Agricultural credit conditions in the Tenth Federal Reserve District tightened in the second quarter of 2024 due to declining farm income, lower crop prices, and high production costs (link). Farm incomes continued to weaken, particularly in crop-heavy states like Kansas, Missouri, and Nebraska, while cattle prices provided some support. Farm borrower liquidity declined, and loan demand increased sharply, but repayment rates fell, indicating growing financial pressure on farmers.

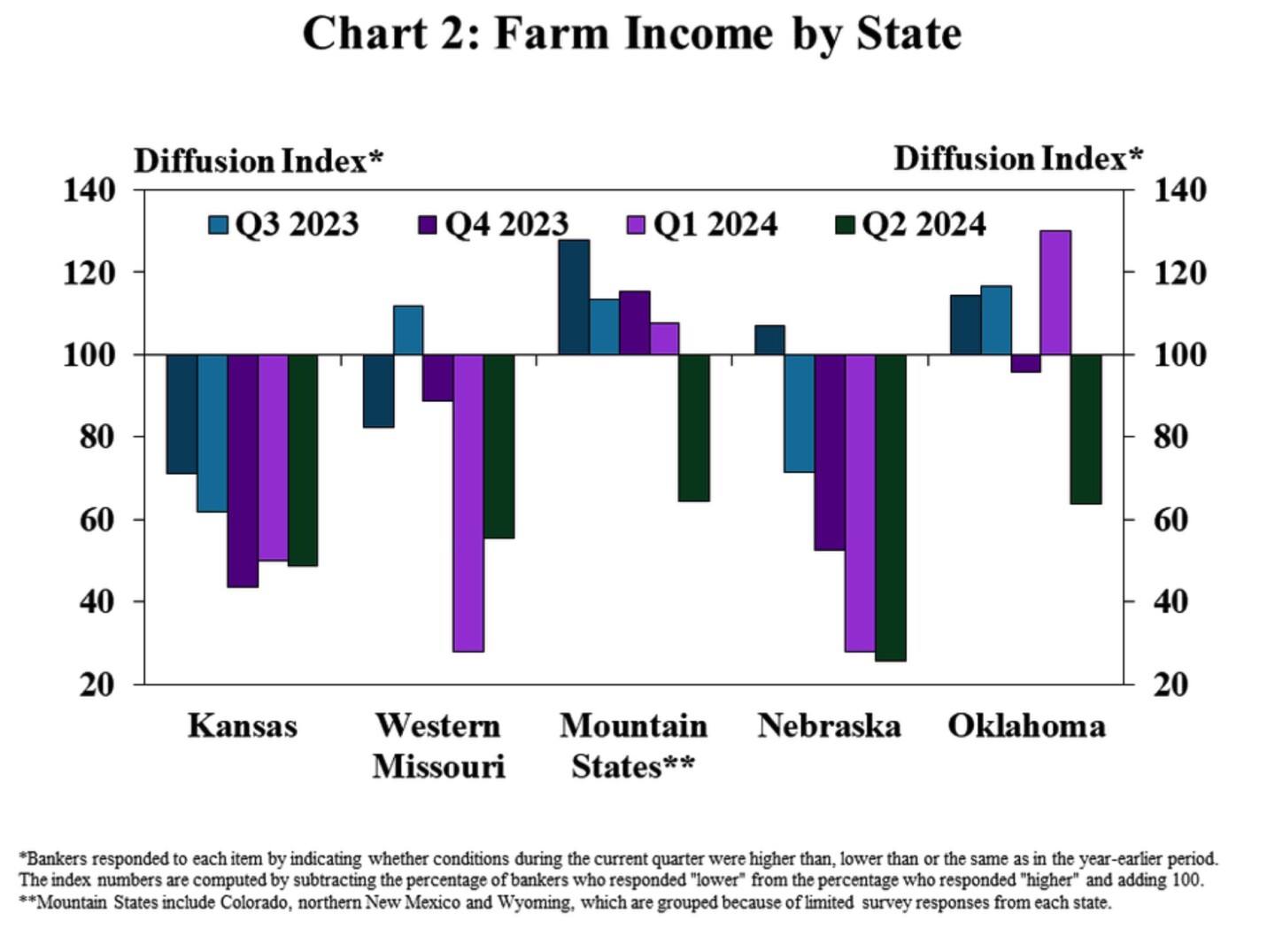

Farm income was lower in all states, but the retraction remained especially pronounced in areas more impacted by low crop prices. The index of farm income was lower in Kansas, Missouri, and Nebraska, where crops make up a larger share of farm revenues (Chart 2). After strengthening last quarter, farm income in the Mountain States and Oklahoma declined in the second quarter as 30% of lenders in those states reported lower farm income than a year ago.

Despite these challenges, agricultural credit stress remained limited, though signs of financial strain are emerging. Interest rates on farm loans stayed relatively high, and farmland values grew more slowly, with ranchland values showing relative strength. Lenders expect land values to stabilize, with some anticipating further declines in cropland values and increases in ranchland values. Overall, the agricultural sector is experiencing modest financial deterioration amid ongoing economic pressures.

Banker Comments Q2 2024 “Beef producers have experienced good margins over the last 12-18 months, but increasing replacement costs and interest costs will reduce margins moving forward.”– Kansas “Lower grain prices and continued drought are causing stress.”– Kansas “Inflation has increased family living expenses for our producers. Lower crop prices compared to a year ago is also worrisome to farmers in the area but continued high livestock prices have helped our cattle producers.”– Kansas “Inflation is having a substantial effect on family living. Equipment upgrades and new purchases are a rare conversation with stressed cash flows.”– Missouri “We expect profit margins to be reduced in the row crop sector while we should see significant improvement in profit margins in the cattle sector.”– Missouri “The cattle market has provided much needed profit for cattle producers, but expansion and replacements have a lot of risk for borrower and lenders if a correction is to take place in the near future.”– Missouri “We are seeing quite a few of our farm lines of credit approaching their max already, which would be a few months earlier than normal.”– Nebraska “Inflation is keeping household spending higher, liquidity took a hit and we have seen some refinancing needed against land, but land prices are still high even with higher interest rates.”– Nebraska “Interest rates and commodity prices and primary concerns in our area.”– Nebraska “If cattle prices maintain, cattle producers will be okay until stockers are purchased, but if cattle prices deteriorate, it could be ugly. Crop farmers with low prices are hurting and yields were all over the spectrum.” – Oklahoma “Cost of living is increasing significantly, and equipment and parts cost are increasing significantly.” - Oklahoma “Higher rates are straining farmers cash flow and ability to operate with increasing input costs.” - Oklahoma |