News, markets, policy updates: July 11, 2024

| Today’s Digital Newspaper |

MARKET FOCUS

· Annual U.S. inflation rate reaches 3%, lowest since June 2023

· Annual core inflation rate slowed to 3.3%, lowest since April 2021

· Tom Essaye of The Sevens Report on the latest CPI report

· Wells Fargo on the June CPI report

· Atlanta Fed GDPNow estimate for Q2 growth jumped to 2.0% from 1.5%

· Apple climbed to a record high Wednesday

· Costco raising membership fee for first time since 2017

· CHS says earnings from grain and petroleum sectors fell by $100 million apiece

· Delta shares plummeted nearly 10% in premarket trading Thursday

· JPMorgan Chase, Citigroup, and Wells Fargo will report results Friday

· EIA reports bigger-than-expected draw in crude oil inventory

· OPEC keeps world oil demand forecasts steady for 2024 and 2025

· Ag markets today

· Corn price outlook… how low can futures go?

· Ag trade update

· Port of Houston returns to normal start times for operations at its eight public terminals

· NWS weather outlook

· Pro Farmer First Thing Today items

BALTIMORE BRIDGE COLLAPSE

· Senators debated whether gov’t should cover 90% or 100% of $1.7 billion cost

CONGRESS

· Dems remove SNAP food restriction pilot from USDA/FDA funding bill

· House GOP chairs seek agency reactions to SCOTUS Chevron deference decision

· Bipartisan senators announce deal to ban stock trading by lawmakers

· Thompson criticizes EPA regulations at House Ag hearing

ISRAEL/HAMAS CONFLICT

· Israeli military extends evacuation order to all of Gaza City

RUSSIA & UKRAINE

· Ukraine seizes cargo of ‘looted’ grain

CHINA

· NATO calls out China for supporting Russia

· China announces more regs to stabilize stock market

· China probes claims that cooking oil was hauled in unwashed fuel tankers

· Opinion: China goes whole hog in EU trade tussle over pork imports

TRADE POLICY

· Biden announces new tariffs on Chinese metals routed through Mexico

· Biden prods Mexico to better police evasion of tariffs

POLITICS & ELECTIONS

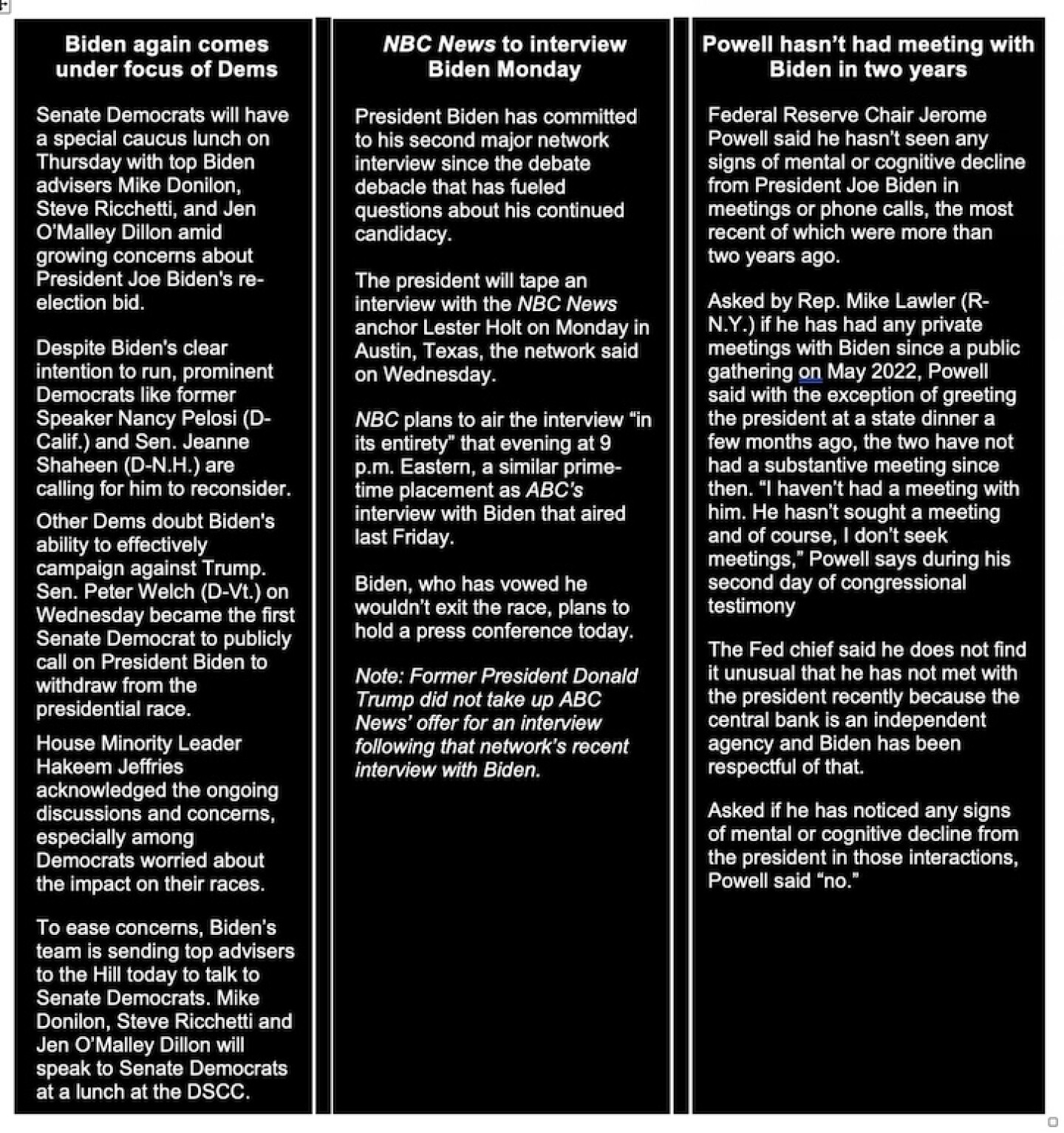

· Biden faces critical test today with unscripted news conference at NATO summit

· Vilsack has been a staunch defender of President Biden, and his policies

OTHER ITEMS OF NOTE

· Acting Labor Secretary affirms commitment to advancing rules and policies

| MARKET FOCUS |

| Note: Earlier this morning, we filed a Special Report (link) on “Perspective on Survey Response Rates for USDA’s NASS Reports. “ |

— Equities today: U.S. Dow opened slightly higher, went lower and is now back up slightly following a surge in value on Wednesday. Traders are focusing on a weaker-than-expected CPI report, which boosted expectations of a Federal Reserve rate cut in September. U.S. annual inflation fell to 3% in June, its lowest in a year, below the anticipated 3.1%. The monthly CPI decreased by 0.1% against a 0.1% increase prediction. Annual core inflation also dropped to 3.3%, the lowest since April 2021. Asian and European stock indexes were mostly firmer overnight. In Asia, Japan +0.9%. Hong Kong +2.1%. China +1.1%. India flat. In Europe, at midday, London +0.3%. Paris +0.4%. Frankfurt +0.2%.

U.S. equities yesterday: The Dow rose 429.39 points, 1.09%, at 39,721.36. The Nasdaq rallied 218.16 points, 1.18%, at 18.647.45 218.16. The S&P 500 increased 56.93 points, 1.02%, at 5,633.91, topping the 5,600 level for the first time ever and its 37th record this year.

— Apple climbed to a record high, and this week became the first stock to top a market capitalization of $3.5 trillion. Apple aims to ship at least 90 million iPhone 16s in the second half, counting on AI services to fuel demand. The company told suppliers and partners it’s targeting about 10% growth in shipments compared with earlier models.

— Costco is raising its membership fee for the first time since 2017. Starting in September, the new cost will be $65 a year for individuals and $130 for executive memberships, up from $60 and $120. The new fee will go into effect on Sept. 1 and will impact around 52 million members in the U.S. and Canada. Costco had warned back in May that a membership increase was coming. “It’s something that is still a case of when we increase the fee rather than if we increase the fee,” Costco Chief Financial Officer Gary Millerchip said.

— CHS, the largest U.S. agribusiness cooperative, said earnings from its grain and petroleum sectors fell by $100 million apiece during the third quarter of its fiscal year. Link for details.

— Delta shares plummeted nearly 10% in premarket trading Thursday after the airline’s third-quarter forecast fell short of analysts’ expectations. Despite predicting record revenue due to strong summer travel demand, Delta anticipates a 5%-6% increase in flying capacity compared to last year, below the 8% growth expected in the second quarter. While travel demand is at record levels, profits are hindered by rising industry costs. Delta’s reported earnings met expectations, with adjusted revenue at $15.41 billion, slightly under the $15.45 billion consensus estimate from LSEG.

— JPMorgan Chase, Citigroup, and Wells Fargo will report their results on Friday. Investors are watching for signs of banking system weakness after recent bank failures, the effects of prolonged high interest rates, and consumer financial strain. Key indicators include unrealized losses on balance sheets, commercial real estate losses, lending profits, and investment banking fees. For regional banks, the focus is on cash and liquid securities, as they are seen as vulnerable points in the U.S. banking system.

— Energy prices Wednesday: WTI traded up $0.69 0.85% to close at $82.10. Brent traded up $0.42 0.5% to close at $85.08.

— Ag markets today: Corn, soybeans and wheat posted corrective gains during the overnight session. As of 7:30 a.m. ET, corn futures were trading 3 to 5 cents higher, soybeans were 4 to 9 cents higher, winter wheat markets were 7 to 10 cents higher and spring wheat was a nickel higher. The U.S. dollar index was nearly 200 points lower, and front-month crude oil futures were modestly firmer.

Wholesale beef weakens. Wholesale beef prices declined for a second straight day on Wednesday, as Choice fell $1.61 to $324.05, and Select dropped 37 cents to $303.94. However, the price drop the past two days has triggered a combined load count of 286, signaling there’s still strong retailer demand under the market. Seasonally, beef prices weaken during summer, though there are indications retailers plan to keep actively featuring beef.

Cash hog index firms, futures’ discounts build. The CME lean hog index is up 24 cents to $88.67 as of July 9. July lean hog futures, which expire July 15 and are settled against the index July 17, finished Wednesday 22 cents below the index. August hogs extended their discount to the cash index to $3.995.

— Agriculture markets yesterday:

· Corn: December corn fell 1 1/4 cents to $4.07 1/4, a high-range close after reaching a fresh near-term low early on.

· Soy complex: August soybeans dropped 18 cents to $11.13 1/4, near the session low and hit a contract low. September soybean meal closed down $4.00 at $321.20, near the session low and also hit a contract low. September soybean oil closed down 65 points at 46.14 cents and near the session low.

· Wheat: December SRW wheat fell 10 1/2 cents to $5.85, marking a two-week low close, while December HRW wheat fell 12 1/2 cents to $5.83 3/4, a four-month low close. December HRS futures fell 6 3/4 cents to $6.29 1/2.

· Cotton: December cotton closed up 38 points at 70.93 cents and near mid-range. December futures prices hit a three-week low early on.

· Cattle: August live cattle futures slid 10 cents to $182.25, whereas August feeder futures tumbled $1.375 to $254.35.

· Hogs: August lean hog futures settled a tick above limit down, plunging $3.725 to $84.675, leading the hog complex lower.

— Quotes of note:

· Federal Reserve Chair Jerome Powell said he doesn’t need inflation below 2% before cutting rates. He added the labor market has cooled “pretty significantly.”

· Tom Essaye of The Sevens Report on the latest CPI report: “This gives the Fed that ‘good’ data on inflation, make a September rate cut nearly a 100% probability and continue to rally in stocks. We’d expect the grind higher to continue led by growth and defensive sectors, but all 11 sectors SPDRs should be positive on this news. The 10-year Treasury yield should fall hard, likely below 4.20% and to a multi-month low and that will boost stock prices. The Dollar Index should also drop below 105, perhaps for good this time while commodities (especially gold) should see strong rallies on the weaker dollar (gold might be the biggest winner).”

· Wells Fargo on the June CPI report: “This morning’s CPI report was arguably the most encouraging one the FOMC has received since it began its inflation fight nearly two and a half years ago. Consumer prices declined by 0.1%, led lower by a drop in energy prices and a modest increase in food prices. Excluding food and energy, the core CPI increased by just 0.1% (0.06% unrounded), which was the smallest increase since January 2021. We remain of the view that the FOMC will cut the federal funds rate by 25 bps at its September meeting and reduce the fed funds rate by another 25 bps in December.”

— In June 2024, the annual inflation rate in the U.S. decreased for the third consecutive month, reaching 3%, the lowest since June 2023. This was a drop from 3.3% in May and below the forecasted 3.1%. The Consumer Price Index (CPI) also unexpectedly fell by 0.1% from the previous month, contrary to expectations of a 0.1% rise, following a flat reading in May. A significant factor in this decline was a 3.8% drop in the gasoline index, which followed a 3.6% decline in May, counteracting the increase in shelter costs.

Additionally, the annual core inflation rate, which excludes volatile items like food and energy, slowed to 3.3%, the lowest since April 2021, down from 3.4% in May and below the forecast that it would remain steady. The monthly core inflation rate also decreased to 0.1% from 0.2%, against the expectation of it staying at 0.2%.

Impacts: This may be the final “push” Fed officials need to start cutting interest rates as early as September, according to Citi’s chief economist Andrew Hollenhorst. The yield on the U.S. 10-year Treasury note slumped 10bps to the 4.20% mark on Thursday, its lowest in over three months, after the softer inflation consolidated expectations of a rate cut by the Federal Reserve this quarter. The data backed investors’ bets that disinflation may sustain its trend toward the U.S. central bank’s target of 2%, driving 85% of the market to position for a Fed rate cut in September, 10 percentage points higher than last session. The result strengthened the backdrop required for the Fed to start lowering borrowing costs following downward revisions to non-farm payrolls in the U.S. economy, underscoring a softening labor market.

— Federal Reserve Chair Jerome Powell stated that while inflation is receding, he is not yet confident it is sustainably moving towards the Fed’s 2% goal. During his second day of testimony, Powell noted “modest further progress” in recent price readings but emphasized the need for more data before feeling assured. He also highlighted balanced risks in policy decisions, with concerns about both inflation and unemployment.

Powell’s comments suggest the Federal Open Market Committee is unlikely to cut rates at the July 30-31 meeting. The Fed has maintained its policy rate at a two-decade high of 5.25% to 5.5% for nearly a year.

Powell also discussed ongoing efforts to trim the Fed’s balance sheet, with $1.7 trillion reduced so far, and plans to continue offloading holdings cautiously to avoid market disruptions.

Regarding bank regulations, Powell mentioned that the Fed and other agencies are close to revising their plan for big banks to hold more capital. This proposal is under discussion and will be issued soon, with some parts not republished for comment.

Markets are watching for signals on potential rate cuts at the Sept. 17-18 FOMC meeting, especially given recent unemployment rate increases and political pressure. The Fed’s preferred inflation measure rose 2.6% in the 12 months through May, down from 7.1% in June 2022, while unemployment has edged up to 4.1% over the last three months.

— The Atlanta Fed GDPNow estimate for Q2 growth jumped to 2.0% from 1.5%, following recent data releases. This rise marks a positive shift after a series of declines, driven by stronger personal consumption and private domestic investment growth. This increase to 2.0% breaks a pattern of declining estimates seen in recent updates. For instance, on June 3, the estimate had decreased to 1.8% from 2.7% on May 3. GDPNow is a model-based projection and not an official forecast. It doesn’t capture subjective adjustments or anticipate impacts beyond the standard internal dynamics of the model.

Market perspectives:

— Outside markets: The U.S. dollar index was weaker, with the euro and British pound higher against the greenback. The yield on the 10-year U.S. Treasury note was little changed, trading around 4.29%, with a mixed-to-positive tone in global government bond yields. Crude oil futures were little changed, with U.S. crude around $82.05 per barrel and Brent around $85.12 per barrel. Gold and silver futures were higher, with gold around $2,387 per troy ounce and silver around $31.21 per troy ounce.

— The EIA reported a bigger-than-expected draw in crude oil inventory, with a drop of 3.443 million barrels versus an estimate of 1.333 million. Gasoline inventory also saw a significant draw, while distillates posted a larger-than-expected build. Crude production increased slightly to 13.3 million barrels per day.

— OPEC kept its world oil demand forecasts steady for 2024 and 2025, with growth expected at 2.25 million barrels per day in 2024 and 1.85 million barrels per day in 2025. Meanwhile, Russian production and OPEC’s own production both decreased in June.

— The Port of Houston has returned to normal start times for operations at its eight public terminals. Refineries and offshore production facilities saw limited storm damage and have largely returned to normal operations, easing concerns of a supply disruption.

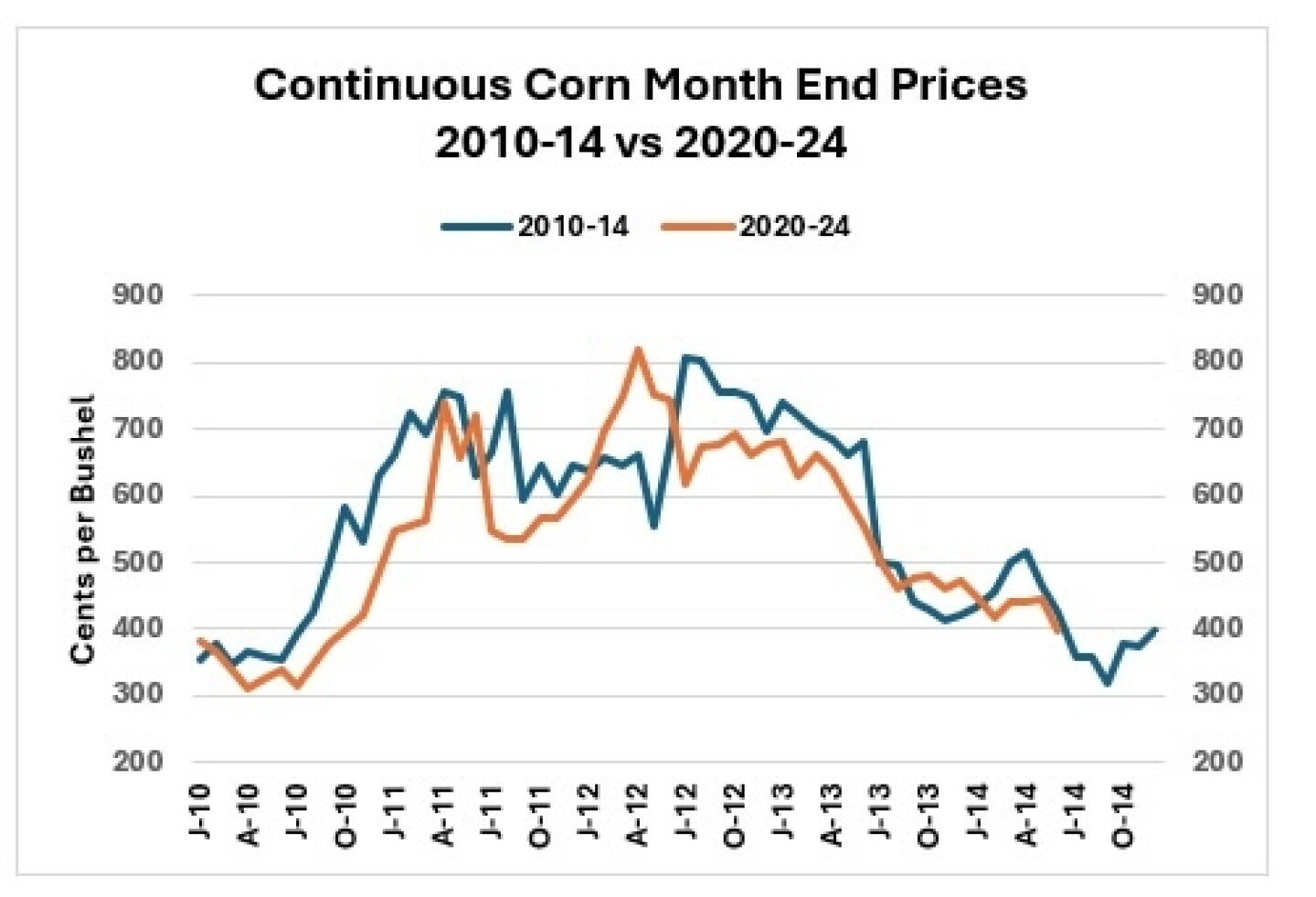

— A growing number of ag industry analysts are lowering their corn price forecasts, with lows for futures reaching $3.50 to $3.75 depending on yield. Some say the most important factor is all the corn stocks being held by farmers. Others say any average corn yield above 180 bushels will tank prices. Note the following chart, with the biggest difference being difference funds are record short now... they were long in 2014.

— Ag trade update: Japan purchased 107,330 MT of milling wheat, including 50,440 MT U.S., 27,540 MT Canadian and 29,350 MT Australian. South Korea tendered to buy up to 140,000 MT of corn to be sourced from South America or South Africa and up to 70,000 MT of optional origin feed wheat, but passed on another tender to buy up to 68,000 MT of corn.

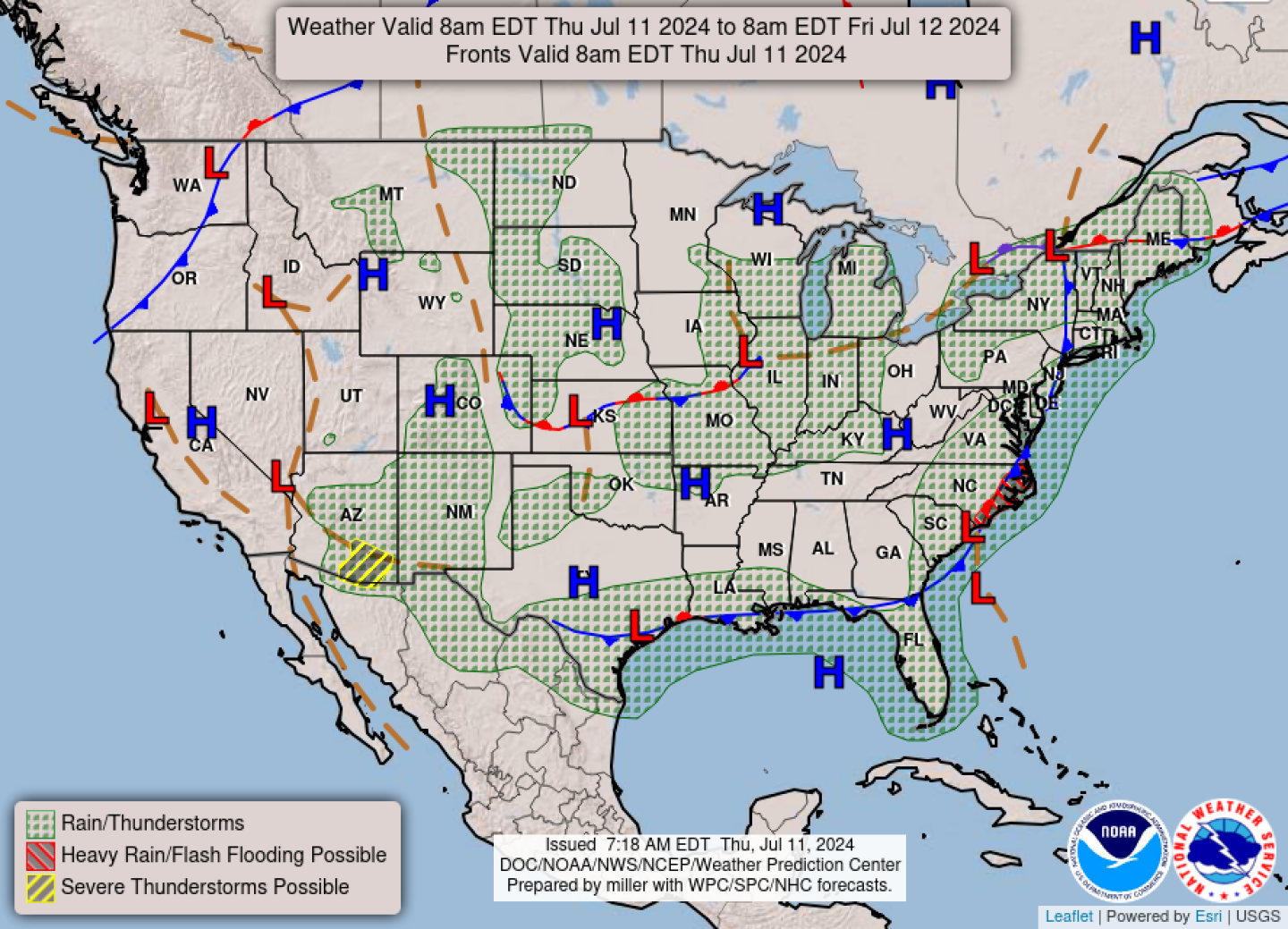

— NWS weather outlook: Stalled surface front to cause scattered Flash Flooding across portions of the Mid-Atlantic through Friday... ...Dangerous heat and record high temperatures to continue for much of the West through the end of the work week.

Items in Pro Farmer’s First Thing Today include:

• Corrective buying in grains overnight

• Strategie Grains raises EU wheat production forecast

• UK economic growth builds in May

| BALTIMORE BRIDGE COLLAPSE |

— Senators debated whether the federal gov’t should cover 90% or 100% of the $1.7 billion cost to replace Baltimore’s Key Bridge, which collapsed in March. President Biden and Maryland lawmakers advocate for full federal funding, citing past disaster precedents.. The Biden administration has requested $4 billion in emergency disaster relief funding, which includes $3.1 billion for rebuilding highways and roads damaged by disasters, such as the Key Bridge.

Sen. Shelley Moore Capito (R-W.Va.) opposed full funding, highlighting existing financial shortfalls and Maryland’s revenue from bridge tolls, which amounted to $56 million in fiscal year 2023. Maryland’s Transportation Secretary argued the state needs toll funds for operations and maintenance, especially with toll revenue loss during bridge reconstruction. Federal officials and lawmakers also discussed broader infrastructure concerns and potential reimbursements from insurance and third-party claims.

| CONGRESS |

— Democrats remove SNAP food restriction pilot from USDA/FDA funding bill. On Wednesday, the House Appropriations Committee saw minority-party Democrats successfully remove a pilot project from the annual USDA/FDA funding bill that aimed to restrict SNAP recipients from purchasing “unhealthy foods.” The pilot project, proposed by Rep. Andy Harris (R-Md.) was criticized by Democrats as being both paternalistic and impractical.

The pilot project, known as the SNAP Choice pilot program, intended to block SNAP recipients from buying unhealthy foods in a five-state, three-year trial. Democrats argued against it, highlighting the impracticality and the undue burden it would place on recipients and grocers. Rep. Adriano Espaillat (D-N.Y.) criticized the project, referencing the minimal daily per person SNAP benefit of $6. The amendment to remove the project was passed by a voice vote, led by Rep. Sanford Bishop (D-Ga.).

Democrats, including Rep. Rosa DeLauro (D-Conn.), argued that the pilot project imposed unnecessary restrictions and inserted the government into personal choices at the checkout line. Rep. Bishop and DeLauro emphasized opposition from grocers and the impractical nature of the restrictions.

Rep. Harris defended the pilot, citing its potential to promote healthier eating habits and reduce obesity-related medical costs, which are estimated at $644 million annually. He noted opposition from major soft drink and snack food companies.

The USDA/FDA bill totals $210 billion, with $6.75 billion allocated for the FDA and $345 million for the Commodity Futures Trading Commission. The bill passed the committee on a 29-26 party-line vote after three and a half hours of debate.

Key provisions include:

• Blocking USDA enforcement of livestock marketing regulations.

• Cutting $619 million from the Food for Peace program.

• Increasing scrutiny on foreign purchases of agricultural land and businesses, especially by nationals from China, Russia, Iran, and North Korea.

Riders included in the bill:

• Overriding USDA regulations on milk allowances in the WIC program.

• Blocking USDA from implementing President Biden’s executive order on racial equity.

• Delaying FDA actions on sodium reduction in food.

• Directing FDA to prioritize cracking down on vaping products over banning menthol cigarettes or setting nicotine limits for cigarettes.

Of note: This morning, Senate appropriators will mark up and likely advance their $27 billion version of the Agriculture/FDA funding bill.

— House GOP chairs seek agency, including USDA, reactions to Supreme Court’s Chevron deference decision. House Republican committee chairs will send letters to agency heads, including USDA Secretary Tom Vilsack, seeking their reactions to the Supreme Court’s recent decision in Loper Bright Enterprises v. Raimondo, which overturned the Chevron doctrine. This ruling, issued on June 28, 2024, overturned the long-standing Chevron doctrine, which had previously granted deference to federal agencies in interpreting ambiguous statutes when writing regulations. House Majority Leader Steve Scalise (R-La.) emphasized the importance of checking federal agencies’ power and holding them accountable. He noted that the Supreme Court’s ruling restores the constitutional separation of powers, preventing agencies from expanding their authority unchecked.

Specifically, the committee chairs requested:

• Lists of existing regulations that were challenged in court and upheld based on Chevron deference.

• Pending rules that could have been defended using Chevron deference.

• Rules that could have a significant annual effect on the economy, consumer costs, or employment.

This move by House Republicans is seen as an attempt to provide a roadmap for potential legal challenges to agency regulations considering the Supreme Court’s decision.

For USDA, this ruling could impact ongoing efforts to reform the Packers and Stockyards Act. Vilsack had been pushing for tighter enforcement of this 103-year-old act through a series of rules aimed at fairness and market competition. These proposed rules, including changes to poultry grower payment systems and clarifications on “unfair” practices in livestock and poultry markets, may now face greater scrutiny and potential legal challenges.

The letter to Vilsack is signed by House Ag Committee Chairman Glenn “GT” Thompson, House Education & the Workforce Committee Chairwoman Virginia Foxx, and House Oversight and Accountability Chairman James Comer.

— Bipartisan senators announce deal to ban stock trading by lawmakers. A bipartisan group of senators, including Gary Peters (D-Mich.), Jeff Merkley (D-Ore.), Josh Hawley (R-Mo.), and Jon Ossoff (D-Ga.), announced an agreement on Wednesday to ban members of Congress from buying and selling stocks. The Senate Homeland Security and Governmental Affairs Committee will mark up the legislation on July 24.

The deal aims to prevent lawmakers from leveraging their positions for personal financial gain. It bans members of Congress from buying individual stocks immediately and prohibits selling them 90 days after the bill’s enactment. Spouses and dependent children will also be banned from trading stocks starting in March 2027, the same date the president and the vice president would be required to divest from specified investments. However, the legislation permits holding and managing ETFs and mutual funds.

Violations of the law would incur penalties equivalent to the officials’ monthly salary or 10% of the value of the traded asset, whichever is higher.

Hawley, the only GOP co-sponsor, highlighted bipartisan support for the bill, criticizing Capitol Hill leadership for previously stalling votes on the issue. Some Republicans, including freshmen senators, have shown support for banning congressional stock trades. Critics of the bill argue that the existing STOCK Act, which criminalizes insider trading by Congress members, is sufficient.

Of note: Efforts to pass similar legislation have faced obstacles in the past.

— Thompson criticizes EPA regulations at House Ag hearing. At a House Agriculture Committee hearing titled “Consequences of EPA’s Actions on American Agriculture,” Rep. GT Thompson (R-Pa.) criticized the Biden administration for imposing regulations that he claims punish farmers and ranchers. Thompson expressed frustration with the EPA’s approach and mentioned that EPA Administrator Michael Regan had testified before the committee in April, the first such appearance since 2016. Thompson had invited Regan to testify again, but the administration deemed it unprecedented for him to appear twice in 14 months.

Rep. David Scott (D-Ga.), the committee’s ranking member, defended the EPA, highlighting efforts to incorporate farmers into its decision-making processes. Witnesses acknowledged the EPA’s attempts to engage with the agricultural community but stressed the need for further improvements.

Witnesses: Jeff Kippley from the National Farmers Union, Chris Chinn from the Missouri Agriculture Department, Gary Cooper from the National Pork Producers Council, and Rebecca Larson from the Western Sugar Cooperative all shared their perspectives. They commended the creation of the EPA’s Office of Agriculture and Rural Affairs but voiced concerns over specific regulations and their impact on agriculture.

| ISRAEL/HAMAS CONFLICT |

— Israeli military extended its evacuation order to all of Gaza City, causing tens of thousands of Palestinians to flee. This new directive exacerbates the situation for more than 250,000 residents already displaced since Sunday, according to a UN office. Concurrently, the Biden administration has resumed the shipment of 500-pound bombs to Israel, which had been paused over two months ago due to concerns about their use in the Rafah operation. The shipment of larger 2,000-pound bombs remains on hold.

| RUSSIA/UKRAINE |

— Ukraine seizes cargo of ‘looted’ grain. Ukraine seized a foreign cargo ship in the Black Sea off its Odesa region and detained the captain on suspicion of helping Moscow export Ukrainian grain from Russian-occupied Crimea, the Security Service of Ukraine (SBU) said. The vessel, which it did not identify, was travelling under the flag of a central African country and repeatedly docked at the Crimean Sea port of Sevastopol to pick up “looted” agricultural products in 2023-24, SBU said. SBU said the captain and 12 crew members helped Russia export Ukrainian grain taken from the occupied south to the Middle East for sale on behalf of Russia.

| CHINA UPDATE |

— NATO calls out China for supporting Russia. NATO issued a declaration on Wednesday night calling out China’s military support for Russia in Ukraine. The declaration described China as a “decisive enabler” of Russia’s war against Ukraine.

China on Thursday criticized the claim, saying it “comes with malicious intent.” China’s foreign ministry urged NATO to “take concrete action to de-escalate rather than shift blame” in the situation. Chinese foreign ministry spokesperson Lin Jian said Beijing had lodged representations with NATO over the accusations, which he called “biased, slanderous, and provocative” and dismissed the alliance as “a relic of the cold war.” Lin added that China’s “constructive role” on the war in Ukraine was “widely recognized by the international community.” In an earlier statement, China’s mission to the EU said Beijing had never provided lethal weapons to either side, adding that its “normal trade flows” with Russia should not be subject to disruption or coercion. “Without any evidence, NATO continues to spread falsehoods fabricated by the U.S., openly smearing China, sowing discord between China and Europe, and undermining China/European co-operation,” Lin said.

— China announces more regs to stabilize stock market. The China Securities Regulatory Commission (CSRC) announced more regulations to stabilize its flagging stock market. CSRC said securities re-lending, in which brokers borrow shares for clients to short sell, would be suspended. In addition, margin requirements would be raised for short-sellers. CSRC also urged stock exchanges to publish detailed rules to regulate program trading, especially high-frequency trading. China has taken a series of measures to discourage short-selling since last August, and the latest moves are “in response to investor concerns, and aimed at stabilizing the market,” CSRC said.

— China probes claims that cooking oil was hauled in unwashed fuel tankers. We have covered this for several weeks, but the New York Times (link) and Financial Times (link) have discovered the issue. Caixin has also covered the topic (link).

— Opinion: China goes whole hog in EU trade tussle over pork imports. The Chinese Commerce Ministry’s investigation into pork imports from the European Union is a calculated message from Beijing to Brussels: Protectionist measures will have far-reaching consequences. Link to Nikkei Asia item.

| TRADE POLICY |

— President Biden announced new tariffs on Chinese metals routed through Mexico, a move aimed at closing a trade loophole and protecting American industries. Mexico, which recently increased its own tariffs on steel and aluminum from certain countries, will require importers to provide more information about where their steel products come from, the announcement said. The changes will take effect immediately. Key details:

New tariff measures. The Biden administration has implemented the following tariffs:

• A 25% tariff on Mexican steel that undergoes melting or pouring processes outside of North America before reaching its final form.

• A 10% tariff on Mexican aluminum entering the U.S. if it includes material that has been smelted or cast in China, Belarus, Iran, or Russia.

These measures are part of an agreement between the U.S. and Mexico under section 232 of the Trade Expansion Act, which pertains to imports that could potentially threaten U.S. national security.

Objectives and rationale. The primary goals of these new tariffs are:

• Preventing tariff circumvention: The measures aim to stop China from evading existing U.S. tariffs by channeling its metals through Mexico.

• Protecting domestic industries: The administration seeks to safeguard American steel and aluminum factories, particularly those that have benefited from recent public investments.

• Strengthening North American supply chains: The initiative is part of a broader effort to fortify steel and aluminum supply chains within North America.

Collaborative efforts with Mexico. The U.S. and Mexico are working together to address this issue:

• Mexico has agreed to enhance its scrutiny of steel product imports to determine their origin.

• Importers will be required to provide more detailed information about the origins of their steel products.

• Mexico has recently raised its own tariffs on steel and aluminum from specific countries.

• The U.S. will separately continue discussions with Mexico about more general surges in imports of steel from the country, officials said.

Impact and scope. While the immediate financial impact may be relatively modest, the measures are forward-looking:

• In 2023, only about 13% of total steel imports from Mexico originated elsewhere.

• The U.S. imported 3.8 million tons of steel from Mexico last year, with 13% having been poured or melted outside that country.

• For aluminum, the U.S. imported 105,000 metric tons from Mexico, with only 6% smelted or cast outside the country.

Response. Kevin Dempsey, the president of the American Iron and Steel Institute, which represents metal makers, welcomed the action, and called for vigorous enforcement of the rule. “We urge the U.S. government to continue to press for additional actions to address the many schemes by steel traders to circumvent and evade U.S. trade laws,” he said.

Michael Stumo, the chief executive of the Coalition for a Prosperous America, which represents domestic manufacturers, said the tariffs didn’t go far enough to address rising imports of metals from Mexico, which the countries had agreed to limit as part of a 2019 deal. “Today’s announcement shows that White House foreign policy bureaucrats that negotiated this deal care more about Mexico than about American workers,” Stumo said.

— Biden prods Mexico to better police evasion of tariffs. The U.S. government pushed the trade partner to boost monitoring of whether metals are coming from China as domestic companies have complained about pressure from lower-cost goods. Link to more via the Wall Street Journal.

| POLITICS & ELECTIONS |

— President Joe Biden faces a critical test today with an unscripted news conference at the NATO summit in Washington, DC. This follows a poor debate performance that has raised concerns about his mental fitness for another term among voters and some Democratic donors. Actor George Clooney, a major supporter and donor, publicly called for Biden to withdraw from the race, stating in a New York Times opinion piece (link) that the party won’t win in November with Biden as the candidate. Clooney also mentioned that some lawmakers privately agree and believe the country should consider other potential candidates.

— Vilsack has been a staunch defender of President Biden, and his policies. In a recent statement, Vilsack cited Biden’s record on job creation as evidence of his competence. Vilsack has been actively promoting the Biden administration’s efforts to support farmers, particularly small and historically underserved farmers. He has highlighted the administration’s initiatives to address long-standing discrimination and provide financial assistance to these groups.

Vilsack has praised the Biden administration’s support for the biofuel industry, stating that “no administration in my 30 years of dealing with this issue, no administration, has been more supportive of the biofuel industry than the Biden-Harris administration.” He has pointed to policies such as approving summer sales of higher ethanol blends and setting higher biofuel mandates.

At a Western Governors’ Association meeting, Vilsack defended the Biden administration’s efforts to fight climate change, including initiatives to reduce methane output from cattle.

Vilsack has been a key figure in promoting Biden’s $5 billion investment plan for rural America. He accompanied Biden on a tour to highlight these investments, emphasizing their importance for rural communities.

Vilsack has addressed criticisms of the administration’s agricultural policies, particularly from small farmers who feel the changes aren’t aggressive enough. He has emphasized that the Biden administration “has done more than any previous administration in terms of trying to provide opportunity” for small and medium-sized farms.

As Secretary of Agriculture, Vilsack has been instrumental in implementing Biden’s agricultural agenda, including efforts to transform the food system, address climate change, and promote equity in farming.

| OTHER ITEMS OF NOTE |

— Acting Labor Secretary Julie Su affirmed the U.S. Labor Department’s commitment to advancing rules and policies despite the Supreme Court’s recent decision in Loper Bright Enterprises v. Raimondo, which ended the Chevron deference doctrine. Su expressed concern over recent Supreme Court rulings that have restricted workers’ rights and government intervention but maintained confidence in the legality of the department’s regulations. Su emphasized that the department’s rules, which include expanding overtime pay eligibility and updating worker classification tests, are within legal authority and crucial for saving lives and creating opportunities. Her remarks followed a tour of a training center in Philadelphia, where she and Deputy Treasury Secretary Wally Adeyemo discussed new rules under the Inflation Reduction Act.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |