News/Markets/Policy Updates: Sept. 26, 2024

— Potential dockworker strike threatens major U.S. ports, cargo owners brace for disruptions. A dockworker strike could shut down all major container ports on the U.S. Atlantic and Gulf coasts if a deal isn’t reached by Oct. 1 between the International Longshoremen’s Association (ILA) and the U.S. Maritime Alliance (USMX). Key issues include wages and automation, with uncertainty surrounding the extent of the strike’s impact, though military goods and passenger cruise vessels would not be affected. Some ports are extending hours, while carriers impose surcharges and suspend bookings to mitigate disruptions ahead of the holiday season. Retailers with stockpiled goods may be less affected, but industries like pharmaceuticals, perishable foods (perishable food imports, beef and pork exports), and auto parts face significant risks. More perspective on the impacts is in the Markets section. — Donald Trump and Kamala Harris each agreed to a separate town hall in early October hosted by Univision, the Spanish-language network announced. Trump’s town hall will take place on Oct. 8, at 10 p.m. ET in Miami, while Harris’ town hall will be held on Oct. 10, at 10 p.m. ET from Las Vegas, according to Univision. The events will be moderated by journalist Enrique Acevedo. — Harris positions herself as pro-labor capitalist, pledges support for manufacturing and worker protections. In a major economic address, Vice President Kamala Harris outlined her vision for an “opportunity economy,” pledging tax credits for union jobs in the metal sector and investments in blockchain, AI, and advanced industries. Harris positioned herself as both pro-labor and pro-business, contrasting her policies with Donald Trump’s, emphasizing fair competition, worker protections, and middle-class growth. Her campaign seeks to win over skeptical voters, especially in key swing states, ahead of the 2024 election. Her plan would cost $100 billion, funded by international tax reform. Link to a New York Times article on Harris’ economic plans. Paul Neiffer notes that Harris suggests a standard deduction for small business, something he says may help some, but likely will not help many farmers. Of note: Harris released an 82-page document (link), “A New Way Forward for the Middle Class,” outlining her positions. — Harris also delivered her first solo sit-down interview since the debate, speaking to MSNBC’s Stephanie Ruhle last night, expanding on her economic message and lambasting Trump’s approach. “You just don’t throw around the idea of tariffs across the board,” Harris told Ruhle. “[H]e’s not serious about how he thinks about some of these issues.” — Texas Democrat Colin Allred gains ground in tight Senate race against Ted Cruz. Rep. Colin Allred, a Dallas Democrat and former NFL linebacker, is challenging Sen. Ted Cruz in a closely watched race. Most polls show a statistical tie, with Allred focusing on moderate positions and appealing to independents, younger voters, and the growing Hispanic population. Allred is actively courting independents and moderate Republicans, focusing on issues like border security and healthcare. Allred is riding momentum from voter anger over abortion restrictions and excitement for Kamala Harris’ presidential campaign. A Morning Consult poll conducted from Sept. 9 to 18 placed Allred slightly ahead of Cruz, with 45% support compared to Cruz’s 44% among likely voters. However, this lead falls within the poll’s margin of error of plus or minus 2 percentage points. The candidates have agreed to a televised debate on Oct. 15, at Dallas’ WFAA-TV studio. Of note: Texas has not elected a Democrat to statewide office since 1994, making this a challenging race for Allred despite the current polling. |

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed to firmer overnight. U.S. Dow opened 230 points higher, thanks to strong tech earnings, more Chinese stimulus and more global rate cuts. In Asia, Japan +2.8%. Hong Kong +4.2%. China +3.6%. India +0.8%. In Europe, at midday, London +0.2%. Paris +1.6%. Frankfurt +1.2%.

U.S. equities yesterday: The Dow gave up 293.47 points, 0.70%, at 41.914.75. The Nasdaq gained 7.68 points, 0.04%, at 18,082.21. The S&P 500 lost 10.67 points, 0.19%, at 5,722.26.

— Investors have poured $126 billion into money-market funds since the Federal Reserve’s 50-basis-point interest-rate cut. That sent assets in such funds to a record $6.76 trillion as of Tuesday, based on Crane Data going back to 1998.

— Ag markets today: Soybeans and wheat extended Wednesday’s gains during the overnight session, while corn struggled to find buyer interest. As of 7:30 a.m. ET, corn futures were trading around a penny lower, soybeans were mostly a nickel higher and wheat futures were mostly 2 to 4 cents higher. The U.S. dollar index was modestly weaker, and front-month crude oil futures were around $1.75 lower this morning.

Wholesale beef prices plunge. Wholesale beef prices faced heavy pressure on Wednesday, with Choice down $3.72 to $298.17 and Select $3.59 lower to $283.28. That’s the lowest Choice price since May 10. While movement stayed strong at 171 loads, indicating strong retailer demand under the market, falling wholesale prices maintained packer margins solidly in the red and will likely make them reluctant to raise cash cattle prices for a third straight week.

Cash hog index continues to bleed. The CME lean hog index is down another 16 cents to $84.05 as of Sept. 24. While pressure hasn’t been strong, the persistent slide in the cash index is likely to limit buying in futures. October lean hog futures finished Wednesday $1.575 below today’s cash quote.

— Agriculture markets yesterday:

• Corn: December corn rose 3 1/2 cents to $4.15 1/4, closing near the session high and at a two-month high close.

• Soy complex: November soybeans rose 11 cents to $10.53 1/4, near the session high and closed at a two-month high close. December soybean meal gained $2.30 to $328.20 and near the session high. December soybean oil rose 81 points to 44.15 cents, nearer the session high and hit a two-month high.

• Wheat: December SRW wheat rallied 11 1/4 cents to $5.89 1/4, while December HRW futures rose a dime to $5.81, both forging high-range closes. December spring wheat futures rose 5 1/4 cents to $6.17.

• Cotton: December cotton fell 89 points to 73.20 cents and near the daily low.

• Cattle: Cattle futures ended Wednesday narrowly mixed, with nearby October live cattle slipping 15 cents to $183.05 and most-active October feeder futures gaining 22.5 cents to $246.025. Expiring September feeder futures, which expire at noon today, rose 42.5 cents to $245.375.

• Hogs: December lean hog futures fell 7.5 cents to $74.90 and settled near mid-range. Nearby October futures climbed 35 cents to $82.475.

— Of note:

• Traders anticipate Fed Chair Powell’s remarks amid key economic data releases. Traders are eagerly awaiting pre-recorded remarks from Fed Chair Jerome Powell for clues on future monetary policy. This follows Fed Governor Adriana Kugler’s endorsement of last week’s half-point rate cut. Upcoming economic data includes the Fed’s preferred price metric and consumer demand insights tomorrow, along with jobless claims, durable goods orders, and revised Q2 GDP data on Thursday.

• Fed and Wall Street differ on pace of rate cuts as economic conditions evolve. Wall Street and the Federal Reserve agree on the need for further interest-rate cuts following the recent half-point reduction but differ on the pace. While markets expect quicker cuts due to potential economic downturns, Fed officials, like Governor Adriana Kugler, favor a more gradual approach, citing a cooling labor market and stable growth. The Fed projects another percentage point reduction by the end of 2025, with potential for further cuts depending on unemployment and job growth data in the coming months.

• “We’ve got a problem with contested logistics. The Pacific Ocean is really big, it’s far away.” — Gen. James Rainey, on U.S. efforts to establish military supply lines in the Pacific.

— The contract rate on a 30-year fixed mortgage eased 2 basis points to 6.13%, the eighth straight weekly drop. Applications to refinance mortgages surged for a second week as more Americans capitalized on the lowest borrowing costs in two years. The Mortgage Bankers Association’s refinancing index jumped 20.3% in the week ended Sept. 20 to the highest level since April 2022, the group said Wednesday. Homeowners can look forward to more than $4,000 a year in annual refinancing savings with rates now nearing 6%.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly lower, with the euro and British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note fell, trading around 3.77%, with a mixed-to-negative tone in global government bond yields. Crude oil futures were down, with U.S. crude trading at around $67.55 per barrel and Brent trading at around $70.85 per barrel. Gold and silver futures were up, with gold around $2,707 per troy ounce and silver around $32.88 per troy ounce.

— Oil prices fell for a second consecutive day as reports emerged of Saudi Arabia’s plan to increase output in December, aiming to regain market share by moving away from its $100-per-barrel target, the Financial Times reported (link). Additionally, rival factions in Libya reached an agreement, potentially paving the way for a resumption of crude production in the OPEC member nation.

— Silver hit the highest since 2012 as expectations for additional interest-rate cuts from the Federal Reserve help boost precious metals. Prices climbed as much as 2.8% to top $32.70 an ounce.

— U.S. railroads halt grain shipments to Mexico amid growing backlog. BNSF Railway and Union Pacific Railroad have suspended grain shipments to Mexico due to Ferromex’s inability to handle rising demand. The embargoes, driven by Mexico’s rail network congestion, have caused delays at key Texas border crossings. Mexico, the largest export market for U.S. agricultural goods, relies heavily on rail for two-thirds of its grain imports. The Surface Transportation Board is monitoring the situation as stakeholders seek a resolution.

— Farm Bureau warns of severe impact on agriculture from potential East Coast port strike. The American Farm Bureau Federation in a report (link) said it is deeply concerned about the potential impact of a looming U.S. East Coast port strike on American agriculture. This labor dispute between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) could have far-reaching consequences if an agreement is not reached before the contract expires on Sept. 30. Highlights of Farm Bureau’s report:

Impact on agricultural exports:

• The stakes for American farmers and ranchers are incredibly high. In 2023, over 70% of U.S. agricultural exports by value, totaling more than $122 billion, were transported through ocean ports.

• A strike would primarily affect containerized agricultural exports, which make up about 30% of U.S. waterborne agricultural exports by volume.

East Coast ports at risk:

• Approximately 46% of containerized agricultural exports, or 16.6 million metric tons, depart from East Coast ports.

• Nine major ports account for nearly 94% of all East Coast containerized agricultural exports, with Norfolk and Savannah leading the way.

• Economic Impact: Over a one-week period, the potential value of disrupted containerized agricultural exports is estimated at $318 million.

Commodities at risk. While bulk grain shipments are largely protected from disruption, several key agricultural products face significant risks:

• Soybeans: 2.67 million metric tons of soybeans were exported through East Coast ports in containers in 2023, representing 6% of U.S. waterborne soybean exports.

• Poultry: Nearly 80% of waterborne poultry exports could be jeopardized, potentially lowering prices for poultry producers.

• Other products: Hay, cotton, red meat, vegetables, dairy products, and edible nuts would also face significant disruptions.

Impact on consumers. A port strike would not only affect farmers and ranchers but also consumers across the nation. Many everyday food items rely on smooth port operations:

• Over 1.2 million metric tons of bananas arrive annually at ILA-handled ports, supplying over a fifth of the nation’s bananas.

• Nearly 90% of imported cherries, 85% of canned foodstuffs, and 82% of hot peppers come through these ports.

• 80% of imported beer, wine, whiskey, and scotch, and 60% of rum arrive at East and Gulf coast ports

Potential solutions and challenges. While redirecting exports through unaffected West Coast ports could provide some relief, this strategy faces several challenges:

• Infrastructural limitations on how many containers ports can process.

• Increased transportation costs and logistical hurdles for producers farther from West Coast ports.

• Potential vulnerabilities in certain regions lacking access to efficient transportation options.

Bottom line: The report emphasizes that a port strike would create significant backlogs of exports, denying farmers access to higher prices in the world market. This could lead to domestic oversupply, driving down prices for key commodities and further eroding farm profitability. As the agricultural sector braces for potential rising operational costs and supply chain shifts, U.S. farmers find themselves in an increasingly precarious position.

— H&P Report expected to show marginally larger hog herd. Analysts expect USDA’s Hogs & Pigs Report this afternoon to show the U.S. hog herd grew 0.2% from year-ago to 76.285 million head as of Sept. 1. Market hog inventories are expected to be up 0.4%, while the breeding herd is anticipated to be down 2.1%. Analysts expect USDA to report a 0.9% smaller summer pig crop despite ongoing record litter sizes, as summer farrowings likely declined 1.4%. Looking forward, analysts expect farmers to farrow 0.4% fewer sows during fall but 0.1% more this winter. As always, revisions to past data will be key.

— Cold Storage Report also out this afternoon. USDA will detail frozen meat stocks at the end of August. The five-year average is a 5.1-million-lb. increase in beef stocks and a 5.3-million-lb. rise in pork stocks during the month.

— Brazil’s $523 billion agribusiness industry is plowing over ancient archaeological finds, moving deep into the Amazon to meet global demand for soy, corn and sugar, according to a Bloomberg focus item (link).

— USDA daily export sale:

• 115,000 metric tons of corn to Mexico, 2024-2025 marketing year.

— Ag trade update: Japan purchased 112,580 MT of milling wheat via its weekly tender, including 64,510 MT U.S., 23,310 MT Canadian and 24,760 MT Australian. South Korea tendered to buy up to 70,000 MT of corn from South America or South Africa.

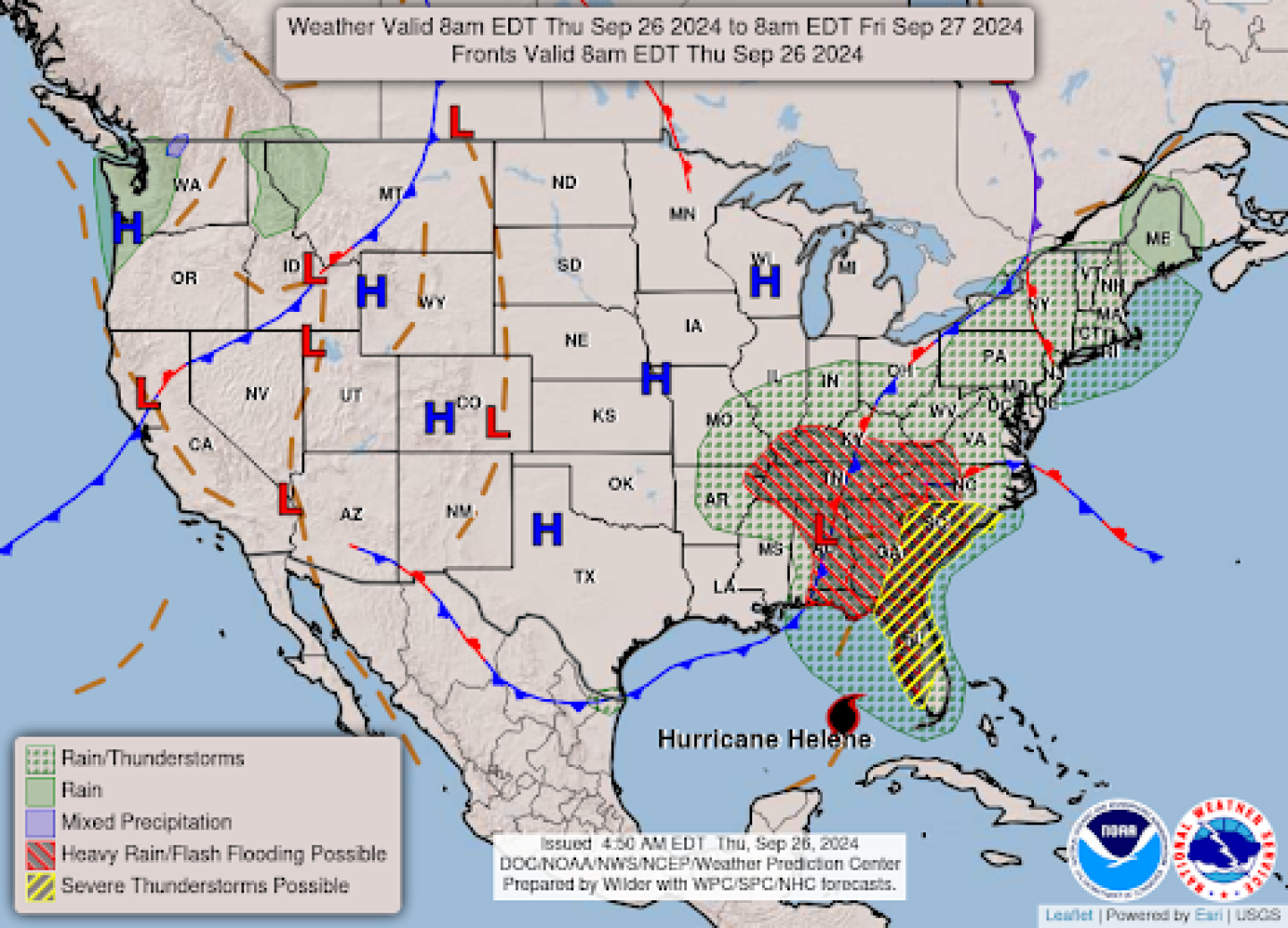

— Helene update:

• Helene is forecast to be a Category 3 or higher storm, making landfall on Florida’s northwestern coast Thursday evening. Warnings extend into south-central Georgia, with emergencies declared in Florida, Georgia, and the Carolinas.

• Storm surges up to 20 feet in Florida’s Apalachee Bay could be “catastrophic and life-threatening.”

• Helene is expected to be one of the largest storms to hit the region in recent years, according to hurricane expert Phil Klotzbach, surpassing most Gulf hurricanes since 1988, including Irma (2017), Wilma (2005), and Opal (1995).

• Agricultural concerns center on cotton crops, with 68% of bolls open in Georgia, 80% in South Carolina, and 68% in North Carolina.

• Energy impacts: 17 production platforms and one non-dynamically positioned (DP) rig have been evacuated, with three DP rigs moved out of the storm’s path. Approximately 29.2% of oil production and 16.9% of natural gas production in the Gulf has been shut down.

— NWS outlook: Helene is forecast to rapidly intensify to a major hurricane in the Gulf today and bring life-threatening impacts to Florida and the Southeast through Friday... ...Rare High Risks of excessive rainfall are in place for parts of the Florida Panhandle where Helene will make landfall, and for the southern Appalachians where catastrophic flash flooding and landslides are expected... ...Above average temperatures and summer-like warmth forecast to stretch from the Southwest to northern Plains.

Items in Pro Farmer’s First Thing Today include:

• Followthrough buying in soybeans, wheat

• Cold temps nip Aussie wheat crop

• IKAR lowers Russian wheat production forecast

CONGRESS |

— Congress passes stopgap spending bill, heads into recess early. Congress cleared a continuing resolution (HR 9747) to avoid a partial government shutdown, sending lawmakers into recess two days ahead of schedule. The stopgap, set to expire in December, allows for a pause to reassess fiscal year (FY) 2025 appropriations post-November elections. While some Republican leaders aim to delay final spending decisions, critical issues like additional disaster aid and Ukraine support remain unresolved.

The House passed the funding bill which will keep federal agencies open until Dec. 20 by a vote of 341-82. Every Democrat voted yes. Speaker Mike Johnson (R-La.) got the support of a majority of House Republicans — 132 Republicans voted yes.

The 78-18 Senate vote means the bill is now on its way to President Joe Biden’s desk well ahead of the Sept. 30 deadline to prevent a partial government shutdown.

The bill is mostly a clean extension of current spending levels to Dec. 20. It includes an extra $231 million for Secret Service protection accounts and frees up $20 billion for the Federal Emergency Management Agency (FEMA) for disaster relief starting Oct. 1.

Of note: “The most important person deciding what we’re going to do is going to be the president-elect of the United States, whoever that is,” House Appropriations Chair Tom Cole (R-Okla.) told reporters yesterday.

— Over half of House GOP urges leadership to pass farm bill in lame-duck session. More than half of House Republicans have signed a letter (link) urging leadership to bring the GOP’s Farm, Food, and National Security Act of 2024 to the floor during the upcoming lame-duck session. The bill passed out of the Agriculture Committee in May but has faced delays due to concerns about support. High-profile GOP lawmakers, including several committee chairs, signed the letter, calling the farm bill “must-pass” legislation. House GOP leadership may opt for a short-term extension of the current farm bill instead.

— House Democratic leader prioritizes farm bill for lame-duck session, urges bipartisan action. House Democratic Leader Hakeem Jeffries (D-N.Y.) placed the farm bill third on his post-election must-pass list, behind averting a government shutdown and ensuring military preparedness. The lame-duck session offers the last chance to pass the bill before the new Congress begins in January. With Democrats hoping to regain control of the House, Jeffries emphasized the importance of supporting farmers, addressing public nutrition, and combating the climate crisis. Despite months of stalled negotiations, bipartisan calls, including from former agriculture secretaries, urge swift passage of a new farm bill.

Of note: Former agriculture secretaries Ann Veneman and Dan Glickman, who served, respectively, under George W. Bush and Bill Clinton, signed a letter to the leaders of the Senate and House Agriculture committees offering the help of the Bipartisan Policy Center (BPC) “to build the consensus necessary to usher a bipartisan bill through Congress this year.” Meanwhile, the board of directors of the National Association of State Departments of Agriculture, meeting in Indianapolis, passed a resolution urging “expeditious passage of a comprehensive bipartisan farm bill in 2024.”

ISRAEL/HAMAS CONFLICT |

— Biden administration is urging Israel and Hezbollah to agree to a temporary 21-day cease-fire, hoping to prevent a full-scale ground war along Israel’s northern border. U.S. officials are proposing a multi-week halt in hostilities, with both sides potentially seeking a diplomatic resolution as Israel intensifies its military buildup and Hezbollah faces significant losses in leadership and weaponry.

RUSSIA/UKRAINE |

— Zelenskyy to present “victory plan” at White House amid urgent plea for continued U.S. aid. Ukrainian President Volodymyr Zelenskyy is set to visit the White House today to request further U.S. support for Ukraine’s defense against Russia. While the details of his “victory plan” are unclear, it is expected to focus on immediate needs to counter Russia’s invasion. Meanwhile, Russian President Vladimir Putin issued a stark warning, threatening potential nuclear retaliation if Ukraine uses Western missiles against Russia.

Meanwhile, President Biden directed that Ukraine receive the remaining $5.5 billion worth of American weapons and equipment previously authorized by Congress, ahead of his meeting with Zelenskyy.

Of note: VP Kamala Harris and Zelenskyy will deliver remarks at 3:05 p.m. ET and the two will hold a meeting at 3:25 p.m. ET.

POLICY UPDATE |

— Southern Ag Today: Mounting losses in agriculture: farmers face record declines amid uncertain farm bill support. Dr. Bart Fischer and Dr. Joe Outlaw, writing in Southern Ag Today (link) note the following:

• Row crop producers recently lobbied in Washington, D.C., highlighting the need for a new farm bill and disaster assistance amid escalating challenges such as droughts, inflation, and market downturns.

• The current farm bill structure leaves producers in limbo, with uncertainty about future safety net coverage. Direct government payments are forecasted to hit a 42-year low in 2024, the lowest since the 1980s farm crisis.

• USDA projects a $35 billion drop in crop cash receipts in 2024, the largest single-year decline in 50 years, with 2025 set to be even worse.”

• Congress has extended government funding through Dec. 20, but farm bill negotiations remain unresolved, leaving farmers facing potentially dire financial conditions heading into the New Year.

CHINA UPDATE |

— Another week of sizable U.S. soybean sales to China. USDA weekly Export Sales data for the week ending Sept. 19 included another round of major soybean sales to China, but some reductions in other commodities. Activity to China for the week included net sales reductions of 74 metric tons of wheat, net reductions of 7,010 metric tons of corn, net reductions of 1,000 metric tons of sorghum, net sales of 869,736 metric tons of soybeans, and net sales of 4,679 running bales of upland cotton. Activity for 2024 included net sales of 2,104 metric tons of beef and 2,736 metric tons of pork.

— China pledges new economic support, fuels hopes for fiscal stimulus boost. China’s top leaders, including Xi Jinping, surprised markets by promising additional fiscal and monetary measures to revive the economy, signaling potential for stronger stimulus. The Politburo’s unexpected meeting underscores a growing urgency to hit annual growth targets, with new policies aimed at stabilizing the housing sector and boosting domestic demand. However, economists caution that without robust fiscal action, the impact of recent monetary easing may be short-lived, and China’s economic recovery could face further delays.

China is also considering injecting up to 1 trillion yuan ($142 billion) of capital into its biggest state banks to increase their capacity to support the struggling economy, according to Bloomberg.

— China sets 2025 TRQs for wheat, corn, rice and cotton imports. China set its import tariff rate quotas (TRQs) for 2025 at about 9.64 MMT for wheat, 7.2 MMT for corn, 5.32 MMT for rice and 894,000 MT for cotton. Those levels are unchanged from previous years. TRQs allow the designated quantity of imports at a reduced duty.

— China targets Canadian tariffs with anti-discriminatory probe. China has launched an anti-discriminatory investigation against restrictive measures taken by Canada, including additional tariffs on Chinese electric vehicles (EVs), steel and aluminum products, its commerce ministry said. Canada joined the U.S. and EU in putting in place tariffs of 100% on Chinese EVs and 25% on Chinese aluminum and steel. China said it strongly deplored and firmly opposed Canada’s “discriminatory unilateral restrictive measures” and it had requested talks with Canada at the World Trade Organization about the tariffs. Separately, China’s commerce ministry urged the U.S. to “promptly” remove all additional tariffs on Chinese goods.

— China to stabilize beef, dairy sectors to aid farmers. China’s agriculture ministry said it would stabilize beef and dairy production, shore up consumption and assist farmers amid falling prices. The ministry’s plan called for the promotion of beef and milk consumption and support for farmers by offering loan extensions and lowering feed costs. The plan said localities would be required to accelerate the expansion of herds, while promoting higher quality cows. Vouchers will be used to push more milk consumption. The ministry called for prevention and control of disease in cow herds and said more targeted support policies would eventually be rolled out for agriculture and other sectors. China’s beef prices have fallen to the lowest level in five years.

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA refines 2024 food price forecasts as 2025 projections evolve. USDA refined its 2024 food price inflation forecasts, projecting increases of 2.2% for all food, 1.1% for groceries, and 4.1% for restaurant prices. These figures represent a slight easing for all food and grocery prices compared to the previous month’s outlook, with both categories lowered by 0.1 percentage points.

Historical context and forecast volatility. The current projections remain close to the initial outlook issued in July 2023, which predicted a 2.4% rise in all food prices, a 1.0% increase in grocery prices, and a 4.5% increase in restaurant prices. However, these forecasts have fluctuated monthly, sometimes dramatically:

• In December, USDA significantly lowered its projections, forecasting a 1.2% increase for all food and a 0.6% decrease for grocery prices.

• Since April, forecasts have stabilized, with all food prices ranging between 2.2% and 2.3%, and grocery prices between 1.0% and 1.2%.

USDA’s 2025 forecasts have seen more significant changes:

• All food price outlook was initially set at 2.0% in July, maintained in August, but lowered to 1.6% in September.

• Grocery price projections started at 0.7%, increased to 1.1% in August, then decreased to 0.8% in September.

• Restaurant price forecasts have remained relatively stable at 3.1% for the past two months.

Egg prices continue to demonstrate high volatility:

• The 2024 outlook initially predicted a 16.6% decline.

• In March, this shifted to a projected 4.8% increase.

• Current forecasts now anticipate a 5.9% rise in egg prices.

For 2024, USDA projects price decreases in:

• Fish and seafood (-1.6%)

• Dairy products (-0.3%)

• Fresh fruits (-0.7%)

Key takeaways:

• USDA forecasts have become more consistent from April onward for all food and grocery prices under their current methodology.

• Grocery prices are a significant focus, as they are projected to account for 60% of the food budget.

• Historical patterns show that food prices generally increase year-over-year, with only two years since 1974 (2016 and 2017) experiencing overall declines in grocery prices.

• The forecasts suggest that lowering grocery costs for consumers remains challenging, as prices have consistently risen in most years since 1974.

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |