Updates: Policy/News/Markets, Feb. 11, 2025

— Federal spending surges 15% in early fiscal 2025, driven by entitlements and interest on debt. Federal spending jumped 15% in the first four months of fiscal year (FY) 2025, according to a Congressional Budget Office report. Outlays rose $317 billion to $2.43 trillion. Adjusting for timing shifts, spending increased by $157 billion, or 7%. Entitlement programs were the primary drivers: Social Security spending rose 7%, Medicare 5%, and Medicaid 9% due to rising enrollee costs. Notably, President Trump has taken entitlement reforms off the table. Defense spending climbed 8%, but interest payments on the national debt surged 13% due to higher interest rates and mounting debt. For the first time, interest expenses have surpassed defense outlays—a troubling trend enabled by bipartisan neglect. — Trump imposes sweeping steel and aluminum tariffs, sparking trade war risks. President Donald Trump as expected raised tariffs on steel and aluminum imports to a flat 25% without exceptions (but see next item), aiming to support struggling domestic industries but escalating trade tensions worldwide. The measures, effective March 12, eliminate country-specific exemptions and extend to downstream steel and aluminum products, affecting key suppliers such as Canada, Mexico, Brazil, and South Korea. The move expands Trump’s 2018 Section 232 tariffs, justifying the action on national security grounds. “It’s 25% without exceptions,” Trump emphasized, adding that reciprocal tariffs on countries taxing U.S. goods will be announced soon. Canada criticized the action as unjustified, citing its critical role in U.S. supply chains. The European Commission, South Korea, and other affected nations expressed concern, with retaliatory measures and negotiations expected in the coming days. U.S. steel and aluminum producers saw stock gains, while foreign steelmaker shares fell. — Trump considers exemption for Australia on steel, aluminum tariffs. President Trump agreed to consider exempting Australia from newly reinstated steel and aluminum tariffs, following a call with Australian Prime Minister Anthony Albanese. Trump reintroduced a 25% tariff on imports after previously allowing duty-free quotas. The decision could escalate trade tensions globally. Citing Australia’s trade surplus with the U.S. and the strategic Indo-Pacific partnership, Trump acknowledged the exemption request, saying he would “give great consideration” due to the strong bilateral ties and Australia’s minimal share of U.S. steel (1%) and aluminum (2%) imports. Albanese described the call as constructive, expressing confidence in a favorable outcome. Australian officials highlight the importance of steel exports for U.S. defense supply chains, especially under the AUKUS pact. — South Korea’s acting President Choi Sang-mok said the government would seek talks with the Trump administration on the tariffs Washington is imposing to reflect the interests of domestic companies. The CEOs of 20 major South Korean conglomerates plan to visit the U.S. in the near future, while the government intends to discuss response measures with Japan and the European Union, Choi said. — EU to respond strongly to U.S. steel and aluminum tariffs. The European Union pledged a robust response to the U.S.’ recent imposition of 25% tariffs on steel and aluminum imports, a move that has reignited transatlantic trade tensions. European Commission President Ursula von der Leyen warned that “unjustified tariffs” will trigger “firm and proportionate countermeasures.” The EU is exploring several options, including: German Chancellor Olaf Scholz and French Industry Minister Marc Ferracci have both emphasized the need for a unified EU response. The European Commission has convened an emergency meeting of trade ministers to discuss next steps, signaling the potential for a broader trade conflict if the U.S. does not reconsider its tariff policy. — Trudeau slams U.S. tariffs on Canadian Steel and Aluminum as “unjustified.” Canadian Prime Minister Justin Trudeau criticized U.S. tariffs on steel and aluminum as “entirely unjustified,” according to a CBC video posted on X. Trudeau emphasized that Canada’s response “will be firm and clear” while the government engages with Donald Trump’s administration to underline the tariffs’ negative impact on both nations. When asked about the possibility of retaliatory tariffs, Trudeau expressed hope that escalation could be avoided. — Trump confirms speaking with China’s Xi since taking office. President Donald Trump revealed in a Fox News interview that he had spoken with Chinese President Xi Jinping since his inauguration on Jan. 20 but did not disclose details of the conversation. “We have a very good personal relationship,” Trump said, though he did not specify when the call took place or what was discussed. Despite rising tensions between the U.S. and China over trade, cybersecurity, Taiwan, and other issues, Trump previously stated he was in no rush to contact Xi regarding the ongoing trade conflict. The Chinese Foreign Ministry did not confirm the latest conversation, instead referring to a scheduled call on Jan. 17 before Trump officially took office. Meanwhile, China recently responded to U.S. trade tariffs with targeted duties on American imports and potential sanctions on several U.S. companies, including Google. Trump’s plan to call Xi following his latest round of tariffs on China has been delayed, with no contact yet made. Trump says he’s “in no hurry,” but the Wall Street Journal says insiders suggest that Beijing hasn’t proposed a concrete plan to curb China’s role in the U.S. fentanyl crisis — a key demand behind Trump’s decision to impose an additional 10% tariff on Chinese goods. A U.S. administration official noted that the tariffs could be paused if “serious headway” is made on fentanyl during the next Trump-Xi conversation. Unlike the quick deals reached with Mexico and Canada that resulted in suspended tariffs, China has yet to offer a concession. “The Chinese should just offer to crack down on fentanyl once and for all,” an American executive told the WSJ, highlighting Beijing’s proven efficiency in suppressing dissent and private enterprise. But President Xi appears in no rush. Instead, he’s pursuing a broader agreement that could shape long-term U.S./China relations. Beijing’s initial proposal, according to the Wall Street Journal, involves reinstating elements of the 2020 trade deal, a renewed pledge not to devalue the yuan, and commitments for increased U.S. investments. For now, however, Xi seems willing to absorb the additional tariffs, relying on Chinese companies’ ability to reroute exports through third countries. In response to the U.S. tariffs, China has imposed modest retaliatory measures, avoiding full escalation while keeping leverage on the table. Actions include new tariffs on U.S. energy imports and an investigation into Google for potential antitrust violations. Of note: 1.36 billion shipments entered the U.S. in fiscal year 2024 using the de minimis provision. The provision allowed bargain platforms Shein and Temu to skirt import duties on low-value packages from China. — U.S. resumes food aid donations after suspension left a lot of aid in limbo. The U.S. lifted a pause on food donations to the UN World Food Program (WFP), ending a suspension that had stalled 500,000 metric tons of food, according to a WFP announcement on Sunday. The food, purchased from U.S. farmers under the Food for Peace Title II program, had been in limbo due to a 90-day foreign aid review initiated by former U.S. President Donald Trump as part of his “America First” policy. Despite a waiver for emergency food assistance, Washington had instructed WFP to halt work on several U.S.-funded grants, affecting aid programs in countries like Yemen, Sudan, South Sudan, Haiti, and the Central African Republic. A report from the USAID Office of Inspector General warned that the uncertainty placed $489 million worth of food assistance at risk of spoilage or diversion. With the pause now lifted, food purchases and deliveries under existing USAID agreements can resume. — Judge rules Trump administration violated funding order. A federal judge has determined that the Trump administration violated his order to resume funding for federal grants blocked by a recent spending freeze. U.S. District Judge John McConnell instructed the administration to “immediately restore frozen funding” to programs such as the National Institutes of Health and initiatives under the Biden-era Inflation Reduction Act and Infrastructure Improvement and Jobs Act. Of note: Farmers across the U.S. are reporting millions of dollars in missing funding promised under USDA programs, despite assurances from the Trump administration that individual benefits would not be affected by a federal funding freeze. On his first day in office, President Donald Trump ordered the USDA to freeze funds related to the 2022 Inflation Reduction Act, impacting key programs such as the Environmental Quality Incentives Program (EQIP) and the Rural Energy for America Program (REAP). These initiatives support farmers in building renewable energy systems and improving infrastructure. Many farmers find themselves financially stranded, having invested their own money upfront with expectations of government reimbursement. USDA has stated that contracts are under review in compliance with executive orders, leaving farmers uncertain about the future of their businesses. — Judge extends pause on ‘deferred resignation’ deadline. A federal judge extended the block on the Trump administration’s controversial “deferred resignation” program on Monday, just hours before the deadline for federal employees to accept the offer. U.S. District Judge George A. O’Toole Jr. is considering turning the temporary restraining order into a preliminary injunction but has yet to indicate how he will rule. The program, which offers federal employees eight months’ pay in exchange for resigning by Sept. 30, has been challenged by unions, including the American Federation of Government Employees (AFGE), for allegedly violating the Administrative Procedure Act due to its chaotic implementation. While the Justice Dept. argues unions lack standing, critics warn that employees who accept the deal may lose the right to litigate their departures. Lee Saunders, president of AFSCME, praised the decision to maintain the pause: “We must continue to stop the purge of federal workers... until they receive the respect they deserve.” — Musk-led DOGE cuts USDA contracts worth $9 million. The Department of Government Efficiency (DOGE), led by Elon Musk, terminated 18 USDA contracts, according to a DOGE post on X Monday. The canceled programs, totaling around $9 million, included contracts such as Central American gender assessment consultant services, Brazil forest and gender consultant services, and the Women in Forest Carbon Initiative mentorship program. USDA secretary nominee Brooke Rollins praised the move on X, stating, “Our farmers and ranchers and all Americans deserve so much better … hopefully I will be there soon.” — Trump issues ultimatum on Hamas hostage release: ceasefire hinges on Saturday deadline. President Donald Trump warned that if all hostages held by Hamas are not returned by Saturday at noon, the ceasefire deal should be canceled, stating, “all hell will break loose.” When asked to clarify his statement, Trump responded, “They’ll find out.” He acknowledged the grim possibility that many hostages may already be dead but refrained from committing U.S. troops if the situation escalates. Trump emphasized that Israel retains ultimate decision-making power, but he stands firm on the urgency of the deadline. “If all of the hostages aren’t returned by Saturday at 12 o’clock — not in drips and drabs — I would say, cancel it, and all bets are off,” Trump declared. “Let hell break out.” Hamas said it would delay the release of more Israeli hostages. Under its ceasefire deal with Israel the militant group was due to free three of those being held captive this Saturday. It accused Israel of stopping displaced Palestinians returning to Gaza. |

| FINANCIAL MARKETS |

— Equities today: Asian and European shares were mixed in trading overnight. U.S. stock indexes are set to open weaker. In Asia, Japan closed. Hong Kong -1.1%. China -0.1%. India -1.3%. In Europe, at midday, London flat. Paris flat. Frankfurt +0.1%. U.S. stock futures are lower and yields are higher after President Trump officially announced 25% tariffs on steel and aluminum imports late yesterday, reigniting global trade war worries. Federal Reserve Chair Jerome Powell faces tough hearings with both Democrats and Republicans likely to prod him on Trump’s policies.

Equities yesterday: All three major indices started the week with gains. The Dow finished up 167.01 points, 0.38%, at 44,470.41. The Nasdaq rose 190.82 points, 0.98%, at 19,714.27. The S&P 500 gained 40.45 points, 0.67%, at 6,066.44.

— Coca-Cola’s Q4 surprise: Revenue growth and strong demand drive shares up. Coca-Cola reported a surprise rise in comparable revenue and exceeded profit estimates for the fourth quarter, driven by higher prices and resilient demand for its beverages. Shares rose 4% in premarket trading. The company focused on expanding its portfolio in North America with premium brands like Fairlife milk and Topo Chico sparkling water while capturing demand in emerging markets such as India. Partnerships with fast-food chains like McDonald’s further boosted sales. Q4 net revenue rose 4.2% to $11.40 billion, beating expectations of $10.68 billion. Profit per share stood at 55 cents, surpassing the forecast of 52 cents. Global volumes increased 1% in North America and 2% in its sparkling drink segment, led by Fanta and Sprite. Prices rose 9% in Q4 following a 10% increase in the previous quarter. In contrast, rival PepsiCo reported a 3% decline in North American beverage and snack volumes last week. Analysts attribute Coca-Cola’s outperformance to strong growth in no-sugar and sparkling beverages. Looking ahead, Coca-Cola expects organic revenue growth of 5% to 6% in 2025, following a 12% rise in 2024.

— Dollar steady amid trade uncertainty, focus shifts to Powell testimony and inflation data. The U.S. dollar held steady on Tuesday as markets shrugged off U.S. tariff threats and awaited key events, including Federal Reserve Chair Jerome Powell’s testimony and upcoming inflation data. Powell is set to speak before the Senate Banking Committee, with U.S. inflation figures due Wednesday following robust jobs data that recently boosted Treasury yields and the greenback. Meanwhile, President Donald Trump announced plans to raise tariffs on steel and aluminum imports, with further measures expected. Futures markets are pricing in about 40 basis points of Federal Reserve rate cuts by year-end, reflecting a cautious outlook despite Fed officials’ “wait-and-see” approach.

The U.S. dollar index remained flat, following last week’s 0.37% rise. The euro and sterling saw slight declines against the dollar. European Commission President Ursula von der Leyen warned that the EU would respond to the U.S. tariffs on European steel, raising fears of further trade tensions. Some analysts noted the risks of a prolonged trade dispute, with concerns that extended uncertainty could weigh on global economic growth.

Of note: Faced with the threat of rising inflation, the Federal Reserve will wait until next quarter before cutting rates again, according to a majority of economists in a Reuters poll who previously expected a March cut.

— Gold rallied past a record $2,942 an ounce after Trump’s announcement. The precious metal has surged about 11% this year as the president’s moves on trade and geopolitics reinforce bullion’s role as a haven in uncertain times.

— Trump administration eases anti-corruption rules, escalating tensions with Judiciary. President Donald Trump ordered the Department of Justice to stop enforcing a 48-year-old law prohibiting U.S. companies from bribing foreign governments, claiming it would boost American business competitiveness. Following the order, a Trump-appointed U.S. attorney dismissed corruption charges against New York Mayor Eric Adams, who faced allegations of accepting bribes from Turkey. This policy shift is part of a broader challenge to established norms, with a judge accusing the White House of defying a court order to unfreeze federal payments, signaling growing friction between the executive and judicial branches (see related items above).

| AG MARKETS |

— Ag markets today:

- Grains firmer in quiet overnight trade. Corn, soybeans and wheat mildly favored the upside in a quiet overnight session ahead of USDA’s February crop reports later today. As of 7:30 a.m. ET, corn futures were trading fractionally to a penny higher, soybeans were 2 to 4 cents higher and wheat futures were 3 to 5 cents higher. The U.S. dollar index was modestly weaker, while front-month crude oil futures were around $1.00 higher.

- Packers continue to slow cattle slaughter runs. This week’s cattle slaughter is expected to slow even more from last week’s estimated 584,000 head tally, as beef plants continue to control throughput amid tight supplies and poor margins. High carcass weights are helping make up for some of the reduced numbers.

- Pork cutout jumps to three-month high. Pork cutout firmed $2.62 to $99.62 on Monday behind strong gains in all cuts except butts – the highest level since Nov. 11. Surging wholesale values have kept packer margins in the black despite rising cash hog prices.

— Ag trade: South Korea purchased 30,000 MT of U.S. milling wheat and 50,000 MT to 60,000 MT of optional origin feed wheat.

— USDA’s February crop reports out at noon ET. Analysts expect USDA to make modest changes to its domestic usage and ending stocks forecasts in the Supply & Demand Report. Traders expect slightly smaller ending stocks of 1.526 billion bu. for corn (1.540 billion bu. in December) and 374 million bu. for soybeans (380 million bu. in December). Wheat ending stocks are expected to be 799 million bu. (798 million bu. in December). USDA’s global production and ending stocks forecasts may attract more market attention.

— Santos port gears up for record harvest exports; efforts to manage grain export surge amid growing truck traffic. Brazil’s Port of Santos is preparing for a significant increase in cargo flow due to Brazil’s record-breaking 2024-2025 grain harvest, estimated at 322.3 million tons. Truck traffic at the port is expected to spike from the usual 3,000 trucks per day to 15,000 during peak export months of March to June, with soybeans and corn being the primary exports to around 70 countries. Public agencies, transporters, and exporters are collaborating to prevent logistical bottlenecks. Industry leaders have highlighted concerns about truck congestion and weather conditions affecting exports, while port scheduling improvements aim to ease traffic. Upcoming construction projects and potential ship queues add to the complexity, underscoring the need for coordinated efforts to maintain smooth operations at Brazil’s largest export hub.

— French farmers planted a little more winter wheat than initially expected. France’s ag ministry increased its estimate of winter wheat plantings to 4.57 million hectares from 4.51 million hectares in its initial projection in December. That’s 10% above 2024 and 0.4% above the five-year average though still relatively low from a historical perspective. Planting in the major Centre-Val de Loire crop region was little changed from last year due to waterlogged conditions last fall. Soggy fields in several regions could affect winter crop yields or lead to reseeding with spring crops, the ministry added.

— Agriculture markets yesterday:

• Corn: March corn rose 4 cents to $4.91 1/2, closing near the session high.

• Soy complex: March soybean futures closed flat on the day at $10.49 1/2. March meal futures fell 90 cents to $300.50, near mid-range. March bean oil slid 25 points to 45.73 cents, near mid-range.

• Wheat: March SRW wheat fell 3 1/4 cents to $5.79 1/2, nearer the daily low. March HRW wheat lost 7 1/2 cents to $5.96 3/4, nearer the daily low. March spring wheat futures settled 2 1/2 cents lower to $6.25 1/4.

• Cotton: March cotton rose 91 points to 66.54 cents, closing near the session high.

• Cattle: April live cattle rose $1.35 to $198.125, nearer the session high. March feeder cattle gained $3.225 to $268.125, nearer the session high.

• Hogs: April lean hog futures fell 52.5 cents to $91.625 and settled near mid-range, while nearby February futures climbed 45 cents to $87.70.

| FARM POLICY |

— EU to simplify Common Agricultural Policy (CAP) rules. The European Commission is preparing a “simplification package” for the CAP, aiming to reduce administrative burdens on farmers and national administrations. According to a draft document seen by Reuters, the proposal will be unveiled in the second quarter of 2025. A spokesperson confirmed that the initiative seeks to alleviate regulatory pressure on farmers. The CAP accounts for roughly one-third of the EU’s 2021-2027 budget, totaling around 387 billion euros ($399 billion) in payments for farmers and rural development.

| ENERGY MARKETS & POLICY |

— Oil prices climb amid supply worries despite trade war fears. Oil prices rose on Tuesday as concerns about tightening supplies from Russia and Iran outweighed fears that escalating trade tariffs could slow global economic growth. Brent crude rose 0.72% to $76.42 a barrel, while U.S. West Texas Intermediate gained 0.69% to $72.82. Both benchmarks had rebounded nearly 2% in the previous session after three straight weeks of losses. Analysts highlighted that the rebound is driven by financial positioning rather than market fundamentals, following recent price declines. Russian oil output fell below its OPEC+ quota in January, while U.S. sanctions disrupted oil shipments from Russia and Iran, tightening supply to key markets like China and India. Meanwhile, President Trump’s tariff hikes on steel and aluminum imports, along with new duties on Chinese goods, raised concerns about global growth and its potential impact on energy demand.

— Oil prices rebound Monday amid trade war fears and supply concerns. Oil prices rallied after three consecutive weeks of losses despite persistent fears of a U.S./China trade war. Brent crude rose 1.6% to $75.87 per barrel, while WTI gained 1.9%, settling at $72.32 per barrel. The rebound follows last week’s 2.8% drop driven by concerns over global trade tensions. Market sentiment remains wary ahead of President Donald Trump’s executive order on tariffs, which could escalate trade disputes. China’s retaliatory tariffs on U.S. exports, effective Monday, further darken the outlook for global economic and energy demand.

Supply disruptions also supported prices. Russia is considering a temporary gasoline export ban to stabilize domestic prices, while U.S. sanctions on Iran and Russia continue to tighten global supply, impacting oil shipments to China and India. Early U.S. inventory data indicates rising crude and gasoline stockpiles but declining distillate inventories, according to a Reuters poll.

— Gulf refiners reject low-quality Mexican crude, pressuring Pemex. U.S. Gulf Coast refiners are turning away crude shipments from Mexico’s Pemex due to excessive water content — up to six times the industry standard, Bloomberg reports (link). The quality concerns have led to demands for discounts and a shift toward alternative sources from Colombia and Canada.

Pemex’s flagship Maya crude, often arriving with 6% water content, significantly reduces refinery efficiency and increases costs for U.S. refiners. The problem has affected not only U.S. fuelmakers but also Pemex’s own Dos Bocas refinery in Mexico, which remains offline due to salty crude that threatens equipment damage.

The crisis highlights mounting challenges for Pemex, which is already struggling to pay $20 billion in supplier debt, further straining its relationship with key buyers.

| TRADE POLICY |

— Argentines back Milei’s U.S. trade deal push amid tariff concerns. A majority of Argentines support President Javier Milei’s plan to pursue a free trade agreement with the United States despite fears of competition and potential tariffs under Donald Trump’s presidency. According to a January survey by AtlasIntel for Bloomberg, 60% of respondents favor the deal, but only 46% believe local industries can compete with their U.S. counterparts. Nearly 60% fear Trump’s proposed 25% tariffs on steel and aluminum could severely impact major Argentine companies like Tenaris SA and Aluar Aluminio Argentino SAIC. Milei has suggested he may leave the Mercosur trade bloc to secure the pact with the U.S. if necessary.

| CONGRESS |

— GOP budget plans face tight timelines and internal divisions. House Speaker Mike Johnson (R-La.) is reportedly proposing a new budget framework ahead of today’s House GOP conference meeting. His plan seeks spending cuts between $1.25 trillion and $1.5 trillion to offset part of the domestic policy package. This exceeds his earlier proposal but falls short of the $2.5 trillion some conservatives demand. With near-total GOP unity required to pass the reconciliation bill, Johnson’s balancing act is critical.

Meanwhile, Senate Republicans are prepared to move their budget blueprint out of committee this week, but the floor vote timing remains uncertain. Senate Majority Leader John Thune (R-S.D.) aims to bring it up next week, depending on nominee confirmations. Notably, Sen. James Lankford (R-Okla.) sees the Senate’s resolution as a backup plan while awaiting House action, though Sen. John Hoeven (R-N.D.) suggested a floor vote could happen next week.

— House Appropriations chair eyes early start on FY 2026 spending plans. Even though Congress has yet to finalize fiscal year (FY) 2025 spending, House Appropriations Committee Chair Tom Cole (R-Okla.) announced plans to begin markup of FY 2026 spending in late April. In a letter to House committee chairs (link), Cole emphasized his goal of completing the FY 2026 bills before Oct. 1, 2025. He also noted the urgency of addressing programs with expired or soon-to-expire authorizations. Meanwhile, lawmakers continue negotiations to finalize FY 2025 funding before the current stopgap measure expires on March 14.

Of note: In the letter penned to House Agriculture Committee Chair Glenn “GT” Thompson (R-Pa.), he did not specify any programs where funding had lapsed or could soon lapse, but said he was “hopeful that under your leadership that a multi-year farm bill will become law this year.”

| FOOD & FOOD INDUSTRY |

— Trump reinstates push for plastic straws, rolling back environmental efforts. President Donald Trump signed an executive order on Monday encouraging the U.S. government and consumers to buy plastic drinking straws, reversing efforts by his predecessor to phase out single-use plastics. “We’re going back to plastic straws,” Trump told reporters at the White House, criticizing paper alternatives as ineffective. “I don’t think plastic is going to affect a shark very much, as they’re munching their way through the ocean,” he added. The order is part of a broader rollback of environmental policies. Trump also withdrew the U.S. from the Paris climate agreement and overturned a Biden-era plan to phase out single-use plastic products on federal lands by 2032. The OECD projects plastic waste could rise from 81 million metric tons in 2020 to 119 million tons by 2040.

| TRANSPORTATION & LOGISTICS |

— ILA nears final approval of six-year contract with port employers. The International Longshoremen’s Association (ILA) is on the verge of finalizing a six-year master contract with port employers covering East and Gulf coast ports.

- Wage Scale Committee approval: On Feb. 7, the ILA Wage Scale Committee unanimously approved the agreement with the United States Maritime Alliance (USMX), moving the contract toward a final ratification vote.

- Ratification vote: Scheduled for Feb. 25, the vote will involve approximately 25,000 ILA members working at ports from Maine to Texas.

Contract highlights:

- 62% wage increase over six years

- Job guarantees tied to automation introduction

- Enhanced healthcare and retirement benefits

- Retroactive implementation from Oc. 1, 2024, through Sept. 30, 2030

ILA President Harold J. Daggett called it “the greatest ILA contract” and emphasized the complexity of the negotiations, describing the deal as critical for securing the future of ILA workers amid industry changes and automation challenges. If ratified, this agreement will mark the end of a contentious negotiation period, which included a three-day strike in October 2024, with both the ILA and USMX describing the contract as a “win-win” for job protection and port modernization.

| RUSSIA & UKRAINE |

— Kazakhstan resolves grain transit issues with Russia. Kazakhstan has resolved most of its grain transit and transshipment issues with Russia, allowing grain exports to Europe and North Africa through Russia’s Baltic ports to flow unhindered, the country’s agriculture minister said. The two countries have been in a grain trade dispute since last year with both banning each other’s grain from their domestic markets. Russia allowed transit of Kazakh grain through its ports last November, but on condition the grain was loaded directly from railcars into vessels without going into temporary storage, creating logistical problems for Kazakh exporters.

| CHINA |

— Homeland Security will hold a hearing this morning on Chinese investments in ports across the Western Hemisphere and potential implications for U.S. security.

— China maintains soybean, corn and cotton import forecasts. China’s ag ministry made no changes to its supply and demand tables for 2024-25 this month. The ministry continues to forecast 2024-25 imports at 9 MMT for corn (down from 23.41 MMT in 2023-24), 94.6 MMT for soybeans (down from 104.75 MMT in 2023-24) and 1.7 MMT for cotton (down from 3.25 MMT in 2023-24).

| WEATHER |

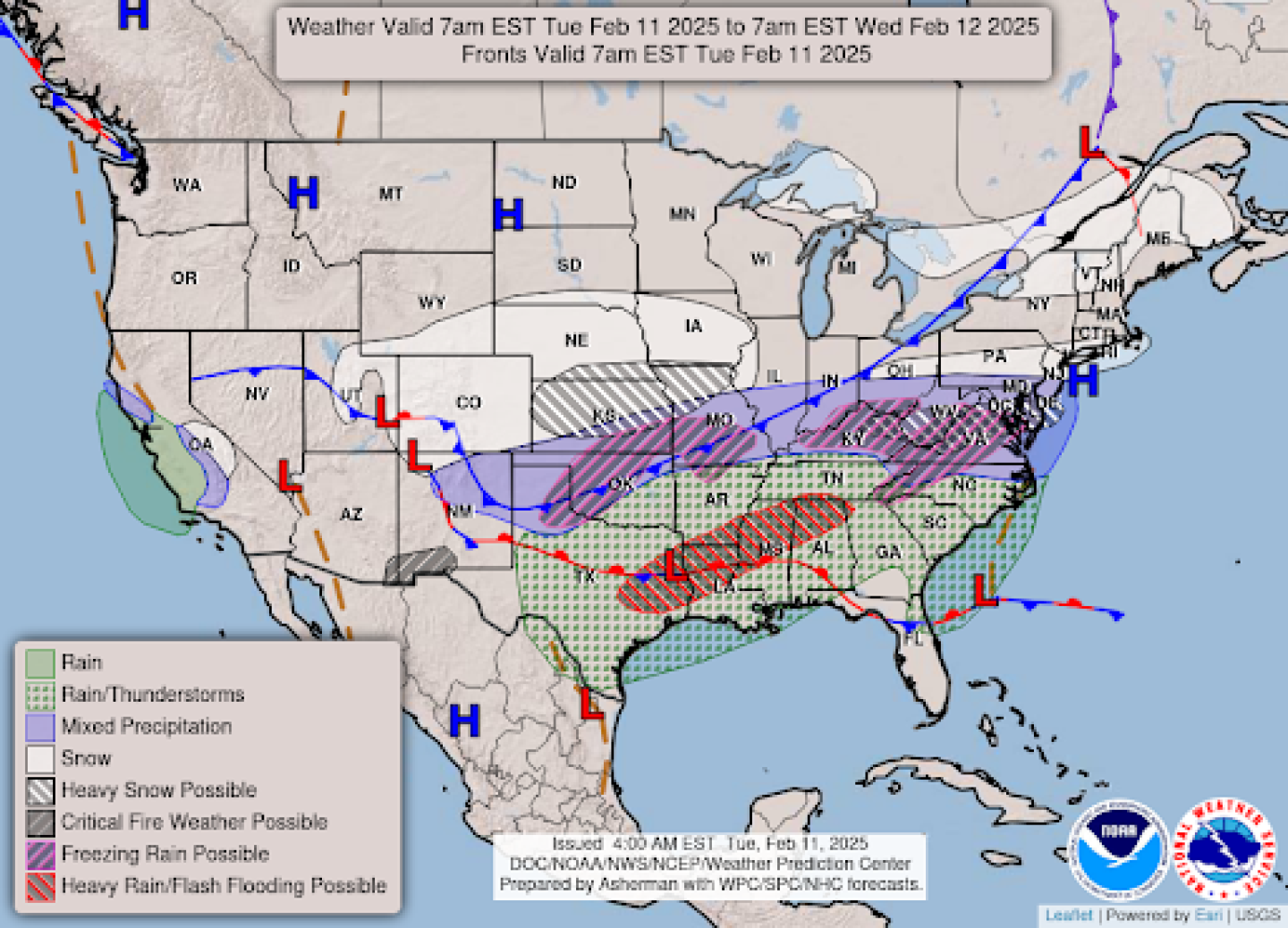

— NWS outlook: Heavy snow over the Mid-Atlantic on Tuesday; Heavy snow over the Central Plains to the Great Lakes on Wednesday... ...Rain/freezing rain over parts of the Southern Plains to the Mid-Atlantic/Central Appalachians with 0. 50 inches of ice accumulations possible on Tuesday and Wednesday: Rain/freezing rain over parts of the Southern Plains to the Northeast with 0. 10 inches of ice accumulations possible on Wednesday... ...There is a Slight Risk of excessive rainfall over parts of the Lower Mississippi Valley, Tennessee Valley, and Southern Appalachians on Tuesday and Wednesday... ...There is a Slight Risk of Severe Thunderstorms over parts of the Lower Mississippi Valley and the Southeast on Wednesday......Temperatures will be 25 to 35 degrees below average across the Northern Rockies eastward to the Upper Great Lakes and southward to the Central High Plains.

| KEY DATES IN FEBRUARY |

11: USDA Crop Production, WASDE, world market circulars

12: Consumer Price Index report

13: Producer Price Index-FD | USDA outlook reports for several commodities

14: Retail Sales | Valentine’s Day

16: Daytona 500

17: Presidents Day; U.S. gov’t and market holiday

21: Univ. of Mich. Consumer Sentiment | Existing Home Sales | USDA Cattle on Feed

25: Consumer Confidence | USDA Food Price Outlook

27: Durable Goods Orders | GDP | USDA Outlook Forum | Outlook for U.S. Agricultural Trade report

28: Personal Income and Outlays (PCE Price Index) | International Trade in Goods | USDA Outlook Forum concludes

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | Trump tariffs | Greer responses to lawmakers |