Updates: Policy/News/Markets, March 5, 2025

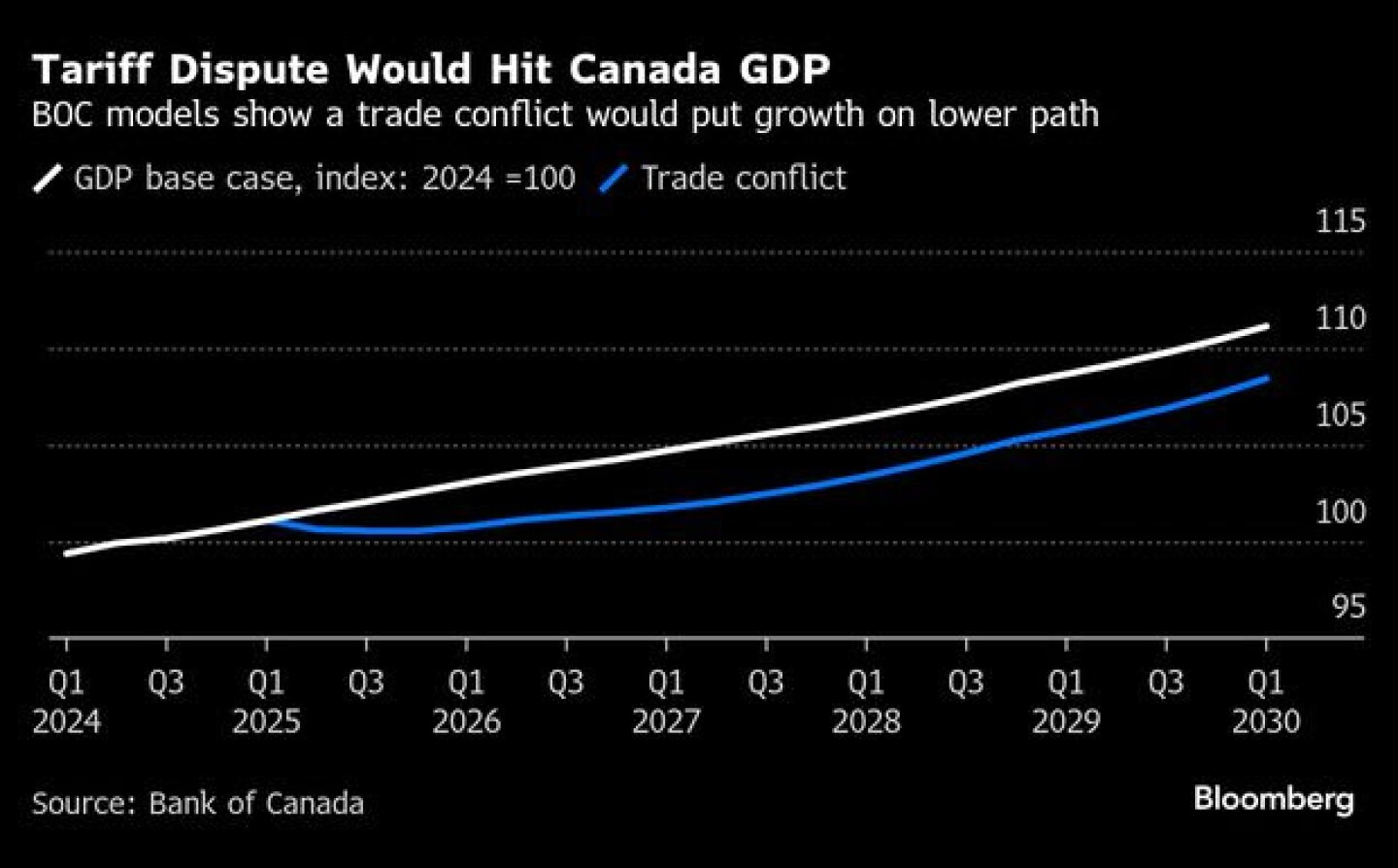

Modified report as I am en route to Nashville, Tennessee. — Zelenskyy signals readiness for swift peace talks amid U.S. aid pause. Ukrainian President Volodymyr Zelenskyy expressed his willingness to move quickly toward ending Russia’s war on Ukraine, following President Donald Trump’s decision to halt all U.S. military aid. Zelenskyy proposed initial steps, including prisoner releases and a ceasefire on missile and drone strikes, contingent on reciprocal actions from Russia. The aid freeze impacts $3.85 billion in U.S. weapons, heightening pressure on Kyiv. — China targets ‘around 5%' GDP growth amid intensifying trade war. At the opening of the National People’s Congress (NPC) in Beijing, China set its 2025 GDP growth target at “around 5%" as it faces a deepening trade war with the U.S. and weak domestic demand. Premier Li Qiang’s government work report emphasized the need for expansionary spending and boosting domestic consumption. The budget deficit target was raised to 4% of GDP, with increased issuance of special government bonds and treasury bonds to support state banks and infrastructure projects. The inflation target was lowered to 2%, reflecting deflationary pressures. The NPC will deliberate on the 2025 government plan and national budget, with sessions concluding on March 11. — China raises 2025 grain production target amid U.S. trade tensions. China has set its 2025 grain production target at around 700 million tons, up from recent goals of at least 650 million tons, as it aims to bolster food security amid a trade war with the U.S. The announcement came during the National People’s Congress, alongside new tariffs on American crops and a focus on boosting domestic soybean and oilseed production. Premier Li Qiang emphasized the importance of maintaining control over the nation’s food supply while advancing agricultural infrastructure and exploring alternatives to reduce dependence on U.S. imports. — Trump administration signals possible tariff relief for Canada and Mexico. The Trump administration may announce a path to tariff relief for Mexican and Canadian goods under the North American free trade agreement as soon as Wednesday, according to Commerce Secretary Howard Lutnick. While President Donald Trump is not expected to fully roll back the tariffs tied to the flow of fentanyl and migrants into the U.S., a compromise could see reduced tariffs if Canada and Mexico meet certain trade conditions. Lutnick emphasized that any relief would be contingent on adherence to the rules of the U.S.-Mexico-Canada (USMCA) trade pact, stating, “If you live under those rules, then the president is considering giving you relief.” Stocks dipped globally following the tariff announcement, but auto and bank stocks rebounded in post-market trading on hopes of a tariff compromise. Lawmakers on Capitol Hill, including some of Trump’s allies, urged the administration to reconsider the tariffs, warning of potential impacts on American consumers and industries. — Trump tariffs threaten Canadian economy with recession and price surge. Canada faces a potential recession as President Donald Trump’s new tariffs — 10% on Canadian energy and 25% on all other goods — threaten to cut 2 to 4 percentage points from GDP growth (although other analysts are below that range). Retaliatory Canadian tariffs on American goods could exacerbate economic woes, spiking inflation and straining the Bank of Canada’s monetary policy options. With a 95% chance of an imminent interest rate cut, economists warn of a “moderate recession” and stagflation risks as the tariff standoff unfolds. “A couple of quarterly contractions are likely for Canada, i.e., a moderate recession, before growth gradually resumes,” Sal Guatieri and Shelly Kaushik, economists at the Bank of Montreal, wrote in a report to investors. “Counter-tariffs and a weaker currency could see inflation spike more in Canada.” The key takeaway is that the impact of the tariffs on Canada will largely depend on their duration. There is uncertainty surrounding Trump’s commitment to the tariffs, as he has previously shown unpredictability by offering temporary reprieves. Economist Derek Holt suggests Trump may have introduced the tariffs for show, potentially hinting they could be short-lived. The Bank of Canada might respond by cutting interest rates, but with caution due to the potential effects on supply chains and inflation. — President Donald Trump addressed a joint session of Congress Tuesday evening, marking his first speech to lawmakers since returning to office six weeks ago. Here are the key highlights from his 100-minute address: Economic and Policy Achievements. Trump touted his administration’s swift actions in the first 43 days, claiming to have accomplished more than most administrations do in 4 or 8 years. He highlighted: Egg prices. Trump briefly mentioned working to reduce egg prices, instructing his Agriculture Secretary to “do a good job on that one.” “Trump claimed that “Joe Biden especially let the price of eggs get out of control — and we are working hard to get it back down. Immigration and Border Security. The president emphasized his administration’s efforts to curb illegal immigration: Foreign Policy and Trade. Trump addressed several international issues: Government Reform. The president highlighted his efforts to reshape the federal government: Cultural Issues. Trump leaned into cultural conflicts during his speech: Democratic Response. The speech was marked by vocal protests from Democrats: — U.S. expands influence over Panama Canal with $23 billion port deal. A consortium led by American asset manager BlackRock has agreed to purchase majority stakes in two strategic ports at both ends of the Panama Canal in a nearly $23 billion deal. The acquisition, which includes Hong Kong-based CK Hutchison’s 90% ownership of Panama’s Balboa and Cristóbal ports, strengthens U.S. influence over this critical trade route amid concerns about Chinese involvement. The transaction also provides BlackRock control of over 40 ports in 23 countries, underscoring its global reach. The U.S. is the largest user of the Panama Canal, responsible for about 70% of its shipping traffic. |

| KEY DATES IN MARCH |

5: Ash Wednesday

7: Employment report

8-20: FOMC blackout where Fed officials cannot comment on monetary policy or the economy.

9: Daylight saving time starts

11: USDA WASDE, Crop Production

12: CPI

13: PPI-FD

13: Purim Fun Jewish holiday

14: Final day of current continuing resolution (CR)

15: Tax filing deadline for partnerships and S corporations

18: NCAA men’s basketball finals

18-19: FOMC meets (interest rates)

20: Spring equinox

20: NCAA women’s basketball finals

21: USDA Chicken & Eggs report | Cattle on Feed | Milk Production

25: USDA Cold Storage report | USDA Food Price Outlook

27: USDA Hogs & Pigs report

27: MLB Opening Day

28: Personal Consumption Expenditures Price Index

29: Last day of Ramadan

31: USDA Prospective Plantings, Grain Stocks and Rice Stocks reports | Ag Prices

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | NEC task force on HPAI, egg prices | Options for HPAI/Egg prices | Trump tariffs | Greer responses to lawmakers | Trump reciprocal tariffs |