News/Markets/Policy Updates: Aug. 20, 2024

— The first day of the 2024 Democratic National Convention, held in Chicago, was marked by significant speeches and symbolic moments that set the stage for the upcoming election. Delegates and convention speakers spent the day trying to strike a balance between thanking the 81-year-old Biden for his four years as president and looking forward to promoting Harris, 59, as Democrats aim to retain the White House and prevent Donald Trump, the 78-year-old former Republican president, from reclaiming it. Some highlights: • Keynote speech by President Joe Biden Biden started speaking at 11:27 p.m. ET — limiting the number of live viewers. About half of Americans live in the eastern time zone. He wrapped up well after midnight. Biden celebrated Vice President Kamala Harris as the party’s presidential nominee, effectively passing the torch to her. Biden emphasized his pride in selecting Harris as his running mate in 2020, describing it as the best decision of his career. Biden gave Harris his backing, calling her “tough,” “experienced,” and a person of “enormous integrity.” Choosing her as his vice president. His speech was not only a farewell but also a call to action, urging attendees to support Harris and Tim Walz, her vice-presidential running mate. He reiterated his commitment to democracy and expressed his readiness to support the new ticket as a volunteer. Biden criticized former President Donald Trump, particularly referencing “the Jan. 6 insurrection” and Trump’s claims about the 2020 election. He stated, “He claims we’re losing. He’s the real loser,” and emphasized the need to preserve democracy against authoritarianism. Biden reflected on his administration’s achievements, including legislative successes in public works and climate programs, sharing credit with Harris. • Vice President Kamala Harris’ surprise appearance Of note: According to the latest CBS News-YouGov polling, more than one in three voters say they don’t know what Harris stands for, far more than say that about Trump. • Notable speakers and themes The session addressed issues such as reproductive rights and the Covid-19 pandemic, with several speakers criticizing former President Donald Trump’s handling of the pandemic. • Protests • Tuesday events include speeches by former President Barack Obama and Michelle Obama. The former president plans to lay out the task in front of Democrats in the final 11-week sprint until Nov. 5. Meanwhile, Harris and Minnesota Governor Tim Walz will hold a rally at Milwaukee’s Fiserv Forum today, the same venue where Republicans recently nominated Donald Trump. With Harris now leading the Democratic ticket, the race has tightened, particularly in Wisconsin. Recent polls show Harris slightly ahead of Trump, but the margin remains close and within the margin of error. — Kamala Harris proposed raising the corporate tax rate to 28% from the current 21% to fund her other plans, including expanding the child tax credit and forgiving medical debt. That compares to former President Donald Trump, who wants to preserve the tax cut to 21% he implemented in 2017. Note that any changes need to be approved by both houses of Congress. — Trump said he would consider ending a $7,500 tax credit for electric vehicle buyers, and would be open to naming Tesla’s Elon Musk to a cabinet or advisory role. — The Democratic Party’s 2024 platform (link) emphasizes several key ag policies aimed at addressing current challenges and advancing sustainable practices. Here are the main priorities outlined: • The DNC 92-page platform calls for the elimination of the stepped-up basis, labeling it a “loophole for the wealthiest Americans.” The rationale behind this stance is that the stepped-up basis allows wealthy individuals to pass on significant assets to their heirs with minimal tax liability, thereby perpetuating wealth inequality. By eliminating this provision, the DNC aims to increase tax revenue from capital gains and address wealth disparities. Farm groups argue that the stepped-up basis is crucial for maintaining family farming operations. Many farms are asset-rich but cash-poor, meaning they have substantial land and equipment value but limited liquid assets. Without the stepped-up basis, heirs could face substantial capital gains taxes upon inheriting a farm, potentially forcing them to sell parts of the farm to pay the tax liability. This could disrupt the continuity of family-owned farms, which are often passed down through generations. Key agricultural policies • Climate-smart agriculture: The U.S. farm sector would be the first in the world to achieve net-zero greenhouse gas emissions by 2050 with the assistance of projects such as the USDA’s climate-smart agriculture initiatives The platform highlights investments in climate-smart agriculture, leveraging funds from the Inflation Reduction Act (IRA) to support sustainable farming practices. This includes initiatives to reduce greenhouse gas emissions and improve soil health, which are part of broader efforts to tackle the climate crisis. “Under President Biden’s landmark climate law, USDA is paying farmers to adopt climate-smart practices, which sequester carbon from the atmosphere, improve soil health and biodiversity, and restore water cycles, all while opening new revenue streams from ecosystems services markets,” said the platform, referring to the $3.1 billion climate-smart initiative. “Already, over 80,000 farms covering 75 million acres have adopted these practices.” Comparison with Republican goals. While both parties share some common goals, such as addressing foreign ownership of U.S. agricultural land and ensuring robust domestic supply chains, their approaches differ: Implications — The food industry is pushing back against Harris’ proposal to ban “price gouging” in response to rising grocery prices, the Wall Street Journal reports (link). Harris, the Democratic presidential nominee, has blamed corporate greed for food-price inflation, but industry executives argue that higher costs for labor and materials are driving prices. The proposal, which includes new regulatory powers for the Federal Trade Commission and state attorneys general, aims to curb excessive profits and anti-competitive practices. Food companies are countering with their own strategies, such as offering more affordable store brands and slowing price increases. Critics within the industry argue that the definition of price gouging is unclear, and that Harris’s plan would be difficult to enforce. The Wall Street Journal noted that food industry officials counter that there are several factors involved in grocery prices, including costs from labor and things like cocoa, forcing them to try to maintain profit margins to be able to fund development of new products. “We understand why there is this sticker shock and why it’s upsetting,” said Andy Harig, a vice president at FMI, a trade group representing food retailers and suppliers. “But to automatically just say there’s got to be something nefarious, I think to us that is oversimplified.” Officials from food companies told the paper that their costs have increased “permanently” and that means they have to raise prices to reflect those higher costs. It is important to remember that Harris’ effort on preventing price gouging would require congressional approval and so far, any legislation that has been introduced along those lines has not gained traction. However, that still leaves open the potential for regulatory or executive order actions to address certain areas. Meanwhile, Sens. Ron Johnson (R-Wis.) and Rick Scott (R-Fla.) criticized Harris’ economic proposals, including her plan to ban food price gouging, labeling them as “socialist.” The two GOP allies targeted Harris during the first day of the Democratic National Convention, with Scott highlighting the rising costs of everyday items like eggs and baby formula. Their remarks aimed to refocus the Republican campaign on economic concerns and Harris policy agenda. — Iranian hackers target 2024 election: FBI links cyber-attacks to Trump and Biden-Harris campaigns, Iran denies involvement. The U.S. government concluded that Iran was behind the hack-and-leak operation targeting both the Trump and Biden-Harris campaigns. The FBI’s briefing to Trump, coupled with the unsuccessful attempts against the Biden-Harris campaign, shows the seriousness with which U.S. intelligence and law enforcement agencies are treating these actions. The fact that news organizations received documents believed to be from a senior Trump campaign official’s account suggests that the hackers successfully obtained sensitive information, potentially aiming to disrupt or discredit campaigns. Iran’s denial of involvement is not unexpected, as state actors often reject accusations of cyber activities that could be construed as meddling in foreign affairs. U.S. officials’ belief that this is part of broader efforts by Iran and possibly other countries to influence the 2024 election. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened around 40 points lower. In Asia, Japan +1.8%. Hong Kong -0.3%. China -0.9%. India +0.5%. In Europe, at midday, London -0.6%. Paris +0.1%. Frankfurt -0.1%. There are two Feds speakers, Bostic (1:35 p.m. ET) and Barr (2:45 p.m. ET) and if they join other colleagues in expressing openness to cutting rates in September, it should be a mild boost for stocks.

U.S. equities yesterday: All three major indices opened the week with gains. The Dow ended up 236.77 points, 0.58%, at 40,896.53. The Nasdaq gained 245.05 points, 1.39%, at 17,876.77. The S&P 500 rose 54.00 points, 0.97%, at 5,608.25.

Of note: The CBOE Volatility Index is now at 14.7 after topping 65 during the sell-off on Aug. 5.

— Lowe’s exceeded second-quarter earnings expectations but fell short on sales and lowered its full-year outlook due to weakening DIY spending and a challenging macroeconomic environment. The retailer now expects comparable sales to drop by 3.5% to 4%, worse than its previous forecast of a 2% to 3% decline. Additionally, Lowe’s revised its full-year sales projection to $82.7 billion to $83.2 billion, down from the earlier estimate of $84 billion to $85 billion.

— Kroger has sued the Federal Trade Commission, claiming that the agency’s in-house tribunal is illegal, Reuters reports (link). The FTC has sued to temporarily block Kroger’s acquisition of Albertsons.

— Carl Icahn and his company, Icahn Enterprises, agreed to pay a $2 million fine to settle SEC charges for failing to disclose significant borrowing against company shares. (Billionaire Icahn agreed to pay $500,000. His company, Icahn Enterprises, will pay $1.5 million.) This modest settlement pales in comparison to the impact of a short-seller report by Hindenburg Research last year, which led to a 68% drop in the company’s shares, halved its dividend, and forced loan renegotiations. The selloff wiped out over $8 billion from Icahn’s personal holdings. Hindenburg’s report accused Icahn Enterprises of being overvalued, inflating asset values, and paying an unsustainable dividend.

— Harley-Davidson revised its diversity policies following pressure from conservative activist Robby Starbuck. The company announced it will stop participating in the Human Rights Campaign’s LGBTQ+ inclusion scoring system and will review its sponsorships, shifting its focus to its “loyal riding community.” Additionally, Harley-Davidson will no longer set spending goals for purchasing from minority- or women-owned suppliers. It follows similar campaigns against Deere and Tractor Supply, which both shelved their DEI protocols earlier in the summer.

— Ag markets today: The grain and oilseed markets struggled to maintain Monday’s strength overnight, though selling pressure was limited. As of 7:30 a.m. ET, corn futures were steady to a penny lower, soybeans were 2 to 3 cents lower and winter wheat futures were around a penny lower. Outside markets were quiet this morning as front-month crude oil futures are modestly higher and the U.S. dollar index was around 50 points lower.

Cash cattle fundamentals slip. Cash cattle prices are down for the third consecutive week, sinking $2.20 from the prior week to $189.14. Historically, cash prices tend to trade relatively sideways until some potential strength returns to cash cattle in October. Choice cutout dipped $1.90 to $315.55, and Select fell 55 cents to $302.01 on Monday.

Hog index continues lower. After brief strength last week, the CME lean hog index has continued its seasonal trend lower and is down 14 cents to $89.95 as of Aug. 16. Pork cutout continues to fall under pressure, led lower by big losses in bellies. Cutout is down $1.58 to $97.09.

— Agriculture markets yesterday:

• Corn: Corn rallied 7 3/4 cents to $4.00 1/4, closing above the 10-day moving average and marking the largest daily gain since July 22.

• Soy complex: Soybeans surged 19 cents to $9.76, closing just shy of the session high, while December soymeal rose $8.40 to $310.50, ending the session above the 10-day moving average for the first time since Aug. 2. September soyoil rose 52 points to 40.47 cents.

• Wheat: December SRW wheat futures fell 1/4 cent to $5.52 1/4. December HRW wheat futures rose 1 1/2 cents to $5.56 1/2. Both markets closed nearer their daily highs. December HRS fell 5 1/2 cents to $6.03 1/2.

• Cotton: December cotton futures rose 144 points to 68.68 cents and nearer the session high.

• Cattle: Expiring August live cattle futures settled unchanged at $182.80 Monday, whereas most-active October futures advanced 72.5 cents to $179.025. The nearby August feeder cattle contract dipped 40 cents to $242.375, while most-active October feeders slipped 22.5 cents to $235.875.

• Hogs: Hog futures rebounded strongly from last week’s late losses, with the nearby October futures leaping $1.725 to $76.80.

— Quotes of note:

• “The barcode just celebrated its 50th birthday. I think we should all try to make the switch.” — Stephane Lannuzel, of L’Oréal, on the push by retailers and their suppliers toward QR codes.

• “Brian is not taking the train from Newport or flying JetBlue.” — Raheela Anwar, of Group 360 Consulting, on a decision by Starbucks to give Brian Niccol, its new CEO, access to a corporate jet to commute to the Seattle headquarters or other sites. Such corporate perks, she said, are worth it if it means a company can land a star CEO.

— Which states have price-gouging laws? Approximately 37 states in the United States, along with the District of Columbia, Guam, Puerto Rico, and the U.S. Virgin Islands, have enacted price-gouging laws. These laws are designed to prevent the excessive increase in prices of essential goods and services during emergencies, such as natural disasters or declared states of emergency.

The states that do not have specific price-gouging laws include:

Alaska

Arizona

Colorado

Delaware

Minnesota

Montana

Nebraska

Nevada

New Hampshire

New Mexico

North Dakota

Ohio

South Dakota

Washington

Wyoming

However, some of these states, like Ohio, have other consumer protection laws that can address price gouging indirectly, such as laws against “unconscionable sales practices.”

In states with price-gouging laws, these regulations are typically triggered by a declared state of emergency and may apply to a range of goods and services deemed essential during such times. The specifics of what constitutes price gouging, the duration of the law’s applicability, and the penalties for violations can vary significantly from state to state.

Market perspectives:

— Outside markets: The U.S. dollar index was lower, with the British pound stronger against the greenback. The yield on the 10-year U.S. Treasury note fell, trading around 3.87%, with a mixed tone in global government bond yields. Crude oil futures were mixed, with U.S. crude weaker around $74.30 per barrel and Brent trading higher around $77.75 per barrel. Gold and silver futures were sharply higher with gold around $2,564 per troy ounce (see next item) and silver around $29.85 per troy ounce.

— Gold surged to a record high of over $2,520 per ounce on Tuesday, driven by expectations of less restrictive monetary policies from major central banks and ongoing geopolitical concerns. Signs of disinflation in the U.S. have fueled speculation that the Federal Reserve may begin cutting rates, with markets anticipating 100 basis points in cuts this year. Similar easing trends are seen globally, with central banks like Sweden’s Riksbank and the ECB also signaling rate reductions. This outlook has bolstered demand for safe-haven assets like gold, as the opportunity cost of holding non-yielding bullion decreases. Central bank purchases have supported gold’s rally, with net purchases totaling 483.3 tons in the first half of the year (equivalent to nearly 40K gold bars), but some analysts expect consolidation ahead, with the odds of further easing already baked in unless the Fed signals deeper rate cuts.

— Canadian National Railway Co. and Canadian Pacific Kansas City Ltd. are facing a potential nationwide shutdown on Thursday if they cannot reach an agreement with their unionized workers, affecting over 9,000 employees. The impending strike threatens to disrupt the movement of essential goods like wheat, chemicals, and fertilizers, with industries bracing for billions in losses.

The impact is expected to extend beyond the C$1 billion ($732 million) worth of daily goods transported by rail, affecting farmers, food security, and Canada’s global supply chain reputation. Canada is the world’s top potash producer and 75% of fertilizer moves by rail. Over 90% of Canadian grain moves by rail, so there could be a near-total stoppage of grain movement. USDA warned the impact would be “devastating,” and hit the flow of farm goods in the U.S. “and beyond.” The country is also a major wheat producer and if exports stop, providers could face demurrage fees, contract extension penalties or sales defaults. The petrochemical industry is also bracing. U.S. firms sold about $28 billion in chemicals to Canadian customers last year, and the sector imports about $25 billion worth of chemical products from Canada into the U.S. every year.

Talks continue, but the parties remain far apart on key issues, including crew fatigue and wage increases. The Canadian government has urged both parties to intensify their efforts to reach an agreement. Although the government has the authority to impose binding arbitration, it has so far preferred to let the parties resolve their issues through negotiation. Canada’s labor minister told the railways and the union last week that he would not impose binding arbitration on them. The government has also engaged federal mediators to facilitate the negotiations.

Ag sector sends letter. The National Grain and Feed Association, the American Farm Bureau Federation and the Corn Refiners Association were among dozens of industry groups that sent a letter (link) Monday afternoon to the Canadian government, urging officials to “take action to ensure railroad operations continue before a lockout or strike occurs to prevent serious damage to the Canadian and U.S. economies.” They added: “Operational railroads are essential on both sides of the border for the integrated North American supply chain. While we believe a negotiated solution is always the preferred outcome, your government should be prepared to move quickly if negotiations fail.”

— Day 1 Crop Tour results for South Dakota and Ohio. Scouts on the first day of the Pro Farmer Crop Tour found an average corn yield of 156.51 bu. per acre in South Dakota, down from 157.42 bu. per acre last year but up from the three-year average of 142.44 bu. per acre. Soybean pod counts in a 3’x3’ square came in at 1,025.89 for South Dakota, up from 1,013 last year and from the three-year average of 960.42

In Ohio, samples yielded an average corn yield of 183.29 bu. per acre, down from 183.94 bu. per acre in 2023 and up from the three-year average of 181.06 bu. per acre. Soybean pod counts in a 3’x3’ square totaled 1,229.92 for Ohio, down from 1,252.93 in 2023 but above the three-year average of 1,193.31.

Today, scouts on the eastern leg of the Tour will sample routes from Noblesville, Indiana to Bloomington, Illinois, and scouts on the western leg will sample central and southern Nebraska.

— Farmers slow to sell 2023 production. With commodity prices in a slump, a majority of farmers in an AgWeb straw poll said they did not plan to sell corn or soybeans left over from the 2023 harvest before harvesting this year’s crops. Link for more.

— USDA daily export sales:

• 132,000 MT soybeans to China during 2024-2025 marketing year

• 239,492 MT soybeans to Mexico during 2024-2025 marketing year

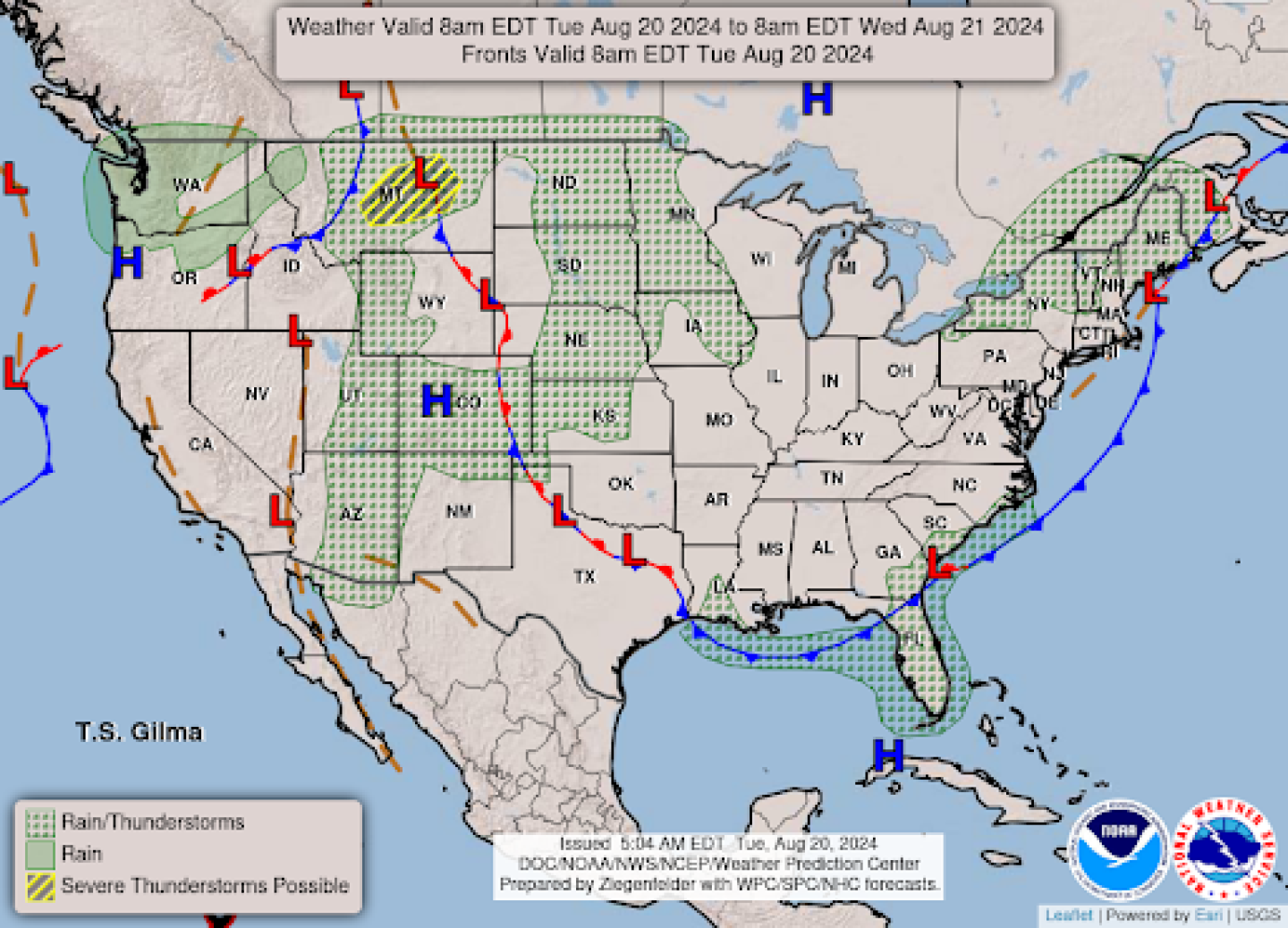

— NWS outlook: Severe thunderstorms possible across the central to northern High Plains through Wednesday with flash flood potential continuing over the Southwest... ...Record breaking heat continues across Texas.

Items in Pro Farmer’s First Thing Today include:

• Corn, soybeans and wheat lower

• Cordonnier leaves U.S. corn, soy forecasts unchanged

• U.S. corn, soybean and spring wheat CCI ratings inch down

| ISRAEL/HAMAS CONFLICT |

— Israeli forces recovered the bodies of six hostages during a military operation in Khan Younis, Gaza. Prime Minister Benjamin Netanyahu confirmed that the hostages were held by Hamas, which he described as a “murderous terrorist organization.” Currently, 109 Israeli hostages remain in Gaza, with 36 believed to be dead. This development comes amid ongoing ceasefire negotiations, with U.S. Secretary of State Antony Blinken stating that Netanyahu has agreed to a U.S. “bridging proposal” and that the next step is for Hamas to agree to the deal. Hamas said it was “keen” on reaching a cease-fire agreement with Israel in Gaza, denying what it said were U.S. claims that the Iran-backed Palestinian group is backing away from ongoing negotiations to end the 10-month conflict. In a statement posted on Telegram, Hamas said remarks by U.S. Secretary of State Antony Blinken and President Joe Biden were “misleading and don’t reflect the reality of the movement’s position that it’s keen to reach a cessation of aggression.” It said the recent draft deal, which the U.S. has described as a “bridging proposal,” was different than what was originally proposed by Biden in May.

| POLICY UPDATE |

— USDA announced results of its 2024 Conservation Reserve Program (CRP) enrollments, accepting 2.2 million acres across various signups. This brings total CRP acreage close to the legislative cap of 27 million acres. The Grasslands CRP has now become the largest component of the program, with over 10 million acres enrolled. USDA is nearing its cap, meaning further enrollments might be limited. With 481,639 acres set to mature on Sept. 30, many are expected to re-enroll, leaving little room for new enrollments before hitting the cap. Future general and Grasslands CRP signups are unlikely.

| CHINA UPDATE |

— The People’s Bank of China (PBoC) kept its key lending rates unchanged during the August 2024 fixing, aligning with market expectations. This decision maintained the one-year loan prime rate (LPR) at 3.45% and the five-year LPR at 3.85%. These rates are significant as the one-year LPR serves as the benchmark for most corporate and household loans, while the five-year LPR is a reference for property mortgages. This move comes after unexpected rate cuts in July, where both the one-year and five-year LPRs were reduced by 10 basis points to support China’s fragile economic recovery. Despite maintaining ultra-loose monetary policies, economic indicators such as lending activity and industrial production suggest ongoing economic weakness, potentially prompting further rate cuts in the future.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |