Updates: Policy/News/Markets, Feb. 17, 2025

— Rollins and RFK Jr. consider banning junk food from SNAP. USDA Secretary Brooke Rollins announced plans to collaborate with Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. to potentially ban the use of food stamps for junk food. Rollins emphasized the need to ensure taxpayer funds support healthier choices for SNAP recipients. She also suggested that Elon Musk and the Department of Government Efficiency (DOGE) evaluate the program for waste, questioning whether SNAP is providing a “hand up” or becoming a long-term dependency. — USDA issues conditional license for bird flu vaccine amid outbreak. USDA has granted a conditional license for a bird flu vaccine for chickens as an outbreak devastates poultry flocks and drives up egg prices. While such vaccines have historically raised concerns over virus detection and trade, the worsening spread — now affecting cattle and other animals — appears to be shifting strategies. The Trump administration is rolling out a new strategy to combat avian flu, moving away from mass culling of infected flocks. Spearheaded by National Economic Council Director Kevin Hassett and USDA Secretary Brooke Rollins, the plan prioritizes enhanced biosecurity measures and medication to control the spread of the virus. Link for more. Of note: In the last 30 days alone, at least 145 flocks have been infected, impacting over 20 million birds. Since the outbreak began in 2022, more than 150 million birds have been affected. — Nominee votes. Senators will take a procedural vote Tuesday on Kash Patel’s nomination as FBI director. That will allow Senate Majority Leader John Thune (R-S.D.) to file cloture on the controversial pick. After that vote, the Senate will move to confirm Howard Lutnick as Commerce secretary. The Senate agenda also includes confirming former Sen. Kelly Loeffler (R-Ga.) as Small Business administrator. Loeffler and Patel’s nominations both only require two hours of post-cloture time. On Wednesday, the Senate Veterans’ Affairs Committee will meet to consider Paul Lawrence to be deputy secretary of the VA. The Senate HELP Committee will meet to consider former Rep. Lori Chavez-DeRemer’s (R-Ore.) nomination to be Labor secretary. On Thursday, the Senate Commerce Committee will hold a hearing on Steven Bradbury’s nomination to be deputy secretary of Transportation. The Senate Homeland Security and Governmental Affairs Committee will hold a hearing on nominations for top DHS and OMB jobs. |

| DOGE |

— Musk and DOGE reshape federal government with deep cuts and controversial moves. Elon Musk and the DOGE initiative are dismantling DEI programs and employee civil rights initiatives across federal agencies, citing budget savings. Over the weekend, DOGE sought access to IRS taxpayer data, triggering legal challenges, while also expanding its reach into the Pentagon. A draft memo from the IRS indicates that the agency is poised to give Gavin Kliger, a special adviser to the Office of Personnel Management, unlimited access to taxpayer data to provide software engineering expertise.

Mass layoffs of federal employees — particularly probationary workers — are unfolding, impacting over 200,000 government workers across agencies like the IRS, VA, Forest Service, NIH, CDC, and FAA. But firings at the National Nuclear Security Administration were halted due to national security concerns. The federal workforce is employed all over the country, with 80% outside the District of Columbia, Maryland and Virginia metro area. States with a high presence of federal employees include California, Texas, Florida, Georgia, Pennsylvania, Alaska, New Mexico, Oklahoma and Oregon.

Meanwhile, DOGE is touting major cost recoveries, including $20 billion in rescinded EPA grants and nearly $2 billion in recovered HUD funds.

Confusion reigns on Capitol Hill over how federal agencies will function post-downsizing, with USAID now folded into the State Department (see next item).

— Senate Dems divided on strategy to counter Trump’s USAID actions. Senate Democrats are grappling with how to respond to President Trump’s restructuring of the U.S. Agency for International Development (USAID), which is being folded into the State Department under Elon Musk’s Department of Government Efficiency (DOGE). While some Democrats favor bipartisan engagement to protect USAID, others advocate for obstruction, court battles, and public opposition to counter what they see as an unconstitutional power grab.

- Collaborative approach: Sen. Amy Klobuchar (D-Minn.) leads efforts to enlist Republican allies who prioritize national security and global influence through foreign aid.

- Obstruction strategy: Sen. Brian Schatz (D-Hawaii) and other Democrats push for aggressive measures, including delaying State Department nominee confirmations and considering a government shutdown to gain leverage.

The shutdown of many of USAID’s operations, coupled with the firing of its Inspector General, has paralyzed key programs. Though Secretary of State Marco Rubio claims critical aid continues, disruption within the agency has left the global aid community in chaos. Rubio’s waiver to exempt humanitarian aid is temporary, and no federal funds are currently flowing to NGOs. Food aid has started moving, according to the World Food Program (link). Rubio issued a waiver on Jan. 28 exempting life-saving humanitarian assistance from the freeze. But no U.S. cash is flowing. Trump fired the USAID IG the day after the watchdog published a report (link) detailing how the administration’s staffing cuts — 90% of the workforce — left no safeguards in place to protect foreign aid distribution.

Republican response has been mixed, with some warning that halting aid creates security risks, while others defend Trump’s moves as essential to reducing waste. Despite temporary court injunctions and whistleblower tip lines, Democrats remain frustrated by the limited scope of Republican support.

Sen. Joni Ernst (R-Iowa) defended Elon Musk and the Department of Government Efficiency (DOGE) in Congress, arguing their actions are exposing wasteful federal spending. Critics claim DOGE’s moves, including shuttering USAID, are unconstitutional. Ernst, the DOGE Caucus Chair, highlighted questionable expenditures, such as migrant reintegration bags containing Barbie dolls and a $69,000 dance diplomacy program in Wuhan. She urged stricter oversight of USAID and backed President Trump’s push for government efficiency. “The question that we really should be asking at this point isn’t why USAID’s grants are being scrutinized, but why it took so long,” Ernst said. Ernst sent a letter (link) to Secretary of State Marco Rubio saying she has faced situations in years past where USAID has obstructed oversight efforts, writing “it is of the utmost importance to conduct a full and independent analysis of the recipients of USAID assistance.” Multiple lawsuits challenge DOGE’s legality, but Ernst praised Trump and Musk for disrupting the status quo.

— NOAA concerns: Potential privatization sparks alarm. As President Trump pursues aggressive budget cuts, some conservatives propose dismantling the National Oceanic and Atmospheric Administration (NOAA) and privatizing its functions. However, meteorologists warn that such a move could destabilize weather forecasting, which relies on NOAA’s free, high-quality data. Critics argue that AI cannot yet replace NOAA’s expertise, and without it, the spread of unreliable forecasts could lead to public confusion and inadequate disaster responses. Even AccuWeather, a major private forecaster, opposes NOAA’s privatization, underscoring the agency’s crucial role in public safety and economic savings.

— Will DOGE look at USDA’s NASS and World Ag Outlook Board? Several farmers, traders and analysts have asked this question, considering the private industry does most if not all of NASS and WAOB functions. But to date, no such DOGE action has been mentioned. Said one observer: “Look at the DOGE pattern of cut deep on first look and ask questions later.”

Says one veteran ag industry analyst: “That would be terrible. Most private analysts try to slant their ‘independent’ analysis to drive a point… position in the market. Too much money involved, and farmers would get crushed. USDA also keeps all the rest of the world in check. That information keeps them honest. Without that, U.S. farmers wo depend on exports could get hammered. The only ones that would be hurt is if their markets have any exposure to world export markets. Most private market analysts only try to mimic USDA to front run reports.”

Says another industry observer: “If this action is taken, it would be a dangerous move as it would then leave matters solely in the private sector which would subject data to biases. The report affects price discovery for an array of commodities. While the WASDE prep involves many individuals in other agencies, terminating the World Board would put us behind China who has in recent years developed their own version of the S&D report. As for NASS, there are certain payments tied to their statistics — ARC, PLC, DMC, to mention a few. Season average prices are not futures prices and there are commodities where there is no underlying futures market. Plus, even private firms adopt USDA data at the end of the season. Otherwise, there is no formal marker of supply. If they get rid of USDA data, then how can other government data be justified? Get rid of it all and see how markets react to not having a clue.”

| FINANCIAL MARKETS |

— Equities Friday and for the week: The Dow and S&P 500 ended lower Friday ahead of the Monday U.S. holiday while the Nasdaq posted a modest rise. For the week, all three scored gains with the Dow up 0.55%, the Nasdaq gained 1.47%, and the S&P 500 was 2.57% higher. On Friday, the Dow fell 165.35 points, 0.37%, at 44,546.08. The Nasdaq rose 81.13 points, 0.41%, at 20,026.77. The S&P 500 edged down 0.44 point, 0.01%, at 6,114.63.

— Trump’s economic team resumes talks with Fed Chair Powell. Kevin Hassett, Director of the White House National Economic Council, announced plans to meet regularly with Federal Reserve Chair Jay Powell to exchange views on the U.S. economy. Hassett emphasized the meetings will not compromise the Fed’s independence but will provide President Trump with a channel to share his economic perspectives. The move revives a practice from Trump’s first term when tensions were high between the administration and Powell, particularly over interest rates. While Trump previously criticized Powell and considered firing him, Hassett reaffirmed the importance of open communication. Hassett plans to hold regular lunches with Powell and other Fed governors to foster dialogue and coordination on economic policy. Meanwhile, Treasury Secretary Scott Bessent also recently met with Powell, describing the meeting as constructive.

| AG MARKETS |

— Agriculture markets Friday and for the week:

• Corn: March corn futures closed 2 3/4 cents higher to $4.96 1/4, marking a 5 1/4-cent gain on the week.

• Soy complex: March soybean futures rose 6 cents to $10.36, near mid-range and on the week down 13 1/2 cents. March soybean meal futures gained $3.20 to $295.90, near mid-range and on the week down $5.50. March soybean oil futures fell 18 points to 46.07 cents, near mid-range and for the week up 8 points.

• Wheat: March SRW surged 22 1/4 cents to $6.00 and settled near session high, gaining 17 1/4 cents on the week. March HRW futures gained 23 cents to $6.21 1/4, rallying 17 cents on the week. March HRS futures closed 16 1/4 cents higher, marking a 5 1/4-cent gain on the week.

• Cotton: March cotton futures rose 28 points to 67.11 cents, nearer the daily low and for the week up 148 points.

• Cattle: The cattle markets continued their late slide Friday. Expiring February live cattle dropped $1.80 to $197.75, while most-active April tumbled $2.275 to $194.25. The closing quote represented a weekly drop of $2.525. March feeder futures ended the week at $266.35, marking a daily loss of $1.625 and weekly gain of $1.45.

• Hogs: The February lean hog contract expired at $89.475 at noon Friday, up 10 cents from Thursday. The deferred contracts declined, with most-active April sinking 50 cents to $92.60. That represented a weekly rise of 45 cents. Cash hog and wholesale pork prices look set to end the week on a strong note.

| TRADE POLICY |

— What are reciprocal tariffs? Reciprocal tariffs are trade fees imposed by the U.S. on imports to match the tariffs, value-added taxes (VAT), subsidies, and regulations that foreign countries apply to American exports. The goal is to level the playing field for American businesses in global markets. Unlike most countries, the U.S. does not have a national VAT; it relies on state-level sales taxes, which do not affect imports directly.

The plan includes investigating and countering non-reciprocal trade practices such as higher VATs and foreign government subsidies that hinder U.S. exports. Accounting for the VATs in U.S. duties would be unusual because the taxes are generally considered non-discriminatory as they hit both imports and domestically produced goods in other countries, Capital Economics and Goldman Sachs wrote in research notes.

While the exact method for calculating these tariffs is uncertain, the strategy is part of a broader effort to address what former President Trump described as unfair trade imbalances. A New York Times article (link) notes that “calculating individual tariff rates on thousands of products drawn from more than 150 countries poses a monumental problem of execution for a vast range of companies, from American manufacturers dependent on imported parts to retailers that buy their goods from overseas.”

The average trade-weighted tariff (which adjusts for quantities shipped) charged by the 15 largest U.S. trading partners is 6.7%, compared to the roughly 2.6% average the U.S. imposes, according to Paul Ashworth, chief North American Economist at Capital Economics. Including VATs, American imports would be hit with a total tariff of 29% if they’re from India, 28% from Brazil, 25% from the European Union, 23% from Mexico and 19% from Canada, Ashworth wrote in a research note.

Higher costs ahead? A leading electronics industry trade association, IPC, warned that increased trade protectionism would damage the American economy. “New tariffs will raise manufacturing costs, disrupt supply chains, and drive production offshore, further weakening America’s electronics industrial base,” the association’s president, John W. Mitchell, said in a statement.

Others say Trump’s approach could lower costs. They see Trump’s approach a potential negotiating tactic aimed at forcing trading partners to lower their own tariffs, rather than the U.S. lifting its own. If so, the process of calculating new tariff rates might actually lower prices.

Of note: The Obama administration took on non-tariff barriers when it tried to negotiate trade agreements with Asia-Pacific countries and the European Union. It concluded the Trans-Pacific Partnership (TPP), which Trump killed. The talks with the EU ground to a halt because of political opposition in Europe to lowering non-tariff barriers.

— Trump’s reciprocal tariff plan faces major hurdles. Former President Donald Trump’s push for reciprocal tariffs sounds appealing but is fraught with challenges, according to a detailed analysis (link) by trade experts Edward Alden and Jennifer Hillman (Council on Foreign Relations, Feb. 14, 2025).

The Trump administration intends to match U.S. tariffs to those imposed by trading partners, with a focus on countries running large trade surpluses with the United States, such as China and India. However, the plan’s complexity — requiring customized tariffs for each country — makes implementation nearly impossible, the authors note.

Historically, U.S. trade policy has relied on reciprocity but in a multilateral framework. The 1934 Reciprocal Trade Agreements Act introduced the “most-favored-nation” (MFN) principle, ensuring uniform tariffs for all countries. Trump’s proposal would abandon this approach, potentially triggering a global tariff spiral.

Moreover, legal and administrative barriers could stall the initiative. The U.S. would likely violate its World Trade Organization (WTO) commitments, prompting retaliation from trading partners. U.S. Customs and Border Protection, already struggling with enforcement duties, would face overwhelming logistical burdens in tracking and applying variable tariffs.

Impact: While some countries might lower tariffs preemptively to avoid U.S. action, a poorly executed tariff war could leave American companies disadvantaged, the authors conclude. The administration’s decision to conduct a prolonged investigation before implementing the tariffs suggests recognition of these risks.

— Draghi urges EU to focus on internal barriers, not U.S. tariffs. The European Union should prioritize dismantling its own trade barriers rather than worrying about potential U.S. tariffs, former European Central Bank President Mario Draghi argued in the Financial Times. Draghi, an Italian economist, emphasized that the Eurozone’s sluggish growth stems from internal constraints, including fragmented markets and weak consumer demand due to strict fiscal policies. Trade between EU nations is less than half that between U.S. states, underscoring the need for reform. According to Draghi, addressing these issues is within the EU’s control but will require “a fundamental change in mindset.”

| CONGRESS, POLITICS & ELECTIONS |

— Senate in focus on reconciliation strategy. The House is in recess, but the Senate returns Tuesday and is poised for a pivotal week in its effort to advance President Donald Trump’s agenda, especially as it prepares to chart its path on budget reconciliation.

While the House Budget Committee has already approved a sweeping budget resolution with $1.5 trillion in spending cuts, $4.5 trillion for potential tax cuts and a $4 trillion increase in the debt limit, the Senate’s approach is different. Senate Budget Chair Lindsey Graham’s (R-S.C.) fiscal blueprint focuses on $300 billion for border security and defense funding, leaving tax cuts for a later reconciliation package. Senate Majority Leader John Thune (R-S.D.) will decide this week whether to move the Senate’s budget resolution to a floor vote.

Of note: The Senate can’t consider more money for the Pentagon or the border until there’s a deal with the House. That is why the Senate resolution only directs the committees to do so.

Key factors:

- Strategic timing: The Senate may push ahead with its own budget plan as a backup in case the House effort faces delays. Some Senate Republicans prefer to secure a win on border funding now and negotiate tax policies later.

- Tax policy tensions: Senate Republicans are dissatisfied with the House’s $4.5 trillion instruction for tax cuts, which doesn’t align with their goal of making the 2017 Trump tax cuts permanent. Thune, Senate GOP Whip John Barrasso (R-Wyo.), Senate Finance Committee Chair Mike Crapo (R-Idaho) and fellow tax writers signed onto Sen. Steve Daines’ (R-Mont.) letter (link) vowing to oppose a tax package that doesn’t make the 2017 Trump tax cuts permanent. President Trump also wants the tax cuts to be permanently extended.

- House challenges: Despite progress in the House Budget Committee, the full House vote will be tough, with razor-thin margins for passing the resolution and contentious debates ahead on spending and tax cuts.

Bottom line: How these dynamics unfold in the coming weeks will shape the future of reconciliation efforts.

| WEATHER |

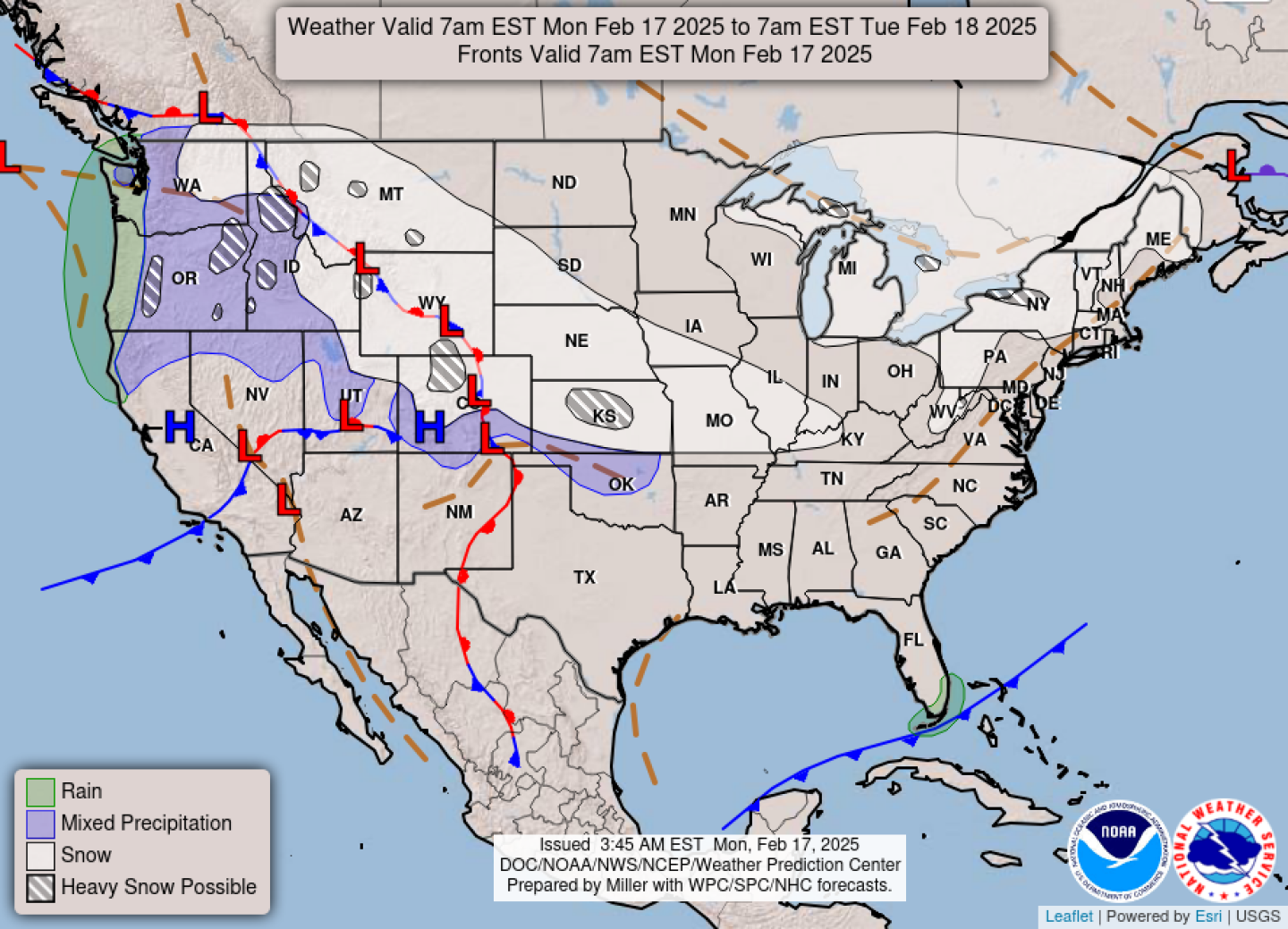

— NWS outlook: A surge of arctic air will bring record cold temperatures further southward into the mid-section of the country through the next few days... ...Potential of a winter storm increasing from the central Plains to the mid-Mississippi Valley Tuesday into Wednesday morning... ...Mountain snow and lower-elevation rain across the Pacific Northwest and northern Rockies will have a lull on Tuesday before another Pacific system brings the next round of unsettled weather into the Pacific Northwest Tuesday night... ...Snow gradually tapers off in New England today behind a big storm but lake-effect snow and blustery conditions continue.

| KEY DATES IN FEBRUARY |

17: Presidents Day; U.S. gov’t and market holiday

21: Univ. of Michigan Consumer Sentiment | Existing Home Sales | USDA Cattle on Feed

25: Consumer Confidence | USDA Food Price Outlook

27: Durable Goods Orders | GDP | USDA Outlook Forum | Outlook for U.S. Agricultural Trade report

28: Personal Income and Outlays (PCE Price Index) | International Trade in Goods | USDA Outlook Forum concludes

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | NEC task force on HPAI, egg prices | Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |