News/Markets/Policy Updates: Oct. 2, 2024

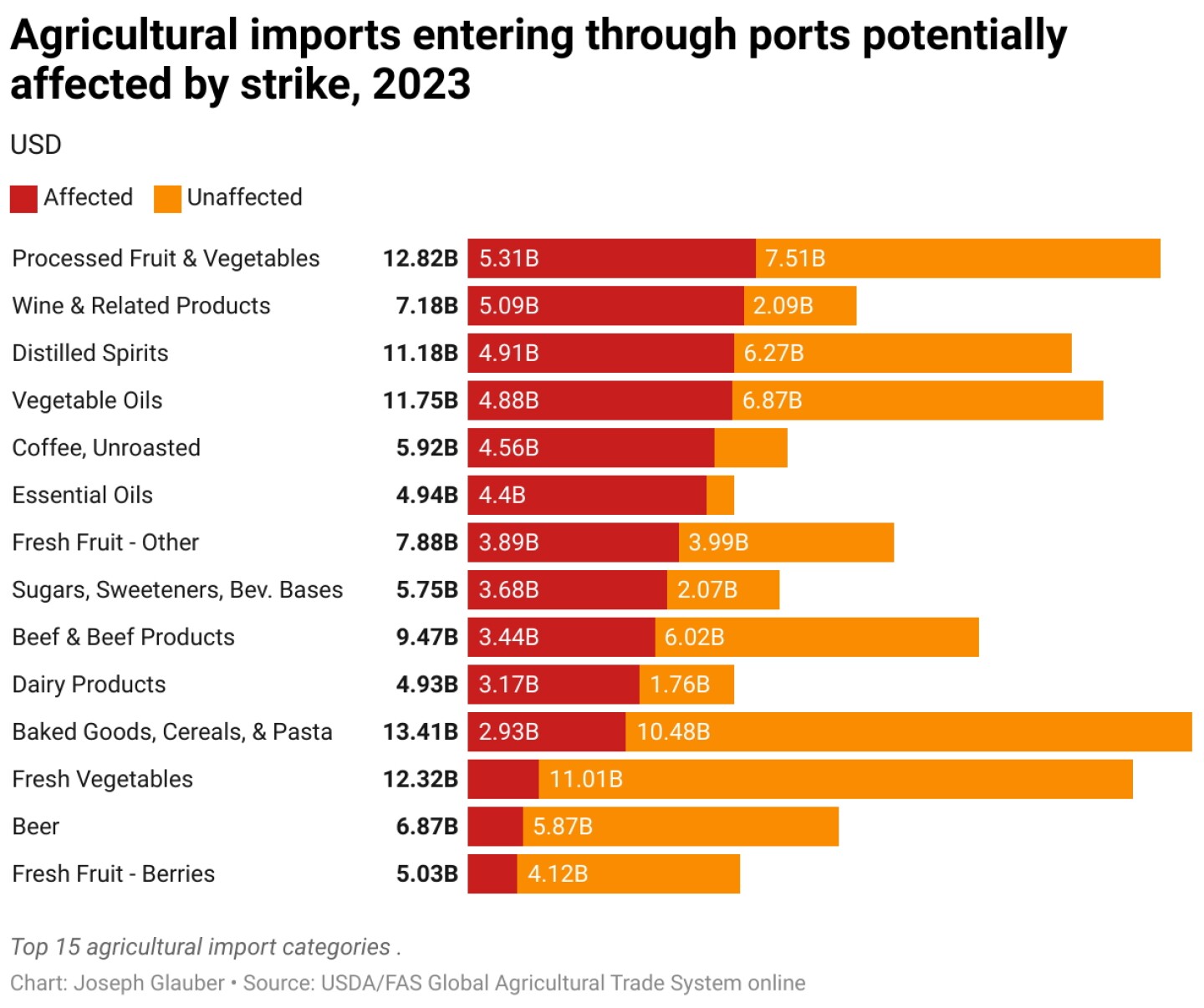

— The vice-presidential debate between Tim Walz and JD Vance was civil compared to previous presidential debates, with both candidates finding some common ground while still highlighting key policy differences. Analysts say the debate is unlikely to change the trajectory of the presidential race. The Wall Street Journal in a commentary said Vance was “respectful, well prepared, articulate, and relentless in reminding voters about the flaws of what he called ‘the Kamala Harris Administration.’ This is a case Donald Trump was unable to make in his debate, or for that matter anywhere in the weeks since President Biden left the race.” The newspaper said, “on presence and command, Mr. Vance won the debate going away.” Overall tone Israel and Iran Immigration and border security Climate change Economy and housing Trade policy Tax policy Abortion Controversial moments Personal exchanges CBS moderators — Port of Long Beach ready to absorb cargo amid East and Gulf Coast strikes. The Port of Long Beach, the second-busiest maritime trade hub in the U.S., is prepared to handle more cargo diverted from the East and Gulf Coast ports, where dockworkers are on strike for the second day. Currently operating at 70% capacity, the port is in a strong position to manage any surge in shipments, according to CEO Mario Cordero. As of Wednesday, 28 container ships were anchored outside the major Atlantic ports and Houston, with many more en route from Asia and Europe. Asked by Bloomberg for his advice to the Biden administration about whether or not Washington should intervene to stop the strike, Cordero said stakeholders in the dispute are in a “wait-and-see” mode and there’s optimism for a resolution quickly without government involvement. — Fears about major supply chain disruptions and product shortages may be overblown, since many companies stocked up in anticipation of a potential strike. Automobile industry inventories have recovered in the past year, making significant supply shortages and inflation shock unlikely. Bananas, nearly all imported from overseas, could see the biggest impact. About three quarters of all bananas consumed in the U.S. come through the ports on strike, the American Farm Bureau said. Port Wilmington in Delaware is the top U.S. hub for banana imports via Dole and Chiquita. — U.S. longshoreman strike and its implications for agricultural trade. Joe Glauber, former top USDA economist and now a Senior Research Fellow with IFPRI’s Markets, Trade, and Institutions Unit, has a blog out on the impacts of the U.S. longshoreman stroke on ag trade (link). — White House urges resolution of dockworkers strike, avoids intervention amid mounting pressure. The White House is urging striking dockworkers and business owners to return to negotiations to resolve a massive strike that could disrupt the economy just weeks before the election. Despite increasing pressure from business groups, President Biden, who identifies as pro-union, has refused to intervene using the Taft-Hartley Act, emphasizing his support for collective bargaining. Business leaders, like Eric Hoplin of the National Association of Wholesaler-Distributors, are calling on Biden to act, fearing significant impacts on supply chains. Shipping giants Maersk and Hapag-Lloyd have announced plans for surcharges and schedule revisions due to the strike’s expected delays and increased costs at East Coast and Gulf Coast ports. Biden directed his chief of staff, Jeff Zients, along with other top officials to send a message to both sides that they should resolve their differences “fairly and quickly.” Said Biden: “It’s only fair that workers, who put themselves at risk during the pandemic to keep ports open, see a meaningful increase in their wages as well.” House Republicans are escalating pressure on the Biden/Harris administration to intervene in the strike, which has raised concerns about price increases and delays to consumer goods in the aftermath of a major hurricane and the run-up to U.S. elections. Top members of the House Transportation and Infrastructure Committee urged President Joe Biden in a letter sent Tuesday to step in using the Taft-Hartley Act, a federal law limiting union powers. The act would allow Biden to restore operations and bring parties back to the negotiating table, they said. House Speaker Mike Johnson (R-La.) is also urging the administration to keep both sides at the negotiating table, warning that just one day of paused operations will lead to “higher prices, empty shelves, and lost economic output.” Of note: $1,500-$3,780 is A.P. Moller-Maersk’s proposed per-container local port disruption surcharge for all cargo moving to and from the U.S. East Coast and Gulf Coast terminals. The charge is subject to regulatory approval and depends on the impact of the disruption from the U.S. dockworkers’ strike to the supply chain. — ILA President Harold Daggett continues to insist that the union will not return to the bargaining table until the USMX accepts their demand for a 77% rise in wages over the life of the contract and said he will demand provisions on automation at ports which have port operators “scared.” The USMX offered language which would keep the current rules on automation in place, but Daggett said he has “strong language” that he insists will be in any new contract. Further, Daggett pledged that he will also travel to other ports around the globe in a bid get the issue of automation addressed at those ports and potentially shut down ports to make that happen. — USDA to hold virtual data users’ meeting to gather public input on agricultural statistics. USDA’s National Agricultural Statistics Service (NASS) will host its biannual Data Users’ Meeting on Oct. 15-16 via Zoom. The free event is open to the public and aims to share updates on recent and upcoming changes to statistical programs, while gathering feedback from stakeholders. The meeting will include updates from several USDA agencies, breakout sessions, and a public forum. Registration is required, and details are available on the NASS website (link). The event provides an opportunity for stakeholders to influence future agricultural statistical programs. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. China markets are closed for a holiday this week. U.S. Dow opened lower but is now up slightly. In Asia, Japan -2.2%. Hong Kong +6.2%. China closed. India closed. In Europe, at midday, London +0.2%. Paris +0.1%. Frankfurt -0.3%.

U.S. equities yesterday: All three major indices moved lower Tuesday, weighed down by geopolitical concerns as tensions have been rising in the Middle East. The Dow was down 173.18 points, 0.41%, at 42,156.97. The Nasdaq fell 278.81 points, 1.53%, at 17,910.36. The S&P 500 declined 53.73 points, 0.93%, at 5,708.75.

— Reuters and CNN join growing trend of subscription-based digital news. Reuters and CNN are the latest media outlets to introduce paid subscriptions for their digital news services. Reuters, known for licensing content globally, will begin charging $1 a week for direct access to its news site and apps, starting in Canada this month and expanding to the U.S. and Europe. Similarly, CNN will charge $3.99 a month for unlimited access to its website after a limited number of free articles. This shift follows industry trends, as ad-supported models struggle. Reuters President Paul Bascobert emphasized that subscriptions will allow for expanded coverage, while CNN aims to grow into a more consumer-focused digital product. Despite the success of this model for established outlets like the Wall Street Journal and The New York Times, newcomers face challenges in a crowded subscription market, which could reduce web traffic and affect advertising.

— Front-month Brent crude futures ended Tuesday up 2.6% at $73.56 a barrel. West Texas Intermediate crude was just shy of $70 a barrel at settlement, both at their highest since Sept. 24. Earlier in the day, both benchmarks had jumped by over 5%.

— Ag markets today: Corn and wheat futures firmed amid followthrough buying overnight. Soybeans traded higher at points overnight but are weaker early this morning. As of 7:30 a.m. ET, corn futures were trading mostly 4 cents higher, soybeans were 1 to 2 cents lower, winter wheat markets were 7 to 8 cents higher and spring wheat was 4 to 5 cents higher. The U.S. dollar index was around 100 points higher, and front-month crude oil futures were around $2.50 higher.

Wholesale beef price bottom? At a minimum, it appears wholesale beef prices have stabilized and there are solid signs of a short-term bottom. Choice beef firmed $2.09 to $300.17, while Select rose 77 cents to $$285.30 on Tuesday. Despite the beef strength, packer margins remain in the red and it appears steady-at-best is the likely path for cash cattle prices.

Cash hog index, pork cutout firm. The CME lean hog index is up 12 cents to $84.13 as of Sept. 30, marking a gain in two of the past four days. The pork cutout firmed 47 cents on Tuesday to $96.31, while movement improved to 315.5 loads. Improving cash fundamentals are encouraging buying in futures. As of Tuesday’s close, the discount October hog futures held to today’s cash quote declined to 63 cents.

— Agriculture markets yesterday:

• Corn: December corn futures rose 4 1/4 cents to $4.29, nearer the session high and hit a three-month high.

• Soy complex: November soybeans rose 1/4 cent to $10.57 1/4 and near mid-range. December soybean meal gained $5.90 to $347.50, nearer the session high and hit a 2.5-month high. December soybean oil fell 40 points to 42.91 cents, closing nearer the session low.

• Wheat: December SRW wheat rallied 15 cents to $5.99, the highest close since July 5, while December HRW rose 14 1/2 cents to $5.98 1/4. December spring wheat rose 13 cents to $6.34 3/4.

• Cotton: December cotton fell 52 points to 73.09 cents and nearer the daily low.

• Cattle: October live cattle rose 70 cents to $184.475, a more-than-one-month high close, while November feeders fell 22.5 cents to $244.675.

• Hogs: October lean hogs rallied $1.25 to $83.50, marking the highest close since May 22.

— Quotes of note:

• Fed rate cuts historically lead to tighter credit spreads, MFS strategist says. Benoit Anne, managing director at MFS Investment Management, states that Federal Reserve interest-rate cuts generally benefit credit spreads. While each easing cycle varies, historically, rate-cutting periods have been linked to tighter spreads. Examining data since 1989, Anne notes that spreads tend to widen modestly before a rate cut, then stabilize or compress following the first cut, especially during “soft-landing” scenarios where the economy avoids a hard downturn.

• Bank of America’s Yuri Seliger predicts the supply of U.S. investment-grade bonds for October will be between $90 billion and $100 billion. Typically, since 2019, October bond supply has ranged from $82 billion to $87 billion, except in 2021 when it spiked to $120 billion due to very low yields. The supply would be a slowdown from the $180 billion of bonds issued in September, which is a record. However, a reduction in October isn’t considered unusual. Seliger notes strong momentum in the investment-grade market, driven by high demand in anticipation of Federal Reserve rate cuts.

— U.S. manufacturing activity shrank in September for a sixth month, reflecting weak orders and declining employment. The Institute for Supply Management’s factory gauge held at 47.2, data out Tuesday showed, extending a period of persistent softness. A reading below 50 indicates contraction.

— Hurricane Helene’s devastating impact on the U.S. Southeast. Hurricane Helene has left a trail of destruction across the U.S. Southeast, triggering a multifaceted crisis with far-reaching consequences. The storm’s impact extends beyond coastal areas, affecting inland regions and mountain towns with unprecedented flooding and damage.

The economic impact of Hurricane Helene is staggering:

Agricultural losses:

• Cotton crops ready for harvest have been flattened, and USDA estimates insurance payouts for crop losses could reach $7 billion. “The future of hundreds of agricultural operations across Georgia is uncertain,” the state’s Agriculture Commissioner Tyler Harper said in a letter to its Congressional delegation. The storm “could not have come at a worse time for our farmers and producers, who are already faced with record-setting drops in net farm income caused by inflation, high input costs, labor shortages, global competition and low commodity prices.”

• Every regional commodity market was impacted, with cotton, pecans, poultry and timber the hardest hit, according to Matthew Agvent, communications director for the Georgia Department of Agriculture. While it’s still early in the assessment stage, the state expects Helene to be more costly than Hurricane Michael in 2018, which caused $2.5 billion in agricultural damage.

• Between 400,000 to 800,000 cotton bales may be lost due to the hurricane, though it will take at least four to six weeks to get more clarity, said Peter Egli, an independent consultant to the industry. That would represent as much as 5.5% of total U.S. production for this season, according to a calculation based on USDA data. As of Sept. 29, USDA reported that 6% of cotton in Georgia, 1% in North Carolina and 5% of cotton in South Carolina had been harvested.

• Poultry industry: Some 107 poultry facilities had been “damaged or totally destroyed by the storm,” Georgia Governor Brian Kemp said in a press conference Saturday.

• Mining Disruption: High-purity quartz mining operations in North Carolina, crucial for semiconductor manufacturing, have been halted.

Environmental damage. The storm has caused significant environmental concerns:

• Water contamination: Millions of gallons of sewage have been released due to inundated wastewater systems.

• Chemical spills: Hundreds of spills have been reported, including ammonia release from a Florida phosphate plant.

• River flooding: The French Broad River in Asheville, North Carolina, reached record levels, flooding industrial areas and potentially contaminating water sources.

Infrastructure impact. Helene has severely damaged critical infrastructure:

• Power outages: At its peak, the storm knocked out electricity to over 4 million homes and businesses.

• Grid damage: Georgia Power reported damage to 1,200 transformers, calling Helene the most destructive hurricane in the company’s history.

• Road closures: Major highways have been closed, isolating parts of western North Carolina.

Human toll. The hurricane has had a devastating impact on human lives:

• Fatalities: At least 166 deaths have been confirmed across six states.

• Displacement: Thousands have been displaced, with over 1,000 people occupying 29 shelters.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, but most foreign rival currencies were also firmer against the U.S. currency. The yield on the 10-year U.S. Treasury note was firmer, trading around 3.76%, with a mixed tone in global government bond yields. Crude oil futures have continued to move higher, with U.S. crude around $72 per barrel and Brent around $75.60 per barrel. Gold and silver futures were under significant pressure ahead of US trading with gold around $2,670 per troy ounce and silver around $31.71 per troy ounce.

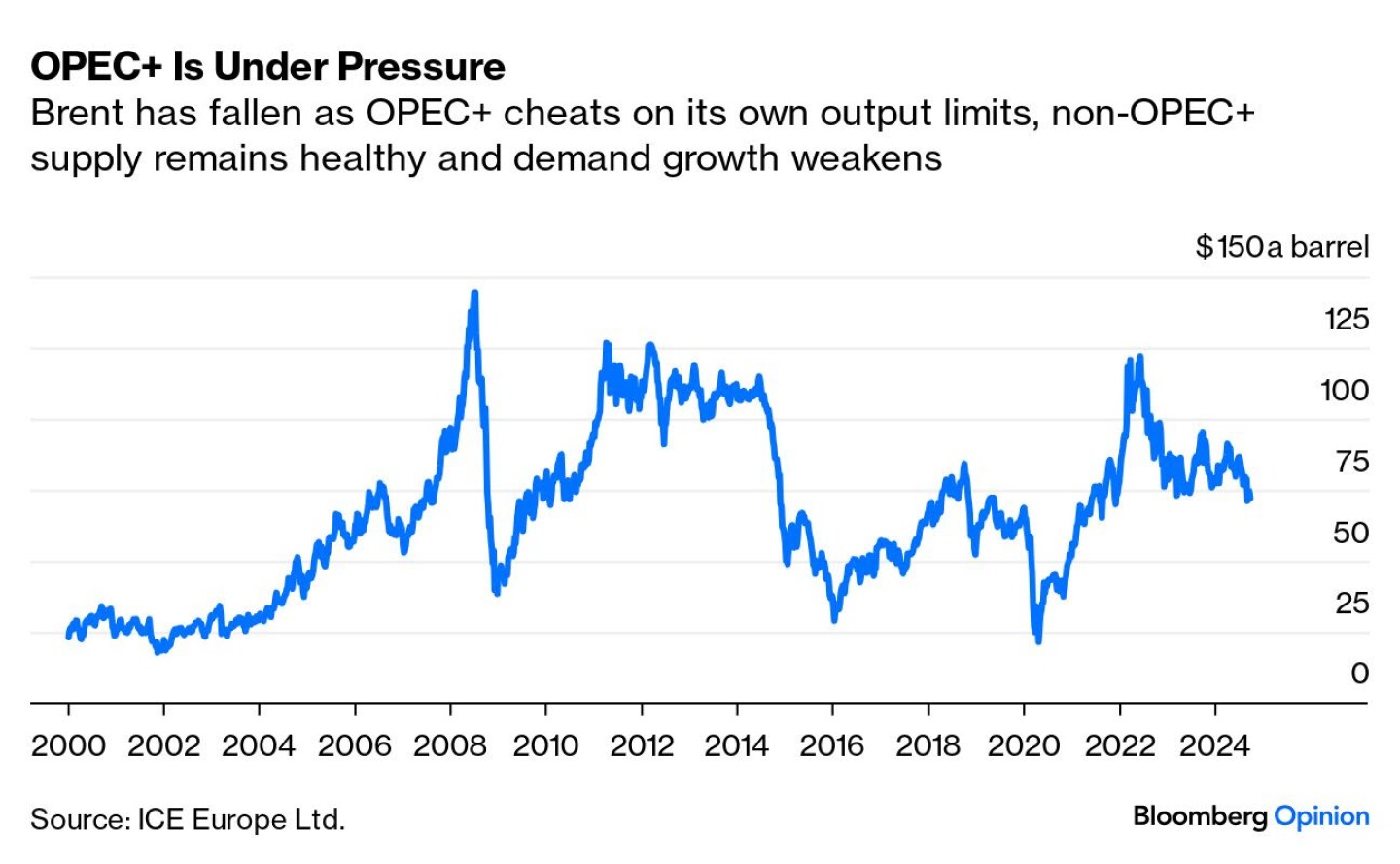

— Saudi Arabia warns of potential $50 oil amid OPEC+ cheating, threatens price war. The Wall Street Journal reports (link) that Saudi Arabia’s oil minister has warned that oil prices could drop to as low as $50 per barrel if OPEC+ members fail to comply with agreed production limits, citing OPEC delegates. This warning is seen as a veiled threat of a potential price war if countries continue overproducing, with Iraq and Kazakhstan singled out for flouting quotas. Despite geopolitical tensions such as Iran’s missile attack on Israel, oil prices have stayed below $75 per barrel, largely due to weak economic growth. Saudi Arabia, which needs oil prices around $85 per barrel to fund its economic reforms, has previously opened production spigots to protect its market share. Rising global production in Brazil, Guyana, and the U.S. could further heat up competition next year.

— StoneX raises U.S. corn, bean crop estimates. Commodity brokerage firm StoneX raised its U.S. corn crop estimate to 15.222 billion bu. (15.127 billion bu. last month) on a yield of 184 bu. per acre, up 1.1 bu. from last month. StoneX raised its production estimate to 4.613 billion bu. (4.575 billion bu. last month) on a yield of 53.5 bu. per acre, up 0.5 bu. from early September. The firm’s estimates are based on surveys of its customers and assume USDA’s harvested acreage.

— Romania’s agriculture threatened by drought as farmers face water crisis. Romania, home to a third of all EU farms, is grappling with drought and water shortages that threaten its key role in Europe’s food supply chain, Bloomberg reports (link). The country’s irrigation infrastructure, neglected since the fall of communism, is being revived with a €5.5 billion ($6.12 billion) plan to restore the Siret-Baragan canal. However, progress is slow, and many farmers face their fourth consecutive year of crop losses. As climate change worsens, with extreme weather becoming more frequent, Romania’s farmers are calling for a comprehensive irrigation strategy to ensure long-term agricultural sustainability.

— Ag trade update: Thailand purchased 120,000 MT of optional origin (except Black Sea and EU) feed wheat. Algeria tendered to buy up to 320,000 MT of corn to be sourced from Brazil or Argentina. Japan is seeking 137,048 MT of milling wheat via its weekly tender. Jordan tendered to buy up to 120,000 MT of optional origin milling wheat.

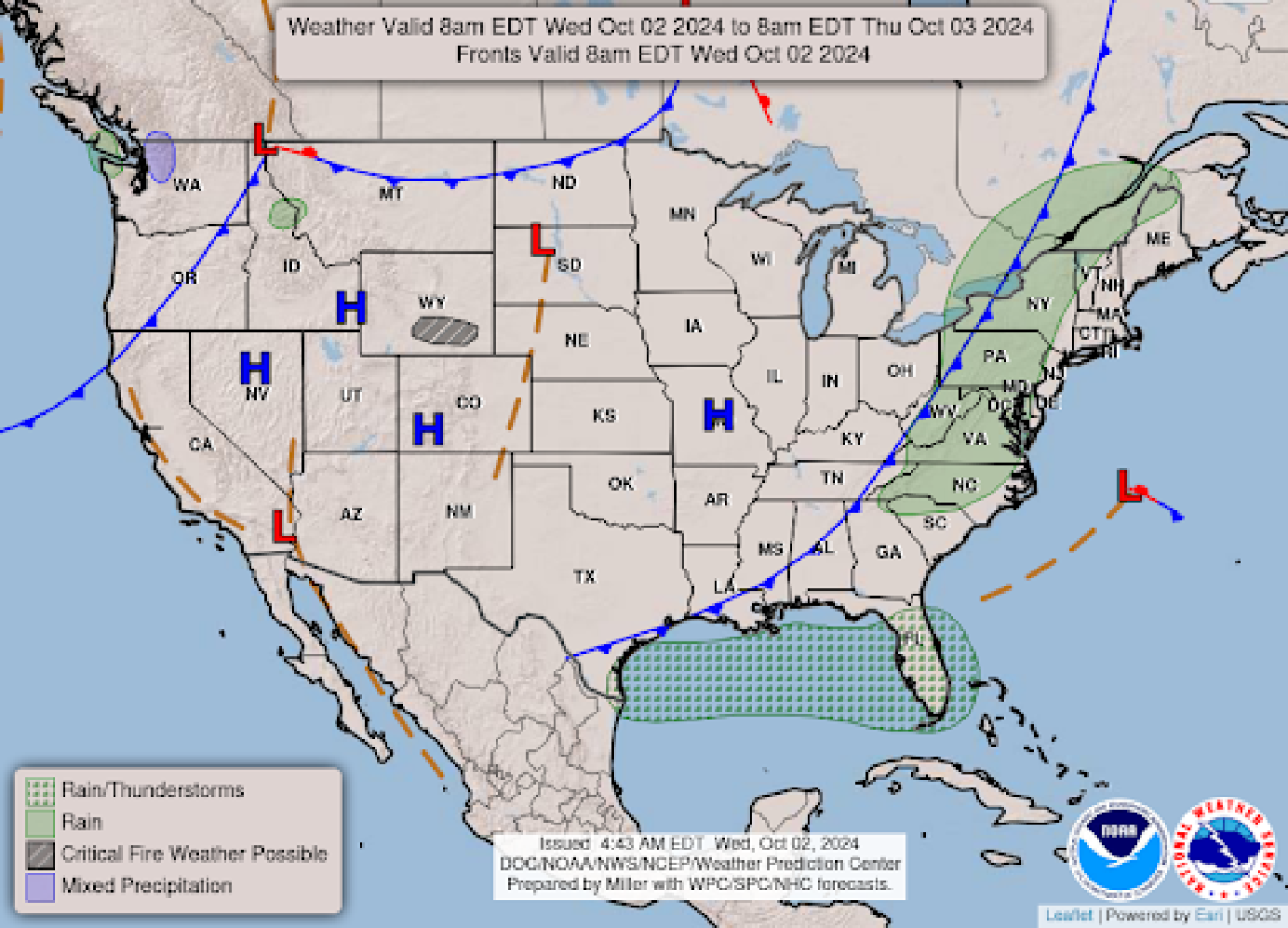

— NWS outlook: There is a Marginal Risk of excessive rainfall over parts of the Central Gulf Coast on Thursday... ...There is a Critical Risk of fire weather over parts of the Central High Plains/Central Rockies on Wednesday... ...There are Excessive Heat Warnings and Heat Advisories over parts of Southern California and the Southwest.

Items in Pro Farmer’s First Thing Today include:

• Corn and wheat higher, beans weaker early this morning

• Russia’s weather agency sees ‘worse’ conditions for winter crops in key regions

| ISRAEL/HAMAS CONFLICT |

— Iran launches missile attack on Israel, Netanyahu vows retaliation. Iran on Tuesday launched approximately 200 missiles at Israel, most of which were either intercepted or missed their targets, intensifying tensions in the Middle East. In response, Israeli Prime Minister Benjamin Netanyahu vowed retaliation, stating that Iran “made a big mistake” and would face consequences. Netanyahu emphasized Israel’s determination to defend itself and respond to its enemies, leaving the situation on edge as the conflict could escalate further depending on Israel’s next move.

Oil market impact: Brent crude, the international benchmark, was trading above $75 a barrel today, up 3% and its highest level in a month. It rose more than 5% yesterday after the attack, but eased some of the gain by the close. The research firm ClearView Energy Partners estimates that an attack on Iranian infrastructure could increase them by $13 a barrel, while a Strait of Hormuz closure scenario could raise prices by up to $28 a barrel.

| RUSSIA/UKRAINE |

— Russia stops Kazakh grain transit in retaliation to imports ban. Russia effectively banned the transit and import of Kazakh grain and some other agricultural products on phytosanitary grounds, which some exporters viewed as retaliation for Kazakhstan’s earlier ban on Russian grain supplies. Russia’s agricultural watchdog said in a statement that from Sept. 23, its systems would automatically block the issuance of phytosanitary certificates for grain, grain products, sunflower seeds, tomatoes and peppers from Kazakhstan, which exports its grain to Europe and Turkey through Russian seaports. Without such certificates, the goods cannot cross the border.

| CHINA UPDATE |

— U.S. official: IMF ‘too polite’ on China policies, financing assurances. The International Monetary Fund (IMF) is “too polite” when it comes to criticizing China’s economic policies and should more fully disclose financing assurances given by China and some other countries to support IMF loan programs, a senior U.S. Treasury official said. Brent Neiman, Treasury’s deputy undersecretary for international finance, said IMF has failed to apply enough analytical rigor to China’s industrial policies. Neiman offered unusually pointed criticism of the IMF’s approach to China ahead of IMF and World Bank annual meetings later this month.

— China files appeal to WTO on Canadian tariffs on EVs, metal products. China’s commerce ministry said it has asked the World Trade Organization (WTO) to rule on Canada’s imposition of steep tariffs on Chinese electric vehicles as well as steel and aluminum products. “China has raised a litigation to the WTO over Canada’s unilateral and trade protectionist measures and will conduct anti-discriminatory probe into these restrictive measures,” the ministry said. The ministry repeated its strong opposition to the tariffs, which it says will “disrupt and distort global industrial and supply chain.”

| TRADE POLICY |

— EU delays landmark anti-deforestation law amid global pressure. The European Commission proposed a 12-month delay for its key legislation aimed at curbing global deforestation, responding to intense pressure from commodity-producing countries and industry. Bloomberg first reported the possibility of a delay (link). “Since all the implementation tools are technically ready, the extra 12 months can serve as a phasing-in period to ensure proper and effective implementation,” the Commission said in unveiling its delay. Initially set to take effect on Dec. 30, the law requires importers to ensure products like coffee, cocoa, soy, and beef are not sourced from recently deforested areas. While designed to reduce the EU’s deforestation footprint, the regulation has faced strong opposition from countries like Brazil and Indonesia, who argue it unfairly targets smallholder farmers. Industry groups within the EU have also raised concerns about supply chain disruptions and rising costs. Approval for the delay is needed from both the European Parliament and the bloc’s 27 member states.

The Commission also offered additional guidance documents and a stronger international cooperation framework (link) as part of the package.

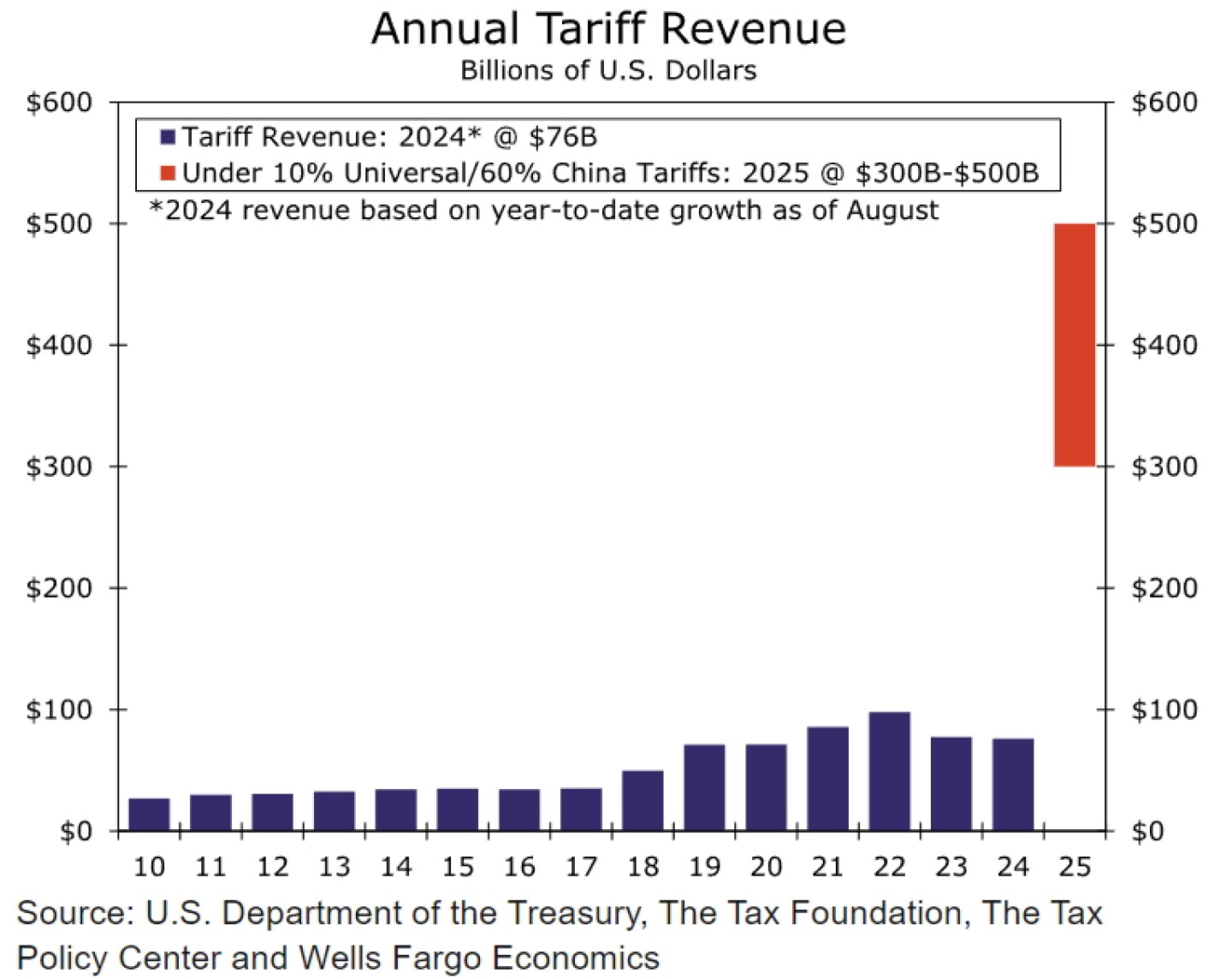

— Trump’s proposed tariffs could generate over $500 billion annually, Wells Fargo estimates. If Donald Trump wins the election and imposes a 10% tariff on all imports and a 60% duty on Chinese goods, Wells Fargo economists estimate that the U.S. government could have collected over $500 billion in tariffs last year. Although these tariffs would likely reduce imports, particularly from China, the economists suggest the U.S. could still generate hundreds of billions of dollars annually from the proposed rates. However, the estimate represents an upper-bound scenario, with actual revenue depending on the impact on import volumes.

| ENERGY & CLIMATE CHANGE |

— Treasury aims to finalize clean energy credits by year-end, leaves 45Z timing unclear. The U.S. Treasury is working to complete rules for clean energy credits under the Inflation Reduction Act (IRA) by the end of 2024, focusing on clean electricity production and investment credits under 45Y and 48E for technologies that produce electricity with no greenhouse gas emissions, according to Aviva Aron-Dine, acting assistant Treasury secretary for tax policy. Additionally, rules for clean hydrogen production (45V) and the advanced manufacturing production credit (45X) are expected to be finalized by the end of this year. However, Treasury did not provide a timeline for the completion of the 45Z clean fuel production credit, 45U zero-emission nuclear power credit, and the 45W commercial clean vehicle credit. Aron-Dine did say the agency continues to “actively work” on the 45Z and other credits, and has “received substantial stakeholder input regarding the unique dynamics of the credits’ respective markets; we’re now working to evaluate these issues with help from experts at other agencies.” USDA Secretary Tom Vilsack has indicated the 45Z credit will likely be finalized before the Biden administration leaves office in January.

— U.S. Commerce Dept. sets preliminary tariffs on solar imports from Southeast Asia. The U.S. Commerce Dept. imposed preliminary duties on solar imports from Southeast Asia, citing illegal government subsidies benefiting the equipment. The tariffs, affecting countries like Thailand, Vietnam, Cambodia, and Malaysia, are a win for domestic solar panel manufacturers who argue that cheap imports harm U.S. operations. However, the tariffs could drive up costs for renewable energy developers reliant on foreign solar equipment. Rates vary, with Thailand facing a 23.06% duty, and Vietnam 2.85%, but final rates could be higher pending further investigation. Some solar developers worry these tariffs may slow the US energy transition.

| POLITICS & ELECTIONS |

— Rep. Raúl Grijalva announces retirement after November election. Rep. Raúl Grijalva (D-Ariz.), the House Natural Resources Ranking Member, has announced that he will not seek re-election after the November election, marking the end of his two-decade tenure in Congress. First elected in 2002, Grijalva has been largely absent this year while undergoing treatment for lung cancer. Despite his plans to retire, he is expected to win re-election in November as his district is considered solidly Democratic.

| OTHER ITEMS OF NOTE |

— No U.S. soybean referendum to be conducted. USDA’s Agricultural Marketing Service (AMS) announced that too few soybean producers wanted a referendum to be held on the Soybean Promotion and Research Order or checkoff. A referendum would have been triggered if 41,336 soybean producers (10% of the total nationwide soybean producers) had completed a valid Request for Referendum. There were 229 soybean producers that participated in the process with 207 valid petitions received.

— EPA imposes new restrictions on chlorpyrifos use to protect endangered species. EPA announced new restrictions on the use of chlorpyrifos, an insecticide, to limit its impact on endangered species and reduce its usage. The agency will limit the chemical to 11 crops and modify product labels to prevent runoff and spray drift into sensitive habitats. These changes could reduce chlorpyrifos use by 70% compared to past levels. While the Center for Biological Diversity advocates for a total ban, calling the pesticide hazardous to wildlife and farmworker communities, the EPA’s new rules will also impose geographic limitations and application restrictions to safeguard vulnerable species and ecosystems.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |