The Week Ahead: Feb. 9, 2025

Other topics include: (1) Trump to unveil reciprocal tariffs; (2) Canada eyes stronger trade ties with EU amid U.S. trade uncertainty; (3) Trump’s climate funding freeze sparks uncertainty across the U.S.; (4) Federal-worker buyout legal update; (5) China’s inflation picks up in January as holiday demand boosts prices; (6) Trump set to attend Super Bowl in historic first for a sitting president; Fox to interview him; (7) More Senate votes this week on Trump nominees; (8) Fed chairman to offer semiannual testimony to lawmakers on Tuesday and Wednesday; (9) Senate and House Ag panels to hold hearings on agricultural economy; (10) Tax group says Trump’s tax cuts could cost $5 trillion to $11 trillion over a decade; (11) Policy focus this week will be on country responses to Trump’s trade policy moves; (12) Trump also seeks reciprocity on taxation to level the playing field for U.S. firms; (13) China to implement retaliatory tariffs on select U.S. imports; (14) How tariffs affect U.S. communities; (15) Axios: Iran’s assassination threat against Trump was worse than publicly known; and (16) Sen. Graham unveils fiscal 2025 budget blueprint ahead of Feb. 12-13 markup.

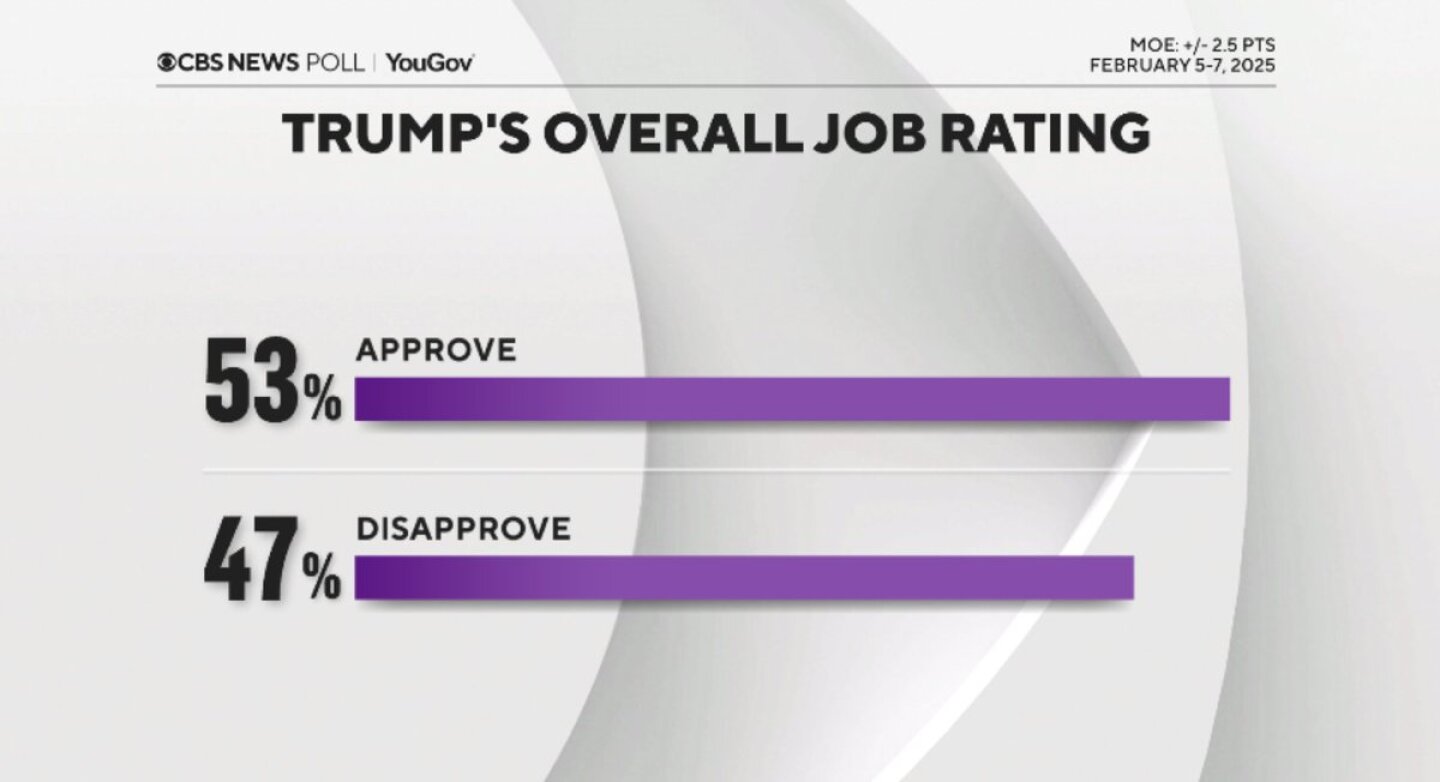

— Trump to announce ‘reciprocal’ tariffs Monday or Tuesday. President Donald Trump revealed plans to impose “reciprocal” tariffs on all countries that match the duties those nations place on U.S. goods. Link to details and impacts via a report we filed Saturday. Trump’s announcement is already getting reaction from the EU, as noted in the next item. — Brazil braces for potential U.S. tariffs amid trade war threats. Brazil’s government is preparing for a possible trade war with the U.S. following President Donald Trump’s announcement of new “reciprocal tariffs” that will affect “everyone,” according to Folha de S. Paulo (link). At the request of Vice President Geraldo Alckmin, officials are analyzing sectors that could be impacted by U.S. tariffs and weighing countermeasures. The measures under consideration include raising tariffs, suspending the ex-tariff regime that temporarily lowers import taxes, and strengthening trade ties with other BRICS nations, particularly China, Russia, and India. A study by Alckmin’s team warns that retaliation could increase costs for Brazilian companies. Brazil’s key exports to the U.S. — crude oil, steel products, and aircraft — could face significant challenges. Despite running a trade deficit with the U.S. since 2008, a 25% tariff could shrink Brazil’s exports to the U.S. by 70%, potentially weakening the Brazilian real. Of note: Brazil currently imposes an 18% tariff on ethanol imports from U.S. This tariff was reinstated by the Brazilian Foreign Trade Chamber (Camex) on Feb. 1, 2023, after a period of zero tariffs that had been in place since March 2022. The tariff rate was initially set at 16% for 2023 and increased to 18% for 2024 and beyond. In contrast, the U.S. does not impose any tariffs on ethanol imports from Brazil. This imbalance in tariffs has raised concerns among U.S. ethanol producers and policymakers. U.S. industry groups and lawmakers have called for parity in market access and fair-trade practices. Besides the tariff, there are non-tariff barriers that further complicate bilateral ethanol trade. For instance, Brazilian ethanol producers have access to U.S. renewable fuel programs, while U.S. producers face challenges in accessing Brazil’s biofuel program. — EU mulls lowering tariffs on U.S. cars to ease trade tensions. The European Union is exploring a proposal to reduce tariffs on U.S. car imports from the current 10% to a rate closer to the 2.5% imposed by the U.S. on European vehicles. The move aims to de-escalate trade tensions with the Trump administration and prevent a potential trade war. Current situation and proposed changes: Motivations and industry reactions: Potential impacts: Bottom line: While the proposal signals a significant shift in EU trade policy if announced, its success depends on how the Trump administration responds. — Canada eyes stronger trade ties with EU amid U.S. trade uncertainty. On Saturday, Feb. 8, Canada’s Trade Minister Mary Ng met with EU officials in Brussels to deepen economic ties between Canada and the European Union. The visit is part of Canada’s broader effort to strengthen partnerships beyond the U.S., particularly as both regions face trade challenges. Key objectives of the visit: Canada aims to diversify trade relationships and reduce dependence on the U.S., targeting a 50% increase in non-U.S. exports by 2025. This strategy includes deals with Indonesia, Ecuador, and greater involvement in the Indo-Pacific. Upshot: Minister Ng’s discussions with EU Trade Chief Maros Sefcovic highlighted business promotion efforts and the push for full CETA ratification. The visit signals a shared interest in renewable energy and critical minerals, crucial for navigating current global trade dynamics. — Trump’s climate funding freeze sparks uncertainty across the U.S. President Donald Trump’s Day 1 executive order to freeze tens of billions in climate funding has left states and nonprofits scrambling. The Washington Post reports (link) that Trump’s action paused disbursements under the Inflation Reduction Act (IRA) and related programs, potentially clawing back as much as $32 billion of the $50 billion in climate-related grants. The executive order has been met with both legal challenges and political support. While Democratic lawmakers call it an illegal move to block binding contracts, many congressional Republicans back the measure. Senate Majority Leader John Thune (R-S.D.) said the freeze is a necessary review of spending, labeling the IRA as part of “the Green New Deal” agenda that contradicts Trump’s priorities. “This is not unusual for an administration to pause funding and take a hard look,” Thune said. However, nonprofit groups and local governments are already feeling the squeeze. Thrive New Orleans, a nonprofit that teaches students how to protect their communities from climate risks, had to lay off four employees after its $500,000 grant was frozen. “We can’t make our payroll,” Executive Director Chuck Morse told the WaPo. “We’re going to have to shut down our programs… It’s hurting the people we pledged to serve.” The funding freeze is causing ripple effects nationwide. An EPA program to reduce greenhouse gases, with nearly $13 billion allocated, is among the hardest hit. Projects like replacing diesel trucks and reducing pollution at Los Angeles-area ports — critical for combating health issues in nearby communities — are now in limbo. “If these grants don’t get funded, it will impact manufacturing jobs across the country,” said South Coast Air Quality Management District spokesperson Connie Villanueva. In some cases, the funding pause has spread to unrelated programs, like the Low-Income Home Energy Assistance Program (LIHEAP), which helps millions of Americans with heating bills. “It’s cold in Minnesota and we suddenly couldn’t get our energy assistance money,” said Pete Wyckoff, deputy commissioner for energy at the Minnesota Department of Commerce. The math: The Washington Post analysis found that although federal agencies raced to finalize payments under the IRA before Biden left office, only $18 billion of the $50 billion in grants has been disbursed, leaving the remainder vulnerable to Trump’s freeze. Democrats continue to pressure the administration to resume funding. During a protest outside the EPA, Sen. Edward J. Markey (D-Mass.) declared, “Thousands of EPA projects worth tens of billions of dollars have been illegally shut down… Climate can’t wait.” — Federal-worker buyout legal update. A federal judge on Monday will hear arguments over whether to grant a temporary restraining order to block Trump’s federal-worker buyout offer while litigation challenging the program proceeds. The legal fight over former President Trump’s flurry of executive orders is escalating, with courts issuing rulings at a rapid pace. As of Saturday, eight orders have been temporarily blocked, while others remain undecided. Many of these cases are expected to reach higher courts, potentially ending up in the Supreme Court. Meanwhile, National security adviser Mike Waltz on whether foreign aid cuts give China and Russia an opening, on NBC’s Meet the Press: “Absolutely not. … All too often, these missions and these programs, number one, are not in line with strategic U.S. interests like pushing back on China. They’re doing all kinds of other things that frankly aren’t in line with strategic interests or the president’s vision.” Here’s a breakdown of the key lawsuits: 1. Immigration. At least 10 lawsuits target Trump’s immigration policies, with seven focused on his attempt to revoke birthright citizenship. Judges have so far been skeptical, with two preliminary injunctions issued. Other lawsuits challenge deportation memos, restrictions on asylum claims, and efforts to penalize sanctuary cities. 2. Budget freezes and federal firings. Trump’s attempt to freeze $3 trillion in federal funds and overhaul the civil service faces strong opposition. Courts have blocked several initiatives, including efforts to encourage federal employees to resign and to remove job protections for thousands. 3. Transgender rights. Litigation in this area challenges policies that would transfer transgender women in federal prisons to male facilities and deny them medical care. Other lawsuits address bans on transgender individuals in the military and restrictions on gender-transition care for minors. 4. Jan. 6 investigators. FBI agents and employees are suing to prevent the release of their identities in connection with the Jan. 6 investigation, fearing retaliation. The government has agreed to withhold the names while the case proceeds. Upshot: With appeals and new rulings expected, these legal battles will likely define the trajectory of Trump’s executive legacy for months to come. — China’s inflation picks up in January as holiday demand boosts prices. China’s consumer inflation rose 0.5% year-on-year in January, up from 0.1% in December, driven by rising food and service prices ahead of the Lunar New Year, according to the National Bureau of Statistics. Core CPI, which excludes volatile food and energy prices, climbed 0.6%, marking its fourth consecutive monthly increase. Pork prices surged 13.8%, and air ticket prices rose 8.9%. Monthly CPI also grew 0.7%. Meanwhile, producer prices dropped 2.3% year-on-year, reflecting continued deflation in the manufacturing sector. — Trump set to attend Super Bowl in historic first for a sitting president; Fox to interview him. Donald Trump plans to make history as the first sitting U.S. president to attend the Super Bowl, using the high-profile event as a political stage. The game between the Kansas City Chiefs and Philadelphia Eagles in Louisiana comes after years of Trump’s tumultuous relationship with the NFL. Known for his criticism of player protests and battles with league leadership, Trump now aims to reconnect with football fans. The president’s Super Bowl appearance will include a pre-game interview with Fox News’ Bret Baier. The Saturday afternoon interview segment will air during the 3 p.m. Eastern hour of Sunday’s Super Bowl pregame show, bringing back an annual tradition that has been dormant for the past two years as Joe Biden opted not to do it. The rest of Baier’s interview, which should last for at least 30 minutes, will air on the Monday edition of his 6 p.m. show Special Report. Axios reports that during the interview, Baier asks President Trump if he trusts Elon Musk. “Oh, he’s not gaining anything,” Trump replies. “In fact, I wonder how he can devote the time to it. He’s so into it… I’m going to tell him very soon, like maybe in 24 hours, to go check ... the Department of Education,” Trump adds. “He’s going to find the same thing. Then I’m going to go to the military. Let’s check the military. We’re going to find billions, hundreds of billions of dollars of fraud and abuse.” Trump’s NFL ties run deep — Trump was an owner in the defunct USFL, criticized NFL diversity efforts, and clashed with Commissioner Roger Goodell. His feud with Taylor Swift, a vocal supporter of his 2024 opponent Kamala Harris, adds another layer of drama, especially with Swift’s connection to Chiefs star Travis Kelce. While congratulating the Chiefs on their AFC title win, Trump notably snubbed the Eagles, continuing a long-standing grudge since canceling their White House visit during his first term. Of note: A new CBS News poll puts President Trump’s approval rating at 53%, which is higher than any rating the network had for Trump in his first term, CBS’ Margaret Brennan notes. But there are some warning signs. Two-thirds of Americans say he’s not focused enough on prices and inflation — an issue that helped deliver Trump the election. — Axios: Iran’s assassination threat against Trump was worse than publicly known. Iran’s threat to assassinate Donald Trump during the 2024 campaign was far more serious than previously disclosed, leading to extreme security measures — including the use of a decoy plane to avoid a potential attack, Axios reports. In his upcoming book Revenge: The Inside Story of Trump’s Return to Power, out March 18, Axios’ Alex Isenstadt reveals that U.S. law enforcement warned Trump last year that Iranian operatives inside the U.S. had access to surface-to-air missiles. This fueled fears that his personal jet, “Trump Force One,” could be targeted during takeoff or landing. After a foiled assassination attempt at Trump’s West Palm Beach golf course on Sept. 15, the concern about Iran’s involvement escalated. Although Iran hasn’t been linked to that incident, Trump’s team took it seriously. During a subsequent trip, Trump flew on a decoy plane owned by Steve Witkoff, Trump’s envoy to the Middle East. Most aides didn’t know about the switch until boarding. Meanwhile, Secret Service warned of a potential shooting targeting Trump’s motorcade after a Sept. 18 rally in Long Island. During a trip to Pennsylvania, a drone followed Trump’s motorcade and was disabled by Secret Service agents using an electromagnetic gun. Isenstadt’s book gives rare behind-the-scenes insight into the dangers Trump faced and the extraordinary lengths his team went to for his protection during the 2024 campaign. |

| WASHINGTON FOCUS |

The House and Senate are in session this week.

— More Senate votes this week on Trump nominees. Sources expect the Senate to move through several nominations throughout the week, including Tulsi Gabbard for director of national intelligence, Robert F. Kennedy Jr. for HHS secretary, Howard Lutnick for secretary of Commerce, Brooke Rollins for USDA secretary and Kelly Loeffler to be administrator of SBA.

— Graham unveils fiscal 2025 budget blueprint ahead of Feb. 12-13 markup. Senate Budget Chairman Lindsey Graham (R-S.C.) late last week released the fiscal year (FY) 2025 budget resolution, directing nine authorizing committees to draft a filibuster-proof reconciliation bill by March 7. The proposal prioritizes border security, military spending, and domestic energy expansion. The Budget Committee will consolidate the submitted plans into a single package for markup on Feb. 12-13.

The resolution outlines $342 billion in funding over four years:

- $175 billion for border security (including the border wall and increased staffing for ICE and immigration judges),

- $150 billion for defense (shipbuilding, air and missile defense, and nuclear overhaul),

- $17 billion for the Coast Guard.

The blueprint also targets repeal of the 2022 methane emissions fee on oil and gas producers and proposes expanded domestic drilling.

To balance the spending, committees must propose revenue offsets or spending cuts, with some committees (like Agriculture) required to reduce the deficit by at least $1 billion over the next 10 years. Cuts could come from subsidies and conservation programs or tightened eligibility for food assistance programs like SNAP.

Graham’s plan assumes significant reductions over the next decade, including $11.5 trillion in net spending cuts and $3.7 trillion in revenue losses from future tax cuts, aiming for $8 trillion in lower deficits over ten years. While nonbinding, the reconciliation instructions offer flexibility for committees to adjust their plans.

House Republicans are working on a separate, more comprehensive package incorporating debt ceiling negotiations and tax cut extensions. Speaker Mike Johnson (R-La.) on Republicans’ budget-bill blueprint, on Fox News Sunday: “It has to be the one-big-bill strategy… That gives us the highest probability of success. … We’ll be in the suite [at the Super Bowl], we’ll talk about that… We were going to do a Budget Committee markup next week. We might push it a little bit further because the details really matter… We’ve got a few more boxes to check, but we’re getting very, very close.”

— Fed chairman to offer semiannual testimony to lawmakers on Tuesday and Wednesday. Fed Chair Jerome Powell is expected to highlight the economy’s resilience during his upcoming testimony before lawmakers. But despite earlier progress in reducing inflation, consumer prices remain stubborn, with core CPI rising 0.3% in January for the fifth time in six months, bringing the annual increase to 3.1%. Meanwhile, job growth surged, with payrolls averaging 237,000 over the last three months, the strongest since early 2023. Fed officials are holding rates steady for now, aiming to assess the impact of new trade, tax, and immigration policies from the Trump administration, which could keep inflation pressures elevated.

— House Oversight Committee to hold hearing Tuesday on sanctuary city policies. The House Oversight and Government Reform Committee will hold a hearing on sanctuary city policies, inviting the mayors of Boston, Chicago, Denver, and New York City to testify. The hearing follows President Trump’s launch of his second term with a sweeping immigration agenda aimed at deporting millions of undocumented immigrants and securing the southern border. Since Trump’s inauguration, over 8,000 people have been arrested by federal immigration authorities. However, senior officials reportedly have voiced frustration with Immigration and Customs Enforcement for failing to meet targets.

— Senate Ag Committee to hold second hearing on agricultural economy. The Senate Ag panel will continue its examination of the agricultural economy with a second hearing titled “Perspectives from the Field: Farmer and Rancher Views on the Agricultural Economy, Part 2,” scheduled for Thursday. This follows the initial hearing on Feb. 5, where farm groups shared their insights on the sector’s current state.

The upcoming hearing will feature two panels of witnesses representing diverse agricultural sectors:

Panel 1: Representatives from fresh produce, Farm Bureau, state agriculture departments, and specialty crop associations.

Panel 2: Leaders from livestock and poultry organizations, including sheep, beef, dairy, pork, turkey, and egg producers.

Key topics for discussion include:

- Financial challenges: Declining incomes, rising debt, and policy uncertainty. USDA recently increased farm income forecasts because of the significant boost this year in ad hoc payments ($10 billion in economic aid; $21 billion in ag disaster aid).

- Input costs: Stabilized feed, fertilizer, and pesticide prices but ongoing high labor costs. USDA reported last week that Cash expenses are easing. While seed costs are forecast to rise in 2025, fertilizer and pesticide expenses are expected to fall. Labor expenses... including noncash employee compensation... are forecast to be record high in 2025 at $51.7 bil., an increase of $2.9 bil. from 2024.

- Trade concerns: Uncertainty in U.S. trade policy and potential retaliation from trading partners.

- Farm bill: Calls for a modernized bill with a stronger farm safety net.

- Labor issues: The availability and cost of farm labor, and concerns about how coming migrant deportations could impact farm and ag industry labor.

- Climate and environmental policies: Potential regulatory changes that could affect the sector.

— House Ag Committee hearing Tuesday will also focus on the ag sector financial situation. Witnesses include several farmers and John Newton, executive head of Terrain.

— Tax group says Trump’s tax cuts could cost $5 trillion to $11 trillion over a decade. A new analysis (link) from the Committee for a Responsible Federal Budget estimates that President Donald Trump’s proposed tax cuts could cost the federal government between $5 trillion and $11.2 trillion in lost revenue over the next ten years. The potential deficit spike would result from extending the 2017 Trump tax cuts and introducing additional tax reductions, including eliminating taxes on tips, overtime, and Social Security benefits.

While Trump’s plan also proposes modest tax increases — such as ending carried interest and sports team owner tax breaks — budget watchdogs warn these adjustments won’t significantly offset the cost. The report suggests that without corresponding spending cuts or new revenue sources, the federal debt could reach between 132% and 149% of GDP by 2035, up from nearly 100% currently.

Trump and GOP lawmakers will dispute CRFB report for several reasons:

- Disagreement on economic growth projections. Trump and Republican lawmakers will likely argue that the CRFB analysis underestimates the economic growth potential of the proposed tax cuts. They may contend that lower tax rates will stimulate economic activity, leading to increased tax revenues that offset some of the projected costs.

- Differing views on revenue estimates. The Trump administration and GOP may challenge the revenue loss projections, claiming they are overstated. They might point to the performance of the 2017 Tax Cuts and Jobs Act (TCJA), arguing that it generated more revenue than initially predicted due to economic growth.

- Dispute over baseline assumptions. Republicans may contest the baseline assumptions used in the CRFB analysis, potentially arguing that it doesn’t accurately reflect current economic conditions or the full impact of existing policies.

- Emphasis on spending cuts. GOP lawmakers are likely to stress that the tax cut package will be accompanied by significant spending reductions, which they argue will help offset the cost of the tax cuts. They may claim that the CRFB analysis doesn’t adequately account for these potential spending cuts.

- Alternative scoring methods. The Trump administration and Republicans might advocate for the use of dynamic scoring, which considers the potential economic effects of tax policy changes, rather than static scoring methods. They may argue that dynamic scoring would show a lower overall cost for the tax cuts.

- Timeframe considerations. Some Republicans are considering shorter-term extensions of certain tax cuts, which could alter the long-term cost projections. They may argue that the CRFB analysis doesn’t reflect these potential adjustments to the tax plan.

Bottom line: Trump and GOP lawmakers will likely frame the tax cuts as necessary for economic growth and job creation, potentially downplaying concerns about long-term deficit impacts. They may argue that the benefits of the tax cuts outweigh the projected costs. While the CRFB report presents one analysis of the potential fiscal impact of Trump’s proposed tax cuts, the administration and GOP lawmakers are expected to challenge its findings based on differing economic assumptions, alternative scoring methods, and their own political narrative focused on economic growth and job creation.

— Policy focus this week will be on country responses to Trump’s trade policy moves, including delayed tariffs on Canada and Mexico and Trump’s comments that Monday or Tuesday he will unveil plans to impose “reciprocal” tariffs on all countries that match the duties those nations place on U.S. goods. As detailed above, the EU is already mulling ways to work with Trump’s latest trade policy strategy.

— Trump also seeks reciprocity on taxation to level the playing field for U.S. firms. Trump aims to revamp tax and trade policy to address what his administration sees as unfair taxation of U.S. companies abroad, according to National Economic Council Director Kevin Hassett. Speaking with Bloomberg, Hassett highlighted the administration’s focus on “reciprocity” in tax policy, citing the $370 billion in taxes paid by U.S. firms overseas compared to just $57 billion paid by foreign companies operating in the U.S. Trump’s plan, as described by Hassett, will combine trade policy, tariffs, and tax code revisions to create a “level playing field” for American businesses. The comments come as Congress works on tax reforms and Trump considers further tariff actions to support his broader economic agenda of reshoring manufacturing and defending U.S. tech interests abroad. Meta CEO Mark Zuckerberg recently met with Trump at the White House to discuss how Meta could support the administration’s push to strengthen U.S. tech leadership.

Meanwhile, this is what Hassett said on other topics during the Bloomberg interview:

- The biggest news from the latest jobs report is the Bureau of Labor Statistics’ downward revision to payrolls figures. “The headline for me when I’m looking at this is that it was the biggest downward division — the benchmark goes through last March — the biggest downward division since 2009,” Hassett said. “Why is it that we keep seeing sort of positive jobs numbers and then when we look back a year later, it’s way worse than we thought?” Revisions that the government only carries out once a year now show job growth averaged 166,000 a month last year, a slowdown from the initially reported 186,000 pace. He adds the downward revisions indicate the Trump administration has a lot of work to do.

- What happened with Canada and Mexico over the last week is not a trade war but a “drug war,” Hassett said.

- When asked about what the Trump administration’s approach will be toward Europe, Hassett said, “I’m not aware of, nor have I been informed of, massive fentanyl shipments from Europe. And so, the discussions we have with Europe will be about other things.”

— China set to implement retaliatory tariffs on select U.S. imports in response to the Trump administration’s additional 10% tariff on all Chinese goods that took effect on Feb. 4 (President Trump said the 10% additional tariffs on China are just “an opening salvo.” On the campaign trail, he threatened tariffs as high as 60% on Chinese imports.) These new Chinese tariffs are set to begin on Feb. 10. U.S. tariffs apply to all Chinese imports and come on top of levies that were previously applied to select Chinese goods, which totaled around $401.4 billion in the first 11 months of 2024, according to Census Bureau data.

China’s Ministry of Finance outlined the following tariff measures:

- 15% additional tariff on U.S. imports of:

- Coal

- Liquefied natural gas (LNG)

- Other related products falling under 8 Harmonized Tariff Schedule (HTS) codes

- Crude oil

- Agricultural machinery

- Large-engine vehicles

- Pickup trucks

- Other commodities falling under 72 HTS codes

- 10% additional tariff on U.S. imports of:

- Crude oil

- Agricultural machinery

- Large-engine vehicles

- Pickup trucks

- Other commodities falling under 72 HTS codes

China has stated that these tariffs are a direct response to the “unilateral practice” of the United States imposing additional tariffs, which China claims “seriously violated the World Trade Organization rules.” The Chinese government has emphasized that no exemption or reduction mechanism will apply to these retaliatory tariff measures.

Additional Chinese measures. China has also implemented other trade actions:

- Export controls on critical minerals including tungsten, tellurium, bismuth, molybdenum, and indium

- Addition of two U.S. companies to its Unreliable Entity List

- Initiation of an antitrust investigation into Google

- Filing a formal complaint with the World Trade Organization (WTO) dispute settlement body against the U.S. tariffs

There is potential for further escalation or negotiation between the two countries. The Trump administration has indicated that it may increase or expand the scope of its tariffs if China retaliates, which could lead to a cycle of retaliation and counterretaliation.

— How tariffs affect U.S. communities. Trade wars usually follow a familiar script: one country imposes tariffs, and the other retaliates. The U.S./China trade dispute reignited when the Trump Administration announced a 10% tariff on Chinese goods. In response, China implemented tariffs on American exports like coal, liquified natural gas, crude oil, and large-engine vehicles. These measures, effective Feb. 10, are expected to hit rural U.S. communities hardest, especially in states like North Dakota, Indiana, Ohio, and West Virginia, where affected industries dominate local economies.

A Brookings Institution report reveals that nearly two-thirds of the jobs at risk are in counties that voted for Trump in 2024. Although urban centers like Houston and Detroit could see a larger number of jobs affected, smaller rural communities could feel the brunt of the economic impact. For instance, in Sargent County, North Dakota, 59% of local jobs could be affected despite its small size. The same pattern applies to other counties across the Midwest and Southern states.

Historically, Trump’s tariffs have not diminished his support in affected areas. Brookings researchers note that in prior tariff battles, voters in regions hit hardest by Chinese import competition remained loyal, viewing Trump’s policies as action-oriented, even if they hurt the local economy. West Virginia, a major coal exporter, remains a stronghold of support, with industry leaders backing the administration despite potential losses from Chinese tariffs.

The Brookings study estimates that 400,000 to 700,000 U.S. jobs could be affected, particularly in industries like automotive, petroleum, and construction equipment. While trade wars may have global implications, their most tangible effects are deeply felt in small communities across America’s heartland.

| OTHER EVENTS & HEARINGS |

Notable congressional hearings this week include:

Monday, Feb. 10

- House Committee on Rules: Meeting to discuss HR 77 — Midnight Rules Relief Act.

- Crop insurance industry annual convention, through Wednesday, Bonita Springs, Florida.

- Trade conference: Washington International Trade Conference, through Tuesday.

Tuesday, Feb. 11

- Clean Water Act. House Transportation and Infrastructure Subcommittee on Water Resources and Environment: Hearing titled “America Builds: Clean Water Act Permitting and Project Delivery.”

- China’s strategic port investments in Western Hemisphere. House Homeland Security Subcommittee on Transportation and Maritime Security: Hearing on “Examining the PRC’s Strategic Port Investments in the Western Hemisphere and the Implications for Homeland Security, Part I.”

- Reining in administrative state. House Judiciary Subcommittee on Administrative State, Regulatory Reform, and Antitrust: Hearing on “Reining in the Administrative State: Regulatory and Administrative Law Reform.”

- Economic crisis in farm country. House Ag Committee hearing titled “Examining the Economic Crisis in Farm Country.” Link to video of hearing.

- Fed Chairman Powell. Senate Committee on Banking, Housing, and Urban Affairs: Hearing to examine the Semiannual Monetary Policy Report to Congress.

- National Council of Farmer Cooperatives annual meeting, through Thursday, La Quinta, California.

- National Rural Health Association’s Rural Health Policy Institute, through Thursday, Arlington, Virginia.

Wednesday, Feb. 12

- Federal Reserve Chairman Jerome Powell to deliver semi-annual monetary policy testimony before the House Financial Services Committee.

- Carbon capture, sequestration. Senate Committee on Environment and Public Works: Hearing on advancing carbon capture, utilization, and sequestration technologies.

- Nomination: Secretary of Labor. Senate Committee on Health, Education, Labor, and Pensions: Hearing to examine the nomination of Lori Chavez-DeRemer for Secretary of Labor.

- Importance of Arctic and Greenland to U.S. interests. Senate Committee on Commerce, Science, and Transportation: Hearing on the Arctic and Greenland’s geostrategic importance to U.S. interests.

- Farm labor. Wilson Center event, “U.S./Mexico Farm Labor Policy Recommendation Launch,” Woodrow Wilson Center.

- Senate Budget Committee meeting to consider the FY 2025 budget resolution.

Thursday, Feb. 13

- USAID. House Committee on Foreign Affairs: Hearing titled “The USAID Betrayal.”

- Nomination: FBI director. Senate Committee on the Judiciary: Business meeting to consider the nomination of Kashyap Patel for Director of the FBI.

- Defense. Senate Committee on Armed Services: Hearing to examine the posture of U.S. Northern Command and U.S. Southern Command.

- Ag economy. Senate Ag Committee. Hearing on farmer and rancher views on the agricultural economy. Link for video of hearing and statements.

- Senate Budget Committee continues to consider the FY 2025 budget resolution.

- Panama Canal. Wilson Center event, “The Future of the Panama Canal,” Woodrow Wilson Center.

Friday, Feb. 14

- National Cotton Council annual meeting, through Sunday, Dallas.

| ECONOMIC REPORTS & EVENTS |

Key economic data and earnings reports to watch this week. Investors will focus on inflation data, the Fed chairman’s testimony before two congressional panels, and a wave of fourth-quarter earnings this week. On Wednesday, the Bureau of Labor Statistics (BLS) will release the January consumer price index (CPI), offering clues on inflation as the Federal Reserve pauses interest-rate cuts. The January producer price index (PPI) follows on Thursday. Other key economic indicators include the Small Business Optimism Index on Tuesday and January retail sales data from the Census Bureau on Friday.

Earnings highlights:

- Monday: McDonald’s

- Tuesday: Coca-Cola, DoorDash, Marriott, Shopify, Super Micro Computer

- Wednesday: Cisco Systems, Robinhood Markets, Ventas, Vertiv Holdings

- Thursday: Airbnb, Applied Materials, Coinbase, Deere, Wynn Resorts, Zoetis

- Friday: Enbridge, Moderna

Monday, Feb. 10

- Treasury Auctions: The U.S. Department of the Treasury will conduct auctions for 3-month and 6-month bills.

- Consumer Inflation Expectations

Tuesday, Feb. 11

- Federal Reserve. Fed Chair Jerome Powell testifies before the Senate Committee on Banking, Housing, and Urban Affairs.

- Federal Reserve: Governor Michelle W. Bowman speaks on bank regulation at the 2025 Iowa Bankers Association Bank Management and Policy Conference.

- Federal Reserve. Governor Adriana D. Kugler will speak on “Entrepreneurship and Aggregate Productivity” at the 2025 Miami Economic Forum in Miami, Florida.

- Federal Reserve: Cleveland Fed President Beth Hammack is expected to speak on the economic outlook before the University of Kentucky Gatton School of Business and 2025 Economic Outlook Conference in Lexington.

- Federal Reserve: New York Fed President John Williams to give keynote remarks before the Pace University Economics Society in New York.

- NFIB Business Optimism Index

Wednesday, Feb. 12

- Consumer Price Index (CPI): The Bureau of Labor Statistics will release the CPI data for January, providing insights into inflation trends.

- Federal Reserve: Fed Chair Jerome Powell testifies before the House Financial Services Committee.

- Federal Reserve: Governor Christopher J. Waller speaks at the Stablecoin Infrastructure for Real World Applications, San Francisco, Calif.

- Federal Reserve: Atlanta Fed President Raphael Bostic to speak on the economic outlook in a moderated conversation before the Atlanta chapter of the National Association of Corporate Directors in Atlanta.

- Monthly Budget Statement

Thursday, Feb. 13

- Initial Jobless Claims: The Department of Labor will publish the number of first-time claims for unemployment benefits for the week ending February 8, serving as a measure of labor market health.

- Producer Price Index (PPI): The PPI for January will be released, offering information on wholesale inflation.

- Fed Balance Sheet

- Money Supply

Friday, Feb. 14

- Retail Sales: January’s retail sales data will be released, reflecting consumer spending patterns.

- Industrial Production and Capacity Utilization: Federal Reserve will report on industrial production and capacity utilization for January, indicating the output of factories, mines, and utilities.

- Consumer Sentiment: The preliminary University of Michigan Consumer Sentiment Index for February will be available, providing insights into consumer confidence.

- Export and Import Prices

- Business Inventories

| KEY USDA & INTERNATIONAL AG & ENERGY REPORTS & EVENTS |

Ag focus is Tuesday when USDA releases its monthly supply and demand report.

Energy sector: The three most prominent oil forecasters — the IEA, OPEC and the EIA — will publish their monthly market outlooks. More major energy companies will unveil 4Q results during the week, including BP Plc on Tuesday.

Monday, Feb. 10

Ag reports and events:

- Dubai Sugar Conference, day 1

- Malaysia’s Feb. 1-10 palm oil exports

- Export Inspections

- Catfish Production

Energy reports and events:

· China due to impose tariffs on some U.S. goods including oil

Tuesday, Feb. 11

Ag reports and events:

- French agriculture ministry report on grains

- Dubai Sugar Conference, day 2

- EU weekly grain, oilseed import and export data

- China’s agriculture ministry (CASDE) monthly report on supply and demand for corn and soybeans

- Cotton Ginnings

- Crop Production

- WASDE

- Cotton: World Markets and Trade

- Grains: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- Holiday: Japan, Malaysia, Qatar

Energy reports and events:

- India Energy Week 2025, New Delhi (through Feb. 14)

- World Governments Summit in Dubai (through Feb. 13)

- Oslo Energy Forum (through Feb. 13)

- EIA due to publish monthly STEO report

- API weekly report on US oil inventories

- Earnings: BP 4Q, FY; Energy Transfer 4Q, FY

Wednesday, Feb. 12

Ag reports and events:

- Dubai Sugar Conference, day 3

- FranceAgriMer’s monthly grains balance sheet

- Meat Price Spreads

- Broiler Hatchery

- Vegetables, Annual

- Dairy Monthly Tables and Dairy Quarterly Data

- Season Average Price Forecasts

- Wheat Data

- Holiday: Thailand, Myanmar

Energy reports and events:

- Genscape weekly crude inventory report for Europe’s ARA region

- Oslo Energy Forum (through Feb. 13)

- OPEC due to publish its Monthly Oil Market Report

- India Energy Week 2025, New Delhi (through Feb. 14)

- World Governments Summit in Dubai (through Feb. 13)

- EIA weekly report on US oil inventories, supply and demand

- ICE gasoil February futures expire

- Earnings: Aker BP; Dominion Energy 4Q

Thursday, Feb. 13

Ag reports and events:

- Black Sea Grain Europe 2025 conference, Prague, day 1

- Dubai Sugar Conference, day 4

- Brazil’s Conab releases production, area and yield data for corn and soybeans

- Quick Stats Database

- Slaughter Weekly

- Cotton and Wool Outlook Tables

- Feed Grains Database

- Oil Crops Outlook

- Feed Outlook

- Rice Outlook

- Wheat Outlook

- Weekly Export Sales

- Tree Nuts: World Markets and Trade

- Earnings: Deere & Co.

Energy reports and events:

- Singapore onshore oil-product stockpile weekly data

- Insights Global weekly oil product inventories in Europe’s ARA region

- IEA due to publish its monthly oil market report

- Oslo Energy Forum (last day)

- India Energy Week 2025, New Delhi (through Feb. 14)

- World Governments Summit in Dubai (last day)

- EIA weekly report on US natural gas inventories

- Earnings: Duke Energy 4Q, FY; Neste 4Q, FY 2024 and capital markets update

Friday, Feb. 14

Ag reports and events:

- Black Sea Grain Europe 2025 conference, Prague, day 2

- FranceAgriMer weekly crop conditions report

- CFTC commitments of traders report

- Farms and Land in Farms

- North American Potatoes

- Peanut Prices

- Potato Stocks

- Turkey Hatchery

Energy reports and events:

- Shanghai exchange weekly commodities inventory

- India Energy Week 2025, New Delhi (last day)

- Baker Hughes weekly rig count report,

- ICE Futures Europe weekly commitment of traders report

- WTI March options expire

- Earnings: Enbridge 4Q; TC Energy 4Q

| KEY DATES IN FEBRUARY |

9: Super Bowl

11: USDA Crop Production, WASDE, world market circulars

12: Consumer Price Index report

13: Producer Price Index-FD | USDA outlook reports for several commodities

14: Retail Sales | Valentine’s Day

16: Daytona 500

17: Presidents Day; U.S. gov’t and market holiday

21: Univ. of Michigan Consumer Sentiment | Existing Home Sales | USDA Cattle on Feed

25: Consumer Confidence | USDA Food Price Outlook

27: Durable Goods Orders | GDP | USDA Outlook Forum | Outlook for U.S. Agricultural Trade report

28: Personal Income and Outlays (PCE Price Index) | International Trade in Goods | USDA Outlook Forum concludes

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | U.S./China Phase 1 agreement | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum | Eggs/HPAI | Trump tariffs |