News/Markets/Policy Updates: Sept. 30, 2024

— Ports along the East and Gulf coasts are on the verge of shutting down as labor talks stalled. No negotiations are planned before dockworkers’ contracts expire today. President Joe Biden said Sunday he wouldn’t intervene in any dockworkers strike. Resolving the dispute is a matter for collective bargaining, he told reporters in Delaware. J.P. Morgan doesn’t see any port strike lasting longer than a week, but warned that the consumers could face higher prices or empty shelves for certain products. The International Longshoremen’s Association said it will provide an update on any new developments on Monday by 11 a.m. ET. More details in Markets section. — President Joe Biden will visit some of the affected communities of Hurricane Helene later this week, “as soon as it will not disrupt emergency response operations,” the White House said Sunday. Biden will comment on the topic later this morning. Biden was briefed Sunday by FEMA officials on the crisis situation in North Carolina and other Southern states following Hurricane Helene. — Kamala Harris leads among Latino voters, but Democratic margin narrows. A recent NBC/CNBC/Telemundo poll shows Vice President Kamala Harris leading Donald Trump 54% to 40% among Latino voters, significantly down from President Biden’s 36-point lead in 2020. This marks the narrowest margin for a Democratic candidate with this group since at least 2012. Economic concerns, particularly inflation, have contributed to the swing, with Trump outperforming Harris on these issues. Harris has made price gouging a key focus of her campaign, but the strategy to tackle higher prices remains unclear. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. Chinese stocks had their best day since 2008, after China took more steps over the weekend to rejuvenate the economy. . But many analysts warned that the stimulus measures aren’t enough to boost sagging demand. The Shanghai Composite Index surged 8% on the final day of trading Monday, its biggest daily jump since 2008. The 17% gain in the final month of the quarter was its biggest monthly climb since China’s 2015 stock-market bubble. In Japan, stocks slid after Shigeru Ishiba became leader of the ruling Liberal Democratic Party. The former defense minister is seen as favoring tighter fiscal and monetary policy. In Asia, Japan -4.8%. Hong Kong +2.4%. China +8.1%. India -1.5%. In Europe, at midday, London -0.7%. Paris -1.7%. Frankfurt -0.6%.

U.S. equities Friday and the week: All three major indices registered gains for the week with the Dow ending with another record close — its 32nd record close for the year. For the week, the Dow was up 0.59%, the Nasdaq gained 0.95%, and the S&P 500 was up 0.61%. All three major indexes still marked their third consecutive week of gains. On Friday, the Dow closed up 137.89 points, 0.33%, at 42,313.00. The Nasdaq lost 70.70 points, 0.39%, at 18,119.59. The S&P 500 eased 7.20 points, 0.13%, at 5,738.17.

— DirecTV to acquire Dish in two-step deal, assuming rival’s debt. DirecTV announced a deal to acquire its rival Dish in a two-step transaction. First, TPG, a minority shareholder in DirecTV, will buy AT&T’s majority stake for $7.6 billion. Then, DirecTV will purchase Dish for just $1, while assuming Dish’s significant debt, including $2 billion due in November. A major uncertainty remains whether government regulators will approve the merger.

— Oil prices rose on Friday but ended the week lower, as investors balanced rising global supply expectations with new stimulus from China. Brent crude gained 38 cents (0.53%) to $71.89, and U.S. WTI rose 51 cents (0.75%) to $68.18, though both fell 3-5% over the week.

— Ag markets today: Wheat futures rebounded from Friday’s losses during the overnight session, while corn and soybeans pulled back from their gains at the end of last week. As of 7:30 a.m. ET, corn futures were trading fractionally lower, soybeans were 5 to 8 cents lower and wheat was mostly 2 to 3 cents higher. The U.S. dollar index was around 100 points lower, and front-month crude oil futures were about 50 cents lower.

Another week of higher cash cattle trade. Cash cattle traded higher for a third straight time last week, though traders will have to wait until later this morning to get the official price. Cash opinions are uncertain to open this week, with some looking for higher prices again, while others feel recent hefty purchases by packers, negative margins and a fresh supply of contracted cattle will halt gains.

Cash hog index slips, pork cutout firms. The CME lean hog index is down 4 cents to $84.03 as of Sept. 26, ending a one-day uptick and marking a new seasonal low. The pork cutout value firmed $1.11 to $95.75 on Friday, as strong gains in loins, butts, picnics and ribs more than offset modest declines in hams and bellies.

— Agriculture markets Friday and the week:

• Corn: December corn futures climbed 4 3/4 cents to $4.18, ending near this week’s highs and marking a 10 3/4 cent gain on the week.

• Soy complex: November soybeans rallied 24 3/4 cents to $10.65 3/4 and surged 53 3/4 cents on the week, while December soymeal closed $17.30 higher at $344.10, marking a three-month high close and a $24.90 week-over-week gain. December soyoil slid 54 points to 42.36 cents but notched a 100-point weekly gain.

• Wheat: December SRW wheat futures fell 4 1/4 cents to $5.80, near mid-range and on the week up 12 1/2 cents. December HRW wheat futures dipped 2 1/4 cents to $5.76 3/4, nearer the daily high and for the week up 12 3/4 cents. December spring wheat futures fell 3 1/4 cents to $6.08 1/4 and rose 1/4 cent on the week.

• Cotton: December cotton fell 30 points to 72.72 cents and gave up 80 points on the week.

• Cattle: December live cattle futures fell 35 cents to $184.475 but for the week gained $1.275. November feeder cattle futures rose 72 1/2 cents to $245.70 and on the week were up $3.885.

• Hogs: Hog futures closed mostly lower in the wake of Thursday’s USDA Hogs & Pigs report. Nearby October futures inched up 2.5 cents to $82.05, while most-active December fell 55 cents to $73.375.

— Quotes of note:

• Blinder: Powell prioritizes economic risks over consensus in Fed’s 50-point rate cut. Alan Blinder is a professor of economics and public affairs at Princeton, and also served as vice chairman of the Federal Reserve, 1994-96. Writing in the Wall Street Journal (link), he says Fed Chairman Powell demonstrated a willingness to prioritize economic considerations over consensus-building, noting he pushed for the larger cut despite knowing it would lead to dissent. This marks the first governor dissent since 2005, highlighting the significance of the decision, according to Blinder. Powell’s choice suggests a determination to avoid being “late” in responding to economic shifts, as the Fed was criticized for in 2022, Blinder reasons. He says the FOMC’s decision reflects its current view of the economy:

• Inflation progress: The 12-month inflation rate has decreased from 7.1% in June 2022 to 2.5%, nearing the Fed’s 2% target.

• Employment concerns: While unemployment remains low at 4.2%, the Fed appears more worried about employment risks than inflation.

• Policy rate adjustment: Even after the cut, the real federal funds rate (4.9% minus 2.5% inflation) stands at 2.4%, still above the Fed’s estimated neutral rate of 0.9%.

Blinder also notes the Fed’s decision demonstrates its independence from political pressure: The committee wasn’t deterred by potential criticism from former President Donald Trump, writing they understood the minimal impact a September rate cut would have on the November election.

• Economist cautions inflation fight not over despite progress, core inflation still above Fed target. Quincy Krosby of LPL Financial warns that it’s premature to declare victory over inflation in the U.S., citing the August PCE report. While headline inflation is nearing the Fed’s 2% target at 2.2%, core inflation remains higher at 2.7%. Krosby suggests another 50-basis point rate hike may need consideration, depending on labor market conditions. However, overall inflation is trending in the right direction.

• “Either supermarkets elect to absorb that cost, or they will pass it on.” — Tim Ryan, owner of Florida-based importer Square 1 Farms, on the higher costs of bringing produce into the country during a port strike.

— ECB likely to cut interest rates in October amid Eurozone economic slowdown. Economists now predict a 0.25% interest rate cut by the European Central Bank (ECB) in October, following weak inflation data and a sharp contraction in business activity across the Eurozone. Indicators such as France and Spain’s low inflation rates and a drop in the Eurozone’s Purchasing Managers’ Index (PMI) have led to a reassessment of the ECB’s stance. Previously expected in December, the cut may come earlier as the ECB shifts its focus from inflation control to supporting economic growth. Bond markets now price in an 80% chance of the rate cut at the Oct. 18 meeting.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly weaker ahead remarks from Fed Chair Jerome Powell later today. Most foreign currencies were higher against the greenback ahead of U.S. action. The yield on the 10-year US Treasury note was higher, trading around 3.78%, with a higher tone in global government bond yields. Crude oil futures shifted lower, with U.S. crude around $67.90 per barrel and Brent around $71.35 per barrel. Gold and silver futures were under moderate pressure ahead of US market action, with gold around $2,663 per troy ounce and silver around $31.53 per troy ounce.

— Dockworkers are preparing to strike at midnight across dozens of U.S. ports. The International Longshoremen’s Association (ILA), which represents 45,000 dockworkers at East Coast and Gulf Coast ports, is threatening to shut down some of the country’s main gateways for imports of food, vehicles, heavy machinery, construction materials, chemicals, furniture, clothes and toys.

ILA’s leader, Harold Daggett, has said he won’t negotiate until employers agree to a 77% increase in wages over six years. Talks then would cover thorny subjects such as the use of automation. Port employers and ocean carriers, represented by the United States Maritime Alliance, have offered an almost 40% wage increase, an offer that Daggett last week called “insulting.” The ILA says a strike won’t affect military cargoes or cruise ship services.

Dockworkers in the U.S. enjoy some of the highest blue-collar wages, with base hourly rates of $39 often leading to six-figure annual incomes due to overtime and work rules. In 2020, over half of the 3,726 dockworkers at the Port of New York and New Jersey earned more than $150,000, with 665 workers surpassing $250,000, according to the port’s regulator.

USDA Secretary Tom Vilsack on Saturday encouraged the union and the ports to stay at the table. He noted that for the agriculture industry, the impact is more significant on the import side, especially “valued-added” items from Europe. “We haven’t had a circumstance where we’ve had a strike in 50 years,” he said. “So, we know that it can get done.”

JP Morgan equity analysts estimate a ports strike would cost the U.S. economy between $3.8 billion and $4.5 billion a day, some of which would be recovered once normal operations resume, but perishables including imports like bananas and U.S. agriculture exports could be stuck and potentially lost for good. The White House believes the country’s supply chains are resilient, and that the economy could weather a short strike of up to about a week.

Shipping and energy industry officials say they expect exports of oil and liquefied natural gas at Gulf Coast ports to be unaffected because the ILA has little or no involvement in those operations.

The union’s bulk-ship operations, which handle industrial commodities such as coal and grain, are covered under a separate contract.

Most containership movements at the two coasts are expected to stop.

— Hurricane Helene had a major impact on U.S. cotton production, particularly in the southeastern states. Impacts:

• Substantial damage to cotton crops in several southeastern states, including Georgia, Florida, and South Carolina. The storm hit during a critical time, as many cotton fields had open bolls and were nearing harvest.

• In Georgia, cotton producers reported yield losses ranging from 35% to total loss, depending on the location, according to Georgia Cotton Commission (GCC) Executive Director, Taylor R. Sills (link). The high winds and heavy rainfall degraded cotton fiber quality and quantity. Official reports of losses will be coming in the coming weeks as University of Georgia Cooperative Extension Service personnel collect data.

• Open cotton bolls were particularly vulnerable, as water from the storm degrades the fiber.

The hurricane disrupted the cotton harvest in multiple ways:

• Wet ground conditions made it difficult to use heavy equipment for harvesting.

• High winds blew cotton lint to the ground and tangled plants, further complicating the harvest process.

• Many farmers had to delay defoliation (removal of leaves before harvest) due to the storm.

Economic impact. The damage to cotton crops is expected to have significant economic consequences:

• Losses in Georgia alone are estimated to be in the hundreds of millions of dollars.

• The impact extends beyond farms to cotton gins, agribusinesses, and rural communities.

Market reaction

• Cotton futures on ICE gained more than 1% following the storm, as traders anticipated potential supply disruptions.

• However, the market remained cautious, waiting for more concrete data on the extent of the damage.

• While the full extent of Helene’s impact on U.S. cotton production is still being assessed, reports note the hurricane caused significant damage to crops and disrupted harvesting operations in key cotton-producing states. The effects are likely to influence cotton supply and potentially prices in the coming months.

— Indonesia to increase October crude palm oil reference price, export tax set to rise. Indonesia will raise the crude palm oil (CPO) reference price to $893.64 per metric ton in October, up from $839.53 in September, according to the Trade Ministry. This increase will lead to an export tax of $74 per metric ton, with the tax rate set at 7.5% of the reference price. A 3% to 6% tax range will apply to more refined palm oil products. The new regulation on the reference price has yet to be officially published.

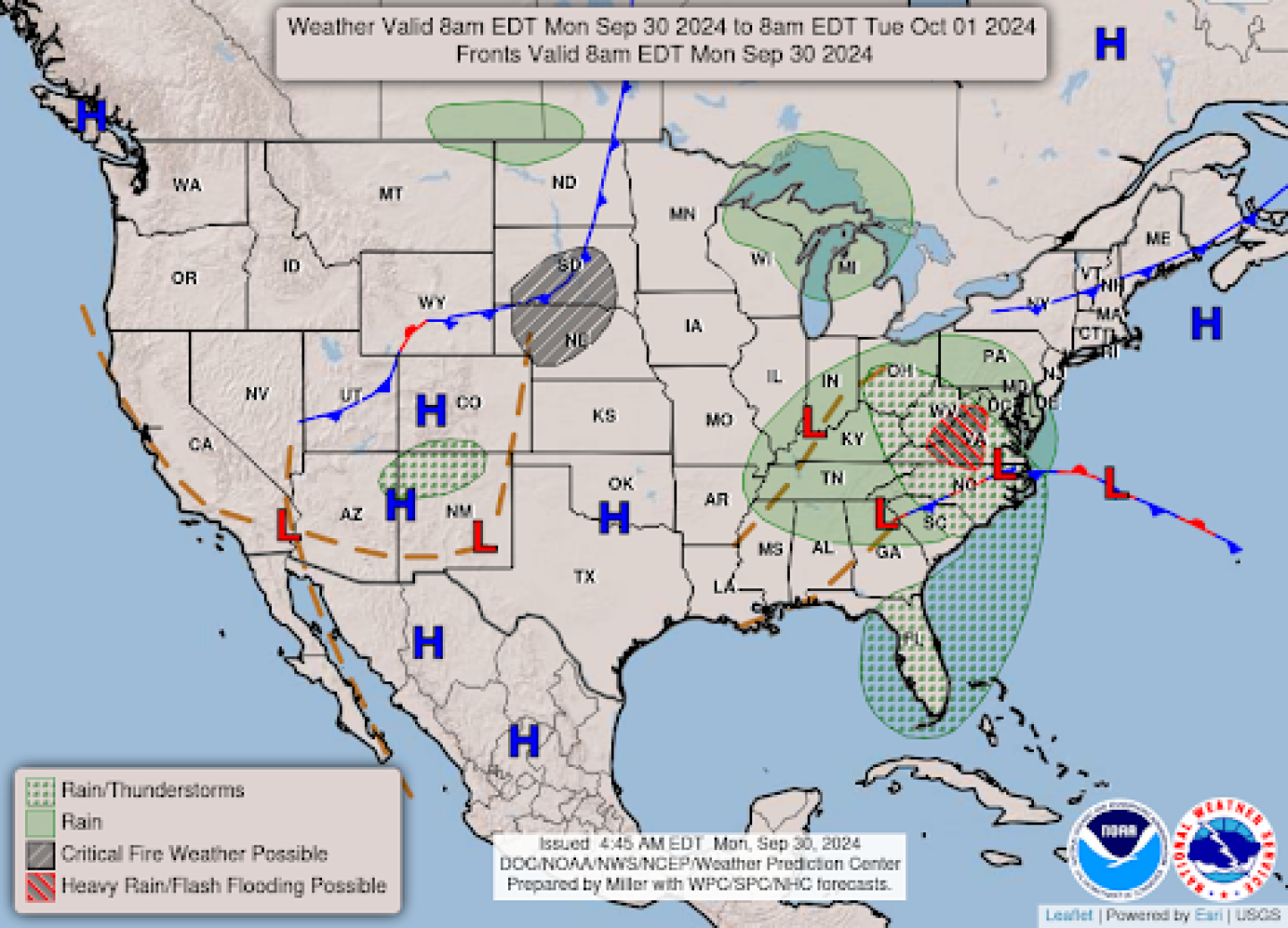

— NWS outlook: There is a Slight Risk of excessive rainfall over parts of the Central Appalachians/Mid-Atlantic on Monday... ...There is a Critical Risk of fire weather over parts of the Northern/Central Plains on Monday... ...There are Excessive Heat Warnings and Heat Advisories over parts of Southern California and the Southwest.

Items in Pro Farmer’s First Thing Today include:

• Wheat firmer, corn and beans weaker this morning

• Helene rips through Southeast

• Key grains stocks data out at noon ET

• PBOC ramps up net purchases of sovereign bonds in September

| CHINA UPDATE |

— China’s Manufacturing PMI falls below expectations, signaling weakest activity since July 2023. The Caixin China General Manufacturing PMI dropped to 49.3 in September 2024, missing forecasts and marking the lowest level since July 2023. New orders saw a renewed downturn, reaching a two-year low, while foreign sales declined the most in 13 months. Employment and purchasing levels also fell, reflecting subdued market conditions. Despite a marginal rise in output, growth was the slowest in the current cycle. Input prices dropped due to lower raw material costs, while output prices fell at the fastest rate in six months amid intensified competition. Business sentiment hit its second-lowest level on record.

— China’s sow herd contracts. China’s sow herd stood at 40.36 million head at the end of August, down 4.8% from a year earlier, according to the ag ministry. The sow herd was modestly smaller than the 40.41 million head at the end of July.

Several factors appear to be driving this contraction in China’s sow herd:

• Low prices: Swine and pork prices have been low, causing losses for producers and leading to herd liquidation.

• Disease issues: Lingering animal diseases, including African swine fever (ASF), have continued to affect the sector, particularly in North China.

• Market oversupply: The aggressive expansion of China’s swine herd in 2020-2021 led to production exceeding market demand.

• Producer exits: More small- and medium-sized producers have exited the market due to financial challenges and difficulty obtaining loans.

The contraction in the sow herd is part of larger shifts in China’s pork industry:

• Shift to large-scale production: The share of large-scale swine producers versus small- to mid-sized producers is growing significantly.

• Improved efficiency: With fewer inefficient sows, the number of piglets weaned per sow per year has improved.

• Production forecast: Despite the sow herd decline, China is still expected to produce 695 million head of swine in 2024, though this represents a 3% year-on-year decline.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— FDA chief warns of bird flu pandemic risk, updates on food labeling efforts. FDA Commissioner Robert Califf raised concerns about the threat of avian influenza, highlighting the significant number of U.S. dairy cattle infected. He warned that a mutation allowing the virus to infect humans could trigger the next pandemic. While current containment measures are focused on farms, Califf emphasized the need for robust surveillance systems.

Meanwhile, he expressed optimism about finalizing new definitions for “healthy” food labels and progressing with front-of-pack labeling initiatives, which he believes will drive industry change.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |