The Week Ahead: Oct. 13, 2024

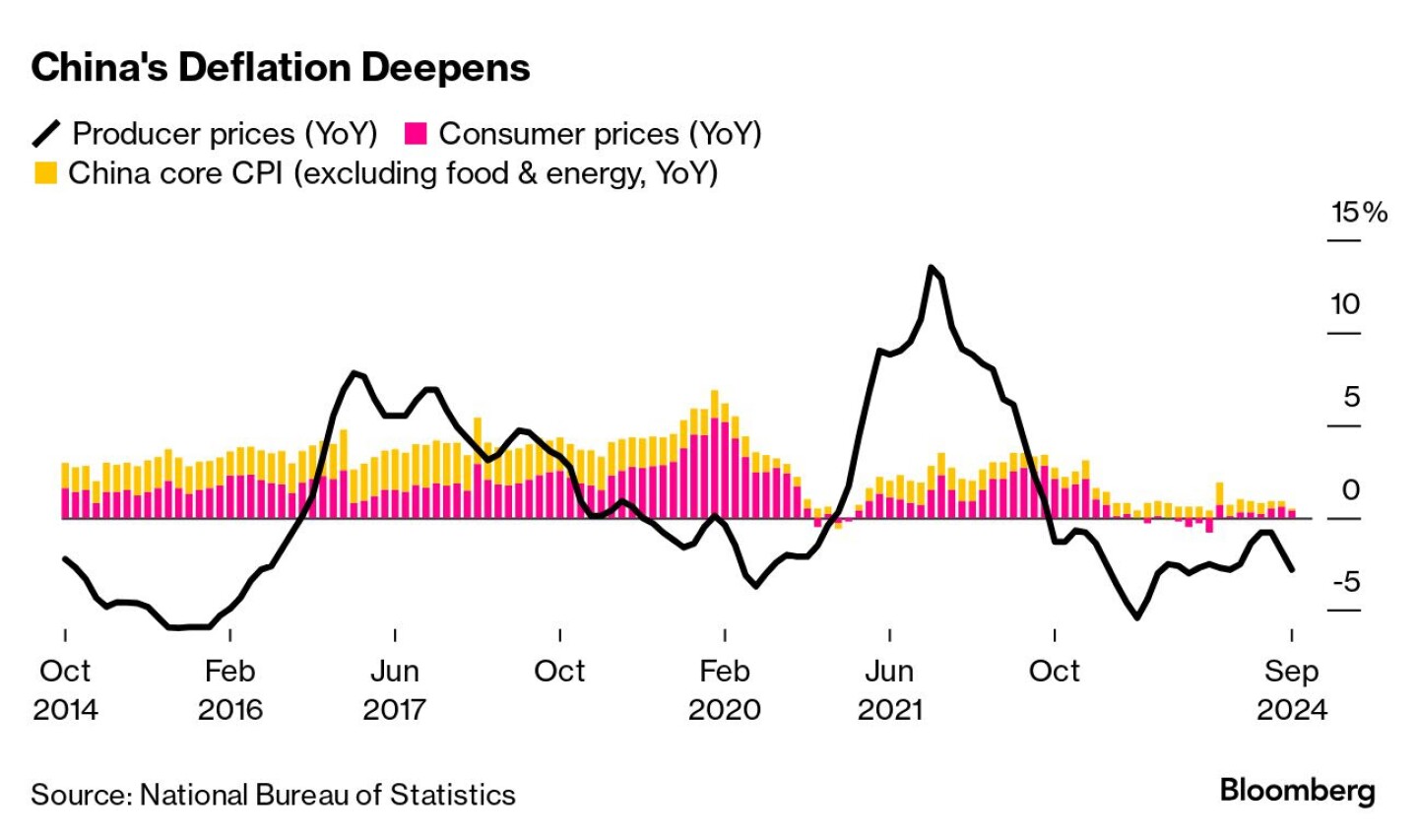

— House Speaker Mike Johnson (R-La.) on why he’s not calling Congress back early to pass more disaster aid, on CBS’ Face the Nation: “Congress appropriated $20 billion additional to FEMA… Less than 2% of that funding has actually been distributed… We’ll provide the additional resources. But it would be premature to call everyone back now, because these storms are so large in their scope and magnitude, it’s going to take a little bit of time to make those calculations. …FEMA was slow to respond. They did not do the job that we all expect and hope that they will do.” — Biden tours Florida storm damage and urges Congress to approve more aid. President Joe Biden visited hurricane-damaged areas of Florida on Sunday, announcing $612 million in Energy Department funding to enhance grid resilience. He continues to push Congress to return from recess and approve additional disaster aid, as the region recovers from two recent hurricanes. Biden said Friday that the damage from Milton alone could be around $50 billion based on early assessments. House Speaker Mike Johnson (R-La.) said more funding could reach $100 billion but noted that action will follow once local officials assess their needs. Biden emphasized the importance of bipartisan support, especially for small businesses. — Biden to visit Germany after postponement, will meet Chancellor Scholz. President Joe Biden will travel to Berlin on Friday to meet with Chancellor Olaf Scholz, following a delay caused by Hurricane Milton. The visit, now scaled back, no longer includes a stop at Ramstein Air Base. Biden is expected to receive Germany’s highest civilian honor during the trip. His earlier plan to meet other leaders, including UK Prime Minister Keir Starmer and French President Emmanuel Macron, remains uncertain. Biden has also reiterated his intention to reschedule his postponed trip to Angola. — Rep. Jim Clyburn (D-S.C.) on whether he commits to certifying the election if Trump wins, on CNN’s State of the Union: “Absolutely. …Al Gore presided over his own defeat. So that is what this country’s all about: Have the election, and when the election’s over, you put it behind us and move on with trying to continue this pursuit toward a more perfect union. You don’t sit around and tell lies about the election or resist the process; you go forward.” — The Wisconsin Senate race between incumbent Democrat Tammy Baldwin and Republican challenger Eric Hovde indicate a tightening contest, raising concerns for Democrats. The Cook Political Report with Amy Walter recently reclassified the Wisconsin Senate race from “Lean Democrat” to “toss-up”. This shift suggests the race has become more competitive than previously thought. Several recent polls show Baldwin’s lead over Hovde shrinking: Several factors may be contributing to the tightening race: Despite the tightening race, Baldwin still maintains some advantages: — WSJ: U.S. to deploy antimissile system to Israel amid talks on Iran strike. The Biden administration plans to send an advanced antimissile system, known as Thaad, to Israel along with nearly 100 U.S. troops to operate it, according to the Wall Street Journal, citing U.S. officials (link). This deployment aims to bolster Israel’s defenses as the two nations discuss a potential Israeli attack on Iran. American officials have advised Israel not to target Iran’s oil facilities or nuclear sites in the planned strike. If Iran retaliates, it would be the third time this year Tehran has attacked Israeli territory. The timeline for the Pentagon’s deployment of the Thaad system remains unclear, and the White House has not yet provided a comment on the move. — China announced stimulus measures on Saturday, Oct. 12. China’s Finance Minister Lan Fo’an held a news conference on Saturday to outline plans for increased fiscal support and economic stimulus. However, the announcement lacked specific details on the overall size of the stimulus package, which disappointed some investors and analysts. The stimulus plans include several components: The announcement was met with mixed reactions: Of note: China’s finance minister hinted at a deficit increase during a closely watched briefing. He told reporters that the central government has “rather large” room for a deficit increase but noted that policy discussions are still underway. Analyst projections for how much stimulus is needed to prop up China’s economy is 2 trillion to 10 trillion yuan ($283 billion to $1.415 trillion). Upshot: While the announcement signaled China’s intent to support its economy, many investors and analysts are still waiting for more concrete details, which may come in the upcoming meeting of China’s legislature. — China announced both the Producer Price Index (PPI) and Consumer Price Index (CPI) figures for September 2024. Key details: Consumer Price Index (CPI). The CPI, which measures inflation at the consumer level, rose by 0.4% year-on-year in September. This represents a slowdown from the 0.6% increase observed in August. The September CPI figure fell short of economists’ expectations, which had projected a 0.6% growth. Producer Price Index (PPI). The PPI, which measures inflation at the producer or wholesale level, fell by 2.8% year-on-year in September. This represents a steeper decline compared to the 1.8% drop recorded in August. Bottom line: These figures indicate that China is experiencing deflationary pressures, particularly at the producer level. The government in Beijing is implementing additional stimulus measures to boost demand and improve economic performance in response to these trends (see previous item). |

| WASHINGTON FOCUS |

The U.S. House and Senate have paused activities to campaign ahead of the Nov. 5 elections and are set to return on Nov. 12, after Veterans Day. While U.S. gov’t offices will be closed on Oct. 14 for Columbus Day (also known as Indigenous Peoples’ Day in some areas), most markets will operate as usual, except for the bond market, which will reopen the following day. The holiday will cause delays in releasing some reports, with Crop Progress now slated for Tuesday, Export Sales on Friday, and U.S. government oil inventory data delayed by one day.

The second Monday in October is also Thanksgiving Day in Canada, a federal statutory holiday.

— Tuesday, Oct. 15, is Tax Day for anyone who was granted a six-month extension back in April. Failure to file could result in a penalty of 5% of taxes due for every month that your return is late. However, the IRS is granting extensions to taxpayers who live in disaster areas, those returning from a combat zone and taxpayers affected by the terrorist attacks in Israel. Link for details.

| | |

| OTHER EVENTS & HEARINGS |

Monday, Oct. 14

• Columbus Day. U.S. gov’t offices are closed while markets are open except for the bond market which will be closed for the holiday. The National Christopher Columbus Association holds its 2024 National Columbus Day Ceremony, including wreath presentations, patriotic music, remarks from the Diplomatic Corps, and the Columbus Essay Contest winner.

• Federal Reserve. Fed Governor Christopher Waller speaks on the Economic Outlook in California.

• Monetary policy. Stanford University’s Hoover Institution conference on “A 50-Year Retrospective on The Shadow Open Market Committee and Its Role in Monetary Policy.”

• International disasters. Johns Hopkins University School of Advanced International Studies virtual discussion on “International Disasters: Preparedness and Response.”

• International issues and the U.S. elections. Brookings Institution’s Foreign Policy Program and the Baker School Student Union 272 discussion on “The Future of America’s International Alliances and Partnerships: What’s at Stake in the 2024 Election.”

Tuesday, Oct. 15

• Federal Reserve. Fed Governor Adriana Kugler delivers virtual remarks on Career Opportunities and Diversity in Economics. San Francisco Fed President Mary Daly scheduled to speak.

• Trump appearance. Bloomberg News and the Economic Club of Chicago (EEC) co-host an interview with former President Donald Trump.

• China and Taiwan. Center for Strategic and International Studies discussion on a new report, “Employing ‘Non-Peaceful’ Means Against Taiwan: The Implications of China’s Anti-Secession Law.”

• Iraq energy, other issues. Atlantic Council third annual Iraq Initiative Conference, focusing on “the key challenges and opportunities in advancing the Iraqi energy sector, efforts toward sustainable economic diversification, and the evolving trajectory of U.S./Iraqi relations.”

• Housing finance. Ginnie Mae and the Housing and Urban Development Department strategic summit on “Mortgage Market Resilience and Access to Credit.”

• Indonesia and US relations. The Quincy Institute for Responsible Statecraft holds a virtual discussion on “A New Leader in Indonesia: What Are the Implications for the United States?”

• State of unions in U.S. National Press Club Newsmaker Program discussion on the state of union organizing in the United States.

• Ukraine energy issues. Wilson Center Kennan Institute for Advanced Russian Studies virtual discussion on “Ukraine’s Energy Sector: Short-Term Threats and Long-Term Prospects.”

• Environmental program funding. EPA’s Funding Environmental Programs meeting of the Environmental Financial Advisory Board to discuss current advisory charges, provide updates on previous EFAB deliverables, and to learn more about the Administration’s infrastructure investment opportunities.

• War in Ukraine, Middle East. Washington Post Live virtual book discussion on Bob Woodward’s “War,” focusing on the wars in Ukraine and the Middle East and the struggle for the American presidency.

• Global economic outlook. Peterson Institute for International Economics virtual discussion on “Global Economic Prospects: Fall 2024.”

• World Bank reform. Reuters virtual “NEXT Newsmaker” discussion on efforts to re-tool the World Bank, address poverty and boost economic growth.

Wednesday, Oct. 16

• Climate disclosure litigation. Federalist Society for Law and Public Policy Studies’ Regulatory Transparency Project virtual discussion on “Climate Disclosure Litigation: Examining Legal Battles Against California and the SEC.”

• Coin designs. United States Mint meeting of the Citizens Coinage Advisory Committee to discuss several semi-quincentennial coins, including the dime, quarters, and half dollar.

• India trade. Peterson Institute for International Economics virtual discussion on “India and Trade: Where is the Country headed?”

• Railroad issues. Surface Transportation Board meeting of the Passenger Rail Advisory Committee for discussions regarding ideas on how to improve efficiency on passenger rail routes, reduce disputes between passenger rail carriers and freight rail hosts, and improve regulatory processes related to intercity passenger rail.

• Energy panel. Department of Energy virtual meeting of the Secretary of Energy Advisory Board for remarks from SEAB Chair Arun Majumdar, remarks from Energy Secretary Jennifer Granholm, and discussion of the SEAB report from the Tribal and Community Benefits working group.

• Fiscal impact of Trump, Harris plans. The Committee for a Responsible Federal Budget virtual discussion on “The Fiscal Impact of the Harris and Trump Campaign Plans.”

• Climate and global security. Truman Center virtual book discussion on “Threat Multiplier: Climate, Military Leadership, and the Fight for Global Security.”

• China’s nuclear policy. Carnegie Endowment for International Peace discussion on “China’s Evolving Nuclear Policy: What It Means for US Security and International Stability.”

Thursday, Oct. 17

• Federal Reserve. Chicago Fed President Austan Goolsbee scheduled to speak.

• China economic issues. Peterson Institute for International Economics (PIIE) and the Princeton School of Public and International Affairs virtual discussion on “China’s Economic Troubles: Temporary Woes or Structural Reckoning?”

• 2030 Census. Census Bureau virtual meeting of the 2030 Census Advisory Committee provide insight, perspectives, and expertise through recommendations on planning and implementation of the 2030 Census; runs through Friday.

• AI and 2024 elections. McCain Institute virtual discussion on “Artificial Intelligence (AI) and the 2024 Elections: Navigating a Messy Information Space.”

• India growth and job creation. George Washington University conference on “Envisioning India: Why Is India Growing Fast but Not Creating Enough Jobs?”

• FERC meeting. Federal Energy Regulatory Commission (FERC) open meeting.

• Prevailing wages. Office of Personnel Management virtual meeting of the Federal Prevailing Rate Advisory Committee to discuss the determination of prevailing wage rates for the Federal Wage System.

• Across-the-board tariffs. Brookings Institution’s Hamilton Project virtual discussion on “How Would Across-the-Board Tariffs Create Chaos in 2025?”

• U.S./China relations. Quincy Institute for Responsible Statecraft virtual discussion on “U.S./China Science and Technology Exclusion Pressures Building Toward Conflict.”

• Economic growth and development. Center for Global Development 2024 Growth Summit, with the theme “Recentering Economic Growth in Development;" runs through Friday.

• Latin America port security. Center for Strategic and International Studies virtual discussion on “Navigating Geopolitics and Security in Latin America’s Ports.”

• U.S. elections and foreign policy. Council for a Livable World; J Street; and Foreign Policy for America virtual discussion on “Election 2024: The Future of Progressive Foreign Policy,” focusing on the upcoming election and its implications for nuclear and national security policy.

Friday, Oct. 18

• Federal Reserve. Fed Governor Christopher Waller delivers remarks on Decentralized Finance at a conference in Vienna, Austria.

• 2030 Census. Final day of the Census Bureau virtual meeting of the 2030 Census Advisory Committee provide insight, perspectives, and expertise through recommendations on planning and implementation of the 2030 Census.

• Critical minerals and national security. Center for Strategic and International Studies conference on “The Future of Critical Minerals and National Security.”

• Russian artillery supply chain. Wilson Center’s Global Europe Program; the Wilson center’s Kennan Institute; and the Wilson Center’s Wahba Institute for Strategic Competition discussion on “Disrupting Russia’s Artillery Supply Chain.”

• Preparing for climate risks. Brookings Institution virtual discussion on “Helping Communities Prepare for Climate Risks.”

| ECONOMIC REPORTS & EVENTS |

In the coming days, key economic data will be released, including inflation reports from the UK, Canada, India, and Japan, along with UK unemployment and wages data, U.S. industrial production figures, and China’s third-quarter GDP estimate. The European Central Bank’s Monetary Policy Committee meeting on Thursday will be closely watched, with economists expecting a 0.25 percentage-point rate cut due to slowing growth in the Eurozone.

Earnings reports:

• Major U.S. banks including Goldman Sachs, Morgan Stanley, Citigroup (Oct. 15-16)

• Johnson & Johnson (Oct. 15)

• UnitedHealth Group (Oct. 15)

• Netflix (Oct. 17)

• Taiwan Semiconductor Manufacturing (Oct. 17)

Monday, Oct. 14

• Federal Reserve. Fed Governor Christopher Waller speaks on the Economic Outlook in California.

• Elliott Hill becomes Nike president and chief executive, succeeding John Donahoe who retired yesterday.

• China: September trade balance figures.

Tuesday, Oct. 15

• Federal Reserve. Fed Governor Adriana Kugler delivers virtual remarks on Career Opportunities and Diversity in Economics. San Francisco Fed President Mary Daly scheduled to speak.

• Empire State Manufacturing

• Switzerland: World Trade Organization General Council meeting begins in Geneva, continuing until Wednesday, Oct. 16.

Wednesday, Oct. 16

• Import & Export Prices

Thursday, Oct. 17

• Federal Reserve. Chicago Fed President Austan Goolsbee scheduled to speak.

• IMF managing director Kristalina Georgieva gives a curtain raiser speech on the outlook for the global economy and policy priorities ahead of her organization’s 2024 annual meetings in Washington.

• Jobless Claims

• Philadelphia Fed Manufacturing

• Retail Sales

• Industrial Production

• Business Inventories

• Housing Market Index

• Fed Balance Sheet

• Money Supply

• EU: European Central Bank interest rate decision. Monetary policymakers are widely expected to reduce rates. Having previously not anticipated a cut until December, investors now view a quarter-point reduction to 3.25% as very likely. The expected October cut could usher in a series of faster and steeper reductions in borrowing costs to stop inflation from persistently undershooting its target, economists said. Financial markets are now pricing in that the ECB will lower rates to just 1.7% by the second half of next year. In September, annual inflation fell to 1.8%, putting it below the ECB’s 2% medium-term goal for the first time in more than three years.

Friday, Oct. 18

• Federal Reserve. Fed Governor Christopher Waller delivers remarks on Decentralized Finance at a conference in Vienna, Austria.

• Housing Starts

• China: Q3 GDP data

| KEY USDA & INTERNATIONAL AG & ENERGY REPORTS & EVENTS |

China’s first batch of trade figures for September, including soybean and edible oil imports, will be released Monday, while the International Grains Council’s monthly report comes Thursday.

In the energy sector, the International Energy Agency will publish its monthly oil market report on Tuesday, and its World Energy Outlook 2024 the following day. OPEC will issue its monthly report on Monday.

Monday, Oct. 14

Ag reports and events:

• U.S. holiday: Columbus Day. U.S. gov’t offices are closed while markets are open except for the bond market which will be closed for the holiday.

• China: September trade balance figures

• Holiday: U.S., Canada, Japan, Thailand

Energy reports and events:

• OPEC monthly oil market report

Tuesday, Oct. 15

Ag reports and events:

• Export Inspections

• Dairy Monthly Tables

• Season-Average Price Forecasts

• Feed Grains Database

• Wheat Data

• Crop Progress

• France agriculture ministry’s latest 2024 crop estimates

• EU weekly grain, oilseed import and export data

• Brazil’s Conab releases production, area and yield data for corn and soybeans

• Malaysia’s Oct. 1-15 palm oil exports

Energy reports and events:

• IEA Monthly Oil Market Report

• EU energy ministers meet

Wednesday, Oct. 16

Ag reports and events:

• World Coffee Innovation Summit, London, day 1

• FranceAgriMer monthly grains balance sheet

• Cotton and Wool Outlook Tables

• Oil Crops Outlook

• Feed Outlook

• Wheat Outlook

• Rice Outlook

• Turkey Hatchery

• Broiler Hatchery

Energy reports and events:

• API US inventory report

• Genscape weekly crude inventory report

• IEA World Energy Outlook 2024

• Angola preliminary program (December)

• Holiday: Myanmar

Thursday, Oct. 17

Ag reports and events:

• Feed Grains: Yearbook Tables

• IGC monthly grains market report

• World Coffee Innovation Summit, London, day 2

• European Cocoa Association’s third quarter grinding data

• Port of Rouen data on French grain exports

Energy reports and events:

• EIA Petroleum Status Report

• Weekly Ethanol Production

• EIA Natural Gas Report

• Singapore onshore oil product stockpile weekly data

• Rystad Energy Summit, London

• WTI November options expire

• Holiday: Taiwan, Myanmar, Israel

Friday, Oct. 18

Ag reports and events:

• CFTC Commitments of Traders report

• Export Sales

• Livestock, Dairy, and Poultry Outlook

• Sugar and Sweeteners Outlook

• Peanut Prices

• China’s 2nd batch of Sept. trade data, including agricultural imports

• Grains Industry of Western Australia monthly crop report

• China’s 3Q pork output and inventory

• FranceAgriMer’s weekly crop condition report

Energy reports and events:

• ICE weekly Commitments of Traders report for Brent, gasoil

• Baker-Hughes Rig Count

• Holiday: Argentina, Hong Kong, Myanmar

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |