News/Markets/Policy Updates: Dec. 10, 2024

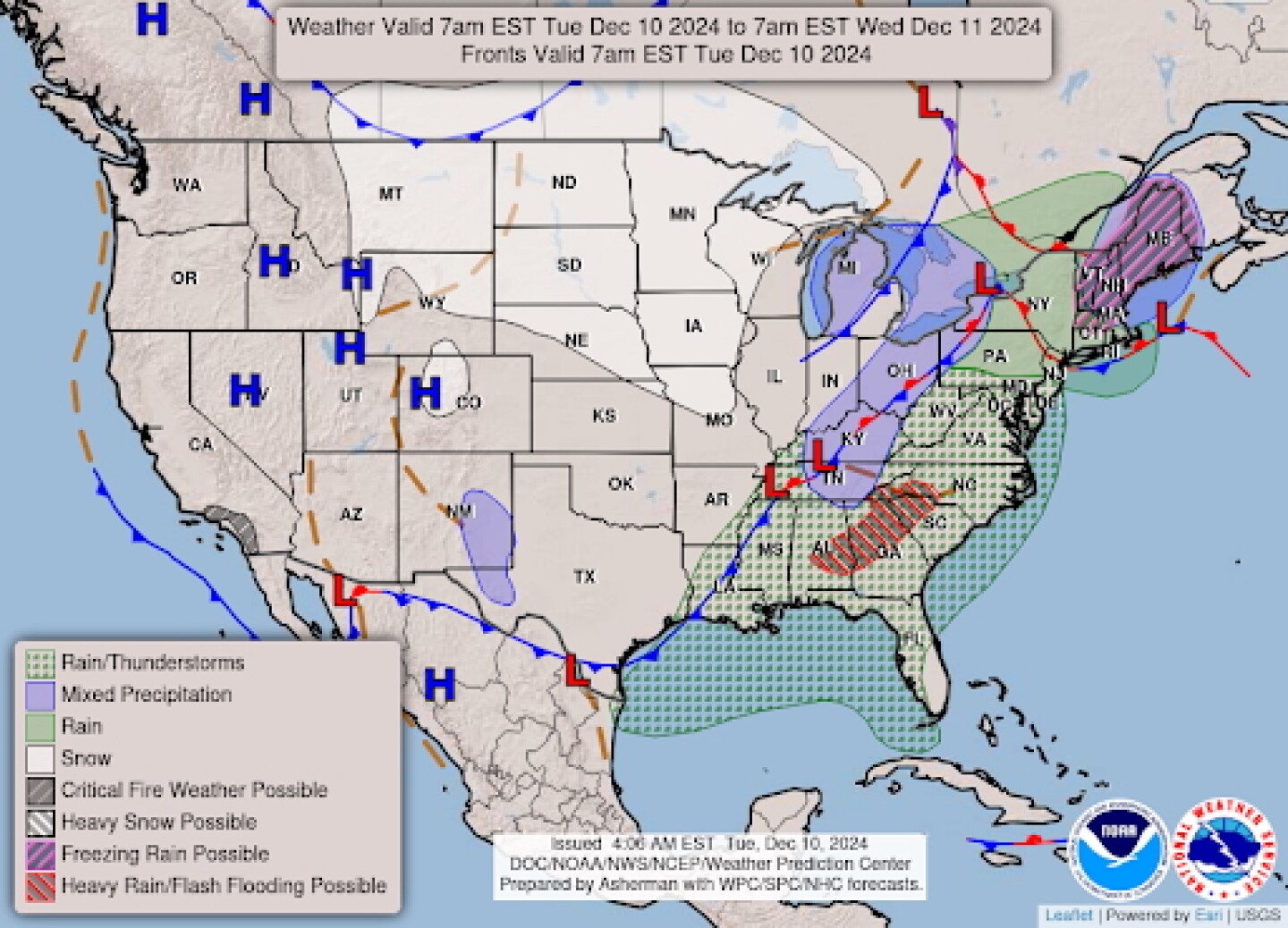

Note: Modified report today as I recently spoke to rice growers in Little Rock, Ark., and am en route to Kansas City to speak at a National Grain & Feed Assn. event. — Time near for must-have decisions on must-have issues. The House must act this week on a continuing resolution (CR) expected to go into March. The four top appropriators need to reach a consensus on production loss for as disaster aid. The four ag committee leaders need a consensus on economic and farm bill baseline/safety net boost via extension of the 2018 Farm Bill. They are running out of time. They will get something done. But if they act faster, they could do better for producers, sources advise. The next layer is congressional leadership approval. That too takes time, so farm-state lawmakers need to hustle to build buy in. But currently there is no consensus, and the situation is very fluid. Outlook: A disaster aid package is widely expected. Most sources do not think there will be agreement on boosting reference prices via a 2018 Farm Bill extension. Reason: costs. Sources do think some economic aid will be cleared but the dollar level is murky… some say it could total up to $9 billion. That would be a cutback from levels via a bill introduced by Rep. Trent Kelly (R-Miss.). — USDA advances rule on climate-smart agriculture for biofuels. USDA has submitted an interim final rule (link) to the Office of Management and Budget (OMB) concerning technical guidelines for climate-smart agricultural practices for biofuel feedstocks. Based on earlier public feedback, the rule aims to establish voluntary standards for quantifying and verifying greenhouse gas (GHG) reductions in crops like corn, soybeans, and winter oilseeds. It aligns with the Biden administration’s Clean Fuel Production Credit (45Z) initiative, targeting sustainable practices such as no-till farming, cover crops, and improved nitrogen management. The standards may support U.S. clean fuel policies and emerging environmental service markets under the 2008 Farm Bill authority. In the RFI, USDA said it considers corn, soybeans, sorghum, and spring canola as “the dominant biofuel feedstock crops” and is “considering winter oilseed crops (brassica carinata, camelina, pennycress, and winter canola)” and sought feedback on whether biofuel feedstocks exist that should be analyzed as part of the effort, including crops, crop residues, and biomaterials. — USDA launches specialty crop assistance program. USDA opened applications for the Marketing Assistance for Specialty Crops (MASC) program, aimed at expanding domestic markets or developing new ones for specialty crops. Backed by $2 billion from the Commodity Credit Corporation, applications are open through Jan. 8, 2025.Key details: • Payment limit: $125,000 per producer. Payments will follow a tiered model, with smaller-scale producers receiving higher payment factors. If demand exceeds funding, payments will be prorated. — Hershey’s stock experienced a notable surge following reports that Mondelez International, the maker of Oreo and Cadbury, is considering a merger with the company. The potential deal could create one of the largest candy companies globally, driving investor optimism and heightened market activity around Hershey. — China pledges economic revival and sparks market rally. Chinese stock markets surged on Tuesday following a commitment from the country’s leaders to implement stronger measures to rejuvenate the economy. On Monday, Communist Party officials announced plans to adopt a “more proactive” fiscal policy and boost consumption “forcefully.” Bond yields hit record lows as the monetary-policy stance shifted from “prudent” to “moderately loose.” — China’s November 2024 export slowdown reflects trade tensions. China’s export growth decelerated to 6.7% year-on-year in November 2024, falling short of the 8.5% market forecast and sharply below October’s 12.7% surge. Despite this slowdown, November marked the eighth consecutive month of expansion, with exports reaching a 26-month high of $312.31 billion. Growth was driven by manufacturers front-loading orders ahead of potential tariffs, particularly under the second Trump administration. Export highlights: China’s year-to-date exports expanded 5.4%, totaling $3.24 trillion, led by gains in aluminum (15.9%) and mechanical/electrical products (7.0%). Regional growth was strong, with exports to Hong Kong up 33.1% and ASEAN rising 12.9%, underscoring China’s focus on regional partnerships amidst global trade uncertainties. With the U.S., China’s exports are on track to exceed last year’s level and the trade surplus was $327 billion, a figure likely to grow further as importers boost inventories ahead of threated Trump tariffs. Of note: Adding to the urgency for importers to book Chinese shipments now, U.S. dockworkers who handle cargo at East and Gulf Coast ports are threatening to strike Jan. 15 — a work stoppage that would disrupt trade five days before Trump’s inauguration. — Hegseth’s nomination for Defense secretary gains momentum amid GOP shifts. Pete Hegseth’s nomination to lead the Defense Department has seen a shift in momentum, with GOP support stabilizing after a turbulent rollout. Despite unresolved allegations of sexual assault, alcohol abuse, and financial misconduct, prominent critic Sen. Joni Ernst (R-Iowa) has softened her opposition, signaling a potential path forward. Hegseth continues meeting with key senators, including Sens. Susan Collins (R-Maine) and Lisa Murkowski (R-Alaska), while facing intense scrutiny ahead of public hearings. Backed by President-elect Donald Trump, Hegseth has remained steadfast, countering accusations as politically motivated attacks. The confirmation remains uncertain, with Senate Republicans working to prevent further opposition while Democrats prepare to challenge his suitability. — Key Democratic candidate forums in House committees. The New Democrat Coalition is hosting candidate forums during their lunch today for the contested ranking member positions on the House Oversight, Agriculture, and Natural Resources Committees. Separately, the Congressional Black Caucus (CBC) plans to hold a forum on Wednesday for Agriculture Committee candidates. A critical point of interest will be whether embattled Agriculture Committee ranking member David Scott (D-Ga.) participates. He is being challenged by Reps. Jim Costa (D-Calif.) and Angie Craig (D-Minn.). The CBC’s approach to this situation is noteworthy because in previous years, the CBC has backed Scott as the top Ag panel Democrat. However, this time, the CBC has not issued a statement of support for Scott, indicating a potential shift in their stance. — In his first year as Argentina’s president, Javier Milei has significantly reduced inflation from 25% to below 3% and cut the budget deficit through strict austerity measures, which have pushed poverty rates above 50%. Despite these challenges, Milei remains popular, aided by improved investor confidence and softened rhetoric toward key trading partners. However, looming challenges include a potential economic recession and the expiration of his sweeping executive powers in June, which could destabilize progress. — Ivy league grad charged in UnitedHealthcare CEO murder. Manhattan prosecutors have charged Luigi Mangione, 26, with murder and other offenses in the killing of UnitedHealthcare CEO Brian Thompson. The high-profile crime spurred a nationwide manhunt and spiked online criticism of the insurance industry. Mangione, an Ivy League graduate from a prominent Baltimore real estate family, was arrested in Altoona, Pa., where he also faces gun and fake ID charges. When questioned by police, Mangione reportedly became silent and visibly shaken. Social media activity linked to Mangione shows an interest in tech, AI, and health topics, along with a Goodreads review of the Unabomber’s manifesto. Friends noted Mangione had been reclusive in recent months, reportedly due to chronic back pain. — NWS outlook: Widespread heavy rain threat emerging across the central to eastern Gulf Coast region today will spread rapidly up the entire East Coast on Wednesday... ...Active Lake effect snows to begin Wednesday and continue throughThursday downwind of the Lakes... ...Record warm morning lows likely along the east coast Wednesday morning... ...Arctic air to surge south into the Northern Plains/Upper Mississippi Valley region late Tuesday into Wednesday... ...Santa Ana winds along with critical to extreme fire weather danger across portions of southern California. |