The Week Ahead: Sept. 29, 2024

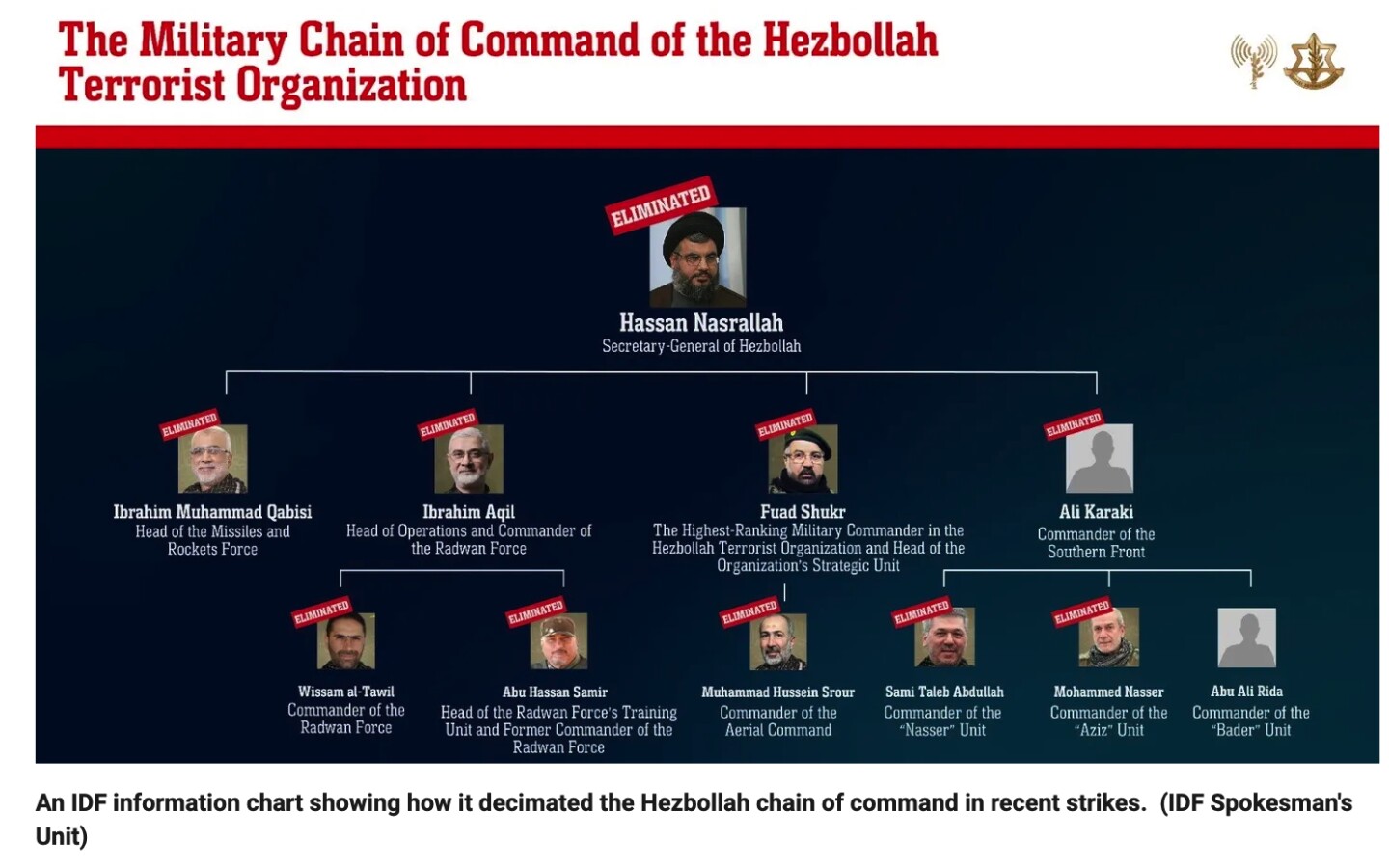

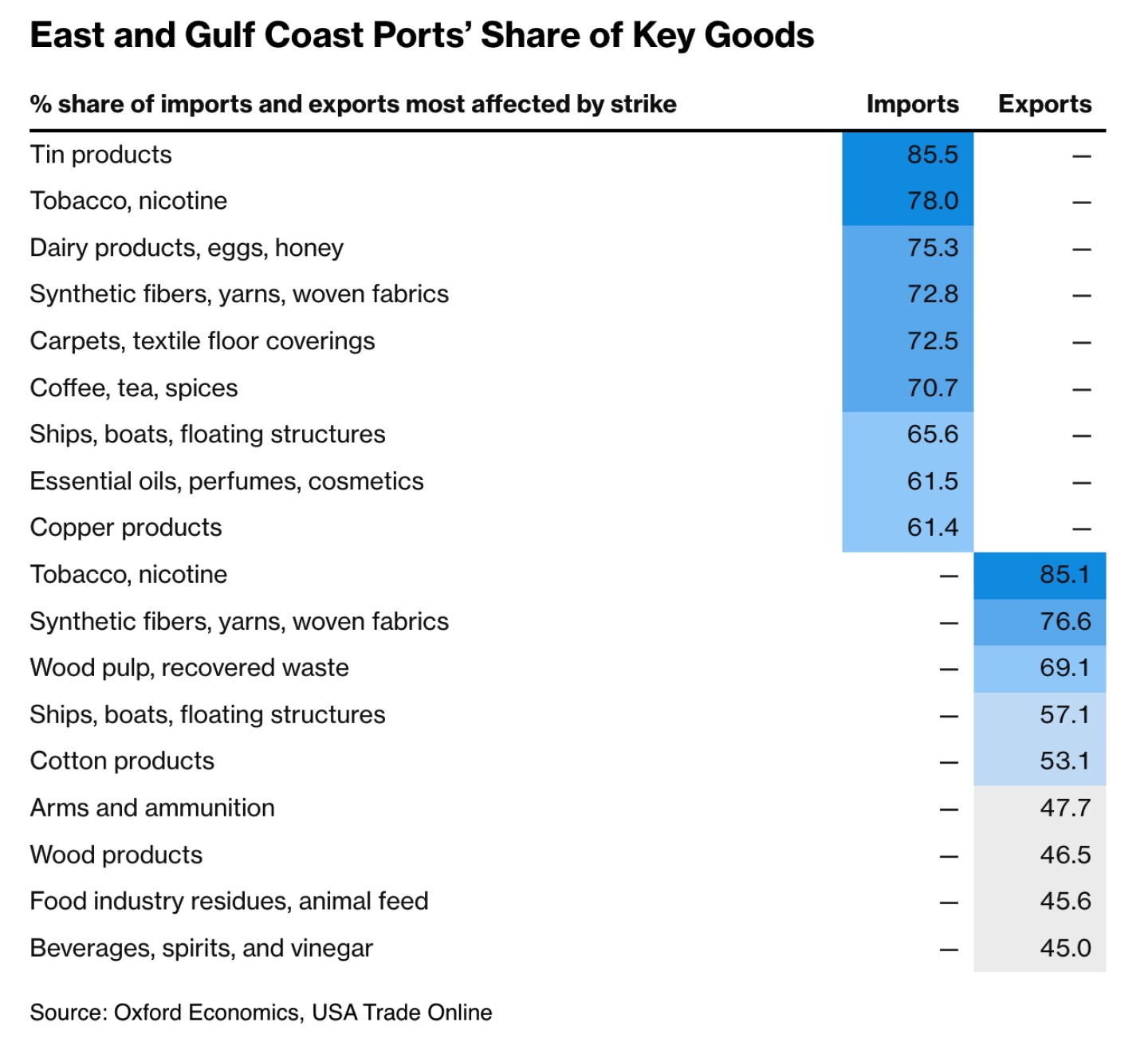

— Hezbollah confirmed that its leader, Hassan Nasrallah, was killed in an Israeli airstrike on Beirut, marking a significant development in the ongoing conflict between Israel and Hezbollah. Nasrallah had been at the helm of Hezbollah for over 30 years, serving as both a political and spiritual leader. His death is considered a significant victory for Israel due to Nasrallah’s close ties to Tehran and his role in shaping Hezbollah’s strategic and military ideologies. Israel said it had killed another of the group’s commanders in a strike on Dahiyeh on Saturday, the southern suburb where Nasrallah was assassinated. The Israeli military said Sunday it killed Nabil Kaouk, a member of Hezbollah’s central council, who was sanctioned by the U.S. in 2020 for his key role in the organization. Kaouk was believed to be in the running to replace Nasrallah after his death. Analysts note that Israel has changed its strategy from tit-for-tat responses to a pre-emptive campaign to degrade Hezbollah’s missile stores, launchers and military leadership. Israel’s air force struck the bunker with about 80 tons of bombs, according to several people familiar with the situation. The attack used a series of timed, chained explosions to penetrate the subterranean bunker, a senior Israeli military official said. The exact timing of the strike, Israeli officials said, was opportunistic, coming after Israeli intelligence learned about the meeting hours before it occurred. The coming days are expected to be uncertain for the region, with questions about potential responses from Iran and other allied groups. During a speech in Tel Aviv on Saturday night, Israeli Prime Minister Benjamin Netanyahu struck a defiant tone and warned that “Israel is on the rise,” as Hezbollah allies across the region called for a swift response. “These are big days. We are at what appears to be a historic turning point,” Netanyahu said. President Biden issued a statement Saturday calling the death of Hezbollah leader Hassan Nasrallah, who was killed a day before in an Israeli strike on Lebanon’s capital city, a “measure of justice.” U.S. Defense Secretary Lloyd Austin stated that the U.S. was not involved in Israel’s operation and received no advance warning. (Washington, Israel’s closest ally, got only a last-minute heads up as its latest bid to stop the violence failed.) The U.S. said it’s beefing up its already-substantial military presence in the region, a clear signal to Tehran about the risk of reacting too aggressively. Meanwhile, Israel was downgraded for the second time this year by Moody’s Ratings as the economic costs mount from almost 12 months of fighting in Gaza and a worsening conflict with Hezbollah. Moody’s cut Israel by two notches to Baa1 from A2, the ratings company said late on Friday, leaving the country three steps above non-investment grade. The outlook remains negative. — A dockworker strike at East and Gulf Coast ports could begin as soon as Oct. 1 when the current contract expires. On Friday we reported (link) that the Biden administration is encouraging both sides to continue negotiating in good faith to reach an agreement. But White House officials insist that they will not invoke the Taft-Hartley Act to force workers back on the job. Labor leaders have insisted that any invocation of the Taft-Hartley Act would be met with work slowdowns and foot-dragging. A White House official said the administration will be watching freight rates and surcharges imposed by ocean carriers, and doesn’t want to see anti-competitive price moves. The two largest container lines have already announced plans to impose extra fees tied to work stoppages. If a strike goes ahead, it’ll be the first major labor disruption at U.S. maritime hubs since a nine-month standoff in 2014-15 led to work slowdowns and reduced productivity at ports on the West Coast. The last ILA strike on the East Coast was in 1977. The International Longshoremen’s Association represents about 45,000 dockworkers at ports from Texas to Maine. Major issues in the negotiations include wages and concerns about automation. Ports were preparing to scale down operations on Monday, with some —like New York-New Jersey — offering extended hours to pick up freight. Near Norfolk, the Port of Virginia said marine operations will cease at 1 p.m. local time on Monday, and Port Houston in Texas plans to shut at 7 p.m. In Boston, the last vessel operation is scheduled to end at 8 p.m. if no labor agreement is reached. Wells Fargo economists said concern about the fallout from a strike may be overstated, partly because inventory levels have been replenished, and because the political resistance to government intervention will fade as a strike unfolds. “The doomsday reporting about shortages and major disruption overstates the scope of potential disruption,” they wrote in a research note (link) on Friday. “Disruption and controlled chaos have been the norm in the global shipping business throughout the current expansion, and we see reasons to believe that businesses will be able to weather this storm.” Agricultural exports at risk — Update on labor dispute at Port of Montreal: — Friday brings the September Jobs report. Economists forecast 145,000 job additions for the month (like the August increase and leaving three-month average job growth near its weakest since mid-2019), the unemployment rate to stay at 4.2%, while average hourly earnings are projected to have risen 3.8% from a year earlier. — Harris and Trump in tight contest in Michigan and Wisconsin, new polls show. New polling from the New York Times/Siena College reveals a close race between Kamala Harris and Donald Trump in two critical battleground states, Michigan and Wisconsin, as the 2024 presidential election approaches. Harris holds a slim lead in Wisconsin with 49% support compared to Trump’s 47%, while Michigan is virtually tied, with Harris at 48% and Trump at 47%. Trump’s edge on economic issues is chipping away at Harris’s previous lead, and concerns about regional stability and key issues like the economy and abortion will likely influence voter turnout in these states. Link to New York Times for details. Meanwhile, Harris leads Trump by nine points in Nebraska’s Second District, which could be pivotal for the electoral college, while Trump has a stronger advantage in Ohio. |

| WASHINGTON FOCUS |

Lawmakers are out until mid-November, with the focus turning to U.S. economic reports (Jobs on Friday), the VP debate on Tuesday, and updated news regarding a potential dockworker strike at U.S. East and Gulf Coast ports.

On Saturday, grain terminal workers at the Port of Vancouver started returning to work following a tentative agreement to end a four-day strike that disrupted crop exports during the critical harvest season. The settlement, reached under the guidance of a federal mediator, will be recommended for union ratification this Friday.

Meanwhile, longshoremen at the Port of Montréal are set to begin a three-day strike on Monday, potentially disrupting cargo shipments at one of Canada’s busiest seaports.

— Reps. Valadao and Panetta introduce $14 billion agriculture disaster relief bill. Reps. David Valadao (R-Calif.) and Jimmy Panetta (D-Calif.) on Friday introduced the Agriculture Disaster Relief Supplemental Appropriations Act, which allocates $14 billion to USDA to support farmers impacted by 2023’s natural disasters, including droughts and flooding. The legislation is backed by key agricultural organizations, including the American Farm Bureau and the California Farm Bureau, and urges swift congressional action to provide critical relief for farmers and rural communities. Link to full text of bill. Link to one-page summary of bill.

The Agriculture Disaster Relief Supplemental Appropriations Act:

• Appropriates $14 billion to the Office of the Secretary for Agriculture for necessary expenses related to 2023 disasters.

• Includes a $1.5 billion carveout for livestock losses and provides expanded assistance to livestock producers, including relocation of livestock, feed crop losses, and shelter-in-place procedures.

• Covers quality loss from smoke-tainted wine grapes due to wildfire.

• Includes additional provisions modeled after the 2021 Emergency Relief Program and the Supplemental Appropriations Act of 2022 covering the definition of drought, direct payments to producers, payment limitations, crop insurance requirements, etc.

• Includes a new provision to ensure payments are administered simultaneously for all producers, regardless of type of qualified loss.

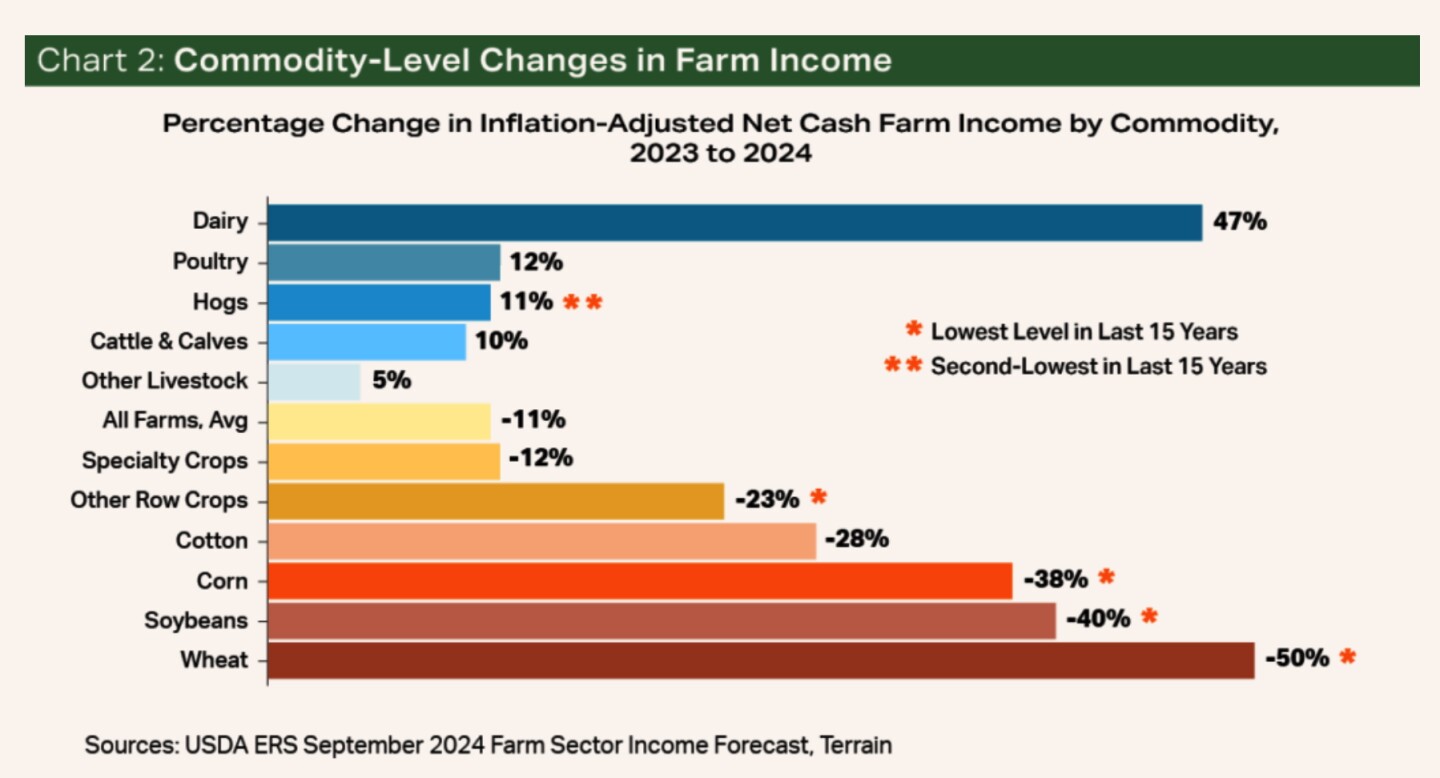

— Tight margins for most crops, livestock and dairy see limited gains. John Newton (link), now executive head of Terrain, has released his first report (link) on farm profitability by state since transitioning from his role as chief economist for Senate Republicans. Terrain, the advisory service for American AgCredit, Farm Credit Services of America, and Frontier Farm Credit, based the report on USDA’s September 2024 income forecast. The report provides a state-by-state analysis of farm profitability, offering insights into how different regions are faring amid tightened margins and changing economic conditions.

The Terrain report notes USDA’s September 2024 Farm Sector Income Forecast reports shrinking profit margins across nearly all crop categories nationwide, with some farmers facing prices below breakeven levels. While livestock and dairy operations show signs of improved profitability due to strong beef demand, high replacement costs and labor challenges hinder expansion. Dairy and poultry farmers face uncertainty from the ongoing avian influenza outbreak. Despite tight margins, Newton says opportunities may arise from the Federal Reserve’s recent rate cut, offering potential for cost reduction. Farmers are encouraged to explore marketing, risk management, and USDA programs to navigate the challenging economic landscape.

— USDA Secretary Tom Vilsack will speak at the Global Dairy Summit at World Dairy Expo in Madison, Wis. on Friday, Oct. 4. The Global Dairy Summit will be hosted by DATCP. Besides Vilsack, the Global Dairy Summit will also feature presentations by national dairy industry leaders including:

• Krysta Harden, President and Chief Executive Officer, U.S. Dairy Export Council

• Mike McCully, President and Owner, McCully Consulting

• Heather Anfang, President, Dairy Foods; and Executive Vice President, Land O’ Lakes, Inc.

• Dave Lenzmeier, Chief Executive Officer, Milk Specialties Global

Of note: Donald Trump was turned down to speak at the World Dairy Expo, which includes a Global Dairy Summit on Oct. 4. The World Dairy Expo, not specifically the Global Dairy Summit, declined Trump’s request to visit. The World Dairy Expo is scheduled to take place from Oct. 1-4, 2024. The World Dairy Expo’s communications manager, Lisa Behnke, stated that they “respectfully declined the opportunity” for Trump to attend, citing the expo’s traditionally non-political stance. The Trump campaign had been exploring potential visit dates between Oct. 1 and 4, which coincided with the expo’s operating dates. The decision to decline Trump’s visit was made to maintain the World Dairy Expo’s nonpartisan position and avoid any indication of political bias.

— Gov. Gavin Newsom vetoed a bill that proposed strengthening protections for California farmworkers working in extreme heat. Senate Bill 1299 would have made worker compensation claims presumed work-related when agricultural employers are not complying with heat safety standards. A 2005 California law already requires agricultural employers provide shade, hydration access, rest breaks and heat illness prevention training.

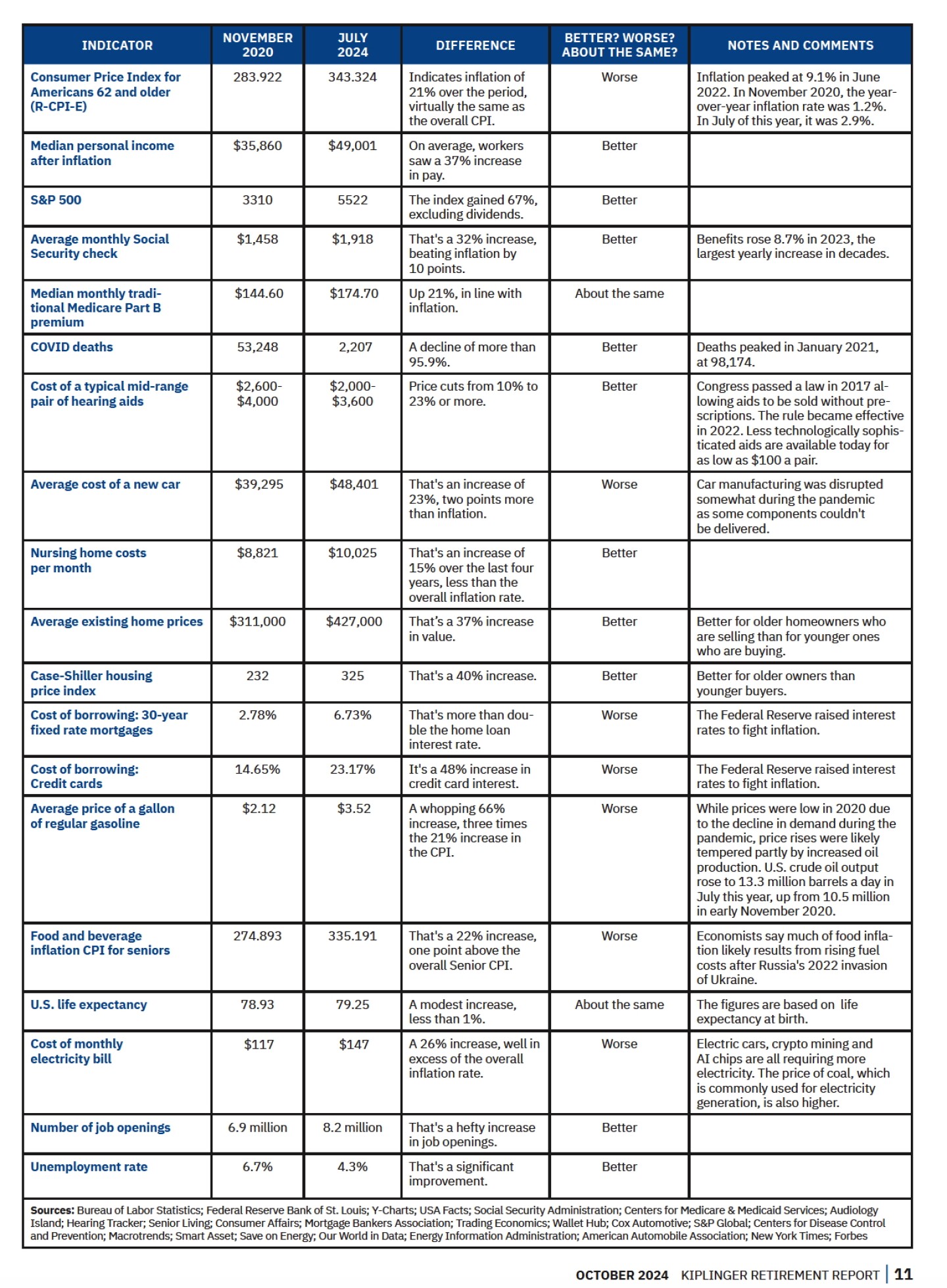

— Are you better off now? By the numbers. With that in mind, Kiplinger built a table of key economic and social indicators. The details include where the metric was in November 2020, and where it was recently. Kiplinger marks each indicator as “better,” “worse” or “about the same.” They consider the overall rate of inflation, 21% over the period, as worse. But generally, if a price goes up less than the overall inflation rate, then Kiplinger counts that as better. If, however, a price rises at a rate greater than inflation, it’s counted as worse. Conversely, if an asset value or income exceeds inflation, Kiplinger counts that as better.

| OTHER EVENTS & HEARINGS |

Monday, Sept. 30

• Federal Reserve. Fed Chairman Jerome Powell speaks on the Economic Outlook to the National Association of Business Economics. Fed Governor Michelle Bowman speaks on the Economic Outlook and Monetary Policy at the Georgia Bankers Association.

• EV issues. Energy Department virtual meeting of the Electric Vehicle Working Group for a report out and discussion lead by each of the three subcommittees: medium/heavy-duty adoption, grid integration, charging network.

• Economic outlook. American Bankers Association’s Economic Advisory Committee news conference to present the latest consensus economic forecast.

• Taiwan situation. Center for Strategic and International Studies virtual discussion on “One Day One: A U.S. Economic Contingency Plan for a Taiwan Crisis.”

• Buffer stocks. Peterson Institute for International Economics virtual discussion on “Price Stability in an Age of Emergencies: Revisiting the Case for Buffer Stocks.

• China and nuclear power. Atlantic Council virtual discussion on a new report, “Adapting U.S. Strategy to Account for China’s Transformation into a Peer Nuclear Power.”

Tuesday, Oct. 1

• Federal Reserve. Fed Governor Lisa Cook speaks on AI, Big Data, and the Path Ahead for Productivity in Atlanta, Georgia. Atlanta Fed President Raphael Bostic to deliver remarks.

• Vice presidential debate. Sen. JD Vance (R-Ohio) and Minnesota Governor Tim Walz participate in a debate hosted by CBS News.

• Climate and U.S. foreign policy. Wilson Center’s Environmental Change and Security Program; the Wilson Center’s Africa Program; the Wilson Center’s Middle East Program; and the Wilson Center’s Polar Institute hold a discussion on “The Story Behind Climate Security and What It Means for U.S. Foreign Policy.”

• U.S. nuclear activity. Center for Strategic and International Studies virtual discussion on “Accelerating U.S. Nuclear Leadership.”

• Supreme Court outlook. Federalist Society for Law and Public Policy Studies discussion on “Supreme Court Preview: What Is in Store for October Term 2024?”

• Sanctions and nuclear deterrence. George Washington University Elliott School of International Affairs discussion on “The Ethics of Sanctions, Deterrence, and Nuclear Proliferation.”

Wednesday, Oct. 2

• Federal Reserve. Fed Governor Michelle Bowman speaks on Building the Community Banking Framework for the Future at a conference in St. Louis. Cleveland Fed President Beth Hammack, St. Louis Fed President Alberto Musalem, and Richmond Fed President Thomas Barkin are scheduled to speak.

• Biden foreign policy. Carnegie Endowment for International Peace virtual discussion on the Biden administration’s approach to foreign policy.

• Israel/Hamas conflict. Council on Foreign Relations virtual briefing on “Israel, Gaza, and the Middle East a Year After the Hamas Attack.”

• COP29 outlook. New America virtual discussion on “Road to Baku: How COP29 will Shape Climate Finance, Renewables, & the Path to 1.5C.”

• AI and utilities. United States Energy Association virtual media briefing on “The Artificial Intelligence (AI) Revolution Underway in the Utility Space.”

• Supreme Court preview. Heritage Foundation virtual discussion on “Supreme Court Preview of the 2024-2025 Term.”

Thursday, Oct. 3

• Federal Reserve. Atlanta Fed President Raphael Bostic and Minneapolis Fed President Neel Kashkari are scheduled to speak.

• Global Agriculture Productivity report. Global Agriculture Productivity at Virginia Tech holds an event to launch its 2024 Global Agriculture Productivity Report.

• Trade and climate policies. Center for Strategic and International Studies virtual discussion on “Trade and Tradeoffs: Are U.S. Trade and Climate Policies at Odds?”

• U.S. elections. Heritage Foundation virtual symposium on “By the People, for the People: Election Integrity and the Conservative Legal Movement.”

• Trade issues. Carnegie Endowment for International Peace discussion on “Trade Intervention for Freer Trade.”

• Inclusive development in rural areas. Brookings Metro and the Local Initiatives Support Corporation discussion on “Advancing Inclusive Development in Rural Towns.”

• Former presidential candidate Nikki Haley. Georgetown University’s Institute of Politics and Public Service discussion with former U.S. Ambassador to the United Nations and Republican presidential candidate Nikki Haley on “Reflections on Running.”

Friday, Oct. 4

• Federal Reserve. New York Fed President John Williams is scheduled to speak.

• USDA Secretary Tom Vilsack will speak at the Global Dairy Summit at World Dairy Expo in Madison, Wis. (see related item).

• U.S. and China in Latin America. Brookings Institution discussion on “The United States and China in Latin America: Rivalry, Cooperation, or Something In-Between?”

| ECONOMIC REPORTS & EVENTS |

The week’s main event will be the jobs report on Friday. Economists’ consensus estimate is for an increase of 145,000 nonfarm payrolls in September, slightly more than in August. The unemployment rate is expected to hold steady at 4.2%. Americans’ average hourly earnings are forecast to be up 3.8% from a year earlier.

Of note: Fed Chairman Jerome Powell will discuss the U.S. economic outlook at a National Association for Business Economics (NABE) conference on Monday.

Monday, Sept. 30

• Chicago PMI

• Dallas Fed Mfg. Survey

• Fed Chairman Jerome Powell speaks on the Economic Outlook to the National Association of Business Economics. Fed Governor Michelle Bowman speaks on the Economic Outlook and Monetary Policy at the Georgia Bankers Association.

Tuesday, Oct. 1

• PMI Manufacturing

• Construction Spending

• ISM Manufacturing Index

• JOLTS

• Federal Reserve. Fed Governor Lisa Cook speaks on AI, Big Data, and the Path Ahead for Productivity in Atlanta, Georgia. Atlanta Fed President Raphael Bostic to deliver remarks.

Wednesday, Oct. 2

• Motor Vehicle Sales

• ADP Employment Report

• Fed Governor Michelle Bowman speaks on Building the Community Banking Framework for the Future at a conference in St. Louis. Cleveland Fed President Beth Hammack, St. Louis Fed President Alberto Musalem, and Richmond Fed President Thomas Barkin are scheduled to speak.

Thursday, Oct. 3

• Jobless Claims

• PMI Composite Final

• Factory Orders

• ISM Services Index

• Fed Balance Sheet

• Money Supply

• Federal Reserve. Atlanta Fed President Raphael Bostic and Minneapolis Fed President Neel Kashkari are scheduled to speak.

Friday, Oct. 4

• Employment

• Federal Reserve. New York Fed President John Williams is scheduled to speak.

| KEY USDA & INTERNATIONAL AG & ENERGY REPORTS & EVENTS |

Key U.S. grain stocks data out Monday (Sept. 30). USDA’s Quarterly Grain Stocks Report will set final 2023-24 ending stocks for corn and soybeans. The report has a history of surprises, especially for corn, with analysts routinely missing those estimates by a wide margin. USDA will also issue its final estimates for 2024 wheat production, though only modest changes are expected. Also, the United Nations’ monthly food price index will be released Friday.

On the energy front, the OPEC+ Joint Ministerial Monitoring Committee will hold discussions on Wednesday.

Monday, Sept 30

Ag reports and events:

• Export Inspections

• Livestock and Meat Domestic Data

• Small Grains Summary

• Grain Stocks

• Crop Progress

• World Agri-Tech Innovation Summit, London, day 1

• Malaysia’s September palm oil exports

Energy reports and events:

• BNEF Forum: Energy Transition; Tokyo

• Reuters Energy Transition Europe 2024 conference; runs through Tuesday

• Brent November options expire

• Holiday: Canada

Tuesday, Oct. 1

Ag reports and events:

• Commodity Costs and Returns

• Milk Cost of Production Estimates

• Cotton System

• Fats & Oils

• Grain Crushings

• World Agri-Tech Innovation Summit, London, day 2

Energy reports and events:

• API weekly U.S. oil inventory report

• Holiday: China, South Korea, Hong Kong, Myanmar, Nigeria, Mexico

Wednesday, Oct. 2

Ag reports and events:

• Broiler Hatchery

Energy reports and events:

• OPEC+ Joint Ministerial Monitoring Committee meeting via video conference

• EIA Petroleum Status Report

• Weekly Ethanol Production

• Genscape weekly crude inventory report

• Holiday: India, China

Thursday, Oct. 3

Ag reports and events:

• Export Sales

• Port of Rouen data on French grain exports

Energy reports and events:

• EIA Natural Gas Report

• Singapore onshore oil product stockpile weekly data

• ICE gasoil options for October expire

• Holiday: China, South Korea, Iraq, Israel, Germany

Friday, Oct. 4

Ag reports and events:

• CFTC Commitments of Traders report

• Dairy Products

• Peanut Prices

• United Nation’s FAO food price index and monthly grains report

• AMIS Market Monitor

• FranceAgriMer’s weekly crop condition report

Energy reports and events:

• Baker-Hughes Rig Count

• ICE weekly Commitments of Traders report for Brent, gasoil

• Holiday: China

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |