News/Markets/Policy Updates: Sept. 18, 2024

— Fed’s rate cut decision sparks debate over size and impact. As the Federal Reserve prepares for its first interest rate cut in four years, debate continues over whether the cut will be a cautious 0.25% or a larger 0.5%. Traders are leaning toward a bigger cut, with 61% odds on a 0.5% reduction, while most economists favor a slower approach. The decision is expected to influence the presidential campaign, with Democrats backing larger cuts and Donald Trump advocating for a delay. The Fed’s economic outlook, including its dot plot forecast, will provide further insight into future rate paths. More on this topic below. — As organized labor notches more wins, around 45,000 dockworkers have begun threatening industrial action at U.S. East Coast and Gulf of Mexico ports. “A strike on Oct. 1 seems more likely as time is running out,” warned the International Longshoremen’s Association. Negotiations for a new labor contract have stalled, but the United States Maritime Alliance, which represents port employers including ZIM and Maersk, is willing to resume talks “at any time.” A looming strike has raised supply chain concerns ahead of the busy holiday season, with retailers bringing in products earlier or rerouting shipments. East and Gulf Coast ports accounted for 44% of U.S. waterborne pork exports and 29% of waterborne beef exports in the first half of this year. New York/New Jersey, Wilmington and Charleston were the largest East/Gulf ports for pork exports and Houston was largest for beef. Given its geographic footprint, poultry exports would be greatly impacted. Roughly 65% of total U.S. chicken exports pass through East and Gulf Coast ports. — Kamala Harris proposes 7% cap on childcare costs, aims to bolster economic agenda in tight race against Trump. Vice President Kamala Harris unveiled a plan to cap childcare costs for working families at 7% of their income, a key policy initiative aimed at addressing economic concerns in her campaign for the White House. Speaking at an event in Philadelphia with the National Association of Black Journalists, Harris emphasized the importance of affordable childcare for both families and the broader economy. Her proposal echoes a similar one from President Joe Biden’s earlier Build Back Better plan. Harris also outlined measures to raise wages for childcare providers and proposed tax reforms to fund her agenda, including a 28% capital gains tax on people earning $1 million or more and for raising the corporate tax rate to 28% from 21%. Her economic proposals contrast sharply with former President Donald Trump’s, who advocates for deeper corporate tax cuts and has criticized Harris’ plans as “communist price controls.” The economy remains the defining issue in the close race. — A U.S. security panel has granted Nippon Steel permission to refile its plans to purchase U.S. Steel for $14.1 billion, likely pushing a decision on the politically contentious takeover past the U.S. elections Nov. 5. The Committee on Foreign Investment in the U.S. (CFIUS) needs additional time to understand the impact the deal will have report on national security relative to key US supply chains for critical industries. The review will take nearly the full 90 days to be completed. The deal has faced opposition from the Biden administration, unions, and former President Donald Trump. The CFIUS said in a letter to the two steel firms that the deal could result in negative impacts to steel supplies for transportation, construction, and agriculture projects as it would lead to a reduction in domestic steel capacity. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S Dow opened slightly higher as Wall Street braced for the Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s commen→ts this afternoon. In Asia, Japan +0.5%. Hong Kong closed. China +0.5%. India -0.2%. In Europe, at midday, London -0.7%. Paris -0.5%. Frankfurt -0.1%.

U.S. equities yesterday: All three major indices closed with minimal changes in either direction as traders await the Fed meeting conclusion on Wednesday. The Dow ended down 15.90 points, 0.04%, at 41,606.18. The Nasdaq rose 35.93 points, 0.20%, at 17,628.06. The S&P 500 was up 1.49 points, 0.03%, at 5,634.58.

— JPMorgan in talks to take over Apple credit card from Goldman Sachs. Apple and JPMorgan Chase are in advanced talks about JPMorgan taking over Apple’s $17 billion credit card program from Goldman Sachs, after the latter’s partnership with Apple soured. While discussions have progressed, key details like pricing remain unresolved. If JPMorgan becomes Apple’s card issuer, it would further solidify the bank’s dominance, potentially raising concerns among critics of big banks while benefiting JPMorgan shareholders.

— Ag markets today: Soybean futures posted double-digit gains overnight, while corn and wheat traded modestly higher. As of 7:30 a.m. ET, corn futures were trading around a penny higher, soybeans were 12 to 13 cents higher, winter wheat futures were 2 to 3 cents higher and spring wheat was unchanged to fractionally higher. The U.S. dollar index was modestly weaker, and front-month crude oil futures are about $1.00 lower.

Cattle futures narrow discount to cash market. October live cattle futures narrowed the discount to last week’s average cash cattle price to $3.31 on Tuesday. Cash cattle firmed last week, breaking a six-week string of declines, and are expected to be steady/firmer this week as packer margins remain in the black.

Hog futures firm despite falling cash. October lean hog futures posted strong gains Tuesday, strengthening for a second straight day, despite seasonally weakening cash hog prices. The lead contract finished Tuesday at a $2.44 discount to today’s CME lean hog index quote of $84.22 as of Sept. 16.

— Agriculture markets yesterday:

• Corn: December corn futures rose 1 3/4 cents to $4.12 1/2 and near the session high.

• Soy complex: November soybeans rose 1 1/2 cents to $10.06 but ended nearer the session low. December soymeal fell $2.30 to $321.50, while December soyoil rose 77 points to 39.88 cents.

• Wheat: December SRW futures sunk 2 3/4 cents to $5.75 3/4 and closed near mid-range. December HRW futures fell 1/2 cent to $5.93, nearer session lows. December spring wheat rose 1 1/4 cents to $6.21.

• Cotton: December cotton fell 66 points to 72.16 cents, forging a near mid-range close.

• Cattle: October live cattle futures surged $1.575 higher to $178.80, closing near mid-range. October feeder cattle futures rallied $1.75 to $240.75.

• Hogs: October lean hogs rose $1.85 to $81.775, nearer the session high and hit a two-week high.

— Quotes of note:

• “When rates drop, money goes into money funds. It’s the way it works.” — Peter Crane, president of Crane Data.

• “That product isn’t ours.” — Hsu Ching-Kuang, the founder and president of the pager maker Gold Apollo, which was identified as the supplier of devices used in attacks in Lebanon yesterday that killed at least 11 people. Hsu said another manufacturer made the pagers, using his company’s branding as part of a licensing deal.

• Cyber-attack insurance. “Insurance for attritional cyber incidents, such as most ransomware attacks, has expanded in recent years in response to the growing risk; however, the market has pulled back from covering catastrophic cyber incidents.” — Treasury Department Acting Assistant Secretary for Financial Institutions Laurie Schaffer, who said the Treasury is studying how the U.S. government might be involved in crafting insurance to cover catastrophic cyber events.

— Fed’s rate cut decision balances inflation risks against rising unemployment. The Federal Reserve faces a decision today on whether to cut interest rates by a quarter or half percentage point. With inflation trending toward the 2% target but unemployment rising to 4.2%, Chair Jerome Powell and policymakers must weigh the risk of reigniting inflation against a deteriorating labor market. Some Fed officials, like Christopher Waller, advocate for larger cuts, while others call for caution. Futures traders are betting on a 61% chance of a larger cut, with Powell’s comments today offering key insights into the Fed’s upcoming actions.

After today’s announcement, attention shifts to the Federal Reserve’s projected federal funds rate range for the end of 2024, next year, and the longer term. The FOMC’s dot plot will provide crucial insights. In the June projections, the median fed funds rate was 5.1% for the end of 2024 and 4.1% for 2025. Any changes to these forecasts will be key for investors.

— U.S. mortgage rates hit lowest since 2022, boosting home purchase and refinance applications. U.S. mortgage rates dropped last week to the lowest level since September 2022, with the 30-year fixed rate falling to 6.15%, sparking a surge in home purchase and refinancing applications. This marks the seventh consecutive week of rate declines, driven by anticipation of Federal Reserve interest rate cuts. The refinancing index jumped over 24%, and home-purchase applications hit a three-month high, offering potential relief for a constrained housing market and boosting homebuilder confidence.

— South Korea emerges as a top U.S. investor as China tensions escalate. U.S. project commitments from South Korean companies totaled $21.5bn last year, more than any other country. Link to more via the Financial Times.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro and British pound slightly firmer against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 3.68%, with a mostly higher tone in global government bond yields. Crude oil futures were under pressure ahead of U.S. gov’t inventory data due later this morning with U.S. crude around $70.65 per barrel and Brent around $73.20 per barrel. Gold and silver futures were higher, with gold around $2,605 per troy ounce and silver around $30.98 per troy ounce.

— India approves $4 billion in farm support spending amid focus on wheat, rice, and vegoil policies. India’s cabinet has approved $4 billion in spending to support farmers and stabilize food prices through the 2025-26 fiscal year. The funds will help control price volatility for essential commodities, including wheat, rice, and vegetable oils. Additionally, a fertilizer subsidy of 244.75 billion rupees ($2.92 billion) has been allocated for winter-sown crops. As wheat stocks held by the government fell to 25.1 million metric tons (MMT), the flour milling industry is urging the government to release stocks ahead of upcoming festivals to curb rising prices. India may also ease export curbs on non-basmati rice (see next item for details), while vegoil demand is expected to grow by 2%-3% despite import taxes. The government is attempting to balance farmer profitability with affordable food prices for consumers.

— India to consider easing curbs on non-basmati rice exports. India would consider easing curbs on non-basmati rice exports, the country’s food secretary said on Wednesday, as rice inventories have surged. The country imposed various curbs on rice exports in 2023 and continued them in 2024 to keep local prices in check ahead of the general elections held in April-June. Last week, the government removed a floor price for basmati rice exports to assist farmers and boost shipments. India is also considering revising ethanol rates and the minimum sale price of sugar.

— Calls for India to release wheat reserves ahead of demand peak. India’s reductions on the amount of wheat traders and processors can hold are not enough to ease domestic wheat prices during festival season, and the government needs to release stocks to augment supplies, industry officials said. The market is awaiting the government to begin auctioning wheat to private firms as demand is set to rise next month due to festivals amid limited supplies. India initially planned to sell wheat from its state reserves to bulk consumers from July, but it was delayed and there has been no update.

— Ag trade update: Algeria tendered to buy up to 80,000 MT of corn to be sourced from Argentina or Brazil. Tunisia tendered to buy 125,000 MT of soft milling wheat and 100,000 MT of durum — all optional origin.

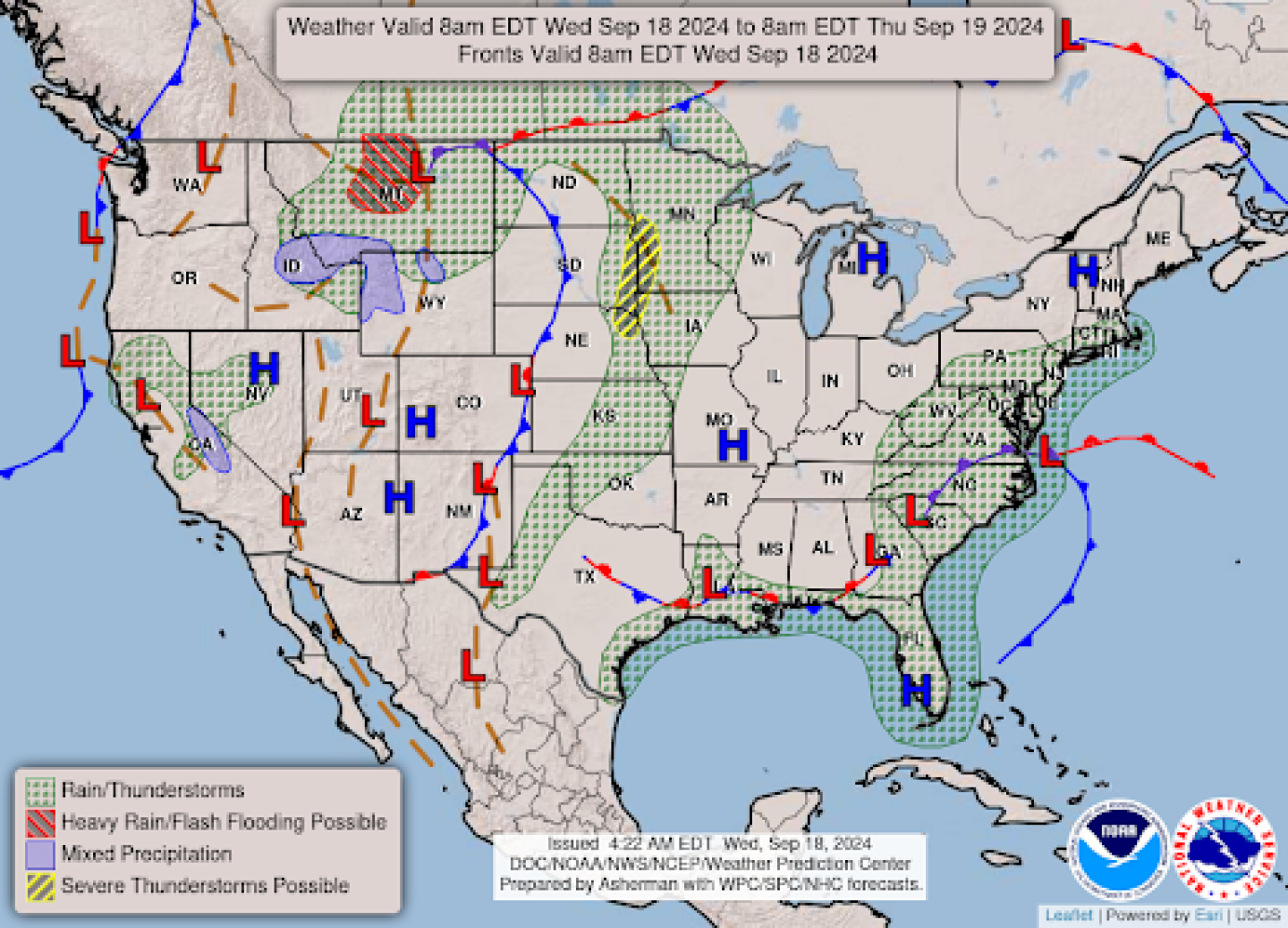

— NWS outlook: Very heavy rainfall and flash flooding possible in Montana today... ...Severe thunderstorms possible in the northern and central Plains and Upper Midwest today and Thursday.

Items in Pro Farmer’s First Thing Today include:

• Soybeans lead overnight price strength

• France slashes wheat export forecast

• Ukraine’s exportable grain surplus plunges nearly 15%

• SovEcon cuts Russian grain crop forecast

• EU consumer inflation falls to more than three-year low

| CONGRESS |

— House set to vote on CR with voting provision, likely to fail. The House is scheduled to vote today on a continuing resolution (CR) to fund the government for six months, including a provision requiring proof of citizenship to vote (SAFE Act). Speaker Mike Johnson (R-La.) pulled the bill last week and is struggling to gain enough support. He will not get it. With no clear backup plan, the measure is expected to fail due to opposition over its length and voting requirements. If it fails, Johnson could propose a clean CR running through mid-December, but a vote on that would not likely occur until early next week. Meanwhile, the Senate is working on its own CR without the voting provision, set to run until Dec. 13. Congress must pass a bill that President Joe Biden can sign by Sept. 30.

Of note: This situation reflects the current dysfunction within the House GOP. Johnson’s approach appears to be setting up the failure of the stopgap bill to push hardline conservatives toward accepting a clean CR. The eventual outcome will likely be a clean CR extending into December, despite the current efforts. In the Senate, there is a desire for bipartisan discussions to salvage the situation. Appropriators will need to address issues not covered in the House bill, including funding for the Secret Service and disaster relief. Time is running short, with a potential deadline of mid-to-late December for a new CR to pass. The urgency surrounding Secret Service funding, especially given recent controversies, adds an additional layer of complexity, with the agency potentially needing to propose creative funding solutions.

— Farm bill extension likely absent from government funding bill. The House’s proposed six-month continuing resolution (CR) to prevent a government shutdown does not include an extension of the 2018 Farm Bill, and the Senate’s version is also expected to omit it on its coming clean CR. Lawmakers aim to keep pressure on for a deal during a post-election lame-duck session. While many provisions expire this month, key components are authorized through year-end. Challenges remain, including funding issues and updates to farmer safety net programs, with ad hoc efforts underway to provide aid to farmers amid falling crop prices and high costs.

— Andy Harris named new chair of House Freedom Caucus (HFC). Rep. Andy Harris (R-Md.) has been chosen to lead the HFC for the remainder of this Congress, succeeding Bob Good (R-Va.). Harris faces significant challenges in guiding the group, which has struggled with internal divisions, fundraising issues, and a loss of influence. As a member of the House Appropriations Committee, Harris’ leadership will be tested on how he balances his committee role with the priorities of hardline conservatives. Some HFC members believe he can bring more unity to the group, though Harris has remained silent on his specific plans.

| ISRAEL/HAMAS CONFLICT |

— Blinken visits Middle East amid rising tensions and military aid controversy. Secretary of State Antony Blinken is in the Middle East for the 10th time since the Gaza war began nearly a year ago. His visit to Cairo follows the Biden administration’s approval of $1.3 billion in military aid for Egypt, bypassing congressional human rights conditions. Regional tensions are escalating after an attack, attributed to Israel, targeted thousands of Hezbollah members. Despite this, oil markets have not yet priced in any geopolitical risk from the developments.

Hezbollah has vowed to respond to an Israeli attack that killed at least 12 people and injured thousands across Lebanon on Tuesday when pagers belonging to members of the Iran-backed militant group exploded almost simultaneously. Footage showed shoppers and pedestrians collapsing in the street following the blasts.

| POLICY UPDATE |

— Sen. Boozman urges immediate farm crisis relief and passage of farm bill. Sen. John Boozman (R-Ark.), ranking member of the Senate Ag Committee, called for urgent emergency assistance for farmers facing financial losses and stressed the need to pass a new farm bill before year’s end. Boozman emphasized that farmers are struggling with inflation, high interest rates, and market prices below production costs, warning of a looming crisis if Congress doesn’t act swiftly. He advocated for immediate aid to bridge farmers through 2024 and called for long-term improvements to the farm safety net in the upcoming farm bill.

Boozman did not suggest how much money should be put into emergency assistance. U.S. taxpayers sent $23 billion to farmers and ranchers in 2018 and 2019 to offset the impact of the U.S./China trade war, and $31 billion in 2020 and 2021 for pandemic relief.

| CHINA UPDATE |

— China expands food security focus beyond staple grains in new guidelines. The State Council released guidelines broadening China’s food security framework, following President Xi Jinping’s push to reflect the modern Chinese diet. The new approach includes expanding orchards for fruits and nuts, boosting domestic forage production, and developing sustainable aquaculture. Innovation in agricultural biotechnology and novel protein sources for livestock feeds is also emphasized. Despite these advancements, the guidelines still prioritize increasing staple crop production by 50 million metric tons by 2030, signaling that traditional crops will continue to dominate local priorities.

— U.S. officials head to Beijing amid surge in cheap Chinese exports. Senior U.S. officials are traveling to Beijing for high-level meetings to address concerns over a surge of Chinese goods flooding global markets. This marks the fifth gathering of an economic working group formed last year to improve communication between the two economic superpowers, and includes participation from Federal Reserve officials.

— China’s pork imports jump in August but still below year-ago. China imported 200,000 MT of pork in August, up sharply from only 90,000 MT in July but still 2.3% below year-ago. Through the first eight months of this year, China imported 1.5 MMT of pork, down 23.1% from the same period last year.

— China: EU’s EV tariffs will damage Germany, China. China’s commerce minister said the European Union’s imposition of tariffs on electric vehicles (EV) will “seriously interfere” with trade and investment cooperation and hurt both China and Germany. In talks on Tuesday with German Vice Chancellor and Economic Minister Robert Habeck, Chinese Commerce Minister Wang Wentao said he hoped to reach a solution in line with World Trade Organization rules as soon as possible and avoid the escalation of China/EU economic and trade frictions. Habeck said that Germany supports free trade, welcomes Chinese auto and parts companies to invest in Europe, and will urge the European Commission to find an appropriate solution with Beijing and make every effort to avoid trade conflicts.

— China’s long-awaited draft energy law updated with new rules for renewables. The much-anticipated legislation, nearly two decades in the making, has been updated with plans to develop and use various forms of renewable energy. Link for details via Caixin.

— Germany’s Habeck says trade conflict with China must be averted. German Economy Minister Robert Habeck urged the European Union and China to find a political solution in a dispute over Chinese-made electric vehicles and said a trade conflict should be avoided “at all costs.” Link to more via Bloomberg.

| TRADE POLICY |

— The European Union’s candidate to become its new trade chief is no strange figure in Brussels. Maros Sefcovic is the longest serving commissioner of the EU executive’s arm as he prepares to start his fourth five-year mandate.

Sefcovic faces several significant challenges in his new role as the European Union’s trade chief:

• Geopolitical tensions: Sefcovic must navigate an increasingly complex geopolitical landscape, balancing trade relations with major powers like China and the United States while addressing concerns over economic security and supply chain resilience.

• Climate policy integration: As the former Executive Vice-President for the European Green Deal, Sefcovic will need to align trade policies with the EU’s climate objectives, including implementing measures like the Carbon Border Adjustment Mechanism.

• Modernizing and concluding trade agreements: There is pressure to update existing free trade agreements and finalize pending deals, particularly with Mercosur, Australia, and ASEAN countries.

• Economic resilience: Sefcovic must address concerns about supply chain vulnerabilities and work to diversify sources for critical materials and technologies.

• Multilateral trading system: He will need to navigate challenges to the World Trade Organization (WTO) and work towards reforming and strengthening the multilateral trading system.

• Balancing interests: Sefcovic must manage competing priorities between promoting open trade and protecting EU industries, especially in sensitive sectors.

• Digital trade: Developing policies to address the growing importance of digital trade and e-commerce will be crucial.

• Post-Brexit relations: As the former Brexit negotiator, Sefcovic will continue to play a role in managing trade relations with the UK.

• Trade defense: He will need to oversee the EU’s trade defense instruments to protect EU industries from unfair competition while maintaining open markets.

• Customs policy: Sefcovic’s role includes overseeing customs policy, which will be important for implementing trade agreements and ensuring smooth cross-border trade.

— Obstacles to exporting U.S. soy products to India. Several Iowa government officials, including Governor Kim Reynolds and officials from the Iowa Soybean Association, U.S. Soybean Export Council and U.S. Grains Council, are in India this week. That prompted us to look at the restrictions India places on imports of U.S. soy products.

There are several obstacles from India regarding imports of U.S. soybeans and soybean meal:

Tariff barriers. India imposes high tariffs on soybean imports, making them economically unviable. The tariff rate on U.S. soybeans is as high as 56.5%, including goods and services tax (GST) and value added tax (VAT). This high tariff structure acts as a significant trade barrier for U.S. soybean exports to India.

Restrictions on genetically engineered (GE) soybeans. India has traditionally restricted imports of GE soybeans and soybean meal. However, in recent years, India has made some temporary exceptions:

• In August 2021, India permitted imports of 1.2 million metric tons (MMT) of soybean meal derived from GE soybeans through October 31, 2021.

• In May 2022, India approved an additional import quota of 550,000 metric tons of soybean meal (including GE-derived) through Sept. 30, 2022.

These exceptions were made to address high domestic soybean meal prices and support the poultry and livestock industries. However, they were temporary measures and not permanent policy changes.

Import restrictions. India only allows the import of soybean in crushed form, not in whole form. This restriction limits the options for U.S. exporters, as crushed soybean has a shorter shelf life, making it less viable for trade, especially when combined with high tariffs.

Phytosanitary and labeling issues. U.S. exporters face challenges related to Food Safety and Standards Authority of India’s (FSSAI) requirements for non-GM soybean products, labeling, and phytosanitary issues. These regulations can create additional hurdles for U.S. soybean exports.

Limited port access. When India has allowed imports of GE-soybean meal, it has restricted shipments to containerized cargo through only two ports. This limitation can significantly constrain the volume of imports within the permitted quota period.

Domestic production protection. India produces about 13-14 million tonnes of soybeans annually and has shown a preference for protecting its domestic soybean industry. This stance often leads to restrictive import policies to safeguard local producers. While India has occasionally opened up imports to address domestic shortages or high prices, these measures have been temporary. The overall policy environment remains challenging for U.S. soybean and soybean meal exports to India due to these various obstacles.

Few know this about India: It is the largest milk-producing country in the world and accounts for nearly 24% of global milk production.

| ENERGY & CLIMATE CHANGE |

— DOE to seek 6 million barrels of crude for Strategic Petroleum Reserve (SPR). The Department of Energy (DOE) plans to acquire up to 6 million barrels of crude oil for the Strategic Petroleum Reserve (SPR), with deliveries slated for early 2025 at the Bayou Choctaw site in Louisiana. This comes as the U.S. faces a funding shortfall for SPR restocking, with only $841 million available, enough for around 12 million barrels. The SPR currently has an estimated shortfall of 320 million barrels following sales mandated by Congress and actions by the Biden administration to lower energy prices.

— Oil industry urges reversal of Biden’s LNG export permit moratorium. The oil and gas industry is pressing the Biden administration to lift its moratorium on new liquefied natural gas (LNG) export permits, arguing it raises energy costs, threatens supplies for European allies, and slows the transition from coal. Chevron CEO Mike Wirth criticized the policy, calling it a failure, while the industry pushes for an “all-in” approach to energy. The moratorium, imposed in January for environmental and security reviews, has sparked concerns in the sector despite the U.S. being on track to double LNG export capacity by 2030.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— FDA finds milk in some “dairy-free” dark chocolate products, urges caution for allergy sufferers. The FDA, alongside state agencies from Pennsylvania and Michigan, has released results from a 2022-2023 sampling of “dairy-free” dark chocolate and chocolate-containing products. Of 210 samples tested, 13 were found to contain milk, with one testing at a hazardous level of 1,083 ppm. The milk contamination was traced to a supplier of dark chocolate rather than manufacturing issues. In response, two manufacturers removed “dairy-free” labels, while a third agreed to do so pending further investigation. The FDA urges consumers with milk allergies to contact manufacturers for detailed product information and will continue monitoring for unintended milk in “dairy-free” labeled products.

| OTHER ITEMS OF NOTE |

— Demolition of Key Bridge remnants set to begin as 12-month design process starts. The Maryland Transportation Authority has begun the 12-month design process for the new Francis Scott Key Bridge while preparing to demolish remaining bridge structures in the Patapsco River. The demolition, expected late this year or early next, will clear the way for the rebuild following the bridge collapse in March that killed six workers. Traffic congestion in the Baltimore area continues to worsen, with over 20,000 vehicle-hours lost daily. The project aims for completion by 2028, with federal funding support still under negotiation.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |