News/Markets/Policy Updates: Oct. 25, 2024

— As Election Day nears, there is hardly a day that USDA Secretary Tom Vilsack doesn’t announce billions of dollars going to some cause. The latest: The Tri-State Generation and Transmission Association, a power cooperative based near Denver, will receive $2.5 billion in grants and loans from USDA for a major clean energy project. Details in Energy section. — CDC rules out human-to-human bird flu transmission, easing pandemic fears. The CDC has ruled out human-to-human transmission of the bird flu after a Missouri patient contracted the virus without known animal contact. Blood tests from five healthcare workers exposed to the patient returned negative, alleviating concerns about a potential pandemic, according to Dr. Demetre Daskalakis, director of the CDC’s National Center for Immunization and Respiratory Diseases. The CDC has confirmed 31 human cases of the current bird flu strain, with most linked to exposure to infected cattle or poultry. California, Colorado, and Washington are among the affected states, with California experiencing rapid spread across 137 dairy herds. However, the two poultry workers in Washington contracted a different flu strain, possibly linked to migrating birds. In response, USDA announced two field trials for vaccines aimed at protecting cows from the virus, though the companies behind the trials were not disclosed. — Onion recall linked to E. coli at McDonald’s spreads to Taco Bell, KFC, and more. A deadly E. coli outbreak has led to a sweeping onion recall, initially linked to McDonald’s Quarter Pounders, and is now affecting other fast-food chains. Taco Bell, KFC, Burger King, and Pizza Hut have removed onions from some menu items as a precaution. Federal regulators suspect the slivered onions used in Quarter Pounders were the contamination source, though investigations are ongoing. Taylor Farms, the onion supplier to McDonald’s across 10 states, issued a recall of several yellow onion products. Meanwhile, McDonald’s has suspended Quarter Pounder sales in affected states, including Colorado, Kansas, and Utah. The outbreak has resulted in 49 confirmed illnesses and one death, with most cases reported in Colorado. Some chains, like Burger King, confirmed their supply chain includes onions from the implicated Taylor Farms facility in Colorado. McDonald’s and other fast-food giants are working with health authorities as the investigation continues. Concerns remain high due to the severity of the E. coli strain, which can lead to life-threatening complications, particularly for children. Details: The move comes after restaurant supplier U.S. Foods, which does not service McDonald’s restaurants, issued a recall notification on Wednesday for four onion products produced by Taylor Farms. Restaurant Brands International, the parent company of Burger King, said it would pull onions from 5% of its U.S. restaurants after determining they came from the Colorado facility at the center of the Taylor Farms recall. Taco Bell owner Yum Brands did not disclose the number of restaurants affected by its decision. — TreeHouse Foods has significantly expanded its voluntary recall of frozen waffle and pancake products due to potential Listeria monocytogenes contamination. The recall now encompasses all products manufactured at their facility in Ontario, Canada that are still within their shelf life. The expanded recall includes: These items were distributed throughout the United States and Canada under various brand names. The affected products are sold at major retailers including Albertson’s, Aldi, Dollar General, Kroger, Publix, Target, Walmart, and others. Link. TreeHouse Foods expanded the recall based on additional testing conducted at their manufacturing facility. The initial recall was issued on Oct. 18 after routine inspections detected Listeria at the Brantford, Ontario plant. Further testing suggested that other production lines at the facility might also be affected by the bacteria. While no illnesses have been reported in connection with these products to date, Listeria monocytogenes can cause serious and sometimes fatal infections, particularly in young children, elderly people, and those with weakened immune systems. TreeHouse Foods has halted production at the affected facility and plans to resume operations after implementing extensive measures, including thorough cleaning, sanitation, and hygienic restoration. — Cargo ship owner to pay $102 million for cleanup after Baltimore bridge collapse. The owner and operator of the cargo ship involved in the collapse of the Francis Scott Key Bridge in Baltimore have agreed to a $102 million settlement with the U.S. Department of Justice. The settlement covers federal cleanup costs, including clearing debris to reopen the Fort McHenry Shipping Channel in June. The lawsuit, filed in September, targeted two Singaporean companies, Grace Ocean Private Limited and Synergy Marine Private Limited. Federal officials allege the companies neglected known electrical and mechanical issues on the ship, contributing to the disaster that claimed six lives. Following the March 26 collapse, over 50 agencies worked together to remove 50,000 tons of debris, temporarily halting operations at the nation’s largest vehicle-handling port. While the shipping channel was restored by June 10, the settlement does not address the reconstruction costs for the bridge, which Maryland estimates will reach up to $1.9 billion by 2028. Maryland has filed a separate claim against the ship’s owner to recover costs for the bridge rebuild, cleanup efforts, and environmental damages, aiming to reduce the federal financial burden. — China schedules key meeting, investors anticipate stimulus announcement. China’s National People’s Congress, the country’s top legislative body, will convene from Nov. 4 to 8, according to state media. Investors are watching closely, hoping the congress will approve new fiscal stimulus measures aimed at boosting economic growth. Experts have called for a major stimulus package to address China’s economic challenges, and The National People’s Congress has the authority to approve such initiatives. The outcome of the meeting could significantly impact market expectations and economic recovery efforts. See more details on this topic in the China section. — Harris struggles to differentiate from Biden. Vice President Kamala Harris is facing challenges in distancing her candidacy from the policies and legacy of the Biden administration, which she replaced atop the Democratic ticket three months ago. A recent Wall Street Journal poll (link) shows that 54% of voters believe Harris would follow the same approach as Biden, while 41% say she would bring fresh ideas to the presidency. Election analyst David Wasserman summed up Harris’s predicament for the WSJ: “She has to generate high enthusiasm among the 37% to 40% of voters who believe that Biden’s presidency has been a success at the same time she appeals for more support among voters who want big change. That’s a really narrow tightrope to walk.” Despite her attempts to frame herself as representing a “new generation of leadership,” Harris has struggled to articulate how her presidency would differ. During an October appearance on The View, she noted that she had been involved in most of Biden’s major decisions, adding, “There is not a thing that comes to mind” that she would have done differently. This statement has become a talking point for Trump and Republican campaign ads, portraying her as unwilling to break from Biden’s policies. The WSJ poll shows Harris and Trump in a tight race, with Trump leading 47% to 45%, within the margin of error. Harris’s team acknowledges the need to create some separation from Biden, but with few undecided voters left, analysts suggest the campaign’s focus may shift toward contrasting her leadership style with Trump’s rather than redefining her policy agenda. — Republicans narrow Democrats’ early voting lead as Election Day nears. With Election Day approaching, nearly 30 million Americans have already cast their votes early, either in person or by mail. Democrats maintain a 7-point edge in early voting, though this advantage has been halved from the 14-point margin they held in 2020. Experts caution that the shift does not offer a definitive prediction of election outcomes. The increase in Republican early voting follows efforts by Donald Trump’s campaign to encourage supporters to vote early — despite his criticism of the practice during the last election. In Pennsylvania, a key battleground, Democratic voters continue to dominate mail ballot requests and returns, comprising nearly 58% of applications and 62% of ballots returned so far. — Latest highlights from the Cook Political Report with Amy Walter: |

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 150 points higher. In Asia, Japan -0.6%. Hong Kong +0.5%. China +0.6%. India -0.8%. In Europe, at midday, London -0.2%. Paris -0.3%. Frankfurt -0.1%.

U.S. equities yesterday: The Dow marked a fourth session of losses while the S&P 500 and Nasdaq moved higher. The Dow was down 140.59 points, 0.33%, at 42,374.36. The Nasdaq rose 138.83 points, 0.76%, at 18,415.49. The S&P 500 was up 12.44 points, 0.21%, at 5,809.86. The index is set for an almost 1% loss in the week after a surge in Treasury yields.

— Microsoft CEO Nadella’s pay rises 63% to $79.1 million despite request for reduction. Microsoft CEO Satya Nadella’s total compensation surged by 63% to $79.1 million for fiscal 2024, according to a company proxy filing. Most of the compensation is stock based, despite Nadella’s request to reduce his cash pay following criticism from the U.S. government over cybersecurity issues. Nadella sought the pay cut to align with the company’s response to recent cyberattacks. Microsoft is now evaluating how employee contributions to security efforts may impact their compensation packages.

— Ag markets today: Selling pressure mounted during the overnight session, with corn, soybeans and wheat trading near session lows early this morning. As of 7:30 a.m. ET, corn futures were trading 3 cents lower, soybeans were 6 to 9 cents lower, winter wheat markets were 7 to 8 cents lower and spring wheat was 2 to 5 cents lower. The U.S. dollar index was trading just above unchanged, and front-month crude oil futures were around 60 cents higher.

Cash cattle rally extends. Cash cattle trade actively traded at mostly $2.00 higher prices on Thursday, extending the string of weekly gains in the cash market to seven. Packers have tried to actively build slaughter inventories during that stretch to take advantage of black ink, though there are signs margins may be peaking as Choice beef retreats from its recent high.

Cash hogs continue to strengthen. The CME lean hog index is up 54 cents to $85.20 as of Oct. 23, marking five straight days of gains. That’s the longest string of gains since July when the index was rising to its seasonal peak on Aug. 1. After sharp losses on Thursday, December lean hog futures fell to a $6.55 discount to today’s cash quote.

— Agriculture markets yesterday:

• Corn: December corn rose 2 1/2 cents to $4.21 1/2, the highest close since Oct. 7.

• Soy complex: November soybeans fell 1 1/4 cents to $9.96 1/4 and settled nearer session lows. December meal futures sunk $4.6 to $310.4, settling on session lows. December bean oil climbed 94 points to 44.33 cents.

• Wheat: December SRW wheat rose 3 cents to $5.81 1/2. December HRW wheat gained 1 1/4 cents to $5.87. Both markets closed nearer their session highs. December spring wheat futures climbed 3 1/4 cents to $6.18 3/4.

• Cotton: December cotton futures fell 98 points to 71.53 cents, settling nearer session lows.

• Cattle: December live cattle rose $1.375 to $189.25 and hit a nearly three-month high. November feeder cattle gained $1.30 to $248.525. Both markets closed near their daily highs.

• Hogs: Hog futures fell significantly Thursday, with nearby December leading the way lower with a $1.525 drop to $78.65.

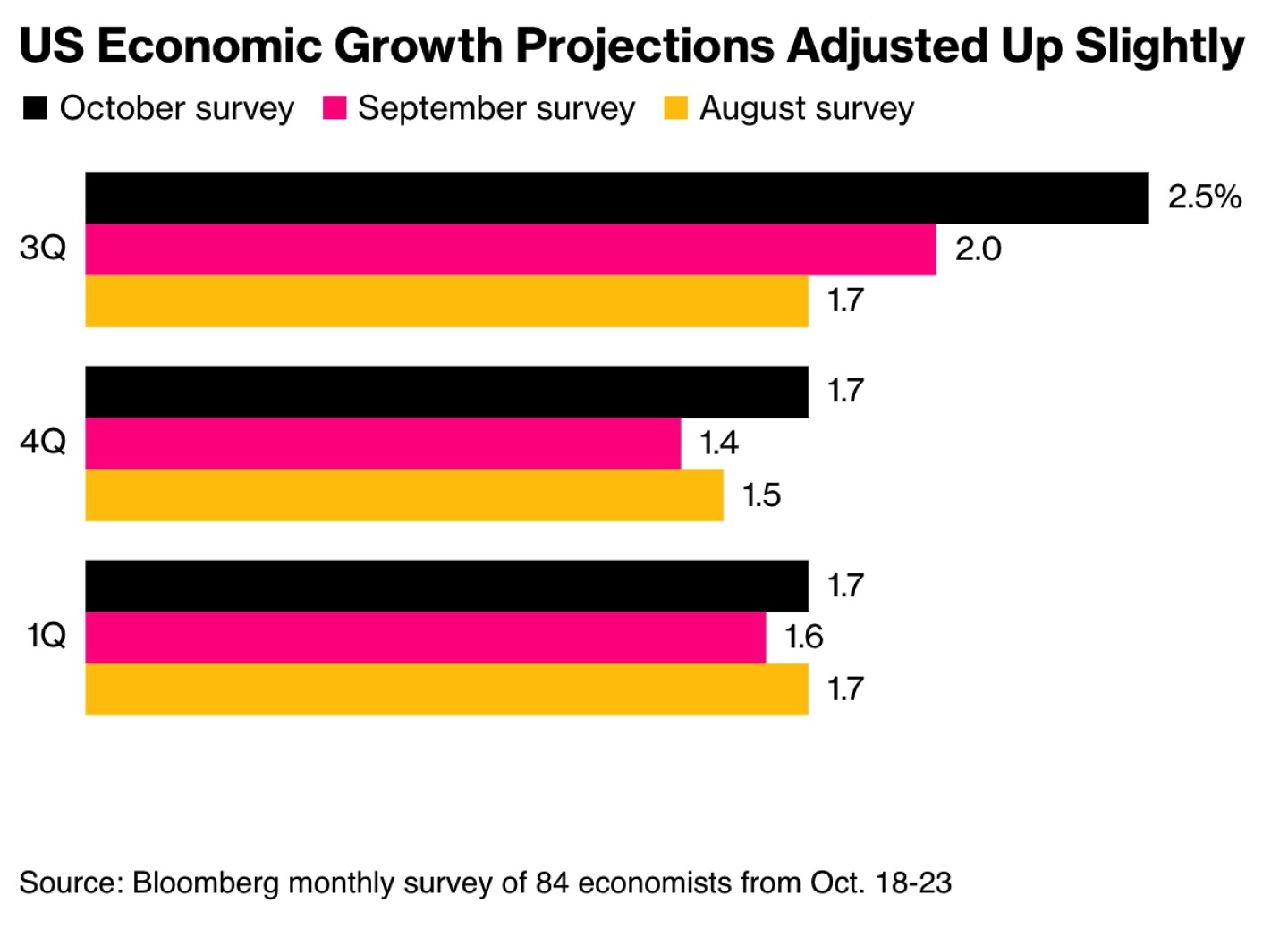

— Bloomberg survey: Economists raise U.S. growth forecasts, predict Fed rate cuts. Economists have slightly raised projections for U.S. economic growth through early 2025, driven by resilient consumer demand and expectations of limited inflation, according to Bloomberg’s latest survey (link) Forecasts now indicate average growth of around 2% from the third quarter of 2024 through the first quarter of 2025.

The survey also showed optimism about recession risks, with forecasters lowering the odds of a downturn to 25% — the lowest since March 2022. Economists expect inflation to remain close to the Federal Reserve’s 2% target, allowing the Fed to lower interest rates in November, December, and by an additional 1.25 percentage points next year.

The labor market is projected to cool slightly, with monthly payroll growth expected to average 125,000 in 2025, down from 200,000 this year. The unemployment rate is forecast to rise modestly to 4.3% from the current 4.1%.

Consumer spending estimates have been revised upward, and business investment is expected to improve at the start of 2025, as political stability following the presidential election boosts sentiment. “A smooth political transition will provide clarity and help support economic prospects in a lower interest-rate environment,” said James Knightley, chief international economist at ING.

— U.S. durable goods orders fall 0.8% in September, driven by drop in transportation equipment. New orders for U.S. manufactured durable goods declined by 0.8% or $2.2 billion to $284.8 billion in September 2024, following a revised 0.8% drop in August, according to the latest data. The decline was slightly better than market expectations of a 1% decrease.

The fall was led by transportation equipment, which decreased by $3.1 billion or 3.1% to $95.4 billion, marking the third decline in four months. Orders also fell for machinery (-0.2%), computers and electronic products (-0.3%), and capital goods (-2.8%).

However, excluding transportation, new orders rose 0.4%. Non-defense capital goods orders excluding aircraft — a key indicator of business investment plans — increased by 0.5%, surpassing forecasts of a 0.1% rise and building on a 0.3% gain in August. Excluding defense, overall durable goods orders declined by 1.1%.

— Social Security Admin. (SSA) formally published the 2025 COLA and related information in the Federal Register today. Link. The SSA has determined a 2.5% COLA for 2025. This adjustment will affect more than 72.5 million Americans receiving Social Security and Supplemental Security Income (SSI) benefits.

Effective dates:

• For Social Security beneficiaries: The increase will begin with benefits payable in January 2025.

• For SSI recipients: The increased payments will start on Dec. 31, 2024.

Earnings limits:

• For beneficiaries under full retirement age: $23,400 (SSA deducts $1 from benefits for each $2 earned over this limit).

• For those reaching full retirement age in 2025: $62,160 (SSA deducts $1 from benefits for each $3 earned over this limit until the month of reaching full retirement age).

Taxable maximum:

• The maximum amount of earnings subject to Social Security tax will increase to $176,100.

The SSA will mail COLA notices throughout December. However, beneficiaries can view their COLA notice online through their personal my Social Security account starting in early December, provided they created their account by Nov. 20, 2024.

Background. The COLA is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the previous year to the third quarter of the current year. For 2025, the average CPI-W for the third quarter of 2024 was 308.729, which exceeded the previous benchmark of 301.236 by 2.5%, resulting in the 2.5% COLA. This annual adjustment, which has been automatic since 1975, ensures that the purchasing power of Social Security and SSI benefits is not eroded by inflation.

Market perspectives:

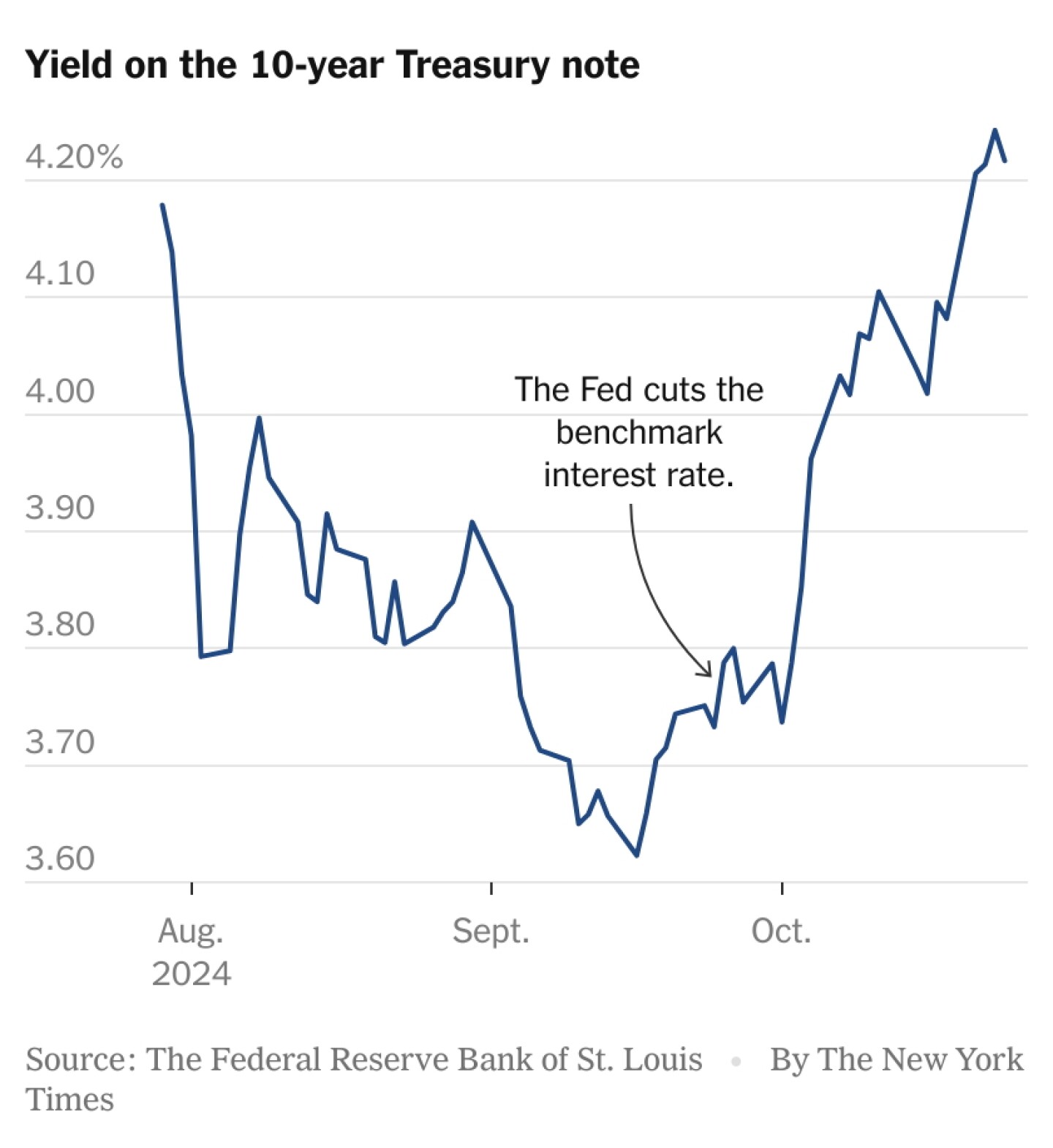

— Outside markets: The U.S. dollar index was slightly weaker, despite weakness in the euro versus the US greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 4.19%, amid a mostly lower tone in global government bond yields. Crude oil futures were moving higher, with U.S. crude around $70.85 per barrel and Brent around $74.65 per barrel. Gold and silver were lower, with around $2,737 per troy ounce and silver around $33.46 per troy ounce.

— U.S. Treasury sell-off sparks volatility across markets ahead of presidential election. A sell-off in U.S. Treasuries is causing volatility across global markets, from gold to currencies, as investors brace for heightened volatility ahead of the Nov 5 presidential election. The 10-year Treasury yield has climbed 0.4 percentage points to 4.2% this month, driven by strong economic data and rising expectations of a “Trump trade” that could reshape fiscal policy. Strong job data and diminished recession fears have scaled back bets on deep Federal Reserve rate cuts, just weeks after the Fed signaled a shift to easing. This shift has boosted the U.S. dollar, which is having its best month in two years, while the yen and Mexican peso have suffered. Swaps markets now suggest the Fed may hold rates at its remaining meetings this year, signaling uncertainty over future monetary policy. Adding to the volatility are political uncertainties, including the potential return of Trump’s tariffs and fiscal policies. Investors are now positioning for prolonged turbulence, and key central bank decisions likely to further complicate market conditions.

— Euro heads for longest weekly slide in 8 months amid ECB rate cut expectations. The euro is on track for its fourth consecutive week of losses against the dollar, marking its longest slide since February, as expectations grow that the European Central Bank (ECB) may implement a half-point interest rate cut in December. The euro has fallen to approximately $1.08, driven by signs of economic weakness across the eurozone. With traders now pricing in a 40% chance of a 50 basis-point cut by the ECB, the euro’s outlook continues to dim, especially as the Federal Reserve shows signs of slowing its own rate-cutting pace. Options markets indicate heightened volatility, with demand for protection against further euro declines reaching a three-month high. Adding to the euro’s pressure is uncertainty surrounding the upcoming U.S. presidential election. A potential win by Donald Trump, with his threat of trade tariffs on Europe, could further boost the dollar and bring the euro closer to parity, according to Goldman Sachs.

— The U.S. corn sales last week of 3 million tons raises some questions, says grain trader and analyst Richard Crow. “The unknown amount continues to grow and is now 3 million tons over a year ago. The destination of that business over time reflects one of two things: someone is front loading, or a piece of added business. Perhaps it is scattered over a large number of people, but it raises the idea of much larger exports.”

— Montreal dockworkers plan new strike, disrupting Canada/U.S. trade. Labor unrest at Canada’s busiest Atlantic port is escalating as dockworkers at the Port of Montreal prepare for a 24-hour strike this weekend. This walkout, the second this month, aims to pressure employers to resolve a year-long negotiation stalemate over a new collective agreement, according to the Wall Street Journal (link). The ongoing dispute is drawing comparisons to a similar standoff in 2020 that required government intervention with back-to-work legislation. Shippers are already diverting cargo to avoid disruptions, a move that could impact trade flows along the St. Lawrence Seaway and into the U.S. Midwest. The prolonged labor impasse threatens to create broader supply chain challenges for Canadian importers and exporters, as the Port of Montreal plays a critical role in linking Atlantic trade routes with North American markets.

— Union Pacific’s net income rose 9% last quarter as strong gains in grain and intermodal volumes pushed freight revenue up 3% to $6.1 billion. Meanwhile, Hapag-Lloyd raised full-year earnings guidance as the container line rides strong demand and higher freight rates.

— Low water levels force barge restrictions on Mississippi River. A lack of rain has led to reduced barge draft and tow sizes along the Mississippi River System (MRS), causing delays and groundings near Hickman, KY, according to USDA’s Grain Transportation Report (link). Dredging efforts are underway to prevent further disruptions. Grain transport along the river has fallen below last year’s levels and the seasonal average. Tow sizes have been cut by up to 46% in sections between Cairo, Ill., and the Gulf. Transit delays of 2-3 days are expected, with no immediate improvement in water levels predicted over the next two weeks.

— Europe faces crop loss and delays as heavy rains disrupt planting. Farmers across Europe are bracing for more crop damage as relentless rain delays winter planting and worsens crop conditions, Bloomberg reports (link).

In northwest Europe, where October is typically a transition period for planting winter crops, the wet weather has left fields too waterlogged for tractors, threatening a second consecutive year of agricultural losses. France, which already experienced its worst wheat harvest in decades, faces further setbacks. “We can’t even go into the field to plant the wheat seeds as it is flooded with water,” said Victor Rabier, president of a farmers’ group in Essonne, France. He added that about 7% of his plantation is unusable, leaving him with rotting onions and unplanted wheat.

Wheat and rapeseed production in the UK is also projected to decline sharply, making the country more dependent on imports this season.

Meanwhile, France’s corn harvest is progressing at its slowest pace in over a decade, with only 25% of the crop harvested by October 21, compared to the 69% five-year average.

Farmers are struggling to stay competitive as European grain prices remain higher than those from the Black Sea region, limiting export opportunities. In France, sugar beet crops are also suffering from reduced sucrose levels and fungal infections.

Farmers’ unions in France have demanded government support to offset rising costs and have threatened renewed protests if their demands are not met by mid-November.

— USDA daily export sales:

• 116,000 MT soybeans to China, 2024-2025 marketing year.

• 136,000 MT corn to Mexico, 2024-2025 marketing year.

— Ag trade update: Iran purchased 120,000 MT of corn that can be sourced from Brazil, Europe or the Black Sea region.

