Today’s Digital Newspaper |

MARKET FOCUS

· ‘September is a live meeting for a rate cut’ — John Lynch

· Wells Fargo looks at Thursday’s CPI report

· Boeing agrees to plead guilty to criminal fraud charge

· Exxon Mobil expects oil prices to boost second-quarter earnings

· Microsoft employees in China only able to use iPhones for

· Paramount Global agrees to merge with Skydance Media

· Number of active drilling rigs in U.S. rapidly declining

· Vietnam’s economic growth is accelerating

· Ag markets today

· South Africa’s growing fruit exports in peril due to crumbling ports

· Ag trade update

· Hurricane Beryl makes landfall in Texas

· NWS weather outlook

· Pro Farmer First Thing Today items

CONGRESS

· Speaker Mike Johnson meeting with Zelenskyy on Wednesday

· Schumer hosting bipartisan meeting with Canadian PM Justin Trudeau on Tuesday

POLICY

· Some states being fined for SNAP errors

CHINA

· U.S. intensifying scrutiny on Chinese land purchases near military bases

· China takes more control over interest rates

· Another exceptionally hot risking Chinese crop harvests

TRADE POLICY

· Global trade in goods and services is rebounding from last year’s downturn

ENERGY & CLIMATE CHANGE

· Another green bubble is deflating in biofuels

LIVESTOCK, NUTRITION & FOOD INDUSTRY

· May U.S. beef export value highest in 11 months; pork exports below year-ago

· Japan, Mexico, Taiwan help push May beef export value over $900 million

· May U.S. pork exports below last year, but still show broad-based strength

· MIT develops AI robot for grocery bagging with delicate handling capabilities

HEALTH UPDATE

· Second gentleman Doug Emhoff tested positive for Covid-19 on Saturday

POLITICS & ELECTIONS

· French toast: Elections in France go from right to left

· President Joe Biden determined to stay in the 2024 race; letter to Dems

· Trump preparing to announce his running mate

OTHER ITEMS OF NOTE

· Cotton AWP moves lower

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed to weaker overnight. U.S. Dow opened 60 points higher and is now around 200 points higher. French stocks advanced on Monday alongside a broad advance in the European market, while bonds and the euro posted small moves. Traders see safety in France’s political gridlock. In Asia, Japan -0.3%. Hong Kong -1.6%. China -0.9%. India -0.1%. In Europe, at midday, London +0.2%. Paris +0.1%. Frankfurt +0.4%.

U.S. equities Friday: All three major indices registered gains for the week with the Nasdaq and S&P 500 ending in record territory. For the week, the Dow as up 0.7%, the Nasdaq gained 3.5%, and the S&P 500 rose 2%. On Friday, the Dow was up 67.87 points, 0.17%, at 39,375.87. The Nasdaq gained 164.46 points, 0.90%, at 18,352.76. The S&P 500 rose 30.17 points, 0.54%, at 5,567.19.

The S&P 500 hit its 34th record close of the year on Friday. Its rally for 2024 has grown to 16.7%. The Nasdaq Composite also closed at a new high, and its year-to-date gain has reached 22.3%.

— Boeing has agreed to plead guilty to a criminal fraud charge stemming from two fatal 737 Max crashes in 2018 and 2019, the Justice Department said in a court filing on Sunday. As part of the plea deal, Boeing will pay a $243.6 million fine, invest upwards of $450 million toward safety and compliance programs and be on probation for three years. The crash victims’ families dislike this deal as they sought tougher terms.

— Exxon Mobil expects oil prices to boost second-quarter earnings. Exxon Mobil said on Monday changes in oil prices would increase the company’s second-quarter upstream earnings by $300 million to $700 million compared with the first quarter.

— Microsoft told employees in China that from September they’ll only be able to use iPhones for work, effectively cutting off Android-powered devices from the workplace.

— Paramount Global agreed to merge with Skydance Media in a deal that hands control of the storied Hollywood studio to producer David Ellison, ending one of the industry’s most dramatic acquisitions. As part of the complicated deal, Paramount Chair Shari Redstone agreed to sell her family’s National Amusements Inc., which controls about 77% of the voting stock in Paramount, for $2.4 billion, according to a statement released by the company Sunday.

— Brent crude futures on Friday settled down 89 cents per barrel, 1.02% lower, to $86.54 a barrel, after reaching their highest since April earlier in the session. U.S. West Texas Intermediate (WTI) crude futures settled at $83.16 a barrel, down 72 cents, 0.9%.

— Ag markets today: Corn, soybeans and wheat posted moderate to sharp losses during the overnight session. As of 7:30 a.m. ET, corn futures were trading mostly a nickel lower, soybeans were 13 to 17 cents lower, SRW wheat was 7 to 8 cents lower, HRW wheat was 9 to 12 cents lower and HRS wheat was mostly 7 cents lower. The U.S. dollar index was modestly firmer, while front-month crude oil futures were around 75 cents lower.

Wholesale beef prices continue to firm. Wholesale beef prices firmed 59 cents for Choice and 68 cents for Select on Friday, though movement slowed to 89 loads. Traders will focus on wholesale prices and movement as the post-Fourth timeframe is typically slower for beef demand.

Cash hog index drops, pork cutout firms. The CME lean hog index is down 25 cents to $89.20 as of July 4, ending two days of mild gains. The pork cutout value firmed $1.28 on Friday amid strength in all cuts except ribs, pausing its recent price slide.

— Agriculture markets Friday and for the week:

· Corn: Bulls shook off a poor export sales report, gaining 4 1/2 cents to $4.24, gaining 3 1/2 cents on the week.

· Soy complex: November soybeans closed 8 1/4 cents higher to $11.29 3/4, gaining 25 3/4 cents on the week. August meal surged $7.1 to $357.2, a weekly gain of $11.2. August bean oil firmed 91 points to 49.55 cents, surging 548 points on the week.

· Wheat: December SRW futures closed 15 1/2 cents higher on the day to $6.13 1/2 marking a weekly gain of 16 1/2 cents, while December HRW futures gained 13 3/4 cents to $6.16, closing 12 3/4 cents higher on the week.

· Cotton: Cotton futures underwent heavy selling pressure to end the week as December futures plunged 138 points to 70.98 cents, marking a 171-point loss on the week.

· Cattle: Live cattle futures struggled to maintain early session gains, but still closed 32.5 cents higher to $186.425 in the August contract, which gained a dollar on the week. August feeder cattle futures sunk $1.90 to $261.475, though still firmed $2,175 on the week.

· Hogs: Lean hog futures saw resurgent selling pressure after showing strength early in the week, as August futures fell 65 cents to $89.89.175, falling $1.70 on the week. The CME lean hog index is up 14 cents to $89.45 as of July 2, though after rising for two consecutive days, the preliminary calculation puts the index down a quarter to $89.20 Monday.

— Quotes of note:

· “September is a live meeting for a rate cut.” — John Lynch, chief investment officer for Comerica Wealth Management, commenting on the weakening trend in job creation and increasing confidence that the Federal Reserve can soon cut rates

· Wells Fargo looks at Thursday’s CPI report: “Consumer price inflation likely firmed in June relative to May but remained on a downward trajectory through the month-to-month noise. We expect that headline CPI rose 0.1% in June and core CPI registered a “high” 0.2% gain (0.24% before rounding). While a bounce back in core services ex-housing is likely to propel the pickup, favorable seasonal factors and broadly easing price pressures should mitigate the extent of June’s rebound.”

— The economic week ahead: Aside from Fed Chair Jerome Powell’s testimony, June consumer price index data released on Thursday will be a highlight for investors this week.

— Ag calendar update for today:

• National Cattlemen’s Beef Association holds Cattle Industry Summer Business Meeting, through Wednesday, San Diego.

• United Soybean Board, in charge of soybean checkoff funds, meets to finalize its budget for fiscal 2025, through Thursday, Baltimore.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note was up, trading around 4.31%, with a mixed-to-positive tone in global government bond yields. Crude oil futures were down, with U.S. crude trading at around $82.50 per barrel and Brent trading at around $86.05 per barrel. Futures had been even lower in Asian trading with US crude around $82.35 per barrel and Brent around $85.90 per barrel. Gold and silver futures were lower, with gold around $2,383 per troy ounce and silver around $31.34 per troy ounce.

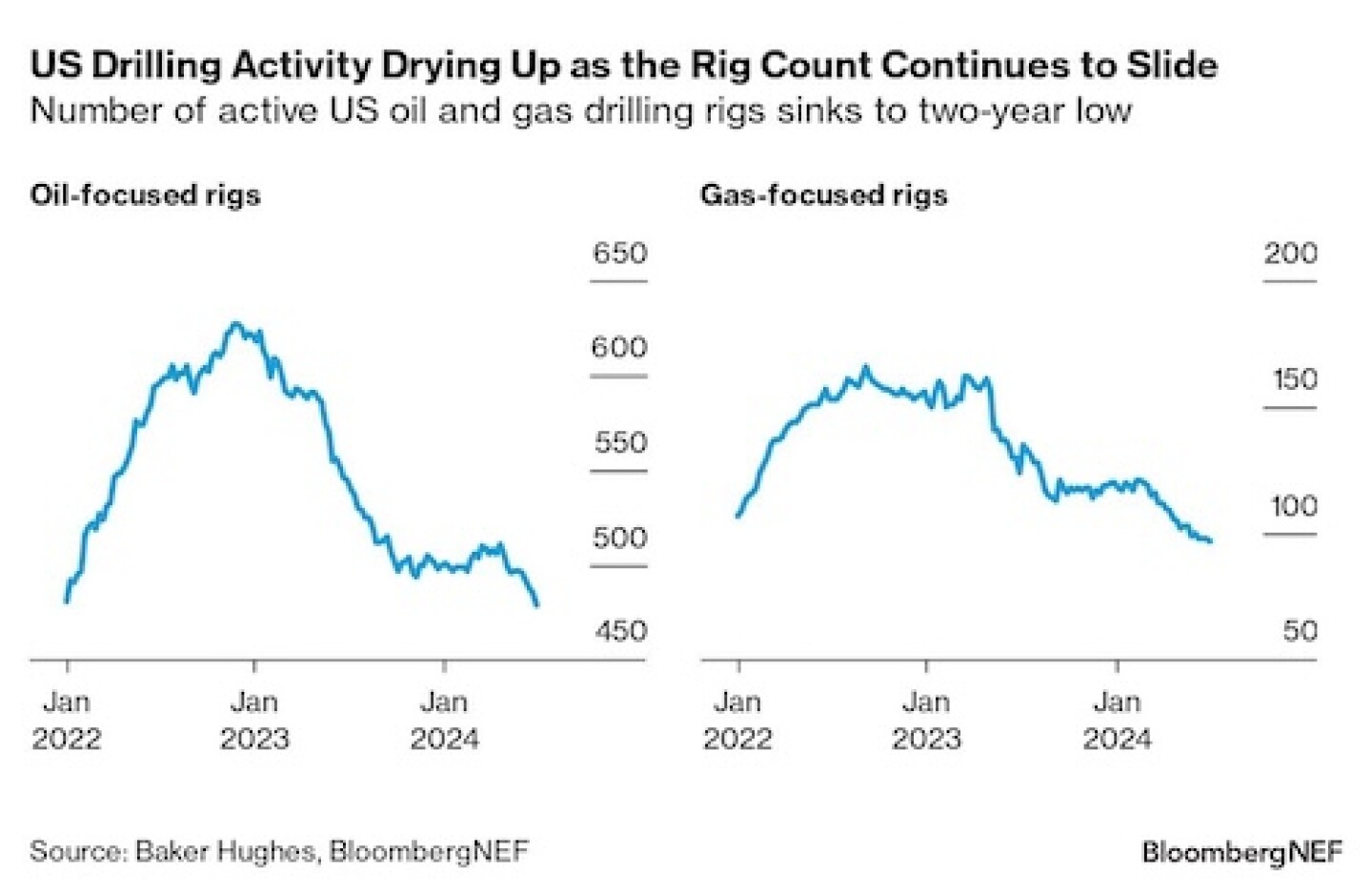

— The number of active drilling rigs in the U.S. is rapidly declining, showing the first significant change in almost a year. Over the past 10 weeks, the rig count has dropped by 41, or over 6%, with most of the decrease coming from oil-focused rigs. This decline is likely influenced by recent consolidation in the shale industry, as deals made in the past year are finalized. Major operators are shelving rigs to optimize their newly acquired assets.

— Vietnam’s economic growth is accelerating and could meet or exceed the government’s 6.5% target this year, according to a government minister. Foxconn, the Taipei-based supplier to Apple, will invest about $551 million in two new projects in Vietnam’s northern coastal province of Quang Ninh.

— South Africa’s growing fruit exports have been a rare bright spot in a stagnant economy. Now they are in peril as well due to crumbling ports. Link to Bloomberg item.

— Ag trade update: Jordan tendered to buy 120,000 MT of optional origin milling wheat. Algeria tendered to buy a nominal 50,000 MT of optional origin soft milling wheat.

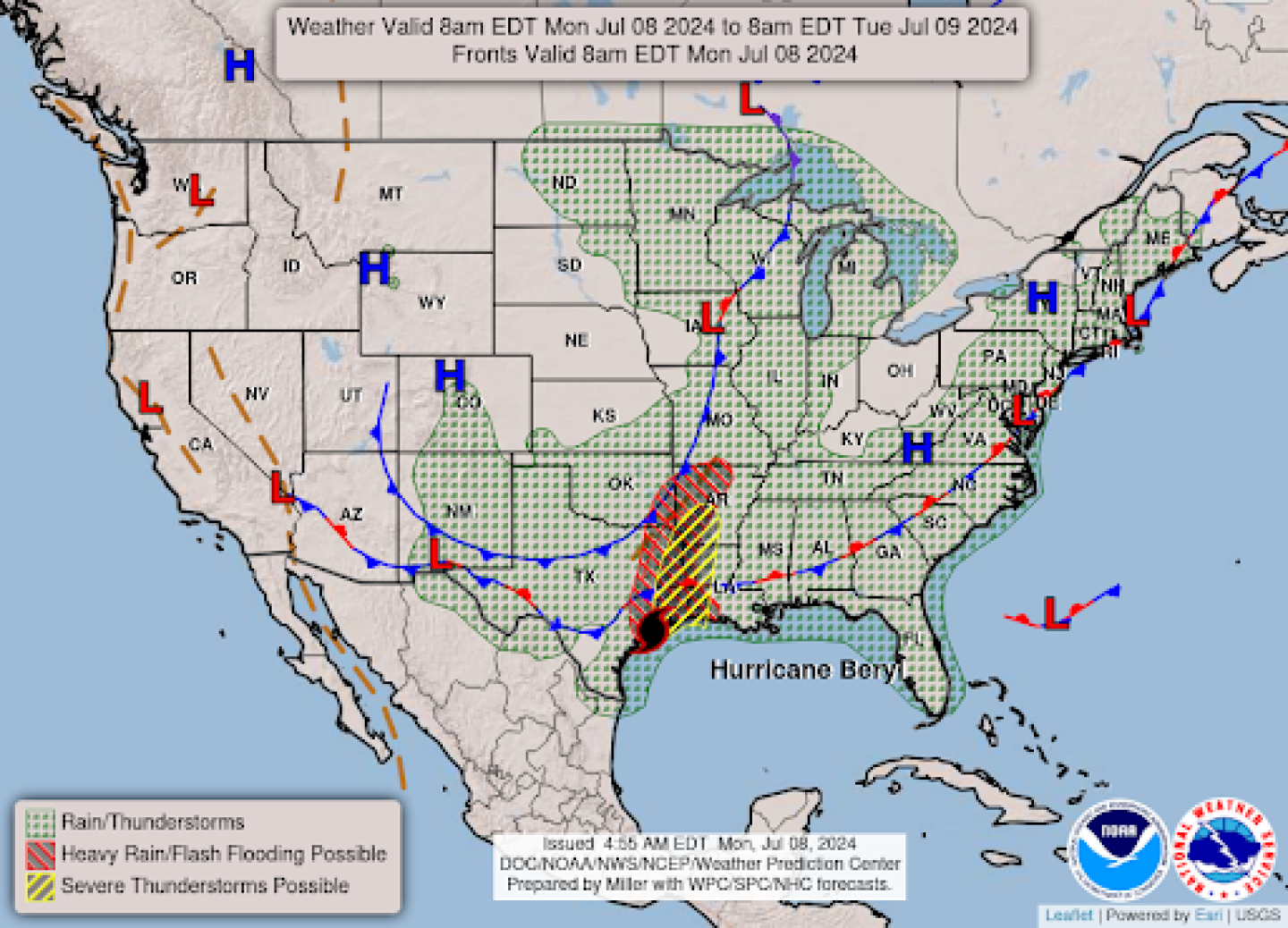

— Hurricane Beryl has made landfall in Texas, affecting over a million people under a hurricane warning. The storm has caused severe wind and rain, particularly impacting the coast and resulting in the cancellation of hundreds of flights in Houston. Forecasters have issued warnings about potential flooding and power outages and have expressed concern that Beryl’s intensity might indicate a severe hurricane season ahead. Beryl is expected to weaken significantly and move inland over eastern Texas, before reaching Arkansas on late Monday or early Tuesday. In May, the National Oceanic and Atmospheric Administration warned as many as 25 named storms could emerge throughout the season — eight to 13 of which could develop into hurricanes. Between four to seven of them could develop into major hurricanes, classified as Category 3 or above with sustained wind speeds higher than 111 mph. On average, 14 named storms are observed every year in the Atlantic.

— NWS weather outlook: Hurricane Beryl to bring very heavy rain, damaging hurricane-force winds and life-threatening storm surge to the Texas coast today... ...Extreme heat re-focuses over the Desert Southwest and interior Pacific Northwest; more heat and humidity for the Mid-Atlantic as well.

Items in Pro Farmer’s First Thing Today include:

• Grains under pressure to open the week

• Heat builds, rains ease

• Eurozone investor morale declines after eight months of increases

CONGRESS |

— House Speaker Mike Johnson (R-La.) is meeting with Ukrainian President Volodymyr Zelenskyy on Wednesday, according to his office, while he’s in town for the NATO summit. He’ll also meet the new UK Prime Minister Keir Starmer jointly with Democratic leader Hakeem Jeffries.

— Senate Majority Leader Chuck Schumer (D-N.Y.) is hosting a bipartisan meeting with Canadian Prime Minister Justin Trudeau on Tuesday, according to his office. He’ll also lead a bipartisan meeting Wednesday with NATO Secretary General Jens Stoltenberg and the leaders of Finland, Sweden, Germany, and the UK, as well as one with Zelenskyy.

POLICY UPDATE |

— Some states are being fined for SNAP errors. Several states are facing penalties from the federal government due to high error rates in administering SNAP (food stamp) benefits:

• Alaska is facing an $11.9 million fine for a 60% error rate in 2023, the highest in the nation.

• Washington D.C. is facing a $4.4 million penalty for a 20% error rate.

• Other states with high error rates include New Jersey (33.48%) and South Carolina (20.94%).

USDA considers an error rate above 6% to be unacceptable. States that exceed this threshold for two consecutive years face financial penalties.

Errors can include overpayments or underpayments of benefits, as well as providing benefits to ineligible recipients. The national overpayment error rate for fiscal year 2023 was 10.03%, with an underpayment rate of 1.64%.

These errors are generally not due to fraud, but rather unintentional mistakes by state agencies or recipients that affect eligibility determinations or benefit amounts.

States facing penalties have options to address the fines:

• They can pay the full amount immediately.

• They can invest 50% of the penalty amount in improving their SNAP administration systems.

USDA is emphasizing state responsibility in improving SNAP accuracy and has implemented measures to support states, including:

• Offering training and guidance

• Providing technology grants

• Requiring corrective action plans from poorly performing states

Both Republican and Democratic lawmakers have criticized the high error rates, calling for improved oversight and accuracy in SNAP benefit distribution.

Factors contributing to high error rates include challenges in unwinding pandemic-related benefits, staffing shortages, and technological issues in benefit processing systems.

CHINA UPDATE |

— U.S. is intensifying scrutiny on Chinese land purchases near military bases due to concerns over national security and espionage, according to a special report (link) by the Epoch Times. In May, President Biden issued an executive order shutting down MineOne Partners Ltd., a Chinese-owned firm near Warren Air Force Base in Wyoming. Chinese investors made the most land transactions among foreign nationals from 2020 to 2022, prompting increased federal and state attention. Despite significant Chinese land holdings in states like Texas and North Carolina, federal legislation to limit such purchases has stalled.

The Government Accountability Office (GAO) identified weaknesses in tracking foreign land purchases, calling for better coordination and data sharing. At a congressional hearing, lawmakers expressed alarm over Beijing’s efforts to undermine U.S. security, emphasizing the threat posed by the Chinese Communist Party (CCP).

Chinese telecommunications firms installing cell towers near military bases raised suspicions of eavesdropping. The Cybersecurity and Infrastructure Security Agency warned of Chinese hackers pre-positioning for potential cyberattacks. Experts advocate for a holistic government approach to address CCP threats, suggesting moving CFIUS oversight from the Treasury to the Defense Department.

State-level actions include bans on foreign adversaries owning land near military facilities, with several states enacting such laws. High-profile cases, like Chinese land purchases near Laughlin Air Force Base in Texas and Grand Forks Air Force Base in North Dakota, have intensified scrutiny. The federal government has expanded CFIUS’s powers to include more sensitive military sites.

Bottom line: Concerns about espionage, intellectual property theft, and potential sabotage of the U.S. food supply underscore the need for vigilant monitoring of foreign land purchases near critical infrastructure.

— China takes more control over interest rates. The People’s Bank of China said it would start conducting temporary bond repurchase agreements or reverse repos to make open market operations more efficient and keep banking system liquidity ample. This effectively narrows the corridor within which short-term rates can fluctuate, with the seven-day reverse repo rate serving as a central guide, giving the central bank more leeway to manage cash conditions and interest rates amid strong demand for bonds.

— Another exceptionally hot summer, accompanied by drought, flooding and typhoons, is risking Chinese crop harvests and lifting power demand as climate change creates more extreme weather. Link for details.

TRADE POLICY |

— Global trade in goods and services is rebounding from last year’s downturn, driven by economic strength in the U.S. and robust exports from developing Asian nations. According to a report (link) by UNCTAD, trade in goods increased by 2% in the first half of the year, adding $250 billion, while services grew by $100 billion compared to the same period in 2023.

UNCTAD highlights significant trade reallocations and increased supply concentration. Despite the overall slowdown in international commerce last year, industrial policies like the US Inflation Reduction Act, China’s Made in China 2025 initiative, and the EU’s Net Zero Industry Act boosted demand for specific goods.

The report notes a 50% rise in electric vehicle trade among major economies, while competition remains strong for solar panels and electric vehicles. However, the battery value chain sector is becoming increasingly concentrated among a few major exporters, with low trade reallocation.

UNCTAD foresees three potential implications:

1. Increased concentration in global trade

2. Splintering into major trade blocs

3. Rising protectionism and costs

ENERGY & CLIMATE CHANGE |

— Another green bubble is deflating in biofuels. Bloomberg Opinion columnist Javier Blas said, “After the stock market debacle for wind companies in 2023, the biofuel sector is the next deflating green bubble. The industry is battling several problems: significant cost overruns and engineering shortcomings, and a glut of biofuels as rosy forecasts for demand never materialized. Oil consumption, instead, is rising. Biofuel margins have tumbled.” Blas says the rush to build biofuel plants, particularly in China, has created a wave of supply that has depressed prices elsewhere, hurting the profitability of projects. U.S. and European companies complain about unfair Chinese competition — another sign of the geopolitical green rivalry. Link to Blas’ comments.

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— May U.S. beef export value highest in 11 months; pork exports below year-ago. The value of U.S. beef exports topped $900 million in May, the highest since June 2023, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Pork exports posted another solid performance in May, but were below last year in both volume and value.

— Japan, Mexico, Taiwan help push May beef export value over $900 million. May U.S. beef exports totaled 110,133 metric tons (mt), down 5% from a year ago but the second largest of 2024. Beef export value reached $902.4 million in May, 3% above last year and the highest in 11 months. Exports trended higher year-over-year to Japan, Mexico, the ASEAN Region, the Middle East, the Caribbean and Central America – which included a record month for Guatemala. May export value was also higher for Taiwan. For January through May, beef exports followed a similar trend, increasing 5% year-over-year in value to $4.29 billion, despite a 4% decline in volume (533,578 mt).

“It has been encouraging to see demand stabilize in Japan, where U.S. beef certainly faces significant headwinds,” said USMEF President and CEO Dan Halstrom. “The tourism boom has provided a much-needed lift for Japan’s foodservice sector, and it is a source of optimism for buyers and importers. Taiwan and the ASEAN region were also bright spots for U.S. beef in May, along with Western Hemisphere markets such as Mexico, Guatemala and the Caribbean.”

— May U.S. pork exports below last year, but still show broad-based strength. May pork exports totaled 251,447 mt, down 4% from a year ago, valued at $715.8 million (down 2%). Shipments to leading market Mexico were below last year’s large volume but still trended higher in value. Exports increased year-over-year to South Korea, the ASEAN region, Central America and Colombia and held steady to Japan. Through the first five months of the year, pork exports were up 6% to 1.29 million mt, while export value was 7% above last year’s record pace at $3.6 billion.

“Pork shipments to Mexico trended a bit lower in May, but that’s following a record April performance,” Halstrom said. “And even at that, export value to Mexico still topped $200 million. U.S. pork also posted another great month in Korea and exports to the ASEAN region were the largest in three years. Demand also continued to strengthen in Central America and the Caribbean.”

— MIT develops AI robot for grocery bagging with delicate handling capabilities. MIT’s Computer Science and Artificial Intelligence Laboratory has developed a sophisticated robot system designed for grocery bagging. This AI-enabled robot features soft, finger-like grippers and a range of advanced technologies to handle items at self-checkout lanes. Equipped with an RGB-D camera and computer vision technology, the robot identifies items on a conveyor belt and estimates their sizes. An algorithm assigns a “delicacy score” to each item, allowing the robot to determine how to handle them — delicate items are placed aside, while sturdier ones are bagged immediately. Pressure sensors in the grippers give the robot nerve-like sensitivities to ensure careful handling of products. This innovation allows shoppers to potentially choose between human or robotic baggers in the future.

HEALTH UPDATE |

— Second gentleman Doug Emhoff tested positive for Covid-19 on Saturday after experiencing mild symptoms, according to a statement from his office on Sunday. Vice President Kamala Harris has tested negative and remains asymptomatic. The couple attended an Independence Day event with President Joe Biden and first lady Jill Biden on Thursday. This positive case in Biden’s inner circle coincides with a summer wave of Covid-19 in the U.S., with infections likely increasing in at least 38 states, according to the CDC.

POLITICS & ELECTIONS |

— President Joe Biden is determined to stay in the 2024 race despite growing calls from within his party to step down after a poor debate performance last month. Sources report that several House Democratic ranking members urged House Minority Leader Hakeem Jeffries (D-N.Y.) on Sunday to convince Biden to withdraw. In response, Biden held campaign events in Pennsylvania to reassure voters of his reelection viability, stating, “I’m up for the job.”

Biden pledged to fellow Democrats he will remain in the 2024 presidential race, seeking to quell an intraparty revolt against his campaign. “I am firmly committed to staying in this race, to running this race to the end, and to beating Donald Trump,” Biden wrote Monday in a letter addressed to Democratic lawmakers and released by his campaign.

Biden is starting a crucial week. He has a NATO summit in Washington and his team has promised that he will hold a solo news conference, his first in Washington since November 2022.

Of note: Sen. Mark Warner (D-Va.) called off a tentative meeting today that was meant to discuss Biden’s standing.

The White House helped draft the questions President Biden was asked in post-debate interviews with Black-owned radio stations last week. One of the outlets, WURD Radio, later parted ways with the host, according to Axios.

Meanwhile, former President Donald Trump is preparing to announce his running mate before the Republican convention in Milwaukee next week, where he will be officially nominated for the third time in eight years.

OTHER ITEMS OF NOTE |

— Cotton AWP moves lower. The Adjusted World Price (AWP) for cotton fell to 57.80 cents per pound, effective Friday (July 5), down from 58.23 cents the prior week. Meanwhile, USDA announced Special Import Quota #12 would be established July 11 for 42,137 bales of upland cotton, applying to supplies purchased no later than October 8 and entered into the US not later than Jan. 6, 2025.

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |