News/Markets/Policy Updates: Nov. 7, 2024

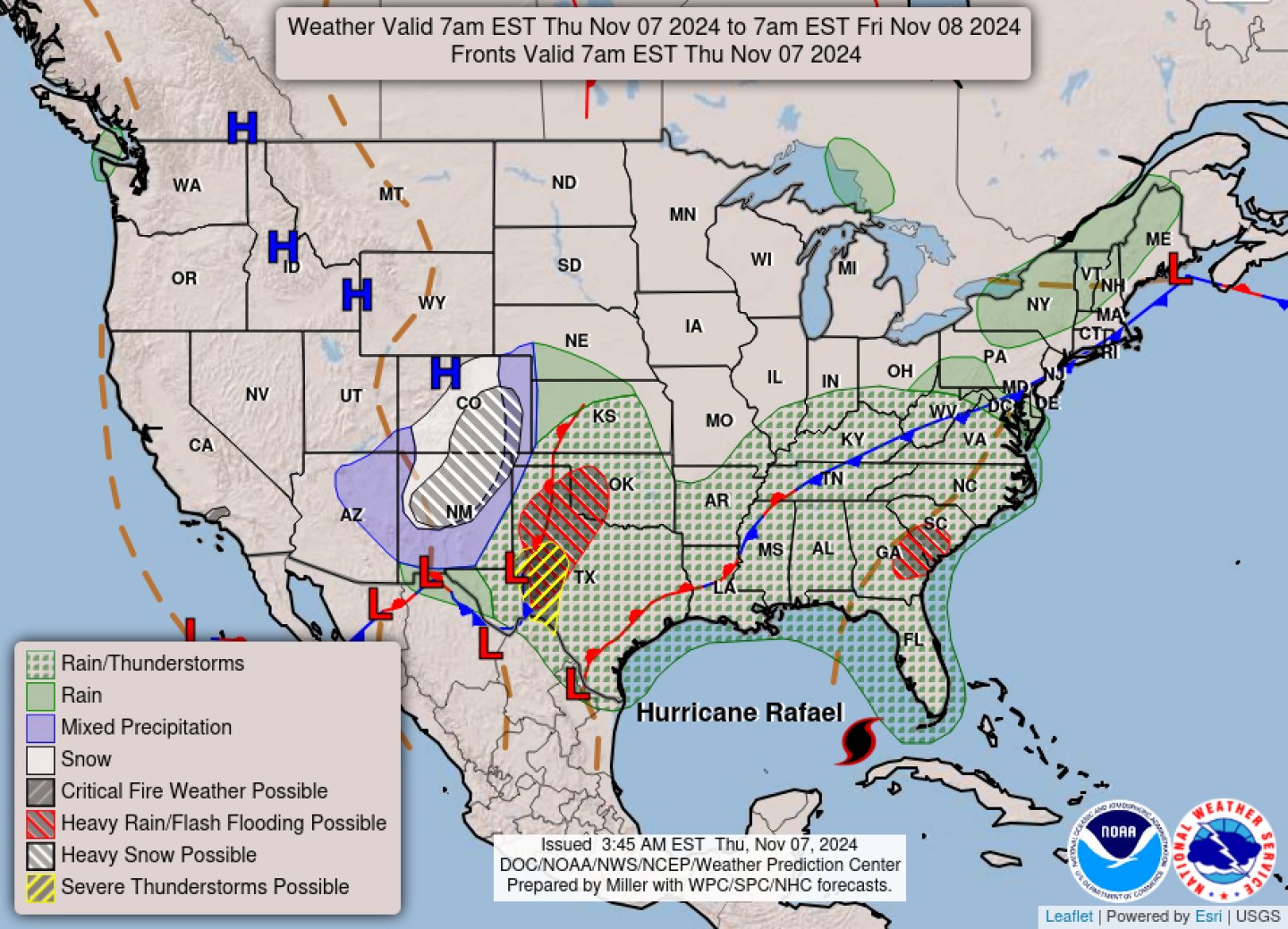

Note: Modified report today as I am in Arizona for a speech for the USMEF. — Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened slightly higher but is now weaker. In Asia, Japan -0.3%. Hong Kong +2%. China +2.6%. India -1%. In Europe, at midday, London flat. Paris +0.6%. Frankfurt +1.3%. Equities on Wednesday: Big gains were scored in all three major indices in the wake of former President Donald Trump prevailing in the Tuesday elections and all three struck new record finishes with the Blue Chip index registering its biggest post-election gain since 1896. The Dow shot up 1,508.05 points, 3.57%, at 43,729.93. The Nasdaq gained 544.29 points, 2.95%, at 18,983.47. The S&P 500 rose 146.28 points, 2.53%, at 5,929.04. — FOMC expected to trim rates as mixed economic signals persist amid post-election uncertainty. The Federal Open Market Committee (FOMC) is expected to cut the Fed funds rate by 25 basis points to a range of 4.5% to 4.75% at the conclusion of its two-day meeting. The decision follows mixed economic data, including a weaker-than-expected October employment report influenced by a Boeing strike and hurricanes. Despite signs of cooling inflation, economic concerns remain for consumers grappling with high prices. Fed Chair Jerome Powell is anticipated to avoid discussing the election’s impact on the economy and inflation, maintaining focus on broader policy implications. — Outside markets: U.S. dollar index was weaker with the euro and British pound firmer against the greenback. The yield on the 10-year U.S. Treasury note eased to around 4.41% with a mixed tone in global government bond yields. Crude oil futures were weaker, with U.S. crude around $71.40 per barrel and Brent around $74.80 per barrel. Gold and silver futures were moving higher ahead of U.S. market action, with gold around $2,685 per troy ounce and silver around $31.52 per troy ounce. — USDA to release early supply/demand projections ahead of 2034 agricultural report. USDA this afternoon (3 p.m. ET) is releasing early supply and demand tables that will feature in its full Agricultural Projections to 2034 report, slated for completion in February 2025. Using the October 2024 WASDE report as a baseline and August economic forecasts, these projections assume policy continuity and normal weather over the next decade. This early data release, tied to budget processes, will remain unchanged in the final report. Link to access data. — Ag markets today: Corn, soybeans and SRW wheat built on Wednesday’s late price strength during the overnight session while HRW and HRS wheat rebounded from their losses. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were mostly 9 to 10 cents higher and wheat futures were 1 to 3 cents higher. The U.S. dollar index was around 325 points lower, and front-month crude oil futures were 75 cents lower. Wholesale beef prices weaken. Wholesale beef prices fell $1.62 for Choice to $315.59 and $2.04 for Select to $283.20 on Wednesday. That’s the lowest Choice price since Oct. 14. While movement stayed strong at 131 loads, packer margins are being squeezed, likely limiting their willingness to pay higher prices for cash cattle this week. December hogs rebound. December lean hog futures filled the Oct. 29 gap on the daily chart and then moderately rebounded to finish near session highs on Wednesday amid support from the contra-seasonally firming cash index. The CME lean hog index is up another 45 cents to $90.24 as of Nov. 5, the 14th straight daily gain and $8.115 above yesterday’s closing price in December hogs. Ag trade: South Korea purchased 65,000 MT of corn from the U.S., South America or South Africa and 128,000 MT of optional origin feed wheat. Japan purchased 121,790 MT of milling wheat via its weekly tender, including 71,712 MT U.S., 28,978 MT Canadian and 21,100 MT Australian. Algeria tendered to buy up to 240,000 MT of corn to be sourced from Brazil or Argentina. — USDA daily export sale: — Beyond Meat cuts revenue outlook amid reduced demand for costly meat alternatives. Beyond Meat lowered its annual revenue forecast to a range of $320 million to $330 million, down from a previous upper range of $340 million. The company attributed the cut to reduced consumer spending on more expensive plant-based products as shoppers opt for cheaper alternatives. Quarterly sales volumes dropped by 7.1% compared to a 3.5% increase in the same period last year. Beyond Meat plans to restructure its balance sheet in 2025 and boost cash reserves, reflecting challenges in the alternative protein market amid changing consumer spending habits. —More big sales of U.S. soybeans to China. USDA’s weekly Export Sales activity for 2024-25 the week ended Oct. 31 included net sales of 9,000 metric tons of corn, net sales of 67,033 metric tons of sorghum, 1,222,742 metric tons of soybeans, and 37,530 running bales of upland cotton. Activity for 2024 included net sales of 223 metric tons of beef and net reductions of 4,978 metric tons of pork. — Ag markets yesterday: — Who will be the new USDA Secretary? That parlor game has returned with a host of possibilities which include: — Potential candidates for U.S. Trade Representative in a second Trump administration: Of note: Trump has expressed a desire to pursue even more aggressive trade policies, including broader tariffs, in a potential second term. This suggests he may favor someone like Lighthizer who has a track record of implementing such policies. However, the final selection will likely depend on various factors as Trump assembles his full economic and foreign policy teams. — Who will be Donald Trump’s chief of staff? This is one of the most important personnel decisions Trump faces. There are several prominent contenders being considered for the position: Bottom line: The final selection will likely depend on various factors, including their relationship with Trump, their ability to navigate Washington politics, and their alignment with Trump’s vision for his second term. — David Wasserman, an election analyst for The Cook Political Report with Amy Walter, shared his insights on the surprising aspects of the 2024 election with Tyne Morgan. While Trump’s victory wasn’t unexpected, Wasserman was particularly struck by Trump’s performance in suburban areas. Trump’s success in white-collar suburbs marked a significant departure from previous electoral trends. Wasserman noted that Trump performed better in many white-collar suburbs compared to 2020. The traditional growing gap between suburban and rural America didn’t materialize as expected. Trump made significant inroads in unexpected places, including: Wasserman highlighted the importance of rural areas in Trump’s victory: • Baldwin County, Georgia, a bellwether with a diverse population, flipped to Trump. This flip contributed significantly to Trump’s ability to overcome Democratic margins in Atlanta suburbs. Wasserman identified several crucial factors in the election outcome: Senate and House results. The Republican Party made significant gains in the Senate. Republicans won at least 53 states, exceeding expectations. Surprising victories included Dave McCormick’s narrow lead over Senator Bob Casey in Pennsylvania. Trump’s strength among Hispanic voters played a crucial role in some Senate races, Wasserman said. Wasserman believes the 2024 election will be remembered for: — Trump’s rural landslide prompts focus on farm bill, rising costs, and tariffs. President-elect Donald Trump secured 63% of the rural vote, surpassing his 2016 performance, and is set to work with farm groups and Congress on overdue agricultural policies. Key issues include passing a new farm bill, mitigating high costs, averting tax hikes, and addressing labor shortages. Senate Republicans aim to increase crop subsidy triggers and reallocate climate funds for non-carbon-focused practices, a move opposed by outgoing Senate Agriculture Chair Debbie Stabenow (D-Mich.). Trump emphasized unity and a focus on “common sense” policies. He also proposed tariffs on imports, with potential repercussions for agricultural exports, while Robert Kennedy Jr. hinted at shifts in food and health policy toward less processed and more natural foods. — Trump, GOP poised to extend expiring tax cuts with new congressional majority. President-elect Donald Trump and Republicans, who secured control of the Senate and are positioned to retain the House, are gearing up to extend expiring tax cuts from 2017 worth trillions. With full congressional control, they could bypass Democratic votes to pass new tax legislation. Key provisions at stake include a higher standard deduction, enhanced child tax credit, and a 20% deduction for some businesses. A GOP-led Congress could also block tax increases, providing leverage against a narrowly controlled Democratic House. House leaders plan to introduce a tax bill within the first 100 days of the new Congress. Markets have responded positively to the prospect of deregulation and stalled tax hikes. — Trade industry braces for new Trump tariffs, supply chain shifts expected. The trade sector anticipates a wave of new tariffs under President-elect Donald Trump, potentially reshaping global supply chains and accelerating moves away from China. Industry experts foresee a rush by U.S. importers to stockpile goods ahead of expected levies, which could drive up freight rates and disrupt shipping markets. Trump has signaled potential tariffs of 10-20% on imports, with even higher rates on goods from China and Mexico. The proposed changes are expected to impact shipping lines, manufacturers, and retailers, potentially leading to higher consumer costs. Companies are preparing strategies to mitigate tariff impacts, including shifting production and diversifying suppliers. — Donald Trump’s relationship with Elon Musk appears to have influenced his stance on electric vehicles (EVs) to some degree, though there are still notable differences in their views. But despite his close ties to Musk, Trump has maintained a largely skeptical position on EVs: However, Trump has also tried to clarify that he is not entirely anti-EV: Despite their differing views on EVs, Musk has become a significant ally for Trump: — Why were there more voters in the 2020 presidential contest versus 2024? Election analysts say there were several factors that contributed to the higher voter turnout in 2020 compared to 2024. Slight decrease in 2024 turnout: While exact numbers are still being finalized, preliminary data shows 2024 turnout was around 64.54% of eligible voters, compared to 66.38% in 2020. This represents a decrease of nearly 6 percentage points. Demographic shifts: There were some changes in voting patterns among certain demographic groups between 2020 and 2024. For example, Trump gained support among Hispanic/Latino voters and first-time voters in 2024 compared to 2020. Voter enthusiasm: There may have been differences in voter enthusiasm and motivation between the two elections, though this is difficult to quantify precisely. Differences in candidates: The 2024 race featured different candidates (Trump vs. Harris) compared to 2020 (Trump vs. Biden), which could have impacted turnout patterns. Of note: While 2024 turnout was lower than the record-setting 2020 election, it was still relatively high by historical standards. The decrease in turnout from 2020 to 2024 does not necessarily indicate a problem with the electoral process, analysts conclude. — The referendum on slaughterhouses in Colorado, specifically in Denver, did not pass. Voters rejected Ballot Measure 309, which aimed to ban slaughterhouses in the city and county of Denver. Key points about the outcome: Opponents of the ban, including the meat industry and workers at the plant, spent over $3.8 million campaigning against the initiative. Supporters of the ban, including animal rights organizations, spent over $600,000 on their campaign. Bottom line: The failure of this measure means that Superior Farms can continue its operations in Denver. The CEO of Superior Farms, Rick Stott, declared victory, stating that the campaign was about “real people” and the value of their work. The outcome preserves jobs at the facility and maintains an important link in the lamb supply chain for Colorado and the Mountain West region. Analysts say had the measure been approved it would have served as a precedent for similar action elsewhere. — CAFO ban defeated in California. By a nearly 6-to-1 margin, voters in California’s Sonoma County defeated an effort to limit the size of livestock farms and phase out operations that exceeded the limits. — Trump’s 2024 win signals tougher immigration policies, mass deportation plans. Donald Trump’s victory in the 2024 presidential election positions him to enact stringent immigration policies, including potential mass deportations and heightened border control measures. In his victory speech at Mar-a-Lago, Trump reaffirmed plans to secure the U.S./Mexico border. His proposed actions may involve using the National Guard and military for removals, challenging existing Biden-era policies like Temporary Protected Status and protections for Dreamers. Immigration advocates and legal experts warn of significant socio-economic impacts and have pledged continued legal challenges to counteract the administration’s plans. Potential changes to lawful immigration, such as H-1B visas, could also be on the horizon. — Indonesia aims to boost palm oil production for rising biofuel demand. Indonesian officials are optimistic about increasing palm oil production to meet rising biofuel demand. Chief Economic Minister Airlangga Hartarto emphasized Indonesia’s biodiesel expansion, including raising the blend from 35% (B35) to 40% (B40) palm oil by 2025, potentially increasing palm oil use for energy to 13.9 million metric tons (MMT). Plans also include a 1% jet fuel blending mandate by 2027. While replanting efforts to enhance palm oil output are underway, they have faced delays. The initiative aims to reduce reliance on fossil fuels and support the palm oil sector. — China’s gov’t officials have been actively encouraging large hog producers to reduce their reliance on soybean imports, particularly soybean meal used in animal feed. This initiative is part of a broader strategy to decrease China’s dependence on imported soybeans and improve food security. In 2023, China’s Ministry of Agriculture and Rural Affairs (MARA) introduced the “Three-Year Action Plan for Reducing Soybean Meal in Fee.” This plan aims to: MARA has provided specific recommendations for feed formulation: Over 88% of soybeans consumed in China are imported, posing risks to national food security. Reducing soybean meal use has led to significant cost savings in feed production, estimated at more than US $17 per ton. Despite government advice, some hog producers have been reluctant to reduce their herds. Some enterprises are unwilling to heed the ministry’s advice due to sustained losses. Crush Capacity: Despite having the world’s largest annual crush capacity at nearly 160 million mt, weekly operational rates in China have been low, ranging from 50% to 60%. — China’s soybean imports slowed in October but on record pace. China imported 8.09 MMT of soybeans in October, down 3.28 MMT (28.8%) from September but up 2.93 MMT (56.8%) from last year. Through the first 10 months of this year, China imported 89.94 MMT of soybeans, up 11.2% from the same period last year and just 10.37 MMT shy of the record in 2020. Chinese buyers are expected to rush to import soybeans before Donald Trump takes office in January. — China’s meat imports continue to slow. China imported 535,000 MT of meat during October, down 1.1% from September and 3.1% less than year-ago. Through the first 10 months of this year, China imported 5.475 MMT of meat, down 12.5% from the same period last year. — China’s exports surge as factories front-run tariff threats. China’s exports surged 12.7% from year-ago in October to a 27-month high of $309.06 billion, up sharply from 2.4% growth in September. This marked the seventh consecutive month of export growth and the fastest pace since July 2022, as manufacturers front-loaded orders in anticipation of further tariffs from the U.S. and EU. China’s imports fell 2.3% from last year to $213.3 billion in October, the first decline since June amid weak domestic demand. That pushed China’s trade surplus to $95.27 billion from $81.71 billion in September. The trade surplus with the U.S. increased slightly to $33.50 billion in October from $33.33 billion in September. For the first 10 months of 2024, China’s trade surplus stood at $785.3 billion, with exports rising 5.1% to $2.93 trillion while imports grew 1.7% to $2.14 trillion. During the period, the trade surplus with the U.S. stood at $291.38 billion. — China’s Xi urges U.S. to ‘get along’ as he congratulates Trump. Chinese President Xi Jinping congratulated Donald Trump on his U.S. presidential win and urged both nations to find the “right way to get along,” amid the threat of sharply increased tariffs and another trade war. Stable, sound and sustainable U.S./China relations serve the interests of both, Xi said, adding that other countries would expect the two powers to “respect each other (and) co-exist peacefully.” Xi also called for strengthened dialogue to properly manage differences. Echoing Xi’s call for stability, the commerce ministry said China was willing to jointly develop healthy economic and trade ties the United States. — China’s central bank head pledges to support economic recovery. People’s Bank of China (PBOC) Governor Pan Gongsheng said China will continue to implement a supportive monetary policy to help promote sustained economic recovery. China will promote the opening of its financial services sector and strengthen communication with markets, Pan said, and “maintain a dynamic balance between economic growth and quality, internal and external factors, as well as investment and consumption, and will continue to implement a supportive monetary policy.” Investors are closely watching a meeting of China’s top legislative body this week for clues on the scale and timing of expected fiscal measures. — China asks banks to lower interbank deposit rates to boost growth. Chinese regulators have asked the country’s banks to lower the rates they pay to deposits from other financial institutions to free up funds to boost the economy, Bloomberg reported, citing people familiar with the matter. China’s interest rate self-disciplinary mechanism, a supervisory body overseen by the central bank, said banks should benchmark the interbank deposit rate against the 7-day reverse repo rate, currently set at 1.5% annually. Some banks paid an annual rate of 1.8% or above to attract savings from financial counterparties. — NWS outlook: Heavy snow expected to impact portions of Colorado and New Mexico while heavy rain, severe weather, as well as increasingly windy conditions sweep across the Southern Plains through the next couple of days... ...Heavy rain threat over the Southeast is expected to gradually diminish by this evening... ...Hurricane Rafael is forecast to track more westward away from the Florida Keys and into the Gulf Mexico through the next couple of days... ...Record warmth continues from the Mid-Atlantic down into the Southeast and along the Gulf Coast. |

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |