News/Markets/Policy Updates: Sept. 16, 2024

The event unfolded on Sunday afternoon at Trump International Golf Club, where Trump was playing golf. Law enforcement sources on Sunday identified the person detained as a 58-year-old owner of a small construction company in Hawaii who frequently criticized Trump on social media. The suspect was observed extending a rifle through the fence surrounding the course. The individual was positioned near the fourth or fifth hole, approximately 400 to 500 yards away from Trump’s location. A U.S. Secret Service agent, who was positioned one hole ahead of Trump’s group, noticed the suspect lurking in the foliage by the fence and immediately engaged him. The officer discharged his weapon, prompting the suspect to abandon his firearm and flee in an SUV. Authorities recovered several items from the scene: The suspect initially escaped in an SUV but was later apprehended in a nearby county. Ryan Wesley Routh is currently in custody and being questioned by law enforcement. At this time, no details about a potential motive have been released. Florida Gov. Ron DeSantis, a Republican, said the state will independently investigate the apparent assassination attempt on Trump. “The people deserve the truth about the would-be assassin and how he was able to get within 500 yards of the former president and current GOP nominee,” he posted on X. Of note: President Joe Biden directed his team to ensure the Secret Service “has every resource, capability and protective measure necessary to ensure the former president’s continued safety.” A congressional panel investigating the July assassination attempt in Pennsylvania is seeking a briefing on the latest attempt. — Iowa Poll: Trump leads Harris on key issues, except abortion. A majority of likely Iowa voters believe former President Donald Trump would handle inflation, immigration, foreign policy, and housing prices better than Vice President Kamala Harris, according to a new Des Moines Register/Mediacom Iowa Poll. Trump leads Harris on six of the seven issues surveyed, with Harris only receiving majority support on handling abortion. Link for details. — CBP faces $3.2 billion annual cost increase to tighten scrutiny on low-value de minimis shipments, requiring resources equal to 39,000 officer salaries, according to Oxford Economics. The figure of $3.2 billion represents the estimated additional annual cost to U.S. Customs and Border Protection (CBP) under a proposal to increase scrutiny on de minimis shipments — those with a low value, typically under $800, which can enter the U.S. with minimal customs review. According to a report from Oxford Economics (link), this cost increase is significant, equating to the salaries of approximately 39,000 CBP officers. The implication here is that increasing scrutiny on these shipments would require a substantial investment in manpower and resources, likely due to the vast volume of low-value goods entering the U.S., particularly from international e-commerce. This proposal could create economic and logistical challenges for CBP and for businesses that rely on quick and efficient import processes. It may also reflect broader concerns over trade enforcement, counterfeiting, and the impact of de minimis shipments on domestic industries. — ADM Illinois carbon capture project faces EPA violations over CO2 leak. EPA has found that ADM’s Illinois carbon capture project violated drinking water safety rules and its permit for underground carbon dioxide injection. A July inspection revealed CO2 had migrated into unauthorized zones, and ADM failed to follow emergency response protocols. The company reported corrosion in one of its deep monitoring wells, which has since been plugged. This incident adds to growing safety concerns about carbon capture and pipeline projects, including the planned Summit pipeline in the Midwest. — David Scott (D-Ga.), the Ranking Member of the House Ag Committee, has confirmed his intention to seek another term as the top Democrat on the panel in the next Congress, despite concerns among fellow Democrats about his health, according to Punchbowl News. Scott, who made history as the first Black lawmaker to chair the Ag Committee in the previous Congress, is facing scrutiny from some committee Democrats, particularly those in swing districts. Scott recently sent a memo to committee members stating that he and Chair G.T. Thompson (R-Pa.) agree on forgoing another short-term extension for key farm bill provisions. They aim to maintain pressure on negotiators to finalize a long-term bill before December, which is viewed as the actual deadline for action. The 79-year-old Scott’s health has been a source of worry for several lawmakers. According to Punchbowl News, “One House Democrat told us doubts about Scott’s ability to steer the committee are ‘widely expressed.’” Some members have privately expressed concerns about his ability to communicate with members and lead farm bill negotiations. Scott’s public appearances are limited, and he relies heavily on his staff for assistance on Capitol Hill. These concerns have led to internal discussions about potential challenges to Scott’s leadership after the election when the Democratic Caucus selects its committee leaders. Potential successors. Two names have emerged as potential successors to Scott: Bennie Thompson, who currently serves as the ranking member on the Homeland Security Committee, still holds seniority on the Agriculture Committee. However, his office has stated that he plans to continue his work on the Homeland Security Committee. If Scott runs again for the Ag Committee leadership position, replacing him could be a complex process that may require delicate intervention from party leadership. Some of Scott’s allies believe that the effort to replace him, primarily led by white members, has “racial undertones,” even though the potential candidates to succeed him are also Black. |

| MARKET FOCUS |

— Equities today: In Asia, Japan closed. Hong Kong +0.3%. China closed. India +0.1%. In Europe, at midday, London flat. Paris +0.1%. Frankfurt -0.3%. U.S. Dow opened around 150 points higher.

U.S. equities Friday and the week: All three major indices scored gains Friday and managed solid advances for the week, with the Dow up 2.61%, the Nasdaq gained 5.95%, and the S&P 500 rose 4.02%. On Friday, the Dow was up 297.01 points, 0.72%, at 41,393.78. The Nasdaq gained 114.30 points, 0.65%, at 17,683.98. The S&P 500 added 30.26 points, 0.54%, at 5,626.02.

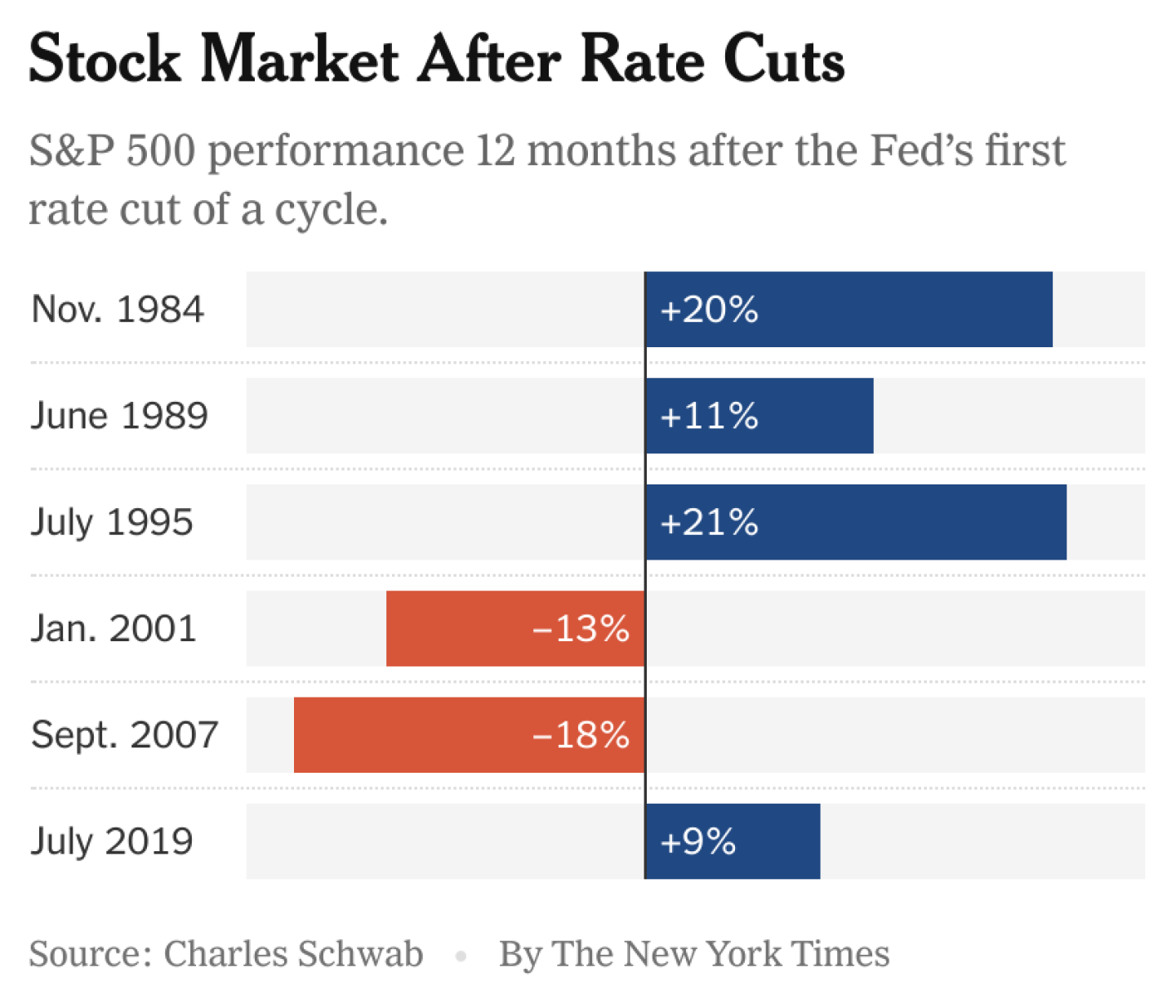

— Rate cuts aren’t always bad news for the markets. Investors often view a lower borrowing-cost environment as a buying opportunity.

— TikTok gets its day in court today. Lawyers for the video app will make oral arguments in their fight against a law that could see it banned in the United States. The U.S. gov’t passed a law in April that would force ByteDance, its Chinese owner, to divest over national security concerns. U.S. lawmakers and intelligence officials have warned that Beijing could use the app to access Americans’ sensitive data or spread disinformation. TikTok sued and mobilized millions of users to back its defense.

— Oil prices eased Friday, trading down as crude production in gulf resumed following Hurricane Francine. Crude prices also took a hit from the U.S. rig count from energy services group Baker Hughes which reported the biggest weekly rise in oil and natural gas rig in a year. WTI traded down $.32 or -.5% to close at $71.61. Brent traded down $.36 or -.5% to close at $68.65.

— Ag markets today: Wheat futures led overnight losses in the grain markets to open the week. As of 7:30 a.m. ET, corn futures were trading 3 cents lower, soybeans were mostly a penny lower and wheat futures were 9 to 11 cents lower. The U.S. dollar index was more than 400 points lower, and front-month crude oil futures were about 75 cents higher this morning.

Choice beef falls to five-month low. Wholesale beef prices fell $2.27 for Choice to $304.91 and $1.47 for Select to $294.17 on Friday. While movement has remained strong, averaging 148.8 loads last week, Choice beef dropped to the lowest level since mid-May.

Cash hog fundamentals continue to weaken. The CME lean hog index is down another 48 cents to $84.87 as of Sept. 12, down $8.77 from the seasonal peak on Aug. 1. October lean hog futures finished Friday $6.42 below today’s quote. The pork cutout value dropped 28 cents on Friday to $93.90.

— Agriculture markets Friday and for the week:

• Corn: December corn futures surged 7 1/4 cents to $4.13 1/4 and closed on session highs, marking a 7-cent gain on the week.

• Soy complex: November soybeans fell 4 1/2 cents to $10.06 1/4 but gained 1 1/4 cents on the week. December soymeal closed down 30 cents at $322.90 and down $1.60 from a week ago. December soyoil fell 86 points to 38.93 cents, marking a 71-point weekly loss.

• Wheat: December SRW wheat futures rose 16 1/4 cents to $5.94 3/4, nearer the daily high and hit a two-month high. On the week, December SRW rose 27 3/4 cents. December HRW wheat gained 13 3/4 cents to $6.00, nearer the daily high and hit a two-month high. For the week, December HRW was up 22 1/2 cents. December spring wheat futures rose 13 3/4 cents to $6.35 1/2 and picked 21 3/4 cents on the week.

• Cotton: December cotton fell 56 points to 69.82 cents but rose 194 points on the week.

• Cattle: October live cattle futures fell 37 1/2 cents to $177.65 and near mid-range. For the week October cattle rose $2.475. October feeder cattle futures lost 62 1/2 cents to $239.125 and near mid-range. On the week, October feeders gained $8.175.

• Hogs: Nearby October settled at $78.45, down 45 cents on the day and $1.05 on the week.

— Of note:

• Upcoming central bank meetings. This week features a series of important central bank meetings:

— Federal Reserve (Tuesday-Wednesday)

— Bank of England (Thursday)

— Norges Bank (Thursday)

— South Africa’s Reserve Bank (Thursday)

— Bank of Japan (Friday)

Upshot: These meetings, especially the Fed and BOJ decisions, are expected to have significant impacts on currency markets and global financial conditions in the coming days.

• The market now sees a 63% chance of a half-point cut by the Fed on Sept. 18, according to the CME FedWatch tool (link). It would be the first cut in four years. Economists say the question is not how big this week’s rate cut is, but how many more cuts the Fed could make and when. Many analysts believe Fed officials could cut the benchmark federal-funds rate from the current 5.25% to 5.5% range to 3% by July 2025.

— Credit card delinquency hits 9.1%, highest in over a decade. According to a report from the Federal Reserve Bank of New York, 9.1% of credit card balances became delinquent over the past year — the highest rate in more than a decade. This rise in delinquencies signals growing financial strain for Americans and is raising concerns on Wall Street about consumer debt levels.

— President Javier Milei issued a bullish outlook for Argentina’s economy as he outlined his first budget since taking office on a platform of drastic austerity. Milei personally presented the 2025 budget to Congress, breaking with tradition of having the economy minister do so. He projected annual inflation will slow dramatically from over 236% currently to 18% by the end of 2025. The budget presentation comes as Milei’s administration has implemented drastic austerity measures to address Argentina’s economic crisis. Milei delivered a combative speech to lawmakers, including insults aimed at opposition members. His minority party will face midterm elections in 2025, making the economic projections politically significant. The budget presentation reaffirms Milei’s commitment to fiscal austerity and reducing inflation as core economic priorities.

Market perspectives:

— Outside markets: The U.S. dollar index was slightly weaker, with the euro and British pound both slightly higher against the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading around 3.64%, with a mixed-to-lower tone in global government bond yields. Crude oil futures were firmer, with U.S. crude around $68.85 per barrel and Brent around $71.75 per barrel following gains in Asian trading. Gold and silver futures were narrowly mixed, with gold weaker around $2,606 per troy ounce and silver firmer around $31.26 per troy ounce.

— U.S. dollar has fallen to its lowest level in over eight months, as measured by Bloomberg’s dollar gauge. This weakness is primarily driven by:

• Expectations of Fed rate cuts: Traders are increasingly betting on aggressive rate cuts by the Federal Reserve, with some now pricing in a 59% chance of a 50 basis point cut at this week’s meeting.

• Narrowing interest rate differentials: The anticipated Fed rate cuts are expected to reduce the interest rate gap between the U.S. and other major economies, making the dollar less attractive.

Yen strength. The Japanese yen has strengthened significantly, reaching its highest level since July 2023 against the US dollar. This surge in the yen is attributed to:

• Speculation about Bank of Japan policy: Traders are eyeing the upcoming Bank of Japan meeting on Friday for potential shifts in monetary policy.

• Potential end to negative rates: There’s growing anticipation that the Bank of Japan might move away from its negative interest rate policy, which would support the yen.

Market implications:

• USD/JPY pair: The dollar has lost around 1.3% against the yen in the past week, with the pair breaking below the 141.01 support level.

• Interest rate expectations: Markets are now pricing in total Fed rate cuts of 125 basis points for 2024.

• Increased volatility: The uncertainty surrounding the size of potential Fed rate cuts (25 or 50 basis points) is likely to cause market volatility following the decision.

— Gold surged to a new record high of $2,589 an ounce, continuing last week’s 3.2% gain. The increase comes as investors anticipate a Federal Reserve meeting that is likely to result in a cut to interest rates, boosting demand for the precious metal as a safe-haven asset.

— Arabica coffee futures have surged to their highest level since 2011, rising more than 40% this year. The increase is driven by shortages of cheaper robusta beans, which has heightened demand for the alternative arabica variety.

— USDA daily export sale:

• 132,000 MT soybeans to unknown destinations, 2024-2025 marketing year.

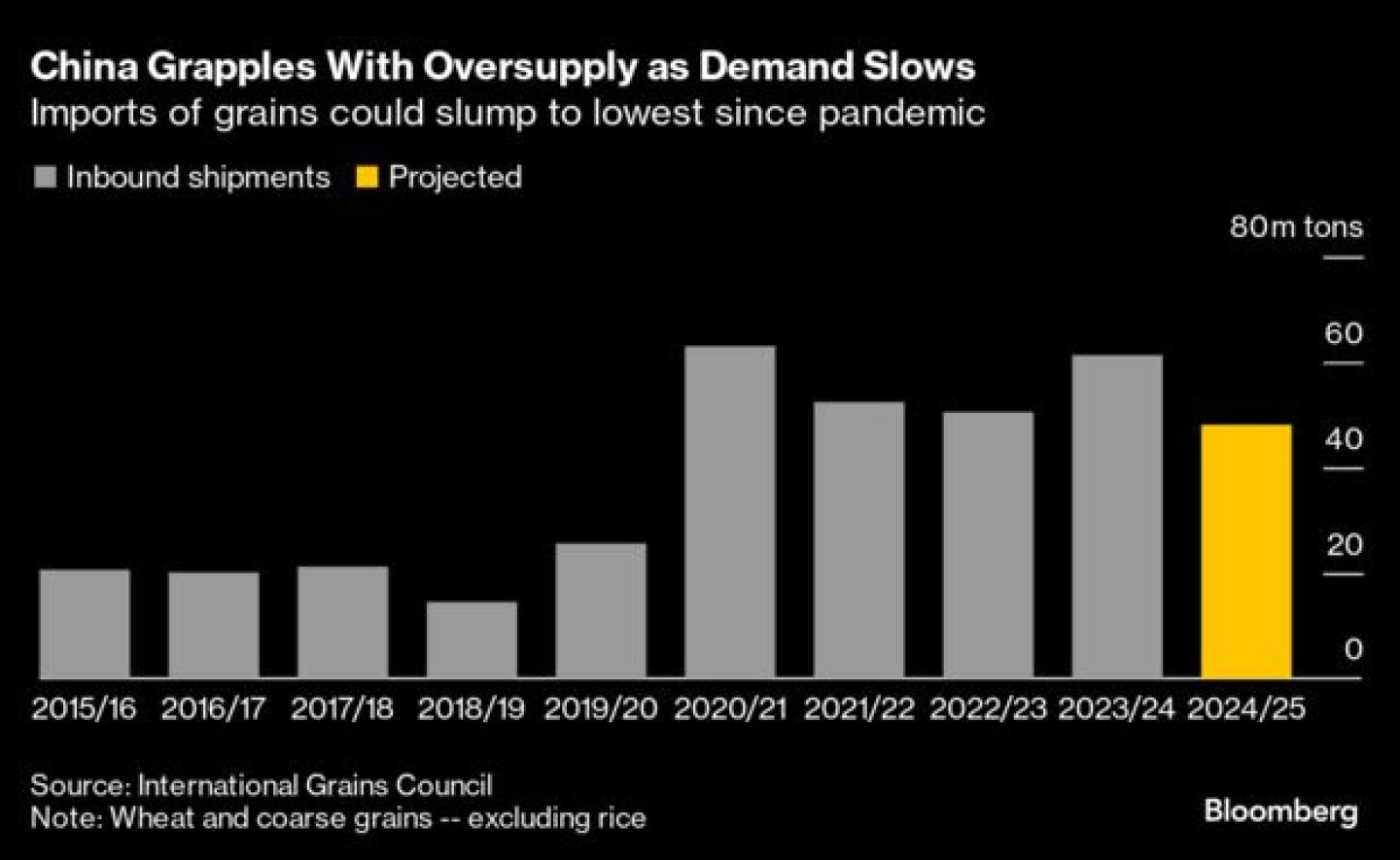

— China’s economic slowdown is leading to a significant impact on global agricultural markets, as the country’s grain reserves swell and demand decreases, Bloomberg reports (link). This is causing concern for farmers worldwide, as China has long been a major customer. The effects are already visible, with declining French barley exports to China and the U.S. struggling to sell corn for the new season. Australian wheat farmers, about to begin harvesting, are likely to feel the pressure as they brace for reduced demand. This downturn could signal a prolonged challenge for global agriculture tied to China’s consumption.

— A portion of Gulf of Mexico oil and natural gas production remains offline, with 19.35% of oil and 27.64% of natural gas production still shut-in as of Sept. 15, according to the Bureau of Safety and Environmental Enforcement (BSEE). Although production is gradually resuming, nearly 10% of manned platforms remain evacuated. The shutdown figures have improved from earlier levels, with 41.85% of oil and 52.3% of natural gas production initially offline, reducing to 29.84% for oil and 40.6% for natural gas by Saturday.

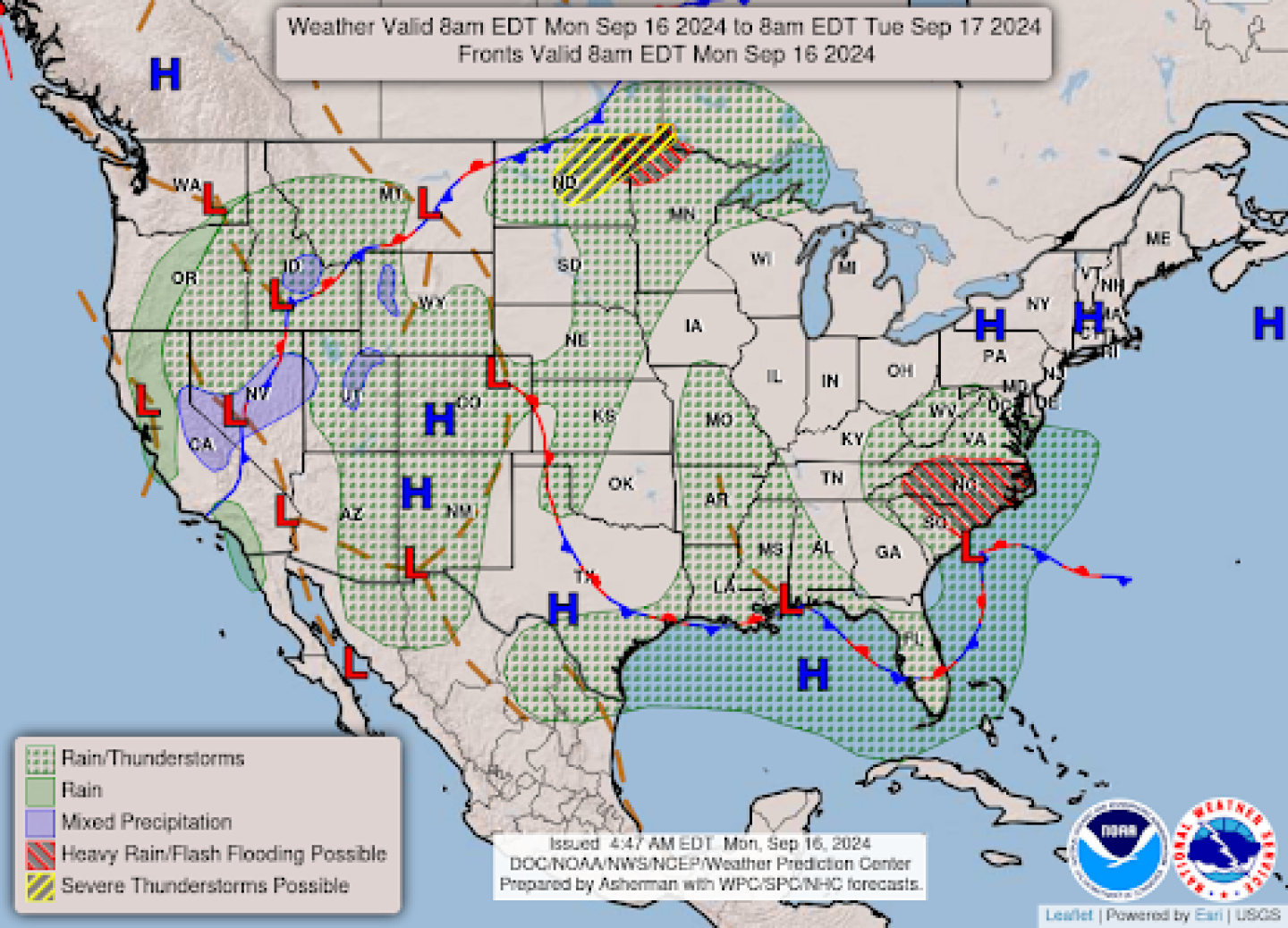

— NWS outlook: Potential Tropical Cyclone Eight will bring wind and heavy rain to the Carolinas and Mid-Atlantic... ...A strong upper low will bring unsettled weather and well below normal temperatures to the West with high elevation snow in the Sierra Nevada and Intermountain West... ...Severe thunderstorms possible for the Northern and Central High Plains Tuesday.

Items in Pro Farmer’s First Thing Today include:

• Grains weaker overnight

• Warm week ahead

• Record August NOPA soy crush expected

• China’s industrial production, retail sales add to economic concerns

• China’s August new lending rises less than expected

| RUSSIA/UKRAINE |

— Russia profits from Ukraine invasion by selling stolen grain on a global black market, the Wall Street Journal reports (link). Russia’s occupation of Ukraine has sparked an illicit grain trade, with Moscow and its allies selling nearly $1 billion worth of stolen Ukrainian crops. Russian forces have seized fertile farmland, coercing farmers to sell at low prices or taking harvests by force. The stolen grain is funneled through a network of loyalists and sold globally, including to countries like Iran and Syria. This black-market trade finances Russian military efforts and keeps allies loyal amid economic pressure. Despite efforts by Ukraine to block these shipments, the trade persists through evasive tactics, sustaining Russia’s war effort.

| CHINA UPDATE |

— Pressure mounts on China to boost stimulus amid economic slowdown. Chinese authorities face increasing pressure to accelerate fiscal and monetary stimulus to meet the 5% growth target for 2023, following the longest slowdown in industrial output since 2021. Recent data revealed weaker-than-expected consumption, investment, and a sharp decline in home prices. The People’s Bank of China signaled its intent to prioritize fighting deflation and hinted at further monetary easing. Missing the GDP target could hurt confidence in the economy, with foreign investors already pulling a record amount of money from China in the second quarter.

— PwC China hit with record $62 million fine and six-month ban over Evergrande audit failures. China’s finance ministry and securities regulator have imposed a six-month suspension and a $62 million fine on PricewaterhouseCoopers (PwC) China for its audits of China Evergrande Group, the property developer whose collapse in 2021 triggered the country’s real estate crisis. This marks the largest fine ever levied on a Big Four accounting firm in China and the first major penalty related to the nation’s real estate collapse.

— Investment banks cut China GDP forecasts. Goldman Sachs and Citigroup each lowered their full-year projections for China’s economic growth to 4.7%. Weak economic activity in August has ramped up attention on China’s slow economic recovery and highlighted the need for further stimulus measures to shore up demand. Goldman Sachs maintained its forecast for China’s 2025 GDP growth at 4.3%. Citigroup cut its 2025 year-end forecast for China’s GDP growth to 4.2% from 4.5% due to a lack of major catalysts for domestic demand.

— China’s sow herd contracts 5.4%. China’s sow herd stood at 40.41 million head at the end of July, down 5.4% from last year, the agricultural ministry said.

— Chinese EVs still cheaper than Teslas in U.S. after tariff hike. The 100% duty on EVs, announced Friday and set to take effect Sept. 27, follows a four-year review prompted by what the Office of the U.S. Trade Representative called unfair trade practices. Link to more via Nikkei Asia.

— China’s release of American pastor David Lin signals goodwill ahead of U.S. election amid strained relations. China’s release of David Lin, a 68-year-old American pastor imprisoned for nearly two decades on fraud charges, can be viewed as a symbolic gesture of goodwill towards the United States. This action may be strategically timed to ease tensions or improve diplomatic relations between the two nations, especially as the U.S. approaches its presidential election. By making such a move, Beijing could be aiming to soften its image, potentially creating a more conducive environment for dialogue, trade, or negotiation.

Some China watchers say the decision to free Lin might be intended to convey a readiness for cooperation, particularly at a time when U.S./China relations have been fraught with economic and geopolitical challenges, including trade disputes, military posturing, and technological competition. The release could also serve as a signal to the international community that China is willing to engage in diplomacy on certain issues, even while broader tensions remain high.

| ENERGY & CLIMATE CHANGE |

— U.S. backs low-carbon ammonia with $1.56 billion DOE loan for Indiana project. The U.S. Department of Energy committed $1.56 billion to a low-carbon ammonia project in Indiana, reflecting growing interest in reducing emissions from ammonia production. The project will likely use carbon capture and storage (CCS) technology to produce cleaner ammonia, which is gaining traction as a sustainable fertilizer and fuel option. This aligns with broader market moves, such as ExxonMobil’s low-carbon ammonia projects, and aims to support decarbonization in agriculture, industry, and energy sectors.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

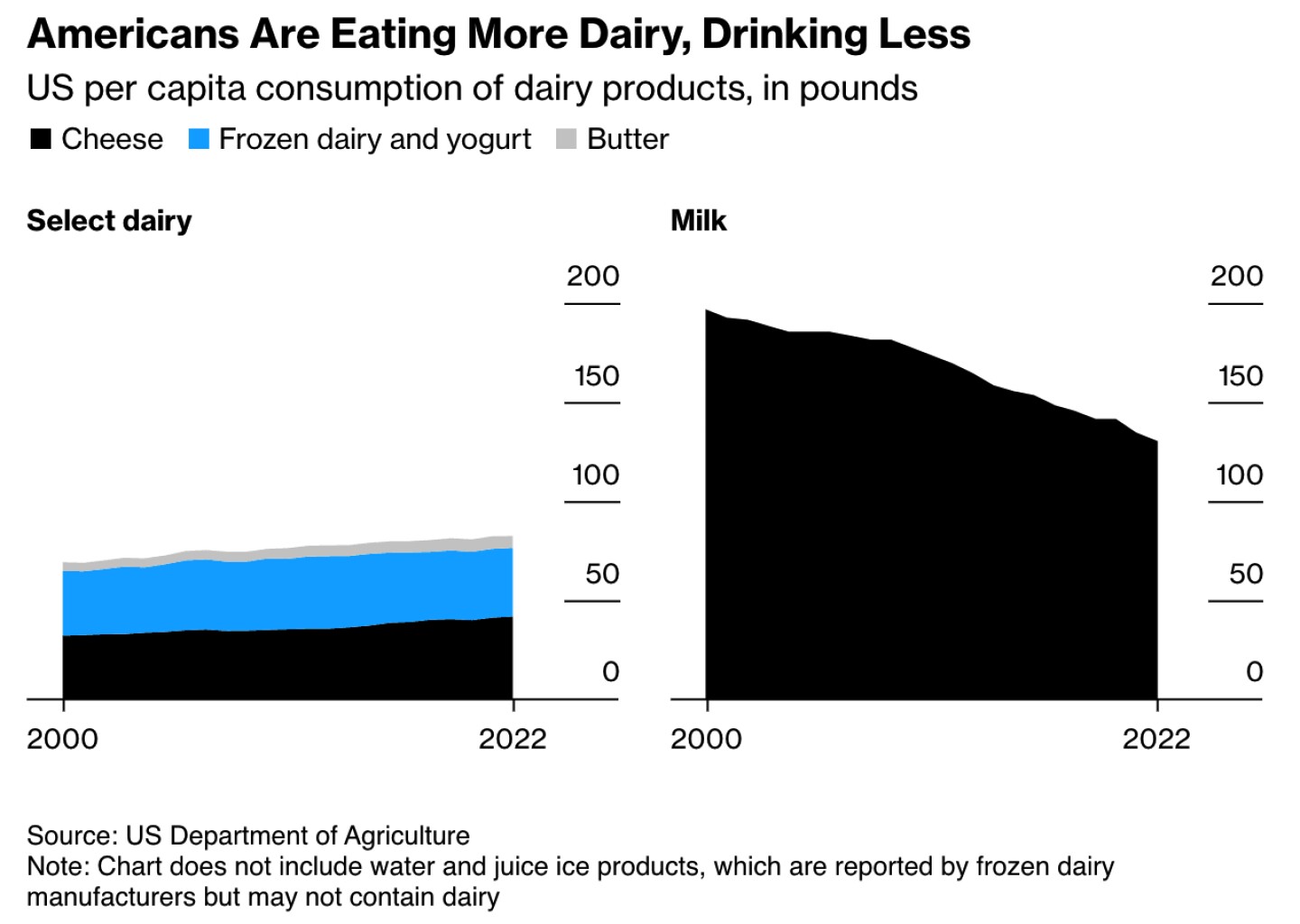

— U.S. dairy industry bets big on cheese amid rising consumption. Cheese consumption in the U.S. has surged, with Americans now eating 42 pounds per capita annually, more than doubling since the government began keeping track in 1975. Dairy producers are investing billions in cheese production, anticipating continued demand. Companies like Great Lakes Cheese and Sargento Foods are expanding capacity, while low-carb diets and pandemic-induced home cooking have boosted cheese’s popularity. However, experts warn of potential oversupply as diet trends shift, though U.S. exports continue to grow. The industry remains hopeful that other dairy products will help balance any excess. Link to more via Bloomberg.

| HEALTH UPDATE |

— Walgreens to pay $106.8 million over alleged fraudulent healthcare billings. Walgreens Boots Alliance has agreed to pay $106.8 million to settle allegations that it submitted claims for prescriptions it never dispensed, violating the False Claims Act and state statutes. The Justice Department accused Walgreens of billing Medicare, Medicaid, and other federal healthcare programs from 2009 to 2020 for prescriptions that were processed but never picked up by patients.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |