News/Markets/Policy Updates: Sept. 27, 2024

— Fed’s favorite gauge shows inflation under control. In August 2024, the U.S. personal consumption expenditure (PCE) price index rose by 0.1% month-over-month, down from July’s 0.2% increase and aligning with expectations. Service prices increased by 0.2%, while goods prices declined by 0.2%. The core PCE index, which excludes food and energy, also rose by 0.1%, lower than July’s 0.2% and the expected 0.2%. Food prices rose slightly by 0.1%, and energy prices dropped by 0.8%. Annually, the PCE inflation rate dropped to 2.2%, its lowest since February 2021, from 2.5% in July, while the core inflation rate edged up to 2.7%, as expected. This will ease the way for future interest rate cuts. Yields on interest rate-sensitive two-year Treasuries, which move inversely to prices, slipped 0.03 percentage points to 3.59% after the figures were published. Fed funds futures covering the central bank’s next meeting Nov. 6-7 suggest investors are currently split evenly between expecting a quarter-point and a half point cut. — In August 2024, U.S. personal income rose by 0.2% to $24.015 trillion, lower than the previous month’s 0.3% increase and below market expectations of a 0.4% rise. Employee compensation increased by 0.5%, with wages, salaries, and supplements also up by 0.5%. However, personal income receipts on assets declined by 0.5%, matching the previous month, as personal interest income and dividend income both shrank. Personal current transfers grew by only 0.1%, down from 0.4% in July, while contributions for government social insurance increased by 0.4%. — The People’s Bank of China (PBOC) lowered interest rates and injected liquidity into the banking system on Friday to stimulate the economy. The PBOC cut the reserve requirement ratio (RRR) by 50 basis points, freeing up about 1 trillion yuan ($142.5 billion) for banks to lend. It also reduced the seven-day reverse repo rate by 20 basis points to 1.50%. PBOC Governor Pan Gongsheng hinted at further RRR cuts. Additionally, China plans to issue 2 trillion yuan ($284.43 billion) in special sovereign bonds as part of its stimulus efforts, with some local governments potentially lifting home-buying restrictions. These moves come amid industrial profit contractions and ongoing economic challenges. Markets responded positively, buoyed by China’s recent measures and expectations of further support. — East and Gulf Coast port employers seek NLRB intervention as strike looms. Port employers have filed an Unfair Labor Practice complaint with the National Labor Relations Board (NLRB) against the International Longshoremen’s Association (ILA) for refusing to negotiate a new Master Contract. With 45,000 union workers set to strike when the current contract expires Tuesday, the employers are seeking immediate injunctive relief to force the union back to the bargaining table. The dispute centers on wages, benefits, and automation technology at East and Gulf Coast ports. The NLRB’s response timeline is unclear, and the strike deadline remains unaffected. No negotiations have taken place since June and the ILA has said they will strike as early as Oct. 1 with the current labor contract expiring Sept. 30. The group representing terminal operators and shipping lines are asking federal labor regulators to order the ILA to start negotiating. The National Labor Relations Board is highly unlikely to intervene, and the White House has already said it won’t invoke federal law to head off a walkout. The Biden administration is monitoring but not intervening. To mitigate disruption, ports like Savannah and Virginia have adjusted operations, extending hours and setting deadlines for cargo movement, according to Freight Waves. Savannah is accepting exports through Monday, while Virginia will begin shutting down on Monday, with all marine operations halting by 5 p.m. Rail carrier CSX is also preparing to curtail services to affected ports. Despite these efforts, the administration has yet to take steps to prevent the strike, leaving uncertainty about its impact. A coalition of agricultural groups has sent a letter to President Joe Biden urging his administration to take action to prevent potential disruptions at East and Gulf Coast ports due to an impending labor dispute. — Ag groups urge Biden to address port labor, Mexican rail embargoes, and Mississippi River water levels impacting U.S. agriculture. U.S. ag and farm groups sent a letter (link) to President Biden today, urging his administration to address a “trifecta of transportation trouble” affecting U.S. agriculture: port labor issues, Mexican rail embargoes, and low water levels on the Mississippi River. The letter, spearheaded by the National Grain and Feed Assn. (NGFA), requests intervention to lift Mexican-imposed rail embargoes on U.S. agricultural exports, which amount to over $30 billion annually, and asks the U.S. Army Corps of Engineers to deepen Mississippi River navigation channels to 12 feet amid historically low water levels. Senior Biden officials and key Congressional committees are also involved in the effort. — Impacts if port labor strike ensues: Economic consequences Agricultural exports at risk Supply chain disruptions. The potential strike threatens to cause significant disruptions across the agricultural supply chain: Import challenges Commodity impact — A truck carrying lithium batteries crashed near the ports of Los Angeles and Long Beach, causing a fire and leading to the closure of several terminals. The fire, which may burn for up to 48 hours, has prompted workers from the International Longshoremen and Warehouse Union to halt operations through Friday. Despite this, officials at the Port of Long Beach do not expect significant disruptions to overall cargo flow. The incident comes as shippers reroute cargo to West Coast ports due to concerns over a potential strike at East Coast and Gulf Coast ports. — The Cook Political Report says Sen. Jon Tester (D-Mont.) is the incumbent most likely to lose. That would be enough to give Republicans a one-seat majority in the next Congress. Democrats are also defending seats in Ohio and Michigan — both rated as toss-ups. — Latest election assessments from Inside Elections with Nathan L. Gonzales: • Presidential race: “Could still go either way… It looks like independent voters in seven states (Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin) will decide the election. The winning candidate likely needs to win four of those seven, although it can’t be the four smallest states… The toss-up states are all within a couple of points, but Trump is a known commodity with a low ceiling and Harris has more upside and a spending advantage, giving her a slight edge.” • Senate: “Unless Texas, Florida, or Nebraska emerge as more serious Democratic takeover opportunities, then Republicans will control the Senate next year… A Trump victory and a West Virginia win are enough for GOP control. And Montana would give Republicans a straight majority. But Republicans are also within striking distance in Ohio, Pennsylvania, Wisconsin, and Michigan, where a boost of a few points could give them a couple more seats. We’re updating our projection to a GOP gain of 2-4 seats. The Democratic path to maintaining control still exists (with Harris and Tester victories) but it’s outside the most likely range.” • House: “The close race for president mirrors a tight race for the House, where there’s at least a couple dozen races that are extremely close… Republicans are still slight favorites to hold the House. They need to win four of the 15 Toss-up races while Democrats need to win 12. Democrats need to gain four seats, and our range is still Democrats +5 to Republicans +5.” — Charlie Cook on the presidential contest: “It is now becoming abundantly clear that the presidential race is so close that it is unlikely we will be able to safely predict the outcome before Nov. 5. Worse yet, we likely won’t know the outcome for sure until after Nov. 5. (Recall that the major networks didn’t make an official call of the 2020 race until the Saturday following Election Day.) Expect the slowest vote counting in years.” — In Maryland, Democrat Angela Alsobrooks pulled ahead of Republican Larry Hogan, with an 11-point lead among likely voters in a new Washington Post-University of Maryland poll (link). — IRS eases estate basis reporting rules, scraps extra requirements. The IRS issued final regulations on estate basis reporting, offering relief from stricter proposals made in 2016. Executors must still report the value of inherited assets to both heirs and the IRS, but the final rules remove the requirement for heirs to report to the IRS when gifting inherited property. Additionally, the proposal to assign a zero basis to assets omitted from estate tax returns has been scrapped, reducing the burden on estates and tax professionals. — Harris may support limiting gain deferrals for like-kind real estate exchanges. Vice President Kamala Harris could support curbing the gain deferral allowed under like-kind exchanges of real estate, a provision viewed by some Democrats as a tax loophole benefiting businesses and the wealthy. The Biden administration’s 2025 budget proposal includes a plan to cap the amount of deferred gain from such exchanges at $500,000 per taxpayer ($1 million for joint filers), with gains above these limits being taxed immediately. This aligns with broader efforts to close perceived tax breaks for high earners. — FCC imposes $6 million fine on Biden deepfake robocaller. The FCC has finalized a $6 million penalty against Steve Kramer for sending thousands of AI-generated robocalls mimicking President Joe Biden’s voice. The calls, aimed at New Hampshire voters, encouraged them to abstain from the state’s primary election. FCC Chair Jessica Rosenworcel emphasized a strong stance against such fraudulent activities, stating, “if you flood our phones with this junk, we will find you, and you will pay.” — Donald Trump leads Kamala Harris 51% to 48% among likely voters in Arizona, according to a Fox News poll (link). Meanwhile, a separate Fox News poll (link) shows Harris leading Trump in Georgia 51% to 48% among likely voters there. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mostly firmer overnight. U.S. Dow opened higher and is currently up around 150 points as more positive stimulus news out of China is being offset by a stronger yen following Japanese election results. China’s stock market was on track for its best week since 2008 following Beijing’s announcement of stimulus packages to boost the country’s flagging economy. China is also planning a fiscal boost worth 2 trillion yuan ($280 billion), or about 1.5% of GDP, including handouts to families with two or more children, according to Reuters. In Asia, Japan +2.3%. Hong Kong +3.6%. China +2.9%. India -0.3%. In Europe, at midday, London +0.4%. Paris +0.2%. Frankfurt +0.9%.

U.S. equities yesterday: Stocks moved higher on Thursday, with the S&P 500 managing another record close while the Dow registered its second-highest finish on record. The Dow rose 260.36 points, 0.62%, at 42,175.11. The Nasdaq gained 108.09 points, 0.60%, at 18,190.29. The S&P 500 was up 23.11 points, 0.40%, at 5,745.37.

— Satellite-TV providers DirecTV and Dish Network are closing in on a merger deal. Talks between the two, first reported by Bloomberg, could create a pay-TV giant with about 19 million subscribers. Both companies have been facing a steady decline in their customer base due to cord-cutting trends and increased competition from streaming services. A merger could potentially result in significant cost savings through the consolidation of operations and infrastructure. The deal would need to clear antitrust hurdles, as it would combine the two largest satellite TV providers in the country. A similar merger attempt in 2002 was blocked by regulators due to competition concerns.

— Oil prices dropped over 3% on Thursday after a report from the Financial Times suggested that Saudi Arabia, the top crude exporter, is preparing to abandon its $100 price target as it plans to increase output, along with other OPEC members, in December. Brent crude fell $1.86 (2.53%) to $71.60 a barrel, while U.S. West Texas Intermediate declined $2.02 (2.90%) to $67.67 per barrel.

— Ag markets today: Soybeans and corn traded on either side of unchanged overnight, but are weaker early this morning, while wheat faced mild followthrough selling throughout the session. As of 7:30 a.m. ET, corn futures were trading around a penny lower, soybeans were 1 to 2 cents lower, winter wheat futures were 4 to 5 cents lower and spring wheat was 2 to 3 cents lower. The U.S. dollar index was trading just below unchanged, while front-month crude oil futures were modestly firmer.

Cash cattle trade higher. Packers actively raised cash bids on Thursday and feedlots in the Southern Plains started moving cattle at mostly $2.00 higher prices. Activity was slower to develop in the northern market, though expectations are cash trade will be sharply higher there as well.

Cash hog index, pork cutout modestly higher. The CME lean hog index is up 2 cents to $84.07 as of Sept. 25. The pork cutout firmed 54 cents to $94.64 on Thursday.

— Agriculture markets yesterday:

• Corn: December corn fell 2 cents to $4.13 1/4, closing near the intraday low.

• Soy complex: November soybean futures sunk 12 1/4 cents to $10.41 and settled near session lows. December meal futures dropped $1.40 to $326.80, settling nearer session lows. December bean oil futures dropped 125 points to 42.90 cents.

• Wheat: December SRW wheat fell 5 cents to $5.84 1/4. December HRW wheat fell 2 cents to $5.79. Both markets closed nearer their session lows. December spring wheat futures fell 2 cents to $6.15.

• Cotton: December cotton futures fell 18 points to 73.02 cents and settled nearer session lows.

• Cattle: Most-active December live cattle rose 50 cents to $184.825, with the expiring October contract surging $1.05 to $184.10. November feeder cattle rose 92 1/2 cents to $244.975. Both markets closed near the session highs and hit seven-week highs.

• Hogs: Hog futures turned lower Thursday, with nearby October falling 45 cents to $82.025.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with most foreign currencies also weaker against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 3.78%, with a mostly negative tone in global government bond yields. Crude oil futures were firmer, with U.S. crude around $67.95 per barrel and Brent around $71.30 per barrel. Gold and silver futures were weaker, with gold around $2,690 per troy ounce and silver around $32.28 per troy ounce.

— In Japan, Shigeru Ishiba’s election victory to become the nation’s next Prime Minister spurred a more than 1% rally in the yen as he is a monetary policy hawk. The yen strength is weighing on the global carry trade, specifically U.S. tech stocks. Ishiba is set to be elected prime minister on Tuesday in a vote in the Diet, a guaranteed outcome due to the LDP’s legislative majority. Speaking at a nationally televised evening news conference, Ishiba outlined challenges Japan faces, ranging from a declining population and the need to boost wages to national security issues such as an increasingly assertive China and continuing threats from North Korea. A former banker, Ishiba has been a lawmaker for nearly 40 years and brings broad ministerial experience in portfolios including defense and agriculture and has also held senior LDP posts including secretary-general, the party’s number two position.

— H&P Report may weigh on nearby futures. USDA’s Hogs & Pigs Report estimated the Sept. 1 U.S. hog herd at 76.480 million head, up 347,000 head (0.5%). The breeding herd declined 135,000 head (2.2%) to 6.044 million head. The market hog inventory increased 483,000 head (0.7%). The summer pig crop declined 265,000 head (0.8%) from last year to 35.030 million head, as a 1.7% drop in sow farrowings more than offset a 0.9% increase in the number of pigs per litter. The report data was mostly neutral compared to pre-report expectations, aside from expected near-term market hog inventories, which could weigh on nearby contracts.

— Supportive frozen meat stocks data. USDA’s Cold Storage Report showed beef stocks declined contra-seasonally during August, while pork stocks rose less than average. Both imply meat demand more than kept pace with supplies last month. Beef stocks totaled 395.2 million lbs. at the end of August, down 7.4 million lbs. from July, whereas the five-year average was a 5.1-million-lb. increase for the month. Pork stocks totaled 453.6 million lbs., up 175,000 lbs.

— USDA daily export sale:

• 20,000 MT soybean oil to South Korea, 2024-2025 marketing year.

— Ag trade update: South Korea passed on a tender to buy up to 70,000 MT of corn from South America or South Africa.

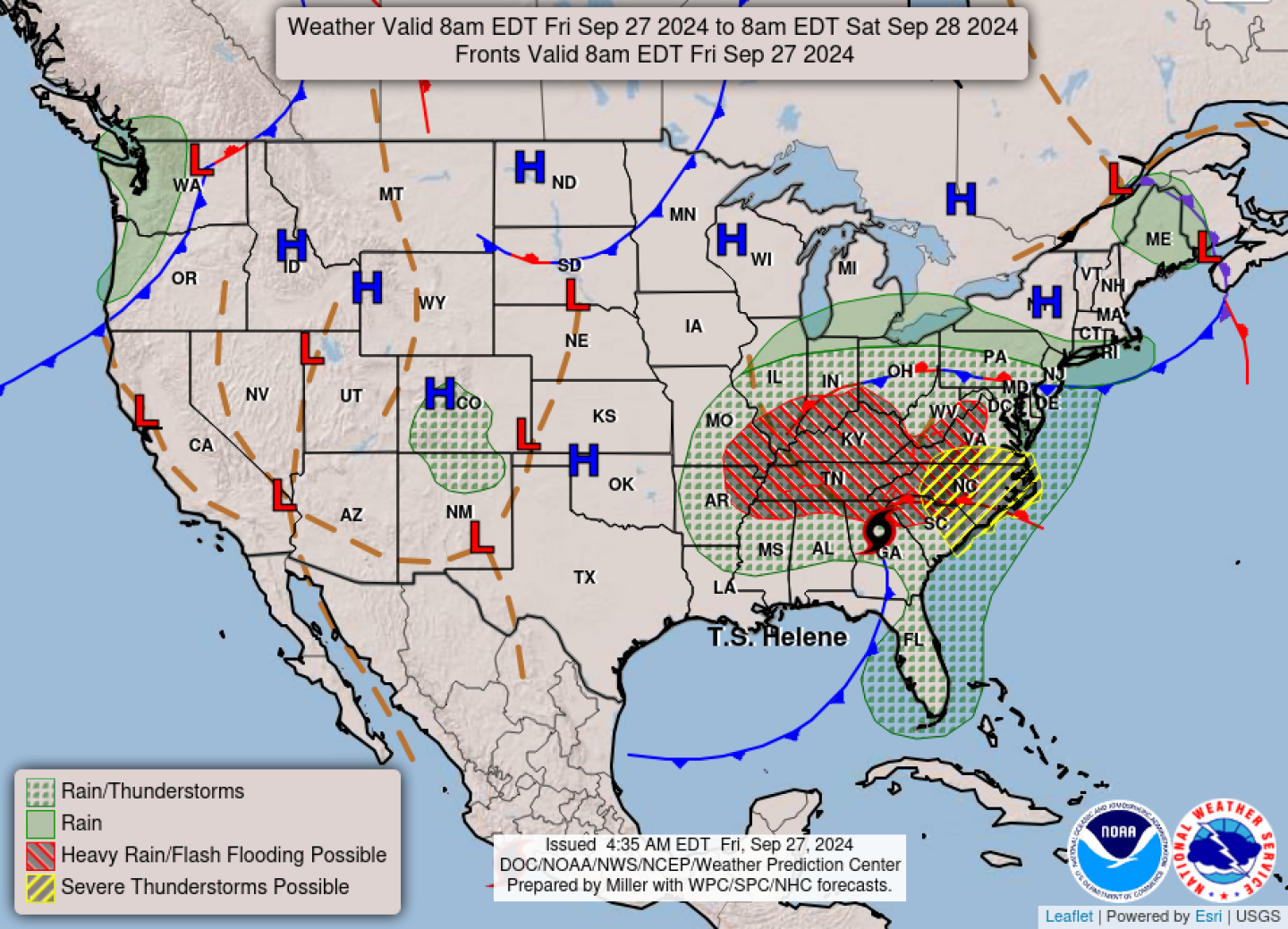

— Hurricane Helene has weakened to a tropical storm after making landfall as a Category 4 storm. As of 5 a.m. ET, the storm’s eye was over central Georgia, and it is expected to become post-tropical by late afternoon. Heavy rainfall is still anticipated, with 6 to 12 inches expected across the Southeastern U.S. and up to 20 inches in isolated areas, potentially causing major flooding. In the Gulf of Mexico, 27 production platforms remain evacuated, and 25.3% of oil production and 19.8% of natural gas production have been shut down due to the storm.

Of note: According to World Weather Inc., “The only good news for the storm from an agricultural perspective is a lower impact on cotton production areas in southwestern Georgia and immediate neighboring areas as the storm’s path veered to the east after coming inland.” Still, the timing and intensity of the storm is reminiscent of Hurricane Michael in 2018, which resulted in a 1.35-million-bale reduction to the U.S. cotton crop.

— NWS outlook: Helene is forecast to continue to move inland to the northwestward to the Ohio Valley by Saturday while slowly weakening... ...There is a High Risk of excessive rainfall over parts of the Southern Appalachians on Friday and a Slight Risk over parts of the Ohio Valley on Saturday... ...There is an Enhanced Risk of severe thunderstorms over parts of the southern Mid-Atlantic on Friday... There are Excessive Heat Warnings over parts of Southeastern California and the Southwest.

Items in Pro Farmer’s First Thing Today include:

• Grains weaker this morning

• Eurozone economic sentiment drops despite lower inflation expectations

| ISRAEL/HAMAS CONFLICT |

— Netanyahu faces domestic opposition amid U.S.-led cease-fire talks to avert regional war. Israeli Prime Minister Benjamin Netanyahu is grappling with domestic opposition while engaging in talks over a potential U.S.-backed cease-fire, aimed at preventing further escalation and a potential regional war. While agreeing to consider the U.S.-proposed three-week cease-fire, Netanyahu faces internal political pressure, especially from far-right factions that oppose any truce. Israel’s Defense and Foreign Ministers have publicly rejected the idea of a cease-fire, emphasizing military action against Hezbollah. Netanyahu’s ally, National Security Minister Itamar Ben Gvir, even threatened to leave the coalition, which could destabilize Netanyahu’s government. Led by U.S. Secretary of State Antony Blinken, Washington is attempting to broker a truce between Israel and Hezbollah, working with European and Arab states.

| RUSSIA/UKRAINE |

— Donald Trump said he will meet Volodymyr Zelenskyy in Newy York today, despite ongoing tension between Ukraine’s president and Republicans. Zelensky publicly denounced JD Vance as “too radical” after the vice-presidential nominee outlined his path to peace earlier this month. On Thursday, President Joe Biden announced more than $8 billion in military aid for Ukraine.

| CHINA UPDATE |

— Beijing signals upcoming fiscal stimulus to boost economy. The Politburo of China unexpectedly announced plans to increase fiscal and monetary support following an ad hoc meeting, signaling concerns about the economy. The leadership hinted at issuing long-term treasury and local government bonds to spur investment, alongside efforts to halt the property sector’s decline. Additional support for the stock market is also expected, with plans to remove barriers for social security, insurance, and wealth management funds. The focus will be on boosting consumption, particularly by increasing income for middle- and low-income groups. China’s leadership aims to drive short-term growth with a combination of monetary easing and fiscal measures.

Trivium China says: “What China’s economy needs even more than a one-off stimulus package are measures that boost consumption by permanently increasing households’ disposable income. That said, we’ll take what we can get. It took a while, but the cavalry is finally coming to boost short-term economic growth.”

— China’s largest industrial enterprises experienced a significant slowdown in profit growth during the first eight months of this year, growing by just 0.5%, down from 3.6% in the first seven months. August saw a sharp decline, with profits falling 17.8% year-on-year, reversing July’s 4.1% gain. This slowdown underscores Beijing’s urgency to implement stimulus measures, highlighted by an unexpected Politburo meeting focused on economic recovery (see previous item).

The profit decline is attributed to weak domestic demand, natural disasters, and a high base effect. Sectors such as mining saw a 9.2% drop in profits, while manufacturing profits increased slightly by 1.1%. To counter these challenges, Beijing has launched initiatives for large-scale equipment upgrades and a consumer goods trade-in program, supported by a 300-billion-yuan cash injection. Additionally, the People’s Bank of China has cut interest rates to further ease economic pressure.

Despite these efforts, the Chinese economy faces hurdles like property sector issues, local government financial strain, and weak investment sentiment. President Xi Jinping has called for stronger support for the private sector and economic revival efforts. The private sector saw modest profit growth of 2.6%, while state-owned enterprises experienced a 1.3% decline.

— Beijing is taking action to support China’s struggling cattle farmers due to an oversupply of beef and dairy products, which has led to falling prices. The Ministry of Agriculture (MARA) and other agencies have introduced measures to stabilize the beef and dairy industries. These include expanding production, reducing feed costs, offering credit to key farms, and investing in dairy processing. They are also encouraging local governments to issue consumer coupons to boost milk demand. Despite the challenges, no new subsidies or reserve purchases were announced, avoiding incentives for overproduction. The market reacted positively, with dairy company stocks surging. Beijing’s focus remains on food security rather than industry profits, and further intervention could occur if farmers continue culling herds.

— China’s newest nuclear submarine sinks, setback for naval expansion. China’s newest nuclear-powered attack submarine sank at a shipyard near Wuhan in late May or early June, according to U.S. officials. The incident, which China tried to cover up, is a significant setback for its naval expansion plans. The sub was the first of a new Zhou-class, built as part of China’s push to challenge U.S. naval dominance and assert maritime superiority. Salvaged in June, the vessel will take months to repair. The cause and possible casualties remain unknown, and concerns about radiation have not been addressed publicly by Chinese authorities.

— The U.S. is sending tariffs on China sharply upwards. Today it will impose higher levies on a range of Chinese-made products: up to 100% on electric vehicles, 50% on solar cells and semiconductors, and 25% on EV batteries, steel, critical minerals and more. The decision, which President Joe Biden’s administration first announced in May, stemmed from a review of the tariffs initially slapped on China by Donald Trump when he was in the White House.

| TRADE POLICY |

— USTR canceled a public hearing scheduled for Oct. 10 on Russia’s compliance with its WTO membership. The hearing was intended to gather public input for a report to Congress, but with only two submissions and no requests to appear, USTR decided to cancel the event. Link for more.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— FDA advances research to ensure dairy safety amid H5N1 outbreak in dairy cattle. The FDA is updating its efforts to safeguard dairy products during the Highly Pathogenic Avian Influenza A (H5N1) outbreak in dairy cattle. Collaborating with academic and federal partners, FDA is conducting research on inactivation methods for H5N1 in fluid milk and cheese production. Key initiatives include thermal and viral inactivation studies, virus viability testing, and exploring genome-edited chickens to reduce avian virus susceptibility. FDA reassured the public that the commercial milk supply remains safe, with ongoing sampling and testing. Further updates are expected in the coming months.

| OTHER ITEMS OF NOTE |

— Cotton AWP moves higher. The Adjusted World Price (AWP) for cotton rose to 61.06 cents per pound, effective today (Sept. 27), up from 58.83 cents per pound the prior week and the first time back above 60 cents per pound since the week of May 24. Meanwhile, USDA said Special Import Quota #24 would be established Oct. 3 for the import of 38,901 bales of upland cotton, applying to supplies purchase not later than Dec. 31 and entered into the U.S. no later than March 31.

— A recent Univ. of Illinois study found that nitrogen fertilizer offers limited benefits for modern, high-yielding soybeans. While nitrogen applications increased yields in most cases, the boost was not significant enough to cover the cost of the fertilizer. Soybeans naturally fix nitrogen through a symbiotic relationship with bacteria, making additional nitrogen largely unnecessary. However, in specific soils with limited early-season nutrients, a single nitrogen application at planting showed some yield benefits. Overall, researchers advise against using nitrogen fertilizer for soybeans in most cases, as it’s unlikely to improve profitability. Link for details.

— Farm groups submit comments, petition to EPA on draft insecticide strategy. The coalition letter, signed by over 200 organizations, criticized the EPA for denying a request to extend the public comment period, despite receiving 27 requests from over 250 organizations. The groups emphasized the critical role insecticides play in preventing crop loss, managing pest resistance, and maintaining conservation practices. They warned that without access to these tools, U.S. agriculture could suffer significant economic and environmental consequences, potentially leading to higher consumer prices.

The comments also highlighted the complexity and cost of the proposed regulations, including the burdensome calculations farmers would need to make for compliance. The groups suggested that EPA could introduce more affordable and practical alternatives, such as training courses, to ease the regulatory burden. The petition, signed by 772 growers and applicators, echoed these concerns and urged EPA to reconsider the proposal, calling it complex and flawed. Both documents also requested revisions to the EPA’s risk assessment process for species, arguing that it is overly conservative.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |