News/Markets/Policy Updates: Jan. 14, 2025

Other topics in this dispatch include: (1) Bloomberg says Trump team studying gradual tariff hikes; (2) Trump team vague on tariff plans; (3) GOP eyes $5 trillion in spending cuts to fund Trump agenda; (4) USDA implements import restrictions on German animal products in response to FMD outbreak; (5) Germany faces export disruptions due to foot-and-mouth disease outbreak; (6) USDA finalizes poultry payment guidelines, withdraws competition rule; (7) Ceasefire talks show hope for Gaza truce and hostage release; (8) Progress report on SAF Grand Challenge; Mexico announces plan to boost local industry, nearshoring to reduce imports from China; (9) China to counter tariffs with stimulus: Goldman; and (10) GOP pushes $85 billion border security plan.

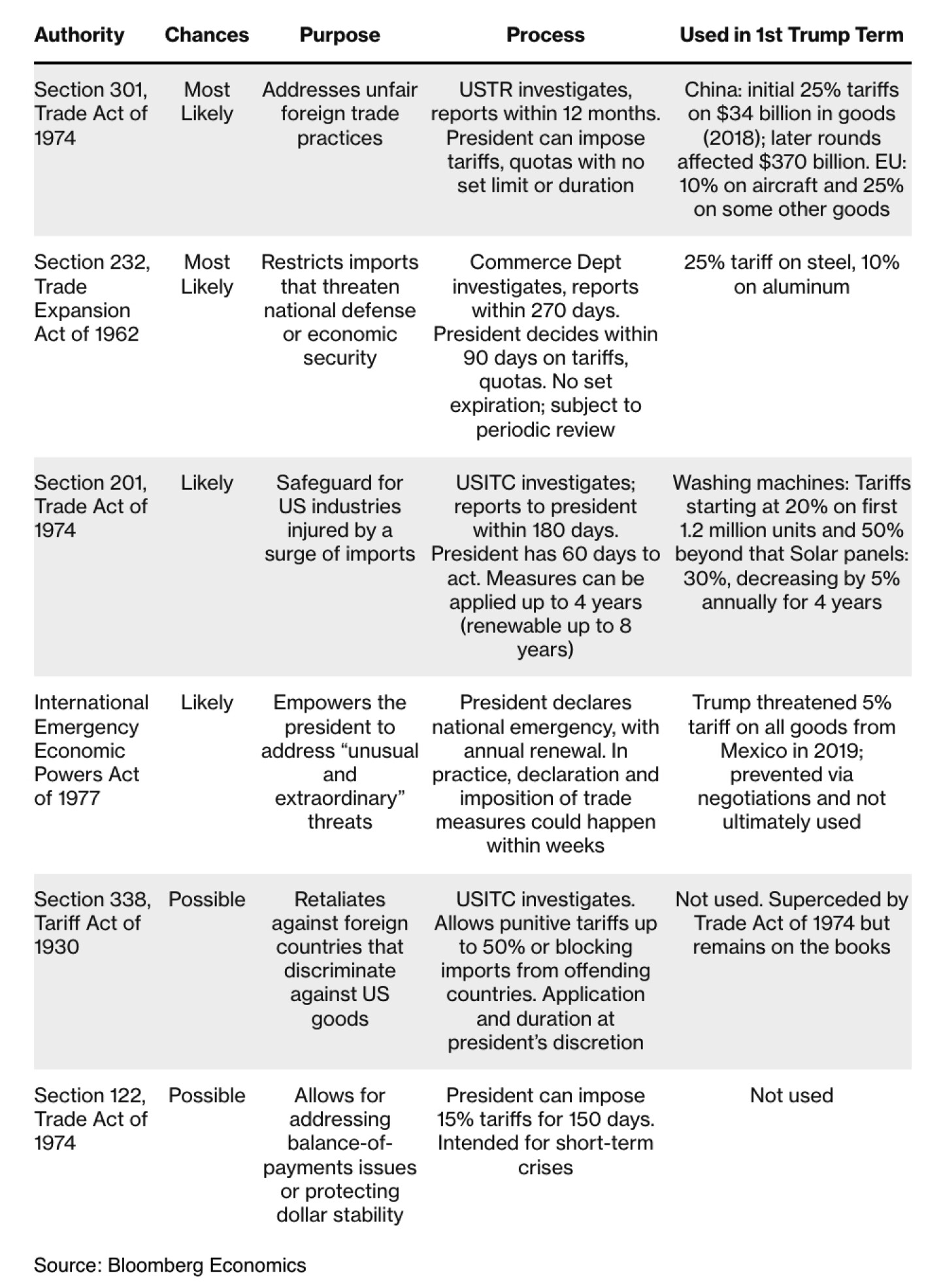

— USDA set to announce Climate-Smart Biofuel guidelines following OMB review. The Office of Management and Budget (OMB) completed its review of the USDA’s “Technical Guidelines for Climate-Smart Agriculture Crops Used as Biofuel Feedstocks” interim final rule on Jan. 13. This rule, rooted in feedback gathered by USDA in July, focuses on climate-smart practices and their verification for biofuel production. Despite significant interest, particularly considering the Treasury Department’s recent preliminary guidance for the Clean Fuels Production Credit (45Z), no external meetings were requested or held regarding the rule since its submission to OMB on Dec. 6, 2024. USDA is now poised to release the finalized guidelines. Of note: With the review now complete and USDA’s history of quickly announcing rules once that review is finished, this could signal that the updated 45ZCF-GREET model from the Department of Energy is poised for release shortly (see related item below). The Biden administration in 2024 announced the updated GREET model for the sustainable aviation fuel (SAF) credit and the pilot program for climate smart corn and soybeans at the same time. — Bloomberg: Trump team studies gradual tariff hikes under emergency powers. Highlights: Plan would boost import duties 2%-5% a month on trade partners; Supporters include Trump advisers Bessent, Hassett, and Miran. Proposal has not yet been submitted to Trump. Plan under discussion. Members of President-elect Donald Trump’s incoming economic team are deliberating a plan to gradually increase tariffs by 2% to 5% per month under the International Emergency Economic Powers Act, according to Bloomberg. This phased approach aims to strengthen negotiating leverage while mitigating inflationary impacts, though the proposal remains in early stages and has yet to reach Trump. Key advisers involved include Scott Bessent (Treasury secretary nominee), Kevin Hassett (incoming director of the National Economic Council), and Stephen Miran (Council of Economic Advisers nominee). None have provided public comments on the matter, while the Trump transition team referred to prior public statements about tariffs. The market reacted swiftly, with China’s yuan and related currencies strengthening. Investors speculate that Beijing may eventually allow currency depreciation if Trump imposes higher tariffs on Chinese goods. A decision to ramp up tariffs gradually once he takes office would be “problematic” for the Federal Reserve as it battles the last mile of inflation, according to Arend Kapteyn at UBS AG. “We think of tariffs as a one-off price level shift and then it goes away a year later, and then provided it’s not big enough you don’t have spillover effects, so you don’t get second round effects that are sort of inflationary,” Kapteyn, UBS global head of economics and strategy research, said Tuesday in a television interview with Stephen Engle in Shanghai. “But if you do rolling tariffs, it’s a little like the repeat of the pandemic and the Ukraine shock that we had, you have one supply shock after another and you start to create a much higher peak in inflation so I think much more difficult to sort of know what to do with that as a central bank,” he said. This comes amid lingering uncertainty about Trump’s trade policies, which could reshape global economic conditions. IMF Managing Director Kristalina Georgieva noted that such tariff threats are already raising long-term borrowing costs worldwide, further complicating the outlook for inflation and growth. Of note: The proposal is in its early stages and has not yet been presented to Trump, the Bloomberg report said. Recall that the Washington Post previously reported that Trump’s aides were considering a phased approach to tariffs, which Trump subsequently denied. According to the WaPo report, Trump’s economic team was discussing gradually ramping up tariffs by about 2% to 5% per month, using executive powers under the International Emergency Economic Powers Act. This approach was aimed at boosting negotiating leverage while helping to avoid a sudden spike in inflation. However, Trump strongly refuted this report on his Truth Social platform, stating: “The story in the Washington Post, quoting so-called anonymous sources, which don’t exist, incorrectly states that my tariff policy will be pared back. That is wrong. The Washington Post knows it’s wrong. It’s just another example of Fake News.” — Trump team stays vague on tariff plans. The Trump transition team continues to offer limited details on how the president-elect will implement his proposed tariff policies. When pressed on Monday about Trump’s plans to impose a 60% tariff on Chinese goods and 10–20% tariffs on imports from other countries, spokesperson Brian Hughes reiterated broad goals without specifics. “President Trump has promised tariff policies that protect the American manufacturers and working men and women from the unfair practices of foreign companies and foreign markets. As he did in his first term, he will implement economic and trade policies to make life affordable and more prosperous for our nation,” Hughes stated. — GOP eyes $5 trillion in spending cuts to fund Trump agenda but a list is just that, an initial summary of potential reductions. Some House Republicans are circulating a proposal to slash over $5 trillion in federal spending over the next decade to finance President-elect Donald Trump’s key priorities, including tax cuts and border security. The document (link), obtained by Politico, includes potential cuts to Medicare, Medicaid, Affordable Care Act programs, and Biden administration climate initiatives, perhaps including biofuel tax incentive programs. But to repeat: these are just proposals from some lawmakers. Key provisions in the options include: The document stems from the House Budget Committee, chaired by Rep. Jodey Arrington (R-Texas), and reflects Republican ambitions for party-line passage of spending reforms. However, with a narrowly divided Congress, major cuts may struggle to gain broad support. House Speaker Mike Johnson (R-La.) has committed to at least $2.5 trillion in cuts but acknowledged uncertainty over reaching the $5 trillion target. Of note: Republican lawmakers will continue internal negotiations and discussions with Trump, focusing on balancing political feasibility with fiscal goals. — USDA implements import restrictions on German animal products in response to FMD outbreak. USDA took swift action in response to Germany’s recent foot-and-mouth disease (FMD) outbreak, implementing significant import restrictions on livestock and animal products from the country. · Livestock ban: USDA’s Animal and Plant Health Inspection Service (APHIS) has prohibited the import of German cattle, sheep, swine, and goats. The restrictions come in the wake of Germany’s first FMD case in nearly 40 years, detected in a water buffalo herd near Berlin. This outbreak has significant implications for Germany’s agricultural sector and international trade. These measures are likely to disrupt Germany’s meat and dairy exports, particularly those destined for markets outside the European Union. The loss of Germany’s FMD-free status under World Organization for Animal Health guidelines (link) has already led to export challenges, with countries like South Korea imposing immediate bans on German pork imports (see next item), with Mexico following suit. USDA’s actions align with standard protocols for protecting domestic livestock from potential FMD introduction, highlighting the serious economic and agricultural risks associated with the disease. — Germany faces export disruptions due to foot-and-mouth disease outbreak. Germany’s recent foot-and-mouth disease (FMD) outbreak has disrupted its exports. South Korea, its second-largest non-EU market after the UK, has suspended German pork imports, including 360 metric tons awaiting quarantine inspection (link). This decision follows Korea’s prior resumption of German pork imports under a regionalization agreement addressing African Swine Fever, but presently Korea does not recognize EU regionalization for FMD. Last year Korea imported about 40,000 mt of pork from Germany, representing 7% of the imported pork market. Frozen pork belly made up the vast majority of these imports. Korea has recognized Brazil’s state of Santa Catarina as FMD-free without vaccination, allowing pork imports from that state. But it took many years to reach that agreement, and access is limited to a single Brazilian state. According to the USMEF, globally, Germany exported 1.277 million metric tons of pork in 2024 (up 18% year-over-year), with 83% to the EU, 6.5% to the UK, and 3.6% to Korea. FMD clauses in export certificates have effectively halted German pork exports to third countries, including key markets like the UK, which imported 79,400 metric tons through October. Germany remains the EU’s second-largest pork producer, with production reaching 3.553 million metric tons (up 2% YoY). While the EU allows regionalized movement within its borders, third-country export recovery hinges on regaining FMD-free status. The U.S. imports minimal volumes of pork from Germany, totaling 238 mt through November and consisting only of prepared pork products. The establishments approved for processed pork are listed here and imports from Germany are subject to FMD requirements specified in 9 CFR 94.11, as explained on this FSIS webpage. Upshot: Efforts are underway to mitigate the outbreak’s effects, including targeted vaccine development to control the pathogen’s spread. German authorities are working to support the agricultural sector and prevent further disruptions. This underscores the need for regionalization agreements that would negate the ability to ban from a whole country. — USDA finalizes rule banning pay deductions for poultry growers amid industry resistance; withdraws long-awaited competition rule. USDA finalized a rule banning poultry companies from penalizing contract growers through pay deductions for underperforming flocks, restructuring the industry’s controversial tournament pay system (link). USDA Secretary Tom Vilsack emphasized that the rule, set to be published Thursday, aims to create a fairer payment structure for growers burdened by heavy debt and limited control over inputs. The new regulation also caps performance-based pay at 25% and mandates transparency in capital improvement requirements for contract renewals. Poultry companies must provide detailed information about capital improvement requirements for contract renewals. Industry pushback is expected, and the rule may face challenges under a new administration. The National Chicken Council has previously argued that such rules could lead to rigid, one-size-fits-all requirements that might stifle innovation and increase consumer costs. Notably, USDA has also withdrawn a Biden-era overhaul of the Packers and Stockyards Act, which was intended to address competition issues in the meat industry. This withdrawal, coming as the Trump administration is set to take over, marks a significant shift in agricultural policy direction. — Ceasefire talks show hope for Gaza truce and hostage release. Hopes are rising for a potential Gaza ceasefire and a hostage release deal as negotiations take place in Doha today. Hamas is expected to release 33 hostages during the first phase of the agreement, marking a potential breakthrough in the Israel-Hamas war. Israeli officials have expressed cautious optimism that a deal may soon be finalized, possibly halting 15 months of intense conflict that has destabilized the Middle East and devastated Gaza. The agreement could facilitate increased aid delivery to Gaza and the return of dozens of hostages held by Hamas since the Oct/ 7, 2023, attack on Israel. Currently, Hamas and its allies hold 94 of the 251 hostages taken, with 34 confirmed dead, according to the Israeli government. Of note: Hamas has accepted a draft agreement for a ceasefire in the Gaza Strip and the release of dozens of hostages, two officials involved in the talks said Tuesday. |

| WHOLESALE PRICES ROSE 0.2% IN DECEMBER, LESS THAN EXPECTED |

— The latest data on wholesale prices in the United States reveals a moderation in inflationary pressures for December 2024. The Producer Price Index (PPI), which measures price changes at the wholesale level, increased by 0.2% in December, falling short of economists’ expectations.

- Monthly increase: The PPI rose 0.2% in December, lower than the anticipated 0.4% increase.

- Annual inflation: On a year-over-year basis, wholesale prices increased by 3.3%, up from November’s 3% but below the forecasted 3.5%.

- Core PPI: Excluding volatile food and energy prices, the core PPI remained unchanged month-over-month, contrary to expectations of a 0.3% rise.

This slower-than-expected increase in wholesale prices is viewed as a positive sign for the economy, especially considering recent concerns about persistent inflation. The data suggests that inflationary pressures within the supply chain may be easing as 2024 ended.

Federal Reserve considerations. The PPI report comes ahead of the highly anticipated Consumer Price Index (CPI) release, which is crucial for the Federal Reserve’s monetary policy decisions. Market predictions currently indicate only a 3% likelihood of the Fed lowering rates during its January meeting, with a greater than 50% chance of a rate cut not anticipated until at least June.

Sector-specific trends

- Food prices: While overall inflation moderated, food prices continued to show volatility. Egg prices, for instance, increased by 7.8% in November due to ongoing impacts of avian influenza.

- Energy: The fuel and power category experienced deflation of 3.79%, an improvement from November’s 5.83% deflation.

Manufacturing: Inflation in manufactured items rose slightly to 2.14% from 2% in the previous month.

Bottom line: This latest PPI report provides a nuanced picture of the inflationary landscape, suggesting that while some pressures persist, overall wholesale inflation is showing signs of moderation as the economy moves into 2025.

| FINANCIAL MARKETS |

— Equities today: U.S. equity futures are higher with global stock markets thanks to easing tariff policy worries (Bloomberg report cited above). Geopolitically, the WSJ reported Israel and Hamas are working on a ceasefire deal that could be finalized as soon as today. In Asia, Japan -1.8%. Hong Kong +1.8%. China +2.5%. India +0.2%. In Europe, at midday, London flat. Paris +1%. Frankfurt +0.8%.

Two Fed officials are scheduled to speak: Schmid (10:00 a.m. ET) and Williams (3:00 p.m. ET), and because hawkish money flows have been a major source of volatility in equities recently, the Sevens Report says their commentary has the potential to move markets today. A more dovish-leaning tone from both would be the most favorable outcome for equities today.

Equities yesterday: All three major indices opened lower but the Dow climbed into positive territory early in the session while the S&P 500 made a late push higher but the Nasdaq still finished lower. The Dow finished up 358.67 points, 0.86%, at 42,297.12. The Nasdaq was down 73.53 points, 0.38%, at 19,088.10. The S&P 500 gained 9.18 points, 0.16%, at 5,836.22.

— China weighs sale of TikTok U.S. to Musk as a possible option. Bloomberg News reports that Chinese officials are considering Elon Musk as a potential buyer for TikTok’s US operations if parent company ByteDance fails to prevent a ban. ByteDance’s preferred approach remains challenging the legislation, currently being reviewed by the U.S. Supreme Court. However, Beijing is preparing contingency plans, with discussions involving Musk’s X platform taking over TikTok’s U.S. user base of over 170 million.

Of note: Musk’s prior investments in President-elect Trump’s campaign and his relationship with Chinese officials through Tesla provide strategic advantages. While ByteDance insists it will fight to retain ownership, Beijing’s “golden share” in ByteDance complicates the situation. TikTok’s U.S. valuation could reach $40–$50 billion, making a potential deal both significant and intricate.

— Cleveland Cliffs poised to renew bid for U.S. Steel amid Nippon deal delay. The Biden administration’s decision to extend the timeline for Nippon Steel to unwind its planned acquisition of U.S. Steel to mid-June has reignited speculation about a potential bid from Cleveland Cliffs. CEO Lourenco Goncalves expressed his intention to make another offer for U.S. Steel, emphasizing an “all-American solution” that would include relocating Cleveland Cliffs’ headquarters to Pittsburgh and retaining the iconic U.S. Steel name.

While Goncalves did not disclose specific details, Reuters reported that Cleveland Cliffs was preparing a bid in the high $30s per share, significantly below Nippon Steel’s $55 per share offer. However, concerns loom over potential antitrust issues, as a merger between Cleveland Cliffs and U.S. Steel could consolidate up to 95% of iron ore production under one company.

— BOJ deputy signals potential rate hike ahead of January meeting. Bank of Japan Deputy Governor Ryozo Himino suggested that a rate hike may be on the table during the central bank’s upcoming policy meeting on Jan. 23-24. Speaking in Yokohama, Himino emphasized the importance of timing in monetary policy, adding that the board will discuss raising the policy rate based on the outlook compiled at the meeting.

This marks a departure from the more cautious tone recently expressed by BOJ Governor Kazuo Ueda. Market watchers now estimate a 60% probability of a rate hike next week and an 82% chance by March, according to overnight index swaps.

Key factors influencing the BOJ’s decision include anticipated wage growth, spurred by labor shortages and strong pay hikes agreed upon last year, alongside evolving U.S. economic policies under the new administration. The yen initially weakened following Himino’s remarks but later stabilized.

Economists see increasing chances of a January hike, with inflation pressures — fueled by rising rice costs and a weaker yen — playing a pivotal role. Himino reiterated that any decision would be based on thorough discussion and the broader economic outlook, stressing that surprises are undesirable outside of crises.

— ECB’s Rehn predicts neutral interest rates by mid-2025. European Central Bank (ECB) Governing Council member Olli Rehn anticipates euro-zone interest rates will reach a neutral level — neither restrictive nor stimulative — by mid-2025. Speaking in Hong Kong, the Finnish central-bank governor noted that disinflation is progressing, wage pressures are easing, and the growth outlook remains subdued.

Rehn highlighted that future monetary policy adjustments would be data-dependent, focusing on inflation dynamics, policy transmission, and incoming information. He also emphasized the potential influence of geopolitical shocks, such as trade barriers and the conflict in Ukraine, alongside policy shifts under the new U.S. administration.

Decisions on rate adjustments will continue to be made at each Governing Council meeting, informed by updated analyses and developments in global economic conditions.

| AG MARKETS |

— Ag markets today:

Grains weaker overnight. Corn, soybeans and wheat mildly pulled back from recent strong gains during the overnight session. As of 7:30 a.m. ET, corn futures were trading mostly 2 cents lower, soybeans were 2 to 4 cents lower and wheat futures were 1 to 3 cents lower. The U.S. dollar index was more than 300 points lower, and front-month crude oil futures were modestly weaker.

Cash cattle rally may be ending. Cash cattle prices jumped another $3.65 last week to $202.58, marking a record high for a second consecutive week. Cash cattle prices have strengthened for eight consecutive weeks, surging $17.79 during that span. Cash sources say packers bought a lot of cattle last week, including some “with time.” After weeks of chasing supplies, it appears packers are no longer short-bought, suggesting the cash market may pull back this week.

Cash hog index halts price slide. The CME lean hog index is up 34 cents to $80.77 as of Jan. 10, halting the recent price decline. Price action in February lean hog futures over the past four sessions suggests traders believe a seasonal low is in place.

— Ag trade: Japan is seeking 132,888 MT of milling wheat via its weekly tender.

— USDA daily export sale:

· 198,000 MT soybeans to China for 2024-25.

— Agriculture markets yesterday:

• Corn: March corn rallied 6 cents to $4.76 1/2, marking the highest close since June 18.

• Soy complex: March soybeans closed on session highs, up 27 3/4 cents to $10.53. March meal surged $9.50 to $307.80, on session highs.

• Wheat: March SRW wheat rose 14 1/4 cents to $5.45, near the daily high. March HRW wheat gained 9 1/4 cents to $5.61 and near the daily high. March spring wheat futures rose 9 1/4 cents to $5.93 1/2.

• Cotton: March cotton rose 63 points to 67.64 cents, closing nearer the session high.

• Cattle: February live cattle fell $1.375 to $197.40, near the session low after hitting a 15-month high Friday. March feeder cattle lost $1.50 to $267.90, near the session low after hitting a contract high Friday.

• Hogs: February lean hog futures led the complex higher, closing 62.5 cents higher to $83.175.

— Conab raises Brazilian soybean production forecast, still below others. Brazilian crop estimating agency Conab raised its 2024-25 soybean crop estimate 110,000 MT from last month to 166.32 MMT, though that’s still below most private crop forecasters that are at or slightly above 170 MMT. Conab trimmed its corn production forecast by 80,000 MT to 119.55 MMT. The soybean and corn production adjustments were due to changes in planted acreage. Conab kept its 2024-25 Brazilian export forecasts at 105.5 MMT for soybeans and 34 MMT for corn.

— India may relax sugar export restrictions. ET Now News reports India is expected to relax restrictions on sugar exports, citing sources familiar with the situation. Approval for the export of 10 lakh tonnes (1 MMT) of sugar is likely soon. India capped sugar exports at 11 MMT in 2021-22, 6 MMT in 2022-23 and didn’t allow any shipments in 2023-24. However, India’s sugar output in 2024-25 is expected to be the lowest since 2019-20 and less than domestic consumption, which has some anticipating the export ban will be extended.

| FARM POLICY |

— USDA opens 2025 enrollment for crop and dairy safety-net programs. USDA announced enrollment dates for its 2025 Agriculture Risk Coverage (ARC), Price Loss Coverage (PLC), and Dairy Margin Coverage (DMC) programs. Producers can apply for ARC and PLC from Jan. 21 to April 15 and for DMC from Jan. 29 to March 31.

ARC and PLC safeguard farmers from significant drops in crop prices or revenues, while DMC provides financial support to offset milk and feed price differences. Producers must sign a contract annually to enroll, even if not changing program elections.

Key program highlights include:

- ARC and PLC: Offer tailored crop-by-crop or whole-farm protection, with election changes optional but enrollment mandatory each year.

- DMC: Provides margin protection with flexible coverage options, including a $0.15 per hundredweight option for $9.50 coverage.

Producers are encouraged to contact their local FSA office for more details or visit the USDA’s ARC, PLC, and DMC webpages.

| ENERGY MARKETS & POLICY |

— Brent snaps three-day gains as market reacts to sanctions and demand worries. Brent crude oil futures fell to around $80.4 per barrel on Tuesday, ending a three-day rally driven by tougher U.S. sanctions on Russia’s energy sector. The restrictions, targeting major producers and hundreds of vessels, have pushed key buyers like India and China to seek alternative suppliers. Early disruptions include India barring sanctioned vessels and China securing oil from the UAE and Oman. Meanwhile, six European countries urged the EU to reduce its $60 per barrel price cap on Russian oil to further pressure Moscow. However, weaker demand from China, marked by a historic drop in crude imports, could offset the effects of constrained supply.

On Monday, Brent crude rose 1.6% to $81.01, and WTI climbed 2.9% to $78.82, marking four-month highs for both. The surge is attributed to expectations that expanded U.S. sanctions on Russian oil will lead major buyers like India and China to seek other suppliers. Both Brent and WTI benchmarks are in “technically overbought” territory for the second consecutive day, indicating strong recent demand.

— Dept. of Energy and other federal agencies released a progress report on the Sustainable Aviation Fuel (SAF) Grand Challenge. The report (link) notes progress in SAF.

- Projected growth: Domestic projects could achieve over 3 billion gallons of annual SAF production by 2030, surpassing the initial target.

- Investment boom: Announced investments total $44 billion to expand SAF capacity.

- Progress: SAF production increased from 5 million gallons in 2021 to 52 million gallons by mid-2024.

Driving factors

- Inflation Reduction Act (IRA): Enacted in 2022, the IRA offers tax credits of $1.25 to $1.75 per gallon for SAF with at least a 50% lifecycle greenhouse gas reduction.

- Government advocacy: Federal efforts, including outreach to corn growers, highlight SAF as a key alternative in the clean energy transition.

- SAF Grand Challenge: A multi-agency initiative that sets ambitious SAF production goals and fosters collaboration.

Challenges and Uncertainties

- Policy delays: Guidance on IRA tax credits remains stalled relative to details, creating uncertainty for producers.

- Political risks: Possible policy rollbacks, particularly under the Trump 2.0 administration, could jeopardize progress.

- Production adjustments: Many SAF projects rely on converting renewable diesel facilities, which may require further incentives and infrastructure changes.

Upshot: Addressing these hurdles will be critical to sustaining growth and achieving the U.S. SAF production goals outlined in the SAF Grand Challenge.

— Stakeholders await updated GREET model details. The Biden administration announced on Jan. 10 that the Department of Energy would release an updated version of the GREET model specifically for use with the Section 45Z Clean Fuels Production tax credit in the coming days. This updated model is called the 45ZCF-GREET model and will be used for determining emissions rates for the 45Z tax credit.

The 45ZCF-GREET model is essential for calculating the lifecycle greenhouse gas emissions of fuels to determine eligibility and credit amounts under Section 45Z. It will provide the methodology for taxpayers to determine the emissions rates of both sustainable aviation fuel (SAF) and non-SAF transportation fuels.

While the full details of the updated model have not yet been released, it is expected to incorporate new data and methodologies specific to clean fuel production pathways. The Treasury Department indicated that the model will be used alongside other approved methodologies, such as those from the International Civil Aviation Organization for sustainable aviation fuels.

The release of this updated GREET model is a crucial step in implementing the 45Z tax credit, as it will provide the technical framework for producers to calculate their eligibility and potential credit amounts. However, some industry groups have expressed disappointment that the full details of the model were not included in the Jan. 10 guidance, leaving some uncertainty for biofuel producers and farmers.

| TRADE POLICY |

— Mexico announces plan to boost local industry and nearshoring to reduce imports from China. Mexican President Claudia Sheinbaum unveiled “Plan Mexico,” aimed at reducing imports from China and strengthening North American trade ties. The initiative seeks to bolster local industries by providing tax incentives for nearshoring and increasing the local content of Mexican-made goods. A decree outlining incentives for domestic and foreign firms will be published on Jan. 17.

Finance Minister Rogelio Ramirez de la O highlighted the potential economic gains for the region, citing a 1.2% GDP boost for Mexico if 10% of Chinese imports are replaced with North American production. Sheinbaum reaffirmed the importance of the U.S.-Mexico-Canada Agreement (USMCA) in countering China’s economic influence, despite tariff threats from incoming U.S. President Donald Trump.

Key goals of “Plan Mexico” include increasing renewable energy capacity, streamlining manufacturing permits, and raising public and private investment to over 25% of GDP. By 2030, the government aims to enhance local content in sectors like automotive manufacturing, with a target of 15% Mexican-made components per vehicle. Industry leaders expressed cautious optimism, emphasizing the feasibility of reducing reliance on Chinese imports.

| MEAT & MEAT INDUSTRY |

— Hormel CEO James Snee to retire at end of 2025. Hormel Foods announced that CEO James Snee will retire at the end of 2025 after nearly nine years in the role. Snee, who has been with the company since 1989 and currently serves as president and chairman of the board, will act as a strategic advisor to the board during his remaining tenure and for 18 months afterward while Hormel identifies his successor. Snee previously led Hormel’s international division in 2011, managing its expanding global portfolio. His retirement comes as the company faces challenges including slowing demand for its products and declining turkey prices. Hormel had forecast lower-than-expected sales and profits for fiscal year 2025.

| CHINA |

— China to counter tariffs with stimulus, Goldman predicts. China plans to roll out extensive monetary and fiscal measures to counteract the effects of expected US tariffs and a lingering housing downturn, according to Goldman Sachs. Chief economist Jan Hatzius forecasts that these policies will cushion the projected slowdown in China’s economic growth to 4.5% in 2025, down from an estimated 5% in 2024.

The anticipated tariffs, possibly as high as 60%, stem from President-elect Donald Trump’s trade threats. Such levies could severely impact trade between the two nations and weigh on China’s export-driven growth. Hatzius noted that the tariffs would also affect U.S. inflation and growth, albeit to a lesser extent.

Of note: China’s record trade surplus last year, driven by frontloading and strategic export redirection to Southeast Asia, highlights its adaptability to geopolitical pressures.

| BORDER, IMMIGRATION, DEPORTATION & LABOR |

— GOP pushes $85 billion border security plan ahead of Trump’s inauguration. The plan according to reports focuses on staffing for Border Patrol and Immigration and Customs Enforcement (ICE), expanding detention capacity, and advancing Trump’s plans to complete the U.S./Mexico border wall. Additional funds are earmarked for recruitment, training, and retention bonuses to address personnel shortages.

The package includes upgrades such as license plate readers, scanners, counter-drone equipment, and fentanyl detection technology. Clearing overgrown vegetation to improve border visibility and funding for agent body armor are also priorities.

To offset costs, Republicans propose increasing fees for asylum applications and other immigration processes. Budget hawks like Sen. Rand Paul (R-Ky.) are pushing for corresponding spending cuts to balance the increases.

Of note: Using budget reconciliation, Republicans aim to bypass the Senate’s 60-vote threshold, focusing on budget-related measures that adhere to parliamentary rules. However, broader immigration policy overhauls remain excluded due to procedural constraints.

| WEATHER |

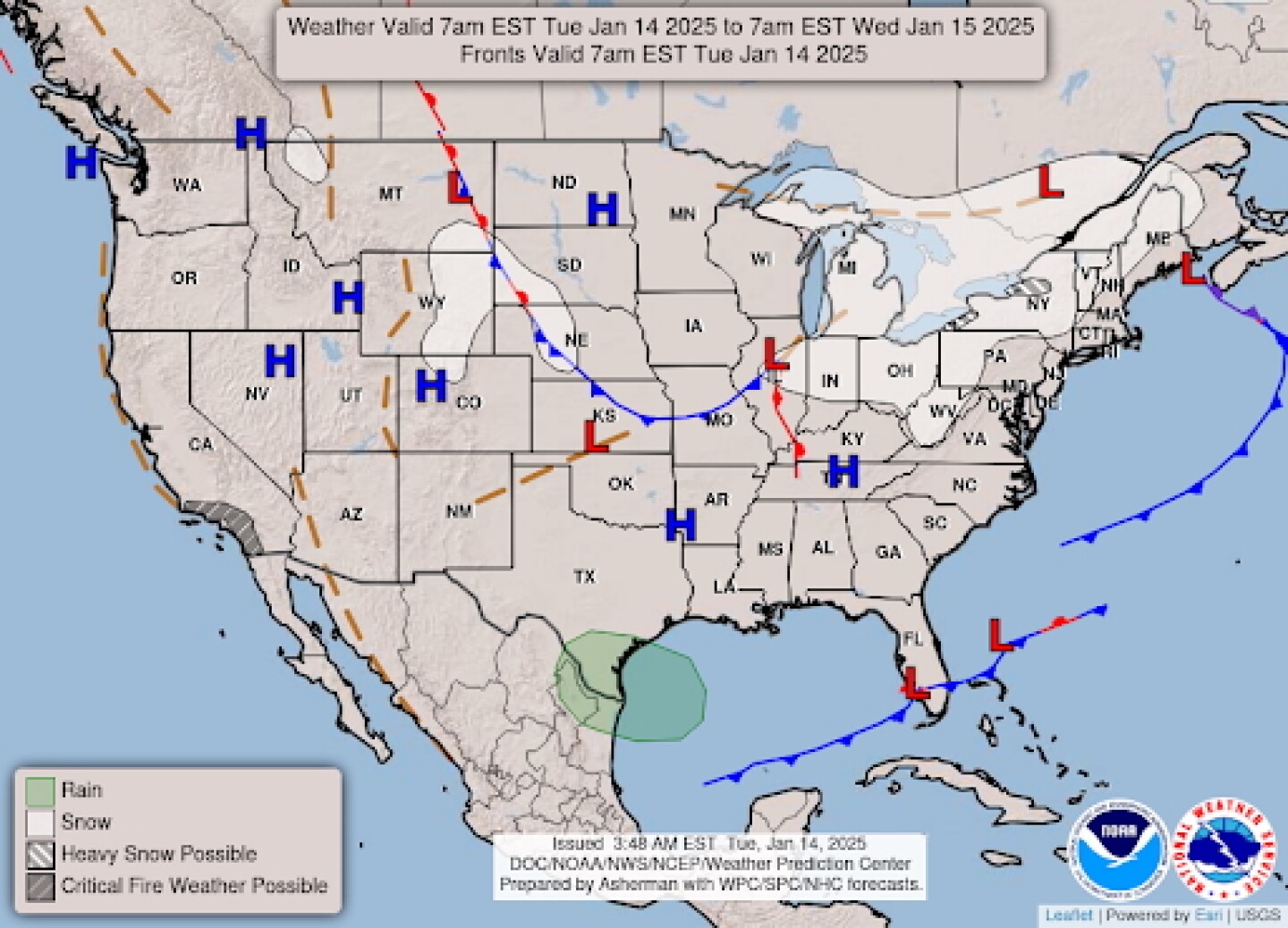

— NWS outlook: Extremely critical fire weather conditions will continue across coastal Southern California today... ...Much below average temperatures from the Midwest to the central Appalachians through Wednesday but warming into the central U.S. on Thursday... ...Locally heavy lake effect snow showers downwind of the Great Lakes through Wednesday.

| KEY DATES IN JANUARY |

15: BLS consumer price index report (inflation)

15: Quarterly estimated taxes due

15: Last day to enroll in a 2025 health plan via HealthCare.gov

20: Inauguration Day

20: College football national championship

24: USDA Food Price Outlook

26: AFC and NFC football championships

27: First day IRS will begin accepting 2024 federal tax returns

28: Florida’s 1st and 6th special primaries

31: Employers and financial institutions should send out W-2 and 1099 tax forms

31: Federal Open Market Committee meets

31: USDA Cattle

| LINKS |

Economic aid for farmers | Disaster aid for farmers | Farm Bureau summary of aid/disaster/farm bill extension | 45Z tax incentive program | Poultry and swine line speeds | WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | RFS | IRA: Biofuels | IRA: Ag | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |