News/Markets/Policy Updates: Oct. 9, 2024

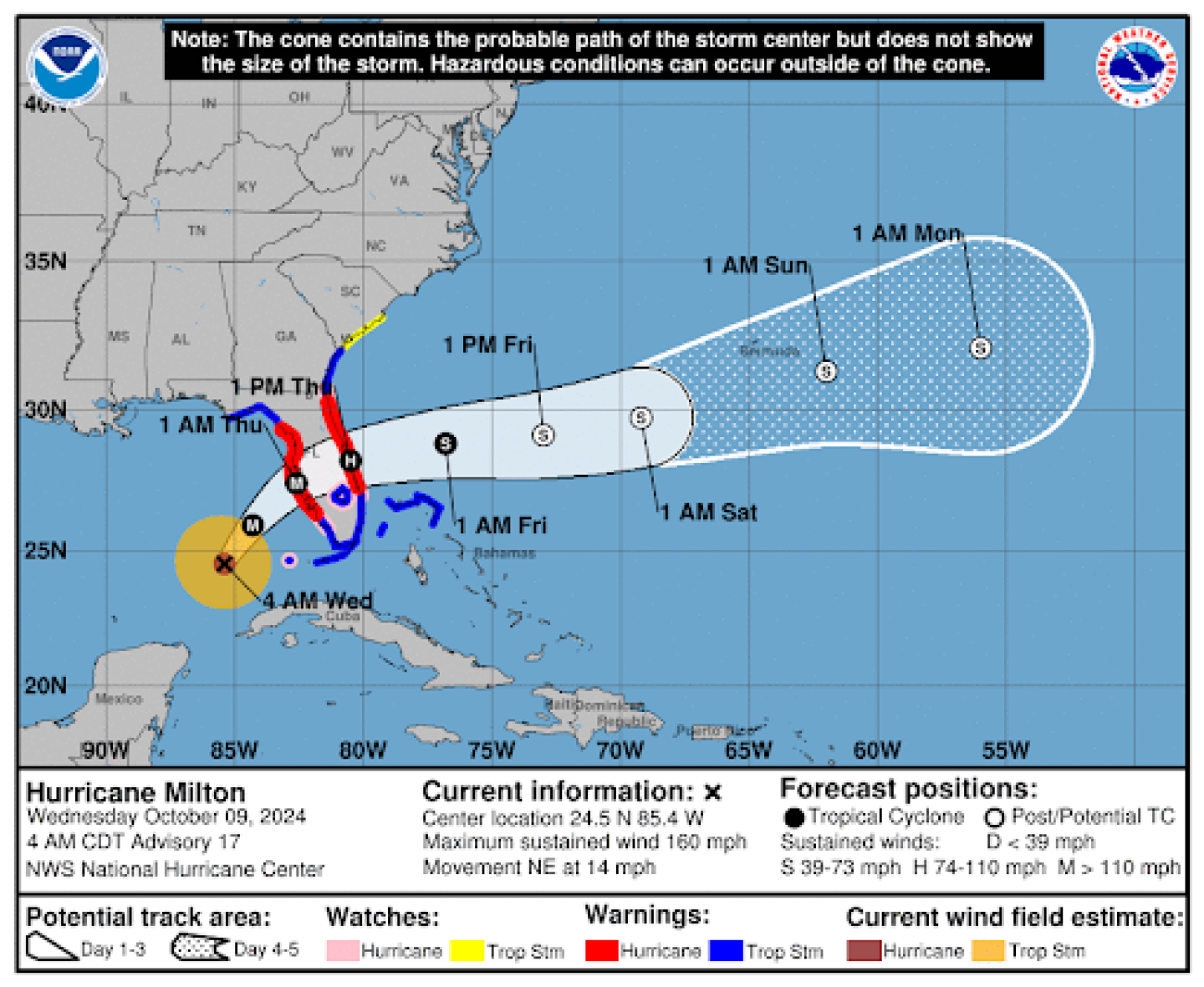

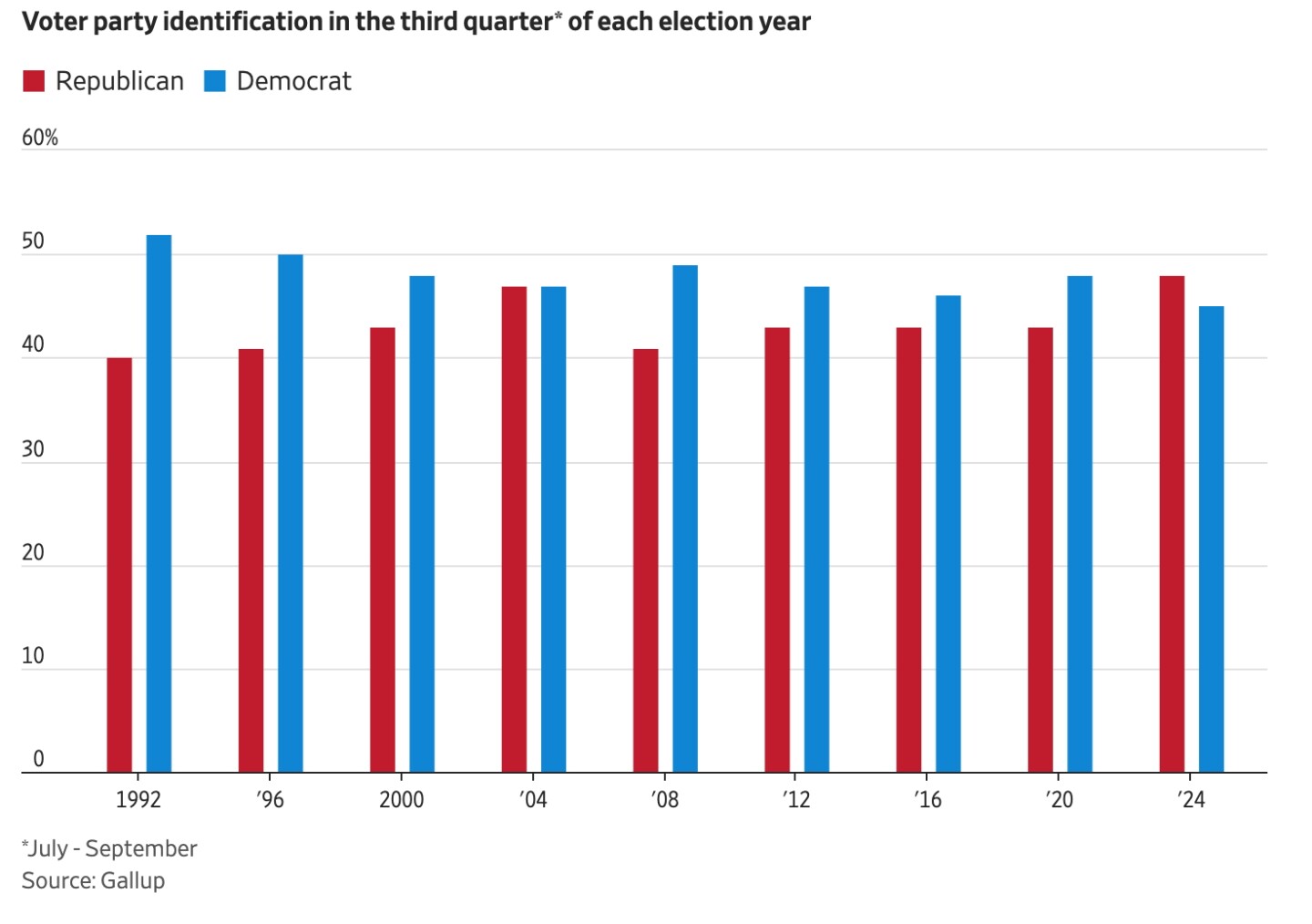

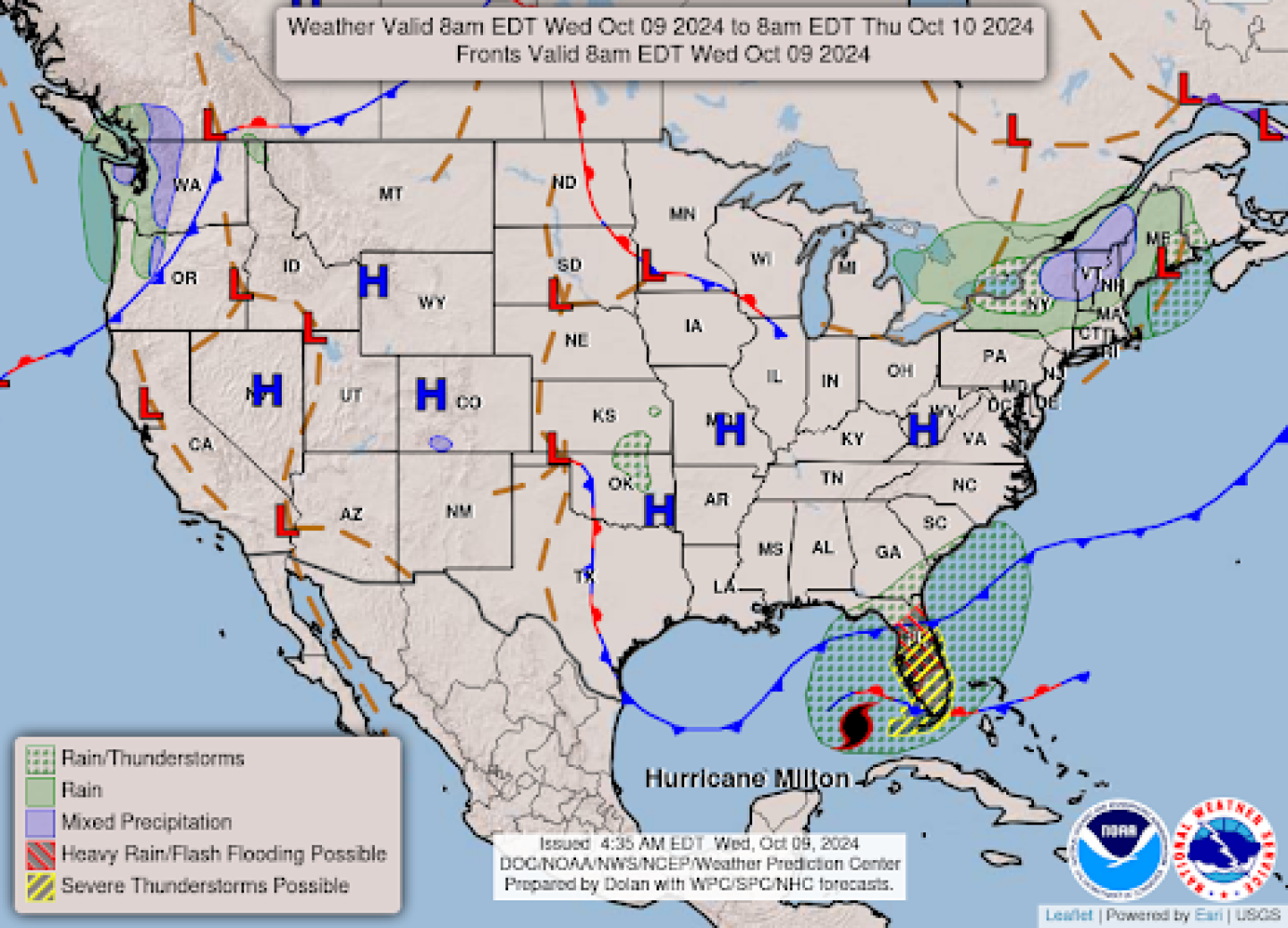

— Hurricane Milton is on track to make landfall on Florida’s Gulf Coast tonight as a Category 4 storm with sustained wind speeds near 130 mph, according to the National Hurricane Center. Its path wobbled farther south than expected Tuesday, leading to a southern shift in the forecast. Current trajectories show the storm barreling toward Sarasota, just south of Tampa Bay. Nearly 20 million people are under hurricane or tropical storm warnings. Forecasters warn of severe storm surges, flooding, and dangerous winds, while officials urge evacuations and scramble to clear debris left by Helene, fearing it could cause further damage when Milton makes landfall. More than 1,600 gas stations in Florida have run out of fuel as residents in Hurricane Milton’s path try to evacuate. Officials say the state’s reserves are falling due to panic buying and drivers topping off tanks, which can make shortages worse. Some 5,000 members of the National Guard have been deployed, with another 3,000 standing by. Facts and figures. The past two weeks of hurricane season have been marked by an unusual shift from an initially quiet phase to an unprecedented surge of activity, resulting in the formation of Helene and Milton. Between Sept. 26 and Oct. 6, five hurricanes formed, surpassing the previous record of two in the same timeframe, according to the Associated Press. Meanwhile, the Tampa and Fort Myers regions could see property losses that together top $240 billion, analysts at Jefferies, the investment bank, said in a research note. That would make Milton the costliest hurricane in U.S. history — surpassing Katrina in 2005 ($192.5 billion). Link to a Bloomberg graphic to tracking the hurricane. — Milton-related postponements. President Biden, who was scheduled to travel Thursday to Germany and then Angola, announced he would instead remain at the White House to monitor the Milton emergency. Meanwhile, the approaching storm forced Univision to cancel a planned Miami town hall interview, scheduled Tuesday night with former President Trump. Biden said he directed his administration to help save lives and provide assistance “before, during and after” the extreme weather events — “and that’s being done,” he added. The White House released a fact sheet (link) to outline administration responses to date. — FEMA to investigate conspiracy theories hampering Hurricane Helene relief efforts. FEMA Administrator Deanne Criswell announced plans to investigate the source of conspiracy theories that are hindering relief efforts for Hurricane Helene. Misinformation, including false claims about diverted funds and aid discrimination, is creating distrust and demoralizing FEMA staff. While Criswell does not yet know if foreign adversaries are involved, she stressed the seriousness of the situation, worsened by amplification from figures like Elon Musk and Donald Trump. The spread of disinformation is discouraging disaster survivors from seeking aid and undermining FEMA’s operations. Comments from Rep. Chuck Edwards (R-N.C.), whose district includes Asheville, N.C., which was devastated by Helene: — Vice President Kamala Harris made an interesting comment on The View as part of her ongoing media tour. This marked Harris’ first live interview and talk show appearance since becoming the Democratic presidential nominee. Of note: When asked if she would have done anything differently from President Biden in the past four years, Harris stated, “there is not a thing that comes to mind.” She emphasized her involvement in most of the administration’s impactful decisions. The appearance on The View was part of a series of media engagements for Harris on Oct. 8, which also included scheduled interviews with Stephen Colbert and radio host Howard Stern. — How much do the rich pay in income taxes? During her interview on 60 Minutes, Vice President Kamala Harris said: “I’m going to make sure that the richest among us, who can afford it, pay their fair share in taxes.” Facts and figures. Based on the latest available data from 2021, the top income earners in the United States pay a disproportionately large share of federal income taxes compared to their share of income. Details: The top 1% of taxpayers, defined as those with adjusted gross incomes (AGI) over $682,577, paid: This group earned 26.3% of total AGI but paid nearly double that percentage in income taxes. The top 10% of taxpayers, those with incomes above $169,800, paid: This group earned 52.6% of total income but paid a significantly higher share of income taxes. The tax burden on high-income earners has increased over time: Comparison to lower income groups: Bottom line: These figures demonstrate that the U.S. federal income tax system is highly progressive, with higher-income individuals paying a larger share of taxes relative to their income. — Vilsack warns of urgency for farm bill deal before year-end, but optimistic Congress will deliver. USDA Secretary Tom Vilsack during a White House ag event stressed the need for Congress to pass the over $1.5 trillion farm bill before the end of 2024 to avoid disruptions for farmers. A “common sense, reasonable, practical” package is still possible, said Vilsack on Tuesday, declaring himself an optimist. “I think there’s better odds than not that we get it done,” he said at a White House conference. The major question, Vilsack said, is how large an increase was possible in crop subsidy spending. If lawmakers fail to reach an agreement by the end of December, new legislation could be delayed for an extended period, particularly with a new Congress and administration taking office. Vilsack also noted that farmers impacted by Hurricane Helene could see crop insurance payouts by early November. Conservation funding and its use, a key debate in the farm bill, remains unresolved, with Democrats opposing Republican proposals to broaden conservation fund applications. — GOP gains edge in party identification, reducing pressure on Trump. In an unusual shift, more Americans are identifying as Republicans than Democrats, marking the GOP’s first sustained lead in party affiliation in over 30 years. This provides former President Donald Trump with a structural advantage in the upcoming election. However, Vice President Kamala Harris still holds a narrow lead in many polls, partly due to her appeal with independent voters and defections from Trump within the GOP. Analysts caution that while the GOP’s edge is significant, it doesn’t guarantee Trump’s victory, especially given the complex factors influencing voter behavior. — Schumer faces warning signs in key Senate races as GOP gains ground. Senate Majority Leader Chuck Schumer’s (D-N.Y.) Democratic defense is under threat in three critical states: Michigan, Ohio, and Wisconsin. Incumbent Democrats Tammy Baldwin (Wis.) and Sherrod Brown (Ohio), who previously benefitted from Trump’s absence in 2018, now face tight races, with Baldwin’s lead shrinking to a toss-up against Eric Hovde and Brown deadlocked with Bernie Moreno — both are now rated toss-ups by the Cook Political Report with Amy Walter. In Michigan, Dem Rep. Elissa Slotkin is facing a growing challenge from GOP’s Mike Rogers. A Wall Street Journal editorial (link) says, “The election is forcing the [EV mandate] policy debate that Congress never had. Michigan’s Senate and presidential races are tight, and if Democrats lose either one, their EV coercion will be a big reason.” While the GOP is cutting back ads in Arizona and Nevada, Republicans are pouring resources into these pivotal Rust Belt states, putting Schumer’s slim Senate majority at risk. It’s not all negative for Democrats as incumber GOP Sen. Debbie Fischer in Nebraska is in a very close race with Independent Dan Osborn. Cook moved this Nebraska race from “Solid” to “Likely R,” with Cook’s Jessica Taylor writing “The surge in GOP money in what should be a sleepy contest and the polling trend line, make it clear this is no longer a Solid race.” — Angela Alsobrooks has taken a significant lead over Larry Hogan in the Maryland U.S. Senate race, according to the latest poll from the University of Maryland Baltimore County (UMBC). Alsobrooks is leading Hogan by 9 percentage points, with 48% of likely voters supporting Alsobrooks compared to 39% for Hogan. The poll has a margin of error of just over 3%. Only 5% of voters remain undecided, indicating that most voters have already made up their minds. To win, Hogan needs to recapture support from moderate and conservative Democrats, close the gender gap, and earn robust support among Black voters, as he did in his gubernatorial races. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 30 points lower. Chinese equities retreated 7% on the session amid ongoing stimulus uncertainty, prompting the government to announce a press event for Saturday to address fiscal policy (see related item in China section). The Shanghai Composite dropped 6.6% and its Hong Kong equivalent shed 1.4%. In Asia, Japan +0.9%. Hong Kong -1.4%. China -6.6%. India -0.2%. In Europe, at midday, London +0.3%. Paris +0.3%. Frankfurt +0.3%.

U.S. equities yesterday: The Dow ended up 126.13 points, 0.30%, at 42,080.37. The Nasdaq gained 259.01 points, 1.45%, at 18,182.92 (Nvidia jumped 4.1%; Broadcom added 3.2%, and Oracle gained 2.6%. Apple, Meta Platforms, and Tesla all rose at least 1.5%). The S&P 500 rose 55.19 points, 0.97%, at 5,751.13.

Wall Street’s volatility gauge — the VIX — dropped from its highest since August.

— Gary Gensler, chair of the U.S. Securities and Exchange Commission, will participate in a fireside chat at New York University with former SEC Commissioner Robert Jackson.

— The Justice Department is considering splitting up Google, among other restrictions, to end what it called an unlawful monopoly in search, according to a court filing submitted Tuesday. The court filing said that the tech giant’s “unlawful conduct persisted for over a decade and involved a number of self-reinforcing tactics.” It follows a judge’s ruling in August that the firm’s search business was an illegal monopoly. The DOJ said recommendations for Google’s search engine business “could include contract requirements and prohibitions; non-discrimination product requirements; data and interoperability requirements; and structural requirements.” It added that it was “considering behavioral and structural remedies that would prevent Google from using products such as Chrome, Play, and Android to advantage Google search and Google search-related products and features — including emerging search access points and features, such as artificial intelligence — over rivals or new entrants.” A ruling on the remedies may not come down until next year, and appeals by Google could draw out the process.

— S&P Global Ratings is evaluating a potential downgrade of Boeing Co.’s credit rating to junk status as the company faces ongoing financial strain from a prolonged labor strike. Boeing is expected to see a cash outflow of around $10 billion in 2024, with additional funding needed to cover daily operations and upcoming debt maturities. This marks a significant financial challenge for the aerospace giant, exacerbating concerns over its liquidity and creditworthiness.

Boeing and the union representing 33,000 striking employees have announced that negotiations have broken down, with no new talks scheduled. Stephanie Pope, CEO of Boeing’s commercial airplanes unit, stated that the union’s demands were “non-negotiable” and exceeded what the company could accept while remaining competitive. As a result, Boeing has withdrawn its offer, and further discussions are off the table for now. The workers, members of the International Association of Machinists, have been on strike for nearly a month, primarily over disputes concerning wage increases and the loss of pension plans. The strike has significantly impacted Boeing’s operations, which were already under strain.

— PepsiCo lowered its revenue forecast for 2024 due to weakening demand for its snacks and beverages, particularly in the North American market. PepsiCo now expects organic revenue growth in the low single-digit range for fiscal 2024, down from its previous forecast of 4% growth. Sales volumes for Frito-Lay North America declined by 1.5%. North American beverage volumes fell by 3%. Consumers are becoming more price-sensitive and cutting back on non-essential purchases. Meanwhile, there’s a shift towards cheaper private-label brands. Also, a significant recall of Quaker Oats products due to salmonella concerns negatively impacted sales. Third-quarter revenue was flat at $23.3 billion, falling short of analysts’ expectations of $23.8 billion. Net income decreased by 5% to $2.9 billion. Adjusted earnings per share were $2.31, slightly above the expected $2.292. PepsiCo shares fell about 1% in premarket trading following the announcement. The company has been implementing price increases to combat inflation, with a 3% global price hike in the third quarter. PepsiCo is focusing on introducing new flavors and offering products at various price points to cater to changing consumer preferences.

— Oil prices fell sharply on Tuesday, driven by worries over the Chinese economy and a lack of anticipated stimulus measures. Brent crude futures fell $3.75, 4.63%, to settle at $77.18 per barrel, while U.S. West Texas Intermediate (WTI) dropped $3.57, 4.63%, to $73.57 per barrel. Both benchmarks hit session lows with losses exceeding $4 per barrel. The recent surge, following Iran’s missile strike on Israel, has corrected as traders exit bullish bets. Lowered tensions regarding a potential Israeli strike on Iran and the impact of Hurricane Milton on U.S. demand have also contributed to the decline. Analysts suggest prices will stabilize but remain sensitive to geopolitical risks.

— Ag markets today: Wheat futures extended Tuesday’s gains overnight, while the corn and soybean markets rebounded from their losses. As of 7:30 a.m. ET, corn futures were trading 2 cents higher, soybeans were 7 to 8 cents higher and wheat futures were mostly 7 to 9 cents higher. The U.S. dollar index was mildly firmer, while front-month crude oil futures were modestly weaker.

Choice beef continues to firm. Wholesale beef prices were mixed on Tuesday, with Choice up 91 cents to $306.84 while Select fell 72 cents to $288.61. Choice beef prices have firmed nearly $10.50 from the Sept. 26 low. While packer margins remain in the red, they have improved with the jump in Choice beef.

Cash hog index, pork cutout decline. The CME lean hog index is down 4 cents to $84.22 as of Oct. 7. The pork cutout fell $1.24 to $94.81 on Tuesday as losses in loins, butts, picnics and bellies more than offset gains in ribs and hams. Daily Livestock Report notes, “The share of negotiated hogs is down to just 1% and the share of hogs sold on a swine or pork market formula is down to 28.5%, i.e. less than 30% of the overall market. As industry has changed, so has pricing, with the pork cutout becoming increasingly more important in influencing the CME index.”

— Agriculture markets yesterday:

• Corn: December corn futures fell 5 1/4 cents to $4.20 3/4 and nearer the session low.

• Soy complex: November soybeans sunk 17 3/4 cents to $10.16 1/4, a more-than-two-week-low close. December meal fell $1.00 to $323.00, forging a high-range close. December soyoil plunged 148 points to 43.09 cents, marking the largest daily decline since Sept. 6.

• Wheat: December SRW futures climbed 2 1/4 cents to $5.94 3/4 and traded on either side of unchanged throughout today’s session. December HRW futures climbed 1/2 cent to $6.03 3/4, settling near mid-range. December HRS futures rose 3/4 cent to $6.45.

• Cotton: December cotton fell 126 points to 72.27 cents, marking the lowest close since Sept. 18.

• Cattle: December live cattle futures climbed 85 cents to $187.875 and settled on session highs. November feeder cattle futures firmed $1.15 to $250.30, nearer session highs.

• Hogs: December lean hogs rose 35 cents to $77.175, nearer the session high and hit a 4.5-month high.

— Quotes of note:

• Multiple Federal Reserve officials set to speak on economic outlook and policy. The Federal Open Market Committee will release minutes from its September meeting today, while several Federal Reserve officials are scheduled to speak on the economy and monetary policy. San Francisco Fed President Mary Daly will participate in a discussion at Boise State University, and Dallas Fed President Lorie Logan will address the Future of Global Energy Conference in Houston. Additionally, Boston Fed President Susan Collins, Atlanta Fed President Raphael Bostic, Chicago Fed President Austan Goolsbee, Richmond Fed President Thomas Barkin, and Fed Vice Chair Philip Jefferson are slated to speak at various events across the country.

Interest-rate futures market pricing currently implies a nearly 90% likelihood of a quarter-point decrease in the fed-funds rate at the Nov 6-7 FOMC meeting, with the balance of odds favoring a pause.

• FOMC minutes expected to shed light on rate cut debate. The Federal Open Market Committee (FOMC) minutes from the Sept. 17-18 meeting will be released today, offering insights into the debate over the 50-basis-point rate cut, which was not a unanimous decision. Fed Governor Michelle Bowman dissented, favoring a smaller 25-basis-point reduction. Fed Chair Jerome Powell had noted significant discussion on the rate cut, and analysts will look closely at the language used to gauge how officials framed their views. The minutes are expected to emphasize the Fed’s meeting-by-meeting approach and hint at a cautious stance toward future rate reductions.

• Fed’s Bostic highlights balancing inflation and job market risks, warns banks on climate impact. Atlanta Fed President Raphael Bostic emphasized the need for the Federal Reserve to balance risks between inflation and the labor market as it considers future interest rate cuts. While inflation risks have decreased, concerns about the labor market have grown. Bostic also stressed the importance of banks preparing for climate-related risks, noting the impact of increased hurricane frequency and rising insurance costs on the economy. Despite recent strong job growth, Bostic signaled patience in adjusting rates unless the labor market weakens significantly.

• Ray Dalio warns of limited Fed rate cuts, cautions against bond investments. Billionaire investor Ray Dalio stated he doesn’t expect significant rate cuts from the Federal Reserve and cautioned that Treasury bonds are a risky investment due to market fluctuations. Speaking at the Greenwich Economic Forum, Dalio criticized investors betting on rapid interest rate cuts, especially after the Fed’s recent half-point reduction. He also highlighted geopolitical risks in the bond market and noted foreign concerns about holding U.S. bonds due to potential sanctions. Dalio praised former President Donald Trump’s economic policies, particularly his tariff proposals, which he argued would raise $800 billion annually but could also drive inflation.

— U.S. agriculture registered another sizable trade deficit in August. U.S. agricultural exports were at $13.01 billion in August, essentially unchanged from July, against imports of $17.19 billion, which were down 2% from July, resulting in a monthly trade deficit of $4.18 billion. So far in fiscal year (FY) 2024, exports total $161.3 billion compared to imports of $188.82 billion, creating a cumulative deficit of $27.52 billion. The sector has recorded monthly deficits in 10 out of 11 months in FY 2024, with three months seeing deficits of $4 billion or more and eight months with a deficit of $1 billion or more.

USDA forecasts agricultural exports at $173.5 billion and imports at a record $204 billion for a projected record trade deficit of $30.5 billion. In FY 2023, the trade gap was $17.1 billion. Based on the FY 2024 forecasts and cumulative trade data, agricultural exports in September would need to reach $12.2 billion to meet the USDA forecast, while imports would need to be $15.18 billion. Historically, the value of imports has declined in September compared to August over the past three years, while the value of exports fell in two of the last three years, with September 2023 being an exception.

Since U.S. agricultural exports peaked at $196.1 billion in FY 2022, they have dropped by 11.5%. USDA’s forecast for exports of $169.5 billion in FY 2025, if accurate, would represent a 15.4% decline in the value of shipments since FY 2022. Meanwhile, imports have consistently set records in recent years, and in FY 2025, they are expected to rise to $212 billion, nearly 4% higher than FY 2024 forecasts.

This trend continues to fuel concerns in U.S. agriculture, particularly over the lack of new free trade agreements (FTAs) pursued by the Biden administration. FTAs are typically aimed at removing tariff barriers for U.S. agricultural products, which can significantly boost market access for American farmers.

— The U.S. federal budget deficit for 2024 has risen by 13% to $1.83 trillion, according to the Congressional Budget Office, the highest level in three years. Despite a strong economy and increased tax revenue, the deficit continues to grow. The reasons are rising spending across key sectors, including Social Security, Medicare, and interest payments on public debt, which have all surged. Interest payments on the debt are now larger at $950 billion than the entire defense budget of $826 billion or Medicare ($869 billion). Interest payments soak up 14% of the budget. Net interest on the debt held by the public soared 34%, or $240 billion. Total revenue hit $4.92 trillion, as individual income taxes rose 11% or $249 billion. Corporate income taxes rose 26% or $109 billion. Spending also rose 11% — by $699 billion to $6.75 trillion.

Of note: Both Vice President Kamala Harris and former President Donald Trump are proposing policies that, if enacted, would cost trillions of additional dollars over the next decade. Much of that spending is expected to be financed with borrowed money. The Committee for a Responsible Federal Budget, a nonpartisan group that seeks lower deficits, projected in a report this week that Trump’s various plans could cost as much as $15 trillion over a decade. Harris’ economic plans could cost as much as $8 trillion.

Cost overruns. The Inflation Reduction Act, which was originally protected to cost less than $400 billion over a decade, is now forecast by some economists to cost more than $1 trillion.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro and British pound weaker against the greenback. The yield on the 10-year U.S. Treasury note was slightly higher, trading around 4.04%, with a mixed-to-negative tone in global government bond yields. Crude oil futures were down ahead of U.S. gov’t inventory data to be released later this morning, with U.S. crude around $73.30 per barrel and Brent around $76.90 per barrel. Gold and silver futures were up, with gold around $2,638 per troy ounce and silver around $30.92 per troy ounce.

— The Russian ruble hit its weakest value since October 2023, at 97.20 against the dollar, according to data from the London Stock Exchange. This comes despite Russia selling off foreign exchange reserves to support its currency. International sanctions and volatile oil prices continue to drag down the ruble.

— USDA daily export sale:

• 126,000 MT corn to unknown destinations, 2024-2025 marketing year.

— Ag trade update: South Korea purchased 30,000 MT of U.S. milling wheat. Algeria purchased between 510,000 and 570,000 MT of optional origin milling wheat, the bulk of which is expected to be sourced from the Black Sea region. Japan tendered to buy 65,000 MT of feed wheat and 25,000 MT of feed barley. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

— NWS outlook: Major Hurricane Milton is expected to make landfall along the west-central coast of Florida overnight Wednesday... ...Milton will bring life-threatening impacts to much of Florida including a destructive storm surge, devastating hurricane-force winds, and catastrophic flash and urban flooding... ...Unseasonably warm temperatures continue over much of the western and central U.S., some record-tying/breaking highs will be possible.

Items in Pro Farmer’s First Thing Today include:

• Grains firmer overnight

• China’s stock market falls the most in more than four years

| CONGRESS |

— House GOP staff retreat focuses on legislative strategy and lame-duck session plans. At the House GOP staff retreat in Baltimore early this week, key Republican staffers gathered to strategize on upcoming legislative challenges. Discussions centered around budget reconciliation, potential rules changes for the 119th Congress, and critical lame-duck session items. Among the top priorities were government funding provisions like the ROUTERS (aimed at protecting devices such as modems from foreign interference) and BIOSECURE (which prohibits some biotechnology companies from working with adversaries) Acts, avoiding an omnibus spending bill, and reauthorizing the farm bill. GOP leaders also discussed possible concessions needed to pass legislation, given the upcoming elections and the need for bipartisan support.

| ISRAEL/HAMAS CONFLICT |

— State Dept.: Biden administration backs Israel’s efforts against Hezbollah in Lebanon. The Biden administration supports Israel’s military operations in Lebanon aimed at degrading Hezbollah, an Iranian-backed militant group, according to State Department spokesperson Matthew Miller. In a briefing, Miller emphasized that Israel’s actions are intended to dismantle Hezbollah’s infrastructure and help implement UN Resolution 1701, which seeks to disarm Hezbollah and maintain peace in southern Lebanon. Despite the ongoing conflict in Gaza, Israel has intensified its operations in Lebanon, targeting Hezbollah strongholds and reportedly attempting to eliminate a key Hezbollah figure in Syria.

Meanwhile, President Biden is expected to speak today with Israeli Prime Minister Benjamin Netanyahu, talks set to include discussion of any plans to strike Iran. Israel has so far refused to divulge to the Biden administration details of its plans to retaliate against Tehran, officials said. The call was scheduled after Netanyahu abruptly postponed a visit to the U.S. by Israel’s defense chief.

| RUSSIA/UKRAINE |

— Russian winter grain seeding ‘going according to plan’. Russian farmers have planted 13 million hectares of winter grain so far this year out of the expected 20 million hectares in total, Agriculture Minister Oksana Lut said. “On the whole, the winter sowing campaign is going according to plan,” Lut told Russia’s upper house of parliament. “The total area under winter grain will be 20 million hectares, which corresponds to last year’s level,” she added. Lut mentioned that in the central regions of Russia, the winter grain sowing campaign is complicated by a lack of soil moisture. Black Sea consultancy SovEcon said the rate of winter wheat seeding fell to an 11-year low as of late September.

| PERSONNEL |

— Ethel Kennedy, the widow of late U.S. Attorney General Robert F. Kennedy, is recovering after suffering a stroke last week. Former Rep. Joe Kennedy III (D-Mass.) posted on the social platform X on Tuesday that his grandmother had suffered a stroke and was taken to a hospital where she is receiving treatment and is “comfortable.” Ethel Kennedy, 96, is former President John F. Kennedy’s sister-in-law and mother to 11 children, including former independent presidential candidate Robert F. Kennedy Jr.

| CHINA UPDATE |

— U.S. and China Commerce chiefs discuss semiconductor tensions, trade restrictions. Chinese Commerce Minister Wang Wentao and U.S. Commerce Secretary Gina Raimondo held a call Tuesday, where Wang voiced concerns over U.S. semiconductor policies and restrictions on Chinese-connected vehicles. Wang stressed the need for clear boundaries on national security in trade to ensure global supply chain stability and cooperation. He urged the U.S. to lift sanctions on Chinese firms and improve the business environment. Raimondo, however, reiterated that U.S. national security is non-negotiable, highlighting the “small yard, high fence” approach to targeted controls. It remains unclear if she discussed potential updates to the U.S. semiconductor restrictions from 2022, which may be influenced by industry lobbying.

— China’s Finance Minister to brief on fiscal policy as investors seek stimulus amid economic slowdown. China’s Finance Minister, Lan Fo’an, is set to hold a briefing on fiscal policy this Saturday, as investors seek further stimulus measures to support the country’s slowing economy. The announcement has sparked speculation that China may unveil new fiscal policies, potentially a package worth up to 3 trillion yuan, to boost growth. This comes as China faces challenges in meeting its 2024 growth target of about 5%, and investors are eager for stronger government intervention.

Chinese stocks initially pared losses, and the offshore yuan strengthened following the news, but optimism faded as traders reassessed the potential scale of any forthcoming stimulus measures. Analysts suggest that any significant fiscal stimulus might be limited due to concerns over debt-driven spending.

The briefing follows disappointment earlier in the week when China’s National Development and Reform Commission (NDRC) did not announce major pro-growth initiatives. The market now looks to the Ministry of Finance to fund projects that could bring a tangible impact on the real economy. However, analysts have noted the risks of inflated expectations, warning that a lack of substantial measures could undermine confidence and recovery efforts.

China’s economy has struggled recently, and while the government’s stimulus efforts have lifted market sentiment, there remains uncertainty over whether these measures will meet investors’ high hopes.

| TRADE POLICY & TRANSPORTATION |

— The battle over robots at U.S. ports is on. Striking dockworkers are back to work — but disagreement over automation stands in the way of lasting peace. Link to Wall Street Journal article. The new dockworker agreement extends only until mid-January. Daggett’s opposition to automation of any kind threatens to derail the continuing negotiations over the next three months and push the dockworkers back to the picket lines.

| ENERGY & CLIMATE CHANGE |

— Iowa Supreme Court hears arguments in Summit pipeline land access case. The Iowa Supreme Court heard arguments on Tuesday, Oct. 8, regarding Summit Carbon Solutions’ right to access private land for surveying its proposed carbon capture pipeline. The case stems from a Hardin County landowner’s refusal to allow Summit access to his farm. While a district court granted Summit injunctive relief, the landowner’s attorney argues that Summit does not qualify as a pipeline company under state law and that the relevant code is unconstitutional. The Iowa Utilities Commission issued a permit and granted eminent domain for the project in August, but the legal dispute began before that decision. The case mirrors similar legal challenges in other states, with a South Dakota ruling questioning Summit’s status as a common carrier. A ruling from the Iowa court is expected before June 2025, but many expect it will come before that.

— Update: EU proposes delay of deforestation regulation amid controversy. The European Union’s Deforestation Regulation (EUDR), passed in 2023 to curb global deforestation by regulating imports tied to forest destruction, faces challenges as its December 2024 implementation date nears. Key hurdles include lack of guidance, logistical concerns, and international pushback from major exporting countries like Brazil and Indonesia. Earlier this month, the European Commission proposed a 12-month delay, sparking mixed reactions. Businesses and conservative groups welcomed the postponement, while environmental groups criticized it as a setback for climate goals. The delay requires approval from the European Parliament and Council of the EU. If passed, larger companies would have until Dec. 30, 2025, to comply, while small and medium-sized enterprises would have until June 30, 2026

Traders are now wondering whether ADM will pull the 20c premium on beans they have said they will pay this year for those that signed up with FBN proving no deforestation. ADM launched the re:source™ Deforestation-free Soybean Program to help producers comply with the new EU Deforestation Regulation. The program offers:

• A premium of $0.15 per bushel for certified deforestation-free soybeans

• An additional $0.05 per bushel for early enrollment and submission of field boundary maps

• Total potential premium of up to $0.20 per bushel

Current status. As of July 2024, ADM has reported:

• Almost 5,300 farmers enrolled in the program

• Over 4.6 million acres across 15 states participating for the 2024 season

ADM has stated they can supply all existing European customers with compliant products when the new rules take effect.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA seeks feedback on cattle market regulations amid concerns over pricing practices. USDA’s Agricultural Marketing Service (AMS) issued an advance notice of proposed rulemaking (ANPR) to gather input on regulatory options for addressing price discovery and fairness in cattle markets. The focus is on alternative marketing arrangements (AMAs), which now dominate cattle trading and often avoid using cash or spot market prices. AMS is particularly concerned about formula price contracts with fluctuating base prices and whether they may violate the Packers and Stockyards Act or antitrust laws. A 60-day comment period will follow the ANPR’s publication in the Federal Register, with USDA saying the input gathered will direct future regulatory actions.

USDA said it wanted to ensure “base prices in fed cattle AMAs are broadly representative of general market conditions” and are not vulnerable to manipulation. “For too long, consolidation in the agriculture industry has been swallowing up family farms, lowering incomes and choices for farmers, and raising prices at the grocery store,” said White House economic adviser Lael Brainard.

NCBA says administration proposals on cattle marketing could destroy the marketing agreements that pay a premium for top-quality carcasses or reward practices such as limited use of antibiotics.

— Lamb Weston announces plant closure amid french fry industry challenges. Lamb Weston, North America’s largest producer of french fries, is closing its potato processing plant in Connell, Washington. The company is laying off nearly 400 employees, representing about 4% of its global workforce. Lamb Weston is also temporarily curtailing production lines and schedules in North America. The company is facing slowing customer demand and an oversupply of products. Restaurant traffic and frozen potato demand have been soft, and this trend is expected to continue through fiscal 2025. Fast-food chains, which account for about 80% of french fry consumption in the U.S., are seeing fewer customers. The restructuring is expected to result in $55 million in cost savings for fiscal 2025. Fast-food chains are offering value menus to attract customers, but this has led to smaller portions of fries being sold. The global french fries market is still expected to grow, reaching around $47.04 billion by 2032, with a CAGR of 6.30% between 2024 and 2032, according to industry forecasts.

— The Halloween candy landscape is undergoing a significant shift in 2024, with confectionery companies moving away from traditional chocolate offerings in favor of less expensive alternatives. This change is driven by several factors, including rising production costs, changing consumer preferences, and economic pressures.

Less chocolate, more gummies. Candy manufacturers are stocking store shelves with fewer Halloween chocolates and instead focusing on cheaper alternatives such as gummies, licorice, and flavored crèmes. This trend is evident in the product offerings of major candy companies:

• Mondelez is promoting its Sour Patch Kids, including special varieties like the apple harvest flavor.

• Hershey has introduced new non-chocolate options, such as Reese’s Werewolf Tracks with vanilla crème and a cinnamon toast-flavored KitKat.

Reasons for the shift:

• Rising chocolate costs: Bad weather patterns have disrupted cocoa bean cultivation in West Africa, which produces 70% of the world’s supply. This has led to higher prices for chocolate ingredients.

• Consumer preferences: There’s a growing demand for limited editions and special varieties of candy.

• Economic factors: Candy companies are facing shrinking margins and slowing sales, prompting them to explore more cost-effective options.

Market impacts:

• Prices on seasonal chocolate candy have increased by up to 7.5% from last year.

• Non-chocolate sweets, while still cheaper than chocolate, have also seen double-digit price increases.

• There are fewer chocolate items per retailer on shelves, with a double-digit increase in non-chocolate items.

Candy companies are adapting their strategies to meet these challenges:

• Hershey is expanding its non-chocolate offerings, seeing potential for higher growth in this segment.

• Retailers like Kroger are putting Halloween candy on shelves earlier than ever, even alongside back-to-school supplies.

Halloween candy industry trends

• The National Retail Foundation expects Halloween spending to reach up to $11.6 billion in 2024.

• 47% of consumers started shopping for Halloween items before Oct. 1.

• Trends like “Summerween” and “Augtober” are extending the Halloween season.

Of note: Halloween remains crucial for candy retailers, with it being the biggest selling season of the year. The National Confectioners Association CEO, John Downs, noted that Halloween candy has become a “bona fide retail phenomenon” in 2024, with demand starting earlier and extending beyond October 31. This shift in the Halloween candy market reflects broader economic trends and changing consumer behaviors, as the industry adapts to new challenges and opportunities in the confectionery landscape.

| HEALTH UPDATE |

— 7%: The increase in the cost of employer health insurance for a second straight year, maintaining a growth rate not seen in more than a decade, according to an annual survey by the healthcare nonprofit KFF. The back-to-back years of rapid increases have added more than $3,000 to the average family premium, which reached roughly $25,500 this year.

| OTHER ITEMS OF NOTE |

— North Korea’s army announced plans to take a “substantial military step” by completely severing road and rail links to South Korea. Since January, Pyongyang has reinforced its fortified border, installing landmines, building anti-tank traps, and dismantling railway infrastructure. North Korean leader Kim Jong Un has also escalated his hostile rhetoric toward South Korea, calling it the North’s “primary foe and invariable principal enemy.” This move is part of rising tensions between the two Koreas, with inter-Korean relations deteriorating amid North Korea’s increased nuclear production efforts and growing ties with Russia. These developments have heightened concerns in the West over the direction North Korea is taking, further isolating the regime.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |