News/Markets/Policy Updates: Jan. 3, 2025

| USDA ADJUSTS SOME REPORT RELEASES DUE TO JAN. 9 CLOSURE |

USDA adjusted some report releases due to the Jan. 9 government closure for National Day of Mourning. USDA will adjust the release of some reports next week as the U.S. gov’t will be closed for the National Day of Mourning Jan. 9 for former President Jimmy Carter. The Livestock Slaughter report scheduled for release Jan. 9 will be released Jan. 10, and the weekly Export Sales report will be released on Jan. 10 instead of the scheduled Jan. 9 date. USDA’s Crop Production, Crop Production Annual, Grain Stocks, and Winter Wheat and Canola Seedings reports will be released on Jan. 10 as scheduled.

| CONGRESS, POLITICS & ELECTIONS |

— The House convenes at noon ET with a vote today on speaker. House Republicans are preparing for today’s unpredictable speaker election, where incumbent Mike Johnson (R-La.) faces a challenging path to retain his gavel. With a razor-thin 219-215 majority, Johnson can afford only one GOP defection if all members vote. Rep. Thomas Massie (R-Ky.) has signaled opposition, while some others remain undecided. Johnson has emphasized the importance of avoiding theatrics, recalling the protracted 2023 speaker vote, and is striving for a first-ballot victory.

Johnson has secured former President Trump’s endorsement and has focused on uniting his party behind key agenda items like border security and tax reform. However, some Republicans demand assurances of a more conservative approach, citing frustrations with Johnson’s reliance on Democratic votes in the previous Congress.

Johnson’s potential ousting could create a leadership vacuum since there isn’t an obvious replacement. Removing Johnson might reignite public clashes among top Republicans, including House Majority Leader Steve Scalise (La.), Majority Whip Tom Emmer (Minn.), and Judiciary Committee Chair Jim Jordan (Ohio). These tensions could fracture party unity and complicate legislative efforts.

Political implications for Trump and the GOP: The disruption could weaken Republican cohesion, making it harder for the party to advance its agenda or align with Trump’s interests, especially heading into the 2024 elections.

If there is a confirmed House speaker today, the schedule ahead includes:

· Saturday: House Republicans will meet at Fort McNair, Washington, D.C., to discuss reconciliation plans.

· Sunday: Republican elected leadership holds a retreat in Baltimore.

· Monday: The House will convene to certify Donald Trump’s Electoral College victory.

— Senate kicks off quietly as House steals the spotlight. As the 119th Congress begins, the Senate’s opening day promises to be largely ceremonial, in contrast to the dramatic House speaker election. Senators will convene at noon ET to swear in new members, hear remarks from Majority Leader John Thune (R-S.D.) and Minority Leader Chuck Schumer (D-N.Y.), and address procedural matters.

Thune’s filibuster pledge: Thune will reaffirm his commitment to preserving the legislative filibuster, emphasizing its role in maintaining the Senate’s deliberative nature. This stance may clash with potential calls from President-elect Trump to abolish the filibuster, as he did during his first term.

Upcoming GOP agenda includes new farm bill: Thune will outline plans to pass individual appropriations bills, a farm bill, and focus on regular order and extended floor debates. The GOP’s initial reconciliation package, targeting border security, energy, and defense, could test the filibuster’s resilience.

Democratic priorities: Schumer will advocate for bipartisan cooperation and outline Democratic goals, despite the GOP’s emphasis on party-line measures.

Cabinet confirmations on hold: The Senate will adopt its organizing resolution today, formally transitioning control of committees to the GOP. However, Cabinet confirmation hearings won’t begin until the week of Jan. 13, allowing more time for senators to meet with nominees, including former Rep. Tulsi Gabbard and Sen. Marco Rubio.

— Republicans 53-seat majority will be delayed slightly because West Virginia Governor Jim Justice is waiting until Jan. 13 to allow Governor-elect Patrick Morrisey to take over before appointing a successor. This delay will affect Justice’s seniority ranking but is not expected to impact Republicans’ legislative activities significantly, given the short timeline.

— Schumer sets Democratic Agriculture panel member list. Senate Minority Leader Chuck Schumer (D-N.Y.) has set the list of Democratic assignments on committees for the 119th Congress, with two new members of the Senate Agriculture Committee – Sens. Adam Schiff (D-Calif.) and Elissa Slotkin. Leaving the panel after the 118th Congress were retired Chair Debbie Stabenow (D-Mich.), defeated Sen. Sherrod Brown (D-Ohio), and Kirsten Gillibrand (D-N.Y.). Sen. Amy Klobuchar (D-Minn.) was previously announced as the new Ranking Member on the panel.

| FBI BRIEFING ON NOLA, LAS VEGAS ATTACKS |

— FBI officials faced questioning from lawmakers during a private briefing on the New Year’s terror attack in New Orleans and a Tesla Cybertruck explosion outside Trump’s Las Vegas hotel, amid mounting Republican tensions with the agency. House Speaker Mike Johnson (R-La.) pressed the FBI on preparedness, citing prior warnings of such an incident. David Scott, the FBI’s assistant counterterrorism director, reported no accomplices tied to Shamsud-Din Jabbar, the New Orleans attacker, though ISIS ties were evident from his car flag and Facebook posts.

The Las Vegas suspect, Matthew Alan Livelsberger, had no ideological link to Jabbar, despite both being Army veterans. The FBI disclosed Livelsberger’s Cybertruck carried explosives, raising further security concerns.

Calls for swift confirmation of Trump’s national security appointees, including Kash Patel for FBI director, have intensified in response to these incidents.

| TRUMP 2.0 ADMINISTRATION |

— Claim of RFK Jr. banning GMOs debunked as parody. A viral Instagram post falsely claims that Robert F. Kennedy Jr. announced a nationwide ban on GMOs effective Jan. 20. The post originated from a parody account, not Kennedy’s verified X account. No credible reports or statements support the claim. Link for details.

— Trump taps Kies for key Treasury post. President-elect Donald Trump picked Ken Kies, a longtime tax lobbyist for clients including Microsoft, as the Treasury Department’s assistant secretary for tax policy.

| FINANCIAL MARKETS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. stock indexes are pointed toward firmer openings. In Asia, Japan closed. Hong Kong +0.7%. China -1.6%. India -0.9%. In Europe, at midday, London -0.1%. Paris -0.9%. Frankfurt -0.4%. Chinese stocks extended the worst start to the year since 2016, reflecting worries about the growth outlook. U.S. equity futures climb, signaling another attempt by the S&P 500 to end a losing streak that stretched to five sessions. The index is on pace for a 1.7% drop since Friday.

Equities yesterday: U.S. stock indices started 2025 with losses. The Dow ended down 151.95 points, 0.36%, at 42,392.27. The Nasdaq declined 30.00 points, 0.16%, at 19,280.79. The S&P 500 was down 13.08 points, 0.22%, at 5,868.55. The market experienced a choppy trading session, reflecting investor uncertainty and profit-taking after the strong performance in 2024.

— The dollar slipped from the two-year high it set Thursday, while Treasury yields ticked lower. The benchmark 10-year yield is nearly 20 basis points above the level prior to Jerome Powell’s hawkish turn at the Dec. 18 Federal Reserve meeting.

— Biden blocks Nippon Steel’s $14.9 billion acquisition of U.S. Steel amid national security concerns. President Joe decision this morning made the announcement following months of political and economic debate. Key concerns include potential threats to domestic steel production and critical industries, with CFIUS warning of supply shortages and delays in sectors essential to national security.

The move holds political weight as U.S. Steel, headquartered in Pennsylvania, a swing state, faced opposition from the influential United Steelworkers union. Both Biden and President-elect Donald Trump supported keeping U.S. Steel under American ownership.

While Nippon Steel offered concessions, including U.S. government oversight and maintaining headquarters in Pittsburgh, these were insufficient to allay concerns. The decision signals a departure from welcoming foreign investment, could strain U.S./Japan relations, and raises the likelihood of legal challenges from Nippon Steel.

Japanese officials pressed Biden to approve the deal. Rejecting it “will send a stark message that investment from Japan, regardless of lack of security concerns, is not welcome in the U.S.,” Takehiko Matsuo, a senior trade minister, wrote to Biden administration officials last month.

— Asian demand fuels gold’s resilience amid strong dollar and rising yields. Gold is on track for its biggest weekly gain since November. Gold today is around $2,671 per troy ounce and silver around $30.24 per troy ounce. Gold prices remain robust despite headwinds from a strengthening U.S. dollar and rising Treasury yields, buoyed by surging Asian demand, particularly from China. Investors turn to gold as a safe-haven asset amid economic uncertainty, geopolitical tensions, and central bank buying, with prices projected to hit $3,000 per ounce in 2025.

— China loosens yuan defense, breaching 7.3 per dollar. The Chinese yuan has weakened past the 7.3 per dollar threshold, a level tightly defended by Beijing throughout December. This shift marks a potential pivot by the People’s Bank of China (PBOC) toward addressing economic pressures through currency adjustments. The move comes amidst a sluggish domestic economy, widening bond yield gaps with the U.S., and poor investor sentiment.

After hitting 7.3174 onshore and showing weakness in overseas trading, the yuan’s slide has impacted regional markets, with Taiwan’s dollar and South Korea’s won also feeling the strain. Analysts suggest further depreciation may follow, with forecasts pointing to 7.45–7.6 by late 2025. However, the PBOC is expected to avoid abrupt changes to maintain financial stability, relying on tools like managed exchange rates and market interventions.

— Hedge funds brace for euro/dollar parity amid market jitters. Hedge funds and asset managers are increasingly betting on the euro reaching parity with the dollar as economic uncertainties and U.S. tariff concerns weigh on Europe’s outlook. Recent data shows a surge in euro options trading, with 2.5 billion euros in parity-targeted wagers changing hands in a single day — four times the monthly average.

The euro has fallen 1.3% this week, making it one of the worst-performing Group-of-10 currencies. Experts foresee the euro testing parity by the second quarter. This level was last breached in 2022 during Europe’s energy crisis. Although the overall sentiment remains bearish, some investors speculate on short-term rallies, as reflected in certain euro option pricing. Meanwhile, technical indicators suggest the euro is in oversold territory, fueling speculation about its immediate trajectory.

— Mortgage rates near 7%, squeezing homebuyers. The 30-year mortgage rate is close to 7%, a nearly six-month high, according to Freddie Mac. Higher rates are sidelining many potential homebuyers, keeping home sales at historic lows despite a slight Q3 uptick. Mortgage rates track 10-year Treasury bonds, which have risen amid uncertainty about Federal Reserve rate cuts and upcoming policies under Trump. Forecasts for 2025 suggest a modest decline to 6-6.5%, unlikely to significantly revive the sluggish housing market.

| AG MARKETS |

— Ag markets today: Corn and soybeans pulled back overnight from recent gains, while wheat mildly extended yesterday’s losses. As of 7:30 a.m. ET, corn futures were trading 1 to 2 cents lower, soybeans were 6 to 8 cents lower and wheat futures were 1 to 2 cents lower. The U.S. dollar index was around 425 points lower and front-month crude oil futures were modestly weaker this morning.

Cash cattle trade sharply higher. Cash cattle trade turned active Thursday afternoon with prices generally $2 to $4 higher than week-ago. That suggest the cash market could challenge the all-time high average price of $197.09 posted in early July.

More pressure on cash hog fundamentals. The CME lean hog index is down another 28 cents to $83.99 as of Dec. 31, the fourth straight daily decline, though 66 cents above the December low. The pork cutout fell 98 cents to $89.32 on Thursday, 68 cents above its low last month.

— Ag trade: Taiwan tendered to buy 114,650 MT of U.S. milling wheat.

— Sales of U.S. soybeans to China continue. USDA weekly Export Sales figures for the week ending Dec. 26 included activity for China of net sales of 3,000 metric tons of sorghum, 617,663 metric tons of soybeans, and net sales of 6,856 running bales of upland cotton. For beef and pork, activity for 2024 included net sales of 378 metric tons of beef and 219 metric tons of pork. For 2025, net sales of 1,793 metric tons of beef and net reductions of 261 metric tons of pork were reported.

— Agriculture markets yesterday:

• Corn: March corn rose a penny to $4.59 1/2, marking a high-range close.

• Soy complex: March soybeans climbed 1 1/2 cents to $10.12 and closed nearer session highs. March meal futures rallied $3.00 to $319.90, nearer session highs. March bean oil fell 9 points to 40.27 cents.

• Wheat: March SRW wheat fell 5 3/4 cents to $5.45 3/4, nearer the daily low. March HRW wheat fell 7 1/2 cents to $5.51 3/4 and nearer the session low. March spring wheat futures fell 6 1/4 cents to $5.89 1/2.

• Cotton: March cotton futures climbed 17 points to 68.57 cents but closed nearer session lows.

• Cattle: February live cattle rose $2.00 to $193.60, nearer the session high and hit a nine-month high. March feeder cattle rose $3.225 to $266.20, nearer the session high and hit a contract high.

• Hogs: Futures stabilized Thursday in the wake of recent losses, but the nearby February contract lost another 15 cents to settle at $81.15.

— Cotton AWP edges higher. The Adjusted World Price (AWP) for cotton is 55.03 cents per pound, effective today (Jan. 3), up from 54.55 cents per pound the prior week. The AWP has moved little over the past few weeks and remains above the mark of 52 cents that would trigger an LDP. Meanwhile, USDA said that Special Import Quota #12 would be established Jan. 9 for the import of 31,716 bales of upland cotton, applying to supplies purchased no later than April 8 and entered into the U.S. no later than July 7.

— Raw sugar prices climb on India’s lower output. Raw sugar prices surged by up to 3.3%, reaching 19.90 cents per pound in New York, following reports of a 16% drop in India’s sugar production this season. The decline, reported by the Indian Sugar and Bio-Energy Manufacturers Association, may prompt the world’s second-largest sugar producer to maintain export restrictions. While Indian producers are seeking government approval to export surplus supplies, domestic demand projections remain uncertain, falling short of broader market estimates.

| ENERGY MARKETS & POLICY |

— Energy markets: West Texas Intermediate (WTI) crude oil is just over $73 per barrel. The Jan. 2 closing price was $73.13. Brent crude is currently nearly $76 following a Jan. 2 closing price of $75.93 per barrel. Both WTI and Brent crude oil prices showed slight increases on Jan. 2, compared to their previous closing prices. The rise in oil prices was attributed to optimism about China’s economic recovery and investors returning from the holiday period.

— Biden prepares offshore drilling ban amid Trump’s energy push. President Joe Biden is set to issue an executive order permanently banning new offshore oil and gas development in key coastal areas, solidifying protections that will complicate President-elect Donald Trump’s plans to expand domestic crude production. Rooted in the 1953 Outer Continental Shelf Lands Act, the decree would protect waters critical to coastal resilience and ecosystems, ensuring Biden’s environmental legacy in the face of potential legal and political challenges.

While the oil industry warns of economic drawbacks, environmental advocates praise the move as vital for safeguarding marine life and combating climate change. Trump is expected to seek a reversal, but legal precedents suggest Biden’s protections may endure.

— ANWR lease sale bid opening delayed to Jan. 10 due to federal closure. The federal government closure on Jan. 9 for the National Day of Mourning for former President Jimmy Carter has led the Bureau of Land Management to postpone the opening of bids for oil and gas lease sales in the Arctic National Wildlife Refuge’s Coastal Plain. Originally scheduled for Jan. 9, the bids will now be opened on Jan. 10, with the submission deadline remaining Jan. 6.

— Indonesia to implement B40 biodiesel by Feb. 28, boost export levy for funding. Indonesia’s Energy Ministry has allocated 15.6 million kiloliters of biodiesel for 2025, phasing in a 40% blend (B40) by Feb. 28. Public service sectors will receive 7.55 million KL under a subsidized scheme financed by the palm oil fund, managed by BPDPKS. To support the required 68% subsidy increase, Indonesia plans to raise the crude palm oil export levy to 10%, pending regulatory approval. Energy and Mineral Resources Minister Bahlil Lahadalia also told reporters that the country was working to increase the biodiesel mix to 50% in 2026. Palm oil futures had come under pressure due to the lack of implementation on Jan. 1, with futures rising Friday in the wake of the government’s announcement.

— India’s palm oil imports drop to 9-month low amid rising soyoil demand. India’s palm oil imports in December plummeted 40% month-on-month to 503,000 MT, hitting a nine-month low as rising palm oil prices pushed refiners to favor soyoil. Soyoil imports climbed 3% to 420,000 MT, marking a four-month high, while sunflower oil imports dropped 22% to 265,000 MT. India sources palm oil from Indonesia, Malaysia, and Thailand, and soyoil and sunflower oil from Argentina, Brazil, Russia, and Ukraine.

| TRADE POLICY |

— Potential impact of tariffs and trade retaliation on U.S. ag sector is significant. The previous trade war’s disruption of around $10 billion per year in exports serves as a stark reminder of the risks involved.

Impact on U.S. agricultural exports. The threat of new tariffs and potential retaliation could have severe consequences for U.S. farmers and the entire agricultural supply chain:

Soybean and corn exports

· Under a scenario where China reverts to previous tariff levels, U.S. soybean exports to China could fall by 14 to 16 million metric tons annually, a 51.8% decline from expected baseline levels, according to an economic study commissioned by the American Soybean Association and the National Corn Growers Association and conducted by the World Agricultural Economic and Environmental Services (link).

· Corn exports to China could decrease by about 2.2 million metric tons annually, an 84.3% decline from baseline expectations.

· In a more severe scenario with a 60% retaliatory tariff, soybean exports to China could drop by over 25 million metric tons, and corn exports could fall by nearly 90%.

Overall agricultural export losses

· A USDA study found that retaliatory tariffs in the previous trade war reduced U.S. agricultural exports by $27 billion from mid-2018 to the end of 2019.

· Soybeans accounted for 71% of this decline, followed by sorghum (7%) and pork (5%).

Economic impact on farmers and rural communities. The potential trade war could have far-reaching consequences:

Price declines

· Under a 60% tariff scenario, U.S. soybean prices could fall by nearly $1 per bushel on average, while corn prices could drop by $0.13 per bushel (link).

· These price declines would occur at a time when costs remain at record levels and commodity prices are already falling.

Production value losses

· U.S. corn and soybean farmers could lose billions of dollars in annual production value.

· In a worst-case scenario, with Chinese tariffs rising by 60% and other countries increasing tariffs by 10%, projected export decreases could reach $15.8 billion for soybeans, $4.4 billion for corn, $2.3 billion for beef, and $2.5 billion for wheat.

Regional economic impact

· States heavily reliant on agricultural exports, such as Iowa, Illinois, and Kansas, could be particularly affected. In these three states alone, GDP losses totaled $3.8 billion through 2019 during the previous trade war.

Broader Implications. The potential trade war poses multiple threats beyond direct export losses:

Input costs

· Farmers reliant on imported machinery, fertilizers, and other inputs may face higher costs, further squeezing already tight margins, according to a USDA trade outlook report.

Market share loss

· Brazil and Argentina could increase their exports and gain valuable global market share, potentially difficult for U.S. farmers to reclaim in the future.

Domestic production shifts

· While tariffs could encourage greater investment in domestic manufacturing and agriculture, they also risk destabilizing existing trade agreements like the USMCA.

Consumer impact

· Both consumers and farmers could experience inflationary pressures as retailers warn of price increases tied to rising import costs.

Bottom line: The potential for a new trade war poses significant risks to the U.S. ag sector, with wide-ranging impacts on exports, prices, and rural economies. The previous trade war’s disruption of around $10 billion per year in exports underscores the magnitude of the threat, and current projections suggest the impact could be even more severe if new tariffs are implemented and retaliation occurs.

| HPAI/BIRD FLU |

— USDA revises HPAI policies, reopens environmental impact statement comment period. USDA’s Animal and Plant Health Inspection Service (APHIS) introduced an interim final rule revising conditions for poultry facilities affected by highly pathogenic avian influenza (HPAI). Key updates include mandatory biosecurity audits before restocking operations and future indemnity payments. Biosecurity audits will also be required for poultry premises within a buffer zone (minimum 4.35 miles or 7 km) before poultry movement. Indemnity payments will not be issued for flocks moved into active infected zones if they contract HPAI within 14 days after the control area is lifted. Public comments on the rule are due by March 3.

Additionally, APHIS has reopened the comment period on its draft programmatic environmental impact statement (EIS) for HPAI response in commercial and backyard poultry operations. The revised EIS explores the environmental impacts of three action alternatives during an outbreak. Comments are now due by Jan. 17. The interim final rule is pending publication in the Federal Register. Link

| FOOD INDUSTRY |

— Global food demand poised to surge by 70% by 2050: BloombergNEF. Global food demand could rise by as much as 70% by 2050, according to BloombergNEF, driven by population growth and rising incomes. Key factors include a global population reaching up to 10.8 billion and income-driven shifts toward higher-calorie diets rich in animal products and vegetable oils. Sub-Saharan Africa is expected to see particularly strong demand growth. Meeting this need will require a 47-61% increase in global crop production, posing significant environmental challenges.

— Global food prices eased in December, driven by sugar drop; FAO index down 0.5%. The FAO Food Price Index fell to 127.0 in December, a 0.5% drop from November but 6.7% higher than December 2023. Sugar prices led the decline, dropping 5.1% for the month and 10.6% year-on-year due to improved crop prospects. For 2024, the index averaged 122.0 points, 2.1% lower than 2023. Cereal prices were steady, though 2024 levels were down 13.3% from 2023, while rice reached a 16-year high. Vegoil prices fell 0.5% in December but rose 9.4% year-on-year. Dairy prices dropped 0.7% in December but were up 4.7% for 2024 due to higher butter prices. Despite declines from a 2022 peak, food import costs remain elevated.

— Egg prices skyrocket amid bird flu crisis, setting new records. Midwest egg prices hit $6.07 per dozen, breaking the previous record of $5.46 from December 2022. Eggs remain a key marker for food inflation and economic trends. Avian flu outbreaks and holiday demand have tightened supply, leading to soaring prices and reports of shortages. Some stores are limiting purchases as the situation persists. The bird flu response may face further challenges under a second Trump administration.

| TRANSPORTATION & LOGISTICS |

— U.S. labor talks loom over ports and railroads as key contracts near expiry. Shipping companies brace for disruptions with dockworkers and port employers resuming contentious contract talks Jan. 7 ahead of a Jan. 15 deadline. Railroads, facing similar challenges, are breaking traditional negotiation methods for early union agreements. Maersk advises customers to prepare for potential strikes.

· Port dependency: U.S. ports handle about half of all containerized imports and exports. Any extended work stoppage could lead to shortages and price hikes for goods ranging from bananas to car parts. This is a sensitive issue as the Trump administration begins.

· Past disputes: Dockworkers briefly went on strike last year over pay. The Biden administration played a key role in brokering a deal.

· Current conflict: The main issue now is automation.

— The union opposes more semi-automated cranes, arguing automation threatens jobs.

— Port employers argue automation boosts capacity, productivity, and hiring by enabling ports to handle more volume with the same infrastructure.

— Two East Coast ports using semi-automation showed increased efficiency, but union restrictions on automation have tightened in recent contracts.

· Political complexity:

— Trump has publicly opposed automation, emphasizing its harm to American workers.

— However, Trump ally Elon Musk has supported automation, criticizing the union’s resistance.

Of note: It’s uncertain if the Biden administration will step in again to facilitate a deal. Resolving the dispute and avoiding a strike would be a significant early win for the Trump administration.

| CHINA |

— China/U.S. trade share hits historic low as new Trump tariffs loom. China’s trade with the U.S. fell to 11% of its total goods trade in 2024, its lowest since joining the WTO in 2001. Beijing has diversified exports, favoring Southeast Asia, and imports, relying more on Brazil and Australia for key commodities. With President-elect Donald Trump signaling potential tariffs, including a 10% levy on nearly all Chinese goods, Beijing braces for renewed trade tensions. Analysts suggest future deals could see China boost U.S. imports to ease conflict.

— FT: China’s central bank signals 2025 rate cuts amid interest rate reforms. China’s central bank (PBOC) plans to cut interest rates from 1.5% “at an appropriate time” in 2025, shifting focus toward market-driven rate adjustments, the Financial Times reports. This reform aligns with policymakers’ commitments to steer credit demand more effectively through monetary policy, moving away from quantitative loan growth objectives. Analysts predict further changes in 2024 to support this transition.

— China to boost 2025 growth with ultra-long treasury bonds. China will significantly increase funding through ultra-long treasury bonds in 2025 to stimulate economic growth, focusing on business investment and consumer incentives. Yuan Da of the NDRC announced plans to fund equipment upgrades and a trade-in program for vehicles and appliances, offering discounts for new purchases. Households will also receive subsidies for digital products, including phones, tablets, and smart wearables, as part of broader efforts to invigorate consumption and industrial upgrades.

| HEALTH UPDATE |

— Surgeon General urges cancer warning labels on alcoholic beverages. The U.S. Surgeon General Vivek Murthy has called for prominent warning labels on alcoholic beverages to highlight the link between alcohol consumption and cancer. Alcohol is the third leading preventable cause of cancer in the U.S., increasing the risk for at least seven cancer types, with about 100,000 alcohol-related cancer cases and 20,000 deaths annually. Congress will ultimately decide on updating the current labels, which now warn about pregnancy and machinery use risks.

| WEATHER |

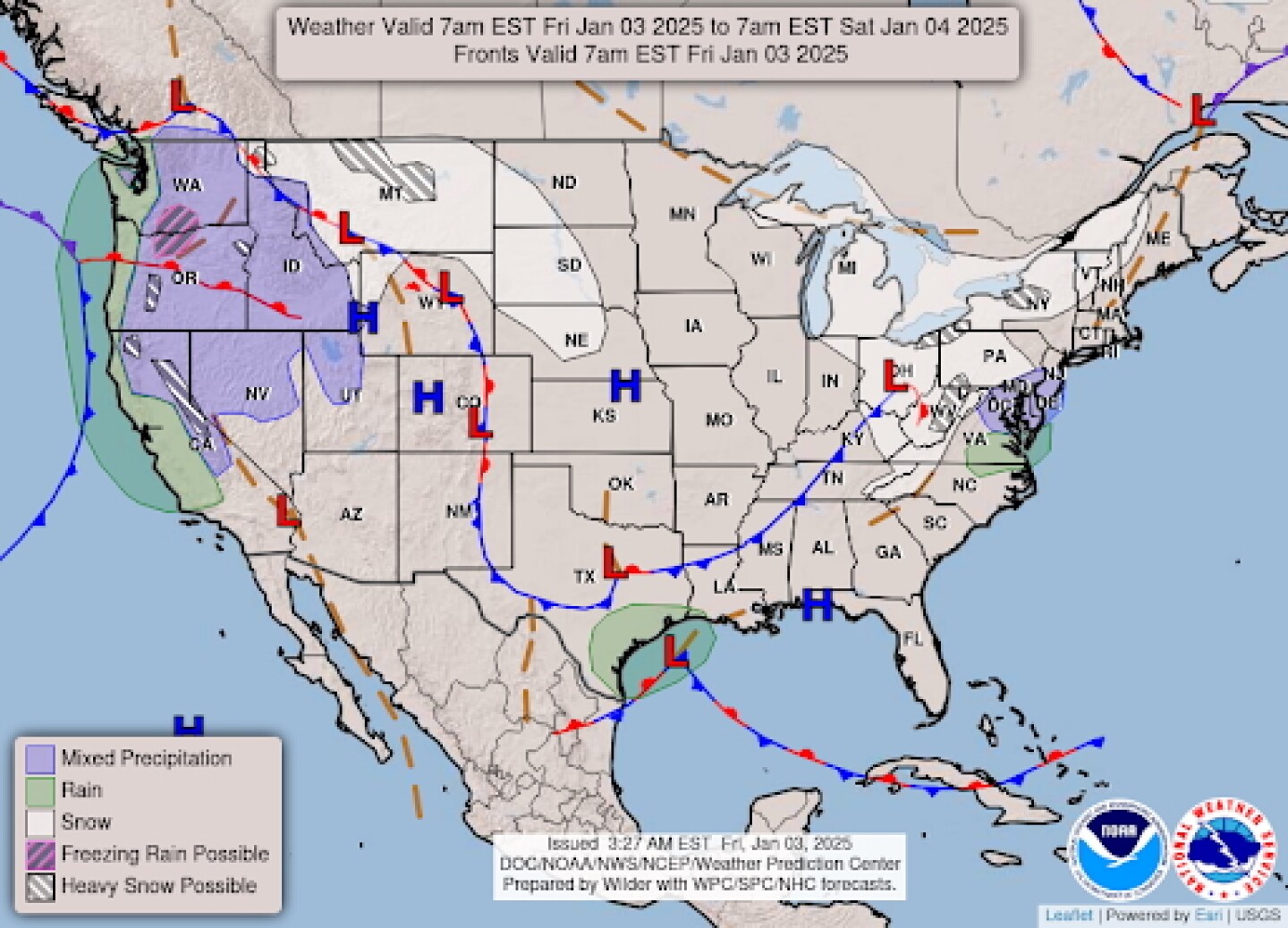

— NWS outlook: Heavy lake-effect snow downwind from Lakes Erie and Ontario; Moderate to heavy lake-effect snow downwind from the Upper Great Lakes... ... Moderate to heavy snow or the Cascades, Sierra Nevada Mountains, and the higher elevation of the West; 0.1 inches of freezing rain over parts of the Central Plains/Middle Mississippi Valley on Saturday... ...Moderate to heavy rain over parts of Pacific Northwest and Northern California on Friday.

| KEY DATES IN JANUARY |

3: New Congress sworn in

3: House speaker election

6: House certification of 2024 presidential election

8: First Social Security benefit checks of the year; cost of living adjustment is 2.5%

9: Day of Mourning for the late former President Jimmy Carter; gov’t closed

10: Bureau of Labor Statistics December employment situation report

10: USDA Annual Summary, WASDE, Crop Production, Grain Stocks, Winter Wheat/Canola Seedings

15: BLS consumer price index report (inflation)

15: Quarterly estimated taxes due

15: Last day to enroll in a 2025 health plan via HealthCare.gov

20: Inauguration Day

20: College football national championship

24: USDA Food Price Outlook

26: AFC and NFC football championships

27: (tentative) First day IRS will begin accepting 2024 federal tax returns

28: Florida’s 1st and 6th special primaries

31: Employers and financial institutions should send out W-2 and 1099 tax forms

31: Federal Open Market Committee meets

31: USDA Cattle

| LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |