News/Markets/Policy Updates: Feb. 4, 2025 (2)

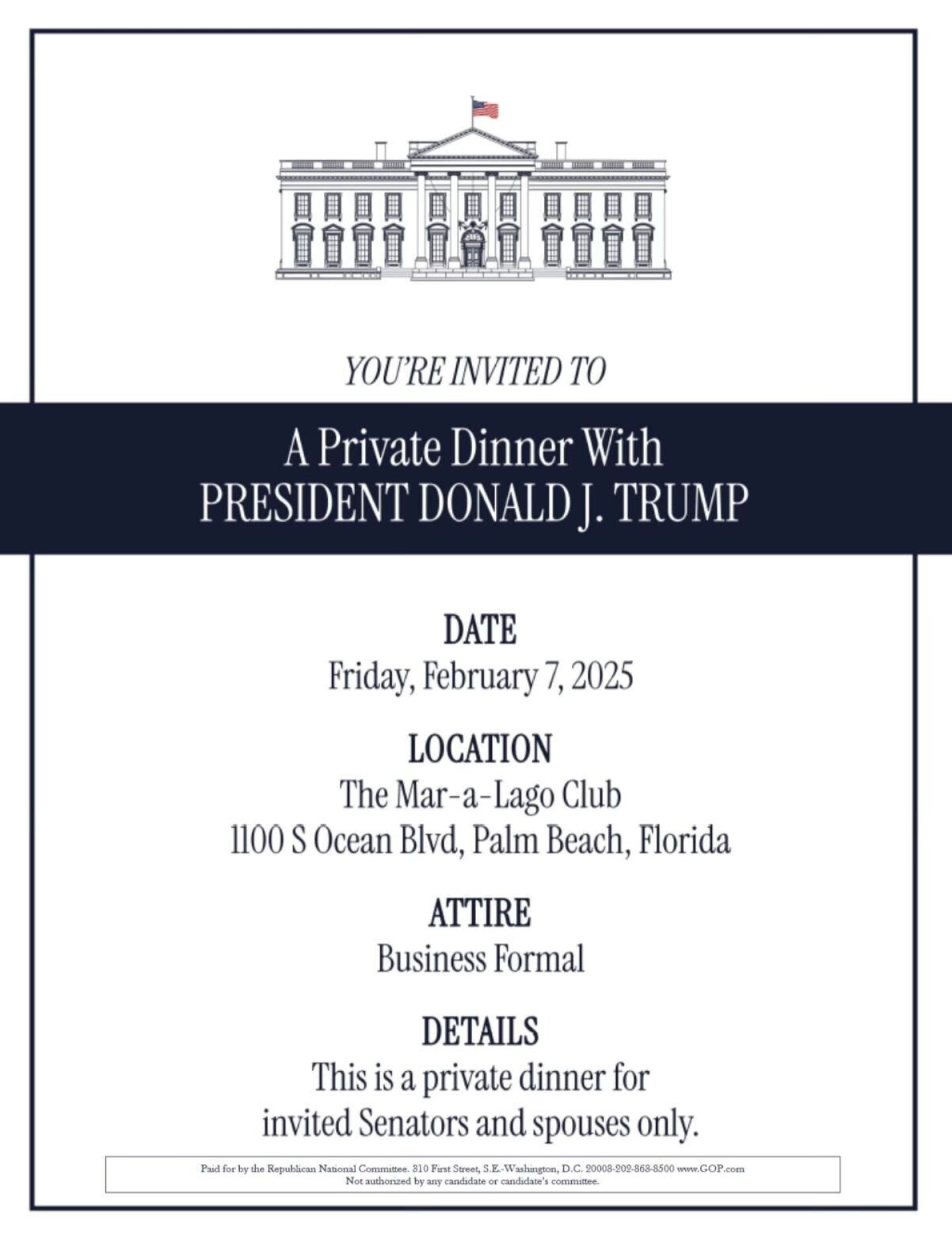

— EU seeks to avert trade war with Trump via negotiation. The European Union sees a potential path to negotiating with the Trump administration to avoid a transatlantic tariff fight, Bloomberg reports, citing a person familiar with the bloc’s thinking. Following Trump’s decision to delay broad tariffs on Mexico and Canada, EU officials believe a diplomatic resolution is possible despite heightened rhetoric from Washington. However, the EU faces challenges in engaging with key U.S. trade officials, as several positions remain unfilled. The bloc is preparing a strategic response, including potential countermeasures targeting politically sensitive U.S. industries, while also seeking common ground on trade, energy, and China policy. With tariffs on European steel and aluminum exports looming, the EU is considering extending a tariff suspension to maintain a positive approach and avoid escalation. Trump ramped up his rhetoric aimed at the EU this week, saying that tariffs “will definitely happen,” citing a large trade deficit with the bloc. Europe responds. “When targeted, unfairly and arbitrarily, the European Union will respond firmly,” Commission President Ursula von der Leyen told reporters after a meeting of EU leaders in Brussels Monday. It’s unclear what Trump wants from EU. — Are tariffs a negotiating tool or real risk? Markets have remained resilient despite tariff threats, largely because investors perceive them as negotiating tactics rather than real policy moves. Historical precedent from Trump’s first administration supports this view, as many tariff threats were either walked back or implemented in a limited manner. However, there are key differences this time, says Tom Essaye of the Sevens Report. He notes Trump’s rhetoric on tariffs has been more consistent and aggressive, with broader targets beyond China. Additionally, his current cabinet members — Rubio, Bessent, and Lutnick — are more aligned with his tariff stance, reducing internal opposition. He reasons that the sheer volume of tariff threats suggests that at least some measures will materialize, particularly as a trade review is underway to build a legal case for broader tariffs. With the S&P 500 trading above 21X forward earnings, markets have little room for disappointment, and tariffs could become a significant headwind for growth and earnings, Essays warns. He concludes that defensive positioning favors U.S.-focused sectors like utilities, consumer staples, and healthcare, while balanced exposure across markets remains a prudent strategy. — “Examining the Economic Crisis in Farm Country” is the topic of a Feb. 11 morning hearing by the House Ag Committee. No witnesses have been announced. It is likely to cover several key issues affecting farmers and rural communities. Potential topics: · Farm income: The hearing may discuss the recent trends in farm income, which has been a concern for many in the agricultural sector. This hearing comes at a time when many farmers are facing significant economic pressures. The agricultural sector has experienced volatility in recent years due to various factors, including market fluctuations, trade disputes, and weather-related challenges. As the hearing date approaches, the committee is likely to announce a panel of witnesses, which may include economists, agricultural industry representatives, and farmers who can provide firsthand accounts of the economic situation in rural America. Of note: U.S farmers entered 2025 with a positive outlook, as the Purdue University/CME Group Ag Economy Barometer rose 5 points in January to 141, driven by higher crop prices and fewer concerns over commodity values. The Future Expectations Index outpaced the Current Conditions Index by 47 points, reflecting strong confidence in the year ahead. Financial indicators also improved, with the Farm Financial Performance Index climbing 13 points, suggesting a more robust 2025. However, concerns persist — more farmers report difficulties in repaying operating loans, and 40% foresee a potential trade war. Meanwhile, interest in leasing farmland for solar energy production continues to grow, with lease rates rising significantly. — Federal worker ‘buyout’ sees 20,000 sign-ups, more expected before deadline. More than 20,000 federal employees — about 1% of the workforce — have accepted an offer to resign with continued salary payments through September. Numbers are expected to rise ahead of Thursday’s deadline, as the Trump administration and Elon Musk aim to trim 10% of federal jobs. However, with nearly half of federal employees ineligible and unions warning against the deal, meeting that goal could prove challenging. The Office of Personnel Management is now providing clearer guidelines amid concerns about the program’s structure and legality. — Kennedy’s nomination advances amid controversy. Robert F. Kennedy Jr.'s nomination for Health and Human Services (HHS) Secretary has passed a key hurdle, advancing to the full Senate after a 14-13 party-line vote in the Senate Finance Committee. Senator Bill Cassidy (R-La.), a physician, cast the decisive vote after securing commitments from the administration on shared policy goals and including threats of a primary challenge in 2026. had Cassidy had urged Kennedy to make clear that he didn’t believe vaccines caused autism, but Kennedy had sidestepped such an endorsement, saying he would review the data. Kennedy, a vocal vaccine critic, has been a divisive nominee, drawing scrutiny for his “Make America Healthy Again” campaign. Of note: Kennedy told Cassidy that the two would meet multiple times a month, Cassidy could consult on hirings at HHS and Kennedy would appear before the Senate HELP Committee on a quarterly basis. Cassidy also said Kennedy committed to keeping up statements on the CDC website that said vaccines don’t cause autism. His confirmation now faces a closely contested Senate vote. Kennedy did not attend Tuesday’s vote. In the full Senate vote, Kennedy can afford to lose up to three Republican votes if all Democrats oppose him. In the event of a tie, Vice President JD Vance can cast the deciding vote. Potential GOP defectors include Sens. Mitch McConnell of Kentucky, a polio survivor, Lisa Murkowski of Alaska and Susan Collins of Maine. No Republicans have said they plan to oppose him. The full Senate vote to confirm Kennedy hasn’t yet been scheduled. President Trump urged lawmakers to support Kennedy in a social-media post shortly before the committee vote Tuesday. “20 years ago, Autism in children was 1 in 10,000. NOW IT’S 1 in 34. WOW! Something’s really wrong. We need BOBBY!!!” Trump wrote. Trump nominated Kennedy to lead a department with a $1.8-billion budget and 90,000 employees. Among the agencies and programs that fall under the department’s purview are the Food and Drug Administration, the Centers for Disease Control and Prevention and the National Institutes of Health as well as Medicaid and Medicare. RFK Jr. has made sweeping promises to focus HHS on addressing rising rates of chronic disease by reorienting scientific research and strengthening food regulations. That includes regulating ultra-processed foods, firing government employees, stripping vaccine makers of legal protections, purging the department of what he describes as conflict of interest issues, and promoting alternative foods and therapies including raw milk and psychedelics, and pushing to ban water fluoridation. Trump’s support has raised concerns among some in the agricultural sector. Trump on Monday publicly approved Kennedy’s examination of pesticide usage amid his global trade war. “We have massive deficits with the European Union. ... We don’t charge them tariffs,” Trump said. “They make it very difficult. Agricultural product, they actually don’t take it. They have a lot of excuses, some of them are the pesticides and the different chemicals used. Bobby Kennedy is actually looking into that very seriously because maybe it’s not necessary to use all of that.” — Senate may move first as House stalls on budget. With House Republicans struggling to unite on a budget resolution, Senate GOP leaders are considering taking the lead to advance President Donald Trump’s legislative agenda. Senate Budget Committee Chair Lindsey Graham (R-S.C.) signaled readiness to push his own resolution, as Speaker Mike Johnson’s (R-La.) timeline slips. Hardline conservatives demand deeper spending cuts, complicating House negotiations. If the Senate acts first, it could reshape reconciliation strategy — potentially splitting the Trump agenda into two bills, a move House leaders have resisted. Trump himself continues to indicate he does not really care if it is one measure or two. — Trump to sign action aimed at reducing Iran oil exports: Reuters. — Panama weighs ending port deal amid U.S./China tensions. Panama is considering canceling a contract with Hong Kong-based Hutchison Ports PPC, which operates two ports near the Panama Canal, in response to pressure from President Donald Trump over China’s influence in the region, Bloomberg reports. The potential move follows U.S. Secretary of State Marco Rubio’s visit, during which Panama pledged free passage for U.S. warships and announced plans to withdraw from China’s Belt and Road Initiative. While no final decision has been made, legal challenges to the contract are also emerging, citing constitutional violations and excessive tax breaks. — Maryland unveils new Francis Scott Key Bridge design. Maryland Governor Wes Moore revealed the new design for the Francis Scott Key Bridge in Baltimore. The cable-stayed structure, the first of its kind in Maryland, will feature wider lanes and shoulders built to modern interstate standards. Pre-construction activities began in January, with demolition set for spring and completion expected by October 2028 at an estimated cost of $2 billion. Governor Moore highlighted the bridge’s critical role in supporting Baltimore’s economy and maritime industry, following the tragic collapse of the original bridge in March 2024. — GOP backs Trump’s birthright citizenship order in court. Republicans on the House Judiciary Committee, led by Rep. Jim Jordan (R-Ohio), have requested to file an amicus brief supporting President Donald Trump’s executive order ending birthright citizenship. The move comes amid legal challenges from Democratic state attorneys general, who argue the order violates the U.S. Constitution. A federal judge in Seattle temporarily blocked the order on Jan. 23, marking an early setback for the administration’s immigration agenda. The case, State of New Jersey v. Trump, is currently before the U.S. District Court for the District of Massachusetts. — Trump invites senators to Mar-a-Lago on Friday. The president is inviting all Republican senators to a dinner at Mar-a-Lago on Friday as the NRSC is holding its winter meeting at the Breakers Resort in Palm Beach, Fla., this weekend. — President Donald Trump is expected to go to the Super Bowl this weekend in New Orleans, according to multiple sources familiar with his plans. |

| KEY DATES IN FEBRUARY |

6: USDA Farm Income forecast

7: January Employment | USDA Ag Trade Data Update

9: Super Bowl

11: USDA Crop Production, WASDE, world market circulars

12: Consumer Price Index report

13: Producer Price Index-FD | USDA outlook reports for several commodities

14: Retail Sales | Valentine’s Day

16: Daytona 500

17: Presidents Day; U.S. gov’t and market holiday

21: Univ. of Michigan Consumer Sentiment | Existing Home Sales | USDA Cattle on Feed

25: Consumer Confidence | USDA Food Price Outlook

27: Durable Goods Orders | GDP | USDA Outlook Forum | Outlook for U.S. Agricultural Trade report

28: Personal Income and Outlays (PCE Price Index) | International Trade in Goods | USDA Outlook Forum concludes

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | Trump tariffs |