News/Markets/Policy Updates: Oct. 15, 2024

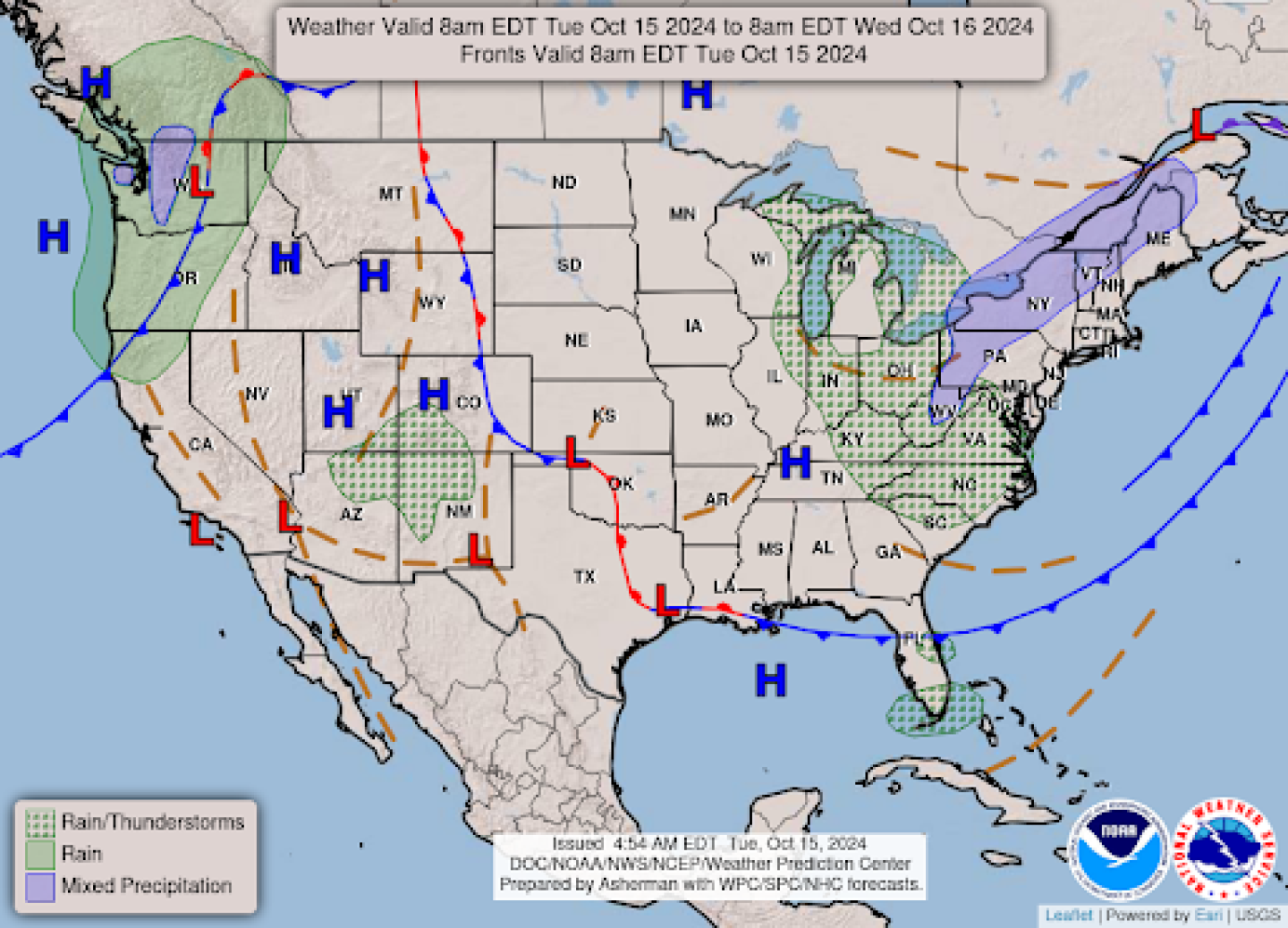

Note: Abbreviated format today as I am in Kansas City for a speech. — Equities today: Asian and European stock indexes were mixed overnight. U.S. stock indexes are pointed to mixed to slightly firmer openings. In Asia, Japan +0.8%. Hong Kong -3.7%. China -2.5%. India -0.1%. In Europe, at midday, London -0.5%. Paris -0.7%. Frankfurt +0.4%. U.S. equities yesterday: The Dow finished up 201.36 points, 0.47%, at 43.065.22. The Nasdaq was up 159.75 points, 0.87%, at 18,502.69. The S&P 500 gained 44.82 points, 0.77%, at 5,859.85, notching its 46th record close of the year. It’s now up 23% this year after adding 0.8% today. The Nasdaq Composite is up slightly more than 23% this year. Earnings reports today: Goldman Sachs, UnitedHealth, Bank of America, Citigroup, Johnson & Johnson, Progressive, United Airlines, and Walgreens Boots Alliance. — Ag markets today: Corn, soybeans and wheat extended recent losses during the overnight session. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 6 to 7 cents lower and wheat futures were 1 to 3 cents lower. Front-month crude oil futures were more than $3.00 lower, and the U.S. dollar index was around 135 points lower. Cash cattle rally continues, but short-term top likely close. Cash cattle averaged $187.21 last week, up 32 cents and the fifth consecutive weekly gain. During that span, cash cattle prices have firmed $6.03. Wholesale beef prices firmed Monday, with Choice up $2.10 to $313.32 while Select rose 38 cents to $289.10. Some packer margins are back in the black, but after the recent string of purchases, including last week’s tally that was the highest since June, a short-term top in the cash market is likely close. Cash hog index slides. The CME lean hog index is down 13 cents to $84.16 as of Oct. 11. After sharp losses on Monday, December hogs held an $8.36 discount to today’s cash quote, suggesting traders sense the cash index will drop about an average of $1.00 per week through mid-December. — Agriculture markets yesterday: — Ag trade: Jordan made no purchases in its tender to buy up to 120,000 MT of optional origin milling wheat; a new tender is expected to be issued. — Train derailment causes temporary halt to U.S. grain movement to Mexico. Mexican rail consortium Ferromex and U.S. railroad company Union Pacific Corp said they have stopped issuing permits for some grain rail shipments moving through Eagle Pass, Texas, after a recent train derailment in Mexico closed the track. The halt is a temporary measure until rail traffic gets cleared after the track reopened, Ferromex told Reuters. Total volume of grain movement between Union Pacific and Ferromex will not be affected. — Turkey relaxes wheat import rules. Turkey relaxed its wheat import rules ahead of the scheduled expiry of a ban. In June, Turkey banned wheat imports until Oct. 15 to protect farmers from low prices, promote domestic procurement of grains by the Turkish state grain board (TMO). The head of the Turkish Flour Industrialists’ Federation told Reuters, “Wheat imports have been allowed for millers and product exporters, with 85% of purchases to be made from grain board stocks and after purchase is fulfilled, the remaining 15% through private imports.” These new rules are expected to extend until the end of the year. — California reports five more possible human H5N1 cases. California is investigating five possible human cases of the H5N1 virus among dairy farm workers, in addition to the six cases previously confirmed in the state. The possible and confirmed cases originated on nine different dairy farms and the individuals had mild symptoms and were not hospitalized, the state said. — China’s meat imports remain weak. China imported 541,000 MT of meat during September, down 24,000 MT (4.2%) from August and 54,000 MT (9.1%) less than last year. Through the first nine months of the year, China imported 4.94 MMT of meat products, down 770,000 MT (13.5%) from the same period last year. — China may raise $850 billion in new debt to boost economy and ease local government debt burden. China is considering issuing 6 trillion yuan ($850 billion) in special treasury bonds over the next three years to support economic growth and reduce local government debt. Though some markets were underwhelmed by the scale of the plan, it is expected to stabilize near-term growth. The funds will mainly provide liquidity for local governments and big banks, aligning with President Xi Jinping’s focus on maintaining China’s industrial and technological leadership. Further details will be discussed in an upcoming National People’s Congress meeting. — Fed’s Waller urges cautious, gradual rate cuts amid strong economy and uncertain data. Federal Reserve Governor Christopher Waller emphasized a cautious approach to future rate cuts, citing strong labor market data and disappointing inflation figures. Speaking at Stanford’s Hoover Institution, Waller suggested moving monetary policy toward a neutral stance at a “deliberate pace” due to recent economic resilience. He noted that upcoming October payrolls could be impacted by hurricanes and strikes, potentially reducing jobs by over 100,000. Waller reaffirmed plans to gradually cut rates over the next year, while reserving the option to pause if inflation escalates. The Federal Reserve will probably need “further modest reductions” in interest rates in the coming quarters, according to Minneapolis chief Neel Kashkari. “Ultimately, the path ahead for policy will be driven by the actual economic, inflation and labor market data,” Kashkari said Monday in Buenos Aires at a conference held by the Central Bank of Argentina. While Kashkari described the Fed’s current policy stance as restrictive, he said the extent to which it’s restrictive is “unclear.” Kashkari said the labor market remains strong and the most recent jobs report provided encouragement that “a rapid labor weakening does not appear to be imminent.” He added that inflation had “come down dramatically from its peak but remains somewhat above our target.” — OPEC lowers global oil demand growth forecasts for third straight month amid slowing fuel use. OPEC cut its global oil demand growth forecast for 2024 by 106,000 barrels per day, marking the third consecutive downgrade as fuel consumption slows. The group now expects a 1.9 million barrel-per-day increase in demand next year. Despite the reductions, OPEC’s estimates remain higher than those of Wall Street and the International Energy Agency. Meanwhile, Iraq reduced its production significantly, though it still exceeds its agreed quota, and other members like Kazakhstan and Russia continue to struggle with compliance. OPEC+ will meet in December to review its output strategy for 2025. — Donald Trump will be interviewed by Bloomberg editor-in-chief John Micklethwait today at the Economic Club of Chicago. He’ll also participate in town halls with Fox News and Univision to be aired on Wednesday. Kamala Harris is scheduled to campaign in Michigan tomorrow, and in Pennsylvania and Wisconsin on Wednesday and Thursday, respectively. She is also set to be interviewed Wednesday on Fox News by Bret Baier, Fox News channel’s chief political anchor. The interview will be taped in Pennsylvania and air at 6 PM ET during Baier’s show Special Report program. This marks Harris’ first formal sit-down interview with Fox News. It comes as she intensifies her media engagements in the final weeks of the presidential race. Reasons for the Fox interview Of note: Baier has stated that there are no preconditions for the interview, and all topics are open for discussion. This appearance is part of a broader trend of Democratic figures appearing on Fox News to reach swing voters and break out of traditional media bubbles. — Harris launches outreach blitz to boost support among Black men ahead of Election Day. With three weeks until Election Day, Vice President Kamala Harris and her allies are intensifying efforts to connect with Black men, a crucial voting demographic. Harris unveiled an economic plan targeting Black entrepreneurs and promoted policies like forgivable business loans, apprenticeship programs, and support for legalizing marijuana. At the same time, events like a celebrity-led NFL watch party in Detroit aim to galvanize voter turnout. This push follows former President Obama’s controversial remarks, which some say alienated Black male voters. Polling shows Harris facing stronger competition from Trump among Black men compared to Black women. — Trump vows to renegotiate USMCA, targeting Chinese automakers and boosting U.S. auto industry if elected in 2024. Donald Trump on a Sunday news show expressed his intention to renegotiate the United States-Mexico-Canada Agreement (USMCA) if he is elected president in 2024. Trump stated that he will formally notify Mexico and Canada of his intention to invoke the six-year renegotiation provisions of the USMCA upon taking office. The review of the agreement is scheduled to commence on July 1, 2026, as stipulated by a clause in the USMCA. Trump’s main reasons for wanting to renegotiate the USMCA include: To achieve his goals, Trump suggested several measures: Despite his criticism of current trade arrangements, Trump has praised the USMCA, referring to the agreement as a “great deal” and an improvement over NAFTA. He acknowledged the need for cooperation. Mexico’s response: Mexican President Claudia Sheinbaum has indicated that her government is prepared to review and renegotiate the trade pact, regardless of who wins the U.S. election. The proposed changes could have significant implications for the auto industry, particularly for U.S. automakers with manufacturing plants in Mexico. Trump’s stance on trade and his focus on protecting U.S. manufacturing are part of his broader appeal to working-class voters, particularly in key states like Michigan. These proposals are part of Trump’s campaign platform, and their implementation would depend on various factors, including his potential election and the complex process of international trade negotiations. — RFK Jr., criticizes U.S. agricultural policies, promotes sustainable farming in social media video. Robert F. Kennedy Jr., an independent presidential candidate, has taken a strong stance against current agricultural policies in the United States. In a recent video posted on social media platform X, Kennedy outlined his vision for transforming America’s farming system. Kennedy asserted that America’s current agricultural policy is “destroying America’s health on every level.” He stood outside USDA’s building in Washington, D.C. to deliver this message, symbolizing his intention to change the system from within. He promised that “when Donald Trump gets me inside the building I’m standing outside right now,” he will rewrite regulations to benefit smaller agricultural operators. This approach aligns with his broader campaign promise to challenge large corporations and support small businesses. A key aspect of Kennedy’s agricultural vision is the promotion of sustainable and regenerative farming practices. He believes these methods can help build soil quality and replenish aquifers. Kennedy pledged to ban agricultural chemicals that are already prohibited in other countries. This aligns with his campaign’s focus on environmental protection and public health. He also promised to remove conflicts of interest from USDA dietary panels, suggesting a reform in how nutritional guidelines are determined. Implementing such sweeping changes would likely face significant challenges, given the entrenched nature of current agricultural systems and the economic interests involved. Kennedy made these statements while soliciting campaign donations, indicating that agricultural reform is a key part of his campaign platform and appeal to potential supporters. — Texas A&M’s Bart Fischer suggests $20 billion disaster aid package for farmers after Hurricane Helene, including commodity payments. Dr. Bart Fischer, co-director of the Agricultural and Food Policy Center at Texas A&M University, has suggested that a potential disaster aid package in response to Hurricane Helene could include commodity payments to farmers. This proposal comes as Southern lawmakers are calling for disaster assistance legislation following the hurricane’s devastation. Fischer outlined several key points regarding the potential disaster aid package, according to the Texas Farm Bureau: This potential disaster aid package is being discussed against the backdrop of several critical issues facing American agriculture: He noted that there has been no disaster assistance for farmers in both 2023 and 2024, despite rising production costs. Bottom line: Washington insiders give high odds of a combined disaster aid/ag financial aid package being approved in the post-election lame-duck session of Congress. There is still a lot of uncertainty as to whether Congress will complete a new farm bill this calendar year. Key to that is whether outgoing Senate Ag Chair Debbie Stabenow (D-Mich.) releases official farm bill text for the Senate to consider. — Mexican President Claudia Sheinbaum has reaffirmed Mexico’s ban on the planting and consumption of genetically modified (GMO) white corn, emphasizing the country’s commitment to food sovereignty. Mexican Secretary of Agriculture Julio Berdegué Sacristán reiterated that no transgenic white corn will be produced or consumed in Mexico. This stance challenges U.S. trade policies under the USMCA, with the U.S. having filed a case against Mexico’s policy. Mexico aims to be self-sufficient in white corn, beans, and other crops while promoting fair trade for agricultural products. Sheinbaum made the comments in her Oct. 1 inaugural speech. — Bloomberg interviews USTR Katherine Tai. Highlights: • U.S. tariffs on China: “At the moment we are not negotiating anything with the PRC on trade, but one day we may be back at the table, in which case these tariffs will be useful as leverage, right?” One reason for the continuation of the tariffs “is we really haven’t seen the PRC make any changes to its fundamental systemic structural policies that would make sense for us to provide any relaxation,” she said. • Worker-centered approach: The Biden administration sees tariffs as “useful, especially if you can combine them with other economic policies” designed to help workers, she said. Tariffs can also be an “effective part of a new kind of industrial policy that both allows you to try to level the playing field and to create this defensive wall to prevent these unfairly produced, excessively produced goods from flowing into your market,” Tai said. • Trade policy coordination: “I would say on say the EV tariffs, the solar tariffs, steel and aluminum, you see us really converging around a more coordinated kind of defense with the Canadians, even with the Mexicans to some degree,” she said. The U.S. still has “challenges with Mexico, but the Mexicans did something very important when on steel for example, they increased their tariffs on all their non-FTA partners in August of 2023,” according to Tai. “Then also with the Europeans too, actually creating a defensive system on EVs.” • WTO leadership race: “There’s a period of time when others who may be interested can throw their hat in the ring. And then once you know what the field looks like, then there’s a whole other process that goes from there,” Tai said. Because it’s a process that’ll take several months, “I think that that’s what you’re seeing playing out in Geneva right now,” she said. “From our perspective, we are going to ensure that the integrity of the process is respected.” — Weak La Niña expected to bring warmer winter across Southern and Eastern U.S. A weak La Niña is forecast to develop before winter, bringing warmer-than-normal temperatures across the southern U.S. and much of the East. This could result in wetter winter storms in these regions rather than snowier conditions. La Niña’s cooler Pacific waters impact global weather patterns, and this year’s weaker event contrasts with the colder, wetter winter of 2023, which was dominated by El Niño. Last winter was the warmest on record for the Lower 48, influenced by both El Niño and climate change. — NWS outlook: Unsettled weather along with high elevation snow to impact parts of the Northwest, Intermountain West, and northern Rockies over the next few |