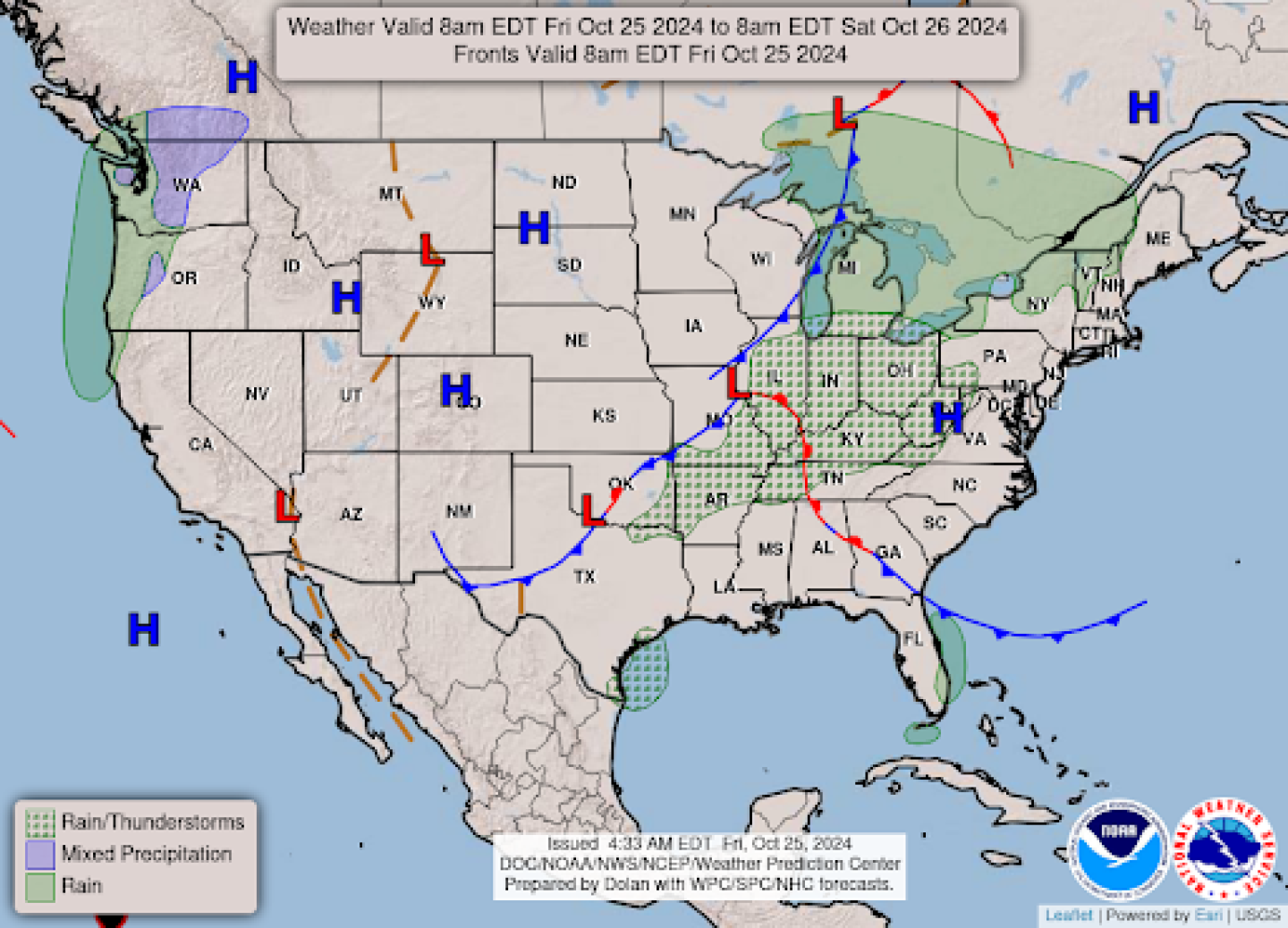

— NWS outlook: Showers and thunderstorms over parts of the Middle Mississippi/ Ohio Valleys... ...Rain over parts of the Northeast... ...Rain moves into the Pacific Northwest.

Items in Pro Farmer’s First Thing Today include:

• Grains lower overnight

• Slightly smaller U.S. feedlot supplies expected

• Cold Storage Report also out this afternoon

RUSSIA/UKRAINE |

— Putin rules out concessions to end war in Ukraine, signals shift in Western rhetoric. Russian President Vladimir Putin stated that Russia will not make any concessions to end its war in Ukraine, though he expressed openness to “reasonable compromises.” In an interview with Russian state television following the BRICS summit in Kazan, Putin emphasized that “there will be no trades” and declined to offer details, citing the absence of substantive negotiations. Putin’s comments reflect growing Kremlin confidence as Russian troops make gains in eastern Ukraine and signs of fatigue emerge among some of Kyiv’s allies. While BRICS leaders discussed de-escalation, none directly confronted Putin on the conflict. “Any outcome should benefit Russia,” Putin said, referencing territories occupied by Russian forces that he now claims as part of Russia. Ukraine and its allies, however, maintain that there can be no territorial compromises or frozen conflicts, with President Volodymyr Zelenskyy reaffirming that Ukraine will not trade land for peace.

Putin also noted a shift in the West’s tone, saying, “Yesterday, they were saying it was necessary to achieve a strategic defeat for Russia. Today, however, the rhetoric has already changed.”

Additionally, Putin revealed that Turkish President Recep Tayyip Erdogan had presented new proposals for ensuring the safety of shipping in the Black Sea, though Putin said he had yet to review them.

Meanwhile, Russia provided targeting data for Yemen’s Houthi rebels, the Wall Street Journal reported (link). The help to the Iranian-backed Houthis, who attacked Western ships in the Red Sea with missiles and drones this year, shows how far Russian President Vladimir Putin is willing to go to undermine the U.S.-led Western economic and political order.

— Russia’s wheat export tax jumps again. Russia’s tax on wheat exports jumped to 2,272.9 rubles ($23.53) per metric ton for the week of Oct. 30-Nov. 5 up from 2,121.2 rubles ($21.96) the previous week. The export tax has surged 71.1% the last three weeks and is 151% above the mid-September level.

Russia’s ag ministry has reportedly asked exporters to not sell wheat below a minimum price of $250 per metric ton. The tax hikes are seen as a way to curb wheat exports.

— Musk’s ties to Putin raise questions amid Trump election push. Elon Musk’s political involvement has come under scrutiny following a report by the Wall Street Journal (link) revealing that he has been in regular contact with Russian President Vladimir Putin since late 2022. The conversations reportedly covered business, personal matters, and geopolitics. On one occasion, Putin allegedly asked Musk not to activate Starlink satellite service over Taiwan to assist Chinese President Xi Jinping.

Musk’s relationship with Putin has raised concerns given his close business ties with the U.S. government. Last year, his companies secured nearly 100 contracts with 17 federal agencies, amounting to $3 billion in payouts. SpaceX plays a critical role in NASA’s launch schedule and Defense Department satellite deployments, while Starlink supports U.S. embassies and government operations.

At the same time, Musk has intensified his campaign efforts for Donald Trump, rallying in Pennsylvania and offering $1 million to voters backing one of his conservative initiatives. Trump has suggested Musk could play a role in his administration, with Musk recently expressing interest in reshaping regulations on self-driving cars if appointed to a government role.

The revelations have triggered questions about the extent of Musk’s interactions with Putin, whether U.S. intelligence has monitored these conversations, and if any national security information was shared. Musk has denied being an apologist for Putin, claiming his companies have done more to counter Russia than any other entity. The Kremlin confirmed only one phone call between Putin and Musk, during which they discussed space technologies.

Trump’s campaign has praised Musk as a visionary leader, saying his ideas would greatly benefit the government.

PERSONNEL |

— Vicki Arroyo, the top policy official at EPA, will leave the Biden administration and return to her previous role as a law professor at Georgetown University.

CHINA UPDATE |

— China projects 2024 grain output to surpass 700 MMT, reduces livestock numbers. China is on track to achieve a record grain harvest in 2024, with output expected to exceed 700 million metric tons (MMT). This represents an increase of approximately 0.7% from the 2023 harvest of 695.41 MMT. The projected growth is attributed to increased investments in farm machinery and seed technology as China strives for greater food security.

Despite the overall increase in grain output, China still faces challenges in specific crop areas:

• Soybeans: The country remains heavily dependent on imports.

• Corn: Planting continues to fall short of requirements.

To address these issues, the agriculture ministry has:

• Developed high-oil and high-yield soybean varieties

• Planned measures for soybean processing subsidies and stockpile acquisition

• Instructed state stockpiler Sinograin to increase corn purchases to boost farmer income and encourage planting

China is making efforts to stabilize its livestock sector:

• Increased slaughter rates for hogs, beef, and dairy cattle have helped moderate prices.

• The ministry is closely monitoring hog production to prevent potential oversupply and price drops in 2025.

— China, EU agree to further talks on EV tariffs amid ongoing disputes. The European Union (EU) and China have agreed to additional technical negotiations over the EU’s proposed tariffs of up to 35.3% on Chinese electric vehicles (EVs). Despite eight rounds of discussions, significant issues remain unresolved, according to the European Commission. The negotiations are exploring potential alternatives to tariffs, including minimum price commitments from China or increased Chinese investments in Europe.

The latest progress followed a video call between EU trade chief Valdis Dombrovskis and China’s Minister of Commerce Wang Wentao. China warned the EU against holding talks with individual companies, but the EU emphasized that discussions with the China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME) would not exclude such engagements.

Additionally, Dombrovskis criticized China’s trade investigations into EU brandy, pork, and dairy, describing them as based on “unsubstantiated” claims. China’s investigations into EU and Canadian imports are seen as a retaliatory measure against forthcoming EV tariffs from both regions.

Of note: China’s Commerce Ministry confirmed the developments, saying the two sides will set up a bilateral communication system for the execution and oversight of price commitments and the two sides agreed that those price commitments will be the solution in the situation.

— China’s top legislative body to meet in early November. China’s top legislative body will hold a highly anticipated session in Beijing from Nov. 4-8, as investors await any approval of fiscal stimulus to revive the slowing economy. The published agenda doesn’t specifically mention any plans for fiscal stimulus, although a previous decision to raise budget deficit mid-year in 2023 was disclosed only after lawmakers approved it, Bloomberg reported. Voting on any stimulus will come on Nov. 8, three days after a U.S. election that could have far-reaching consequences on global trade and China’s exports.

— China keeps short-term rate unchanged. China’s central bank kept its one-year policy rate unchanged, after slashing funding costs by a record amount last month, suggesting authorities are cautiously pacing monetary stimulus to support the economy. The People’s Bank of China (PBOC) issued 700-billion-yuan ($98.4 billion) worth of one-year medium-term lending facility (MLF) loans to some financial institutions at an unchanged rate of 2.00%. A total of 789 billion yuan of MLF loans are due this month, marking a net cash withdrawal of 89 billion yuan ($12.49 billion). PBOC injected 292.6 billion yuan ($41.1 billion) through the reverse repo operation and retained its rate at 1.5%. That compared with a total of 108.4 billion yuan ($15.2 billion) of the seven-day reverse repo due the same day.

ENERGY & CLIMATE CHANGE |

— Carbon pipeline law faces crucial vote in South Dakota. South Dakota voters will decide the future of a controversial $8.9 billion carbon-capture pipeline project during the Nov. 5 elections. The referendum will determine whether to keep or repeal a recently passed law that critics say favors pipeline developers, particularly Summit Carbon Solutions. A repeal would mark a significant setback for the 2,500-mile pipeline, which runs through multiple states including Iowa, Nebraska, and Minnesota. Link to details via Bloomberg.

Opponents argue that the law centralizes pipeline approval at the state level, undermining local control and ignoring concerns over eminent domain. Meanwhile, Summit insists it will continue pursuing the project regardless of the vote outcome, emphasizing the pipeline’s importance for keeping corn-based ethanol competitive as cleaner fuel technologies rise.

Supporters, including the South Dakota Chamber of Commerce and ethanol producers, highlight the law as a way to ensure that landowners are treated fairly while helping the ethanol industry evolve. The pro-pipeline campaign has raised millions for TV ads, while opponents rely on grassroots efforts, including auctioning homemade pies to fund their campaign.

Bottom line: If the law is repealed, Summit’s ability to proceed with the project could be jeopardized, as South Dakota is a critical part of its five-state plan.

— Denver-area power cooperative secures $2.5 billion for clean energy expansion. The Tri-State Generation and Transmission Association, a power cooperative based near Denver, will receive $2.5 billion in grants and loans from USDA for a major clean energy project. USDA Secretary Tom Vilsack announced that the project will replace 1,100 megawatts of coal-fired power with 1,480 megawatts of solar, wind, and battery energy across Colorado, Nebraska, New Mexico, and Wyoming. The transition is expected to reduce greenhouse gas emissions by 5.8 million tons annually and lower electricity rates for cooperative members by 10% by 2034. The funding comes from USDA’s Empowering Rural America (New ERA) program, marking the largest rural electrification investment since the New Deal.

Besides Tri-State, six other rural cooperatives will receive nearly $1 billion in New ERA funding, bringing the program’s total funding to $8.3 billion. Vilsack emphasized that these projects will enhance energy security while improving access to affordable and reliable clean energy in rural communities.

— U.S. approves Nevada lithium mine to boost domestic EV supply chain. The U.S. has approved Australian producer Ioneer’s Rhyolite Ridge lithium-boron mine in Nevada, the first lithium mine approved under the Biden administration. Set to quadruple U.S. lithium production by 2028, the project aims to reduce reliance on China for critical minerals. The $1.2 billion mine, supported by a $700 million federal loan, will produce enough lithium to power 370,000 electric vehicles annually. Despite environmental concerns over the endangered Thiem’s buckwheat flower, regulators approved the project after agreeing on a conservation plan. The mine is part of broader efforts to incentivize domestic lithium production through tax credits and federal support.

Of note: There is no shortage of lithium in the U.S. This week the U.S. Geological Survey said it found between 5 million and 19 million tonnes of lithium reserves located beneath southwestern Arkansas, potentially enough to meet projected 2030 world demand car battery lithium nine times over. Meanwhile, several lithium producers have announced plans to open new U.S. mines and processing plants amid an attempt to tap incentives in the Inflation Reduction Act (IRA/Climate Act). Oil producers ExxonMobil and Occidental are among several companies pursuing pilot lithium projects in Arkansas and California, respectively.

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA releases report on U.S. feedlot practices, highlights health and antibiotic use. USDA’s Animal and Plant Health Inspection Service (APHIS) has published the first findings from the 2021 study of U.S. feedlots (link), conducted by the National Animal Health Monitoring System (NAHMS). The report, based on data from 22 states, provides insights into cattle management practices, antibiotic use, and veterinary services across the feedlot industry.

Highlights from the report include:

• Cattle origins: 54.7% of cattle placed in feedlots came directly from known operations, such as cow-calf or stocker facilities, while 38.2% were purchased from sale barns with unknown health histories.

• Identification practices: 85.4% of feedlots used ear tags for individual cattle identification, with 65.5% of cattle identified either before or upon arrival at the feedlot.

• Antibiotic and hormone claims: Most cattle (85.1%) were placed without meeting specific antibiotic or hormone-free marketing claims. Only 8.4% of cattle met limited or no-antibiotic claims, and 10.2% met no-hormone claims.

• Antibiotic use by feedlot size: Smaller feedlots (65.4%) were less likely to use antibiotics in feed compared to medium, large, and very large operations, which reported usage rates around 35-37%.

• Veterinary services: In 2020, 85.1% of feedlots used veterinarians. Larger operations were more likely to seek veterinary care, with 99.2% of very large feedlots using a veterinarian, compared to 81.2% of small feedlots.

The study also found that 64.2% of feedlots felt adequately prepared to manage the 2017 Veterinary Feed Directive (VFD) rule changes, citing access to resources and veterinary expertise. This report offers an important glimpse into the evolving practices of the U.S. feedlot industry.

POLITICS & ELECTIONS |

— Japan is set to hold a crucial general election for the lower house of parliament on Sunday, Oct. 27. This election has significant implications for Japan’s political landscape and financial markets. The ruling coalition, led by Prime Minister Shigeru Ishiba’s Liberal Democratic Party (LDP) and its junior partner Komeito, is at risk of losing its majority in the 465-seat House of Representatives for the first time since 2009. Recent polls indicate that the LDP-Komeito coalition may fall short of the 233 seats needed for a majority.

Strategists anticipate that a loss of the ruling coalition’s majority could lead to: • Yen weakness: The Japanese yen may depreciate further against other major currencies.

• Stock market volatility: Japanese stocks, particularly those in the Nikkei index, could experience increased volatility and potential downward pressure. The Nikkei index is trading near the lower limit of its growth channel, and the election results may determine whether it continues its upward trend or breaks below the structure.

• Monetary policy uncertainty: A change in government composition might affect the Bank of Japan’s plans for gradual interest rate hikes and monetary policy normalization.

• Fiscal policy shifts: Smaller opposition parties favoring expansionary fiscal policies may gain influence, potentially impacting future economic decisions.

OTHER ITEMS OF NOTE |

— Cotton AWP edges higher. The Adjusted World Price (AWP) for cotton moved up to 59.28 cents per pound, effective today (Oct. 24), up slightly from 59.24 cents per pound the prior week. That still leaves the level more than 7 cents above the level that would trigger an LDP. Meanwhile, USDA announced Special Import Quota #2 will be established Oct. 31 for the import of 34,508 bales of upland cotton, applying to supplies purchased not later than Jan, 28, 2025, and entered into the U.S. not later than April 28.

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |