News/Markets/Policy Updates: Aug. 22, 2024

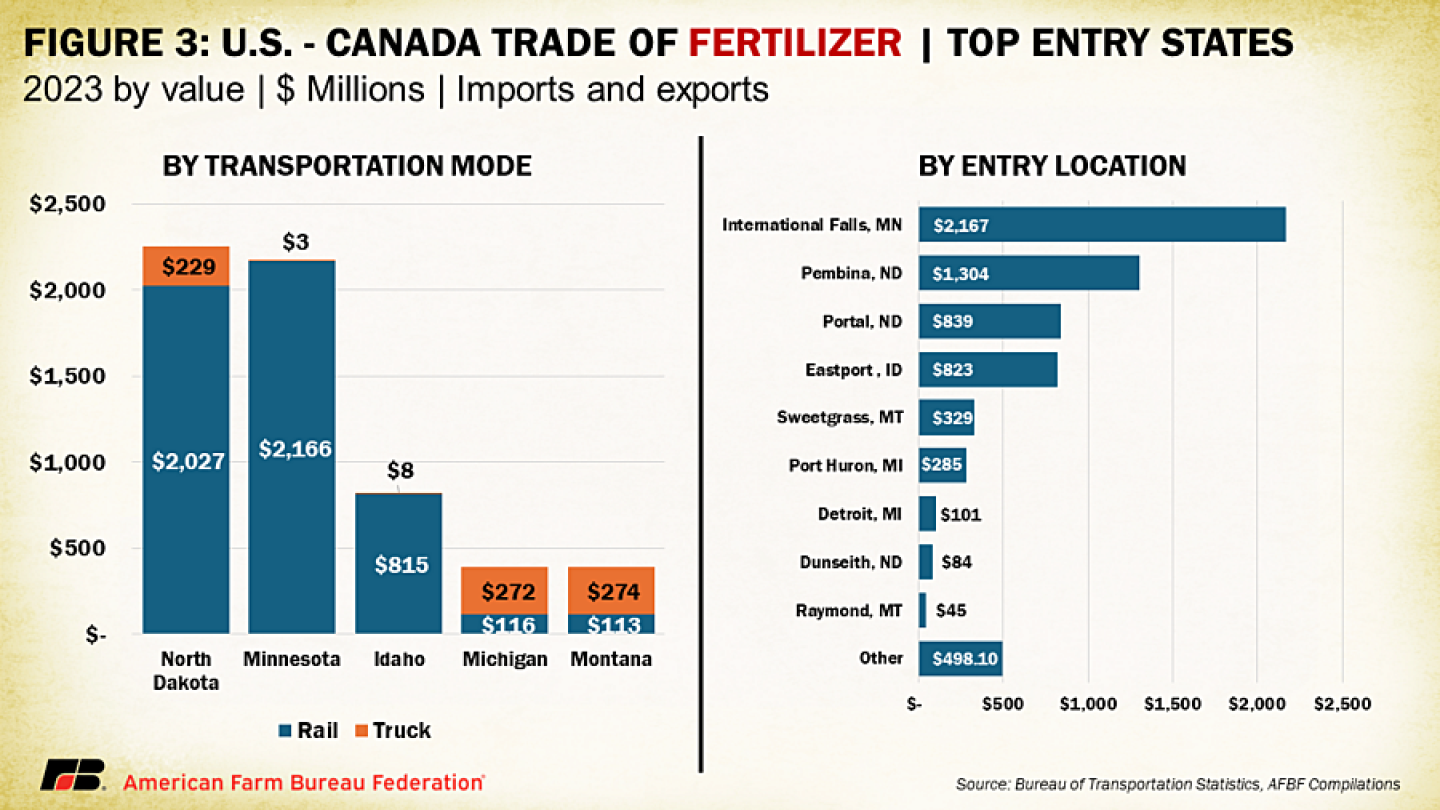

— Canada’s two major railroads, Canadian National Railway and Canadian Pacific Kansas City, locked out over 9,000 employees on Thursday after failing to reach new labor agreements with the Teamsters union. This work stoppage threatens to disrupt hundreds of millions of dollars in daily cross-border trade and significantly impact North American supply chains — the Canadian Chamber of Commerce said a labor stoppage would affect the flow of about $730 million in goods a day. Moody’s estimates a work stoppage at Canada’s railroads could cost the country’s economy about $250 million a day, which is equal to more than 4% of its GDP. About a third of the traffic moved by CN Rail and CPKC also makes its way into the U.S., impacting cross-border trade and disrupting North American supply chains. Businesses and policymakers in Canada are scrambling to mitigate the potential economic damage to the world’s 10th-largest economy. The lockout followed a final, unanswered offer from Canadian National aimed at preventing the labor disruption, with the company urging the union to negotiate with the urgency the situation demands. Fertilizers, grains, and coal are particularly vulnerable to the rail stoppage. Canada’s fertilizer industry alone, for example, stands to lose $50 million a day amid the strike. The auto industry is particularly worried: Canadian trains move components for at least a dozen U.S. plants and 90% of those in Mexico. — Minutes from the Federal Reserve’s July meeting indicate that officials are preparing for a potential interest rate cut Sept. 18, with strong support for the move. Some officials even considered a rate cut in July, citing declining inflation and rising unemployment as reasons to adjust rates. The minutes reveal that several of the 19 officials believed a 0.25 percentage point cut could have been justified at the July 30-31 meeting. More details of the Fed minutes below. — The third night of the 2024 Democratic National Convention in Chicago featured several notable speeches and moments in a convention that is acting like it’s the party out of political power in the White House and that Donald Trump is the incumbent: • Minnesota Governor Tim Walz capped off the evening by accepting the vice-presidential nomination and giving a rather shot speech of just over 15 minutes (likely pleasing many). Minnesota Sen. Amy Klobuchar introduced her home-state governor as a “dad in plaid” as Walz addressed Americans who had no idea who he was until Kamala Harris picked him as her running mate two weeks ago. He delivered a personal largely pe-talk speech highlighting his progressive policies and expressing admiration for Vice President Harris. Walz concluded by rallying the crowd to chant “When we fight, we win!” Walz’s speech touched on various themes that resonated with different segments of the audience, including personal freedom, reproductive rights, and gun ownership. Walz introduced himself to the nation as a teacher, coach and veteran with bipartisan credentials and a simple pledge to “respect our neighbors and the choices they make.” Walz laid out what Harris would do for the country as president, including cutting taxes for the middle class, taking on big pharma to lower prescription drug prices, and fighting to make homes more affordable. “Leaders don’t spend all day insulting people and blaming others,” the Minnesota governor said. “Leaders do the work. So, I don’t know about you, I’m ready to turn the page on these guys.” Of note: The Wall Street Journal reports (link) that Walz is richer than his net worth suggests.

Tim Walz joined by his daughter Hope, from left, his son Gus, and his wife Gwen. • Poll: ‘Walz more country than Vance.’ According to an Axios Vibes poll, Americans perceive Walz as more “authentic” than Ohio Sen. JD Vance, particularly in their understanding of issues affecting rural and small-town America. The poll shows that 41% of respondents believe Walz, a Democrat, understands these issues better than Vance, a Republican, who garnered 35% support. John Gerzema, CEO of the Harris Poll, which conducted the public opinion survey for Axios, noted that Walz is seen as more “country” and embodies a “serving, selfless” ethos, reminiscent of a teacher or coach. By margins of 5 to 8 percentage points, Walz was favored over Vance in areas such as having an authentic connection to everyday Americans, understanding community challenges, and resonating with small-town values. In contrast, Vance was more often viewed as supporting policies that benefit the wealthy and being more self-focused. This perception is significant, given that rural voters, who tend to lean socially and culturally conservative, favored Donald Trump by a 2-to-1 margin in the 2020 election. • Former President Bill Clinton emphasized the importance of the upcoming November election. He framed the choice as between “We the People” and “Me, Myself, and I,” referencing the day’s convention theme. Clinton emphasized that the Harris/Walz ticket represented a “breath of fresh air” politically, and that Americans would welcome a generational change. He also needled Trump on the matter of age, cracking, “The only personal vanity I want to assert is that I’m still younger than Donald Trump.” • In a surprise appearance, Oprah Winfrey delivered an impassioned endorsement of the Harris/Walz campaign. She urged the audience to take action and support Kamala Harris as the next president. She told the audience to choose “optimism over cynicism” and “inclusion over retribution” by voting for Harris. Her speech is being considered as the best of the evening presentations. • Transportation Secretary Pete Buttigieg focused on the campaign’s theme of “joy.” He reflected on the progress represented by his own family and advocated for “better politics” in contrast to Trump’s “politics of darkness.” The convention’s biggest moment comes tonight, when Kamala Harris will speak, making her with the first Black and Asian American woman topping a presidential ballot. The Democrats’ line is that Harris is a middle-class child of a single parent who became a big-hearted prosecutor, while Republicans frame her as a California liberal who is soft on crime and immigration. — Trump traveled to North Carolina for his first outdoor rally since his assassination attempt. He was shielded by bulletproof glass. Trump’s remarks on Wednesday were billed as focusing on national security, part of a series of speeches intended to focus on policy. He visited North Carolina last week for a speech that was supposed to focus on his economic agenda but often veered into personal attacks and asides on other issues and people. Such was the case again Wednesday, with Trump again expressing skepticism at the idea of a policy-centric speech. “My advisors are fired,” he joked, after polling the audience on whether they thought he should “get personal.” “We love to keep it on policy, but sometimes it’s hard when you’re attacked on all ends. They want to put you in jail for nothing.” Among those with whom he “got personal” were military generals who since his presidency have spoken out against him, including Retired General Mark Milley and former Secretary of Defense Jim Mattis. “I call them television generals,” Trump said. — RFK Jr. to exit presidential race and endorse Trump, potentially boosting his polls. Robert F. Kennedy Jr., the most prominent third-party U.S. presidential candidate in recent history, is reportedly preparing to exit the race and endorse Donald Trump. Known for his vaccine skepticism and anti-corporate stance, RFK Jr. has garnered about 5% support nationally and in key swing states, particularly among Black, Latino, and young voters. He is expected to announce his withdrawal in Arizona on Friday, where he is also in discussions with the Trump campaign about a possible endorsement. Trump, who will be campaigning in Arizona that same day, has expressed openness to including RFK Jr. in his administration if he wins the presidency. This endorsement could potentially give Trump a slight boost in the polls, especially as RFK Jr. has been drawing more support from Trump-leaning voters than Biden-leaning ones. However, it could also backfire by reinforcing the Democratic narrative that the Trump campaign is aligning with fringe elements, a strategy that Democrats are likely to exploit. |

MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened 40 to 50 points higher. In Asia, Japan +0.7%. Hong Kong +1.4%. China -0.3%. India +0.2%. In Europe, at midday, London +0.2%. Paris +0.2%. Frankfurt +0.2%.The Fed’s annual Monetary Policy Symposium begins in Jackson Hole, Wyo., running from Aug. 22-24. Fed Chairman Powell is slated to speak at the symposium on Friday morning. Economists and investors widely expect him to signal that the central bank is finally ready to begin lowering interest rates. Futures markets today were pricing in a full percentage point worth of cuts by the end of the year. That would suggest a half-percentage point reduction at one of the three remaining meetings. The “markets, and the Fed itself, will have to consider whether 50 basis points is required” in September if data shows a further weakening of the labor market, Quincy Krosby, an investment strategist at LPL Financial, wrote in a research note yesterday. Key reports ahead: the jobs report on Sept. 6, and the Consumer Price Index five days later.

U.S. equities yesterday: All three major indices ended with modest gains. The Dow was up 55.52 points, 0.14%, at 40,890.49. The Nasdaq 102.05 points, 0.57%, at 17,918.99. The S&P 500 was up 23.73 points, 0.42%, 5,620.85.

— Toronto-Dominion Bank (TD) is preparing to set aside $2.6 billion to cover anticipated fines related to failures in money-laundering controls within its U.S. business. To help cover these costs, TD is selling part of its stake in Charles Schwab, a holding it acquired after selling its interest in TD Ameritrade to Schwab in 2020. TD is expected to report its financial results before the market opens.

— Peloton is showing signs of a successful turnaround, with its shares rising after reporting a significant reduction in losses for its fiscal fourth quarter. The company announced it will prioritize profitability over growth in the coming year. Peloton also experienced a slight increase in sales for the first time since the 2021 holiday quarter. This progress comes as Peloton and its competitors adapt to a shift in the fitness industry, with a growing focus on strength training to align with evolving consumer preferences.

— Ag markets today: Corn futures traded narrowly unchanged most of the night, soybeans favored the downside and wheat saw relative strength. As of 7:30 a.m. ET, corn futures were steady to a penny lower, soybeans were 8 to 9 cents lower, and wheat was around a penny higher. Front-month crude oil futures were trading modestly higher this morning and the U.S. dollar index was nearly 300 points higher.

Cash cattle trade picks up. Sharp selling pressure in futures persuaded packers to accept lower packer bids as cash trade picked up mid-week, with the average so far this week around $2.80 lower than a week ago. Stabilizing futures could encourage packers to have a “floor price” in place around this week’s average at $186.39. Beef cutout stabilized Wednesday, with Choice cutout firming 13 cents and Select climbing 4 cents.

Wholesale pork plunges. Demand remained solid for pork cutout Wednesday morning, though prices plunged in afternoon trade, dragging cutout $2.99 lower to $94.55. Picnics were the sole cut to firm on the day. The CME lean hog index sunk another 50 cents to $89.21, though that is still 83 cents above the July low.

— Agriculture markets yesterday:

• Corn: December corn rose 1/4 cent to $3.98 1/4, a mid-range close.

• Soy complex: November soybeans rose 5 1/2 cents to $9.81 1/2, closing above the 10-day moving average for the first time since July 25. December meal rose 40 cents to $308.70, while September soyoil edged 29 points higher to 41.00 cents.

• Wheat: December SRW wheat futures fell 12 1/2 cents to $5.44. December HRW futures dropped 9 1/2 cents to $5.51 3/4. Both markets closed near their daily lows and closed at new contract-low closes. December spring wheat futures fell 9 1/2 cents to $5.97.

• Cotton: December cotton futures rose 101 points to 70.35 cents, near the session high and closing at a four-week high close.

• Cattle: The expiring August contract rose 20 cents to $181.225, whereas most-active October fell 97.5 cents to $174.625. In contrast, feeder futures bounced modestly. Nearby August futures rose $1.05 to $239.25, while most-active October gained 35 cents to $231.675. A few head of Nebraska cattle traded at $186.00, whereas active Iowa trading took place around $187.00. Considering the latter activity, we doubt Nebraska cattlemen will take less than $187.00 before Friday, if at all. Conversely, moderate Southern Plains trading took place at $183.00, while Kansas cattle changed hands around $183.50. The heavy Iowa trade lifted the daily and weekly five-area averages up to $186.39, which represented an approximate $2.80 drop from last week. Choice cutout rose 67 cents to $315.75, while select cutout surged $1.20 to $302.24.

• Hogs: October hogs settled 22.5 cents lower at $76.15. Traders continue expecting the seasonal breakdown in hog and pork prices to prove quite large in the coming weeks and months, as reflected by the October and December contracts closes around $76.00 and $67.75, respectively. The disparity becomes more evident when one realizes the hog index remains above $89.00.

— Quotes of note:

• Canada strike: Most Americans have “no idea” how dependent the country is on Canadian railroads, said Peter Friedmann, executive director of the Agriculture Transportation Coalition, in a post on LinkedIn earlier this week. Even though alternate routes exist, U.S. railroads and marine terminals have limited capacity. Congestion is even now “rearing its disruptive and costly head,” he wrote.

• Canada strike: “You will have to start slowing down production pretty quickly if railcars aren’t being picked up or delivered.” — The American Chemistry Council’s Jeff Sloan, on the response by chemical producers of a rail stoppage in Canada.

— The Bureau of Labor Statistics (BLS) is facing renewed scrutiny over its data release practices after a delay in posting crucial revisions of U.S. jobs data online allowed at least three Wall Street firms — Mizuho Financial Group Inc., BNP Paribas SA, and Nomura Holdings Inc. — to obtain the information before it was officially available to the public. The BLS missed its scheduled 10 a.m. ET release time by over 30 minutes, during which time these firms managed to call the agency and receive the data. This incident has raised concerns about fair access to sensitive economic information, particularly because it is not the first time the BLS has faced such issues.

The BLS has acknowledged these issues and stated that it is reviewing its procedures to prevent future incidents. However, these recurring problems are fueling concerns about the integrity and fairness of the agency’s data dissemination practices, particularly in the highly sensitive economic information it handles.

— There’s ongoing discussion about the significant revision to U.S. job growth data released yesterday, which showed a reduction of 818,000 jobs for the 12 months through March 2024, averaging a loss of 68,000 jobs per month. This marks the largest downward adjustment since the global financial crisis. While data revisions are common, this scale of change is unusual. Says ING Economics: “Historically, the BLS has been out by 0.1 percentage point (pp) with its estimates versus the tax data — that is the 10Y average. Last year they were out by 0.2pp, requiring a 306k downward revision so [Wednesday’s] announced change is a big error and suggests there are some clear issues regarding some of the assumptions the BLS uses to complement its surveys of U.S. businesses. The BLS has a good handle on what is going on amongst large employers, but has less visibility on the small business sector and has a ‘births-death’ model” (with requests to revise the birth-death models of corporations or other influential factors including undocumented migrants).

• Revision process: The Bureau of Labor Statistics (BLS) initially estimates job growth by surveying 100,000-150,000 businesses monthly, but later re-estimates using 60 million business records, which often reveal a more accurate picture due to factors like seasonal hiring and delayed payroll data.

• Implications: Despite the revision, the overall trend in job growth remains positive, though lower than initially thought. The revised data shows an average of 185K-200K jobs added per month instead of 250K, which likely wouldn’t have changed the Federal Reserve’s monetary policy over the past year.

• Market impact: The revision, combined with rising unemployment and expectations from recent Federal Open Market Committee (FOMC) minutes, has increased speculation about a Fed rate cut Sept. 18. This dovish outlook excited markets, leading to a rise in stocks amid talks of deeper rate cuts.

Of note: Wednesday’s report indicating a significant downward revision to job growth up to March doesn’t necessarily mean that job gains in subsequent months will also be revised downward. In fact, the payroll growth suggested by the preliminary estimate could be revised upward when the actual adjustment is made in February, as has happened in each of the past four years, according to Goldman Sachs analysts. Barclays analysts, however, expect the final revision to be about half the size of the initial estimate. This suggests that while the initial revision was significant, future adjustments could be more moderate or even positive.

— Highlights of the July 30-31 FOMC meeting:

• The vast majority of Fed officials indicated it would likely be appropriate to cut interest rates at the next meeting in September if economic data unfolds as expected.

• Several officials observed that recent progress on inflation and increases in the unemployment rate provided a plausible case for reducing rates by 25 basis points at the July meeting or that they could have supported such a decision.

• Almost all participants remarked that while incoming inflation data was encouraging, they needed additional information to be more confident inflation was moving sustainably toward the 2% target before lowering rates.

• Many officials noted that reducing policy restraint too late or too little could risk unduly weakening economic activity or employment.

• Participants viewed recent data as enhancing confidence that inflation was headed towards the 2% goal, noting broad-based progress across major components of core inflation.

• A majority of participants remarked that risks to the employment goal had increased, while many noted that risks to the inflation goal had decreased.

• The minutes suggest the Fed is on track to cut rates Sept. 18, barring any surprises in upcoming economic data.

• The federal funds rate target range was kept unchanged at 5.25-5.50% at the July meeting.

The minutes mentioned several specific sectors:

• Technology sector: Stocks of larger companies, particularly in the technology sector, underperformed compared to firms with small and medium capitalization, which tend to be more sensitive to interest rates.

• Manufacturing sector: Some participants reported that conditions in the manufacturing sector were somewhat weaker.

• Professional and business services sector: This sector, along with technology-related sectors, was noted to remain strong.

• Agricultural sector: The ag sector continued to face strains due to low commodity prices and high input costs.

— Wages in the Eurozone rose more slowly in the second quarter of 2024, with negotiated wages increasing by 3.55% year-on-year, down from 4.74% in the first quarter. This slower wage growth was less than expected and may pave the way for the European Central Bank (ECB) to further reduce borrowing costs. The ECB had already lowered its key interest rate in June as inflation eased, but indicated that further cuts would depend on continued signs of slowing wage growth. With inflation cooling for energy, food, and goods, but remaining high for labor-intensive services, a slowdown in wages suggests that service prices could also decrease, making another rate cut likely at the ECB’s next meeting on Sept. 12.

Market perspectives:

— Outside markets: The U.S. dollar index was higher, with the euro weaker against the greenback. The yield on the 10-year U.S. Treasury note rose, trading around 3.84%, with a positive tone in global government bond yields. Crude oil futures were higher ahead of US trading with US crude around $72.05 per barrel and Brent around $76.30 per barrel. Futures had been slightly lower in Asian trading. Gold and silver futures were lower, with gold at around $2,534 per troy ounce and silver at around $29.50 per troy ounce.

— U.S. dollar: Tom Essaye of The Sevens Report writes: “The global currency markets are pricing in an aggressively dovish Federal Reserve with the dollar dropping close to par (100). That does not match with the current economic expectations so something will have to give here. Either the dollar decline is ahead of itself, or currency and bond investors are expecting much weaker growth than equity investors.”

— Canada’s two largest railways, which account for nearly 80% of the national network, shut down early Thursday after failing to reach an agreement with the Teamsters Canada Rail Conference. The shutdown, involving over 9,000 employees at Canadian National Railway Co. and Canadian Pacific Kansas City Ltd., immediately disrupted North American supply chains that handle about C$1 billion ($740 million) in trade daily. The stoppage is set to cripple shipments of grain, potash and coal while also slowing the transport of petroleum products, chemicals, and autos.

• Failed negotiations: The shutdown occurred after the union voted in favor of a strike over scheduling and worker fatigue. Despite ongoing negotiations, no deal was reached, leading to a lockout. The rail companies claim they made substantial offers to improve wages and rest time, while the union accuses the companies of prioritizing profits over the economy.

• Serious economic consequences:

— It would disrupt the transport of approximately $1 billion worth of goods per day.

— In 2022, Canada exported $279 billion (C$380 billion) in goods by rail.

— Over 60% of the $23 billion (C$31.8 billion) in Canadian lumber exported in 2023 was transported by rail.

• Cross-border effects: The strike would have significant implications for the United States:

— Cross-border transport would be disrupted, impacting the U.S. supply chain for construction materials and other goods.

— About one-third of the freight carried by CN and CPKC crosses the U.S./Canada border.

— U.S. industries such as agriculture, automotive, construction, and energy could be affected.

• Government response: The Canadian government, particularly Prime Minister Justin Trudeau’s administration, is under pressure to address the situation. However, with the government’s support from the pro-labor New Democratic Party, intervention on behalf of the employers against the workers seems unlikely.

• U.S. concerns: The U.S. is monitoring the situation closely, given the potential impact on the flow of goods into the country. U.S. Transportation Secretary Pete Buttigieg said Monday that his department had been monitoring the situation closely and tracking the flow of vital goods to the U.S.

Of note: This is the first time in decades that workers at both companies have walked out simultaneously, raising urgent questions about the future of labor relations and economic stability in Canada.

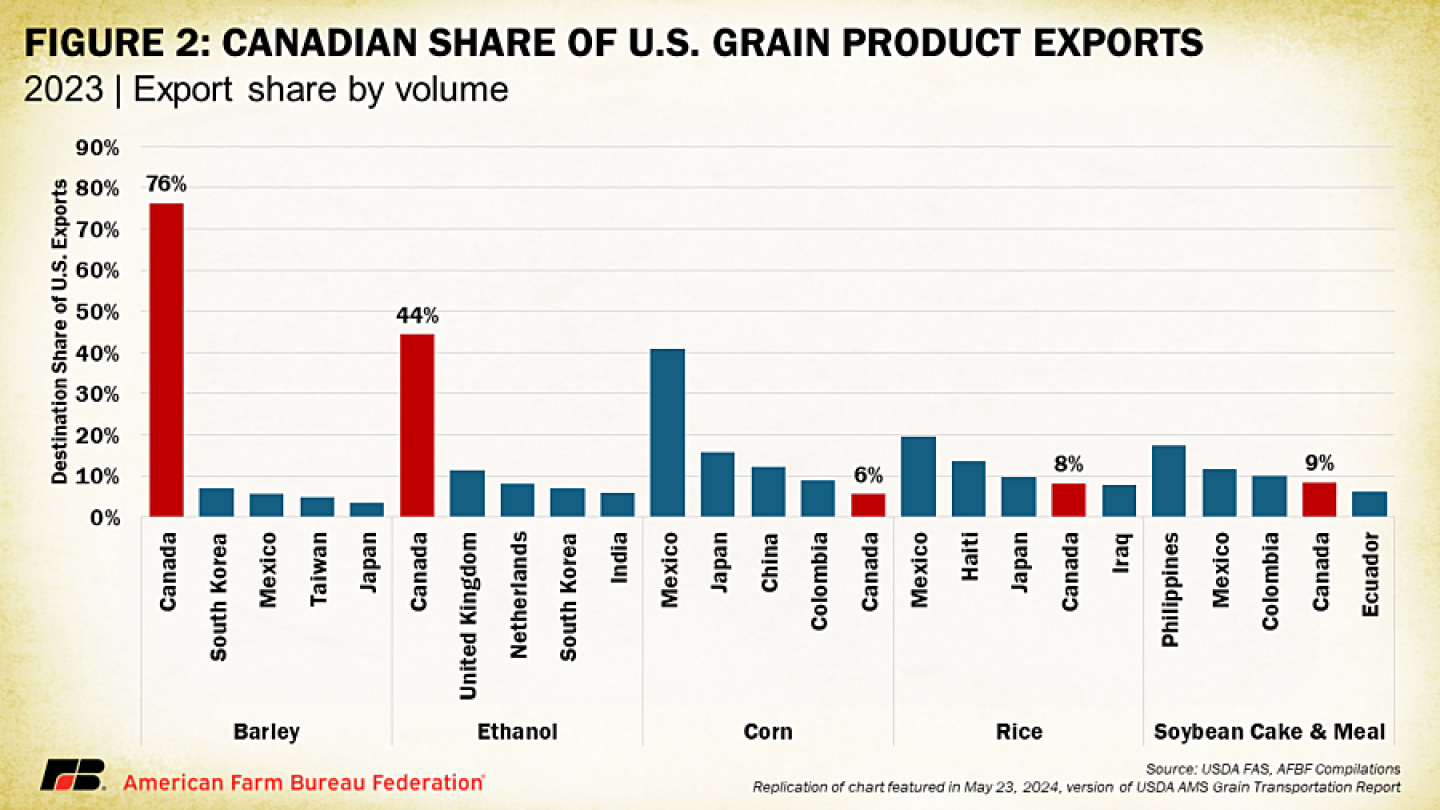

— A recent USDA-Agricultural Marketing Service report (link) highlighted the significant role of rail transport in U.S./Canadian agricultural trade. In 2023, the U.S. exported $28.2 billion worth of agricultural products to Canada, making it the third-largest destination for U.S. exports. Meanwhile, the U.S. imported $40.1 billion of Canadian agricultural products, making Canada the second-largest source of U.S. agricultural imports.

Canada was the leading destination for key U.S. exports like ethanol and barley, and a major market for soybean meal, rice, and corn. Notably, some U.S. exports are transported through Canada to be re-exported via Pacific Northwest ports, which underscores the potential disruption a Canadian rail strike could cause, impacting not only trade with Canada but also with key markets in Asia and Oceania.

— Labor issues in Canada are intensifying as they align with ongoing contract talks involving about 45,000 dockworkers at major U.S. ports from Houston to Boston. The International Longshoremen’s Association (ILA) halted wage negotiations earlier this summer and is preparing to strike if no agreement is reached before the contract expires on September 30. In response, some cargo has been diverted to U.S. West Coast ports, which are already experiencing near-record container volumes, reminiscent of the pandemic era. This situation could exacerbate existing supply chain challenges in North America.

— USDA daily export sales:

• 198,000 MT soybeans to China during 2024-2025 marketing year

• 110,490 MT corn to Mexico during 2024-2025 marketing year

• 105,000 MT soybean cake and meal to Vietnam during 2024-2025 marketing year

• 132,000 MT corn to unknown destinations during 2024-2025 marketing year

— The Renewable Fuels Association (RFA) has underscored the critical need for reliable rail transportation in its comments to the Surface Transportation Board (STB), highlighting the close connection between the freight rail industry and the ethanol sector. RFA Director Justin Schultz emphasized that about 75% of U.S. ethanol is shipped by rail, making efficient and dependable rail services vital for the industry’s operations. Ethanol producers are investing in upgraded rail facilities and support new safety protocols to improve tank car safety. The RFA’s analysis pointed out that Class I railroads often provide varying service levels across different commodities, with ethanol and grain shipments experiencing longer delays, slower speeds, and extended turnaround times compared to other goods like crude oil and coal. The report stressed that transportation delays have significant costs for ethanol plants, which have limited storage capacity and face potential losses from missed market opportunities and increased operational expenses.

— Day 3 Crop Tour results for Illinois and western Iowa. Scouts on day 3 of the Pro Farmer Crop Tour found an average corn yield of 204.14 bu. per acre in Illinois, up from 193.72 bu. per acre last year and the three-year average of 193.58 bu. per acre. Soybean pod counts in a 3’x3’ square averaged 1,419.11 for Illinois, up from 1,270.1 last year and the three-year average of 1,266.70.

In western Iowa, average corn yields for Districts 1, 4 and 7 were 176.59 bu., 195.86 bu. and 191.59 bu. per acre, respectively, compared to 182.58 bu., 168.71 bu. and 184.84 bu. per acre, respectively, in 2023. The three-year averages for Iowa Districts 1, 4 and 7 are 182.55 bu., 183.54 bu. and 183.67 bu. per acre, respectively.

Western Iowa pod counts for Districts 1, 4 and 7 averaged 1,108.76, 1,254.09 and 1,366.22, respectively, compared with 1,137.24, 1,120.30 and 1,170.28 in 2023. The three-year averages for Iowa Districts 1, 4 and 7 are 1,105.44, 1,201.49 and 1,253.91, respectively.

On Day 4 of the Crop Tour today, scouts will sample fields in eastern Iowa and southern Minnesota. The Tour concludes tonight in Rochester, Minnesota.

— Despite production challenges in Europe, wheat prices decline. The decline in wheat prices to around $5.20 per bushel, approaching their lowest levels since September 2020, is influenced by two major factors: transportation disruptions in Canada and an optimistic production outlook from Ukraine.

• Canadian transportation disruptions: There are concerns about a potential rail strike in Canada, involving over 9,000 workers from two major railway companies (see related items). Since over 90% of Canada’s grain is transported by rail, this has led farmers to sell their grain in advance to avoid future transportation issues. Canada is expected to ship around 25.3 million tons of grain in the 2024-2025 marketing year, so any disruption could significantly impact the market.

• Optimistic Ukrainian production forecast: Despite challenges in other parts of the world, particularly in Europe, USDA has increased its forecast for Ukrainian wheat production by 10.8%, bringing it to 21.6 million tons. This unexpected boost in supply has contributed to driving down wheat prices.

• European wheat production struggles: Europe, especially France, is facing a significant drop in wheat production, with French output expected to decrease by 25%, marking one of the worst harvests in decades. This regional issue, however, hasn’t been enough to offset the global price decline, partly due to the more optimistic outlook for Ukrainian production.

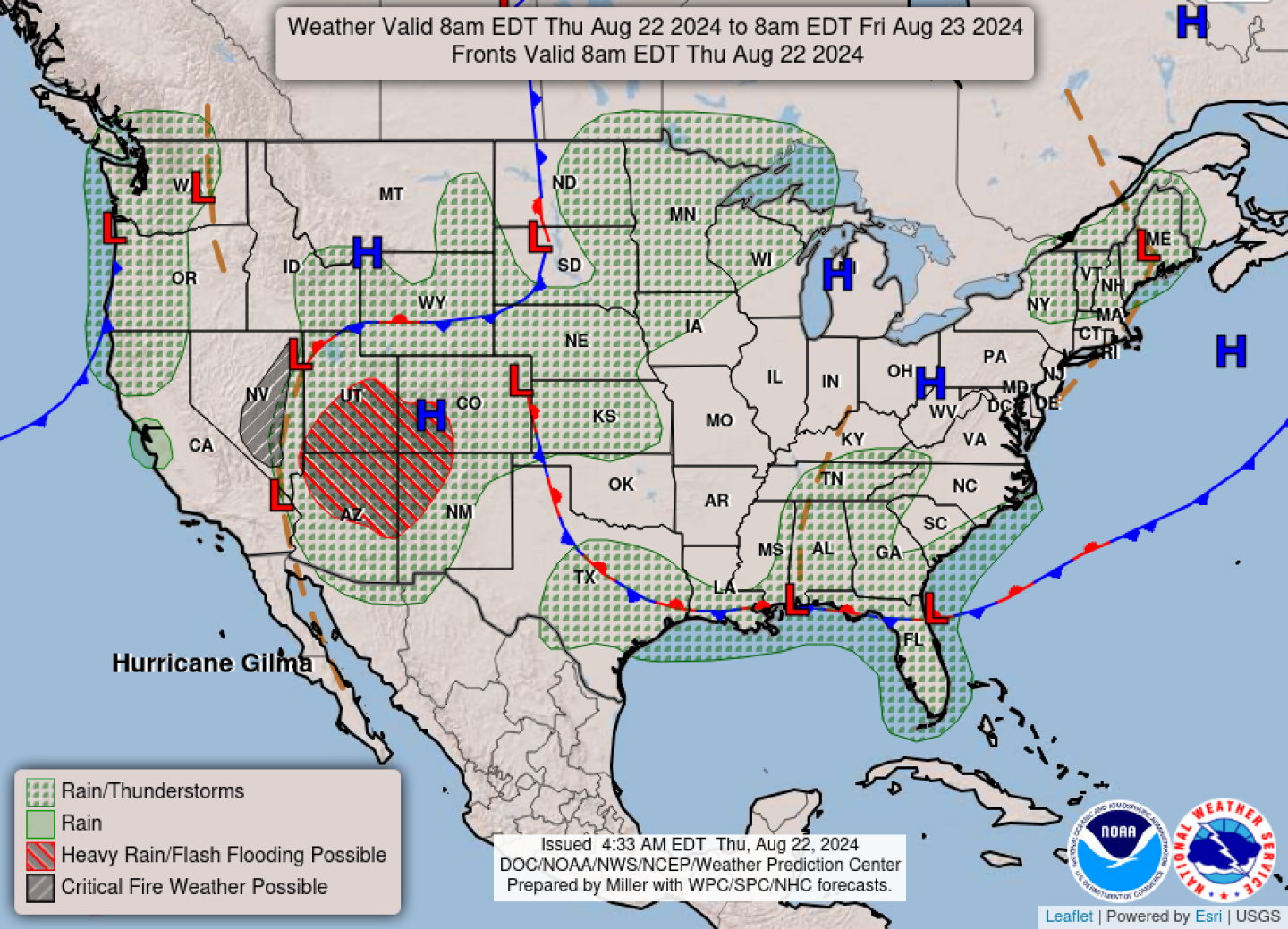

— NWS outlook: Record heat continues into the end of the week across the Southern Plains... ...There is a Slight Risk of excessive rainfall over parts of the Southwest, Great Basin, and Central/Southern Rockies on Thursday... ...Record cold develops across California Friday into Saturday... ...There are Excessive Heat Warnings and Heat Advisories over parts of the Southern Plains...

RUSSIA/UKRAINE |

— Ukrainian troops said they are moving to encircle an estimated 3,000 Russian troops that are hemmed against a river in Russia’s Kursk province, seeking a fresh blow against Moscow.

CHINA UPDATE |

— More info on China’s anti-subsidy probe into EU dairy products amid escalating trade tensions. We previously noted that China’s Ministry of Commerce (MofCom) initiated an anti-subsidy investigation into certain EU dairy products, focusing on whether specific subsidies in 13 EU countries and seven EU-wide schemes have unfairly distorted trade. The products under scrutiny include fresh and processed cheeses, as well as unsweetened, un-concentrated milk and cream with a fat content of 10% or higher. The largest exporters of these products — France, Italy, Denmark, and the Netherlands —a re particularly impacted.

This investigation is part of a broader pattern of escalating trade tensions between China and the EU. The EU has been investigating Chinese companies, industries, and procurement processes, prompting China to respond with its own investigations. This is the third major Chinese trade probe into the EU’s agri-food sector this year, following investigations into EU brandy and pork.

The timing of the investigation is notable, coming less than a day after the EU updated its anti-subsidy probe into Chinese-manufactured electric vehicles (NEVs).

Of note: If MofCom finds that subsidies have indeed distorted the dairy market, further investigations into other dairy products could follow, potentially leading to broader implications for EU dairy exports to China.

— China issued a stern warning to the U.S. against allowing the Dalai Lama to engage in “separatist activities” during his visit to the country and lodged formal protests after senior American officials met with the exiled Tibetan spiritual leader in New York. Chinese Foreign Ministry spokeswoman Mao Ning expressed firm opposition to any country hosting the Dalai Lama or allowing government officials to meet with him, labeling such actions as interference in China’s internal affairs. She urged the U.S. to respect China’s core interests and avoid any form of contact with the Dalai Lama, whom Beijing considers a separatist.

The protest followed a meeting between the Dalai Lama and U.S. officials, including the White House human rights director and the U.S. special coordinator for Tibetan issues, which reaffirmed the U.S.’ commitment to Tibetan human rights. Beijing has consistently opposed international engagement with the Dalai Lama and reacted strongly after the U.S. passed the Resolve Tibet Act, urging China to resume dialogue with the Tibetan leader.

ENERGY & CLIMATE CHANGE |

— Ford’s recent decision to scrap plans for a fully electric SUV and postpone a next-generation electric pickup highlights a significant shift in its electric vehicle (EV) strategy to focus on focusing on hybrids and affordability. The company is set to absorb a substantial financial impact, with estimated losses of around $1.9 billion. Additionally, Ford is reducing its capital expenditure on EVs, decreasing the proportion of its budget from 40% to 30%.

LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— New York Attorney General Letitia James sued JBS USA, the American arm of the world’s largest meatpacker, for allegedly making misleading claims about its efforts to reduce greenhouse gas emissions. The lawsuit, which challenges JBS’s assertions that it will achieve net-zero emissions by 2040, is a significant setback as the company pursues a listing on the New York Stock Exchange. The suit accuses JBS of “greenwashing” by making deceptive statements about its environmental impact in ads and public statements, including claims made by CEO Gilberto Tomazoni during a New York Times event. The National Advertising Review Board had already found JBS’s net-zero claims misleading last year.

JBS, already under scrutiny for its environmental practices and past corruption scandals, disputes the allegations and states it remains committed to reducing agriculture’s environmental impact. The lawsuit could further complicate JBS’s business plans, including its delayed NYSE listing, and serves as a broader warning to companies regarding the serious consequences of misleading environmental claims.

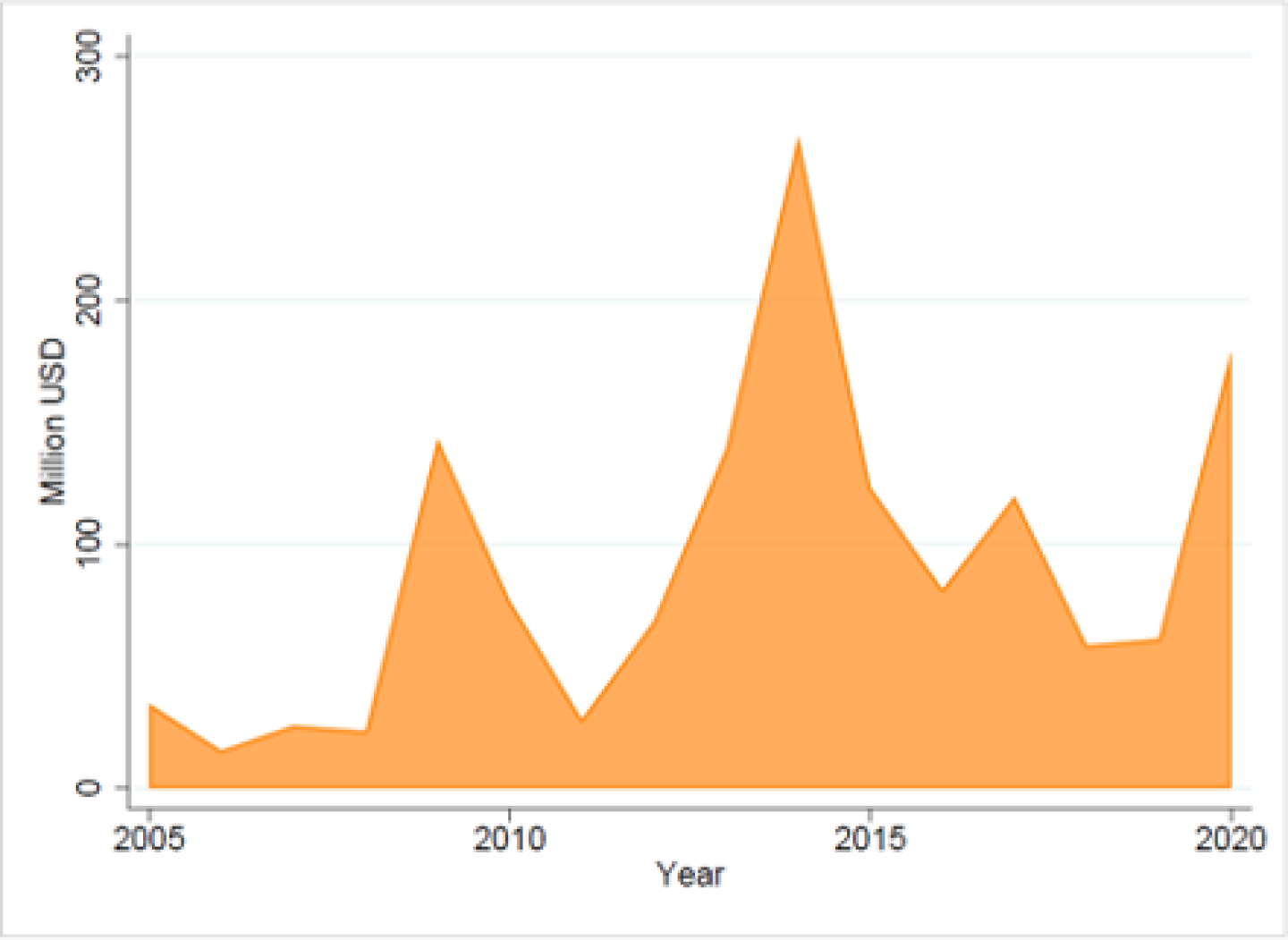

— SAT: Animal diseases cause $96 million annual loss in U.S. soybean exports. Animal diseases have significant economic impacts beyond the immediate loss of livestock, affecting related industries like the U.S. soybean market, which is crucial for animal feed, according to analysis by Southern Ag Today (link). Recent studies show that global outbreaks of animal diseases lead to considerable losses in soybean export potential, with an average of over $96 million lost annually due to decreased demand for soymeal, a primary protein source in animal feed. The U.S., the second-largest soybean exporter globally, has historically supplied key markets such as China, Mexico, and Japan.

SAT writers say these findings highlight the need for policymakers to consider the broader effects of animal disease outbreaks on upstream industries like soybean production. Current animal health policies primarily focus on compensating livestock producers, but they do not adequately address the ripple effects on suppliers, such as the additional costs incurred by grain producers due to extended storage or quality losses. Enhancing supply chain resilience in the face of animal diseases should be a priority to mitigate these wider economic impacts.

— A recent study revealed findings about the nutritional quality and marketing practices of baby foods sold in U.S. supermarkets. The research, conducted in 2024, highlights significant concerns regarding the health impact of these products on infants and toddlers. The study (link) was conducted by researchers at The George Institute for Global Health. The senior author of the study is Dr. Elizabeth Dunford, who is also an adjunct assistant professor of nutrition at the University of North Carolina at Chapel Hill. The research was published in the peer-reviewed journal Nutrients and analyzed 651 baby food products sold across ten major U.S. supermarkets, assessing their compliance with World Health Organization (WHO) nutritional guidelines and advertising standards.

Nutritional content: The study found that nearly two-thirds (60%) of supermarket baby foods in the U.S. contain excessive amounts of sugar and salt. This high proportion of unhealthy options is particularly concerning given the crucial developmental stage of the target consumers.

Marketing practices: Researchers uncovered widespread use of misleading marketing claims on baby food packaging. These deceptive practices may lead parents to believe they are purchasing nutritious options for their children when, in fact, many products fall short of health recommendations.

Compliance with WHO standards: The study revealed that almost none of the examined baby foods met the World Health Organization (WHO) standards for advertising. These standards require clear labeling of ingredients and accurate health information

The research examined a wide range of infant and toddler foods available in U.S. grocery stores, with 60% of the products analyzed failing to meet nutritional recommendations. The issue affects a majority of baby foods across various brands and types.

This study has prompted researchers and health experts to call for stricter regulations on baby food production and marketing in the United States. Key recommendations include:

• Tightening nutritional standards for infant and toddler foods

• Implementing more stringent promotional guidelines

• Improving labeling practices to provide accurate and transparent information to parents

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |