News/Markets/Policy Updates: Oct. 29, 2024

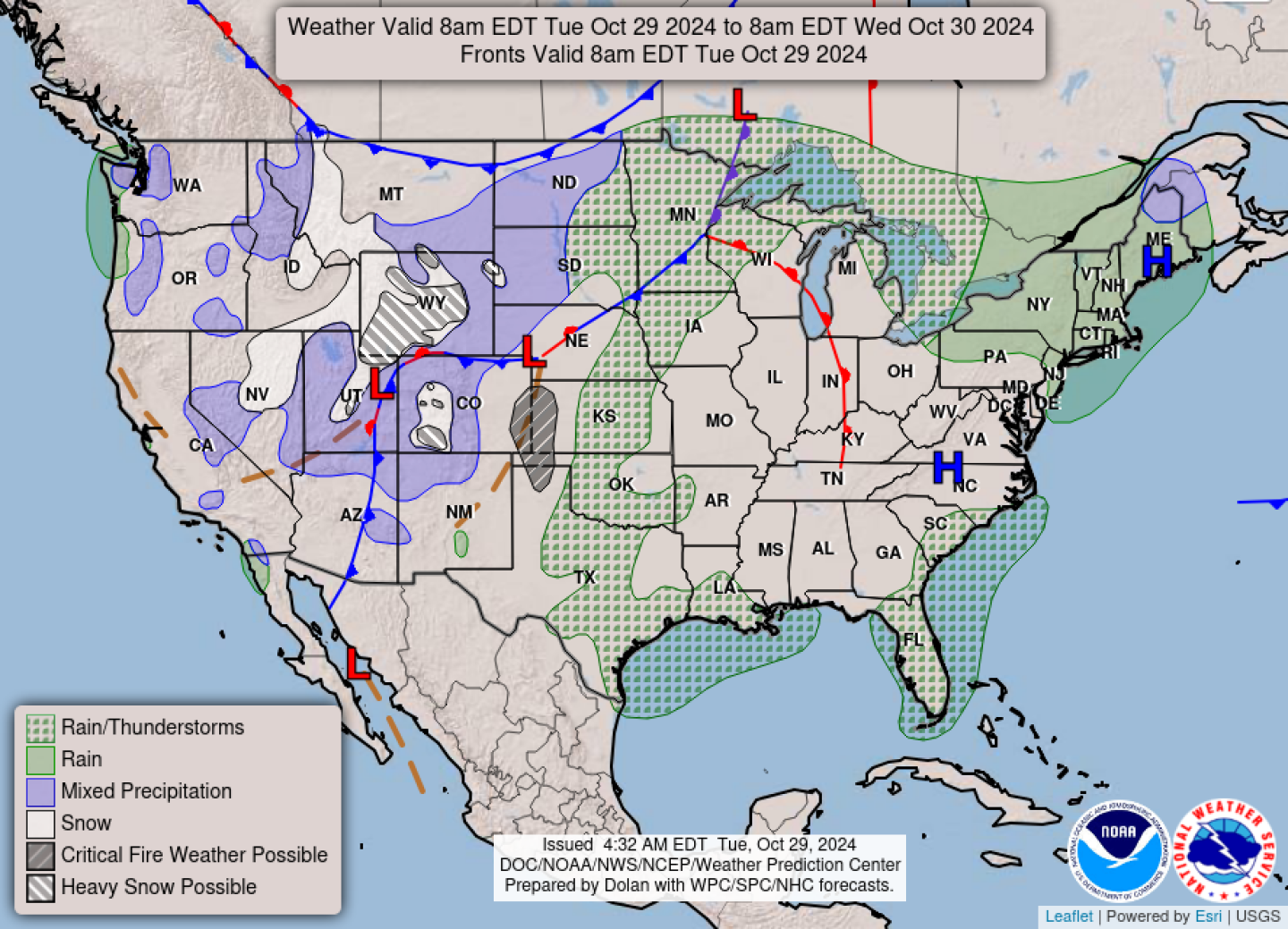

Note: Abbreviated format today as I am in Colorado Springs at a CIPA event. — Equities today: Asian and European stock indexes were mixed overnight. U.S. stock indexes are pointed to slightly lower openings. U.S. equities yesterday: U.S. stocks climbed on Monday. The tech-heavy Nasdaq Composite jumped 0.26% to 18,567.19 , while the S&P 500 rose by 0.27% to 5,823.52. The Dow moved up more than 250 points, 0.65%, leading the gains, to 42,387.57. — McDonald’s Q3 earnings beat expectations despite E. coli outbreak. McDonald’s reported third-quarter earnings that exceeded Wall Street forecasts, with adjusted earnings per share at $3.23 and net sales reaching $6.87 billion. However, the positive results come amid fallout from a deadly E. coli outbreak linked to its Quarter Pounder burgers’ onions, with 75 cases reported, including one death. — U.S. Dept. of Energy announced a new solicitation to purchase up to 3 million barrels of oil for the Strategic Petroleum Reserve (SPR). This move comes in response to recent price declines in oil markets and aims to replenish the nation’s emergency oil stockpile. The SPR has been depleted to approximately half of its level when President Biden took office. The current solicitation for up to 3 million barrels is part of an effort to begin refilling the reserve. The announcement of this purchase has had a positive effect on oil prices. Delivery is expected to take place in April and May. The crude oil will be delivered to the SPR sites. — Ag markets today: Corn, soybeans and wheat rebounded amid modest corrective buying during the overnight session. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents higher, while soybeans and wheat were 3 to 5 cents higher. Front-month crude oil futures were around 90 cents higher, and the U.S. dollar index was modestly firmer. Choice beef continues to strengthen. Wholesale beef prices were widely mixed on Monday, as Choice firmed another $1.26 to $323.50 while Select dropped $2.90 to $292.18. That widened the Choice/Select spread to $31.32. Movement remained strong at 156 loads, including 60.9 boxes of Choice beef. Cash hog fundamentals extend contra-seasonal strength. The CME lean hog index is up another 12 cents to $85.55 as of Oct. 25, the seventh straight daily gain. During that span, the index has firmed $1.69. December lean hog futures finished Monday $4.925 below today’s cash quote. The pork cutout jumped $3.01 on Monday to $101.95 amid strong gains in all cuts. Ag trade: South Korea purchased 136,000 MT of corn to be sourced from the U.S., South America or South Africa. — Agriculture markets yesterday: — Ukraine’s winter grain seeding nearing completion but crops need rain. Ukrainian farmers had seeded 4.68 million hectares of winter grains for harvest next year as of Oct. 28, or 90.2% of the expected area of 5.19 million hectares, the agriculture ministry said. That included 4.13 million hectares of winter wheat, or 92.2% of the projected area, along with 486,100 hectares of winter barley and 66,000 hectares of rye. Ukraine’s state weather forecasters said last week that most of the country’s winter crop was under-developed due to drought. — Some grain handlers strike at Australian exporter GrainCorp. The Australian Workers’ Union (AWU) said GrainCorp handlers in New South Wales – one of the country’s biggest growing regions – would conduct impromptu hour-long strikes over the next 30 days with as little as 10 minutes warning. “We’ll be taking action at peak work periods, if a train comes in, if trucks line up,” said AWU official Tony Callinan. He said around 200 workers were taking part in the work stoppages due to pay raises being far below the rate of inflation during a period of healthy company profits. GrainCorp says the stoppages won’t impact exports but will slow down grain deliveries for farmers. — Indonesia considers importing additional rice from India. Indonesia is considering a plan to import 1 MMT of rice from India in 2025 to secure supply until its main harvest, Coordinating Minister for Food Affairs Zulkifli Hasan said after a meeting of food and agricultural officials. Indonesia’s rice output is estimated to fall 2.43% this year to 30.34 MMT due to a delay in planting and harvest season amid longer dry weather in 2023, the statistics bureau said earlier this month. — Harris and Trump make final push as Election Day nears. With one week until Election Day, Vice President Kamala Harris is set to deliver a pivotal campaign speech at the Ellipse, near the White House. Meanwhile, former President Donald Trump will be rallying supporters in Pennsylvania, visiting Drexel Hill and Allentown. Voter turnout is already surging, with over 43 million ballots cast across 47 states and the District of Columbia. — Authorities investigate fires at ballot boxes in Oregon and Washington. Federal investigators are probing coordinated arson incidents targeting ballot boxes in Portland, Oregon, and Vancouver, Washington, destroying hundreds of ballots. Authorities believe the attacks were “targeted and intentional,” and they come amid heightened warnings from the FBI and DHS about potential election-related violence driven by voter fraud grievances. — The U.S. finalized new restrictions on China’s access to advanced semiconductor technology, particularly focusing on artificial intelligence (AI) chips and related investments. This move is part of an ongoing effort by the U.S. government to limit China’s technological advancements in critical areas. These restrictions, set to take effect on Jan. 2 and aim to prevent American capital and expertise from aiding China’s development of technologies that could pose national security risks. China has already taken some retaliatory measures and is likely to continue responding to these restrictions. — Israel bans UN Palestinian refugee agency amid Gaza war tensions. Israel’s parliament banned the UNRWA, blocking the Palestinian refugee agency from operating in the country despite international backlash. UN officials warn this could have “devastating consequences” for millions of Palestinian refugees under Israel’s control. The ban follows strained relations between Israel and the UN, with Israel accusing UNRWA staff of aiding in Hamas’ Oct. 7 attack —a claim the agency denies. Meanwhile, Israeli airstrikes in eastern Lebanon have killed dozens amid escalating clashes with Hezbollah, according to Lebanese officials. — President Joe Biden is visiting the Port of Baltimore in Maryland today to announce a $3 billion investment aimed at improving and electrifying port infrastructure across the United States. The $3 billion investment comes from the Inflation Reduction Act. It will be distributed as grants through the Environmental Protection Agency’s Clean Ports Program. The funding will be awarded to 55 projects across 27 states and territories. The investment is designed to achieve several objectives: — GOP lawmakers demand answers from USDA on Pure Prairie Poultry bankruptcy. Republican lawmakers have called on USDA to provide explanations regarding the oversight of Pure Prairie Poultry, Inc., which filed for bankruptcy shortly after receiving substantial USDA funding. The situation has raised concerns about the department’s management of grants and loans, as well as its impact on farmers and the poultry industry. Background. Pure Prairie Poultry, a Minnesota-based chicken company, received $45.6 million in USDA funding in 2022 to expand its processing plant in Charles City, Iowa. This funding included a $7 million grant from the Meat and Poultry Processing Expansion Program and a $38.7 million loan from the Food Supply Chain Guaranteed Loan Program. Less than two years after receiving the funding, Pure Prairie Poultry filed for bankruptcy and closed its Charles City processing plant on Oct. 2, 2024. This closure had severe consequences: Republican lawmakers from Iowa, Minnesota, Wisconsin, and other states have expressed their concerns in a letter (link) to Secretary of Agriculture Tom Vilsack. U.S. Rep. Randy Feenstra (R-Iowa) one of the signatories, stated: “Our letter to USDA will help us get answers for our growers and address the federal government’s carelessness with taxpayer dollars.” The letter requests explanations on several key points: Sen. Chuck Grassley (R-Iowa), another signatory, emphasized the need for accountability: “USDA must explain to Congress and the public what went wrong to help prevent a repeat scenario.” A USDA spokesperson defended the department’s programs, stating that they have worked to “rebuild and create new markets for U.S. farmers” after challenges posed by trade wars and the Covid-19 pandemic. The spokesperson also urged lawmakers to focus on passing the overdue farm bill: “Rather than trying to score political points, those members of Congress should work with USDA to reopen the facility and pass a new Farm Bill, which is now two years late.” The lawmakers have requested USDA respond to their questions by Nov. 8. — NWS outlook: Moderate to heavy snow over parts of the Northern/Central Rockies on Tuesday... ...Temperatures will be 20 to 35 degrees above average over parts of the Central Plains to the Great Lake/Ohio Valley... ...There is a Slight Risk of severe thunderstorms over parts of the Middle/Lower Mississippi Valley and Central/Southern Plains on Wednesday. |

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |