News/Markets/Policy Updates: Sept. 13, 2024

— Potential dockworker strike could threaten Kamala Harris’ presidential bid. Retail and transportation leaders warn that a looming dockworker strike along the U.S. East and Gulf coasts could negatively impact Kamala Harris’ presidential campaign. The International Longshoremen’s Association (ILA) has threatened to strike if contract demands are not met, with West Coast port unions pledging solidarity. Concerns are mounting that a strike, especially one lasting over seven days, could lead to significant supply chain disruptions, hurt the economy, and reflect poorly on the Biden administration’s handling of labor issues. The administration is likely working behind the scenes to prevent the strike, as negative media coverage could bolster economic concerns, a key issue for voters. A key dispute is the use of automated technology used to process trucks at some ports, which the union argues violates the terms of their current contract. A strike would be the first in decades. East and Gulf Coast port workers last went on strike in 1977. What’s likely: Sources expect the Biden administration to step in to help broker a deal if talks stall, as it did last year during the West Coast dockworkers’ contract dispute. — U.S. interest payments top $1 trillion as budget deficit swells to $1.9 trillion. The U.S. federal government’s fiscal year-to-date budget deficit hit $1.9 trillion in August, a 24% increase from last year, driven by rising interest payments totaling over $1 trillion for the first time ever. The surge in interest costs is attributed to the Federal Reserve’s aggressive rate hikes, pushing rates to their highest levels in decades. As the Fed prepares to begin an easing cycle, the government’s ballooning deficit continues to pose fiscal challenges. The U.S. government has disbursed $1.049 trillion in interest payments on its national debt in the current fiscal year. This represents a 30% increase compared to the same period last year. When accounting for interest revenue from investments, the net interest payments stand at $843 billion. The U.S. national debt currently stands at $35.3 trillion. Debt rollover: About $8 trillion worth of debt is being rolled over in 2024, with new debt issued at higher interest rates. — Odds rising GOP will win Montana Senate race between incumbent Jon Tester and GOP challenger Tim Sheehy. The Cook Political Report shifted the Montana Senate race from “Toss up” to “Lean Republican.” Inside Elections did the same. — Inside Elections on House races: “Democrats need a net gain of just four seats to win a majority, and our current likely range is Democrats +5 to Republicans +5. But after another handful of rating changes, Republicans are still slight favorites to hold the House. They need to win just two of the 13 toss-up races while Democrats need to win 12 of 13, if the other races end as expected. A district-by-district slugfest isn’t pretty, but Democrats would prefer it over Biden tanking their chances. A close fight for the House also means control might not be known for weeks, when vote counting is completed across the country.” — Kamala Harris gains 5-point lead over Donald Trump after debate, polls show. Vice President Kamala Harris leads former President Donald Trump by five points in two national polls conducted after Tuesday’s debate. A Morning Consult survey of 3,317 likely voters showed Harris at 50%, her widest lead yet, improving from pre-debate numbers. A Reuters/Ipsos poll also found Harris leading by five points, with 53% of respondents saying she won the debate, compared to 24% favoring Trump. — Trump says he won’t appear in another debate after first faceoff with Harris. Trump announced he will not participate in any more debates this election season, following his first debate with Vice President Kamala Harris, where some polls indicated Harris won. Trump cited key issues had already been covered in his debates with President Biden and Harris. Harris reiterated her call for another matchup during a rally in Charlotte on Thursday, saying, “I believe we owe it to the voters to have another debate because this election and what is at stake could not be more important.” — Trump pledges to waive overtime tax, adding to deficit concerns. At a rally in Arizona, Donald Trump promised to waive the tax on overtime pay, offering few details but framing it as a populist appeal to middle-class and blue-collar workers. This follows the Biden administration’s recent expansion of overtime eligibility. Trump’s broader tax plans, including cuts to tips and Social Security taxes, as well as lowering the corporate tax rate, are projected to add $2.3 trillion to the deficit over the next decade, with an overtime tax break likely increasing that figure. In contrast, Vice President Kamala Harris’ tax plans would raise corporate and capital gains taxes, with her proposals expected to increase the deficit by up to $2 trillion. — Vance downplays tariff impact, defends protectionist trade policies. During a Thursday interview with CNBC (link), GOP vice presidential candidate JD Vance supported Trump’s tariff policy, dismissing concerns from economists and agricultural groups about the negative effects on agriculture and consumer prices. He argued that while tariffs may raise prices temporarily, they will eventually lower costs through increased domestic manufacturing, aligning with Trump’s anti-China and protectionist agenda. Vance’s stance diverges from traditional Republican free-trade views and contradicts mainstream economic research, which links tariffs to higher consumer prices and job losses. Critics say Vance lacks evidence to support his claims. — Corn and soybean growers criticize proposed tariffs on imported herbicide 2,4-D. The National Corn Growers Association (NCGA) and American Soybean Association (ASA) expressed frustration with the U.S. Department of Commerce’s recommendation to impose preliminary countervailing duties on imported herbicide 2,4-D. The decision follows a petition by domestic producer Corteva Agriscience, which sought antidumping measures on imports from certain foreign suppliers. Farmers argue that domestic supply is insufficient and rely on imports to meet demand. NCGA President Harold Wolle and ASA President Josh Gackle warned that the proposed duties could drive up costs and strain farmers’ operations at a difficult time, with corn prices having dropped over 40% in two years. Both organizations plan to advocate against the duties as the investigation proceeds, with a final decision expected in 2025. Details: The Department of Commerce published a preliminary determination in the Federal Register that recommends duties on imports of 2,4-D from China (link) |

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. stock indexes are pointed to firmer openings. In Asia, Japan -0.7%. Hong Kong +0.8%. China -0.5%. India -0.1%. In Europe, at midday, London +0.3%. Paris +0.3%. Frankfurt +0.6%.

U.S. equities yesterday: All three major indices registered gains following wholesale inflation data. The Dow gained 235.06 points, 0.58%, at 41.096.77. The Nasdaq rose 174.15 points, 1.00%, at 17,569.68 The S&P 500 was up 41.63 points, 0.75%, at 5,595.76.

— Oil prices were higher Thursday as producers assessed the impact on output in the Gulf. Over 730K/bpd of production (42%) of Gulf of Mexico output was shut in due to the storm. Both contracts had gained more than 2% on Wednesday as companies evacuated offshore platforms due to Francine. WTI traded up $1.66 or 2.5% to close at $68.97. Brent traded up $1.36 or 1.9% to close at $71.97.

— Air Canada urges government intervention to avert pilot strike amid stalled wage talks. Air Canada requested Prime Minister Justin Trudeau’s government to step in as contract negotiations with its pilots have reached an impasse, risking a shutdown of operations next week. The airline, which has been in negotiations with over 5,000 unionized pilots for 15 months, is seeking arbitration to resolve wage disputes. Air Canada plans to begin winding down operations on Sunday if no resolution is reached, urging the government to intervene by this weekend to avoid disruptions.

— Boeing workers on west coast vote to strike over pay dispute. Boeing workers on America’s west coast, represented by the International Association of Machinists and Aerospace Workers, voted 96% in favor of a strike. The union, representing 33,000 workers, is demanding a 40% pay increase, while Boeing has offered 25%. The strike adds pressure to Boeing, already dealing with manufacturing delays and concerns about its safety record. “I hope you will choose the bright future ahead, but I also know there are employees considering another path — and it’s one where no one wins.” — Boeing CEO Kelly Ortberg, who urged union members not to strike. Thousands of machinists walked off the job shortly after midnight Pacific time Friday.

— Ag markets today: Wheat futures firmed overnight amid global supply concerns and rising tensions in the Black Sea region, while corn and soybeans built on Thursday’s gains. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents higher, soybeans were 2 to 3 cents higher, winter wheat markets were 8 to 11 cents higher and spring wheat was 6 to 7 cents higher. The U.S. dollar index was more than 300 points lower, and front-month crude oil futures were around 75 cents higher.

Cash cattle trade mostly steady. Cash cattle trade so far this week took place at roughly steady prices with last week in the Southern Plains, though some feedlots continued to hold out for higher bids. Cash negotiation in the northern market remained limited.

Cash hog slide continues, pork cutout rebounds. The CME lean hog index is down another 11 cents to $85.35 as of Sept. 11. The pork cutout firmed $1.27 on Thursday to $94.18 amid strong gains in bellies, ribs, loins and butts.

— Agriculture markets yesterday:

• Corn: Corn futures rose 2 cents to $4.06 3/4 after reaching the lowest intraday level since Aug. 30.

• Soy complex: November soybeans climbed 10 1/4 cents to $10.10 3/4 and settled nearer today’s highs. October meal futures closed $2.90 higher to $318.90, near session highs. October bean oil futures rallied 55 points to 40.33 cents.

• Wheat: December SRW wheat fell 3/4 cent to $5.78 1/2, nearer the daily low after hitting a a two-month high early on. December HRW wheat fell 2 cents to $5.86 1/4 and nearer the session low. December spring wheat futures rose 5 1/4 cents to $6.21 3/4.

• Cotton: December cotton rose 77 cents to 70.38 cents, ending nearer the session high.

• Cattle: October live cattle rose $1.075 to $178.025 and near mid-range. October feeder cattle gained $2.25 at $239.75, nearer the session high and hit a four-week high.

• Hogs: The nearby October contract fell 85 cents to $78.90 at the close.

— Of note:

• Traders this morning raised the odds that the Fed would lower its prime lending rate by a half-point at next week’s meeting after the Wall Street Journal and the Financial Times reported that some central bankers consider a 0.25 percentage point cut insufficient — 57% for a 25-basis-point cut, and 43% for a 50-basis-point cut. Yesterday the percentages were 72% for 25 and 28% for 50. Meanwhile, Treasuries rallied, and the dollar fell as former Fed official Bill Dudley said there’s “a strong case” for a 50-basis point rate cut next week.

• Christine Lagarde signaled that the European Central Bank is open to an October interest-rate cut, but that a December move is more likely. Link for details.

• 603: The number of pages in the long-awaited rulebook for the corporate alternative minimum tax, President Biden’s 15% minimum tax on large companies. Link for details. Of note: The Treasury Department projects that about 100 companies with at least $1 billion in average profits will pay about $250 billion with the tax over a decade. Without the law, those companies would pay an average of 2.6%, Treasury officials said.

• “Some ports insist on securing their assets, but many cave to the pressure.” — A congressional report on the use of Chinese-made container cranes at U.S. ports.

— Holiday sales to rise modestly amid consumer caution and shorter shopping season. Deloitte forecasts a 2.3% to 3.3% rise in holiday sales this year, reaching up to $1.59 trillion, a smaller increase than last year’s 4.3%. The shorter season, with only 27 shopping days between Thanksgiving and Christmas, and cautious consumer spending driven by credit card debt and economic concerns are key factors. While inflation is easing and promotions abound, shoppers are prioritizing essentials and bargain hunting, with e-commerce sales expected to rise 7% to 9%. Despite these challenges, steady income growth and a strong labor market are expected to support solid overall sales.

Market perspectives:

— Outside markets: The U.S. dollar index was lower, with the euro stronger against the greenback. The yield on the 10-year U.S. Treasury note fell, trading around 3.66%, with a negative tone in global government bond yields. Crude oil futures were higher, with U.S. crude trading at around $69.85 per barrel and Brent trading at around $72.70 per barrel. Gold and silver futures were up, with gold around $2,595 per troy ounce and silver around $30.42 per troy ounce.

— Yen rallies as investors eye BOJ rate decision and Fed easing prospects. The Japanese yen has surged 14% this quarter, outpacing major currencies as investors brace for the Bank of Japan’s (BOJ) next policy moves. Key drivers include growing expectations of BOJ rate hikes and potential Federal Reserve easing. Although no immediate action is anticipated in the upcoming BOJ meeting, analysts foresee a December hike. Recent BOJ tightening and signals of future rate increases suggest ongoing yen strength, with potential ripple effects on currency markets, Japanese stocks, and global interest rate differentials.

— Gold prices surged to a record $2,570.10 per ounce, climbing 0.5% on Friday, driven by growing expectations of a Federal Reserve rate-cutting cycle. The precious metal has gained nearly 25% this year, bolstered by central-bank buying and strong demand as a safe-haven asset amid conflicts in the Middle East and Ukraine. Retail investors are also flocking to CME Group’s micro gold futures contract as the rally continues.

— Months-long labor dispute ends at Australia’s biggest sugar maker. Workers at Wilmar Sugar and Renewables, Australia’s largest sugar maker, voted to accept a pay offer, the company said on Friday, ending a months-long industrial dispute that disrupted sugar production. Labor action since May delayed the start of the cane crushing season and led to several shutdowns after it began. Wilmar said that so far this crushing season its mills had processed about 6.3 MMT of sugar cane, around 40% of the estimated crop.

— Low water levels on Mississippi River disrupt grain barge movements. As of Sept. 12, low water levels on the Mississippi River have forced barge operators to reduce draft limits and tow sizes, particularly affecting grain shipments, according to USDA’s Grain Transportation Report (link). Drafts have been cut to 9.5 feet on the Ohio River, 10 feet from St. Louis to Greenville, and 10.5 feet from Greenville to the Gulf. Tow sizes are down by 14-25%, leading to transit delays of 1-2 days. Barge groundings are common near Memphis, and 24-hour closures in the Vicksburg District have begun to allow dredging. Although Hurricane Francine’s rain may temporarily relieve low water levels, facilities south of Caro, IL, remain closed. Normal operations, including barge flow from the Gulf, may resume later this week, depending on hurricane damage. Diesel prices have also dropped.

— Louisiana and Mississippi temporarily waive trucking regulations amid Hurricane Francine disruptions. In response to Hurricane Francine, Louisiana and Mississippi have temporarily waived hours-of-service (HOS) regulations for vehicles transporting fuel, including propane. Mississippi’s waiver is effective for 14 days or until the emergency ends, while Louisiana’s waiver lasts until Sept. 23 or the end of the emergency. Additionally, Louisiana has waived toll payments and certain size and weight restrictions (up to 88,000 pounds) for commercial vehicles providing emergency relief, applicable on public highways but excluding interstate and non-state-maintained highways. These measures aim to expedite recovery efforts following the storm.

— U.S. cotton yields are expected to hit a nine-year low, and could take another hit from Hurricane Francine. But cotton prices remain subdued, due to weak demand from big textile producers like China, Vietnam and Turkey.

— USDA daily export sale:

• 100,000 MT soybeans to China during 2024-2025 marketing year.

— Ag trade update: Indonesia tendered to buy 450,000 MT of rice that can be sourced from Vietnam, Thailand, Myanmar, Cambodia or Pakistan.

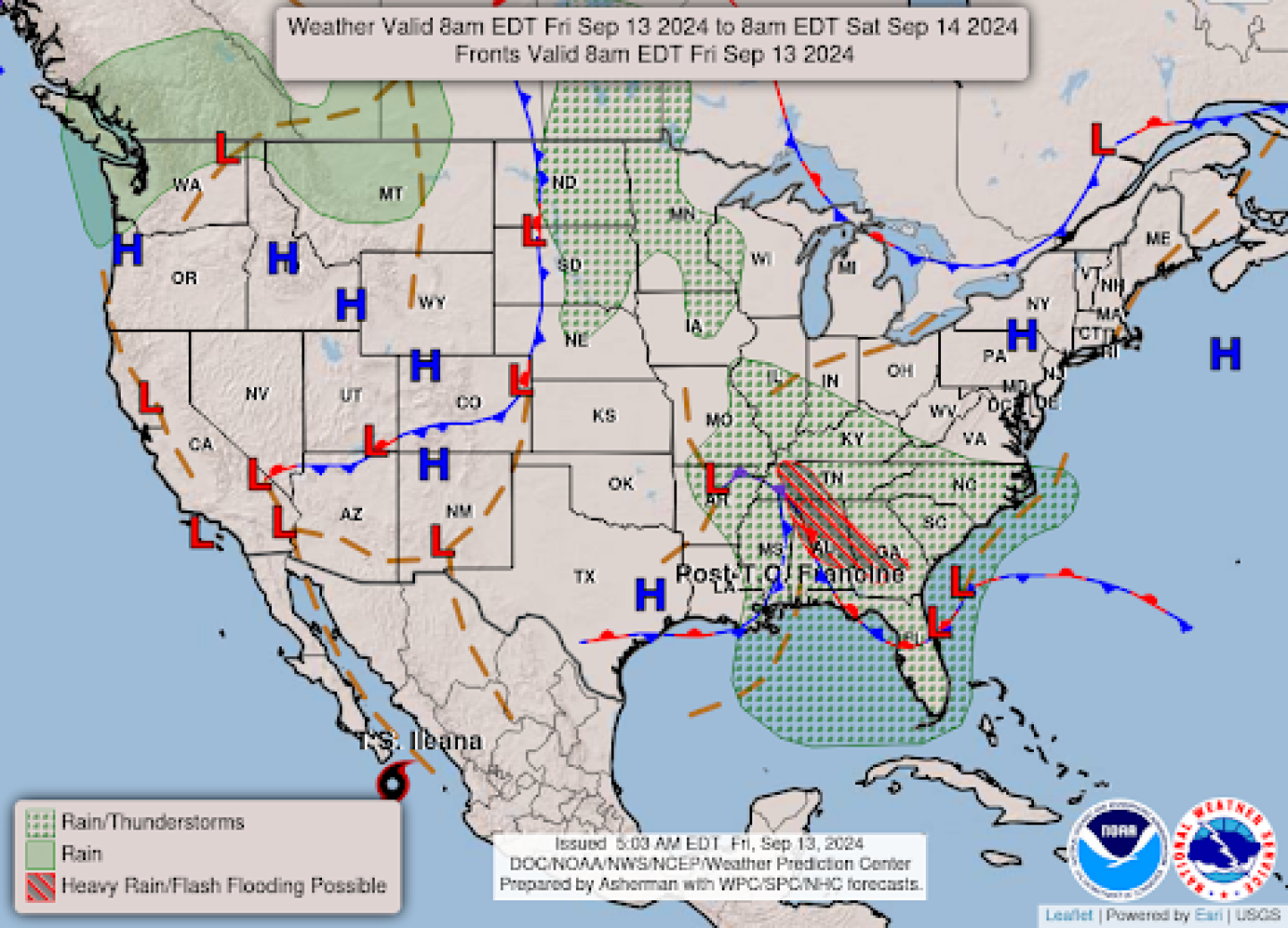

— Hurricane Francine downgraded but continues to bring heavy rains, Gulf oil production still affected. Hurricane Francine is expected to dissipate today. However, it continues to produce heavy rainfall, with 3 to 6 inches expected in parts of central and northern Alabama, and 2 to 4 inches in northeastern Mississippi, western Tennessee, Georgia, and the Florida Panhandle. In the Gulf, 41.74% of oil production and 53.32% of natural gas production remain shut down, according to the Bureau of Safety and Environmental Enforcement, with undamaged facilities set to resume operations after safety checks.

The ports of Cameron, Lake Charles, New Orleans, Plaquemines and St. Bernard have reopened but have restrictions in place, the U.S. Coast Guard said, while the Texas Port of Corpus Christi lifted its restrictions and ports in Freeport, Houston, and Sabine reopened.

Meanwhile, grain export facilities in several locations remain without power, but the North American Export Grain Association and National Grain and Feed Association said that there was little major damage based on reports from their members.

— NWS outlook: Francine will continue to weaken while bringing a heavy rain and flash flood threat to the Southeast over the next couple days... ...Above average temperatures will develop across the Central U.S. and Northeast while below normal temperatures persist in the Southeast and West.

Items in Pro Farmer’s First Thing Today include:

• Wheat leads overnight price strength

• China bond yields sink to record low

• China approves amended statistics law to combat data fraud

• Eurozone industrial production decline slows in July

RUSSIA/UKRAINE |

— Putin warns of escalation as Western allies near deal on long-range missile strikes in Russia. Russian President Vladimir Putin threatened retaliation as the U.S. and U.K. prepare to discuss allowing Ukraine to use Western-supplied missiles to strike targets inside Russia at a White House summit. Putin warned that such a move would be akin to NATO entering the war directly. The meeting, set for today (Sept. 13) between President Joe Biden and U.K. Prime Minister Keir Starmer, could pave the way for Ukraine to use British-made Storm Shadow missiles and possibly U.S.-supplied ATACMS on Russian soil.

This potential shift in Western support follows revelations that Iran has supplied Russia with ballistic missiles, further heightening concerns about the conflict’s escalation.

Western officials are weighing the risks of expanding Ukraine’s strike capabilities while seeking to curb Russian gains in eastern Ukraine. While Washington has long resisted these strikes, the evolving threats are pushing the conversation forward, with decisions expected in the coming weeks.

— Russia initiated a significant counteroffensive in the southern Kursk region, retaking 10 settlements and 63 square kilometers (approximately 24.32 square miles) after Ukrainian forces entered Russian territory in a surprise attack last month. Ukrainian President Volodymyr Zelenskyy confirmed the offensive but described it as a tactical push, stating that Ukraine’s plans remained on course. Meanwhile, Russia has also made gains in eastern Ukraine near Pokrovsk.

— Zelenskyy on Thursday said a Russian missile had struck an Egypt-bound cargo ship which had left the Ukrainian port of Chornomorsk on Wednesday with more than 26,000 tonnes of wheat. Information on Marine Traffic, the vessel-tracking website, showed that the vessel named Aya made a sharp course change, suggestive of a missile strike, at 11pm local time on Wednesday while in Romania’s maritime economic zone. The ship “sustained damage to its port side, including a cargo hold and a crane”, said Ambrey, a maritime security firm. “According to AIS data, the vessel managed to sail to Romania under its own power, indicating that its propulsion system was not compromised.” Zelenskyy said there were no casualties, adding that Ukraine was “waiting for the world to react.” “Wheat and food security should never be targets for missiles,” he said.

Romania’s foreign ministry said the attack on a grain ship by Russia was “unprecedented escalation” in its war against Ukraine. Kyiv accused Russia on Thursday of using strategic bombers to strike a civilian grain vessel in a missile attack in neutral Black Sea waters near Romania.

POLICY UPDATE |

— Vilsack and Boozman discuss farm bill and Prop 12 impacts at pork producers conference. At the National Pork Producers Council’s Legislative Conference, USDA Secretary Tom Vilsack and Sen. John Boozman (R-Ark.) addressed 120 pork producers, focusing on the 2024 Farm Bill and California’s Proposition 12.

Vilsack highlighted the financial strain Prop 12 places on pork producers, including construction costs of up to $4,000 per sow, rising pork prices in California, and reduced sales volumes. He warned that the law’s impact complicates pork inclusion in nutrition programs and risks farm closures, potentially leading to job losses.

Boozman expressed optimism about passing a farm bill this year, emphasizing the need for bipartisan support to address agriculture’s challenges, including Prop 12. NPPC hosted a Capitol Hill food truck to raise awareness about the price hikes linked to Prop 12, engaging lawmakers with “Bacon Bucks” and maple bacon donuts.

CHINA UPDATE |

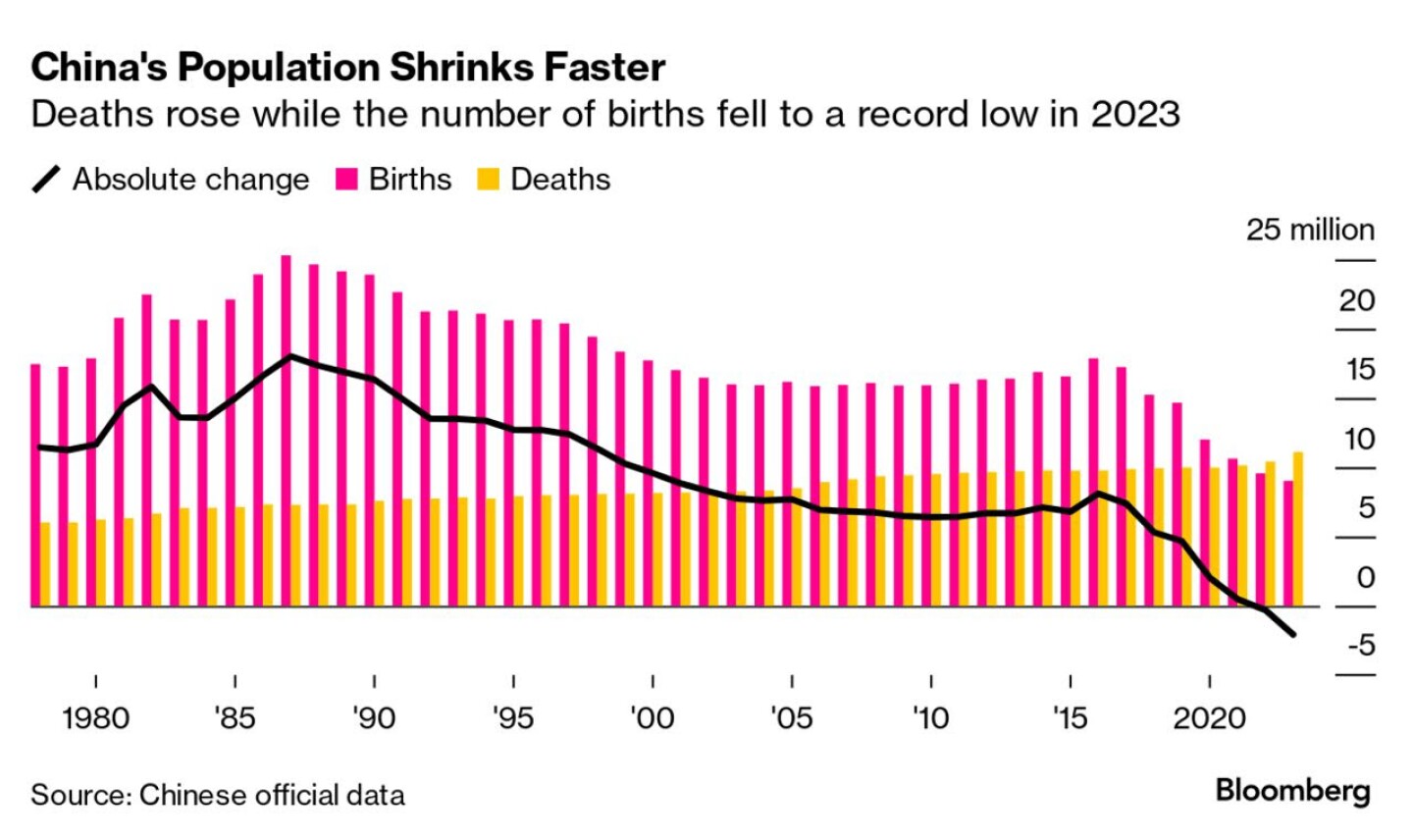

— China announced a significant change to its retirement age policy, marking the first such adjustment since 1978. This decision comes as the country grapples with an aging population and increasing pressure on its pension system. The new retirement ages will be phased in gradually over a 15-year period, starting from Jan. 1, 2025.

The changes are as follows:

• Men: Retirement age will increase from 60 to 63

• Women in white-collar jobs: Retirement age will rise from 55 to 58

• Women in blue-collar jobs: Retirement age will increase from 50 to 55

Several factors have prompted this policy shift:

• Aging population: China’s population is rapidly aging, with those 65 and older expected to make up 30% of the population by 2035, up from 14.2% in 2021.

• Declining birth rates: China’s population has declined for two consecutive years, with birth rates falling to record lows.

• Pressure on pension funds: The Chinese Academy of Social Sciences projected in 2019 that the main state pension fund could be depleted by 2035.

• Increased life expectancy: Life expectancy in China has risen to 78.2 years, necessitating a reevaluation of retirement policies.

TRADE POLICY |

— USTR finalizes modifications to China tariffs after review. The U.S. Trade Representative (USTR) finalized modifications to tariffs on Chinese products under the Section 301 investigation, primarily related to technology transfer and intellectual property issues. Following over 1,100 public comments, updates include changes to tariffs on medical supplies, an exclusion for certain equipment, and adjustments for additional products like tungsten and polysilicon. While economic analysis shows minor negative impacts on U.S. economic welfare, the tariffs have positively affected targeted sectors. The modifications also include 100% tariffs on Chinese electric vehicles, with further machinery exclusions to be announced soon.

Details: Changes include new timing and rates for tariffs on face masks, medical gloves, needles, and syringes; an exclusion for enteral syringes; a proposal regarding coverage of additional tungsten, wafers, and polysilicon tariff lines; an exclusion for ship-to-shore cranes ordered prior to May 14, 2024; an expansion of the scope of the machinery exclusions process to include five additional tariff lines; and modification of the coverage of proposed exclusions for solar manufacturing equipment.

— India imposes tariffs of 12% to 30% on steel imports from China and Vietnam. India will impose tariffs ranging from 12% to 30% on certain steel imports from China and Vietnam, including welded stainless-steel pipes and tubes, for the next five years, according to a directive from the Ministry of Finance. The tariffs aim to protect India’s domestic industry from low-cost imports and market distortions caused by subsidies. These products are essential for various applications, including automotive systems and structural components. The decision follows a probe by India’s Directorate General of Trade Remedies, initiated after complaints from industry associations, confirming that these imports were priced below production costs due to subsidies.

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— H5N1 bird flu detected in eight California dairy herds, USDA confirms. The H5N1 bird flu virus has been found in eight dairy herds in California, according to USDA Deputy Undersecretary Eric Deeble. Cattle from the first three herds tested positive for the same variant detected in other states, with tests on the remaining five herds to be completed this week. All herds have been quarantined. Additionally, a Missouri individual previously hospitalized with avian influenza has recovered. Health officials also announced a campaign to inoculate farmworkers against seasonal flu starting in October.

— 9th Circuit weighs EPA’s CAFO regulation approach in key legal battle. The 9th Circuit Court heard arguments in a lawsuit filed by Food and Water Watch, seeking to compel the EPA to reconsider its denial of a 2017 petition for stricter water pollution regulations at concentrated animal feeding operations (CAFOs). Environmental groups challenge the EPA’s 2023 decision to deny a petition for stricter regulations, arguing that the agency is neglecting its duty to control CAFO pollution. The EPA defends its stance, prioritizing further studies before regulatory changes. Agricultural industry groups, citing a 2005 court decision, support the EPA’s current approach. The outcome could reshape CAFO regulation, with implications for environmental protection and the agricultural sector.

Of note: Senior Judge Jay Bybee called the situation “awkward,” suggesting the court may defer to the EPA’s ongoing evaluations. The lawsuit highlights concerns over the nearly 10,000 unpermitted CAFOs allegedly discharging pollutants into waterways. A decision may take up to a year.

— Online grocery prices see record drop. U.S. consumers are experiencing relief in grocery costs, particularly online, with online grocery prices dropping 3.7% in August, the largest decline since Adobe began tracking in 2014. While online grocery shopping represents about 12% of the total market and tends to fluctuate more than in-store prices, the overall trend aligns with broader grocery pricing patterns. Link to more via Bloomberg.

— Study finds most state food waste bans ineffective, except Massachusetts. A new study in Science (link) reveals that most US state bans on landfill food waste have been ineffective, with Massachusetts as the standout exception. Since implementing its ban in 2014, Massachusetts reduced landfilled and incinerated waste by an average of 7% annually over five years. Key factors behind its success include a high density of food waste processing facilities, simple language with minimal exemptions, and robust enforcement. In contrast, similar bans in California, Connecticut, Rhode Island, and Vermont did not yield significant results. Newer programs in other states are too recent to evaluate, but the study emphasizes the need for more than just legislation to curb food waste.

OTHER ITEMS OF NOTE |

— Report highlights crucial role of agriculture checkoffs in national security and sustainability. A new report from The Directions Group (formerly known as Aimpoint Research) underscores the vital role U.S. agriculture checkoff programs play in national security, social betterment, and environmental sustainability. “The Future of Agriculture Checkoffs” report emphasizes the importance of these programs in driving domestic demand, expanding export markets, fostering innovation, and supporting economic stability for U.S. producers. The research identifies key areas where checkoff organizations can evolve to meet future challenges, including geopolitical risks and the shifting agri-food system. Mark Purdy, executive VP of Agri-Food at The Directions Group, stressed the need for checkoffs to continuously adapt to support the nation’s agricultural leadership. Link for details.

— Cotton AWP eases. The Adjusted World Price (AWP) for cotton moved down to 56 cents per pound, effective today (Sept. 13), down from 57.27 cents per pound the prior week. The current AWP remains 4 cents per pound above the level (52 cents) that would trigger any farm program benefits. The week of Oct. 9, 2020, was the last time that the AWP generated an LDP. Meanwhile, USDA announced Special Import Quota #22 would be established September 19 to allow the importation of 38,901 bales of upland cotton, applying to supplies purchased not later than Dec. 17 and imported into the U.S. not later than March 17.

— Pressure mounts on EU to delay deforestation law amid global concerns. Several countries, including Brazil and Nigeria, are urging the European Union to reconsider its upcoming ban on imports from deforested areas. WTO Director General Ngozi Okonjo-Iweala emphasized the challenges for farmers, citing cases like Nigeria, where land is cleared after long fallow periods. EU officials are reportedly considering delaying or simplifying the law set for Dec. 30, but reopening the legislation could spark major political battles in Europe. Brazil warned that one-third of its exports could be affected, adding to the growing pressure for a postponement.

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |