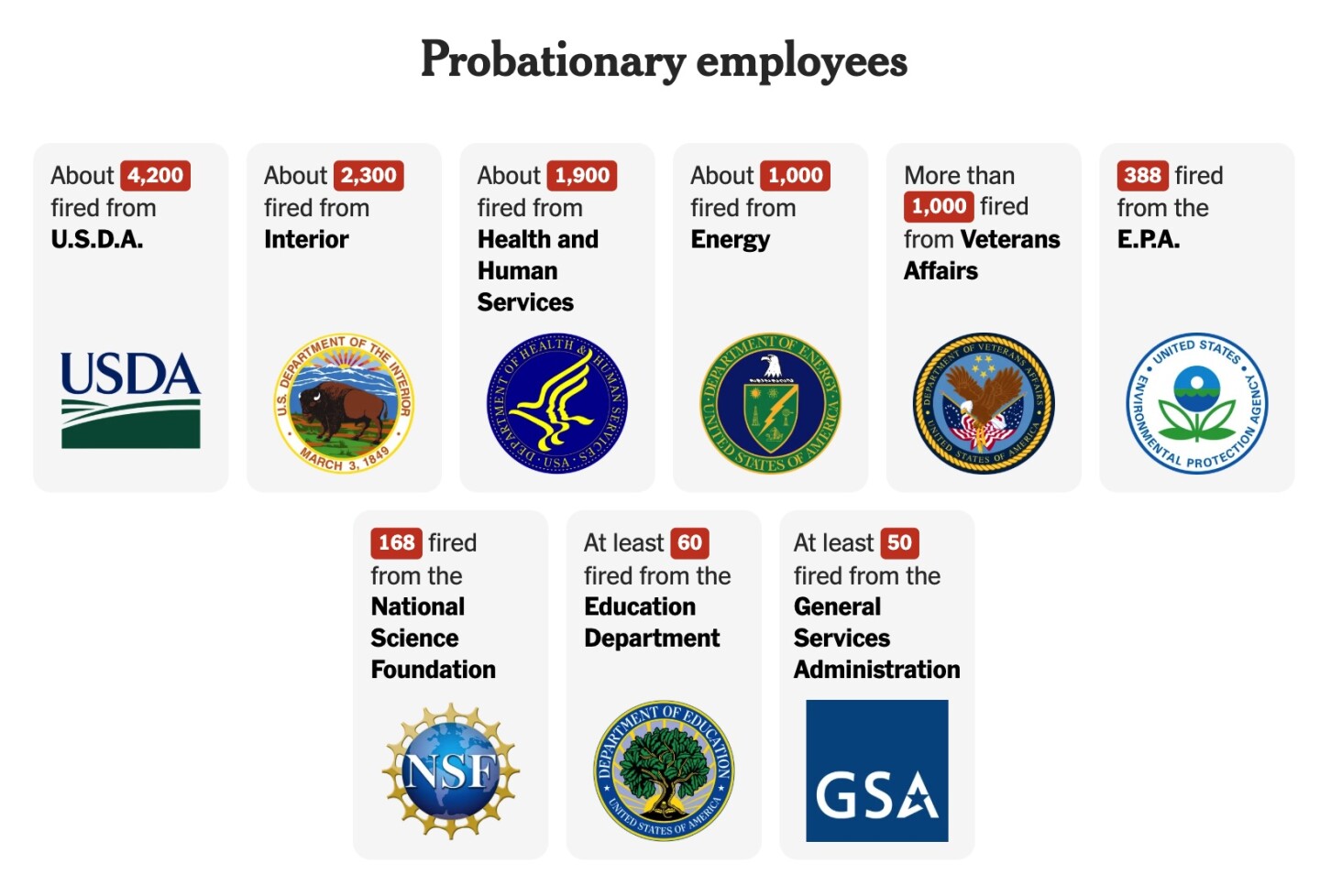

— Trump’s federal workforce overhaul: Key job cuts under Musk’s influence. A New York Times report (link) notes that President Trump has rapidly pushed forward his efforts to shrink the federal workforce, targeting specific agencies, watchdogs, and employees under probationary status. His administration, with significant involvement from Elon Musk’s government efficiency operation, has cut thousands of positions, often in defiance of legal challenges.

Major Workforce Cuts

- Probationary employees: At least 11,060 terminated, including thousands at USDA, Interior, and HHS.

- Agency dismantling: USAID faces the largest reduction, with over 7,000 affected.

- DEI roles: Around 280 workers put on leave or fired, including those from the EPA and Veterans Affairs.

- Jan. 6 & Trump investigators: Over 30 prosecutors and FBI officials removed.

- Government watchdogs: 18 inspectors general fired in one night, sidestepping legal protocols.

- Other cuts: 160 National Security Council staff sent home, 60 State Department contractors fired, and several independent agency heads removed.

As previously noted, several USDA employees tackling the bird flu outbreak were accidentally fired over the weekend, an action the agency is trying to correct. Employees supporting the bird flu response and “other animal health priorities,” including veterinarians and animal health technicians, are exempt from the recent layoffs, an agency spokesperson said in a statement. Probationary employees across government agencies including USDA were laid off over the weekend. “Although several positions supporting HPAI were notified of their terminations over the weekend, we are working to swiftly rectify the situation,” according to the statement. About 1,300 employees were also laid off at the Centers for Disease Control and Prevention, which tracks bird flu’s impact on human health. USDA Secretary Brooke Rollins has said that combating bird flu and animal diseases are a priority for the agency. Frontline workers at the USDA’s Food and Safety Inspection Service (FSIS) “are considered public safety positions” and the agency is “continuing to hire the workforce necessary to ensure the safety and adequate supply of food to fulfill our statutory mission,” the spokesperson added.

Many cuts remain in legal limbo as courts intervene, but the administration continues its aggressive strategy. More layoffs are expected in the coming weeks.

| FINANCIAL MARKETS |

— Equities today: Asian and European shares were mixed to weaker in trading overnight. U.S. stock indexes are set to open weaker. U.S. stocks edged lower from record highs amid concerns over trade tariffs and geopolitical tensions. S&P 500 and Nasdaq 100 futures fell 0.2%, with Palantir dropping further after defense budget cuts. Weak earnings hit Vimeo and Carvana, while gold surged to a record $2,954 an ounce (see related item below). Market jitters were fueled by Trump’s tariff threats and shifting U.S. support for Ukraine. European stocks struggled after lackluster reports from Renault and Airbus. Meanwhile, the dollar and Treasury yields slipped, while the yen strengthened on speculation of a Bank of Japan rate hike. Turning to the Fed, there are multiple speakers today including Goolsbee (9:35 a.m. ET), Musalem (12:05 p.m. ET), Barr (2:30 p.m. ET) and Kugler (5:00 p.m. ET).

Equities yesterday: All three major indices scored modest advances with the Dow pulling into positive territory near the close and the S&P 500 notching its third record finish of 2025. The Dow gained 71.25 points, 0.16%, at 44,627.59. The Nasdaq was up 14.99 points, 0.07%, at 20,056.25. The S&P 500 rose 14.57 points, 0.24%, at 6,144.15.

— Walmart posts strong Q4 with e-commerce surge, raises dividend. Walmart reported a 4% increase in holiday-quarter revenue, with U.S. e-commerce sales soaring 20%. The company expects 3% to 4% net sales growth in the fiscal year ahead, despite potential tariff impacts. CFO John David Rainey described consumer spending as “steady” but acknowledged geopolitical uncertainties. Walmart beat Wall Street expectations with adjusted EPS of 66 cents (vs. 64 cents expected) and revenue of $180.55 billion (vs. $180.01 billion expected). The retailer also announced a 13% dividend hike, its largest in over a decade, as shares have surged 83% over the past year.

— Fertilizer companies show mixed earnings results. CF Industries reported a 20% rise in fourth-quarter profits, driven by higher ammonia sales and stable prices. Net sales in its ammonia segment climbed to $572 million, with the company expecting strong demand in North America and Brazil. CF’s net income reached $328 million, or $1.89 per share, surpassing expectations. In contrast, Nutrien faced a 37% decline in adjusted core profits in its potash segment due to weaker crop input and potash sales, particularly in China and Asia. Its retail sales fell 9% to $3.18 billion, impacted by a 15% drop in crop nutrient sales due to wet conditions in North America.

— Gold hits record high amid tariff fears. Gold prices surged to a record high on Thursday as investors sought safety amid concerns that President Donald Trump’s tariff plans could fuel inflation and escalate a global trade war. Spot gold climbed 0.5% to $2,945.83 an ounce after peaking at $2,947.11, marking its tenth fresh high this year. U.S. gold futures rose 0.9% to $2,963.80. Analysts suggest that fears over trade uncertainty and inflation could push gold toward the $3,000 mark. Despite fewer expected rate cuts from the Federal Reserve, strong physical demand and central bank purchases continue to support gold’s rally. However, a potential peace deal between Russia and Ukraine could slow its momentum.

Other precious metals also gained, with silver rising 0.5% to $32.88 an ounce, platinum up 0.4% at $976.00, and palladium increasing 0.6% to $973.87.

— Trump plans Fort Knox gold audit amid revaluation speculation. President Trump announced plans to verify the U.S. gold reserves stored at Fort Knox, emphasizing the need for accountability. Speaking aboard Air Force One, Trump stated, “We hope everything’s fine with Fort Knox, but we’re going to go… to make sure the gold is there.” His remarks follow speculation about a potential revaluation of U.S. gold reserves, though some observers suggest the idea isn’t seriously considered by top advisers. Fort Knox holds over half of the Treasury’s gold, with additional reserves in Denver and West Point, New York.

— U.S. credit card debt hits record $1.2 trillion. Americans’ credit card debt has reached an all-time high of $1.21 trillion, driven by high interest rates, inflation, and continued consumer spending, according to a New York Fed report. While holiday spending contributed to the rise, debt accumulation appears to be stabilizing, with a smaller increase in balances compared to last year. However, delinquencies are rising, with 11.35% of credit card balances now 90+ days overdue — the highest rate since 2011. Despite concerns, experts note that revolving balances remain below pre-pandemic levels, suggesting many households are still managing their debt effectively.

— FOMC minutes highlight inflation concerns and uncertainty over Trump policies; rate hold decision unanimous; inflation dominates discussion. The Federal Open Market Committee (FOMC) unanimously agreed to keep interest rates steady at 4.25% to 4.5% during its Jan. 28-29 meeting. While labor market concerns took a backseat, inflation remained the primary focus, with officials acknowledging uncertainty surrounding the potential impact of Trump administration policies.

Inflation progress uneven amid policy uncertainty. FOMC members reaffirmed that inflation was moving toward the 2% target but cautioned that progress could be uneven. Factors such as slowing wage growth, anchored long-term inflation expectations, and restrictive monetary policy were expected to keep inflation in check. However, trade and immigration policy changes, along with strong consumer demand, were cited as potential inflationary pressures. Business contacts across multiple districts also indicated that they might pass increased input costs from potential tariffs onto consumers.

Upside and downside risks to inflation. The minutes identified key upside risks to inflation, including:

- Trade and immigration policy shifts

- Geopolitical disruptions to supply chains

- Stronger-than-expected consumer spending

Meanwhile, downside risks to the economy were noted, including:

- Unexpected labor market weakness

- Deterioration of consumer financial conditions

- Tighter financial conditions

However, some officials pointed to possible economic upside, such as a more favorable regulatory environment for businesses and continued strong domestic spending.

Future monetary policy outlook. The Fed emphasized its cautious stance, signaling that it remains “well positioned” to assess economic conditions before making further policy adjustments. Most officials agreed that monetary policy remains restrictive and that additional rate changes would depend on “further progress” on inflation, though no clear definition of this progress was provided.

Balance sheet strategy and debt ceiling concerns. Officials agreed to continue the balance sheet runoff as previously planned, while also discussing potential adjustments to the composition of Treasury purchases once reductions in Fed securities holdings conclude. The minutes also referenced concerns about potential market disruptions due to fluctuations in reserves, especially considering debt ceiling uncertainties. Some participants suggested a temporary pause or slowdown in the balance sheet runoff until those issues are resolved.

Upshot: The FOMC minutes largely echoed Fed Chair Jerome Powell’s statements and recent comments from other officials. The uncertainty surrounding the Trump administration’s trade and immigration policies remains a major factor in inflation projections.

| AG MARKETS |

— Ag markets today:

- Grains rebound overnight. Corn, soybeans and wheat recouped some of Wednesday’s losses during the overnight session. As of 7:30 a.m. ET, corn futures were trading mostly a nickel higher, soybeans were 5 to 7 cents higher, winter wheat markets were 2 to 5 cents higher and spring wheat was 7 to 9 cents higher. The U.S. dollar index was around 250 points lower and front-month crude oil futures were trading just above unchanged. Gold surged to a record high overnight (see related item above.)

- Choice beef faces more price pressure. Choice boxed beef fell $1.88 to $313.89 on Wednesday, the lowest level since Dec. 11. Amid the seasonally weak period for beef demand, wholesale beef prices are likely to face more near-term pressure, especially Choice beef.

- Pork cutout down sharply again. Pork cutout fell another $3.95 to 495.52 on Wednesday, led lower by a $16.75 drop bellies. Over the past two days, the cutout dropped $6.95 amid a $27.00 plunge in primal belly prices. The CME lean hog index continues to strengthen, rising another 79 cents to $90.98 as of Feb. 18.

— Ag trade: Taiwan purchased 102,450 MT of U.S. milling wheat. Japan purchased 96,160 MT of milling wheat via its weekly tender, including 34,890 MT U.S., 34,210 Canadian and 27,060 MT Australian.

— Indian refiners cancel palm oil orders amid price surge. Indian refiners have canceled 70,000 metric tons of crude palm oil (CPO) orders scheduled between March and June due to soaring Malaysian benchmark prices and negative refining margins, Reuters reports. The world’s largest palm oil importer made the cancellations over the past three days, including 40,000 tons on Thursday, following an 11% rise in Malaysian palm oil futures over four weeks. The cancellations may curb further price hikes in Malaysia but could boost soyoil demand, as some refiners shift to the alternative oil. With CPO now priced at around $1,210 per ton CIF India for March delivery — up from $1,120-$1,130 a month ago — refiners are opting to sell back palm oil to suppliers instead of importing. India’s palm oil imports dropped 45% in January to 275,241 metric tons, the lowest in nearly 14 years, as cheaper soyoil imports from Argentina and Brazil gained traction. Market speculation about a potential rise in India’s palm oil import duty to support domestic oilseed farmers has also influenced refiners’ decisions.

— India’s wheat crop hit with warm, dry weather ahead of harvest. India is facing warm, dry weather, threatening its wheat crop and raising the prospect of the government cutting or removing import duties. Rainfall across the country’s northwest region, a major wheat growing belt, has been almost 80% below normal since the beginning of the year, according to the India Meteorological Department. “The forecast shows continued warmer and drier conditions for at least the next month, which will continue to reduce overall wheat yields in the region,” Donald Keeney, a senior meteorologist at commercial forecaster Maxar Technologies Inc., told Bloomberg. “It’s certainly hurting the wheat crop.”

— Russian winter wheat will remain safe from winterkill. Bitter cold air settled into the western and southern Russia’s winter crop region along with Ukraine and western Kazakhstan during the past week. Colder-than-normal temps will persist during the next several days and nighttime readings will again drop near the threshold for crop damage. However, World Weather Inc. says no crop damage is expected since the only threatening temperatures will be in areas with significant snow cover.

— Ukraine has 13.9 MMT of grain to export through June. Ukraine’s exportable grain surplus in 2024-25 is estimated at 41.9 MMT as of mid-February, Ukrainian Ag Minister Vitaliy Koval said, including 16.2 MMT of wheat, 22.1 MMT of corn and 2.8 MMT of barley. As of Feb. 19, Ukraine had exported 28 MMT of grain, including 11.7 MMT of wheat, 13.8 MMT of corn and 2.1 MMT of barley.

— Thailand to aid rice market amid farmer protests. Thailand’s government is considering measures to support the domestic rice market after farmers stepped up protests in Bangkok in the face of falling prices. Commerce Minister Pichai Naripthaphan will convene a panel on rice policy and management today before announcing any decisions. Thai 5% broken white rice — an Asian benchmark — is down about 17% this year, according to the Thai Rice Exporters Association. Farmers staged a protest at Government House on Wednesday to demand assistance, the Bangkok Post reported, after rice prices fell to the lowest level since late 2022.

— Agriculture markets yesterday:

• Corn: March corn fell 4 1/2 cents to $4.97 1/2, marking a low-range close.

• Soy complex: March soybeans fell 6 3/4 cents to $10.31 3/4, nearer the daily low. March soybean meal rose 90 cents to $294.70 and near mid-range. March soybean oil fell 100 points to 46.30 cents, near the session low after hitting a three-month high early on.

• Wheat: March SRW wheat tumbled 12 3/4 cents to $5.92, while March HRW closed down 13 1/2 cents at $6.13 3/4, each closing nearer the session low. March HRS futures fell a nickel to $6.36.

• Cotton: March cotton fell 127 points to 66.24 cents and near the daily low.

• Cattle: Expiring February live cattle futures rose 37.5 cents to $197.825, while most-active April advanced 75 cents to $194.775. In contrast, March feeder futures sank 70 cents to $269.025.

• Hogs: April lean hog futures plunged $3.45 before settling at $89.75, near session lows.

| FARM POLICY |

— Report notes boosting reference prices still on potential list of budget reconciliation actions. House Republicans are mulling whether to use the budget reconciliation process to push through an increase in reference prices that are used to determine benefits to farmers under the farm bill safety net programs like the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC), according to a report from CQ. It confirms what we have been reporting for months. The CQ report quoted a Democratic congressional aide as saying the discussions were taking place with House Republicans viewing it to provide potential increased payments to farmers. However, the item pointed out there still was no final call on whether to take such an action and it quoted Sen. Chuck Grassley (R-Iowa) as questioning whether a boost in reference prices via reconciliation could pass the “Byrd Rule” in the Senate. “I’m not sure that it would beat the Byrd rule in the Senate,” Grassley said Wednesday, adding that it was an issue a “very worthy discussion” for a new farm bill. Lawmakers have now extended the 2018 Farm Bill for two years as they have been unable to come to terms on a new version of the legislation. The prospect of dealing with reference prices and potentially crop insurance outside the farm bill surfaced in late 2024 when lawmakers were putting together the short-term spending measure that has the government operating through March 14, but the provisions were not included in the final plan that was approved.

Comments: Our sources say the issues raised by Grassley relative to the Byrd rule are not a problem as lawmakers can boost reference prices via reconciliation. Says one Washington contact: “If Republicans ever want a farm bill that ‘puts the farm in the farm bill’ this is the only opportunity I can see. Otherwise, look for more extensions and billions in ad hoc relief.”

— GOP caught between Trump’s funding freeze and farmers seeking payments. Farmers across the country are feeling the financial strain of a funding freeze initiated by former President Donald Trump, as congressional Republicans struggle to provide answers or assistance, the Washington Post reports (link). Shanon Jamison, an Iowa corn and soybean farmer, was expecting a $69,000 reimbursement from USDA for cover crops but learned in January that her payment had been halted due to an executive order. Despite contacting her representatives, Sen. Joni Ernst (R) and Rep. Mariannette Miller-Meeks (R), she received little help, the WaPo reports. While their offices later stated they were advocating for Iowa farmers, Jamison has yet to see the funds. “It was very frustrating,” she told the WaPo. “Quite frankly, it seemed like they don’t know what to do.”

This situation is playing out nationwide. Farmers and agricultural groups in ten states have reached out to their congressional representatives, but responses have been mixed. Some lawmakers claim that Trump’s funding freeze does not impact farmers, while others openly support the administration’s review of federal spending. A federal judge recently ordered USDA to release the withheld funds, but affected farmers report that payments have not yet arrived.

USDA Secretary Brooke Rollins acknowledged the delays, stating that USDA is reviewing the affected programs “as quickly as possible.”

In Maryland, flower farmer Laura Beth Resnick contacted Rep. Andy Harris (R) regarding USDA funds for solar panels. Harris, however, defended Trump’s decision, writing that “liberal politicians and pundits rushed to push false narratives.” Resnick remains unpaid and expressed shock at the response.

Similar stories emerge from Kentucky, where farmer Hoppy Henton is still waiting for over $20,000 owed for USDA-supported conservation projects. Despite repeated attempts to contact Rep. Andy Barr (R), he has received no response. “No one is calling me back,” Henton said. “...The silence is deafening.”

While some GOP lawmakers, including Sen. John Boozman (R-Ark.), have called on USDA to honor its commitments, others have downplayed the crisis. Sen. Chuck Grassley (R-Iowa) suggested last week that the issue had already been resolved, despite continued delays in payments. “We’ll need to wait until the end of this 90-day review period before we can make a determination,” Grassley said.

For many farmers, waiting is not an option. Missouri cattle farmer Skylar Holden is at risk of losing his farm after the USDA froze a $240,000 contract. He reached out to Sen. Josh Hawley (R) for help but has yet to receive a resolution. “It’s aggravating,” he admitted. “But at this point, I just figure that’s the way it is with any politics anymore.”

Jamison, still without her reimbursement, is preparing for the worst. “I’m assuming I’m not going to get a dime,” she said, highlighting the growing frustration among America’s farmers as they wait for the funds they were promised.

| ENERGY MARKETS & POLICY |

— Oil prices dip on U.S. stockpile build and economic concerns. Oil prices slipped on Thursday as a rise in U.S. crude inventories weighed on sentiment, erasing gains from the previous session linked to supply concerns in Russia. Brent crude futures fell 17 cents to $75.87 per barrel, while U.S. West Texas Intermediate (WTI) dropped 30 cents to $71.95. U.S. crude stockpiles grew by 3.34 million barrels last week, according to industry data, marking the fourth consecutive weekly increase if official figures confirm analysts’ forecasts. Economic uncertainties, including potential U.S. tariffs and weak European and Chinese demand, also pressured prices.

Meanwhile, Russia reported a 30%-40% reduction in Caspian Pipeline Consortium oil flows following a Ukraine drone strike. Offsetting supply risks, reports suggest Iraq’s Kurdistan region may soon resume oil exports, potentially adding 300,000 barrels per day to the market.

— Oil prices hit year-high amid supply disruptions and geopolitical uncertainty. Oil prices surged to their highest levels since Feb. 11, driven by supply disruptions in Russia and the U.S., while markets await clarity on sanctions amid U.S.-led Ukraine peace talks. Brent crude rose 20 cents, 0.3%, to $76.04 per barrel, and WTI climbed 40 cents, 0.6%, to $72.25.

Key supply concerns include Ukrainian drone strikes on Russia’s CPC pipeline, cutting oil flows by 30-40% (380,000 bpd), and cold weather in North Dakota, potentially reducing U.S. production by 150,000 bpd. OPEC+ may delay its planned April production boost. Traders are also watching for a potential fourth straight weekly increase in U.S. crude stockpiles in Thursday’s EIA report. Gasoline stocks are expected to remain unchanged, while distillate stocks may decline.

Goldman Sachs analysts note that even with a U.S.-brokered peace deal, Russian oil supply would remain constrained by OPEC+ quotas rather than sanctions. Meanwhile, geopolitical factors such as Israel-Hamas ceasefire talks and Trump’s proposed tariffs add further uncertainty, with the latter potentially dampening oil demand by slowing global growth.

— Oil and biofuel groups urge EPA to expand RFS levels. A coalition of oil and biofuel industry groups is urging the Environmental Protection Agency (EPA) to increase biofuel blending requirements in the nation’s fuel supply for 2026 and beyond. According to a Reuters report, the request was made in a letter signed by organizations including the American Petroleum Institute (API) and the Renewable Fuels Association (RFA).

Despite past disagreements over biofuel policy, the groups have united in support of expanding the Renewable Fuel Standard (RFS). “While our organizations have not always agreed on every detail, we have joined together in recognition of the critical role liquid fuels serve in the American economy, to advance liquid fuels, and ensure consumers have a choice of how they fuel their vehicles,” the letter, dated Feb. 19, stated.

The signatories emphasized the need for strong and steady biofuel volume targets, citing investments in feedstocks and production capacity. They also called on EPA Administrator Lee Zeldin to release multi-year RFS standards to provide greater market certainty.

The Biden administration previously indicated in its final regulatory agenda that it aims to finalize 2026 Renewable Volume Obligations (RVOs) by December 2025 — a timeline that is 14 months behind the deadline set by law. The Reuters report noted that the letter did not reference the pending Clean Fuels Production Credit (45Z), which still awaits finalization by the Trump administration.

— U.S. LNG expansion faces market and competitive hurdles. Despite lifting restrictions on LNG export terminal approvals, the U.S. faces challenges in expanding its global natural gas supply, the Wall Street Journal reports (link). While production is set to increase, rising costs, market uncertainties, and competition — particularly from Qatar, which plans to double its LNG output by 2030 — could limit growth. Analysts stress that regulatory approval is just one factor; securing long-term buyers and balancing supply-demand dynamics remain key. With AI-driven energy needs growing and international markets offering higher prices, natural gas remains a crucial player in the energy landscape, though renewables continue to gain traction.

| TRADE POLICY |

— Trump expands tariff list, lumber faces 25% duty. President Donald Trump announced plans to impose new tariffs within the next month, adding lumber and forest products to the list of goods facing duties. Speaking aboard Air Force One, Trump said a 25% tariff on lumber could take effect by early April, alongside similar tariffs on cars, semiconductors, and pharmaceuticals. He claims the tariffs will generate significant revenue but hinted at potential exemptions for countries that lower their own trade barriers. Since his return to office, Trump has escalated trade measures, including a 10% tariff on Chinese imports and delayed 25% duties on Mexican and Canadian goods. While the administration argues tariffs will strengthen U.S. manufacturing, economists warn of potential inflationary risks.

— EU seeks to avert trade war with U.S., open to tariff cuts. The European Union is prepared to discuss reducing or eliminating tariffs on autos and other industrial goods to prevent a trade conflict with the U.S., EU Trade Commissioner Maros Sefcovic said in Washington. Speaking at the American Enterprise Institute, Sefcovic emphasized the EU’s willingness to negotiate, particularly on auto tariffs, amid threats from former President Donald Trump to impose a 25% duty on steel and aluminum starting March 12.

While the EU has yet to propose specific tariff reductions, officials stress that any changes must be reciprocal and follow global trade rules. The bloc has also signaled a willingness to expand purchases of U.S. liquefied natural gas and weapons as a goodwill gesture. However, if Trump’s tariffs materialize, European leaders are prepared to retaliate, potentially targeting politically sensitive American industries as they did during Trump’s first term.

Beyond trade, Sefcovic addressed concerns over EU regulations on U.S. tech giants, arguing they are designed to protect small businesses rather than discriminate against American firms. Meanwhile, German Economy Minister Robert Habeck warned that the EU has countermeasures “up its sleeve,” echoing past actions that hit Trump-supporting states economically.

— Argentina’s Milei to address U.S. aluminum tariffs in Washington visit. Argentine President Javier Milei is expected to discuss the recent U.S. tariff hikes on steel and aluminum during his visit to Washington this week, according to Chubut Governor Ignacio Torres. The tariffs, raised from 10% to 25% under President Donald Trump, could impact Argentina’s aluminum industry, particularly Aluar, the country’s largest exporter. Milei’s agenda includes meetings with Elon Musk and the IMF chief, as well as a likely encounter with Trump at CPAC. Meanwhile, Argentina is also pushing legislation to attract major investments in renewable energy, including wind power.

— Japan’s trade minister to seek U.S. tariff exemptions in March visit. Japan’s Trade Minister Yoji Muto plans to visit the U.S. in March to negotiate exemptions from the Trump administration’s proposed 25% tariffs on steel and car imports, the Asahi newspaper reported. Muto is arranging meetings with U.S. Commerce Secretary Howard Lutnick and Energy Secretary Chris Wright to discuss trade concerns, including Japan’s push to buy more American natural gas and Nippon Steel’s stalled bid for U.S. Steel. With Japan’s car industry employing over 5 million people and contributing significantly to GDP, Tokyo has emphasized the economic stakes of these tariffs. Muto’s visit is tentatively scheduled before the tariffs take effect on March 12.

| CHINA |

— China holds lending rates steady amid economic uncertainty. China kept its benchmark lending rates unchanged on Thursday, signaling a cautious approach to monetary stimulus as authorities prioritize financial and currency stability. A weakening yuan and narrowing net interest margins at commercial banks limit Beijing’s ability to ease monetary policy, especially as U.S./China trade tensions escalate under a new Donald Trump administration.

Key numbers

- One-year loan prime rate (LPR): 3.10%

- Five-year LPR: 3.60%

- New yuan loans in January: 5.13 trillion yuan ($704.35 billion), more than four times December’s figure but at a record-low annual growth rate.

- Yuan depreciation since Trump’s election win: 2.4% against the dollar.

China’s central bank has signaled it will adjust monetary policy as needed to support the economy. However, renewed trade tensions have complicated the outlook. Trump has imposed a 10% tariff on Chinese imports, prompting retaliation from Beijing. Similar tariff battles during his first term drove the yuan down over 12% from 2018 to 2020.

Upshot: Authorities may lower deposit rates and boost bank capital to ease pressure on commercial banks, but analysts expect the central bank to maintain a measured approach, despite external economic pressures.

| HEALTHCARE INDUSTRY |

— Trump to meet pharma leaders amid drug policy push. President Donald Trump will meet with top pharmaceutical executives on Thursday as drugmakers seek government support on pricing policies, Medicare negotiations, and potential tariff exemptions. The meeting, confirmed by a White House official, is expected to address industry concerns over Medicare drug price negotiations, pharmacy benefit managers, and a possible 25% tariff on pharmaceutical imports. Bloomberg reported that Stephen Ubl, head of the Pharmaceutical Research and Manufacturers of America, will attend. Pharmaceutical companies are pushing to modify a Biden-era law allowing Medicare to negotiate drug prices and seeking reductions in rebates paid to pharmacy benefit managers, which they argue inflate drug costs. Trump previously met with industry leaders, including Pfizer and Eli Lilly executives, in December.

| BORDER, IMMIGRATION, DEPORTATION & LABOR |

— Border crackdown shows immediate impact. President Trump’s firm stance on immigration, coupled with swift expulsions and enforcement measures led by White House border czar Tom Homan, has significantly reversed the prior administration’s border crisis. An estimated 10.7 million illegal immigrants crossed the southern border during Biden’s tenure, averaging 7,324 per day. Homan reported Tuesday that Border Patrol encounters in January dropped 85% compared to the same period in 2024. On Feb. 16, only 229 illegal aliens were encountered — just 3% of the daily average under Biden. The administration attributes the drop in crossings to the so-called “Trump effect,” arguing that the fear of arrest and deportation has deterred many from attempting illegal entry. Immigration experts also highlight the certainty of removal as a key factor in the decrease.

Other factors cited:

- Stricter immigration policies, including suspending asylum opportunities and enforcing deportations.

- Declaring a national emergency at the border.

- Ending “catch-and-release” policies, ensuring immediate deportations.

- Deploying U.S. military personnel to assist in enforcement.

— Trump cuts federal benefits for illegal immigrants in new executive order. President Trump signed an executive order Wednesday night prohibiting illegal immigrants from receiving taxpayer-funded benefits. The order directs federal agencies to identify and restrict access to such benefits, aligning with the 1996 Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA). Trump accused past administrations, particularly Biden’s, of expanding benefits to illegal immigrants, which he claims has fueled illegal immigration. The Department of Government Efficiency (DOGE), led by Elon Musk, has been tasked with enforcing the order and identifying additional federal funds going to illegal immigrants.

| WEATHER |

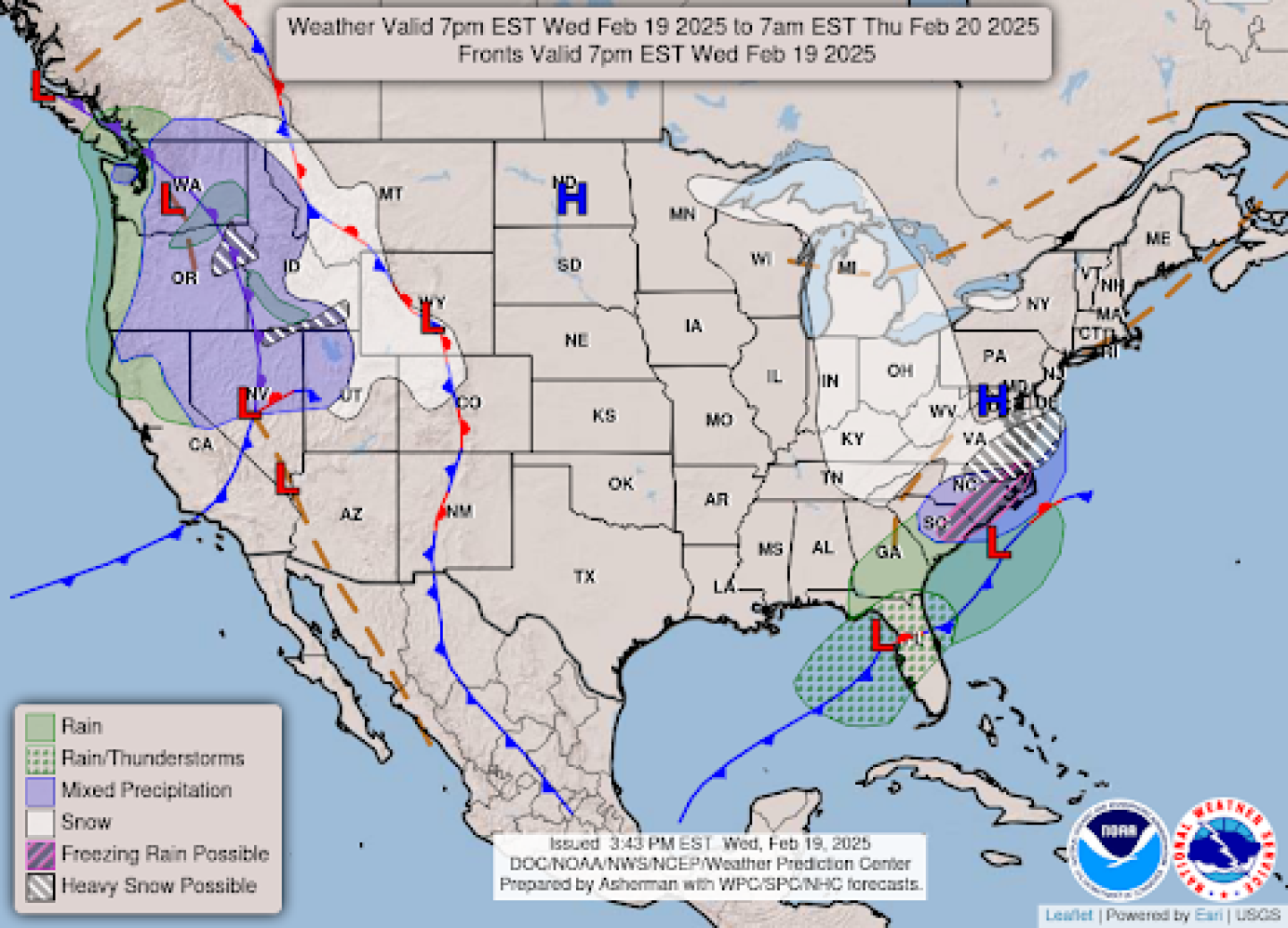

— NWS outlook: Light snow/snow showers expected to move across the central Appalachians and the Mid-Atlantic today as winter storm ends across eastern Virginia and eastern North Carolina but lake-effect snows continue into Friday... ...Widespread record cold temperatures continue through Friday from the central Plains to the Gulf Coast before warming trend sets in by the weekend... ...Snow will reach into the central Rockies today before the next round of unsettled weather moving into the Pacific Northwest Friday and into the weekend.

| KEY DATES IN FEBRUARY |

21: Univ. of Michigan Consumer Sentiment | Existing Home Sales | USDA Cattle on Feed

25: Consumer Confidence | USDA Food Price Outlook

27: Durable Goods Orders | GDP | USDA Outlook Forum | Outlook for U.S. Agricultural Trade report

28: Personal Income and Outlays (PCE Price Index) | International Trade in Goods | USDA Outlook Forum concludes

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | NEC task force on HPAI, egg prices | Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |